“Face the simple fact before it comes involved. Solve the small problem before it becomes big.”

– Lao Tzu

Jobs Update

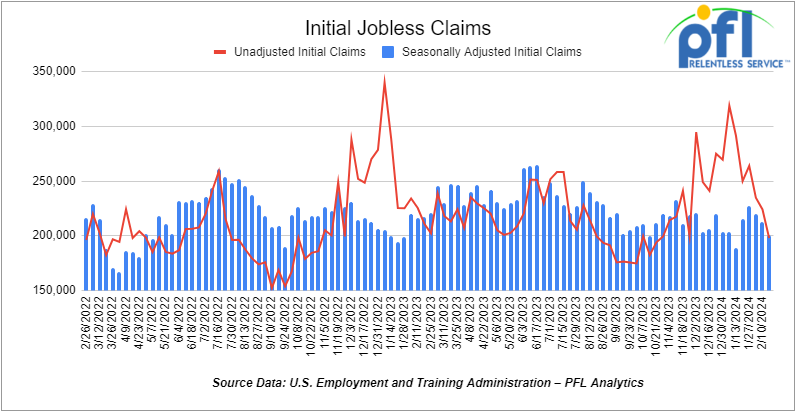

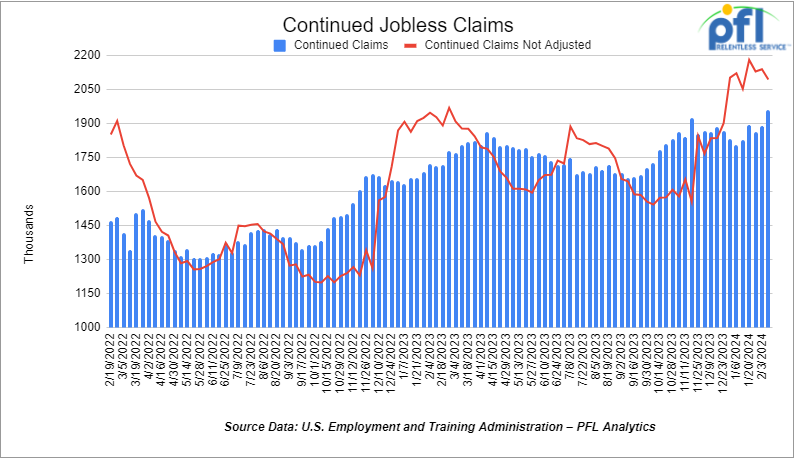

- Initial jobless claims seasonally adjusted for the week ending February 17th, 2023 came in at 201,000, down -12,000 people week-over-week.

- Continuing jobless claims came in at 1.962 million people, versus the adjusted number of 1.889 million people from the week prior, up 73,000 people week-over-week.

Stocks closed mixed on Friday of last week and mixed week over week

The DOW closed higher on Friday of last week, up 62.42 points (0.16%), closing out the week at 39,131.53, up 503.54 points week-over-week. The S&P 500 closed higher on Friday of last week, up 1.77 points (0.03%), and closed out the week at 5,088.8, down -411.77 points week-over-week. The NASDAQ closed lower on Friday of last week, down -44.8 points (-0.28%), and closed out the week at 15,996.82, up 221.17 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 39,150 this morning down 39 points.

Crude oil closed lower on Friday of last week and lower week over week.

WTI traded down -$2.12 per barrel (-2.7%) to close at $76.49 per barrel on Friday of last week, down $2.70 per barrel week-over-week. Brent traded down -US$2.09 per barrel (-2.50%) on Friday of last week, to close at US$81.62 per barrel, down -US$1.85 per barrel week-over-week.

One Exchange WCS for April delivery settled on Friday of last week at US$17.40 below the WTI-CMA. The implied value was US$58.55 per barrel. On Thursday of last week, it settled at US$16.85 below the WTI-CMA for April delivery. The implied value was US$60.92 per barrel.

