“I, not events, have the power to make me happy or unhappy today. I can choose which it shall be. Yesterday is dead, tomorrow hasn’t arrived yet. I have just one day, today, and I’m going to be happy in it.”

-Groucho Marx

Jobs Update

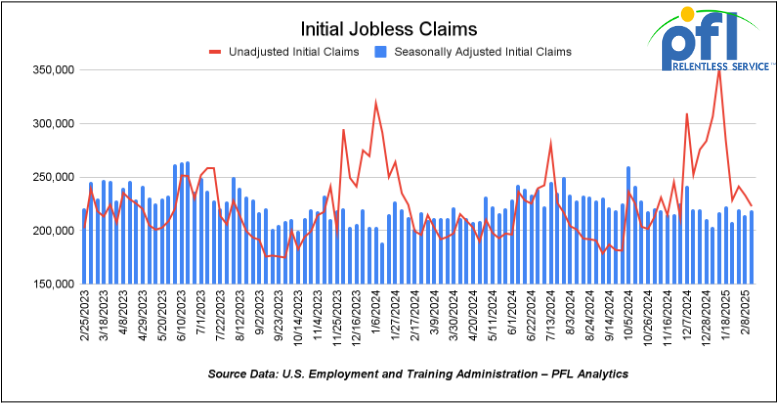

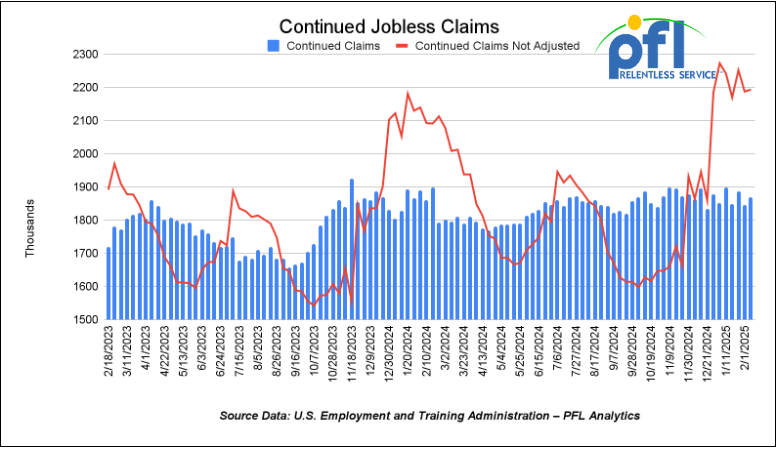

- Initial jobless claims seasonally adjusted for the week ending February 15th came in at 219,000, up 5,000 people week-over-week.

- Continuing jobless claims came in at 1.869 million people, versus the adjusted number of 1.845 million people from the week prior, up 24,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -748.63 points (-1.69%) and closing out the week at 43,428.02, down -1,118.06 points week-over-week. The S&P 500 closed lower on Friday of last week, down -104.39 points, and closed out the week at 6,013.13, down -101.5 points week-over-week. The NASDAQ closed lower on Friday of last week, down 438.36 points (-2.19%), and closed out the week at 19,524.01, down -502.77 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 43,794 this morning up 308 points from Friday’s close.

Crude oil closed lower on Friday of last week, and lower week over week.

West Texas Intermediate (WTI) crude closed down -$2.08 cents per barrel (-2.87%), to close at $70.40 per barrel on Friday of last week, down -$0.34 per barrel week over week. Brent traded down $2.05 cents USD per barrel (-2.68%) on Friday of last week, to close at $74.43 per barrel, down -$0.31 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for April delivery settled on Friday of last week at US$12.90 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$59.28 per barrel.

