“The greater danger for most of us lies not in setting our aim too high and falling short; but in setting our aim too low, and achieving our mark.“

– Michelangelo

Jobs Update

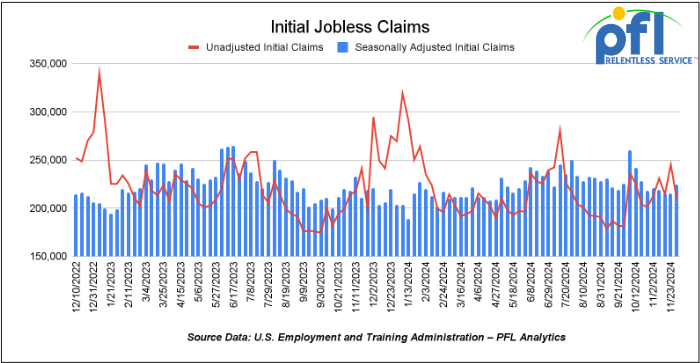

- Initial jobless claims seasonally adjusted for the week ending November 30th came in at 224,000, up 9,000 people week-over-week.

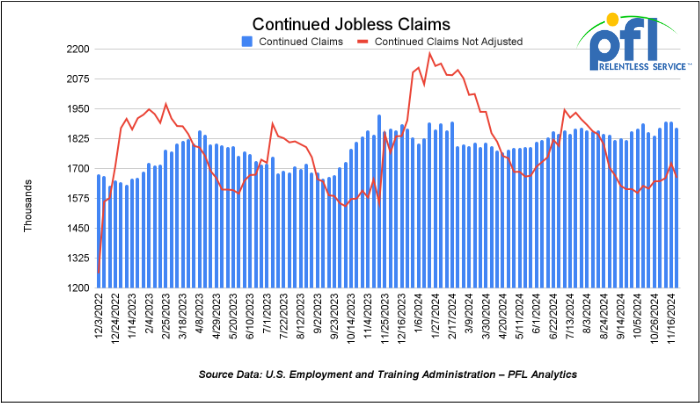

- Continuing jobless claims came in at 1.871 million people, versus the adjusted number of 1.896 million people from the week prior, down 25,000 people week-over-week.

Stocks closed mixed on Friday of last week and mixed week over week

Collectively, Wall Street posted a three-week win streak on Friday, propelled by strengthened expectations for another interest rate cut by the Federal Reserve at its final monetary policy committee meeting of the year later this month.

The DOW closed lower on Friday of last week, down -123.19 points (-0.28%) and closing out the week at 44,642.52, down -268.14 points week-over-week. The S&P 500 closed higher on Friday of last week, up 15.11 points (0.25%), and closed out the week at 6,090.22, up 57.84 points week-over-week. The NASDAQ closed higher on Friday of last week, up 159.05 points (0.83%), and closed out the week at 19,859.77, up 641.61 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 44,691 this morning down -15 points.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed down -$1.10 per barrel (-1.6%) to close at $67.20 per barrel on Friday of last week, down -$1.67 per barrel week over week. Brent traded down -$0.97 USD per barrel (-1.4%) on Friday of last week, to close at $71.12 per barrel, down -$2.01 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for January delivery settled Friday on last week at US$12.00 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$55.68 per barrel.

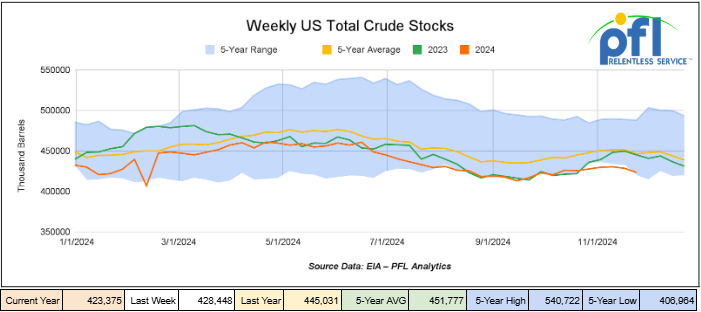

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.1 million barrels week-over-week. At 423.4 million barrels, U.S. crude oil inventories are about 5% below the five-year average for this time of year.