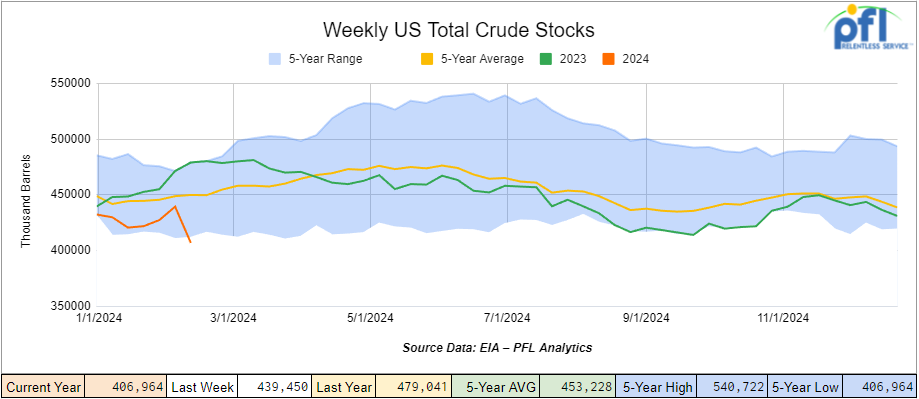

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.5 million barrels week-over-week. At 443 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

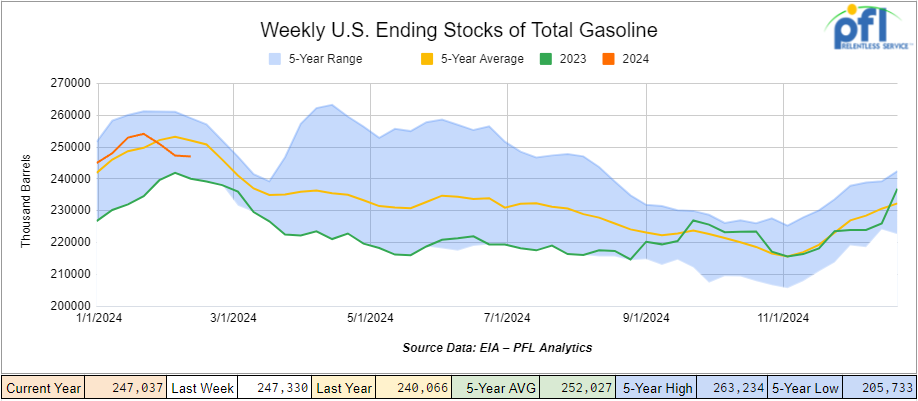

Total motor gasoline inventories decreased by 300,000 barrels week-over-week and are 2% below the five-year average for this time of year.

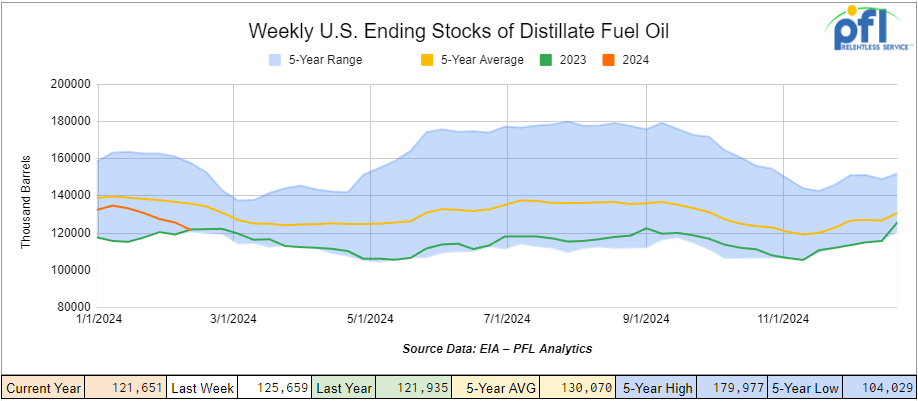

Distillate fuel inventories decreased by 4 million barrels week-over-week and are 10% below the five-year average for this time of year.

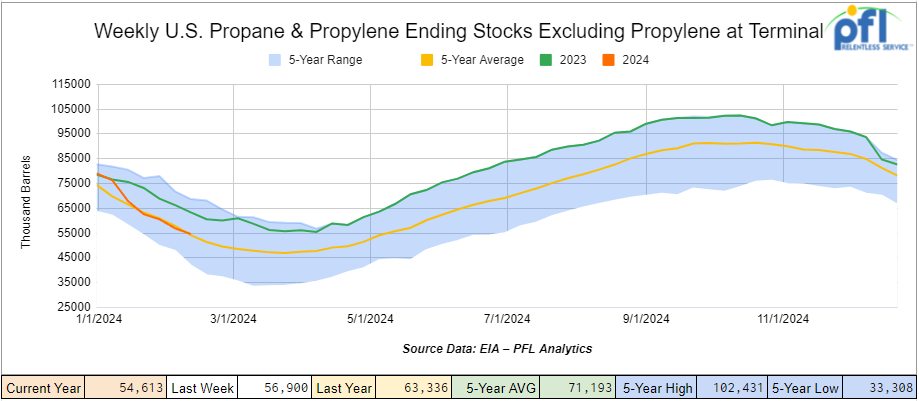

Propane/propylene inventories decreased by 2.3 million barrels week-over-week and are 4% above the five-year average for this time of year.

