“If you do not treat people with the respect they deserve, do not expect any kind of commitment to your productivity goals and target.”

– Ian Fuhr, Founder and CEO of the Sorbet Group

Jobs Update

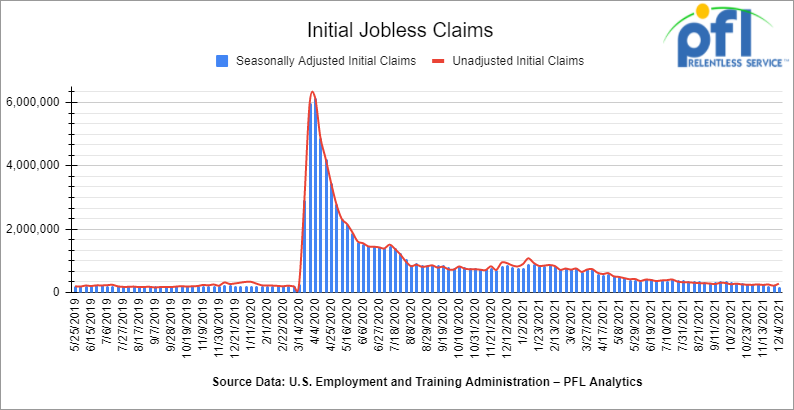

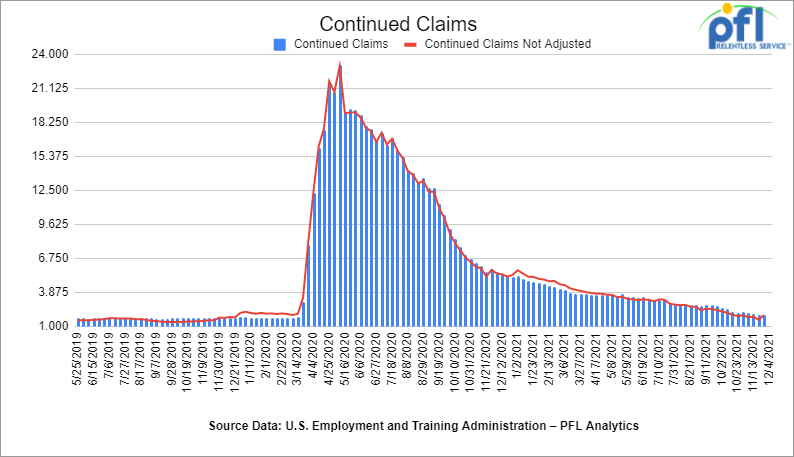

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending December 4th came in at 184,000, down -43,000 people week over week.

- Continuing claims came in at 1.992 million people versus the adjusted number of 1.954 million people from the week prior, up 38,000 people week over week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 216.3 points (+0.6%), closing out the week at 35,970.99 points, up 1,390.91 points week over week. The S&P 500 closed higher on Friday of last week, up 44 points (+0.95%) and closed out the week at 4,712.02, up 173.59 points week over week. The Nasdaq closed higher on Friday of last week, up 113.23 points (0.73%) and closed out the week at 15,630.6, up 545.13 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 36,035 this morning up 68 points.

Oil prices achieved their biggest weekly gain since August

West Texas Intermediate (WTI) crude closed up 73 cents on Friday of Last week, or 1.03% to settle at $71.67 up $5.41 barrel week over week, while Brent futures closed up 73 cents as well, or up 0.98% to settle at $75.15 per barrel, up $5.01 per barrel week over week.

