“The beginning is the most important part of the work.” – Plato

Jobs Update

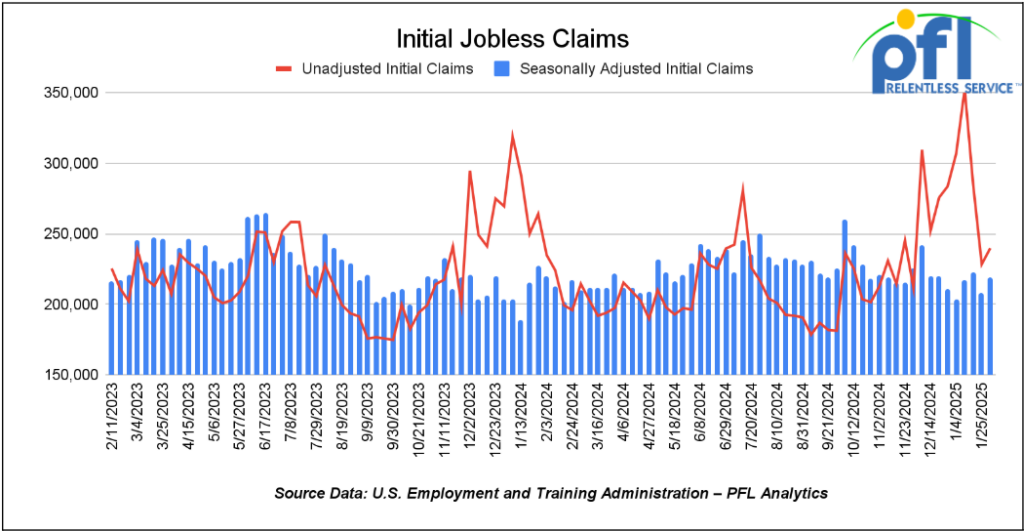

- Initial jobless claims seasonally adjusted for the week ending February 1st came in at 219,000, up -11,000 people week-over-week.