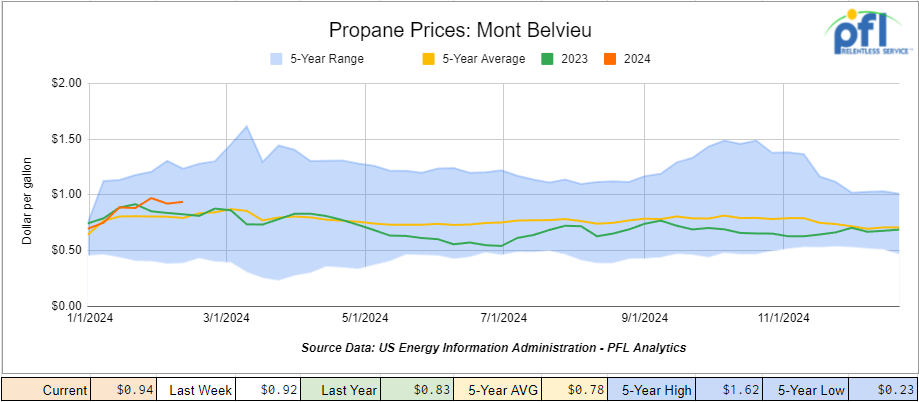

Propane prices closed at 94 cents per gallon, up 2 cents per gallon week-over-week, but up 11 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 800,000 barrels last week. during the week ending February 16, 2024.

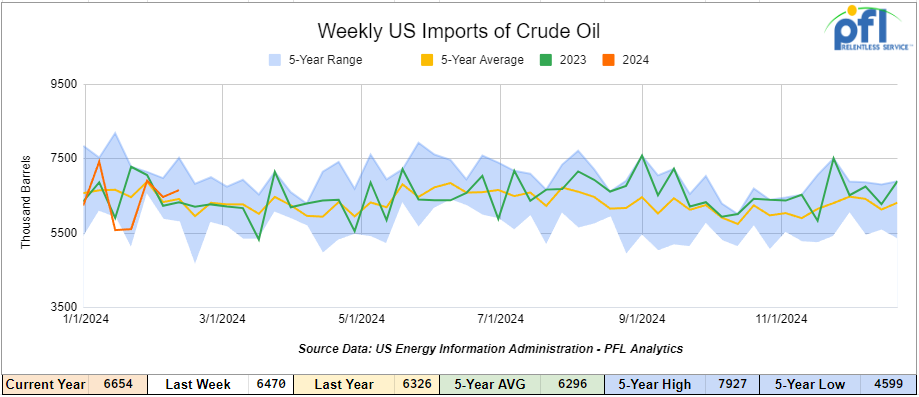

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending February 16, 2024, an increase of 184,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 4.7% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 734,000 barrels per day, and distillate fuel imports averaged 245,000 barrels per day during the week ending February 16, 2024.

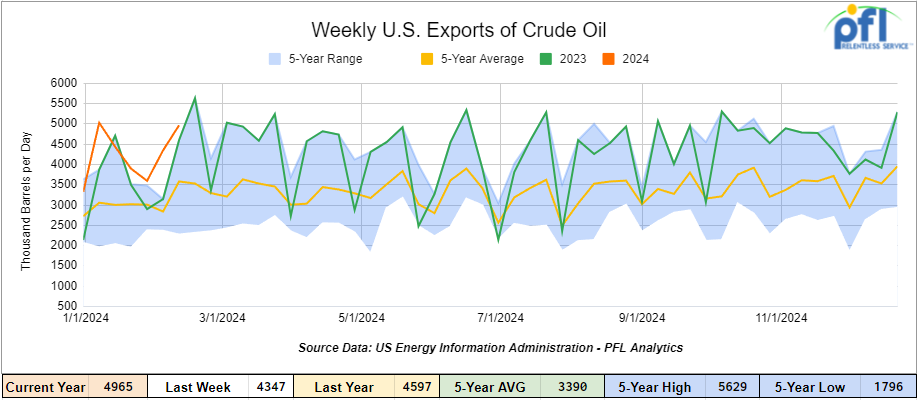

U.S. crude oil exports averaged 4.965 million barrels per day for the week ending February 16th, 2024, an increase of 618,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.201 million barrels per day.

