“Reading is essential for those who seek to rise above the ordinary.”

– Jim Rohn

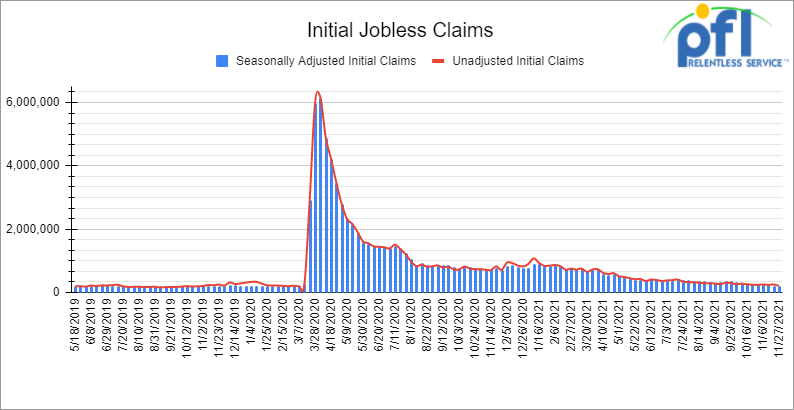

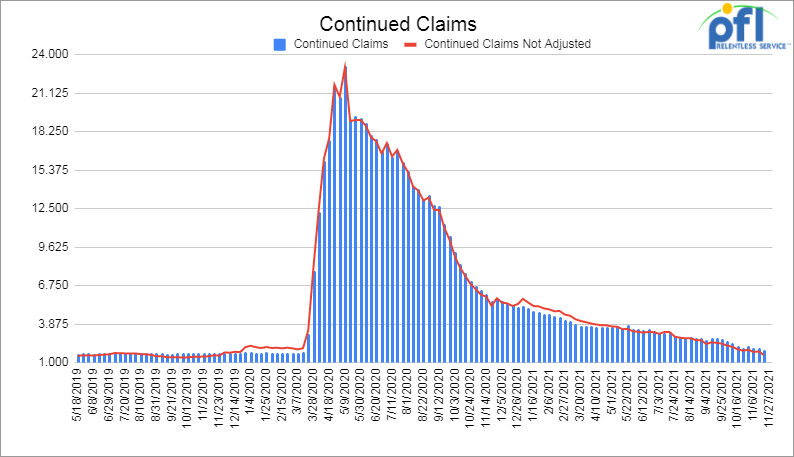

Jobs Update

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending November 27th came in at 222,000, up 28,000 people week over week.

- Continuing claims came in at 1.956 million people versus the adjusted number of 2.063 million people from the week prior, down 107,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -59.71 points (-0.17%), closing out the week at 34,580.08 points, down -319.16 points week over week. The S&P 500 closed lower on Friday of last week, down -38.67 points (-0.84%) and closed out the week at 4,538.43, down -56.19 points week over week. The Nasdaq closed lower on Friday of last week, down -295.85 points (-1.92%) and closed out the week at 15,085.47, down -406.19 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 34,674 this morning up 108 points.