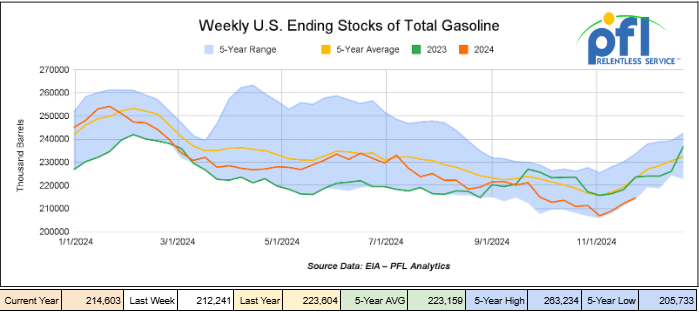

Total motor gasoline inventories increased by 2.4 million barrels week-over-week and are 4% below the five-year average for this time of year.

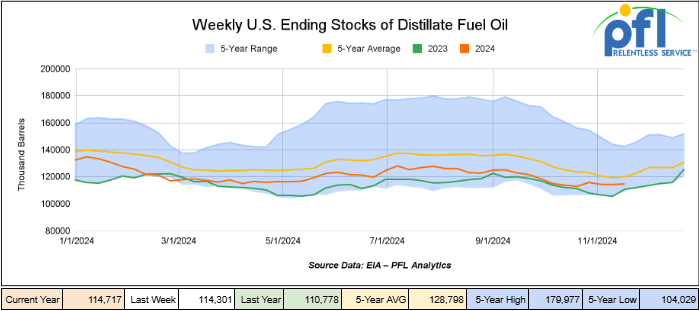

Distillate fuel inventories increased by 3.4 million barrels week-over-week and are about 5% below the five-year average for this time of year.

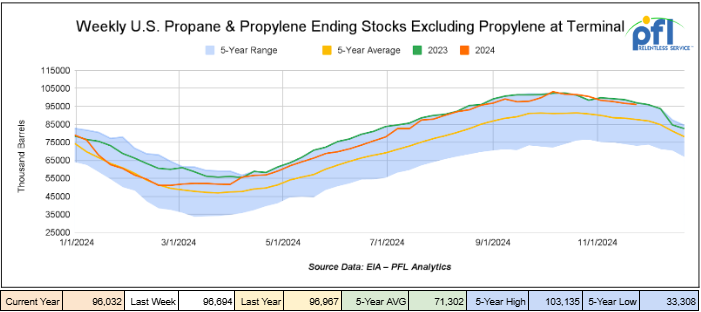

Propane/propylene inventories decreased by 700,000 barrels from last week and are 10% above the five-year average for this time of year.

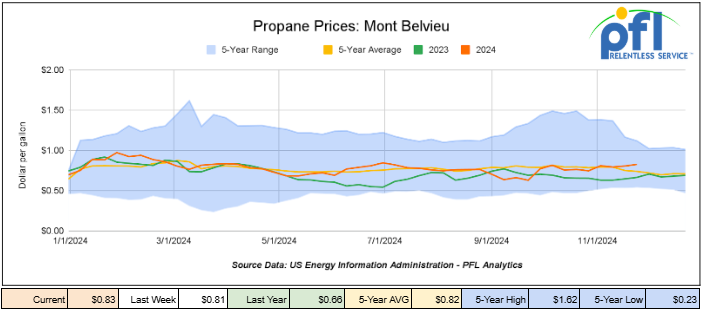

Propane prices closed at 83 cents per gallon on Friday of last week, up 2 cents per gallon week-over-week, and up 17 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 4.7 million barrels during the week ending November 29th, 2024.

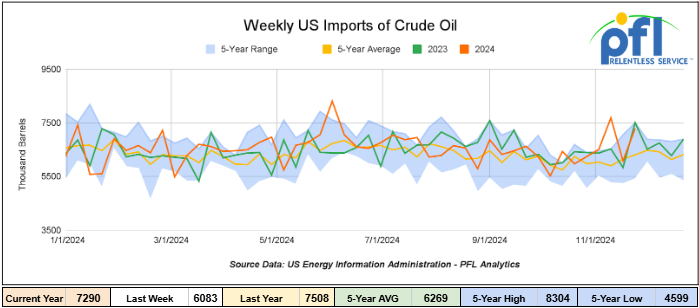

U.S. crude oil imports averaged 7.3 million barrels per day during the week ending November 29th, 2024, an increase of 1.2 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.9 million barrels per day, 5.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 511,000 barrels per day, and distillate fuel imports averaged 116,000 barrels per day during the week ending November 29th, 2024.