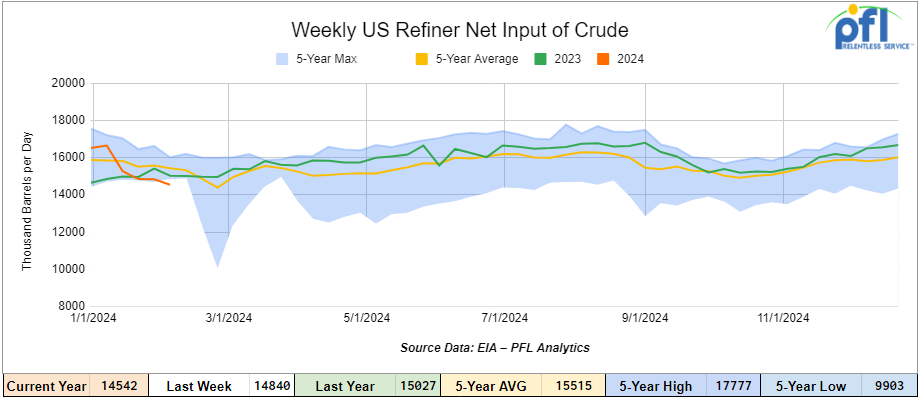

U.S. crude oil refinery inputs averaged 14.6 million barrels per day during the week ending February 16, 2024, which was 31,000 barrels per day more week-over-week.

WTI is poised to open at 76.30, down 19 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 21st, 2024.

Total North American weekly rail volumes were up (2.36%) in week 8, compared with the same week last year. Total carloads for the week ending on February 21st were 345,201, down (-1.35%) compared with the same week in 2023, while weekly intermodal volume was 317,125, up (6.73%) compared to the same week in 2023. 8 of the AAR’s 11 major traffic categories posted year-over-year increases with the largest decrease coming from Coal, down (-11.47%) while the largest increase came from Motor Vehicles and Parts up (+9.44%).

In the East, CSX’s total volumes were up (2.27%), with the largest decrease coming from Grain, down (-14.71%) while the largest increase came from Petroleum and Petroleum Products up (33.67%). NS’s volumes were up (6.75%), with the largest increase coming from Grain (+21.48%) while the largest decrease came from Petroleum and Petroleum Products (-16.26%).

In the West, BN’s total volumes were up (4.73%), with the largest increase coming from Other (+42.84%) while the largest decrease came from Coal, down (-17.79%). UP’s total rail volumes were up (1.21%) with the largest decrease coming from Coal, down (-16.80%) while the largest increase came from Motor Vehicles and Parts which was up (16.69%).

In Canada, CN’s total rail volumes were down (-3.12%) with the largest decrease coming from Grain, down (-25%) while the largest increase came from Farm Products, up (+1.9%). CP’s total rail volumes were up (+7.06%) with the largest increase coming from Intermodal (+73%) while the largest decrease came from Petroleum and Petroleum Products, down (-26.21%).KCS’s total rail volumes were down (-18.38%) with the largest decrease coming from Farm Products (-36.07%) and the largest increase coming from Motor Vehicles and Parts (+45.15%).