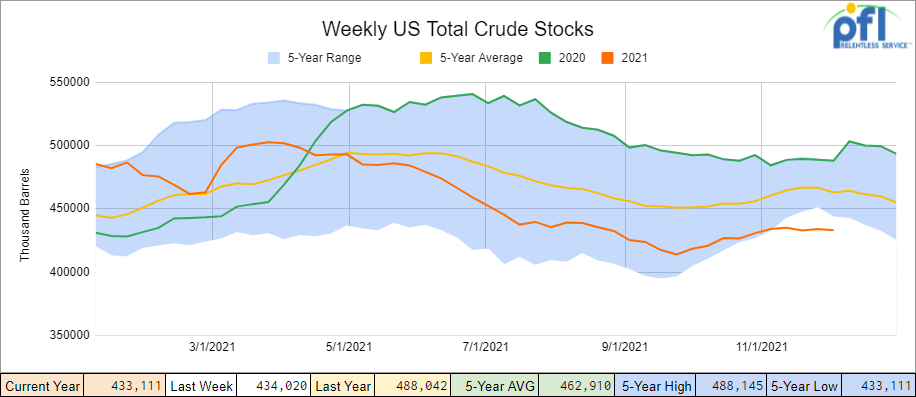

Oil posts sixth straight weekly loss as COVID concerns intensify

Despite the pull back in oil prices, Goldman is still very bullish on oil. Goldman sees upside oil price risk despite OPEC+’s decision to increase production in January by 400,000 barrels per day. Oil prices are primed for gains as Thursday’s decision by OPEC+ to proceed with planned production increases won’t derail an ongoing structural bull market, according to analysts at Goldman Sachs Group Inc. The investment bank sees “very clear upside risks” in its forecast for Brent oil to average $85 a barrel in 2023.

West Texas Intermediate (WTI) crude closed up 93 cents on Friday of Last week, or 1.42% to settle at 66.26, down -$1.89 per barrel week over week, while Brent futures closed up 80 cents, or up 1.16% to settle at $70.14 per barrel, down -$2.58 per barrel week over week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 900,000 barrels week over week. At 433.1 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

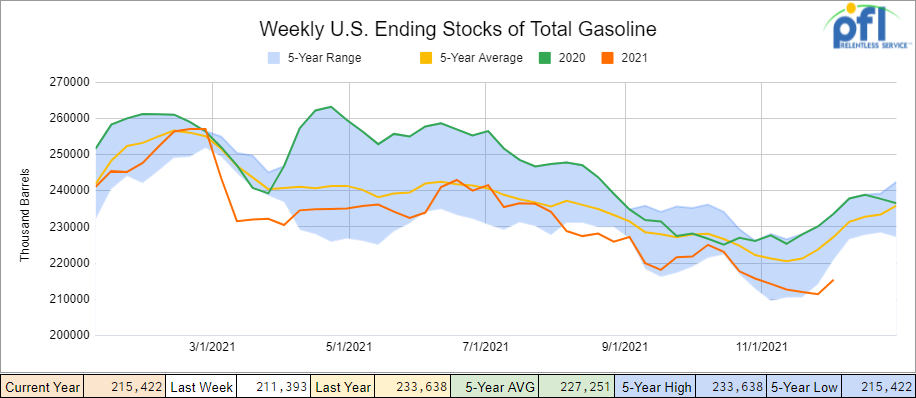

Total motor gasoline inventories increased by 4.0 million barrels week over week and are 5% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

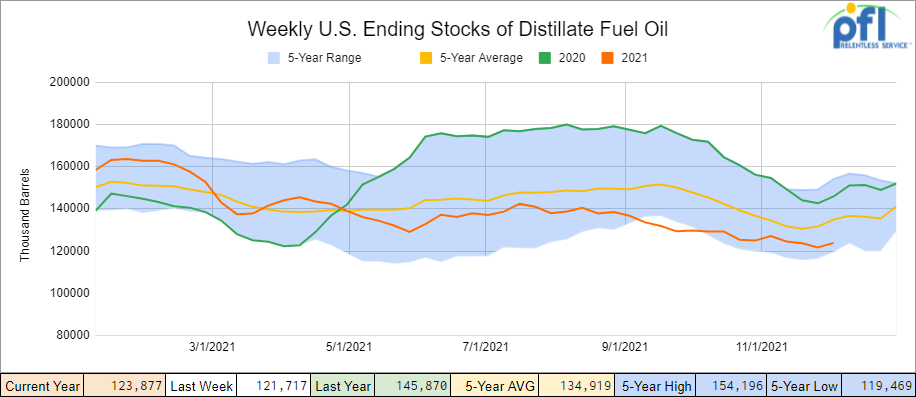

Distillate fuel inventories increased by 2.2 million barrels week over week and are 9% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

