“When angry, count to ten before you speak; if very angry, a hundred.”

–Thomas Jefferson

COVID-19

The United States currently has 19,573,847 confirmed COVID 19 cases and 341,138 confirmed deaths.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 803,000 initial jobless claims. The number of first-time filers for unemployment benefits were lower than expected and were estimated to come in at 885,000.

Markets mostly flat Week over Week as we headed into Christmas

The Dow closed higher on Friday, up +74.04 points (+0.23%) closing out the week at 30,199.87 points up 20.82 points week over week. The S&P 500 closed higher on Friday, up 13.05 points (+0.35%) closing out the week at 3,703.06 points, down 6.35 points week over week. The Nasdaq Composite closed higher as well on Friday of last week, up 33.62 points (+0.26%) closing out the week at 12,804.73 points, up 49.09 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 128 points.

Oil ends seventh straight week of gains

(WTI) for January delivery rose 10 cents or 0.2 percent on Friday of last week , to settle at $48.22 per barrel, down 88 cents per barrel week over week. Brent for February settlement rose 17 cents or 0.3 per cent on Friday of last week to close at $51.37 US per barrel , down 89 cents per barrel week over week.

According to the EIA, U.S. commercial crude oil inventories decreased by 0.6 million barrels from the previous week. At 499.5 million barrels, U.S. crude oil inventories are 11% above the five year average for this time of year. Total motor gasoline inventories decreased by 1.1 million barrels last week and are 4% above the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories decreased by 2.3 million barrels last week and about 10% above the five year average for this time of year. Propane/propylene inventories decreased by 2.3 million barrels last week and are 4% above the five year average for this time of year. Total commercial petroleum inventories decreased by 10.7 million barrels last week.

U.S. crude oil imports averaged 5.6 million barrels per day last week, up by 140,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 5.7 million barrels per day, 12.9% less than the same four-week period last year.

Oil is higher in overnight trading and WTI is poised to open at 48.71, up 48 cents per barrel from Friday’s close.

North American Rail Traffic

Carloads in week 51 increased by 1.9% compared to last year and decreased by 3.9% sequentially. Total US rail car traffic was +2.0% year over year and total Canadian rail car traffic was up +1.6%. UP and CP increased the most year over year at +3.4% and 2.3%, respectively. The industry continues to have easier year over year comparisons in Q4. As we head into Q1 of 2021, we will look for carloads to continue to at least be positive year over year.

Agricultural Products were up (+11.8%) and again increased the most year over year in week 51, followed by Intermodal (+10.2%). Coal shipments we down (-13.2%) and declined the most year over year in week 51, followed by Non-metallic Minerals & Products at (-11.0%) and Chemicals at (-9.4%) also declining significantly year over year. On a four-week rolling basis, carloads are +3.6% and up 2.7% thus far in the fourth quarter.

Rig Count

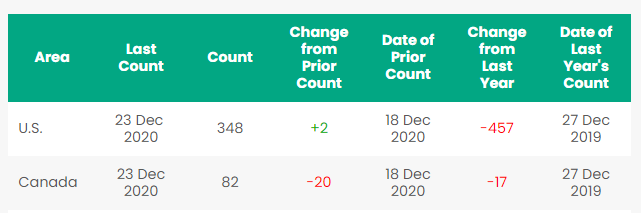

North America rig count is down by 18 Rigs week over week. The U.S. gained 2 rigs week over week. The U.S. currently has 348 active rigs. Canada’s rig count was down by 20 rigs week over week and Canada’s overall rig count is 82 active rigs. Year over year we are down 474 rigs collectively.

North American Rig Count Summary

Things we are keeping an eye on

- The Port of Houston to start New Service to Trans-Pacific Asia – This new partnership, which will start in Kaohsiung, China, and enter the U.S. Gulf Coast through the Panama Canal, will offer regional exporters and importers a new route. As more companies relocate to Texas, driving economic expansion and activity, heightened levels of demand for distribution centers has created an opportunity for the Port of Houston to grow international partners.

