“Folks are usually about as happy as they make their minds up to be.”

― Abraham Lincoln

Jobs Update

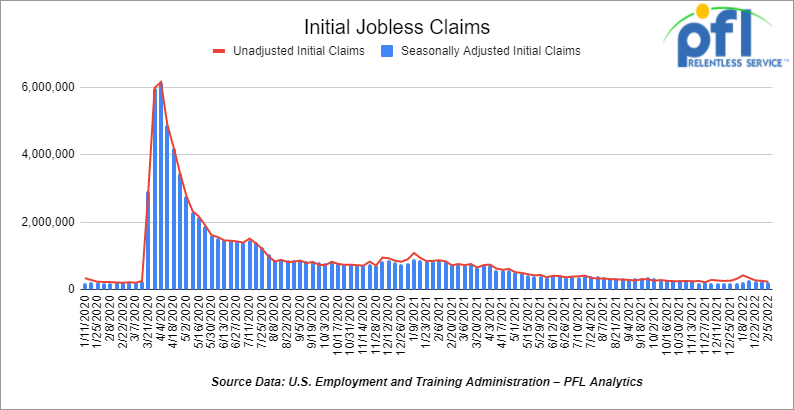

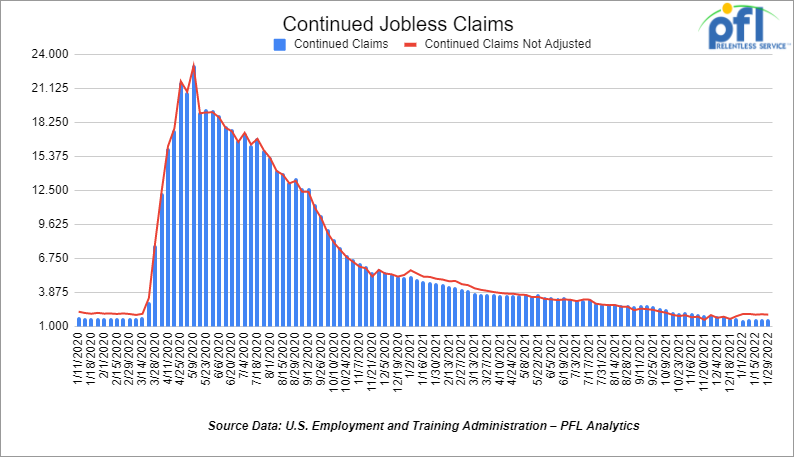

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending February 5th came in at 233,000, down -6,000 people week over week.

- Continuing claims came in at 1.621 million people versus the adjusted number of 1.621 million people from the week prior, flat week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -503.53 points (-1.43%), closing out the week at 34,738.06 points, down -351.68 points week over week. The S&P 500 closed lower on Friday of last week, down -85.44 points and closed out the week at 4,418.64, down 81.89 points week over week. The Nasdaq closed lower on Friday of last week, down -394.49 points (-2.78%) and closed out the week at 13,791.15, down -306.86 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,354 this morning down -270 points.

Oil closed higher on Friday of Last Week up week over week

It was a wild week last week for energy markets folks. Iran seemed to be the center of attention last week of all oil market news, as it was rumored that a deal could happen soon allowing Iranian oil to flow to markets and drove oil below $90 a barrel then news came that OPEC+ continues to underperform by the tune of 1 million barrels per day of supply to the market. The EIA got involved to try and get OPEC+ to produce more oil, India and other major consuming countries chimed in for help. The fact is, Iran’s crude would take several months to reach markets if a nuclear deal were agreed upon and the continued geopolitical tensions particularly in Russia where the Russian Government has even ordered their own people to leave the Russian Embassy in Ukraine spooked the market. As a result, crude closed higher.

West Texas Intermediate (WTI) crude closed up $3.22 (+3.6%) on Friday of last week to settle at $93.10 up 79 cents per barrel week over week, while Brent closed up $3.03 (+3.3%) to settle at $94.44 per barrel up $1.27 per barrel week over week.