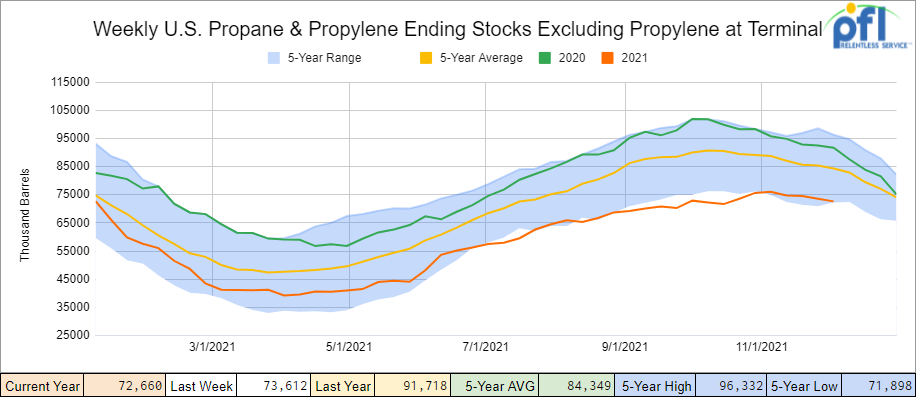

Propane/propylene inventories decreased by 1.0 million barrels week over week and are 14% below the five year average for this time of year.

Source Data: EIA – PFL Analytics

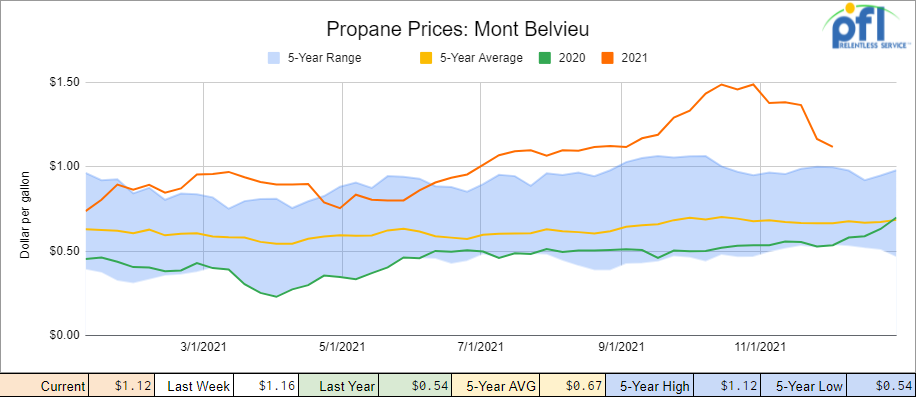

Propane prices continue to decrease and closed here at home at $1.12 per gallon, down 4 cents per gallon week over week.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories increased by 4.3 million barrels week over week.

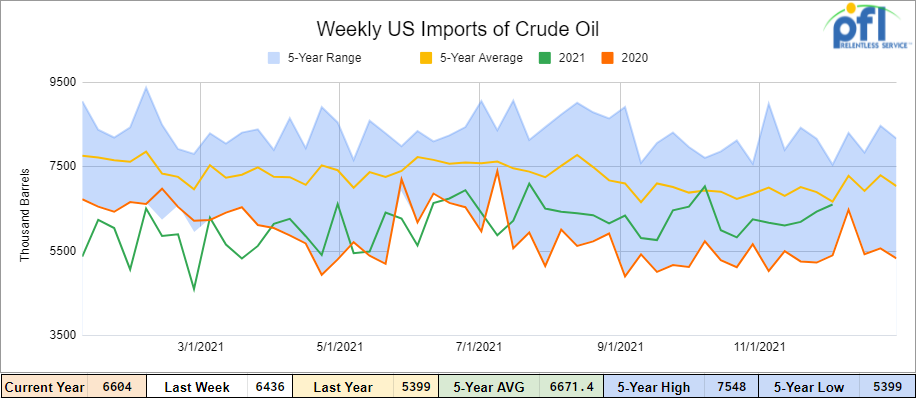

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending November 26th, up by 168,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 18.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) for the week ending November 26th averaged 643,000 barrels per day, and distillate fuel imports averaged 234,000 barrels per day.