- Canadian Crude Basis – WCS closed at its lowest level in some time at -$15.10 on Friday against WTI. Canadian heavy is becoming sought after worldwide and pipelines in Canada are congested – Enbridge is rejecting 44% of its nominations for January from shippers who want to ship crude oil to the United States. Enbridge is shipping record volumes despite COVID-19 on the back of a decrease in production of Venezuelan heavy and some heavy grades that were coming out of Mexico that are declining. As more Canadian production hits the system, expect basis to fall further paving the possible resurgence for crude by rail out of Canada.

- Petroleum By Rail – The four-week rolling average of petroleum carloads by rail on North America’s railroads continued to move higher and rose to 26,056 from 25,779 the prior week . Canadian volumes were lower week over week – CP shipments were down by 4.5% and CN’s volumes were down by 0.3%. In the U.S., the UP had the largest percentage decrease of -8.8% while the BN had the largest percentage increase gaining 10.8%.

- PFL was cited in Argus Petroleum Transportation publication recently as scrap prices soared $100 per gross tons in certain markets across the country. PFL is looking to buy railcars on a delivered basis in key markets. In addition to receiving a higher value for your railcars, there are federal incentives being considered by congress that provides for a new tax credit for replacing or upgrading certain railcars. It may be a time to consider mobile scrapping for those cars that are expensive to move or cannot move – please call PFL for further details 239-390-2885 as it relates to cars being delivered for scrap or PFL coming on site for mobile scrapping.

- In case you didn’t hear, there was a BNSF train derailment on Tuesday of last week near Seattle, Washington. Environmental assessments found no significant damage from BNSF derailment. We find this derailment interesting as two women just a few weeks ago were arrested for trying to derail a BNSF train. No immediate link has been suggested between the derailment and the recent arrest of the two women on terrorism charges for an incident involving BNSF in nearby Bellingham. An FBI spokesman said according to the Seattle Times “it would be speculative to connect other events with this incident”. The incident involved the derailment of 7 cars and 5 crude oil tank cars caught fire. Let’s hope this is an isolated incident, the last thing we need to see is a more coordinated effort to derail trains. The FBI encourages anyone with knowledge of the train derailment to contact tips.fbi.gov.”

- To wrap up the year – As we approach the end of a tumultuous year for the economy and industrial activity, we think markets continue to look through the cycle bottom and into a potential inflection in 2021. While uncertainties surrounding rising COVID-19 cases, timing and magnitude of potential federal stimulus, and other policy revisions remain wildcards that could drive market volatility in the near term, we think optimistic outlooks for the vaccine distribution currently underway will likely support improving Industrial activity in the second half of next year. Broadly, we think demand and production levels for most industrial end markets will continue to slowly return to normalized levels, with seasonality potentially presenting a sequentially slower growth trend in calendar 4Q as it relates to rail traffic. Good luck out there folks and remember todays quote it may come in handy in 2021.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

A sign of things getting better – leasing activity and inquiries have continued to be strong

PFL is seeking:

- 100 31.8K CPC 1232s or 30.3K 117R for the use of Gas and Diesel.

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase

- 50-60 Sulfuric acid cars 13.6 for purchase

- 40-50 molten Sulfur Cars 13.8 for purchase

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

- 30 5400-5800 286 Hoppers needed in Texas off the BN for grain 2 years negotiable

- 10 Veg Oil tanks 30K needed in Mexico off the BN for 2 years negotiable

- 5100 CU FT plus hoppers needed in the Midwest off the BN or UP negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- 140 117R 30.3 Dirty Ethanol located east and Midwest, lease negotiable

- 25 117J 25.5 New Texas UP and BN lease negotiable

- 110 2494 CU FT Gondolas for sales or lease 286 GRL in Montana UP negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale, Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|

Header photo by Yakima County Sheriff’s Office