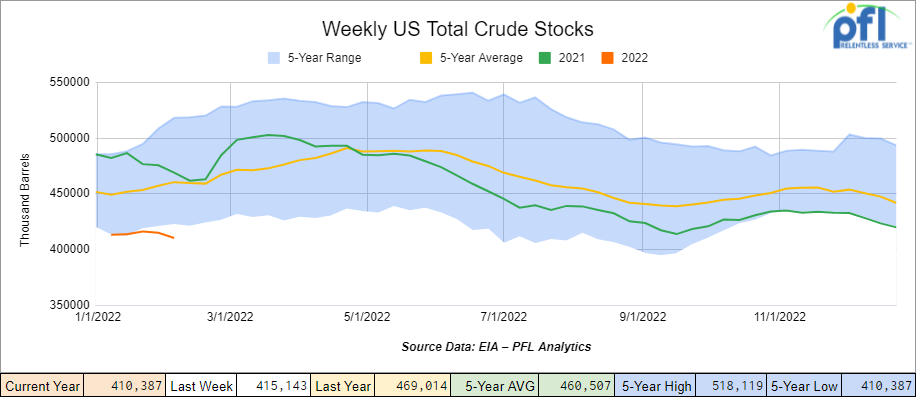

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.8 million barrels week over week. At 410.4 million barrels, U.S. crude oil inventories are 11% below the five-year average for this time of year.

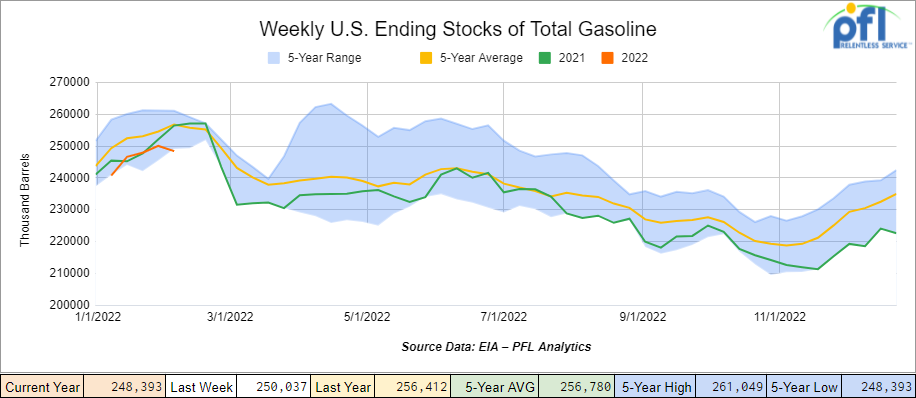

Total motor gasoline inventories decreased by 1.6 million barrels week over week and are 3% below the five-year average for this time of year.

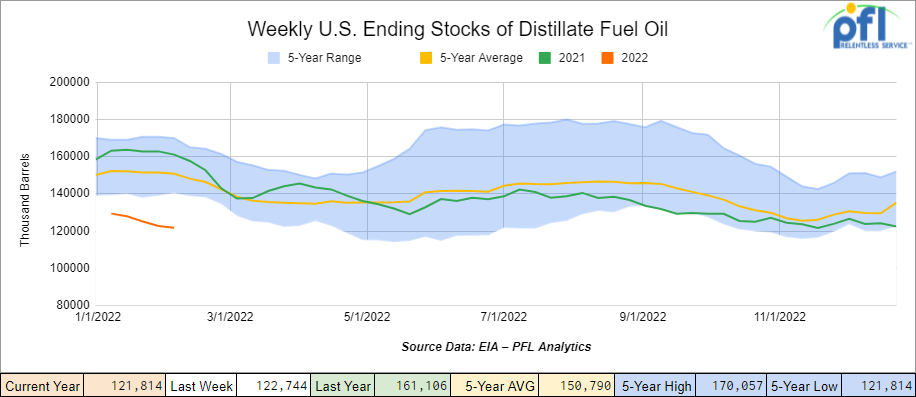

Distillate fuel inventories decreased by 900,000 barrels week over week and are 19% below the five-year average for this time of year.