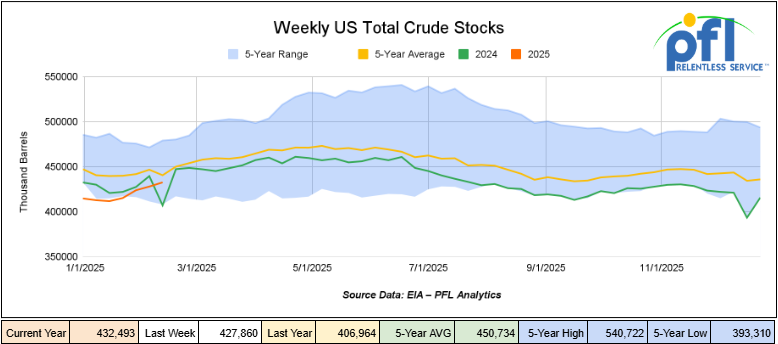

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.6 million barrels week-over-week. At 432.5 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

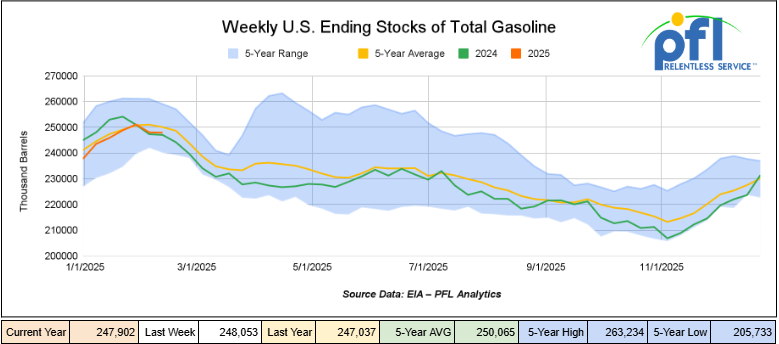

Total motor gasoline inventories decreased by 200,000 barrels week-over-week and are 1% below the five year average for this time of year.

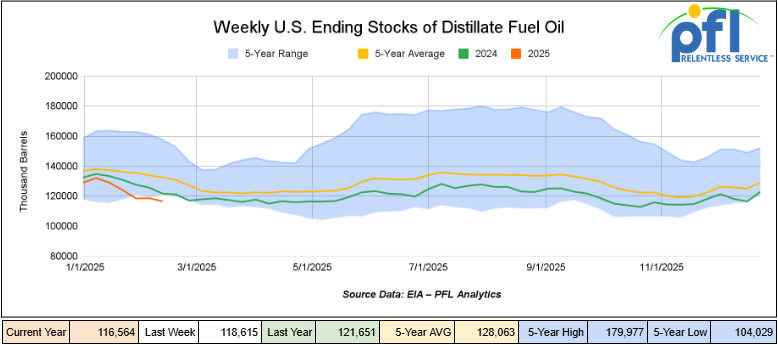

Distillate fuel inventories decreased by 2.1 million barrels week-over-week and are 12% below the five-year average for this time of year.

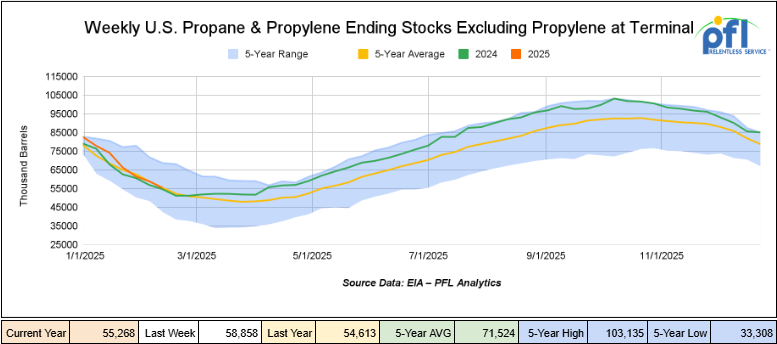

Propane/propylene inventories decreased by 3.6 million barrels week-over-week and are slightly below the five-year average for this time of year.