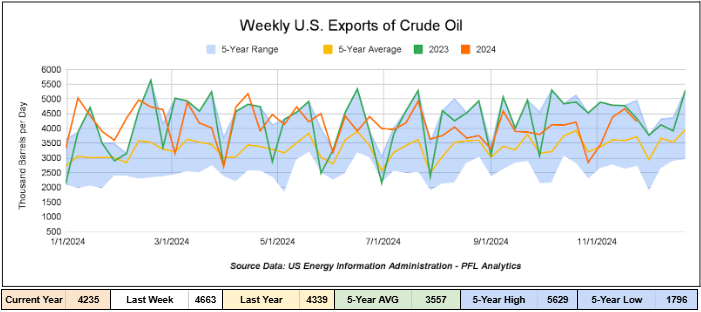

U.S. crude oil exports averaged 4.235 million barrels per day during the week ending November 29, 2024, a decrease of 428,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.179 million barrels per day.

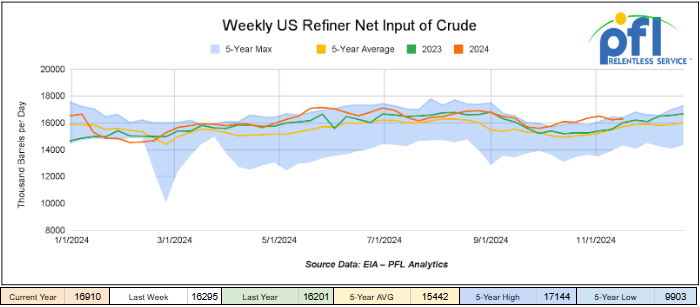

U.S. crude oil refinery inputs averaged 16.9 million barrels per day during the week ending November 29, 2024, which was 615,000 barrels per day more week-over-week.

WTI is poised to open at $68.03, up 0.83 per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 4, 2024.

Total North American weekly rail volumes were down (-10.55%) in week 49, compared with the same week last year. Total carloads for the week ending on December 4th were 308,692, down (-15.27%) compared with the same week in 2023, while weekly intermodal volume was 314,691, down (-5.36%) compared to the same week in 2023. 11 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Coal, which was down (-24.23%).

In the East, CSX’s total volumes were down (-12.53%), with the largest decrease coming from Coal (-4.59%), while the only increase came from Petroleum and Petroleum Products (4.47%). NS’s volumes were down (10.3%), with the largest decrease coming from Petroleum and Petroleum Products (-28.01%).

In the West, BN’s total volumes were down (-12.01%), with the largest decrease coming from Other, down (-27.69%). UP’s total rail volumes were down (11.69%) with the largest decrease coming from Coal, down (-35.04%).

In Canada, CN’s total rail volumes were down (-12.01%) with the largest decrease coming from Other, down (-43.95%), while the largest increase came from Grain, up (+30.42%). CP’s total rail volumes were down (-20.65%) with the largest increase coming from Motor Vehicles and Parts (+65.59%), while the largest decrease came from Petroleum and Petroleum Parts (-51.5%).

KCS’s total rail volumes were down (-8.49%) with the largest decrease coming from Nonmetallic Minerals (-34.66%) and the largest increase coming from Motor Vehicles and Parts (+78.06%).

Source Data: AAR – PFL Analytics

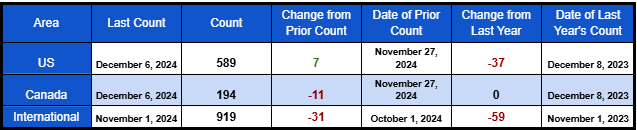

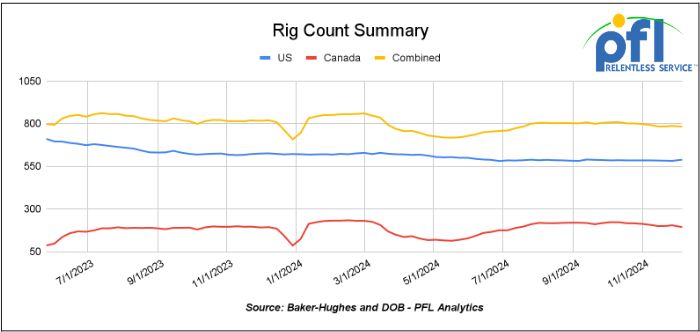

Rig Count

North American rig count was down -4 rigs week-over-week. U.S. rig count was up 7 rigs week-over-week and down by -37 rigs year-over-year. The U.S. currently has 589 active rigs. Canada’s rig count was down -11 rigs week over week and up flat year-over-year and Canada’s overall rig count is 194 active rigs. Overall, year over year we are down by -37 rigs collectively.