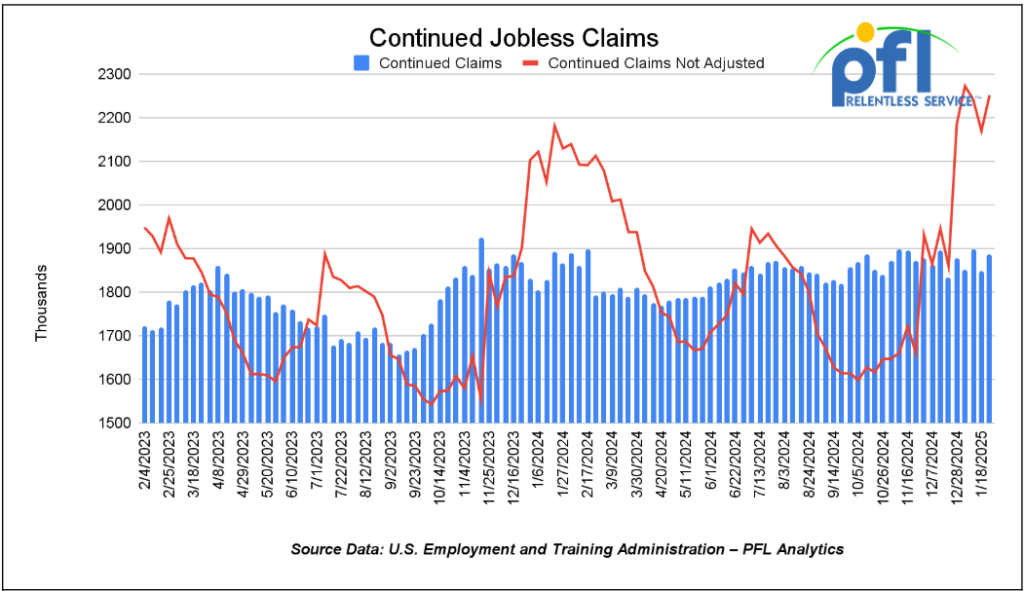

- Continuing jobless claims came in at 1.886 million people, versus the adjusted number of 1.85 million people from the week prior, up 36,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -444.23 points (-0.99%) and closing out the week at 44,303.4, down -241.27 points week-over-week. The S&P 500 closed lower on Friday of last week, down 57.58 points, and closed out the week at 6,025.99, down -14.54 points week-over-week. The NASDAQ closed lower on Friday of last week, down -265.59 points (-1.37%), and closed out the week at 19,523.4, down -104.04 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 44,541 this morning up 120 points.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up 0.32 cents per barrel (0.55%), to close at $71 per barrel on Friday of last week, down -$1.53 per barrel week over week. Brent traded up $0.37 cents USD per barrel (0.5%) on Friday of last week, to close at $74.66 per barrel, down -$2.10 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for March delivery settled on Friday of last week at US$14.00 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$56.27 per barrel.

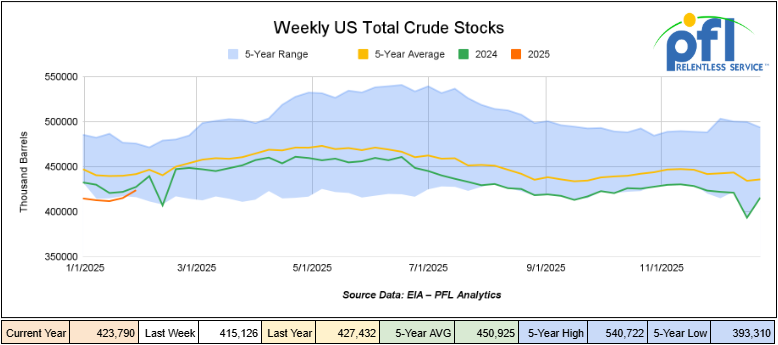

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.7 million barrels week-over-week. At 423.8 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

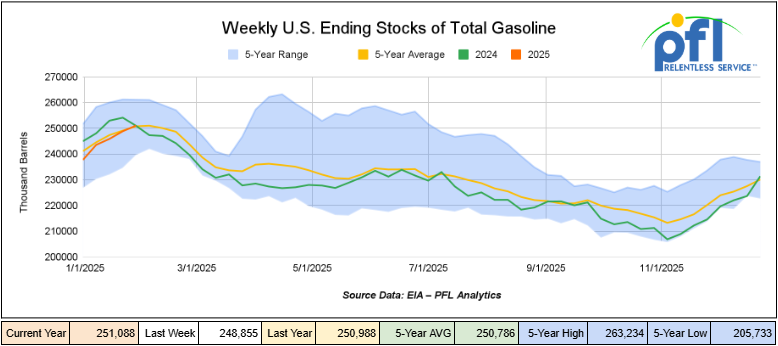

Total motor gasoline inventories increased by 2.2 million barrels week-over-week and are slightly above the five-year average for this time of year.

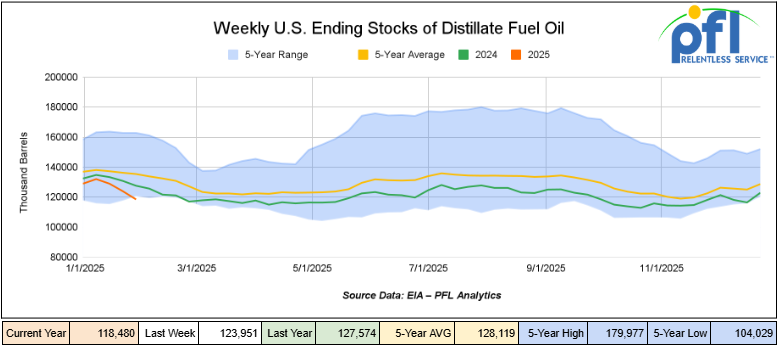

Distillate fuel inventories decreased by 5.5 million barrels week-over-week and are about 12% below the five-year average for this time of year.

