“Life isn’t about finding yourself. Life is about creating yourself.” ― George Bernard Shaw

Due to the Google Outage our live stream was cut during the broadcast. Please enjoy our backup copy of the stream.

COVID 19

The United States currently has 16,737,267 confirmed COVID 19 cases and 306,459 confirmed deaths.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 853,000 initial jobless claims. The number of first-time filers for unemployment benefits were higher than expected and were estimated to come in at 725,000. Continuing claims were 5.757 million versus the expected 5.210 million. Thursday’s report ended a seven-week streak during which new jobless claims held below 800,000. New weekly claims are now about four times greater than they were before the pandemic, when they were averaging about 200,000 per week. Individuals in the Pandemic Emergency Unemployment Compensation program, which offers individuals an additional 13 weeks’ worth of benefits after they use up their allotted six months of continuing benefits, fell by about 36,000 according to last week’s data. Overall about 19 million Americans are claiming unemployment benefits of some form a decrease of 1 million week over week.

Markets Take a Breather Last Week – Down Slightly

The Dow closed higher on Friday, up +47.11 points (+0.16%) closing out the week at 30,046.37 points down 171.89 points week over week. The S&P 500 closed lower on Friday, down 4.64 points (-0.13%) closing out the week at 3,663.46 points, down 35.66 points week over week. The Nasdaq Composite closed lower as well on Friday of last week, down 27.94 points (-0.23%) closing out the week at 12,377.87 points down 86.36 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning roughly 200 points.

Oil gains for sixth straight week albeit marginally

Oil rose for a sixth straight week, buoyed by optimism over Covid-19 vaccine progress. The USDA approved Pfizer’s vaccine to be used in the U.S. this past Saturday and deliveries are happening now. FedEx is looking after the West and UPS the East. At the same time, lockdowns are intensifying in New York and elsewhere causing a significant strain on businesses and continued demand destruction through the holidays. West Texas Intermediate (WTI) for January delivery lost 21 cents on Friday of last week to settle at US$46.57/bbl. WTI eased off a nine-month high alongside a broader market decline as bipartisan talks on another round of U.S. fiscal stimulus stalled. WTI rose less than one percent for the week. Brent for February settlement declined 28 cents on Friday of last week to end the session at US$49.97/bbl. The contract rose 1.5 percent week over week.

With the market outlook improving, U.S. crude futures have gained roughly 30 per cent since the end of October.

According to the EIA, U.S. commercial crude oil inventories increased by 15.2 million barrels week over week previous week. At 503.2 million barrels, U.S. crude oil inventories are 11% above the five year average for this time of year. Total motor gasoline inventories increased by 4.2 million barrels last week and are 5% above the five year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories increased by 5.2 million barrels last week and are 11% above the five year average for this time of year. Propane/propylene inventories decreased by 4.1 million barrels last week and are 4% above the five year average for this time of year. Total commercial petroleum inventories increased by 19.9 million barrels last week.

Oil is higher in overnight trading and WTI is poised to open at 47.06, up 49 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 3.8% year over year in week 49 (U.S. +4.8%, Canada +4.0%, Mexico -10.8%), resulting in quarter to date volumes that are up 2.8% and year to date volumes that are down 7.4% (U.S. -8.1%, Canada -4.7%, Mexico -9.8%). 4 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+9.2%) and grain (+17.5%). The largest decreases came from coal (-8.9%) and petroleum (-23.3%).

In the East

CSX’s total volumes were up 4.8%, with the largest increase coming from intermodal (+12.4%). The largest decrease came from motor vehicles & parts (-12.0%). NS’s total volumes were down 3.3%, with the largest decreases coming from coal (-23.8%) and petroleum (-48.4%). The largest increase came from intermodal (+2.5%).