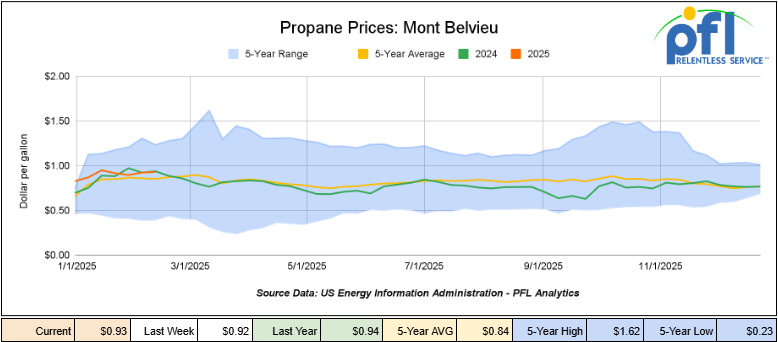

Propane prices closed at 93 cents per gallon on Friday of last week, up 1 cent per gallon week-over-week, but down 1 cent year-over-year.

Overall, total commercial petroleum inventories increased by 200,000 barrels during the week ending February 14th, 2025.

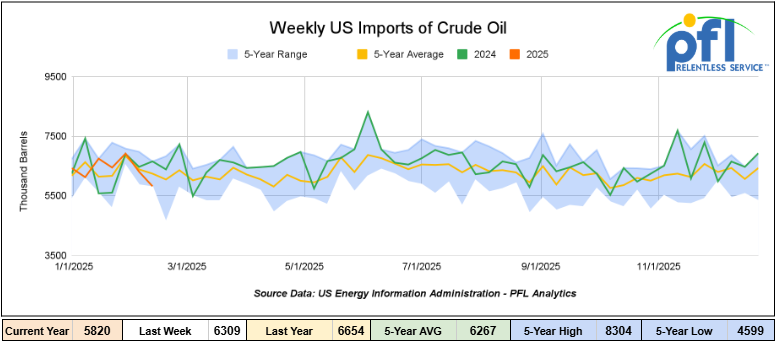

U.S. crude oil imports averaged 5.8 million barrels per day during the week ending February 14th, 2025, a decrease of 488,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 0.6% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 346,000 barrels per day, and distillate fuel imports averaged 267,000 barrels per day. during the week ending February 14th, 2025.

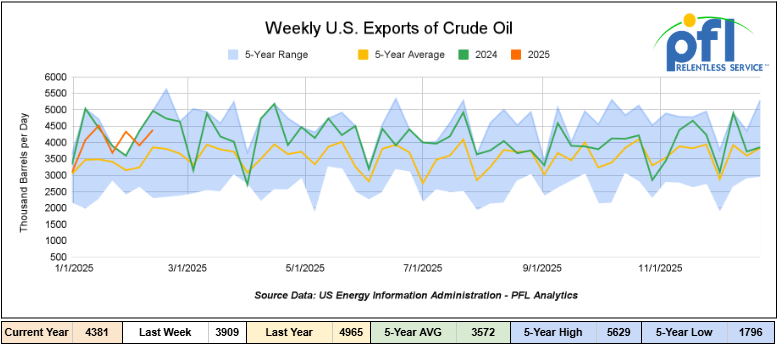

U.S. crude oil exports averaged 4.381 million barrels per day during the week ending February 14th, 2025, an increase of 472,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.077 million barrels per day.

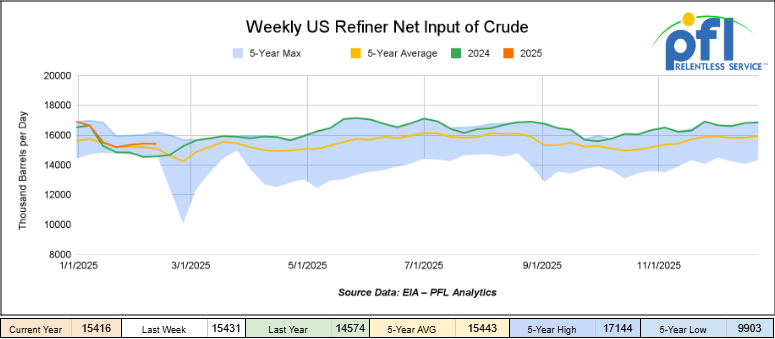

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending February 14, 2025, which was 15,000 barrels per day less week-over-week.

