“Whenever you do a thing, act as if all the world were watching.”

Thomas Jefferson

Jobs Update

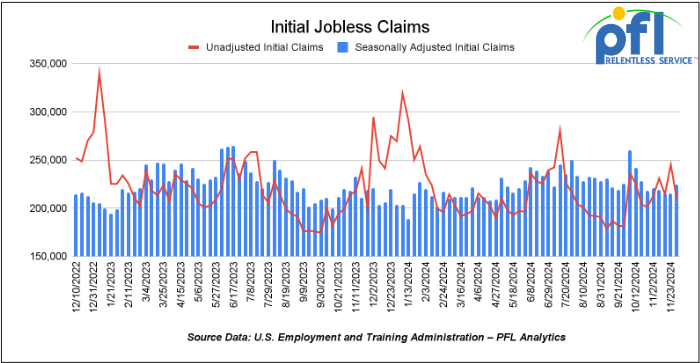

- Initial jobless claims seasonally adjusted for the week ending November 30th came in at 224,000, up 9,000 people week-over-week.

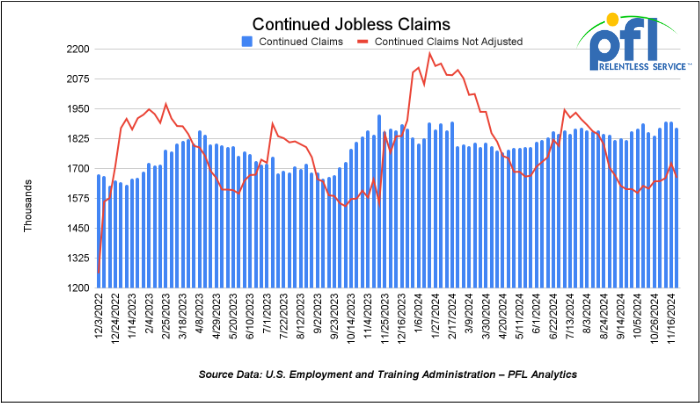

- Continuing jobless claims came in at 1.871 million people, versus the adjusted number of 1.896 million people from the week prior, down 25,000 people week-over-week.

Stocks closed mixed on Friday of last week and mixed week over week

The DOW closed lower on Friday of last week, down -86.06 points (-0.2%) and closing out the week at 43,828.06, down -814.46 points week-over-week. The S&P 500 closed lower on Friday of last week, down -0.16 points, and closed out the week at 6,051.09, down -39.13 points week-over-week. The NASDAQ closed higher on Friday of last week, up 23.88 points (0.12%), and closed out the week at 19,926.72, up 66.96 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 43,901 this morning up 35 points.

Crude oil closed higher on Friday of last week and higher week over week.

West Texas Intermediate (WTI) crude closed up $1.27 per barrel (1.8%) to close at $71.29 per barrel on Friday of last week, up $4.09 per barrel week over week. Brent traded up $1.08 USD per barrel (1.8%) on Friday of last week, to close at $74.49 per barrel, up $3.37 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for January delivery settled Friday on last week at US$12.55 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$57.01 per barrel.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.4 million barrels week-over-week. At 422 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

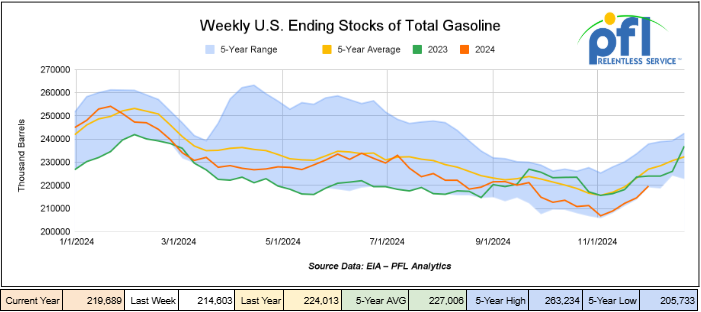

Total motor gasoline inventories increased by 5.1 million barrels week-over-week and are 4% below the five-year average for this time of year.