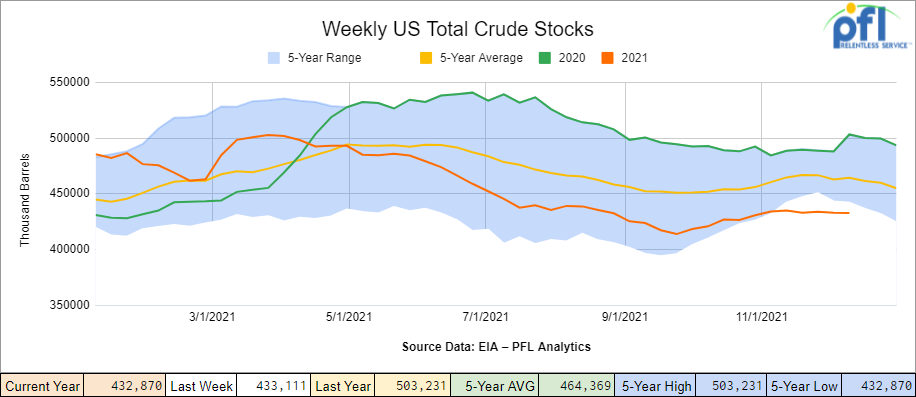

U.S. commercial crude oil inventories decreased by 200,000 barrels the week ending December 3,2021. At 432.9 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year.

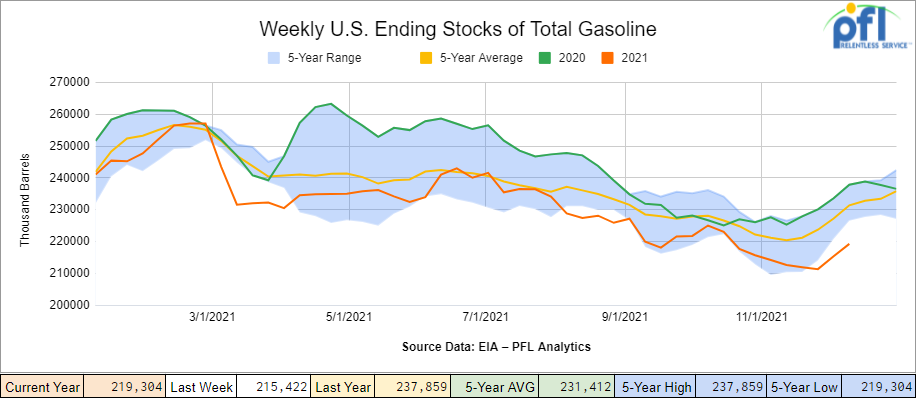

Total motor gasoline inventories increased by 3.9 million barrels week over week and are 5% below the five-year average for this time of year.

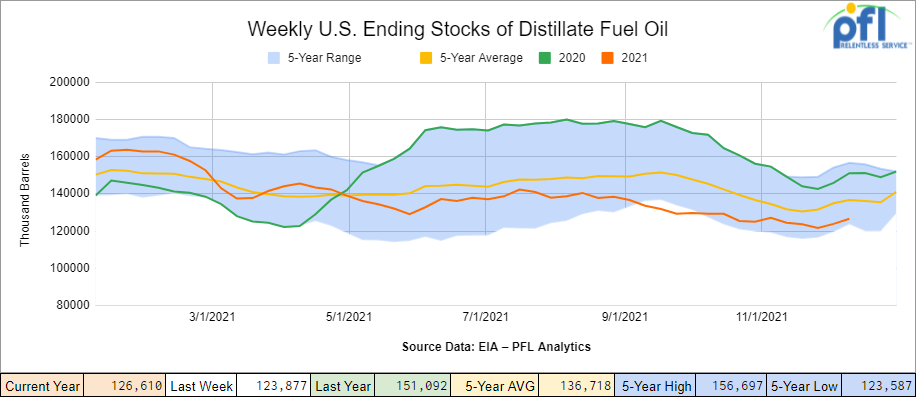

Distillate fuel inventories increased by 2.7 million barrels week over week and are 7% below the five-year average for this time of year.

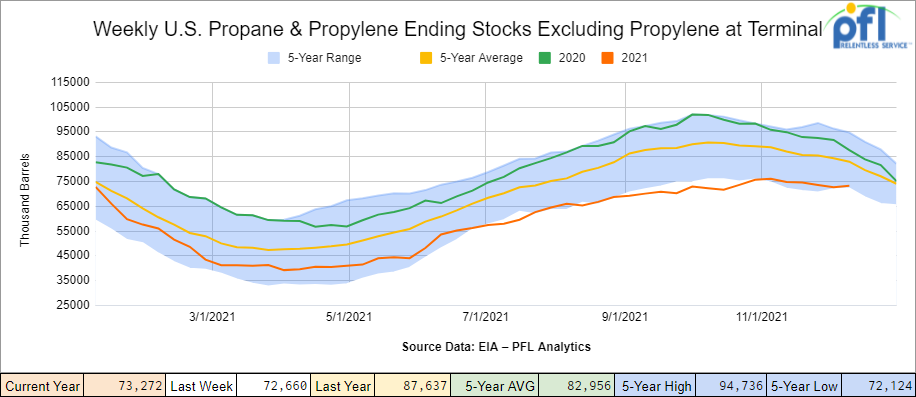

Propane/propylene inventories increased by 600,000 barrels week over week and are 11% below the five-year average for this time of year.