WTI is poised to open at $70.48, up 8 cents per barrel from Friday’s close

North American Rail Traffic

Week Ending February 19th, 2025.

Total North American weekly rail volumes were up (0.71%) in week 8, compared with the same week last year. Total carloads for the week ending on February 19 were 330,518, down (-4.25%) compared with the same week in 2024, while weekly intermodal volume was 336,526, up (6.12%) compared to the same week in 2024.

10 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest increase came from Intermodal Units which was up (6.12%) while the largest decrease was from Grain which was down (-11.17%)

In the East, CSX’s total volumes were up (1.01%), with the largest decrease coming from Metallic Ores and Metals (-11.96%) while the largest increase came from Nonmetallic Minerals (9.12%). NS’s volumes were up (1.19%), with the largest increase coming from Petroleum and Petroleum Products (6.4%) while the largest decrease came from Coal (-12.54%).

In the West, BN’s total volumes were up (1.79%), with the largest increase coming from Petroleum and Petroleum Products (16.74%) while the largest decrease came from Other (-26.54%). UP’s total rail volumes were up (1.71%) with the largest increase coming from Intermodal (12.72%), while the largest decrease came from Motor Vehicles and Parts (-17.31%).

In Canada, CN’s total rail volumes were down (-12.04%) with the largest increase coming from Other, up (+80.21%) while the largest decrease came from Intermodal (-33.7%). CP’s total rail volumes were down (-2.07%) with the largest increase coming from Motor Vehicles and Parts (+66.57%), while the largest decrease came from Forest Products (-20%).

KCS’s total rail volumes were up (11.77%) with the largest increase coming from Farm Products (+48.34%), while the largest decrease came from Other (-33.33%).