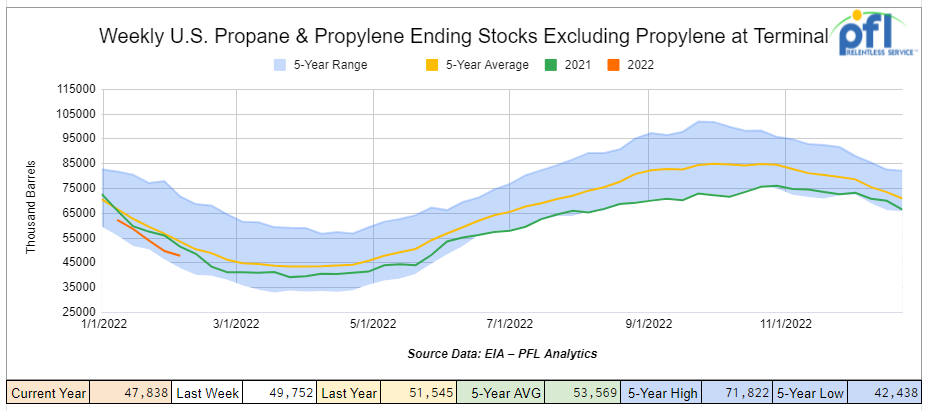

Propane/propylene inventories decreased by 1.9 million barrels week over week and are 11% below the five-year average for this time of year.

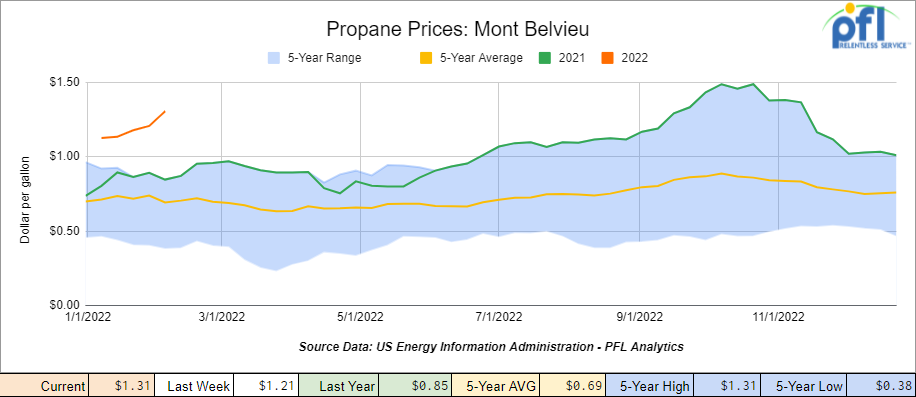

Propane prices continue to trade higher and were up 10 cents per gallon week over week closing at $1.31 per gallon, up 46 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 8.1 million barrels week over week.

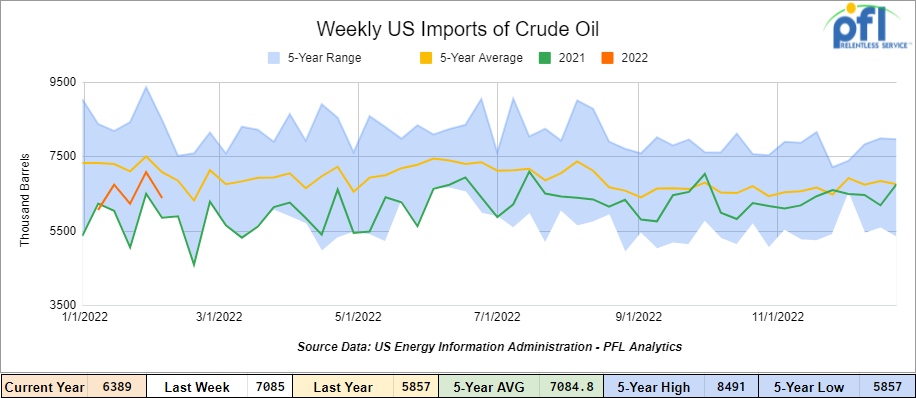

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending February 4th, 2022 and decreased by 700,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 12.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 514,000 barrels per day and distillate fuel imports averaged 440,000 barrels per day for the week ending February 4th 2022..