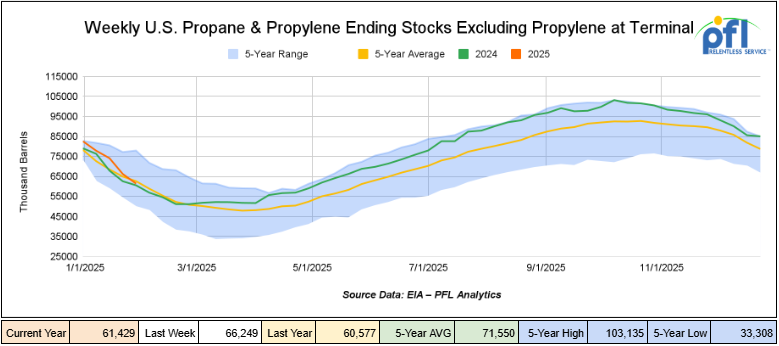

Propane/propylene inventories decreased by 4.8 million barrels week-over-week and are 2% below the five-year average for this time of year.

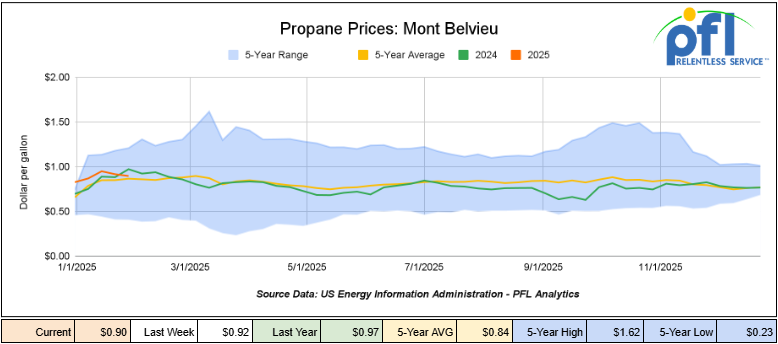

Propane prices closed at 90 cents per gallon on Friday of last week, down 2 cents per gallon week-over-week and down 7 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 2.7 million barrels during the week ending January 31st, 2025.

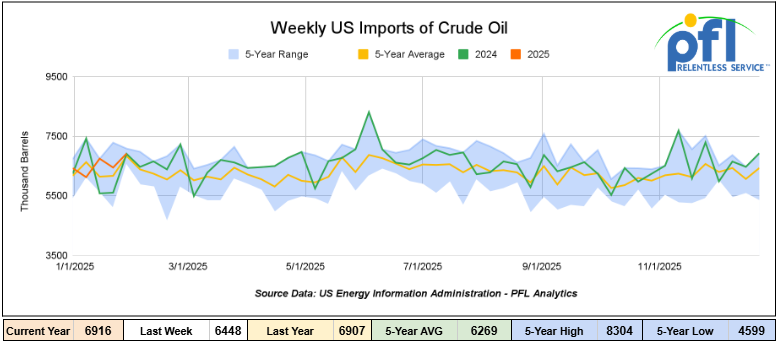

U.S. crude oil imports averaged 6.9 million barrels per day during the week ending January 31st, 2025, an increase of 467,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 2.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 593,000 barrels per day, and distillate fuel imports averaged 159,000 barrels per day during the week ending January 31st, 2025.

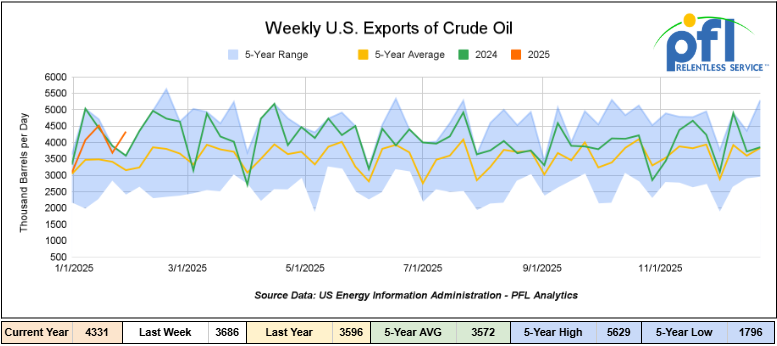

U.S. crude oil exports averaged 3.686 million barrels per day during the week ending January 24th, 2025, a decrease of 829,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3,839 million barrels per day.