Source Data: AAR – PFL Analytics

Rig Count

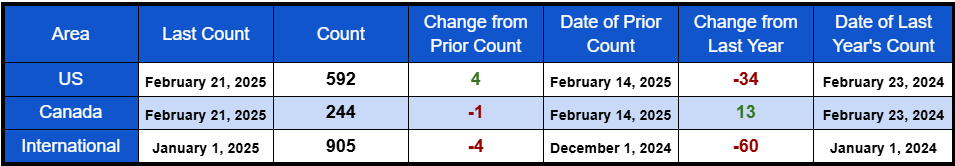

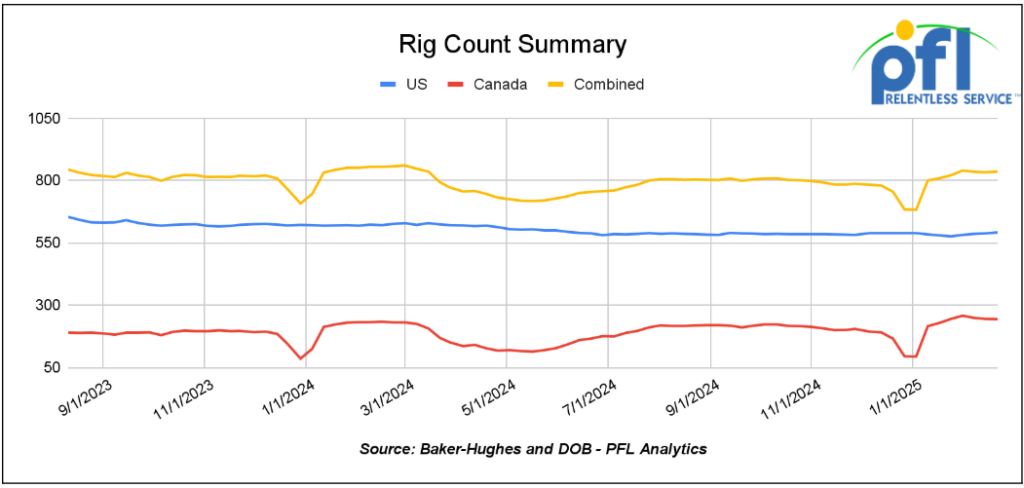

North American rig count was up by 3 rigs week-over-week. U.S. rig count was up by 4 rigs week over week but down by -34 rigs year-over-year. The U.S. currently has 592 active rigs. Canada’s rig count was down -1 rig week-over-week, but up by 13 rigs year-over-year, and Canada’s overall rig count is 245 active rigs. Overall, year over year we are down by -21 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are Watching Tariffs with Canada

At PFL, as most of our readers know, we have offices on both sides of the border and have been working to expand our presence in Canada. We do not claim to understand every aspect of the battle that is brewing. It is true that Justin Trudeau must go and if a conservative government is not elected in Canada’s next election (now expected to take place in April) Canada is in significant trouble. Canada is at a historic moment in its relationship with the United States. The Donald Trump presidency poses threats to the Canadian economy and sovereignty through tariffs and repeated calls by the president for Canada to become the fifty-first state. The everyday Canadian who gets their news from CBC does not know what this means, and there are millions of vulnerable Canadians worried about their jobs and feeding their families.

While it is true that Canada booed the U.S. National Anthem during a Hockey game in Montreal and a basketball game in Toronto and another Hockey game in Vancouver, it is also true that not so long-ago Canadians at a Hockey game sang the American National Anthem when the sound system went out and the person singing the American National Anthem was not able to do so. Booing of the American National Anthem is a new thing and not very Canadian to say the least, hopefully that is the end of it!

At the end of the day, Canadian business leaders and everyday Canadians are trying to reduce the country’s economic dependence on the United States by increasing trade within Canada (believe it or not, in Canada they actually have tariffs between their Provinces that promotes more north south trade – it is the craziest system they have going on up there) and expanding trade to partners beyond the U.S. This is the top political agenda. It makes sense at the end of the day – when you only have one customer you don’t have negotiating power and Trump is the best negotiator out there.

President Trump’s threats and proposed actions have shaken Canada to its core – not just the political and business elite. The administration is no longer all in on trade, no longer viewed as an all-in partner with Canada. Trump said that he does not need anything Canada produces, as it is all here in the U.S. and can be produced and consumed here. Meanwhile, Canadians are asking – are tariffs about the border, fentanyl, trade deficits, revenue for U.S. coffers, renegotiating USMCA, annexing Canada? Or is the President’s knife, repeatedly held to Canada’s neck to extract concessions across all these issues and more? No one knows the art of this deal, but complicity for Canada at this point will not work for them!

In our mind, it is simple for Canada – negotiate the best deal you can right now, eliminate all the ridiculous interprovincial trade tariffs within the country itself, fire the Liberal Government, get rid of their own version of the green new deal, build pipelines and mines and diversify Canada’s markets this is economics 101, folks! The stronger Canada gets the better off the U.S. will be in the long run and maybe that is the message the President is trying to send to Canada. If Canada does these things, rail will explode here in North America and trade will continue in a mutually beneficial way.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,932 from 29,947 which was a loss of 15 rail cars week-over-week. Canadian volumes rose. CPKC’s shipments were higher by +2.4% week over week, CN’s volumes were higher by +9.3% week-over-week. U.S. shipments were mostly lower. The CSX had the largest percentage decrease and was down by -8.7%. The BN was the sole gainer and was up by 25.8%.