Source Data: EIA – PFL Analytics

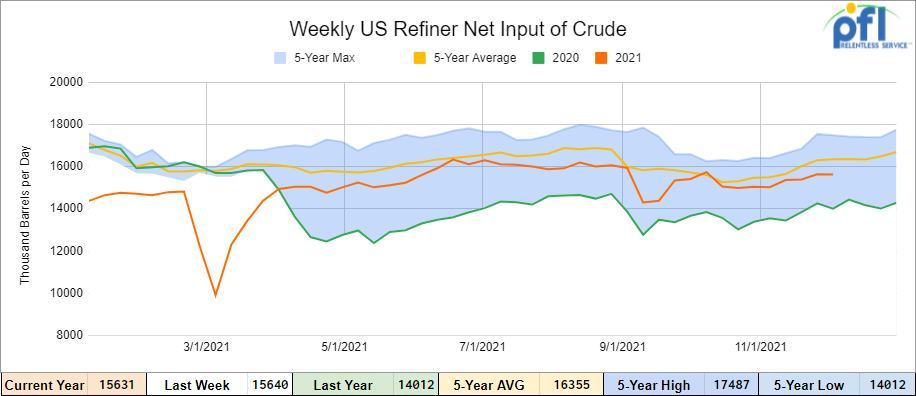

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending November 19, 2021 which was 243,000 barrels per day more than the previous week’s average. Refineries operated at 88.6% of their operable capacity for the week ending November 19th

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at $67.82 , up $1.56 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 10.5% year over year in week 47 (U.S. -4.8%, Canada -28.2%, Mexico -5.4%) resulting in quarter to date volumes that are down 5.2% and year to date volumes that are up 5.5% year over year (U.S. +6.7%, Canada +2.1%, Mexico +3.6%). 8 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decline coming from intermodal (-16.1%). The largest increase came from nonmetallic minerals (+4.0%).

In the East, CSX’s total volumes were down 5.4%, with the largest decreases coming from intermodal (-5.2%), coal (-14.1%) and motor vehicles & parts (-21.2%). NS’s total volumes were down 5.3%, with the largest decrease coming from intermodal (-7.5%).

In the West, BN’s total volumes were down 2.6%, with the largest decrease coming from intermodal (-9.5%). The largest increase came from coal (+12.4%). UP’s total volumes were down 4.9%, with the largest decrease coming from intermodal (-12.6%).

In Canada, CN’s total volumes were down 23.2%, with the largest decrease coming from intermodal (-35.9%). RTMs were down 23.7%. CP’s total volumes were down 29.8%, with the largest decreases coming from intermodal (-43.3%) and grain (-40.1%). RTMs were down 30.9%.

KSU’s total volumes were down 1.8%, with the largest decrease coming from petroleum (-35.0%).

