“Be wiser than other people if you can; but do not tell them so.”

― Dale Carnegie

Jobs Update

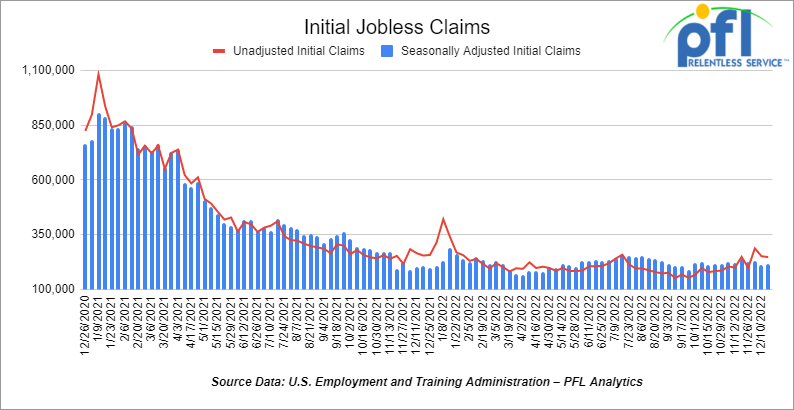

- Initial jobless claims for the week ending December 17th, 2022 came in at 216,000, up +2,000 people week-over-week.

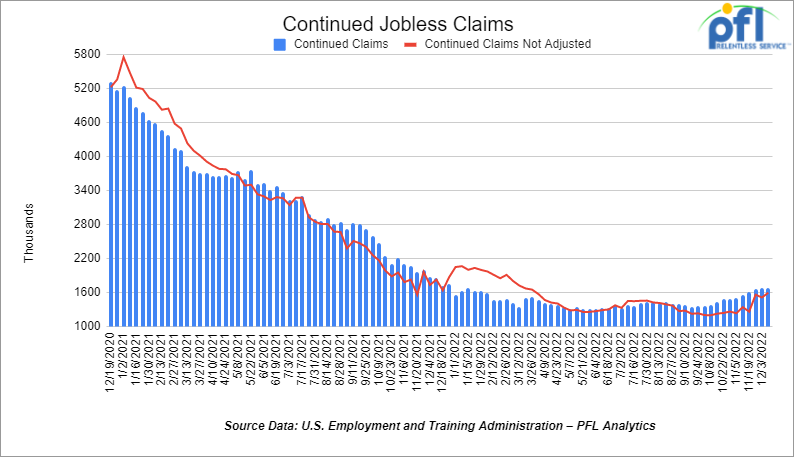

- Continuing jobless claims came in at 1.672 million people, versus the adjusted number of 1.68 million people from the week prior, down -6,000 people week over week.

Stocks closed higher on Friday of last week but mixed week over week

The DOW closed higher on Friday of last week, up +176.44 points (+0.53%), closing out the week at 33,203.93, up +282.47 points week over week. The S&P 500 closed higher on Friday of last week, up +22.43 points (+0.59%) and closed out the week at 3,844.83, down -7.53 points week over week. The NASDAQ closed higher on Friday of last week, up 21.74 points (+.21%), and closed the week at 10,10,497.86, down -207.55 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,591 this morning up +216 points.

Oil closed higher on Friday of last week and up week over week

WTI traded up $2.07 per barrel (+2.67%) to close at $79.56 per barrel on Friday of last week, up $3.27 per barrel week over week. Brent traded up US$2.94 per barrel (+3.63%) on Friday of last week, to close at US$83.92 per barrel, up $4.88 per barrel week over week.

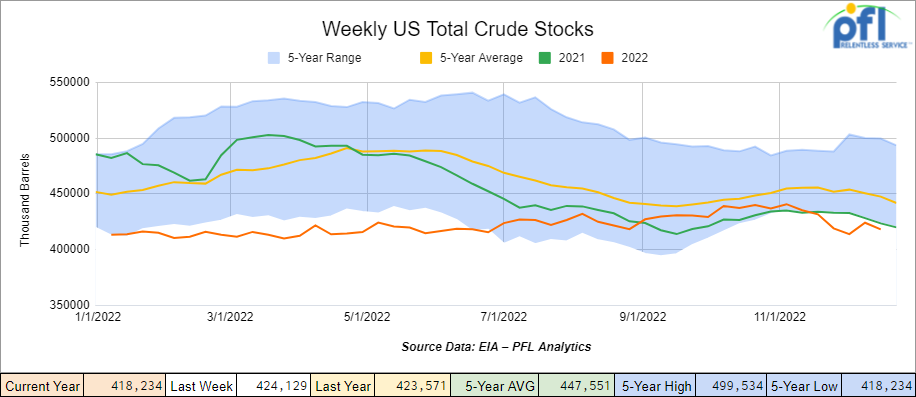

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.9 million barrels week over week. At 418.2 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year.