We Continue to Watch Renewables

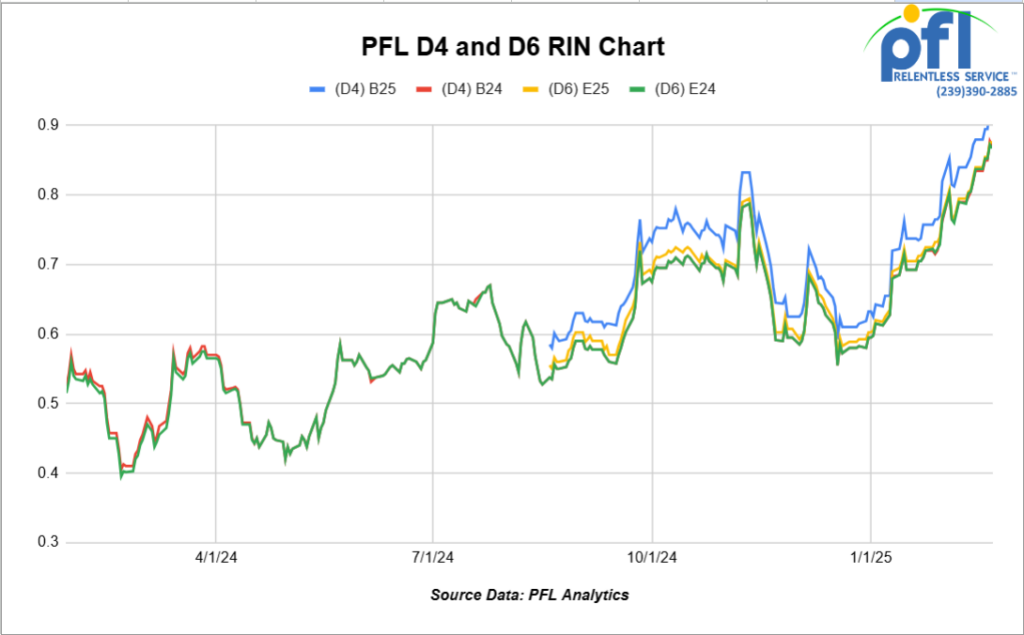

Folks, a lot of headwinds are going on out there with renewables such as renewable diesel, biodiesel, ethanol, and associated incentives for the industry such as RINS and LCFS Credits.. Last week, the Renewable Fuels Association held its annual conference in Nashville and key topics that were discussed included the uncertainty of 45Z, what the Trump administration will do with his approach regarding small refiner exceptions, the necessity for some to have the Biofuels Blenders credit extended and the desire for the industry to have E15 made available to consumers all year long.

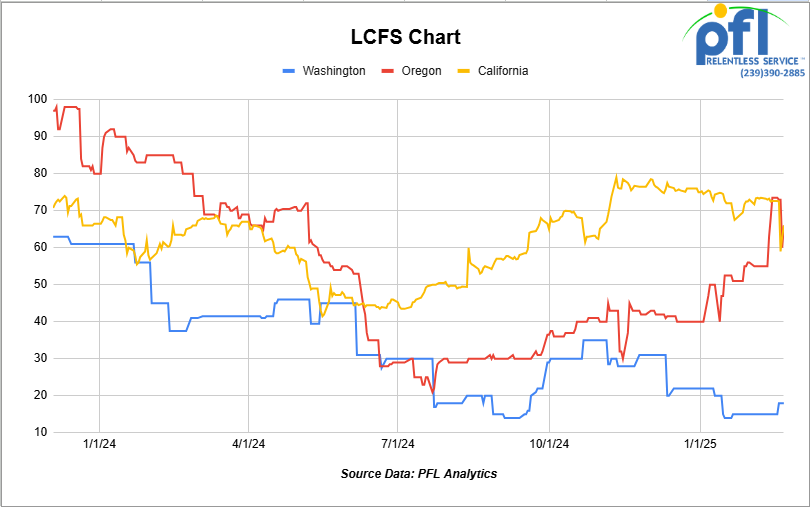

On late Tuesday of last week, during the conference the California Air Resources Board told the market in the state’s Low Carbon Fuel Standard (LCFS) program that amendments to the program passed by the agency in late 2024 have been rejected by the Office of Administrative Law. (“OAL”)

In a notice to market participants, the agency said it recently received a notice of disapproval from OAL due to “inconsistencies of specific regulatory amendment provisions” identified upon review in recent months.