Source: Stephens

Rig Count

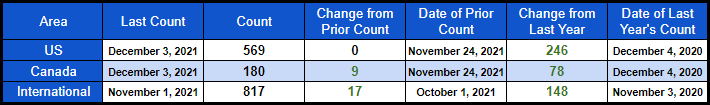

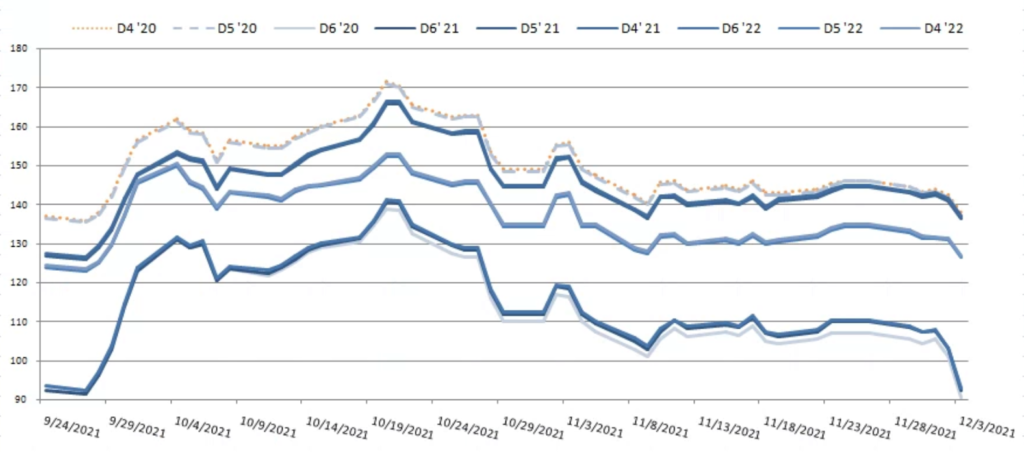

North American rig count is up by 9 rigs week over week. The U.S. rig count was flat week over week but up by 246 rigs year over year. The U.S. currently has 569 active rigs. Canada’s rig count was up by 9 rigs week over week and up by 78 rigs year over year and Canada’s overall rig count is 180 active rigs. Overall, year over year, we are up 324 rigs collectively.

International rig count that comes out monthly was just released and is up by 17 rigs month over month and up 148 rigs year over year. Internationally there are 817 active rigs.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads declined to 24,022 from 24,038, a loss of 18 rail cars week over week. Canadian volumes were mostly mixed: CP volumes were up by 12% and CN volumes were flat week over week. U.S. volumes were mostly lower with the UP having the largest percentage increase (up by 7.3%) and the NS having the largest percentage decrease (down by 8.6%).

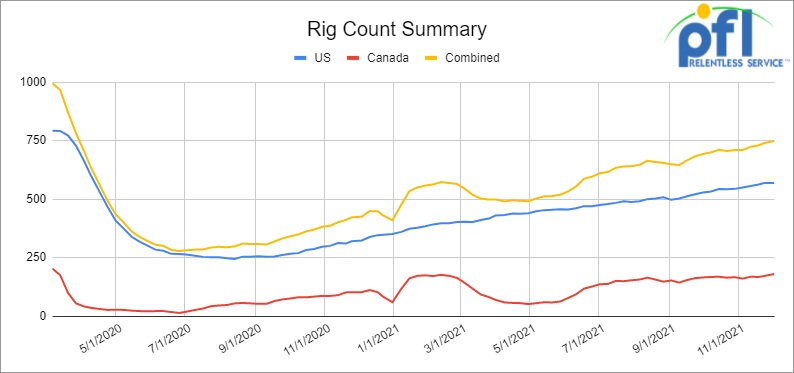

RINS and the Renewable Fuels Standards RVO

The U.S. Administration plans to propose in just days the amount of biofuels oil refiners must blend into their fuel mix this year and next year, as it reaches out to lawmakers to discuss the move. President Joe Biden’s administration has delayed decisions on 2021 blending obligations by more than a year, and it missed a deadline to finalize 2022 obligations last week.

The EPA has told at least two U.S. Democratic Senate offices to expect retroactively lower volumes for 2020 and 2021 and a restoration of volumes in 2022. All market participants have urged the EPA to announce the proposals, saying delays have created uncertainty for the market. After the news on Thursday of last week, prices tumbled week over week. D6 RINS closed out Friday and the week at 91 and ½ cents per RIN flat day over day, but down 8 and ½ cents per RIN week over week. Meanwhile, D4 RINS closed at $1.37 and ½ cents per RIN, down 2 and ½ cents per RIN day over and down 7 and ½ cents per RIN week over week. The effects of a lower RVO could mean less ethanol and biodiesel on the rails in the days to come (see below).

RIN Prices

Source: PFL Analytics

Alberta Crude

Well, we have rising inventories once again in Alberta. Crude inventory levels in Alberta climbed to a record high in October according to the Alberta Energy Regulator as inventories swelled to over 80 million barrels despite Enbridge’s expansion of line 3 that added 340,000 barrels of crude per day.