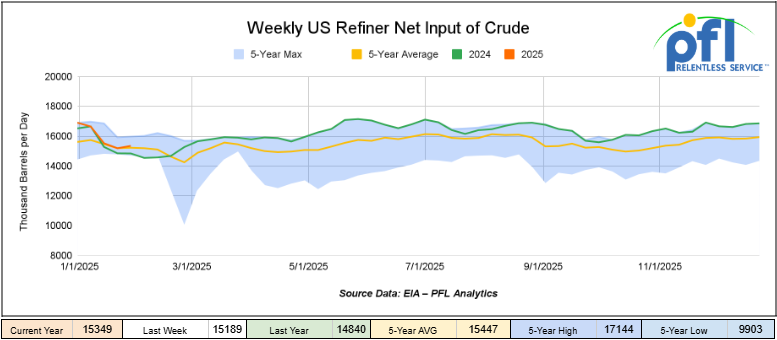

U.S. crude oil refinery inputs averaged 15.3 million barrels per day during the week ending January 31, 2025, which was 159,000 barrels per day more week-over-week.

WTI is poised to open at $71.81, up 81 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 5th, 2025.

Total North American weekly rail volumes were up (2.62%) in week 6, compared with the same week last year. Total carloads for the week ending on February 5 were 347,806, down (-0.33%) compared with the same week in 2024, while weekly intermodal volume was 353,848, up (5.7%) compared to the same week in 2024.

6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest increase came from Nonmetallic Minerals which was up (6.57%) while the largest decrease was from Metallic Ores and Metals which was down (-4.82%)

In the East, CSX’s total volumes were down (-8.21%), with the largest decrease coming from Petroleum and Petroleum Products (-23.06%) while the largest increase came from Nonmetallic Minerals. NS’s volumes were up (2.76%), with the largest increase coming from Grain (11.56%) while the largest decrease came from Other (-10.43%).

In the West, BN’s total volumes were up (7.25%), with the largest increase coming from Grain (12.74%) while the largest decrease came from Other (-6.51%). UP’s total rail volumes were up (6.91%) with the largest increase coming from Intermodal (16.4%) while the largest decrease came from Forest products (-12.54%).

In Canada, CN’s total rail volumes were down (-5.11%) with the largest increase coming from Other, up (+87.06%) while the largest decrease came from Intermodal (-15.85%). CP’s total rail volumes were up (-0.2%) with the largest increase coming from Other (+169.57%), while the largest decrease came from Forest Products (-13.38%).

KCS’s total rail volumes were up (12.86%) with the largest increase coming from Metallic Ores and Metals (+42.84%) while the largest decrease came from Farm Products (-28.14%).

