“You can’t go back and change the beginning, but you can start where you are and change the ending.”

– C.S. Lewis

Jobs Update

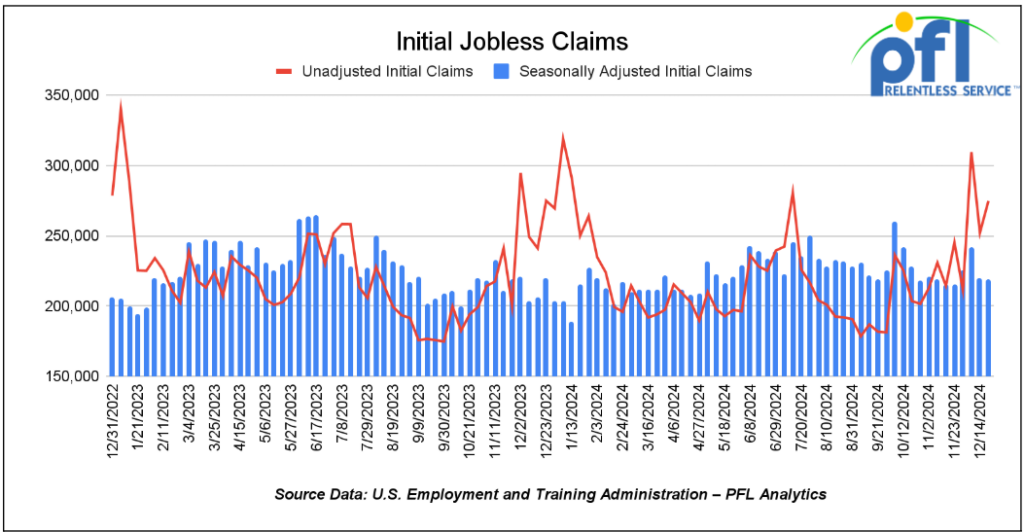

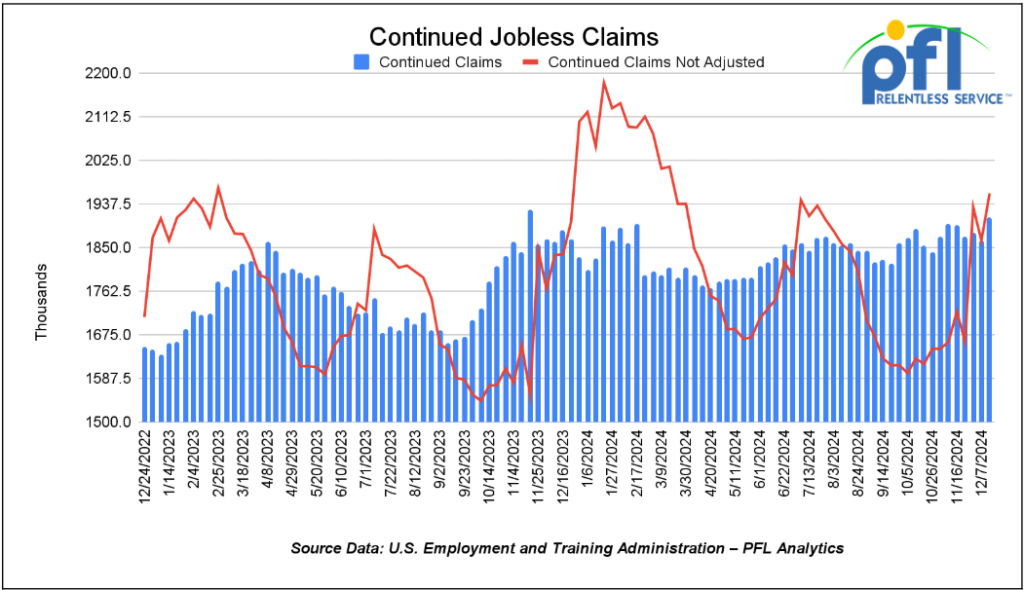

- Initial jobless claims seasonally adjusted for the week ending December 21st came in at 219,000, down -1,000 people week-over-week.

- Continuing jobless claims came in at 1.910 million people, versus the adjusted number of 1.864 million people from the week prior, up 46,000 people week-over-week.