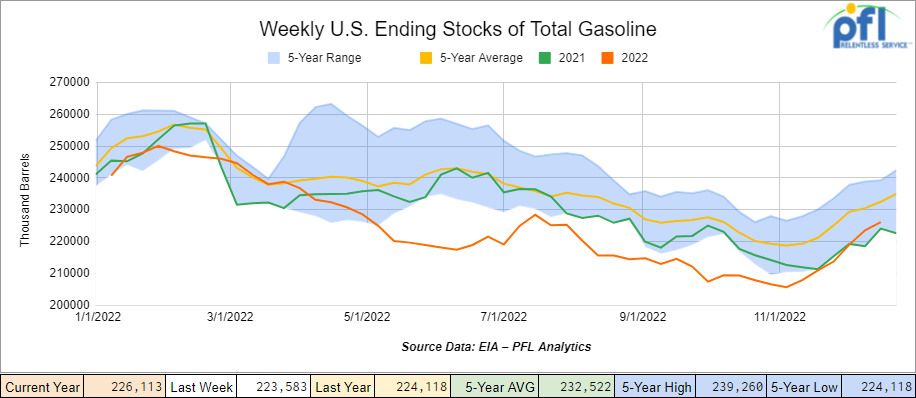

Total motor gasoline inventories increased by 2.5 million barrels week-over-week and are 2% below the five-year average for this time of year.

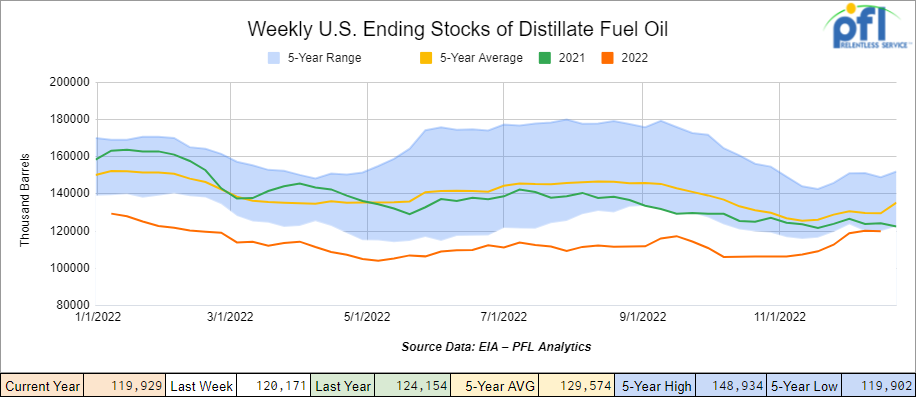

Distillate fuel inventories decreased by 200,000 barrels week-over-week and are 7% below the five-year average for this time of year.

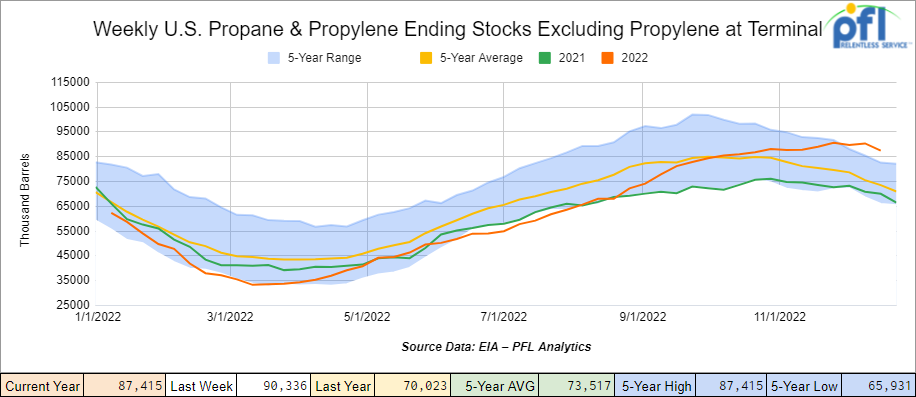

Propane/propylene inventories decreased by 2.9 million barrels week-over-week and are 17% above the five-year average for this time of year.

