“A subtle thought that is in error may yet give rise to fruitful inquiry that can establish truths of great value.”

-Isaac Asimov

Jobs Update

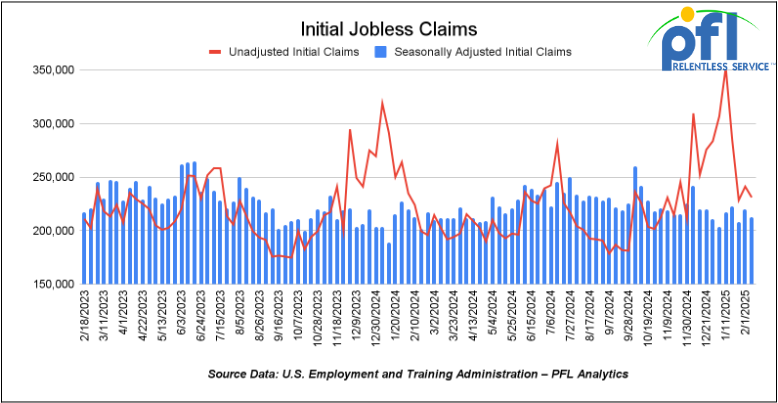

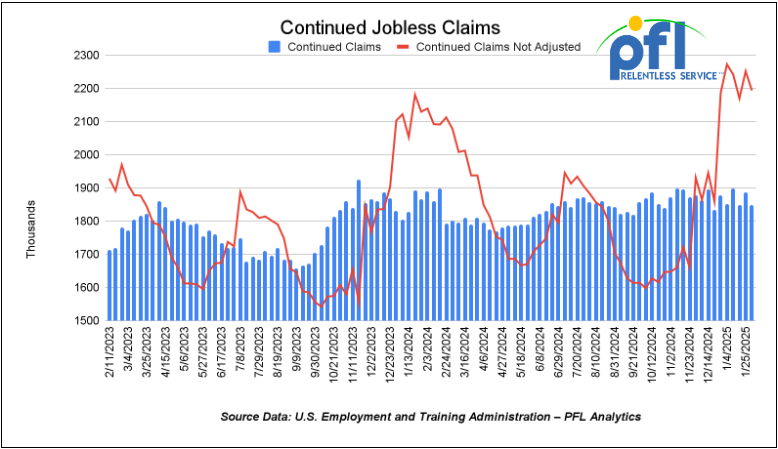

- Initial jobless claims seasonally adjusted for the week ending February 8th came in at 213,000, down -7,000 people week-over-week.

- Continuing jobless claims came in at 1.886 million people, versus the adjusted number of 1.85 million people from the week prior, up 36,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed lower on Friday of last week, down -165.35 points (-0.37%) and closing out the week at 44,546.08, up 242.68 points week-over-week. The S&P 500 closed lower on Friday of last week, down -0.44 points, and closed out the week at 6,114.63, up 88.64 points week-over-week. The NASDAQ closed higher on Friday of last week, up 81.13 points (0.42%), and closed out the week at 20,026.77, up 503.37 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 44,678 this morning up 43 points from Friday’s close.

Crude oil closed lower on Friday of last week, but mixed week over week.

West Texas Intermediate (WTI) crude closed down -$0.55 cents per barrel (-0.77%), to close at $70.74 per barrel on Friday of last week, down -$0.26 per barrel week over week. Brent traded down $0.28 cents USD per barrel (-0.37%) on Friday of last week, to close at $74.74 per barrel, up $0.08 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for March delivery settled on Friday of last week at US$13.15 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$57.90 per barrel.