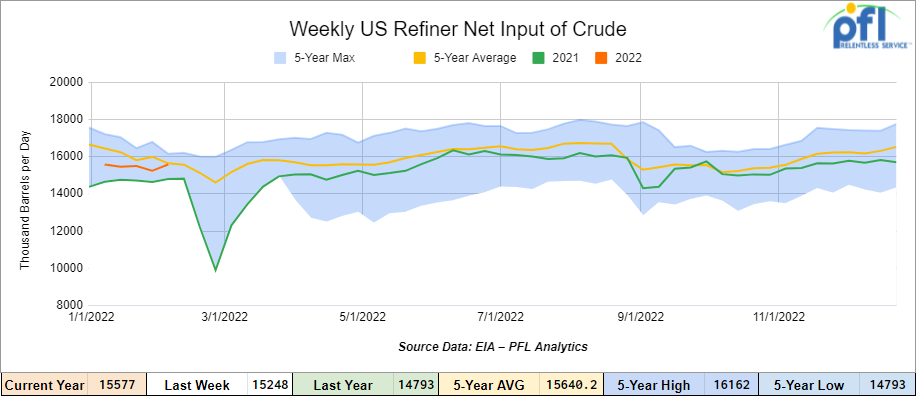

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending February 4, 2022 which was 328,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $93.20, up 10 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 7.6% year over year in week 5 (U.S. -7.6%, Canada -10.5%, Mexico +3.5%) resulting in quarter to date volumes that are down 10.3% year over year (U.S. -9.1%, Canada -15.2%, Mexico -1.4%). 10 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-10.6%), motor vehicles & parts (-26.0%) and grain (-16.5%). The only increase came from coal (+10.2%).

In the East, CSX’s total volumes were down 5.4%, with the largest decreases coming from coal (-21.5%) and motor vehicles & parts (-28.9%). NS’s total volumes were down 10.0%, with the largest decreases coming from intermodal (-9.7%), motor vehicles & parts (-32.7%) and grain (-35.6%).

In the West, BN’s total volumes were down 9.4%, with the largest decreases coming from intermodal (-14.3%) and grain (-15.1%). The largest increase came from coal (+10.3%). UP’s total volumes were down 4.6%, with the largest decreases coming from intermodal (-10.4%) and motor vehicles & parts (-33.6%). The largest increase came from coal (+33.1%).

In Canada, CN’s total volumes were down 10.0%, with the largest decreases coming from intermodal (-16.4%) and grain (-46.6%). The largest increase came from coal (+104.8%). Revenue per ton miles was down 13.7%. CP’s total volumes were down 3.6%, with the largest decrease coming from farm products (-80.2%). The largest increase came from intermodal (+5.5%). Revenue per ton miles was down 9.1%.

KCS’s total volumes were up 4.4%, with the largest increase coming from intermodal (+8.4%). The largest decrease came from petroleum (-19.9%).