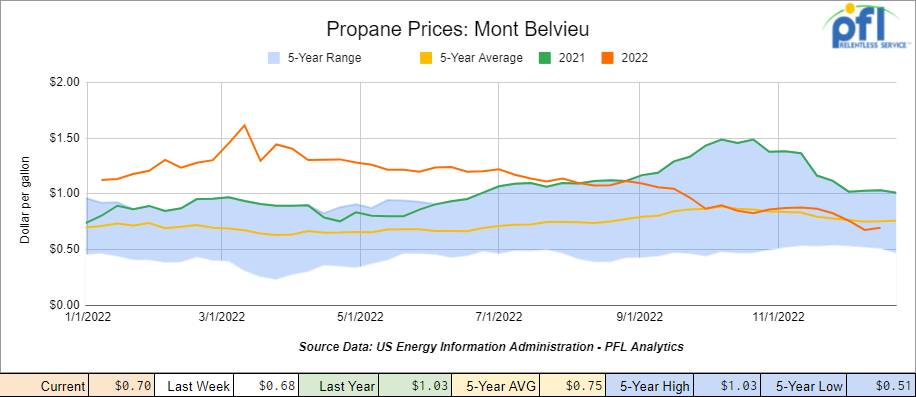

Propane prices were up 2 cents per gallon week over week and down 32 cents per gallon year-over-year. Propane is still a bargain down 5 cents per gallon below the five year average.

Overall, total commercial petroleum inventories decreased by 11.6 million barrels week over week.

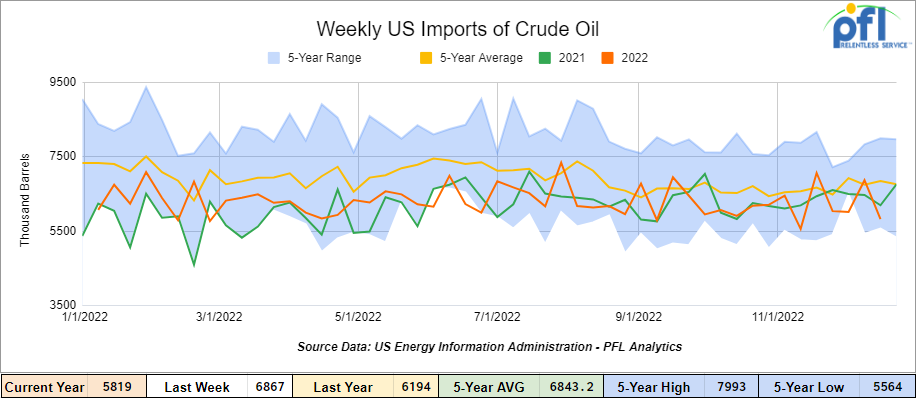

U.S. crude oil imports averaged 5.8 million barrels per day during the week ending December 16th, 2022, a decrease of 1 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 4.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 551,000 barrels per day, and distillate fuel imports averaged 188,000 barrels per day during the week ending December 16th, 2022.

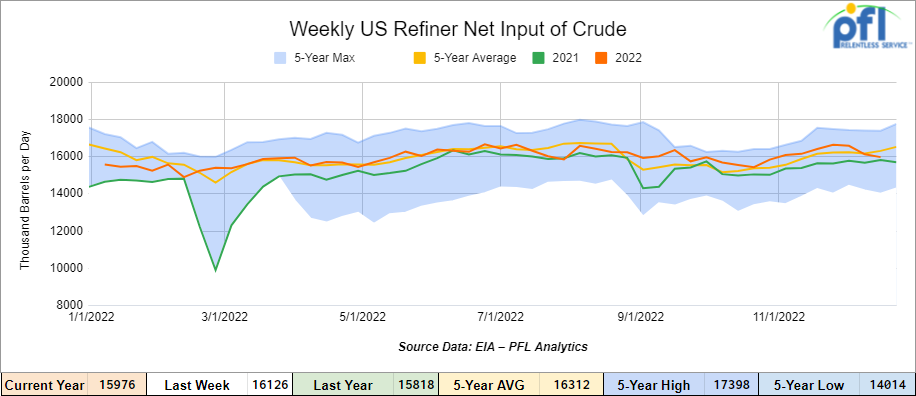

U.S. crude oil refinery inputs averaged 16 million barrels per day during the week ending December 16, 2022, which was 150,000 barrels per day less week over week,

As of the writing of this report, WTI is poised to open at $80.37, up +$0.81 per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 17th, 2022.