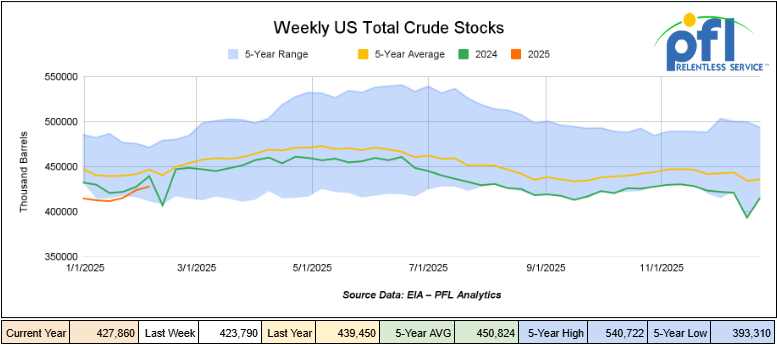

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.1 million barrels week-over-week. At 427.9 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

Total motor gasoline inventories decreased by 3 million barrels week-over-week and are 1% below the five-year average for this time of year.

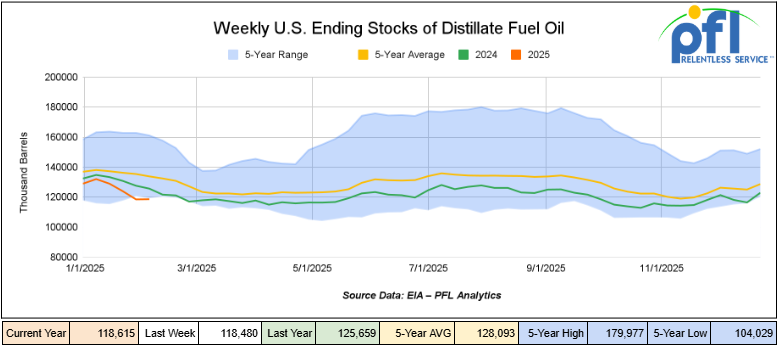

Distillate fuel inventories increased by 100,000 barrels week-over-week and are 11% below the five year average for this time of year.

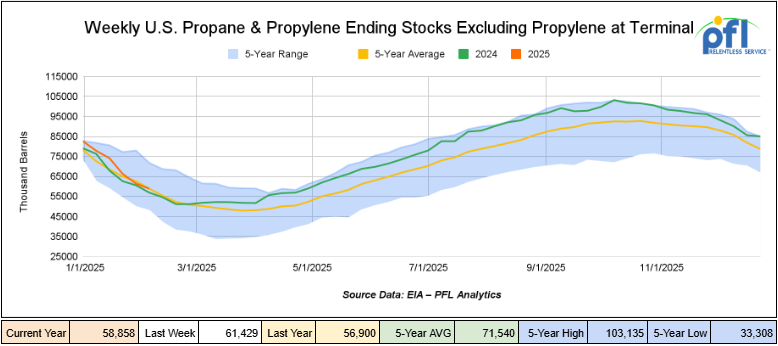

Propane/propylene inventories decreased by 2.6 million barrels week-over-week and are slightly below the five-year average for this time of year.

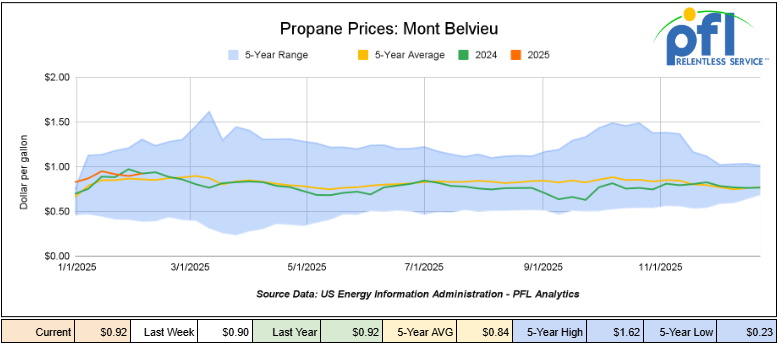

Propane prices closed at 92 cents per gallon on Friday of last week, up 2 cents per gallon week-over-week, but flat year-over-year.