Source: Stephens

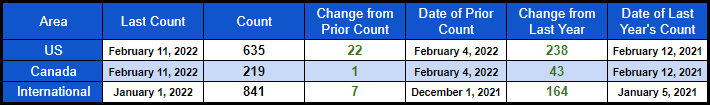

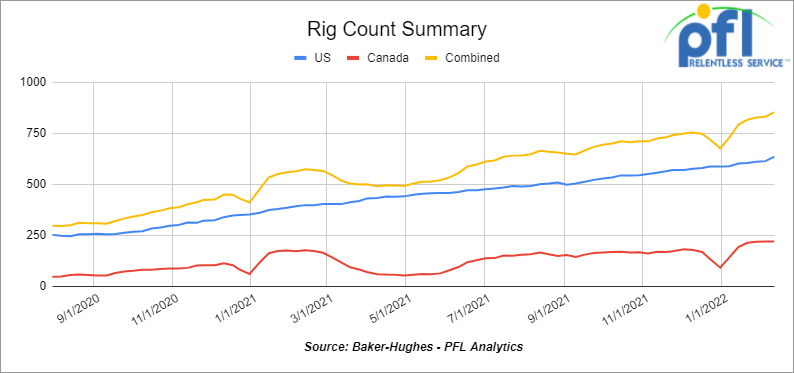

Rig Count

North American rig count is up by 23 rigs week over week. U.S. rig count was up by 22 rigs week over week and up by 238 rigs year over year. The U.S. currently has 635 active rigs. Canada’s rig count was up by 1 rig week over week and up by 43 rigs year over year and Canada’s overall rig count is 219 active rigs. Overall, year over year, we are up 281 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,168 from 23,742, a gain of 426 rail-cars week over week. Canadian volumes were lower: CP volumes fell by 14.3% and CN volumes fell by 7.2% week over week. U.S. volumes were mostly lower with the CSX having the largest percentage increase (up by 7.4%). The BN had the largest percentage decrease, down by 13.1%.

Canadian Truckers

Last week we reported that $10 million dollars was frozen by Go Fund Me due to pressure from the Canadian government to do so. Well, another platform took over the fundraising effort to provide fuel, food and other needs for the truckers protesting and quickly raised $8 million called GiveSendGo. A Canadian judge has issued an injunction blocking money for trucker protesters in Ottawa collected by GiveSendGo. The Ontario government petitioned for the order from Canada’s Superior Court of Justice, which was issued Thursday of last week. It prohibits “any and all parties with possession or control over these donations” from distributing the money. The criminal code allows for such an action against any “offense-related property,” meaning assets collected as part of or supporting illegal activity, according to a spokesperson for Ontario Premier Doug Ford. The Government of Canada has now made it illegal to support the truckers or demonstrators that want all COVID mandates dropped, people that want to end forced vaccinations and want to do away with mask mandates. GiveSendGo is apparently fighting back. Meanwhile, over the weekend police in Windsor Ontario Canada broke up the Ambassador Bridge Blockade. After an unsuccessful attempt to negotiate with protesters on Saturday, on Sunday Police started arresting people and towing vehicles. There is $300 million dollars of trade that crosses that bridge daily representing 8,000 trucks per day and the blockade was having an adverse effect on trade resulting in temporary closure of production lines in the auto industry on both sides of the border ($100 Million a day worth of auto parts). Meanwhile, in Ottawa the nation’s capital 4,000 people amassed in Ottawa to continue their protest in frigid temperatures. It seems to us the more the government of Canada freezes funds or makes laws to shut down the protests the more they intensify. Hopefully, with mandates and relaxation here in the U.S. and elsewhere in the world something can be worked out in Canada – stay tuned to PFL for further details we are watching this one.

Source: BBC Trucker Protest Windsor, Ontario, CANADA

Oakland truckers overwhelmed by looming CARB rule, supply chain obstacles

I think we have learned through COVID that truckers are an essential work force and without them the supply chain is broken. They are responsible for speeding up intermodal traffic on rail or slowing it down. We rely on them to get groceries and everyday necessities of life to our favorite stores. Let’s face it folks, they are heroes. It is sad to see the treatment that they are getting in Canada and being portrayed by some and their own leader as criminals or extremists. We don’t believe that is the case – all across the world we have COVID fatigue and just want to live a normal life once again.

Now look at California- Besides the daily challenges truckers face to keep their small businesses afloat at the Port of Oakland, some are questioning whether they still will be operating this time next year. That’s because of an emissions rule in California that is requiring them to upgrade their trucks to include 2010 model year or newer diesel engines by the end of the year.

One trucker said that “CARB is creating uncertainty if they will be able to earn a living next year.” The CARB rule covers all diesel vehicles with a manufacturer’s gross vehicle weight rating greater than 14,000 pounds. Lynda Lambert, public information officer for CARB, said there is a provision in the Truck and Bus rule for new truck buyers who are experiencing manufacturer delays, but there’s no extension for California truckers who planned to buy used trucks but either can’t find one or can’t afford one because of supply constraints.