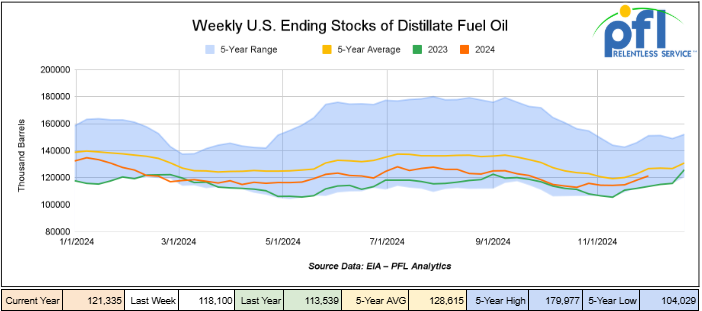

Distillate fuel inventories increased by 3.2 million barrels week-over-week and are 4% below the five-year average for this time of year.

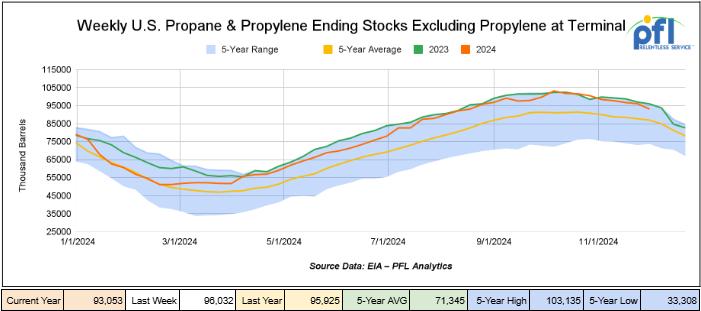

Propane/propylene inventories decreased by 3 million barrels week-over-week and are 7% above the five-year average for this time of year.

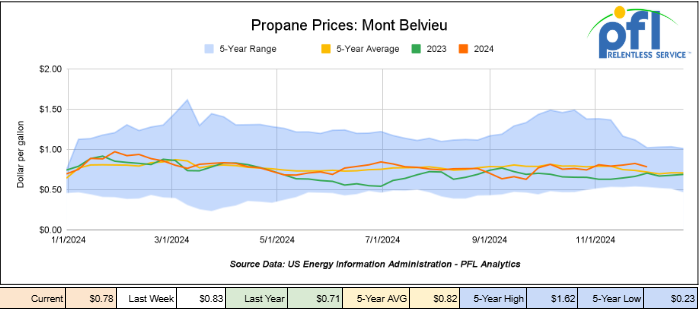

Propane prices closed at 78 cents per gallon on Friday of last week, down 5 cents per gallon week-over-week, and up 7 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 900,000 barrels during the week ending December 6th, 2024.

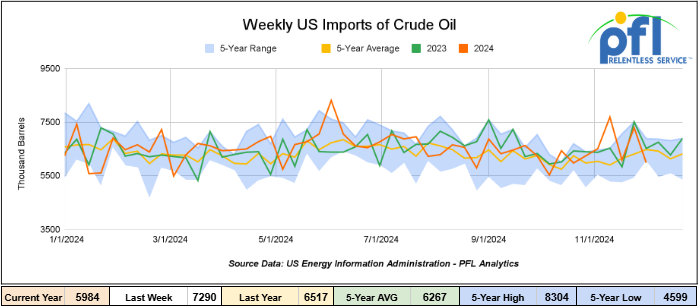

U.S. crude oil imports averaged 6 million barrels per day during the week ending December 6th, 2024, a decrease of 1.3 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.8 million barrels per day, 2.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 464,000 barrels per day, and distillate fuel imports averaged 154,000 barrels per day during the week ending December 6th, 2024.