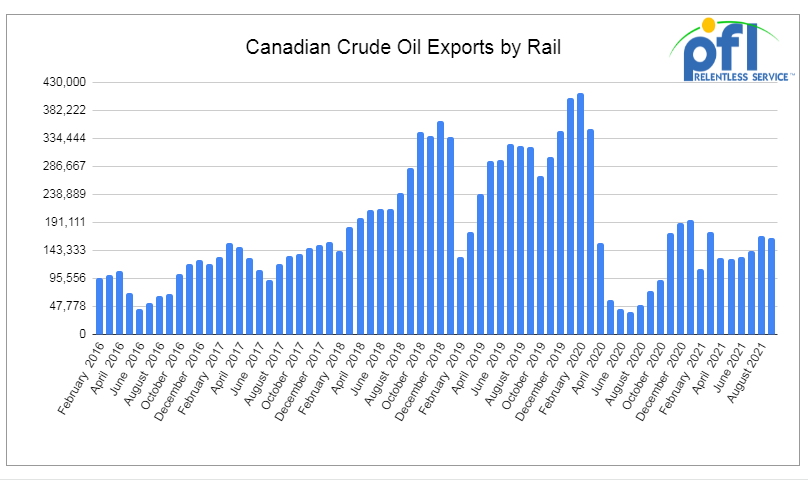

With the Trans Mountain pipeline down and backing up crude into the province due to the disaster in British Columbia, Canada we will have to see how WCS’ basis holds up. We are certainly keeping a close eye on the situation. Going home on Friday we closed out the week with WCS at US -$18.75 per barrel against WTI with an implied value of US$ 47.53 per barrel. As far as crude by rail out of Canada, after 5 months of month over month gains we had a slight decrease month over month ending in September 2021 (see below)

Source Data: Alberta Energy Regulator – PFL Analytics

The Surface Transportation Board Adopts New Rule for Emergencies

The Surface Transportation Board (STB) has adopted a final rule establishing a new “emergency temporary trackage rights class exemption” that could be invoked during natural disasters, accidents or derailments; the rule is effective Dec. 30, 2021. STB on Tuesday of last week reported that the final rule “eliminates the 30-day notice period in certain circumstances, speeding up the process for authorizing trackage rights in response to an unforeseen track outage, and providing benefits to shippers, carriers and the public.”

The Association of American Railroads (AAR) on Oct. 9, 2020, petitioned the STB to institute a new class exemption for emergency temporary trackage rights “for specific limited situations that would allow emergency temporary trackage rights to take effect within five days of filing without requiring a waiver of the 30-day notice requirement,” according to STB.

Some Key Economic Indicators

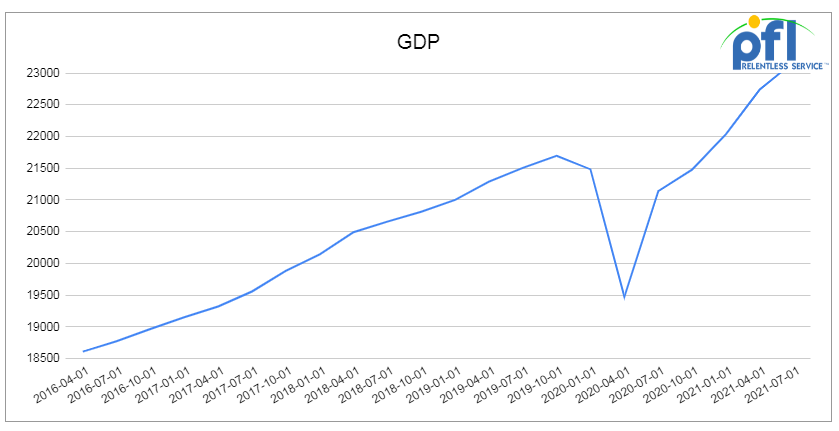

Gross Domestic Product (“GDP”) – The second estimate from the Bureau of Economic Analysis (BEA) released November 24 found that U.S. GDP rose an annualized 2.1% in Q3 2021, a slight increase from the first estimate of 2.0%, but still the slowest the economy has grown since Q3 2020. Adjusted for inflation, the U.S. economy in Q3 2021 was 1.4% larger than its pre-pandemic peak in Q4 2019 and 12.8% larger than it was in Q2 2020, when the economic impact of the pandemic was at its worst.