Stocks closed lower on Friday of last week, but higher week over week

Wall Street continues to be in holiday mode as investors face another holiday-shortened week of sparse economic data and no major scheduled corporate earnings.

The highlights for this week include purchasing managers’ data on Thursday and Friday from the Institute of Supply Management and S&P Global for December. Pending home sales for November will be released today.

Last week’s trading sessions were marked by low volume, as many market participants were on holiday, but it ended with Wall Street snapping a two-week losing streak.

The DOW closed lower on Friday of last week, down -333.59 points (-0.77%) and closing out the week at 42,992.21, up 151.95 points week-over-week. The S&P 500 closed lower on Friday of last week, down -66.75 points, and closed out the week at 5,970.84, up 39.99 points week-over-week. The NASDAQ closed lower on Friday of last week, down -298.33 points (-1.52%), and closed out the week at 19,722.03, up 149.43 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 43,255 this morning down 89 points.

Crude oil closed higher on Friday of last week, and higher in the U.S. week over week.

West Texas Intermediate (WTI) crude closed up 98 cents per barrel (1.4%) to close at $70.60 per barrel on Friday of last week, up $1.14 per barrel week over week. Brent traded up 0.91 cents USD per barrel (1.2%) on Friday of last week, to close at $71.17 per barrel, down -$1.79 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for February delivery settled Friday on last week at US$13.20 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$55.50 per barrel.

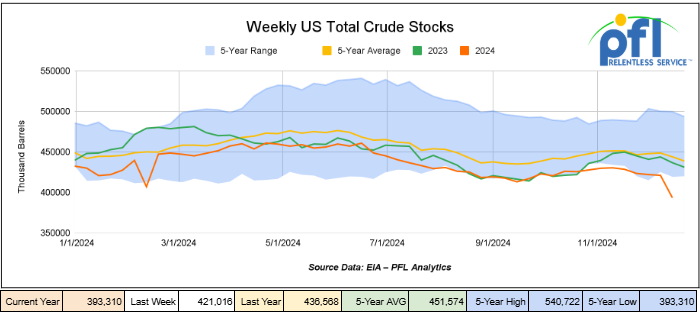

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.2 million barrels week-over-week. At 416.8 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

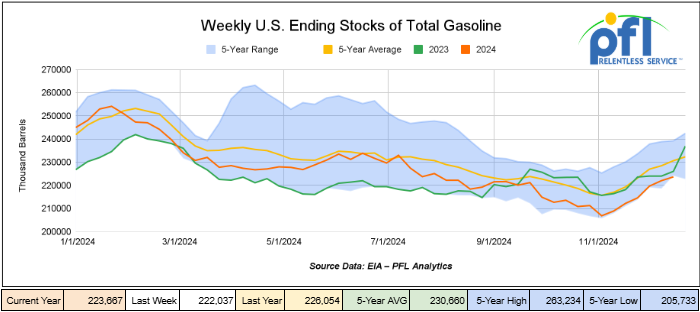

Total motor gasoline inventories increased by 1.6 million barrels week-over-week and are 3% below the five-year average for this time of year.

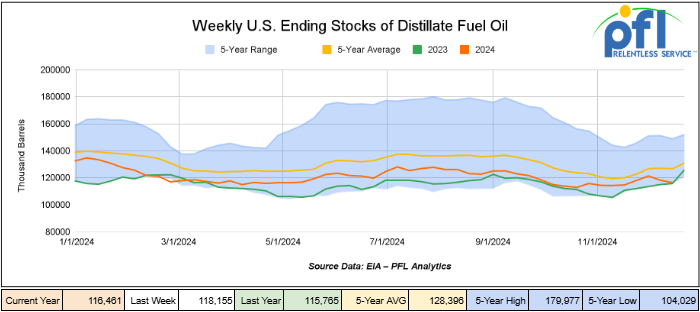

Distillate fuel inventories decreased by 1.7 million barrels week-over-week and are 10% below the five-year average for this time of year.