In the West

BN’s total volumes were up 7.9%, with the largest increase coming from intermodal (+19.2%). The largest decreases came from coal (-8.6%) and petroleum (-24.1%). UP’s total volumes were up 4.4%, with the largest increases coming from intermodal (+8.2%) and grain (+58.6%). The largest decreases came from coal (-17.7%) and petroleum (-24.5%).

In Canada

CN’s total volumes were up 6.3% with the largest increases coming from intermodal (+15.8%) and grain (+21.3%). The largest decreases came from petroleum (-24.0%) and motor vehicles & parts (-24.3%). RTMs were up 3.8%. CP’s total volumes were up 2.8%, with the largest increases coming from intermodal (+7.3%) and farm products (+87.3%). The largest decrease came from petroleum (-42.6%). RTMs were down 2.8%.

Kansas City Southern

KCS’s total volumes were down 1.1%, with the largest decreases coming from intermodal (-6.2%). The largest increase came from petroleum (+34.4%).

Source: Stephens

Rig Count

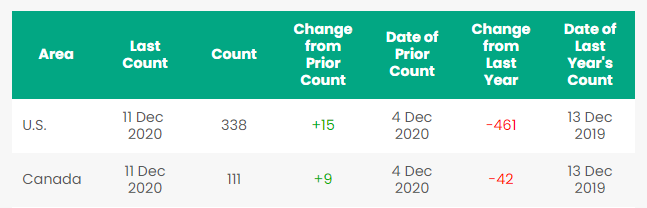

North America rig count is up by 24 Rigs week over week. The U.S. gained 15 rigs week over week with 338 active rigs. Canada’s rig count was up by 9 rigs week over week and Canada’s overall rig count is 111 active rigs. Year over year we are down 503 rigs collectively.

North American Rig Count Summary

Things we are keeping an eye on

- Dakota Access Pipeline (DAPL)- A hearing is scheduled for DAPL this Friday December 18th as it relates to keeping the pipeline operational while it awaits its environmental review. The Standing Rock Sioux Tribe wants the 750,000 barrel a day pipeline shut down and if successful will reap havoc on the State of North Dakota and its producers. Could be a possible tailwind for crude by rail. Stay tuned to PFL, as we are monitoring the situation closely.

- Petroleum By Rail – The four week rolling average of petroleum carloads by rail on North America’s railroads rose to 25,032 from 24,278 the prior week. Canadian volumes fell week over week – CP shipments were down 2.9% and CN’s volumes were up by 2.8%. In the U.S., the NS had the largest percentage increase of 20.2%. Last week’s activity was the highest since April.

- Enbridge Line three – Enbridge has wasted no time since receiving its permit in Minnesota and has started construction on the Minnesota portion of the pipeline. The 760,000 barrel a day pipeline once expanded, stretches from Alberta Canada to Wisconsin. The Canadian portion of the pipeline is already built as are the sections in North Dakota and Wisconsin. The pipeline is expected to be fully operational within 9 months.