Source Data: AAR – PFL Analytics

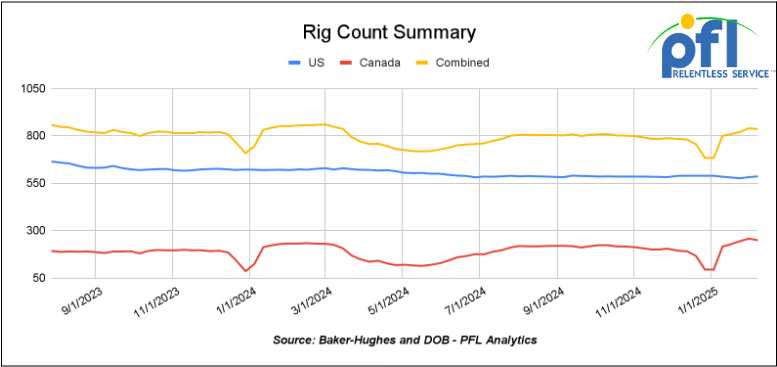

Rig Count

North American rig count was down by -5 rigs week-over-week. U.S. rig count was up by 4 rigs week over week and down by -37 rigs year-over-year. The U.S. currently has 586 active rigs. Canada’s rig count was down -9 rigs week-over-week, and up by 17 rigs year-over-year, and Canada’s overall rig count is 249 active rigs. Overall, year over year we are down by -20 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We were at CN’s annual Reception in Calgary

Last week, PFL had the pleasure of attending CN Rail’s annual Calgary Connect networking reception in Calgary, Alberta. Despite the chilly temperatures, with lows reaching -28°C (-18°F) the event provided a warm and welcoming atmosphere that made braving the cold worthwhile. Cyndi Popov attended on behalf of PFL.

The evening was filled with engaging conversations and valuable connections, offering a great opportunity to network with industry peers and strengthen relationships across the rail sector.

We appreciate CN Rail for hosting such a well-organized and worthwhile event. These gatherings play an important role in fostering collaboration and discussions about significant opportunities ahead. For more information on the CN event call PFL today.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,459 from 29,165 which was a gain of 294 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were higher by +2.5% week over week, CN’s volumes were lower by -5.8% week-over-week. U.S. shipments were up across the board. The UP had the largest percentage increase and was up by +3.2%.

We are Watching Canada – Tariffs Looming

Regular readers of our reports know that we are no fans of Justin Trudeau. When he announced his resignation, we thought it was not a moment too soon. Unfortunately, he remains in power, holding the Canadian government and, by extension, the Canadian people hostage. Even Trudeau, however, is keenly aware that a tariff war with the United States would be disastrous for Canada’s economy, and he is understandably hoping to avoid one.

With the threat of trade tariffs looming, Trudeau held an economic summit Friday of last week with Canadian business and labor leaders to discuss diversifying trade relationships and boosting Canada’s economic growth. There is widespread agreement among Canadian business leaders across the nation that the time has come to simplify interprovincial trade and explore opportunities for export diversification. Key proposals thrown around last week include the development of East-West pipelines and the establishment of free trade between provinces—both of which would bolster Canada’s economy and provide much-needed resilience in the face of external pressures.

Trudeau reportedly told the Summit that Trump’s talk of making Canada the 51st U.S. state is “a real thing.” “They are very aware of our resources, of what we have and they very much want to be able to benefit from those” he reportedly said.

Yet, for Trudeau, these statements are too little, too late. He has spent years doing nothing to foster Canadian growth and help capitalize on these resources. The reality is, Canada’s vast resource wealth and entrepreneurial human capital should be driving its own growth and prosperity—benefiting its own people first. If the potential of these resources were fully unlocked, the benefits would not only be felt in Canada but would likely reverberate across North America. It’s a win-win scenario, where the U.S. also stands to gain significantly from a more prosperous and self-sufficient Canada.

Canada is a nation rich in natural resources, from its oil and gas reserves to its untapped reserves of rare earth minerals, along with a population of highly skilled and innovative individuals eager to contribute to global markets. Unfortunately, years of bureaucratic red tape, poorly thought-out environmental policies, and a lack of strategic vision have stifled economic growth and made Canada more vulnerable to external forces. These inefficiencies have kept Canada from realizing its full potential on the global stage.

The chances of Canada truly becoming the 51st U.S. state are likely none. But, the fact remains that a stronger, more prosperous Canada would be beneficial not only for the Canadian people but also for the U.S. A more self-reliant Canada, with the freedom to harness its resources and engage in meaningful trade relationships, can contribute to regional stability and economic growth. In the end, the U.S. would undoubtedly benefit from a more robust and independent neighbor, one that is not hampered by inept leadership stymieing its people’s potential. A stronger Canada is great for rail and North-South trade.