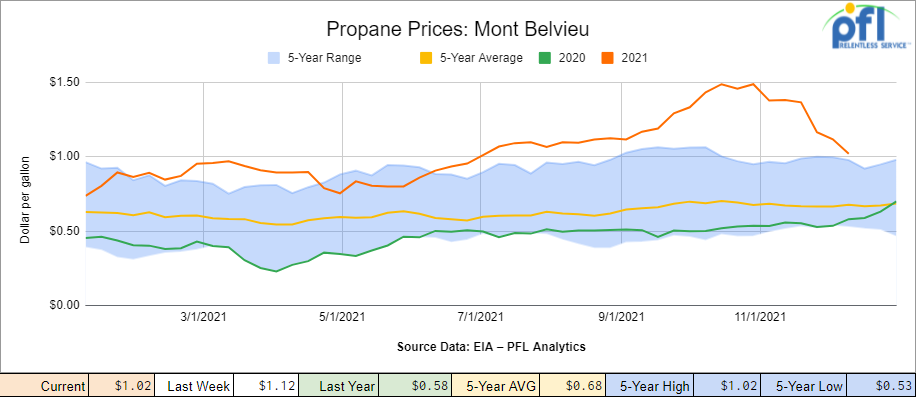

Propane prices continue to fall in Mont Belvieu and are down 10 cents per gallon week over week.

Overall, total commercial petroleum inventories increased by 4.2 million barrels for the week ending December 3, 2021.

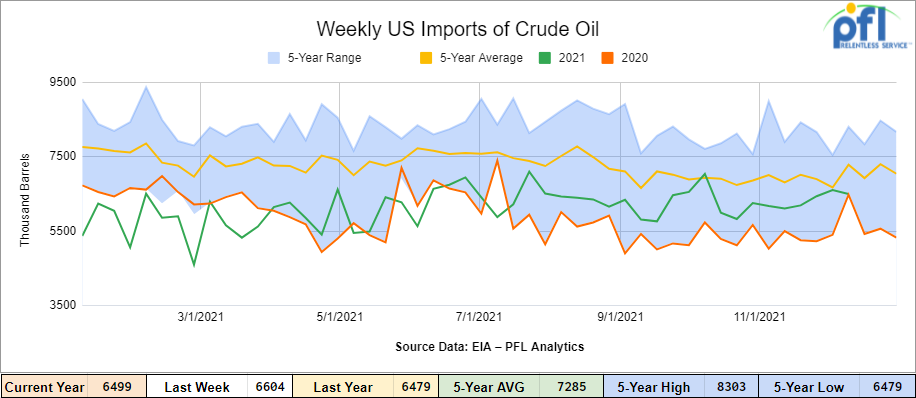

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending December 3rd, down by 105,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, up 15.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 558,000 barrels per day, and distillate fuel imports averaged 269,000 barrels per day.