Overall, total commercial petroleum inventories increased by 1.2 million barrels during the week ending February 7th, 2025.

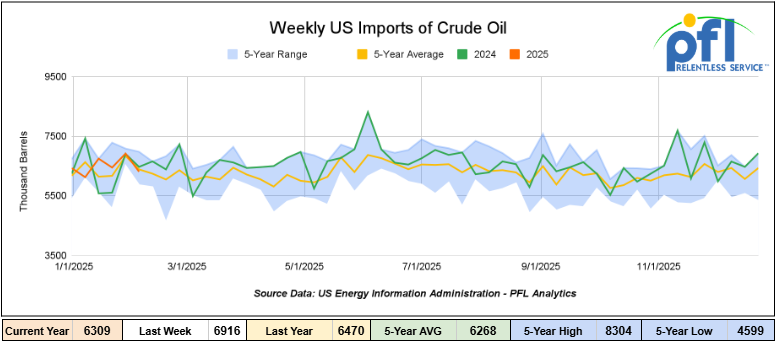

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending February 7th, 2025, a decrease of 606,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 7.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 319,000 barrels per day, and distillate fuel imports averaged 245,000 barrels per day during the week ending February 7th, 2025.

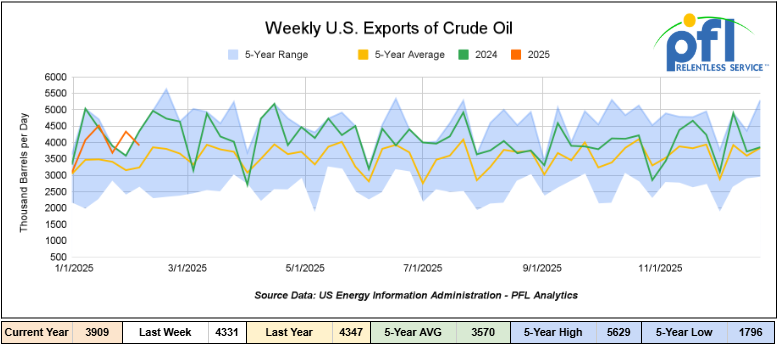

U.S. crude oil exports averaged 3.909 million barrels per day during the week ending February 7th, 2025, a decrease of 422,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.11 million barrels per day.

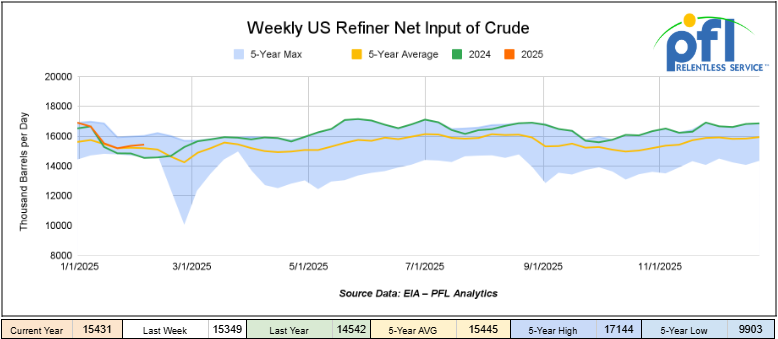

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending February 7, 2025, which was 82,000 barrels per day more week-over-week.

WTI is poised to open at $71.92, up $1.18 per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 12th, 2025.

Total North American weekly rail volumes were up (2.1%) in week 7, compared with the same week last year. Total carloads for the week ending on February 12 were 337,759, down (-3.61%) compared with the same week in 2024, while weekly intermodal volume was 355,427, up (8.2%) compared to the same week in 2024.

6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest increase came from Intermodal Units which was up (8.2%) while the largest decrease was from Metallic Ores and Metals which was down (-10.63%)

In the East, CSX’s total volumes were down (-1.22%), with the largest decrease coming from Coal Products (-17.04%) while the largest increase came from Grain Products (17.04%). NS’s volumes were up (3.06%), with the largest increase coming from Petroleum and Petroleum Products (7.44%) while the largest decrease came from Forest Products (-7.4%).