We are watching Trans Mountain Pipeline

In the wake of looming U.S. tariffs Trans Mountain is evaluating capacity enhancements of 200,000 to 300,000 barrels per day, exploring short-term options including using drag-reducing agents and longer-term solutions like additional pumps. The pipeline can currently carry up to 890,000 bpd of crude from Alberta to Canada’s West Coast and is currently operating at approximately 80% capacity, with expectations of increased utilization as market conditions evolve with the threat of U.S. tariffs.

Additionally, at the Westridge Marine Terminal in the Port of Vancouver, Trans Mountain plans to increase tanker loadings from the current maximum of 24, to 28-30 Aframax vessels per month. This is contingent on the lifting of nighttime transit restrictions for larger vessels in the Second Narrows (Traffic Control Zone 2), which is anticipated to come in short order. These restrictions currently limit vessel transits during nighttime hours meant to mitigate navigational risks. The restrictions were originally put in place to prevent congestion and ensure safety in an area with strong tidal currents and heavy marine traffic. To support this change, the Port of Vancouver is installing new navigation aids to improve vessel safety and traffic management, ensuring that increased tanker traffic can be accommodated without compromising navigational safety.

When fully operational, the upgrades will allow shippers to bring inbound unladen Aframax vessels at night, easing previous daylight-only transit restrictions that have limited Trans Mountain’s loadings thus increasing the capacity of the pipeline. A small but needed fix.

We are Watching AltaGas and Keyera

Calgary-based energy infrastructure companies AltaGas Ltd. and Keyera Corp. have entered into long-term agreements aimed at strengthening their global energy export capabilities. Under the agreements, Keyera will secure a 15-year tolling contract for liquefied petroleum gas (LPG) exports through AltaGas Ridley Island Energy Export Facility, enhancing access to premium Asian markets. Additionally, AltaGas will contract fractionation services at Keyera Fort Saskatchewan (KFS) and gain access to Keyera rail, storage, and logistics infrastructure.

These agreements reinforce both companies’ strategic infrastructure investments, ensuring efficient transport of Canadian energy products to high-demand markets. AltaGas Ridley Island terminal will now reach its base long-term tolling target, with its REEF project expected to come online by late 2026. Meanwhile, Keyera’s expanded fractionation and logistics offerings will support future growth projects, including a proposed expansion at KFS.

Company executives expressed optimism about the collaboration, highlighting its role in enhancing competitiveness for Canadian energy producers. “These agreements improve the value of both companies’ infrastructure while strengthening Canada’s link to key Asian markets said Vern Yu, President and CEO of AltaGas. Dean Setoguchi, President and CEO of Keyera, added that the partnership creates more diversified sales opportunities for our customers, ensuring access to the highest-value markets. It should be great for rail and the pressure car!

We are watching Key Economic Indicators

U.S Unemployment

Total non-farm payroll employment increased by 143,000 in January, following upward revisions to 307,000 jobs in December and 250,000 in November. The unemployment rate edged down to 4.0% from 4.1% in December. Job gains were concentrated in healthcare, retail, and government, while mining and oil and gas extraction saw declines.

Purchasing Managers’ Index (PMI)

In January 2025, the Manufacturing PMI rose to 50.9%, marking the first expansion in over two years. This increase from December’s 49.3% indicates a positive shift in manufacturing activity. However, the recent imposition of tariffs on goods from Canada, Mexico, and China poses potential challenges, with concerns about higher raw material costs and supply chain disruptions.

The Services PMI for January 2025 decreased to 52.8% from December’s 54%. While still indicating growth (readings above 50% signify expansion), the slowdown suggests a tempering in the services sector’s activity. Factors contributing to this decline include adverse weather conditions and apprehensions about the potential impact of new tariffs.

These PMI readings reflect the economy’s current state, with manufacturing showing signs of recovery and the services sector experiencing moderate growth. The introduction of new tariffs adds uncertainty, potentially influencing future business activities.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Round Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website