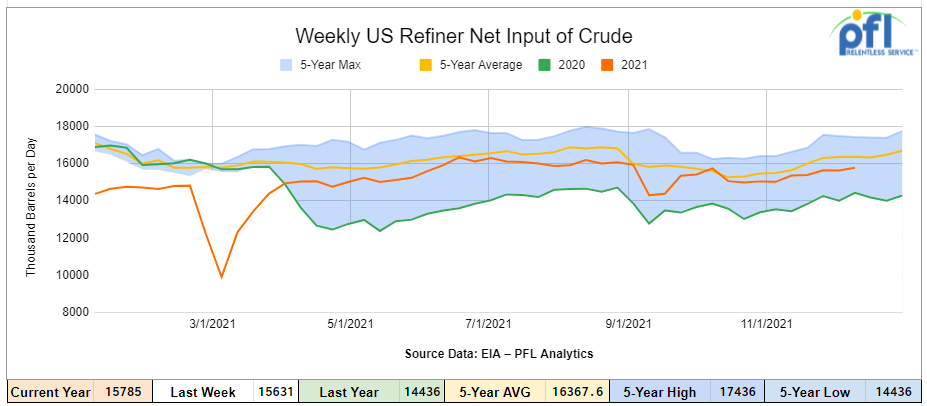

U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ending December 3, 2021, which was 153,000 barrels per day more than the previous week’s average. Refineries operated at 89.8% of their operable capacity.

As of the writing of this report, WTI is poised to open at $71.83 , up 16 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 6.0% year over year in week 48 (U.S. -2.8%, Canada -19.9%, Mexico +8.6%) resulting in quarter to date volumes that are down 5.2% and year to date volumes that are up 5.3% year over year (U.S. +6.4%, Canada +1.6%, Mexico +4.3%). 8 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decline coming from intermodal (-10.8%). The largest increase came from nonmetallic minerals (+13.1%).

In the East, CSX’s total volumes were up 1.1%, with the largest increases coming from intermodal (+2.2%) and chemicals (+11.2%). The largest decrease came from motor vehicles & parts (-12.2%). NS’s total volumes were down 1.3%, with the largest decreases coming from intermodal (-3.9%) and grain (-28.2%).

In the West, BN’s total volumes were down 5.6%, with the largest decrease coming from intermodal (-12.6%). The largest increase came from stone sand & gravel (+37.1%). UP’s total volumes were up 0.3%, with the largest increases coming from coal (+28.2%) and chemicals (+12.4%). The largest decreases came from intermodal (-9.9%) and motor vehicles & parts (-17.4%).

In Canada, CN’s total volumes were down 18.8%, with the largest decrease coming from intermodal (-28.2%). Revenue per ton mile was down 18.7%. CP’s total volumes were down 16.1%, with the largest decreases coming from intermodal (-15.8%), coal (-47.6%), farm products (-72.3%) and grain (-22.4%). Revenue per ton mile was down 19.0%.

KCS’s total volumes were up 1.8%, with the largest increase coming from coal (+44.8%) and the largest decrease coming from petroleum (-45.6%).

Source Data: Stephens

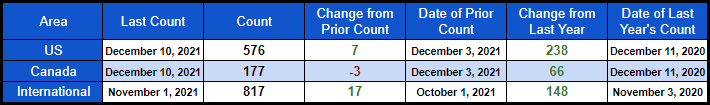

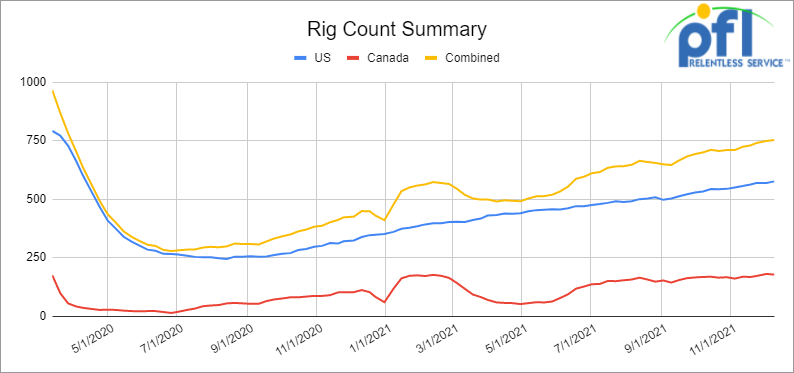

Rig Count

North American rig count is up by 4 rigs week over week. The U.S. rig count was up by 7 rigs week and up by 238 rigs year over year. The U.S. currently has 576 active rigs. Canada’s rig count was down by 3 rigs week over week and up by 66 rigs year over year and Canada’s overall rig count is 177 active rigs. Overall, year over year, we are up 304 rigs collectively.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,206 from 24,022, a gain of 183 rail cars week over week. Canadian volumes were mostly mixed: CP volumes were down by 9% and CN volumes were up by 3.7 % week over week. U.S. volumes were mostly higher with the UP having the largest percentage increase (up by 16.6%) and the NS having the largest percentage decrease (down by 4.4%).