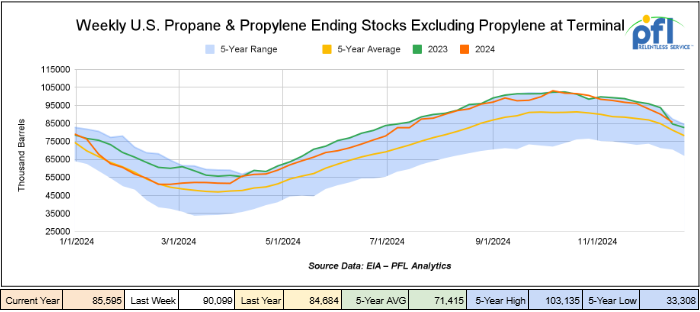

Propane/propylene inventories decreased by 4.5 million barrels week-over-week and are 9% above the five-year average for this time of year.

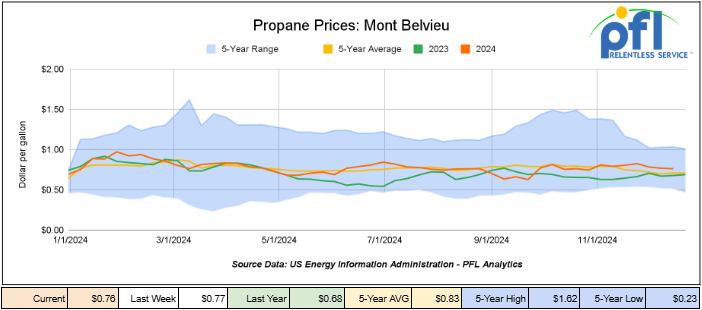

Propane prices closed at 76 cents per gallon on Friday of last week, down 1 cent per gallon week-over-week, but up 12 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 12.7 million barrels last week, during the week ending December 20th, 2024.

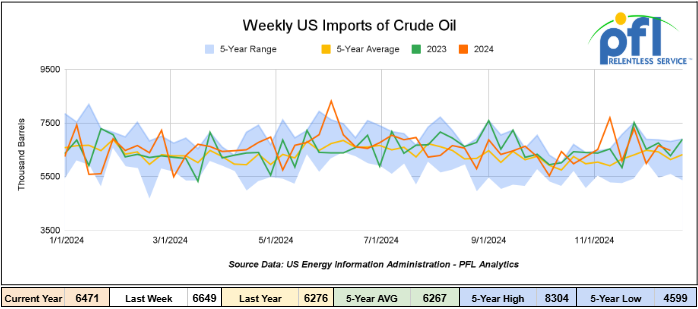

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending December 20th, 2024, a decrease of 178,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.6 million barrels per day, 2.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 657,000 barrels per day, and distillate fuel imports averaged 180 thousand barrels per day during the week ending December 20th, 2024.

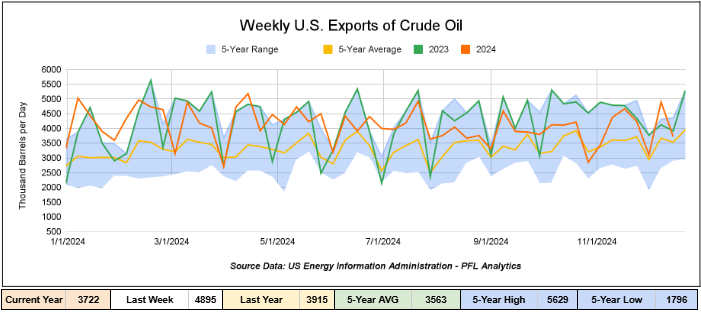

U.S. crude oil exports averaged 3.722 million barrels per day during the week ending December 20, 2024, a decrease of 1.173 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.988 million barrels per day.

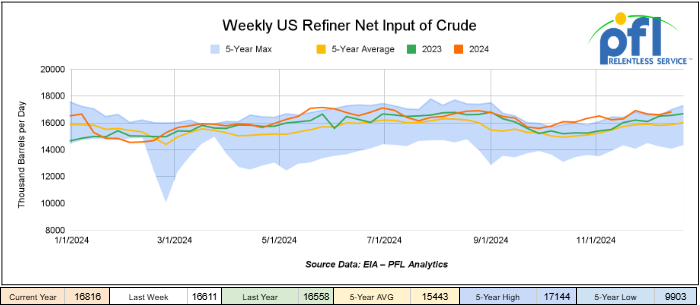

U.S. crude oil refinery inputs averaged 16.8 million barrels per day during the week ending December 20, 2024, which was 205,000 barrels per day more week-over-week.