In the West, BN’s total volumes were up (3.15%), with the largest increase coming from Intermodal (10.67%) while the largest decrease came from Metallic Ores and Metals (-20.27%). UP’s total rail volumes were up (7.89%) with the largest increase coming from Other (19.62%) while the largest decrease came from Motor Vehicles and Parts (-13.04%).

In Canada, CN’s total rail volumes were down (-10.21%) with the largest increase coming from Other, up (+79.72%) while the largest decrease came from Intermodal (-135.22%). CP’s total rail volumes were down (-12.28%) with the largest increase coming from Motor Vehicles and Parts (+36.76%), while the largest decrease came from Grain (-28.66%).

KCS’s total rail volumes were up (21.52%) with the largest increase coming from Metallic Ores and Metals (+69.47%) while the largest decrease came from Coal (-5.69%).

Source Data: AAR – PFL Analytics

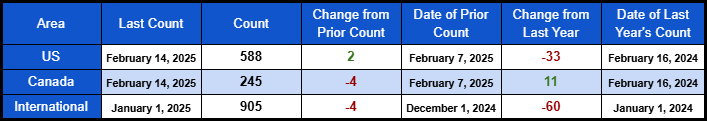

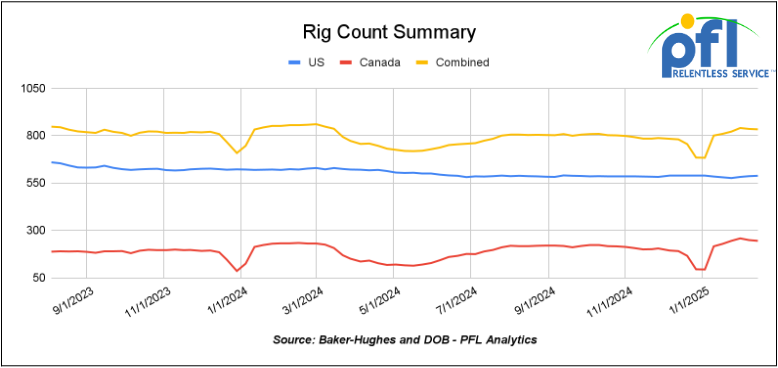

Rig Count

North American rig count was down by -2 rigs week-over-week. U.S. rig count was up by 2 rigs week over week and down by -33 rigs year-over-year. The U.S. currently has 588 active rigs. Canada’s rig count was down -4 rigs week-over-week, and up by 11 rigs year-over-year, and Canada’s overall rig count is 245 active rigs. Overall, year over year we are down by -22 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,947 from 29,459 which was a loss of 512 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -6.5% week over week, CN’s volumes were lower by -4.2% week-over-week. U.S. shipments were mostly lower. The BN had the largest percentage decrease and was down by -19.5%. The CSX was the sole gainer and was up by 4.2%.

We are watching Natural Gas and NGL’s

Natural gas prices have been steadily climbing from recent lows, driven by a combination of factors including increased electricity demand from AI-powered data centers, greater reliance on natural gas-fired generation, and a growing export market. These shifts are also affecting rail traffic as more Natural Gas Liquids (NGLs) are extracted and transported.

Rising Natural Gas Prices and Demand Factors

Following a period of decline, natural gas prices have rebounded and inventories have shrunk as consumption rises. U.S. natural gas stockpiles have now dropped below the five-year average, reinforcing the tightening supply. Working gas in storage was 2,297 bcf as of Feb. 7, 2025, a net decrease of 100 bcf week over week. Stocks were 248 bcf less than last year at this time and 67 bcf below the 5-year average of 2,364 bcf.