The agency said it anticipates that OAL will offer more information on its rationale for the decision soon, at which point CARB will have 120 days to rewrite and resubmit the amendment provisions accordingly.

CARB has been at work amending the program since 2023, when it proposed a variety of new targets for the LCFS that extend to 2045.

The board proposed in August 2024 to revise them, settling on a 22.75% reduction in the carbon intensity of the state’s transportation fuels, up from the currently scheduled target of 13.75%. From there, the targets would increase by 1.45% each year, rising to 24.2% in 2026, 25.65% in 2027, 27.1% in 2028 and 28.55% in 2029 before reaching a 30% target in 2030.

CARB outlined a much faster effort to reduce carbon emissions beyond 2030, starting with 34.5% in 2031 before adding 4.5% each year until ultimately reaching a 90% target reduction from the 2010 baseline in 2045 and beyond.

News of the rejection affected LCFS credit prices, and the market sold off immediately with LCFS prices closing at $58 per MT down $14.50 per MT day over day. The market did rebound by the end of the week on profit taking closing out the day and the week at $66 per MT down $6.50 per MT week over week.

We are watching Rail Car Rising Prices

The railcar industry is facing significant financial pressures as it enters 2025, with initial optimism for railcar orders fading due to high interest rates, trade uncertainties, and rising material and labor costs. These factors have driven up railcar replacement expenses, reshaping leasing dynamics and creating strategic opportunities for both railcar owners and lessees.

Diminishing Railcar Orders:

At the start of 2025, many expected a rise in railcar orders, but that optimism is fading fast. Throughout 2024, inquiries slowed as elevated rates held steady, and with ongoing trade tensions, customers are now prioritizing committed capital projects and managing end-of-life railcars the best they can. The one bright spot- tank cars. The backing for what is perceived by regulators as safer DOT-117 tank cars, demand remains strong. Companies like Greenbrier still expect to fill open production slots in 2025, despite the current slowdown.

Rising Material Costs and Tariffs:

Steel price volatility continues to challenge manufacturers. Scrap metal prices have surged over 40% recently – tariff concerns have added further strain.

Rising energy prices and supply chain disruptions have further exacerbated material costs. Increased demand for key inputs like aluminum and copper, coupled with logistical bottlenecks, have pushed up prices across the board. Labor shortages, particularly among skilled trades like welders and machinists, have driven wages higher, adding another layer of cost pressure.

If steel tariffs are implemented, production costs will rise, likely reducing new orders and pushing buyers toward the secondary market. Less than 10% of railcars produced domestically, tariffs will drive secondary market prices. Reshoring production faces hurdles due to skilled labor shortages and infrastructure.

Opportunities for Railcar Owners and Lessees:

While rising costs present challenges, they also create opportunities for both railcar owners and lessees. Owners can capitalize on higher lease rates, especially for well-maintained older cars that offer a cost-effective alternative to new builds. For lessees, the current environment underscores the value of flexible leasing strategies, enabling them to secure needed equipment without the capital burden of purchasing new railcars. Shifting market dynamics, such as increased secondary market prices and evolving demand across rail sectors, present both risks and opportunities depending on fleet needs.

Strategic Solutions from PFL:

For businesses navigating these shifting dynamics, PFL can help provide flexible leasing solutions designed to help customers adapt. With new car orders slowing, material costs rising, and potential tariffs threatening to tighten the market further, PFL can present smart, cost-effective alternatives.

PFL’s expansive network ensures access to both newer and well-maintained older cars, helping clients avoid the steep costs of new builds. Our team stays on top of market trends – from growing demand for DOT-117 tank cars to fluctuating scrap metal prices – so we can guide customers toward strategic, informed decisions.

PFL works to secure competitive terms and tailor leasing options that align with each customer’s operational needs. Whether you’re seeking short-term flexibility or long-term stability, PFL is equipped to help you optimize your fleet and seize emerging opportunities as they arise.