Total North American weekly rail volumes were down (-5%) in week 50 compared with the same week last year. Total carloads for the week ending on December 17th were 339,384, down (-2.37%) compared with the same week in 2021, while weekly intermodal volume was 313,308, down (-7.69%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant increase coming from Motor Vehicles and Parts (+12.64%). The largest decrease was from Chemicals (-10.95%).

In the east, CSX’s total volumes were down (-2.21%), with the largest decrease coming from Other (-13.38%) and the largest increase from Motor Vehicles and Parts (+30.93%). NS’s volumes were down (-0.38%), with the largest decrease coming from Petroleum and Petroleum Products (-13.04%) and the largest increase from Grain (+36.81%).

In the West, BN’s total volumes were down (-13.47%), with the largest decreases coming from Other (-29.07%), and the largest increase coming from Farm Products (+6.53%). UP’s total rail volumes were down (-1.08%) with the largest decrease coming from Forest Products (-18.71%) and the largest increase coming from Grain (+9.64%).

In Canada, CN’s total rail volumes were down (-5.13%) with the largest decrease coming from Intermodal (-21.02%) and the largest increase coming from Petroleum and Petroleum Products (+23.34%). CP’s total rail volumes were down (-3.93%) with the largest decrease coming from Forest Products (-27.31%) and the largest increase coming from Petroleum and Petroleum Products (+157.60%).

KCS’s total rail volumes were down (-2.08%) with the largest decrease coming from Grain (-24.86%) and largest increase coming from Petroleum and Petroleum Products (+44.67%).

Source Data: AAR – PFL Analytics

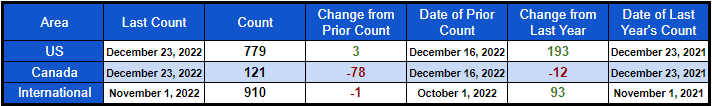

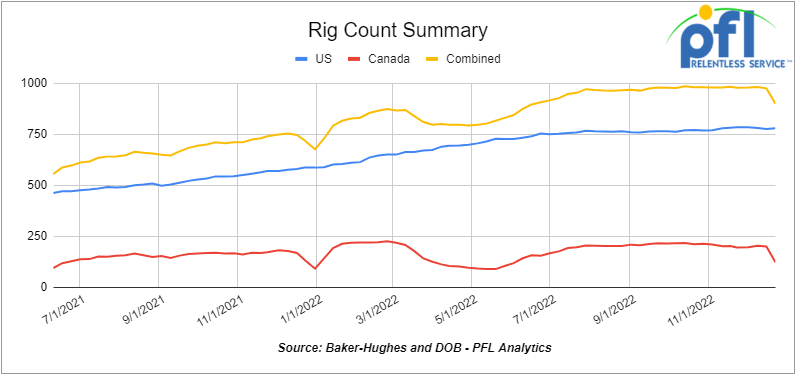

Rig Count

North American rig count was down by -75 rigs week over week. U.S. rig count was up by +3 rigs week-over-week and up by +193 rigs year over year. The U.S. currently has 779 active rigs. Canada’s rig count was down by -78 rigs week-over-week, and down by -12 rigs year-over-year. Canada’s overall rig count is 121 active rigs. Overall, year over year, we are up +181 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,775, from 24,843, which was a loss of 68 railcars week-over-week Canadian volumes were up; CP’s shipments increased by +8.8% week over week, and CN’s volumes were up by +4.7% week over week. U.S. shipments were mixed. The CSX had the largest percentage increase, up by +5.8%, and the BN had the largest percentage decline and was down by -4.4%.