A major factor in demand growth is the rapid expansion of AI-driven data centers, which require massive amounts of electricity. Natural gas remains a critical part of the power generation mix, balancing grid reliability while complementing the push toward renewables. At the same time, LNG export capacity is expanding, with several new terminals expected to increase natural gas demand by 3-4 Bcf/d by the end of the year. With production growth remaining measured, the market is finding a better balance than in previous years of oversupply.

Keyera and AltaGas have announced a key move

Midstream operators such as Keyera and AltaGas are leading the way in processing and distributing NGLs. These companies are expanding their infrastructure to handle growing domestic and international demand. Operating in both Canada and the U.S., they serve as essential connectors in the supply chain, ensuring a steady flow of product-to-end markets.

NGLs and Rail Traffic are growing:

As natural gas production grows, the extraction of liquids such as natural gasoline, propane, and butane is increasing. This trend is boosting rail traffic, particularly for propane exports, which remain in high demand internationally.

- Natural Gasoline: A vital gasoline blending component, its production is rising alongside natural gas output.

- Propane: Used for heating and industrial applications, propane exports are increasing as overseas markets seek North American supply.

- Butane & Ethane: Key feedstocks for the petrochemical industry, both are experiencing steady growth.

Rail continues to be a critical transportation method for these commodities. In Canada, propane and butane primarily move by rail due to limited pipeline capacity. The U.S. also relies heavily on rail for NGL transport, particularly to feed export terminals and domestic distribution networks.

Efforts to introduce LNG transport by rail in the U.S. have faced legal setbacks. In January 2025, a federal court overturned a 2020 rule allowing LNG shipments by rail, citing inadequate safety and environmental risk assessments. This decision reinstates the previous prohibition, emphasizing concerns over potential hazards such as derailments and explosions.

Railcar implications:

The increase in NGL production is driving higher demand for specialized tank cars, making long-term leasing contracts more attractive to shippers and fleet managers. Seasonal market fluctuations and export schedules are also creating a need for additional railcar storage near production hubs and export terminals, giving storage providers a chance to expand their services. Rising utilization rates mean railcars will require more frequent maintenance and inspections, making repair facilities and service providers key players in ensuring compliance with hazardous materials regulations. At the same time, the continued expansion of pipeline networks and export terminals is reshaping transportation routes and altering capacity needs, requiring companies involved in rail to remain flexible and adjust their strategies to keep pace with evolving industry demands.

Looking Ahead: Rail and Energy Logistics in Transition

With natural gas and NGLs playing a growing role in the energy sector, rail remains a key mode of transportation. As production continues to climb and export demand strengthens, investment in rail infrastructure is expected to rise to accommodate increased traffic.

Infrastructure developments such as new pipelines are also helping to reduce bottlenecks, allowing for more efficient transportation of natural gas to export facilities. It is PFL’s belief that the ability of rail networks to adapt to shifting market dynamics will be critical in ensuring stable and efficient distribution of natural gas and NGLs across North America. Stay tuned to PFL, we are watching this one closely.

We are watching New Changes and Regulations for Freight Rail

The freight rail industry is facing a wave of legislative and regulatory changes that could reshape operations for railcar owners, lessors, and shippers. The Freight Railcar Act of 2025, reintroduced in the U.S. House of Representatives on February 11, 2025, proposes a 10% tax credit aimed at modernizing and expanding the nation’s freight car fleet.

The bill, first introduced in 2023, has garnered broad support with backing from Representatives Darin LaHood (R) and Brad Schneider (D), alongside 40 co-sponsors. Simultaneously, the Federal Railroad Administration (FRA) has implemented new safety regulations that will have long-term implications for the industry.

The proposed legislation seeks to encourage investment in the freight rail sector by offering financial incentives for the acquisition of new railcars, refurbishment of older units, and infrastructure improvements. Lawmakers hope the bill will drive efficiency, reliability, and environmental benefits by promoting the use of fuel-efficient, modern railcars. While the act enjoys bipartisan support, its passage remains uncertain, and industry stakeholders must remain vigilant as it moves through Congress.

