It’s only when the tide goes out that you discover who’s been swimming naked.

Warren Buffett

The Latest and Greatest on the Coronavirus

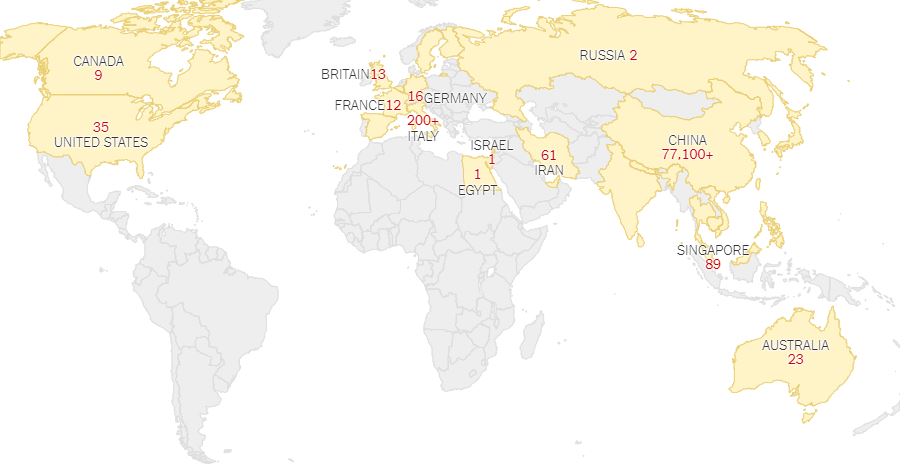

- China’s National Health Commission reported 648 new confirmed cases and 97 additional deaths as of February 22, 2020.

- China’s Hubei province reported 630 new confirmed cases, and 96 additional deaths, as of February 22, 2020 also.

- South Korea’s new case jumped by 169, bringing the country’s total to 602 infected, according to the country’s Centers for Disease Control and Prevention. It also reported a sixth death.

- Infections in Italy saw a sharp spike, surging to more than 100 cases by Saturday.

On the economic side of things, global demand destruction is in full force. China’s demand for crude has dropped by at least 1.5 million barrels a day and crude oil tankers are having to wait several days to unload and demurrage charges are building. Oil prices fell nearly 1% on Friday on renewed concerns about crude demand being pinched by the economic impact of the coronavirus outbreak, while leading producers appeared to be in no rush to curb output. LPG’s and LNG prices have collapsed and Qatar is delaying adding capacity.

The latest signs of infections outside the Hubei province epicenter in China spurred a selloff across financial markets, as G20 policymakers traveled to Saudi Arabia for talks on the global economy.

Some feel that we are dealing with the biggest demand shock since the financial crisis. In the latest evidence of the economic hit, U.S. business activity in both the manufacturing and services sectors has stalled in February.

World Health Organization (WHO) Director General, Tedros Adhanom Ghebreyesus, met with African officials from Geneva on Saturday morning to urge them to prepare for a potential spread of the coronavirus across Africa.

Just one case has been confirmed on the continent, but health officials fear the increasing global spread of the virus, especially to countries with less developed health-care systems.

The Who says it has shipped more than 30,000 sets of personal protective equipment to six countries in Africa and is set to ship 60,000 more sets to 19 countries in upcoming weeks. It has also provided online training courses to 11,000 African health workers, as well as advice to countries on how to conduct screening, testing and treatment.

Shifting topics, increased attention is on Canadian police forces now that Prime Minister Justin Trudeau ordered the enforcement of anti-blockade injunctions. It was reported that protesters who had been blockading a CN Rail line in Quebec, just south of Montreal, since Wednesday cleared out Friday night shortly after riot police arrived on scene ready to enforce an injunction to clear the tracks. However, the blockade of a critical east-west rail line on Tyendinaga territory remains in place — and it is reported that more protests are planned for March 20 along the borders of Manitoba. Saskatchewan Premier Scott Moe says that the protest must remain lawful and that transport routes cannot be disrupted by illegal blockades.