Trans Mountain 300,000 barrels per day Crude Oil pipeline restarts

The Trans Mountain crude oil and products pipeline in Western Canada restarted on Sunday December 5th after a three-week shutdown from record rainfall that triggered severe flooding and landslides in British Columbia, resulting in the longest closure in the pipeline’s nearly 70-year history.

The 330,000 b/d pipeline, which transports more than 300,000 b/d of crude and roughly 25,000 b/d of refined products, is again supplying oil to the Vancouver region and to refineries in the US Pacific Northwest, Trans Mountain said.

The plan originally was to resume partial service by Nov. 26, but Trans Mountain officials said the outage would last until earlier December because of necessary repairs and additional inclement weather. The combination of the pipeline closure and since-resolved rail shutdowns has caused oil and fuel shortages in parts of British Columbia, especially in the Victoria area. The pipeline was shuttered on November 14th

“The Trans Mountain Pipeline was safely restarted,” Trans Mountain said in a Dec. 5 statement. “As part of this process, Trans Mountain will monitor the line on the ground, by air and through our technology systems operated by our control center. The restart comes following the completion of all necessary assessments, repairs and construction of protective earthworks needed for the pipeline to be returned to service.”

“Over the coming weeks, Trans Mountain will continue with additional emergency work,” Trans Mountain noted. “Some of this work includes conducting additional inline inspection, armoring of riverbanks and adding ground cover or relocating sections of the pipeline.”

On the back of the news Canadian crude strengthened throughout the week – WCS for January delivery settled on Friday of last week at US -$16.73 below the WTI. The implied value was US $54.71. On Thursday of last week it settled at US- $16.93 below the WTI January delivery. The implied value was US$53.82/bbl.

Trans Mountain is currently expanding its capacity to 890,000 barrels per day on schedule to be completed by December 31, 2022.

JP Morgan Predicts $125 Crude Oil in 2022.

JP Morgan predicts the end of Covid-19, a strong economy, and $125 oil. Next year could lay the foundation for “a far more vibrant economic environment” and COVID transitioning from a pandemic to an endemic disease, JP Morgan said in its Outlook 2022, titled ‘Preparing for a vibrant cycle.’ According to the investment bank, household net worth is at all-time highs in many developed countries, and excess savings are elevated. Consumption will likely be strong for years amid strong labor market conditions and the capacity to take on more debt, JP Morgan’s strategists said in the report for 2022.

US Steel, the NS, and Greenbrier partner for new rail car

United States Steel Corp., Norfolk Southern Corp. and The Greenbrier Cos. collaborated to create a new high-strength railcar, the companies announced on Thursday of last week. The steel gondola railcars are designed to be lighter weight and more sustainable with an extended life cycle and greater freight capacity. They use a formula for steel developed by U.S. Steel. Each gondola will have an unloaded weight that is reduced by up to 15,000 pounds.

“The use of lightweight, high-strength steel is a real revolution for railcars,” Norfolk Southern CEO James Squires said. “Not only will each gondola carry more material, they will do so by using less energy, making our operations, and our customer’s operations, even more environmentally friendly.”

Norfolk Southern will initially acquire 800 of the Greenbrier engineered gondolas. Gondola rail cars transport loose bulk material such as metal scraps, coils, wood chips, steel slabs and ore. The companies said the partnership is rooted in the recognition that North America has an aging gondola fleet that will soon require substantial replacement with a more sustainable design.

“The work done by U.S. Steel, Norfolk Southern and Greenbrier promises significant benefits to all three companies and the freight transportation industry as a whole,” Greenbrier CEO William Furman said. “The three partners on this next-generation transportation equipment have deep roots in industrial America. Together, we are leading the way to a net-zero carbon economy. I look forward to our continued partnership.” For more information on the new car see the video below:

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20K stainless cars for purchase, 5800 CUFT 286 and 6250 CUFT 286

- 10-20 Covered hopper grain cars in the Midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the Midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors Midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the Midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short-term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty-to-dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in TN off of the CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|