International rig count was down by -31 rigs month-over-month down -59 rigs year-over-year. Internationally there are 919 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,905 from 30,090, which was a loss of 185 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments fell by 4% week over week, CN’s volumes were higher by 1.9% week-over-week. U.S. shipments were lower across the board. The CSX had the largest percentage decrease and was down 20.5%.

We are watching Canada vs. Western Canada

Folks, as most of our readers know, PFL has a strong presence in Canada through PFL Rail Services Canada Inc. We are looking to expand services offered in that Country in an expeditious manner. Certain parts of Canada are open to investment, shunning the wishes of the dysfunctional destructive Trudeau liberal party and their cronies.

Our PFL president, Curtis Chandler was in Calgary last week, attending the UCP Christmas Party and all conservatives were open to business and the exploitation of all of Alberta’s rich resources from mining, farming, and the drilling of oil and natural gas. Alberta wants to play and the woke agenda has all but evaporated in Western Canada and is making its way out East. There is even talk about bringing back the Keystone Excel pipeline – which Alberta would welcome. There is, however, concern over President Trump slapping a 25% tariff on Canadian manufactured goods, but most view it as posturing in getting Justin Trudeau in line with the Trump agenda.

Curtis Chandler With Premier Danielle Smith

Source: PFL – PFL Analytics

Curtis Chandler with the Honorable Rebecca Schulz (Minister of Environment and Protected Areas)

Source: PFL – PFL Analytics

Curtis Chandler with Deputy Minister Mike Ellis

Source: PFL – PFL Analytics

In general, the Alberta government prefers a hands-off, free-market approach to energy development, but it will do whatever is necessary to protect the industry and grow production in light of federal opposition, Premier Danielle Smith said at the Canadian Association of Energy Contractors (CAOEC) 2024 State of the Industry lunch in Calgary last week.

“We’re taking a full hands-on approach for the industry,” Smith said, as Alberta energy supply is too important to global energy security, the Canadian economy, and Alberta’s budget to allow federal policies to limit growth.

After two years of failed negotiations with the federal government, she said it became clear the province needed to act.

The proposed federal emissions cap was one catalyst.

“When they are not choking us in red tape, they’re working to cut production of oil and gas, because that’s what this is,” she said of the emissions cap.

If implemented the cap would result in one million bbls/d of lost production by 2030, and 2.1 million bbls/d of lost production by 2035, she explained, citing the Conference Board of Canada.

The economic impact would be profound, with Alberta losing five percent of its GDP, or $12 billion annually by 2035, equaling half of its current healthcare budget.

“Tens of billions of dollars will disappear from the Canadian GDP.”

“This is a punitive measure that in no way will help the economy or business investment. It will be felt by small, medium, and Indigenous companies in the service industry. It will be felt by our allies who will need to use Russian and Iranian oil and gas.”

The Alberta government has a different vision, with plans to double oil and gas production while reducing emissions.

The industry was the key “to Canadian prosperity for years,” and the province plans on returning it to that position, she said.

The Alberta Government Using ‘Every Weapon’ In Its Arsenal Against Emissions Cap With the New Motion

Province may take control of emissions data reporting.

Alberta Premier Danielle Smith spoke at a news conference on Tuesday of last week.

The Alberta government is willing to fight the federal government’s oil and gas emissions cap in court, and make changes that include assuming control of the industry’s emissions reporting.

In response to the proposed cap, the provincial government is putting forward a motion under the Alberta Sovereignty Within a United Canada Act.

“We have been very clear that we will use all means at our disposal to fight back against federal policies that hurt Alberta and that’s exactly what we’re doing,” Alberta Premier, Danielle Smith told reporters on Tuesday.

Ottawa released draft details of this cap on Nov. 4. The federal government expects final regulations for this cap in 2025, and reporting and verification requirements for large operators to begin in 2026.

This is a cap-and-trade system that works in three-year periods. The first compliance period of 2030 to 2032 is set at 35 percent below 2019 emissions levels.

“We’re fighting back with every weapon in our arsenal,” said Smith. “The Alberta Sovereignty Within a United Canada Act was designed to protect our province from unconstitutional interference and now we’re going to use it again.”

The motion the Smith government is putting forward in the legislature uses the act to ask the legislative assembly for approval to “shield” Alberta if the cap becomes law, she added.