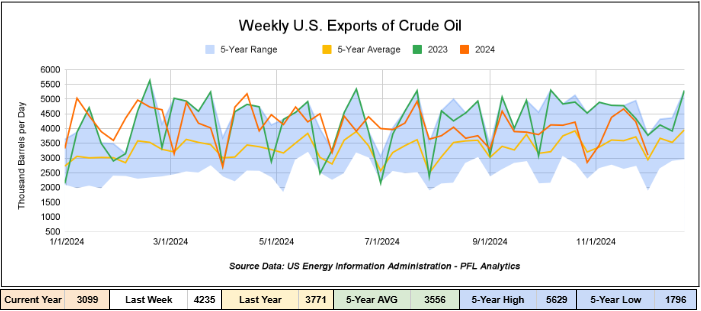

U.S. crude oil exports averaged 3.099 million barrels per day during the week ending November 29, 2024, a decrease of 1.136 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.094 million barrels per day.

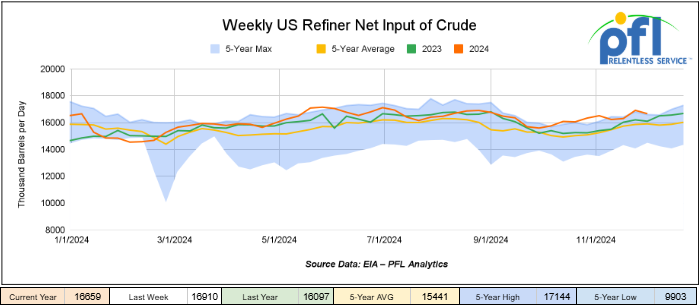

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending December 6, 2024, which was 251,000 barrels per day less week-over-week.

WTI is poised to open at $70.57, down 72 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 11, 2024.

Total North American weekly rail volumes were up (1.53%) in week 50, compared with the same week last year. Total carloads for the week ending on December 11th were 343,001, down (-3.68%) compared with the same week in 2023, while weekly intermodal volume was 359,713, up (7.06%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Motor Vehicles and Parts, which was down (-18.55%) while the largest increase came from Grain (9.95%).

In the East, CSX’s total volumes were up (2.7%), with the largest decrease coming from Motor Vehicles and Parts (-14.8%), while the only increase came from Petroleum and Petroleum Products (10.38%). NS’s volumes were down (-4.48%), with the largest decrease coming from Coal (-21.9%), while the largest increase came from Grain (20.11%).

In the West, BN’s total volumes were up (5.34%), with the largest decrease coming from Other, down (-20.43%), while the largest increase came from Intermodal (13.91%). UP’s total rail volumes were up (6.62%) with the largest decrease coming from Coal, down (-25.8%), while the largest increase came from Grain (17.25%).

In Canada, CN’s total rail volumes were down (-9.42%) with the largest decrease coming from Other, down (-50.47%), while the largest increase came from Grain, up (+24.76%). CP’s total rail volumes were down (-11.16%) with the largest increase coming from Other (+55%), while the largest decrease came from Metallic Ores and Metals (-34.61%).

KCS’s total rail volumes were down (-3.26%) with the largest decrease coming from Coal (-26.64%) and the largest increase coming from Grain (+58.01%).

Source Data: AAR – PFL Analytics

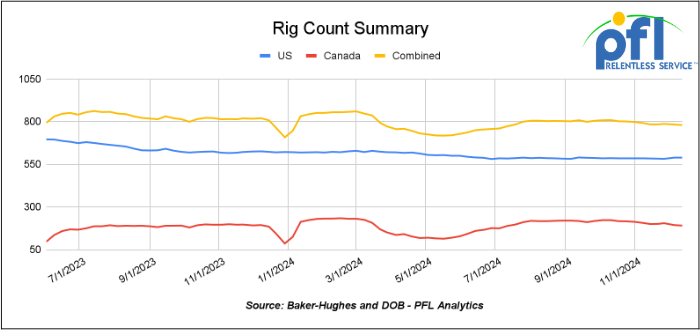

Rig Count

North American rig count was down -3 rigs week-over-week. U.S. rig count was flat week-over-week and down by -34 rigs year-over-year. The U.S. currently has 589 active rigs. Canada’s rig count was down -3 rigs week over week, but up 6 rigs year-over-year, and Canada’s overall rig count is 191 active rigs. Overall, year over year we are down by -28 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,839 from 29,905, which was a loss of 66 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were higher by +2.5% week over week, CN’s volumes were lower by -7.5% week-over-week. U.S. shipments were higher across the board. The CSX had the largest percentage increase and was up by 18.8%

We are Watching Alberta, Canada’s new Border Policy

Folks, Alberta is taking matters into its own hands when it comes to border security since the Canadian federal government won’t. Does that sound familiar? Alberta, The Western Canadian province, will spend C$29 million ($20.46 million) to create a new sheriff-led patrol unit to police its 298-kilometer (185-mile) border with Montana, the Premier said on Thursday of last week.