The barricades, including one on Tyendinaga Mohawk Territory in eastern Ontario, are in response to a move by the RCMP to clear protesters who had been blocking access to a pipeline worksite on Wet’suwet’en territory in northern British Columbia.

‘‘The impact is huge,’’ says Atlantic Provinces Trucking Association of rail the rail shutdown.

Trudeau said the inconvenience to Canadians has gone on long enough, given that the blockades have halted rail lines for weeks. “Let us be clear: all Canadians are paying the price. Some people can’t get to work, others have lost their jobs,” he told a news conference on Friday. “Essential goods cannot get where they need to go.“ Let’s hope folks this is the end of the rail protests in Canada!

Total North American rail volumes were down 6.9% year over year in week 7 (U.S. -8.6%, Canada -3.8%, Mexico +4.9%), resulting in quarter to date volumes that are down 4.3% (U.S. -6.2%, Canada -1.1%, Mexico +10.9%). 6 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-7.9%), coal (-21.2%), grain (-16.2%) and nonmetallic minerals (-7.5%). The largest increases came from petroleum (+14.8%), metallic ores & metals (+3.5%) and motor vehicles & parts (+3.8%).

In the East, CSX’s total volumes were down 5.6%, with the largest decreases coming from coal (-20.4%) and intermodal (-5.5%). NS’s total volumes were down 11.7%, with the largest decreases coming from intermodal (-11.7%), coal (-28.8%) and chemicals (-14.4%). The largest increase came from petroleum (+43.5%).

In the West, BN’s total volumes were down 5.5%, with the largest decreases coming from coal (-14.2%), intermodal (-3.9%), stone sand & gravel (-26.5%) and grain mill (-22.4%). UP’s total volumes were down 10.1%, with the largest decreases coming from intermodal (-14.8%), coal (-30.4%), grain (-23.2%) and stone sand & gravel (-14.9%). The largest increase came from petroleum (+45.7%).

In Canada, CN’s total volumes were down 14.2% due to the illegal blockades that have caused the company to temporarily shut down its Eastern network. The largest decreases came from intermodal (-24.3%) and grain (-40.8%). RTMs were down 8.0%. CP’s total volumes were up 18.0%, with the largest increases coming from intermodal (+18.0%) and petroleum (+76.2%). RTMs were up 22.1%.

KCS’s total volumes were up 7.3%, with the largest increases coming from intermodal (+13.4%) and petroleum (+47.7%).

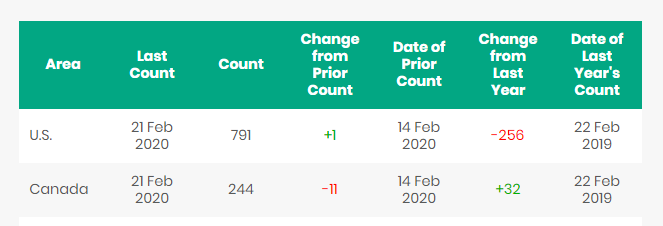

North American Rig count is down 10 rigs week over week with the U.S. gaining 1 rig and Canada losing 11 rigs week over week. Year over year we are down 224 Rigs collectively.

North American Rig Count Summary

The Surface Transportation Board (STB) has released January headcount data for the U.S. rails. For the industry as a whole, declines accelerated with January headcount down 12.4% year over year versus December headcount that was down 10.9% year over year. The most substantial year over year declines occurred at the NS and the UP.

Dan Elliott former Chairman of the STB sent us a PowerPoint presentation about recent actions by the STB about railroads unfair changes to their demurrage tariffs. The information Dan sent can be viewed at the link below and may be helpful if you are having troubles with railroad demurrage charges.

Click here to download.PFL is offering: 340Ws for long and short term lease, 117Rs last in diesel service, various box cars for lease, 31.8’s clean and last in refined products and 25.5K 117Js coiled and insulated. Call PFL for details today!

PFL is seeking: 23.5Ks and 25.5Ks for fuel oil products, 117s with magnetic gauging devices for lease, 89 ft flat cars for purchase, 100 mil gons for short term lease, 117Js last in ethanol, and 4750s for use in coke service.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|