We are watching The Strategic Petroleum Reserves

The Strategic Petroleum Reserve (SPR), the world’s largest supply of emergency crude oil was established primarily to reduce the impact of disruptions in supplies of petroleum products and to carry out obligations of the United States under the international energy program. The federally owned oil stocks are stored in huge underground salt caverns at four sites along the coastline of the Gulf of Mexico. The sheer size of the SPR has authorized storage capacity of 714 million barrels and makes it a significant deterrent to oil import cutoffs and a key tool in foreign policy. When President Joe Biden took office the SPR reserves stood at 634.9 million. By the time Joe Biden left office, the SPR stood at 393.8 or only 55% of capacity.

President Donald Trump has pledged to rapidly restock the SPR to enhance energy security and stabilize oil markets. This plan may have impacts on rail transport, crude-by-rail operations, and the broader oil and gas industry.

Increased domestic oil production, particularly from U.S. shale regions, could boost demand for rail transport due to pipeline capacity constraints. While rail operators may benefit, congestion on key corridors could be challenging. Higher crude prices are possible from the government purchases which might also increase fuel costs, affecting rail and logistics companies and bulk commodity transport industries.

The SPR enhances national energy security by creating a buffer against supply disruptions. A well-stocked SPR allows for future price stabilization, potentially easing costs for consumers and fuel-dependent industries. It was created as a result of the Arab Oil Embargo on the US in the early 70s to mitigate future supply disruptions from other countries. The previous administration drained the SPR for political reasons around election time and that should never have happened. We do feel it is a great idea to restock and are glad the current administration is headed in that direction. We are keeping our eyes on this one, stay tuned to PFL.

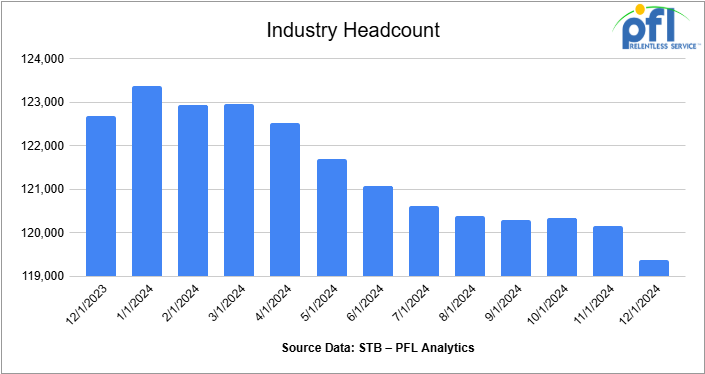

We are watching Class 1 Industry Headcount

Class I railroads employed 119,373 workers in the United States in December 2024, a -0.66% decrease from November 2024’s count of 120,169 and a -2.69% year-over-year decrease from December 2023’s total of 122,677, according to Surface Transportation Board data.

Three of the six employment categories posted month-over-month increases between November and December. These were Executives, officials, and staff assistants, up 0.28% to 7,865 workers; Professional and Administrative, up 1.29% to 9,756 workers; and Transportation (other than train and engine), up 0.08% to 5,047 workers.

The categories that posted month-over-month decreases were Maintenance of Way and Structures, down -1.52% to 28,255 workers; Maintenance of Equipment and Stores, down -0.56% to 17,061 workers; and Transportation (train and engine), down -0.80% to 51,389 workers.

Year over year, only one category posted an employment gain, which was Transportation (other than train and engine), up 1.86%.

Categories that registered year-over-year decreases in December were Executives, officials, and staff assistants, down -4.34%; Professional and Administrative, down -6.01%; Maintenance of Way and Structures, down -0.02%; Maintenance of Equipment and Stores, down -6.30%; and Transportation (train and engine), down -2.40%.

We are watching Key Economic Indicators

Industrial Output & Capacity Utilization

Manufacturing accounts for approximately 75% of total output. Manufacturing output in January was up 0.51% from December 2024.Capacity utilization is a measure of how fully firms are using the machinery and equipment. Capacity Utilization was up 0.39% from December in January.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, GP Tanks needed off of various class 1s in various locations for 1-5 years.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website