Source Data: AAR – PFL Analytics

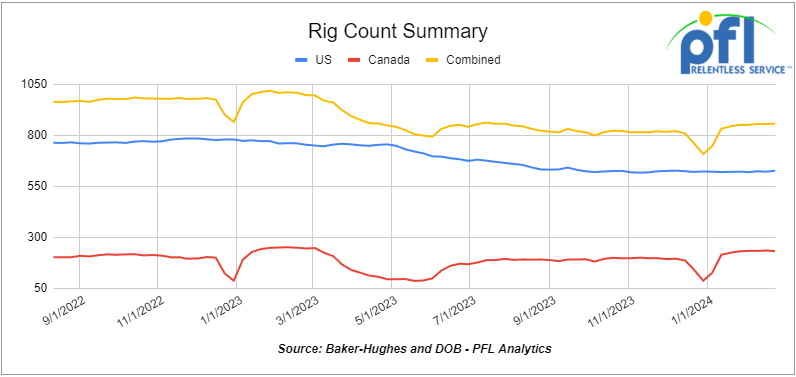

Rig Count

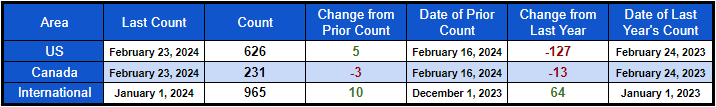

North American rig count was up by 2 rigs week-over-week. U.S. rig count was up by 5 rigs week-over-week and down by -127 rigs year-over-year. The U.S. currently has 626 active rigs. Canada’s rig count was down by -3 rigs week-over-week, and down by -13 rigs year-over-year. Canada’s overall rig count is 231 active rigs. Overall, year-over-year, we are down -140 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 30,067 from 28,994, which was a gain of +1,073 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments rose by +7.3% week-over-week, CN’s volumes were lower by -2.8% week-over-week. U.S. shipments were mostly lower. The UP had the largest percentage decrease and was down by -6.7% week-over-week. The CSX was the sole gainer and was up by 5.8% week-over-week.

We are watching BP

BP plc is continuing the phased restart of its 440,000 barrel per day Whiting, Indiana refinery, a company spokesperson said on Thursday night of last week.

“BP continues its phased restart of the Whiting refinery and is committed to mitigating potential fuel supply disruptions for our customers in the Midwest as we ramp up to normal operations,” said BP spokesperson Christina Audisho in an emailed statement.

Located in northwest Indiana, BP’s Whiting refinery is the largest in the Midwest and BP’s largest anywhere in the world. Whiting is able to process around 440,000 barrels of crude oil every day, and produces a wide range of liquid fuels, along with 7% of all asphalt in the United States. The Whiting refinery should begin restarting today and reach full production sometime in March.

The refinery was shut by a Feb. 1 plant-wide power outage that sent plumes of black smoke over Whiting and neighboring communities southeast of Chicago from the plant’s safety flare system.

Retail gasoline prices in Chicago have climbed 20 cents a gallon since the outage.

We continue to watch Renewables

In a slow end to a short week for RINs on Friday of last week, D4 RINS closed out the day and the week at 41 cents per RIN, down 1 cent per RIN day over day and down 5 cents per RIN week over week. D6 RINS closed at 40 cents per RIN, down ½ of a cent per RIN day over day and down 4 and ½ cents per RIN week over week. Ethanol at Argo closed out the day and the week at $1.45 per gallon, down 1 and ½ of a cent per gallon day over day and down ½ of a cent per gallon week over week. LCFS credits in California closed out the day and the week at $65 per MT, no change day over day but up $2 per MT week over week. The biodiesel producer margins at this point are minimal.

We Continue to watch LNG

With clean burning natural gas here in the U.S. at the lowest prices we have seen in decades we need to burn more or get it exported. Natural gas closed at $1.603 per MMBTU on Friday of last week down -14.1 cents per MMBTU day over day, adjusted for inflation which translates into $0.83 per MMBTU in 1997 dollars when natural gas prices were printing at $2.15 per MMBTU – what a bargain, folks. In addition to value for the U.S. consumer, natural gas could be a massive economic driver for the U.S. economy because we simply have so much of it we are seeing quite a bit of switching from coal to natural gas electricity generation where possible. Coal does not really work that well when natural gas prices are below $3.00 per MMBTU. As our readers know the more natural gas produced the more LPG’s produced. The more clean burning natural gas we produce the better:

1) Reduces our carbon footprint – good for the environment.

2) Helps out our European allies;

3) Creates U.S. jobs;

4) Leads to more production of LPG’s – propane etc

5) Great for rail in the form of increased LPG production creating yet more jobs for rail;

6) Makes the U.S. an energy powerhouse.

While the U.S. government’s recent LNG pause is not impacting timelines for expansion work. At this time, it injects regulatory uncertainty, says a company’s top executive at Cheniere Energy Inc

This past January, the Biden administration said there would be a temporary pause on pending decisions for exports of LNG to countries in which the U.S. does not have a free trade agreement. The U.S. Department of Energy (DOE) will assess if LNG exports are undermining domestic energy security, energy costs and climate change.