Key Facts:

- North American Railcar Fleet: The current fleet comprises over 1.6 million railcars, with approximately 321,000 currently in storage.

- Economic Impact: In 2023, the railway supply industry contributed $75 billion to the U.S. GDP and directly provided 240,000 jobs nationwide.

- Tax Credit Details: The credit is capped at 1,000 new freight cars per taxpayer, with eligible railcars required to have been in service during the 48 months preceding the bill’s enactment.

In addition to potential tax credits, new FRA regulations that took effect on January 21, 2025, introduce strict manufacturing and component sourcing rules for freight railcars. Under the “Freight Car Safety Standards Implementing the Infrastructure Investment and Jobs Act,” all newly built freight cars must be produced by qualified manufacturers operating in approved facilities. This means companies that are state-owned enterprises or tied to foreign entities deemed a security risk will no longer be eligible to supply key components. These new sourcing restrictions aim to bolster national security and intellectual property protections.

By December 19, 2025, all newly manufactured freight railcars must comply with these regulations, a move that could have a profound impact on procurement strategies for railcar owners and lessors. The new rules may lead to shifts in supply chains, potentially increasing costs for shippers relying on leased equipment. As a result, businesses must assess their fleets and procurement plans to ensure compliance and cost-effectiveness in the changing regulatory environment.

Industry-Wide Implications Across North America:

The Freight Railcar Act of 2025 and the new FRA regulations will have significant effects across the entire North American rail industry:

- Fleet Modernization and Efficiency Gains: The tax credit incentivizes fleet upgrades, leading to improved fuel efficiency and increased cargo capacity. This could help reduce transportation costs and environmental impact.

- Supply Chain and Manufacturing Adjustments: With stricter sourcing requirements, domestic manufacturers may see increased demand, while companies relying on foreign suppliers will need to reassess their supply chains.

- Financial Impacts on Car Owners, Lessors, and Shippers: While the tax credit may help offset costs, compliance with new regulations could introduce higher expenses, potentially influencing lease rates and procurement strategies.

- Impact on Railroads and Freight Operations: A modernized railcar fleet could lead to fewer maintenance issues, improved reliability, and enhanced network efficiency, though the transition period may present operational challenges.

- Cross-Border Trade Considerations: Given the interconnected nature of U.S., Canadian, and Mexican freight rail networks, manufacturers and suppliers across North America may need to adjust their production processes to comply with new U.S. standards.

The freight rail industry is at a crossroads, with these legislative and regulatory measures poised to bring sweeping changes. Industry leaders should monitor the progress of the Freight Railcar Act of 2025 while adjusting to the FRA’s newly implemented safety standards. Proactive planning and adaptation will be critical to maintaining operational efficiency and financial stability in the years ahead.

We are watching Key Economic Indicators

Producer Price Index

In January, the Producer Price Index (PPI) increased by 0.4%, slightly above economists’ expectations of 0.3%, following a revised 0.5% rise in December. This was driven by a 0.6% rise in goods prices, with notable contributions from a 44% surge in egg prices and a 1.7% increase in energy costs, particularly diesel and heating oil. Annually, the PPI rose 3.5%, up from 3.3% in December, indicating a continued inflationary trend.

The Consumer Price Index (CPI) rose 0.5% in January, marking the largest monthly gain since 2023 and surpassing forecasts. This increase brought the annual inflation rate to 3.0%, up from 2.9% in December and 2.7% in November. Core CPI, which excludes food and energy, rose by 0.3% over the month, in line with the previous four-month average, bringing the annual core inflation rate to 3.3%. These inflationary pressures suggest that the Federal Reserve may maintain its current interest rate policy, keeping the benchmark rate at 4.25%-4.50% after a cumulative 100 basis points reduction since September 2024.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Round Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website