If passed, actions in the motion include an immediate constitutional challenge, a ban on provincial bodies enforcing the cap, and labeling oil and gas production facilities as essential infrastructure under the Alberta Critical Infrastructure Defense Act.

One of the potential actions would see all information related to greenhouse gases at these facilities declared as owned by the Alberta government with “data reported or disclosed at our discretion,” said Smith.

Through the motion, another proposed action is to prohibit entry of all individuals into these facilities except those licensed to enter by the Alberta government.

Controlling emissions reporting through the province

Smith was later asked how potential restrictions around facility entry and data control line up with the United Conservative Party’s pro-business approach, and influence a company’s ability to comply with international reporting requirements. Related Articles

We are watching increased government oversight – Federal Court Issues Preliminary Injunction Against Enforcement of the Corporate Transparency Act; DOJ Appeals

The United States District Court for the Eastern District of Texas has issued a preliminary injunction in Texas Top Cop Shop, Inc. v. Garland that halts the enforcement of the Corporate Transparency Act (CTA), which mandates certain companies to submit beneficial ownership information (BOI) reports to the Financial Crimes Enforcement Network (FinCEN). The government has appealed Judge Mazzant’s ruling to the Fifth Circuit Court of Appeals.

The Court’s injunction applies nationwide, rather than just to specific plaintiffs, and relieves companies from having to comply with the CTA’s reporting requirements, enjoining FinCEN from nationwide enforcement of the CTA’s reporting requirements, and effectively staying the CTA’s January 1, 2025 reporting deadline.

The CTA aims to enhance transparency and combat financial crimes by requiring companies to disclose their ownership structures. However, the Court’s analysis echoes the sentiments of many business owners, The notion that one may use a company to veil their illicit financial crimes is unassailable. But, the Commerce Clause does not justify regulating all companies based on nothing more than the fear that a reporting company might shelter a financial criminal.”

Prior to this ruling, more than 8 million BOI reports have been submitted to FinCEN, far less than the anticipated 32.6 million filings. The preliminary injunction, however, puts a temporary and national halt to the enforcement efforts related to these reporting obligations.

Given the number of cases challenging the constitutionality of the CTA around the country, many are wondering how Texas Top Cop Shop resulted in a national impact while others have not. The answer is a procedural one. This case closely follows a similar one brought in the Northern District of Texas that resulted in a nationwide injunction four months ago. There, the Court issued an injunction that stopped the Federal Trade Commission from enforcing a ban on noncompete provisions in employment agreements and successfully extended its application to the whole country. This Eastern District of Texas used the same approach for the CTA injunction, citing to a body of Fifth Circuit case law.

By comparison, the other more well-known CTA case is National Small Business United v. Yellen in the Eleventh Circuit. Unlike Texas Top Cop Shop, the NSBU ruling was instead one of summary judgment. Because the NSBU relief request was declaratory and decided summarily, the Court never reached the scope of the application. Therefore, its ruling was limited to the plaintiffs in that case.

Like NSBU, the Texas Top Cop Shop plaintiffs had in fact initially limited the scope of their request to only the plaintiffs. However, the court sua sponte determined that a national injunction was appropriate. It is notable here that the court may have had some help from the government during oral argument. Regarding the proper injunction scope, the government responded to the court’s line of questioning that if the plaintiffs won the injunction, it “would, in practical effect, be a nationwide injunction.” In the opinion, Judge Mazzant responds that, “The Court agrees with the Government’s point. A nationwide injunction is appropriate in this case.”

Next Steps:

Where do companies go from here? The Court’s ruling is authoritative. It has made a legal determination that a nationwide scope is appropriate. Until that opinion is overturned, or the preliminary injunction is lifted, it will continue to stand.

However, this preliminary injunction doesn’t permanently eliminate the CTA. Rather, the result will depend on the outcome of the government’s appeal.

While the incoming presidential administration supports the CTA in its concept, it has expressed reservations regarding its implementation and burden on small businesses (not coincidentally a topic of primary consideration in Texas Top Cop Shop). It is expected that the incoming president will want to take a look at the CTA’s current execution with a view to lightening the burden. This process could then be expected to result in further delays to its implementation.

Currently, companies should analyze their entities and determine their beneficial owners, gathering all appropriate information. They should be ready to file in the event that the injunction is lifted.

PFL will continue to monitor the case and will provide updates as developments unfold.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5 Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2 Years. Cars are needed for use in Lube Oil service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 30K, 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|