Alberta’s plan follows a pledge from President-elect Donald Trump to impose a 25% tariff on imports from Canada and Mexico unless those countries crack down on illegal immigration and drug trafficking.

Premier Danielle Smith said Alberta has been working on increasing border security since July 2023, but Trump’s tariff threat prompted the province to accelerate its plan.

Alberta is Canada’s main oil-producing province and exports around 4 million barrels per day to the U.S., meaning it would be among the provinces hardest hit by tariffs and is hoping that Alberta oil and gas exports from Canada to the U.S. will be spared given the Premier’s proactive action.

The new Interdiction Patrol Team will be part of the Alberta Sheriffs’ law enforcement agency and consist of 51 uniformed officers armed with carbine rifles, four drug-patrol dogs, 10 support staff, four narcotics analyzers to test for drugs and surveillance drones.

Alberta will also create a two-kilometer-deep border zone in which sheriffs will be able to arrest people found attempting to cross the border illegally or trafficking illegal drugs or weapons, without needing a warrant.

“Today’s announcement represents a strong investment from Alberta’s government that reflects the seriousness with which we’re treating this current situation,” said Alberta Minister of Public Safety Mike Ellis, speaking at a press conference alongside Smith.

Alberta has six official points of entry along its sparsely populated border with Montana.

Canada’s federal leaders have vowed to beef up the border, but released few details. Public Safety Minister Dominic LeBlanc did not immediately respond to a request for comment.

It is not clear why Alberta needs the additional powers it is giving law enforcement, Shakir Rahim, lawyer and director of the Criminal Justice Program at the Canadian Civil Liberties Association (“CCLA”), said in a statement.

“Existing legislation provides adequate enforcement powers to address border security and weapons or narcotics trafficking. … CCLA will be closely monitoring the specific details of these new regulations to assess if they are overbroad.”

We Are Watching Key Economic Indicators

U.S Unemployment

The November 2024 U.S. jobs report from the Bureau of Labor Statistics indicates that total nonfarm payroll employment increased by 227,000, while the unemployment rate edged slightly higher to 4.2%. Key areas of growth were in health care, leisure and hospitality, government, and social assistance. Conversely, retail trade experienced a decline in employment.

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50.

In November 2024, the Institute for Supply Management (ISM) reported that the Manufacturing PMI increased to 48.4%, up from 46.5% in October, signaling a slower pace of contraction for the manufacturing sector. The new orders subindex rose to 50.4%, moving into expansion territory for the first time in several months, which suggests a rebound in demand within manufacturing.

Producer Price Index (PPI)

The Producer Price Index (PPI) rose 0.4% in November, slightly exceeding expectations, driven by a 3.1% surge in food prices, particularly a 56% jump in egg prices. Core PPI (excluding food and energy) increased by 0.2%, aligning with forecasts, though its annual growth edged up to 3.4%. Goods prices, which constitute 30% of the PPI, grew 0.7%, while services prices rose 0.2%, continuing their slowdown.

The PPI typically precedes changes in consumer prices. The Consumer Price Index (CPI) rose 0.3% in November, with annual inflation at 2.7%. Core CPI also increased by 0.3%, with signs of easing in housing-related inflation.

The Federal Reserve is widely expected to lower interest rates by 0.25% at its Dec. 17–18 meeting, reflecting (according to the government) progress toward its 2% inflation target. November’s core PCE price index, a key measure for the Fed, is projected to show a 2.9% annual rise when released on Dec. 20th. Markets see a 98% probability of the Fed implementing this rate cut, following previous reductions totaling 0.75% since September.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|