J.D. Power Valuation Services reported that used truck pricing in calendar year 2021 soared over 96% higher than in 2020 because of the chip import issues, which have drastically impacted the new truck market. A new truck can have up to 35 chips that are used to collect data. Truckers are asking for a delay in implementation but that does not look like it is going to happen.

Joe Rajkovacz, director of governmental affairs for the Western States Trucking Association, headquartered in Upland, California, estimates that over 40,000 trucks will be affected by the CARB rule based on the government agency’s data.

If we think there’s a supply chain issue right now, imagine taking that many trucks out of service that can’t be replaced because of the computer chip shortage.

Stephens Annual Rail Shipper Survey Came out last week

The survey reinforced a favorable outlook for 2022 volumes (average expectation was +4%) and 2022 core pricing (average expectation was +5%).

- Service remains a significant headwind, and shippers are skeptical about the outlook with less than 50% believing rail service will not normalize until 2023 or beyond.

- On average, the shippers in the survey expect their 2022 rail volumes to increase 4% year over year. This is in line with the 2022 volume guidance provided during Q421 earnings from CSX (up 4%+) and UNP (up 5%+). We continue to expect a weak start in the first half of 2022 and a stronger finish in the second half of 2022 and continue to be in line with PFL 2022 predictions made in its January 24, 2022 Rail report.

- Outlook for Modal Conversions (Rail vs. Truck). From a modal shift perspective, 33% of shippers expect to shift more freight from truck to-rail while 19% of shippers expect to shift more freight from rail-to truck. This leaves 48% of shippers that are not expecting a modal shift this year.

- For the shippers planning increased conversions from rail-to-truck, this is occurring due to weak (and inconsistent) rail service. Current Rail Service. Based on current trends, according to Stephan’s the average rail service ranking from shippers was 5.9 (1 = Poor, 10 = Strong) and this is down from the average rail service ranking of 6.3 in their survey a year ago.

- Outlook for Rail Service. According to Stephens shippers do not expect rail service to meaningfully improve until the third quarter of 2022 at the earliest, and 48% of respondents to their survey are not expecting a return to normalized levels until 2023 or beyond. Bottom line, given the recent service underperformance, shippers are very skeptical about the pace of improvement going forward.

- Outlook for Rail Pricing. On average, the shippers in the survey expect 2022 rail core pricing (excluding fuel) to increase 5.3% year over year.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 50-100 Pressure Cars for dirty to dirty service in the midwest – 1-2 years

- 100-200 Covered hoppers needed for plastic – 5 year lease

- 50 Ag Gons 2500-2800 CU FT 286 GRL needed in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000 CF – 286 GRL anty location 1-3 years

- Boxcars any size or plate, can take in multiple locations

- 50 25.5 Tanks C&I for heavy fuel oil in Texas dirty to dirty 1-2 years negotiable

- 300 5800 Covered hoppers needed for plastic – 5 year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 20 pressure cars 340’s in SE clean or last in butane or propane 1-2 years Immediate Need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 100 117Js Coiled and Insulated dirty to dirty service BNSF CN or CP

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10 25-28K C&I tanks for veg oil needed in the south for 2 years negotiable

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- Unit Train of 28.3K 117Js for use in Crude service off the CN or BN in MT, ND, or Alberta.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- 200, 28.3K C/I Tank for lease last in crude dirty to dirty service located on the BN in ND.

- 200 CPC-1232s 31.8K gal located in Texas. Last used in diesel. Available 6-24 months dirty to dirt service.

- Sand cars available for sale and lease at a great price call PFL for Details

- Clean 117J’s C/I 25.5K, 28.3K and 29.1K Vintages available.

- Clean CPC 31.8’Ks available.

- 61 DOT117J 29.2K last contained Sweet Bakken Crude. Can go dirty to dirty service.

- 112 DOT117R 31.8K last contained clear or red-dyed diesel can go dirty to dirt service.

- 100 CPC-1232 31.8K gallon capacity last contained clear or red-dyed diesel or gasoline

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- 150 117R’s 31.8 clean for lease in Texas – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 25 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars sale or lease

- 20 20K Stainless cars in 3 locations in the south – sale or lease – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude – available Feb 2022

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|