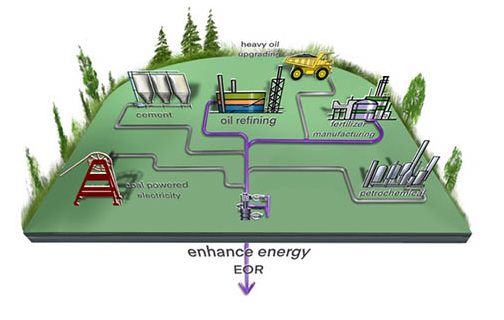

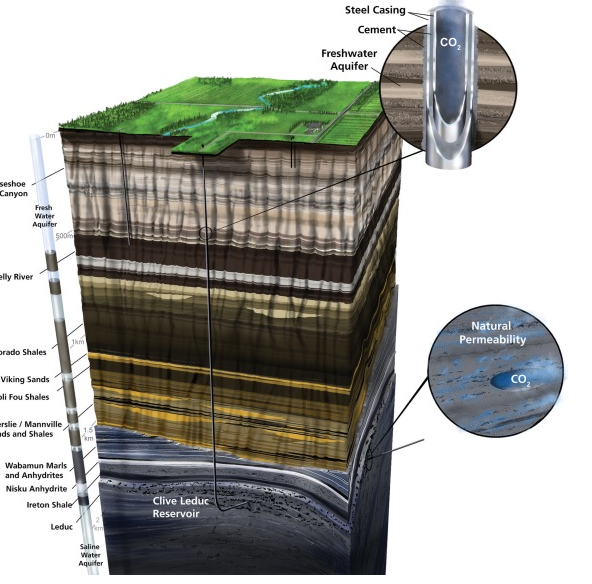

- Canada is betting on Hydrogen to get to net zero by 2050. A national hydrogen strategy to be released “very soon” will seek to make Canada a world-leading producer of clean hydrogen, Natural Resources Minister Seamus O’Regan said this week. The plan is to capitalize on existing regional strengths. “In Alberta and Saskatchewan we can work with the plans announced by the government of Alberta to build on our natural gas and petroleum sector to produce clean hydrogen. We have got natural gas in abundance, and we’ll do that [make grey hydrogen blue] with the help of carbon capture.” Canada already possesses some world-leading carbon capture technology with large scale projects like the recently completed Alberta Carbon Trunk Line (ACTL) that conveys CO₂ from industrial sources to oilfields for enhanced oil recovery. Designed as the backbone infrastructure needed to support a lower carbon economy in Alberta, it has the world’s largest capacity pipeline for CO₂.capable of transporting up to 14.6 million tonnes of CO₂ per year representing 20% of all current oil sands emissions or equal to the impact of capturing CO₂ from more than 2.6 million cars. The ACTL system currently captures CO₂ at the North West Redwater Partnership (NWR) Sturgeon Refinery and Nutrien’s Redwater Fertilizer Facility. The CO₂ is transported to mature oil fields and injected into those fields creating increased pressure thus increasing production and the longevity of depleting oil fields. This represents a win win for industry and environmental groups. (see below – how it works)

CO₂ Captured from Industrial emitters can be separated and compressed for transportation in pipelines for use in enhanced oil recovery and permanent storage in depleting oil and natural gas reservoirs

Once the CO₂ reaches its destination it is injected into the depleting reservoir

5. A state district judge in Austin has ordered the Texas Railroad Commission to stop granting exceptions to environmental rules requiring oil and gas companies to cap unplugged wells and clean up waste pits, advocacy group Public Citizen and the commission said on Thursday of last week. “The Commission does not agree with the Court’s order, and has filed a notice of appeal with the Third Court of Appeals,” Andrew Keese, spokesperson for the Railroad Commission of Texas, said in a statement to Reuters. Public Citizen and two ranchers sued the Railroad Commission in July for unlawfully suspending the rules. The group said Judge Jan Soifer ruled the Railroad Commission gave “insufficient notice to the public that the [commission] would adopt orders that grant exceptions or provide the means to grant exceptions for a year or more without giving notice of the rules at issue.” The Railroad Commission, which regulates the state’s oil and gas industry, has used the exceptions to help oil and gas companies during the COVID-19 pandemic, according to Public Citizen.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

A sign of things getting better – leasing activity and inquiries have continued to be strong

PFL is seeking:

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase

- 50-60 Sulfuric acid cars 13.6 for purchase

- 40-50 molten Sulfur Cars 13.8 for purchase

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

- 30 5400-5800 286 Hoppers needed in Texas off the BN for grain 2 years negotiable

- 10 Veg Oil tanks 30K needed in Mexico off the BN for 2 years negotiable

- 5100 CU FT plus hoppers needed in the Midwest off the BN or UP negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- 140 117R 30.3 Dirty Ethanol located east and Midwest, lease negotiable

- 25 117J 25.5 New Texas UP and BN lease negotiable

- 110 2494 CU FT Gondolas for sales or lease 286 GRL in Montana UP negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale, Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|