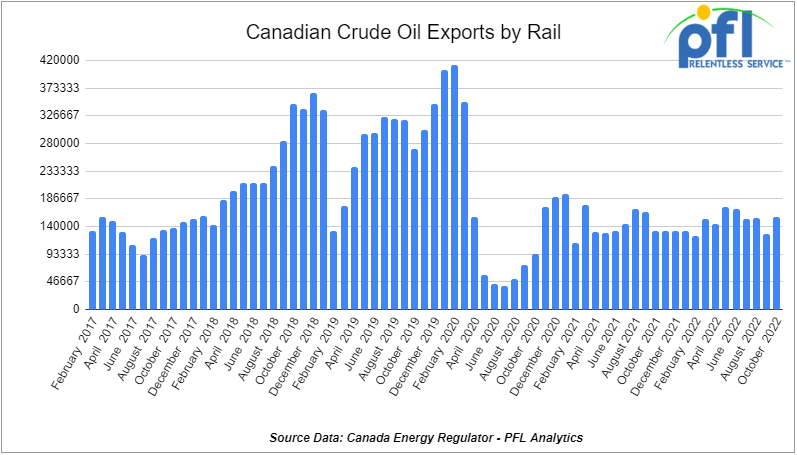

We are eyeing Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on December 20, 2022. For October 2022, Canada exported 155,741 barrels per day by rail (up by 28,681 barrels per day month over month) which is a four month high. Crude by rail out of Alberta has been popular of late for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. We expect to see volumes significantly increase in November and well into December with the rupture of the Keystone Pipeline. Railcars are moving once again to fill the void of a lack of pipeline capacity out of Alberta. In addition, the U.S. government is looking to buy back sour crude for the SPR. Crude by rail is also popular for off-spec products that can be blended here in the United States and in areas where there is no pipeline access. After saying this, it was just announced on Friday of last week that the Keystone Pipeline could be back up and running as early as this week, so time will tell. Before crude by rail out of Canada can come back in a meaningful way, supply needs to exceed pipeline capacity and we need to see a much wider basis for a sustained period of time (or at least predictable). We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins.

Keystone Likely to Startup Sometime this Week

The U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) has approved TC Energy Corporation’s restart plan for the cushing segment.

“We will be commencing activities to support the safe restart of the segment, including rigorous testing and inspections, and this will take several days. We will provide an update on in-service once we are able,” said the company in an update.

On-site activities will continue, despite the adverse weather conditions, although colder temperatures may slow down efforts due to the impact on equipment.- the company said.

Freeport LNG Expects Restart in Second Half Of January

Freeport’s 2bcf per day LNG export facility anticipates the initial restart of its liquefaction facility in the second half of January 2023, the company said in an update. The company had previously expected to restart commercial operations by the end of December 2022.

Freeport continues to have close, collaborative engagement with the regulatory agencies and that engagement will continue as Freeport LNG works towards the safe restart of its facility, it said.

As of Friday of last week, the reconstruction work necessary to commence initial operations is substantially complete, and the company is submitting responses to the last remaining questions included in the Federal Energy Regulatory Commission’s (FERC’s) Dec. 12 data request.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 100-300, C&I Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, Any Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 2-4, Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 5, CPC1232 Tanks needed off of CSX in West Virginia for 2 years plus. Cars are needed for use in Polyacrylamide service. Unlined

• 10-15, 300W Pressures needed off of BNSF, KCS, or UP in Texas for 5-8 years. Cars are needed for use in Various service.

• 5, Tanks needed off of KCS in Texas for 5 years. Cars are needed for use in Calcium Chloride service. Need the cars for 5 years to load from Monterey MX to Corpus and transload to trucks. Need to be lined

• 5, Tanks needed off of BNSF in Texas for 2 years. Cars are needed for use in P-dichlorobenzene service. Immediate need •Unlined•

• 50, Covered Hoppers needed off of BNSF, CN, CP, NS, orUP in the midwest for 5 years. Cars are needed for use in DDG service.

• 50-65, trough tops Covered Hoppers needed off of most class 1s in various locations for 2-3 years. Cars are needed for use in Fertilizer service.

• 25, gravity and pneumatic Covered Hoppers needed off of NS and others maybe in the east or south for Open. Cars are needed for use in Sugar service. Open to purchase as well.

• 15, 117J or R Tanks needed off of CN in the midwest for 1-5 Years. Cars are needed for use in Food Grade Ethanol service.

PFL is offering:

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 150, 3250 CF, Sand Hoppers located off of various class 1s in multiple locations. For sale

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 100, 29K, 117R Tanks located off of UP in Washington. Cars are clean Built in 2014. Coiled and insulated.

• 100, 29K, 117R Tanks located off of UP in Washington State. 2014. Coiled and insulated clean

• 200, Sand Hoppers located off of various class 1s in multiple locations. Offered at a Great Price

• 150, 31.8, 117R Tanks located off of KCS in Texas. Cars are clean Currently being shopped. Call for info.

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 200, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 200, 29K, 117J Tanks located off of BNSF, UP in Oklahoma & Texas. Cars are clean Hempel 15500 Lining.

• 139, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Brand New Cars!

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|