“While this decision does not currently impact our expansion projects or our FERC processes at Sabine Pass and Corpus Christi, it does introduce regulatory and permitting uncertainty into the U.S. LNG industry as a whole,” said Jack Fusco, Cheniere’s president and chief executive officer, in his prepared remarks during the company’s fourth quarter of 2023 earnings call.

Moreover, the benefits of LNG exports are “proven,” he noted.

He added that a fair and transparent regulatory framework is essential for the future development of natural gas infrastructure in the U.S. The CEO noted this is particularly relevant to liquefaction capacity, given its scale of investment, commercial support and time required to bring projects of this kind online.

Fusco said he has never been more confident in the role U.S. LNG plays in the global energy market and believes the DOE’s studies will arrive at the same conclusion.

To this end, he listed the importance of long-term energy security, opportunities for global decarbonization through coal-to-gas switching for power generation and how dispatchable gas-fired power plants backstop intermittent renewables.

He also singled out low and stable domestic natural gas prices, and economic benefits for communities.

“Global energy markets are calling for additional LNG supply,” said Fusco. “The U.S. is significantly advantaged to answer this call with our abundant and low-cost natural resources, flexibility and affordability of U.S. volumes, and — until recently — the reliability and certainty of the U.S. regulatory regime.”

He reiterated that the DOE action has not slowed down its expansion projects and said the company is “full steam ahead on Corpus Christi Trains 8 and 9 and the SPL expansion project development.”

According to Fusco, Gulf Coast LNG sets up the U.S. as a leader in facilitating energy security and worldwide emissions reductions.

“This is a generational opportunity, something we should be proud of and working to maximize, not restrict.”

During the call, an analyst asked how the pause has impacted conversations with customers.

This is nothing new, responded Fusco.

“We’ve been through multiple administrations here at Cheniere,” he added. “We’ve been through multiple studies on the public interest in exporting America’s natural gas.”

“We really believe that the U.S. will be the market’s first 200-million-tonne exporter and we will navigate this with the DOE,” added Anatol Feygin, executive vice-president and chief commercial officer.

Moreover, Feygin said the company is confident that it will be able to navigate “whatever comes out of the DOE and continue to prosecute expansions on our timeline.”

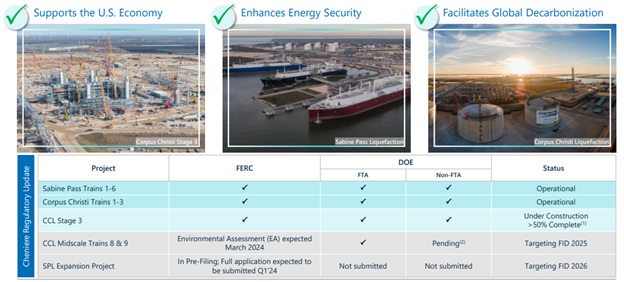

Cheniere Regulatory Update

Source: Cheniere PFL Analytics

We are Watching the NS and STB

Surface Transportation Board Chairman Martin Oberman is concerned about the potential of activist investors succeeding in their effort to replace Norfolk Southern Corp.’s top leadership in favor of a short-term strategy of cost-cutting and workforce reductions to boost profits.

Such a strategy would be “a huge detriment” for the entire rail industry if activist investor Ancora Holdings Group LLC succeeds in its takeover attempt at NS, Oberman said during an interview with Progressive Railroading on Feb. 23. Oberman emphasized he was speaking for himself and not the entire STB. We have listened to Martin speak many times and he often criticizes the railroads for slower service, the lack of investment in infrastructure and not keeping up with staffing requirements (headcount). It is always tug and pull – the need to invest and the need to increase profits from a Wall Street perspective – we will be watching this one stay tuned to PFL.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 50-100, 4750CF Open/Covered Hoppers needed off of BN in Washington for Feb-Jun. Cars are needed for use in Petcoke service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3-bay gravity dump, Hempel 37700

- 30-40, 28.3K DOT117R, DOT117J, DOT111 Tanks needed off of UP in Iowa for 2-3 years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 years. Cars are needed for use in Crude service.

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in the Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 20-30, Open Top Hoppers needed in the Northeast. Cars are needed for use in Aggregate service. Gravity dump

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 80, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean long-term Lease.

- 50, 33K, 340W Pressures located off of in Moving. Cars were last used in Propane. 1-year lease

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1-Year Lease; Free Move on BN

Sales Offers

- 20, Refer Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

- 40, 29K, DOT111 Tanks located off of CN in Canada. C/I; Free Move CN

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website