WTI is poised to open at 70.41, down 19 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 25, 2024.

Total North American weekly rail volumes were up (6.04%) in week 52, compared with the same week last year. Total carloads for the week ending on December 25th were 352,719, down (-0.48%) compared with the same week in 2023, while weekly intermodal volume was 359,534, up (13.31%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Metallic Ores and Minerals, which was down (-7.83%) while the largest increase came from Intermodal which was up (13.31%).

In the East, CSX’s total volumes were up (4.82%), with the largest decrease coming from Coal (-11.12%), while the only increase came from Grain (26.64%). NS’s volumes were up (6.22%), with the largest decrease coming from Chemicals (-11.76%), while the largest increase came from Grain (12.08%).

In the West, BN’s total volumes were up (6.4%), with the largest decrease coming from Forest Products, down (-14.3%), while the largest increase came from Chemicals (17.66%). UP’s total rail volumes were up (11.59%) with the largest decrease coming from Metallic Ores and Metals, down (-14.04%), while the largest increase came from Grain (25.5%).

In Canada, CN’s total rail volumes were down (-6.48%) with the largest decrease coming from Other, down (-48.9%), while the largest increase came from Grain, up (+31.05%). CP’s total rail volumes were down (-2.76%) with the largest increase coming from Other (+114.29%), while the largest decrease came from Coal (-38.79%). KCS’s total rail volumes were up (3.81%) with the largest decrease coming from Nonmetallic Minerals (-19.23%) and the largest increase coming from Motor Vehicles and Parts (+121.29%).

Source Data: AAR – PFL Analytics

Rig Count

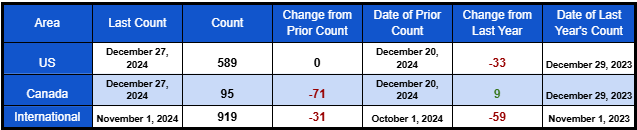

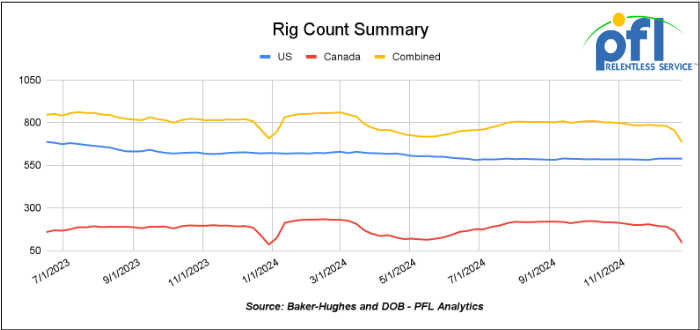

North American rig count was down -71 rigs week-over-week. U.S. rig count was flat week-over-week, but down by -33 rigs year-over-year. The U.S. currently has 589 active rigs. Canada’s rig count was down -71 rigs week over week, but up 9 rigs year-over-year, and Canada’s overall rig count is 95 active rigs. Overall, year over year we are down by -24 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Alberta natural gas and NGL’s – set for growth

In the latest Kevin O’Leary proposed ‘Wonder Valley’ in Alberta, billed as the world’s largest AI data center park.

Entrepreneur Kevin O’Leary, also known as Mr. Wonderful on TV shows Shark Tank and Dragons’ Den, is taking that message to heart with a proposal to develop what his company says would be the world’s largest AI data center industrial park — located in northwest Alberta.

O’Leary Ventures announced that it has signed a letter of intent to purchase land near Grande Prairie from the Municipal District of Greenview, in the Greenview Industrial Gateway, for the proposed AI data center industrial park.

The announcement comes days after the province released its road map to attract $100 billion of investment into data centers over the next five years.

“Once fully built out over a 5-10 year period, the area in northwest Alberta could eventually offer 7.5 gigawatts of energy all powered by clean-burning natural gas. “The area has available land and water, access to fiber-optic networks, and proximity to ample supplies of natural gas that can create electricity,” O’Leary said. “It’s almost impossible to find what Alberta has — because it’s not just power,” he added.