Source Data: Bureau of Economic Analysis – PFL Analytics

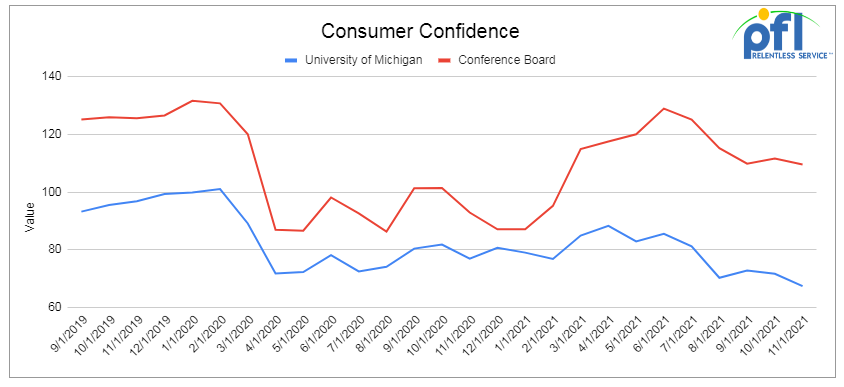

Consumer Confidence – The Conference Board’s index of consumer confidence fell to 109.5 in November from 111.6 in October. Meanwhile, the University of Michigan’s confidence index fell from 71.7 in October to 67.4 in November, the lowest it’s been since November 2011. Expect consumer confidence to erode further with new pandemic scares, the border situation, travel bans, and inflation.

Source Data: Conference Board – PFL Analytics

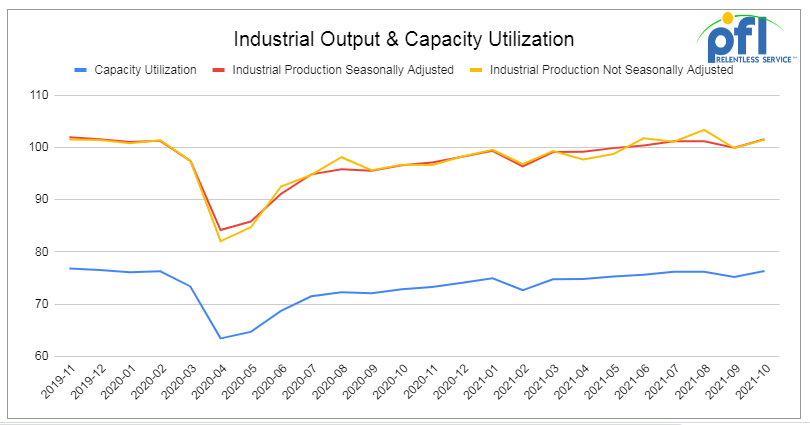

Industrial Output and Capacity Utilization – Total U.S. industrial output rose a preliminary 1.6% in October 2021 from September 2021, reversing a 1.3% decline in September from August, according to Federal Reserve data. If it holds after revisions, October’s gain will be the largest month over month gain in seven months. The Federal Reserve said half of October’s gain reflected recovery from the effects of Hurricane Ida. Manufacturing output rose a preliminary 1.2% in October after declines of 0.7% in September and 0.3% in August. Manufacturing output in October was the highest since March 2019.