The first phase would be 1.4 gigawatts, costing about US$2 billion, while the entire development could top $70 billion if fully built out, factoring in data centers, infrastructure, power, and other structures, the company said.

Premier Danielle Smith met with O’Leary earlier this month while she was in Abu Dhabi and they toured a data center.

Alberta isn’t just talking big; it’s moving swiftly to become a magnet for the world’s largest AI data centers. At a time when global demand for data storage is skyrocketing, this Canadian province aims to turn its unique mix of geography, energy resources, and supportive policies to attract billions in private investment.

Alberta’s Advantages:

- Climate – Data centers run hot, and cooling them down can cost a fortune. Alberta’s naturally cold climate reduces the need for chillers resulting in lower operational costs and fewer environmental headaches.

- Abundant, Steady Energy Alberta’s natural gas reserves offer a reliable energy source, helping ensure that data centers can run without interruptions.

- Low Taxes and Streamlined Processes Alberta is energy-rich and in charge of energy within the province itself – no Federal red tape to jump through. Alberta boasts some of Canada’s lowest corporate tax rates.

- Plans to reduce red tape, cutting down on project delays.

Natural gas is the new green fuel for now and there is no stopping it folks – as we have always said more natural gas production means more LPG production which is great for rail. Stay tuned to PFL, we are watching this one and will keep you informed.

In other natural gas news, LNG buyers and suppliers are acquiring slices of their U.S. feedgas needs. The U.S. is now the world’s #1 supplier of LNG and the new liquefaction/export capacity slated to come online over the next few years suggests it will hold that position into the 2030s. To control more of the LNG value chain and become more familiar with the inner workings of the U.S. natural gas market, a small, but growing number of LNG buyers and suppliers have been acquiring gas production assets close to LNG export terminals along the U.S. Gulf Coast.

We are watching Canadian Crude by Rail

The Canadian Energy regulator reported on December 23, 2024, that 85,279 barrels were exported per day during the month of October 2024, down from 85,867 barrels in September of 2024, a decrease of 588 barrels per day month over month.

Crude by rail numbers in Canada did not change meaningfully month over month. Despite record-high crude oil production in western Canada, crude oil volumes exported by rail declined by 31% in 2023, averaging 98,300 barrels per day compared to 143,300 barrels per day in 2022. So far in 2024, rail exports have averaged just over 90,000 barrels per day. This decline is primarily attributed to increased pipeline capacity for oil exports in recent years.

In 2019, crude exports by rail peaked at an all-time annual high, due to pipeline infrastructure operating near or at full capacity in western Canada. This trend persisted into early 2020, with February setting a monthly record of 412,000 barrels per day. However, rail exports began to decline following reduced oil demand during the COVID-19 pandemic. The downturn continued with the addition of pipeline capacity, such as the Enbridge Mainline Line 3 replacement in October 2021, which added 370,000 barrels per day, and the Trans Mountain Expansion, which recently added 590,000 barrels per day.

Now, President-elect Donald Trump is reportedly considering reviving the Keystone XL pipeline, a 1-million-barrel-per-day project canceled by President Joe Biden on his first day in office, despite being near completion after $15 billion in investments by TransCanada. Sources familiar with the transition team’s discussions indicate that reinstating Keystone XL is part of Trump’s energy independence agenda, reversing Biden’s decision and the environmental opposition that initially halted the project.

Even with the expansion of pipeline infrastructure and Keystone XL potentially back on the table, crude by rail is expected to increase from current levels. Rail remains a viable option for transporting stranded oil without pipeline connectivity and raw bitumen without diluent, which cannot flow through pipelines, but can be shipped as a non-hazardous product. Companies like Cenovus, Strathcona, and Gibson are expanding capacity for raw bitumen shipments, with Strathcona aiming to triple production by the end of 2026. Stay tuned to PFL for updates on these developments.

We are watching Key Economic Indicators

Consumer Confidence

The Conference Board’s Index of Consumer Confidence decreased to 104.7 in November 2024, down from 111.7 in November.

The University of Michigan’s Index of Consumer Sentiment rose to 74 in November, compared to 71.8 in November.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. up to 5 Years; Mid 2029 Return

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|