Source Data: Federal Reserve – PFL Analytics

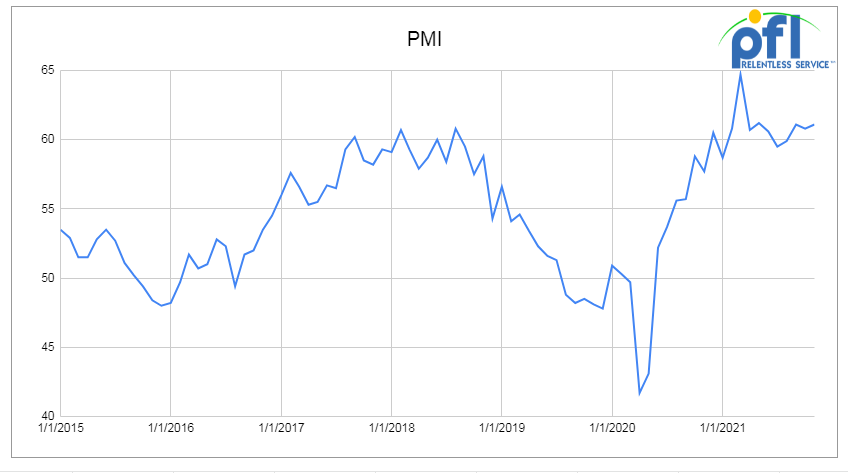

Purchasing Managers Index (“PMI”) – The PMI (which covers manufacturing) and the Services PMI (covering services) are from the Institute for Supply Management. They are based on surveys of supply managers around the country. The surveys track the direction of changes in business activity. A reading above 50% indicates expansion; below 50% means contraction. The more above or below 50, the faster the pace of change. The PMI rose from 60.8% in October to 61.1% in November, matching the highest it’s been in six months. The new orders component of the PMI rose to 61.5% in November from 59.8% in October. Out of the 18 manufacturing industries covered in the PMI, 13 reported expansion in November.

Source Data: PMI – PFL Analytics

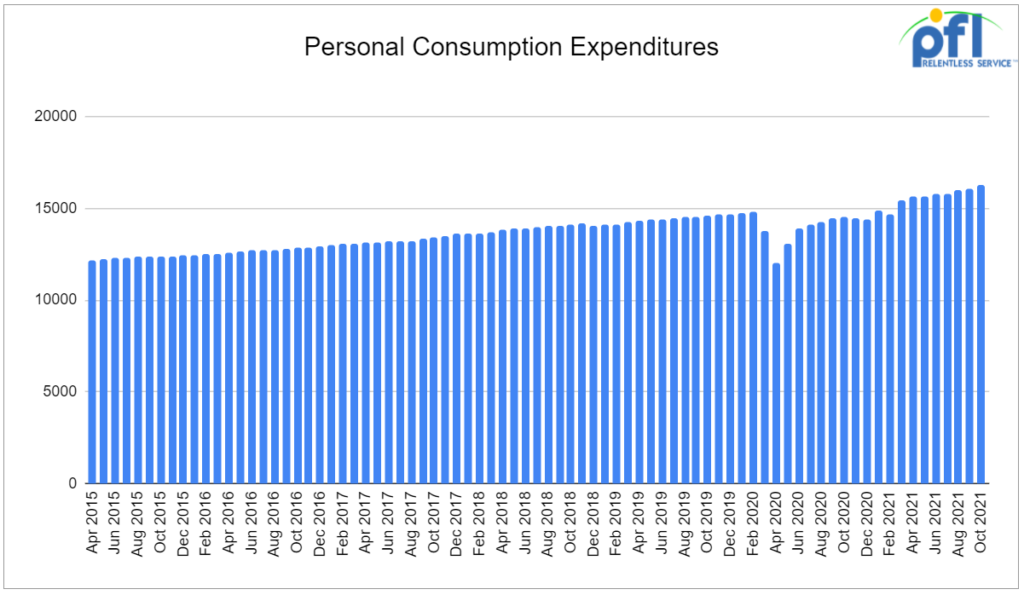

Consumer Spending – Unadjusted for inflation, total consumer spending rose a preliminary 1.3% in October 2021 over September 2021, the largest increase in seven months. Meanwhile, total retail sales (which are equivalent to around 25% of total consumer spending) rose a preliminary 1.7% in October, also the most in seven months.

Source Data: U.S. Bureau of Economic Analysis – PFL Analytics

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- Unit Train of 28.3K 117Js for the use in Crude service off the CN or BN in MT, ND, or Alberta.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|