“Don’t ever break someone’s trust. Once you do, then nobody wants to do business with you.”

– Robert Budi Hartono

Jobs Update

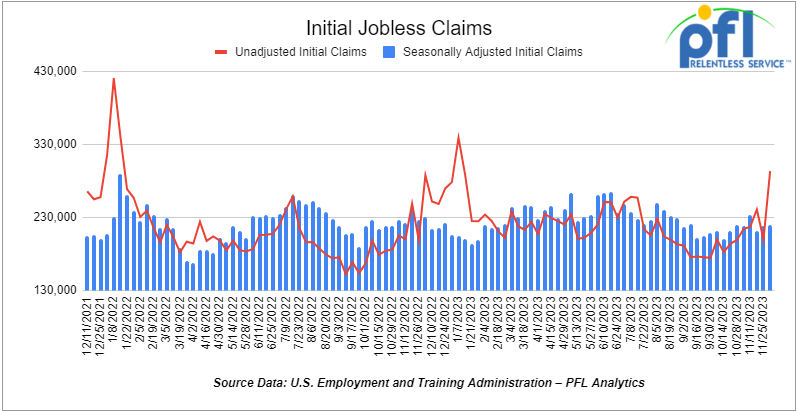

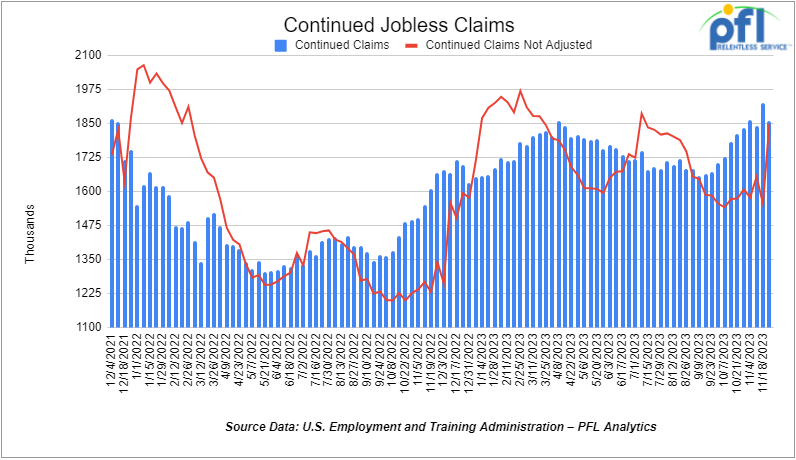

- Initial jobless claims for the week ending December 2nd, 2023 came in at 223,000, up 1,000 people week-over-week.

- Continuing jobless claims came in at 1.861 million people, versus the adjusted number of 1.925 million people from the week prior, down -64,000 people week-over-week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 130.49 points (+0.36%), closing out the week at 36,247.87, up 2.37 points week-over-week. The S&P 500 closed higher on Friday of last week, up 18.78 points (+0.41%) and closed out the week at 4,604.37, up 9.74 points week-over-week. The NASDAQ closed higher on Friday of last week, up 63.98 points (+0.45%), and closed out the week at 14,403.97, up 98.94 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 36,255 this morning down -25 points.

Crude oil closed higher on Friday of last week, but down week over week

WTI traded up $1.89 per barrel (2.7%) to close at $71.23 per barrel on Friday of last week, but down -$2.84 per barrel week-over-week. Brent traded up US$1.79 per barrel (2.4%) on Friday of last week, to close at US$75.84 per barrel, down -US$3.04 per barrel week-over-week.

In Canada One Exchange WCS for January delivery settled on Friday of last week at U.S -$20.00 below the WTI-CMA. The implied value was U.S$51.49 per barrel. On Thursday of last week, the index settled at U.S$19.35 below the WTI-CMA for January delivery. The implied value was US$50.31/bbl.

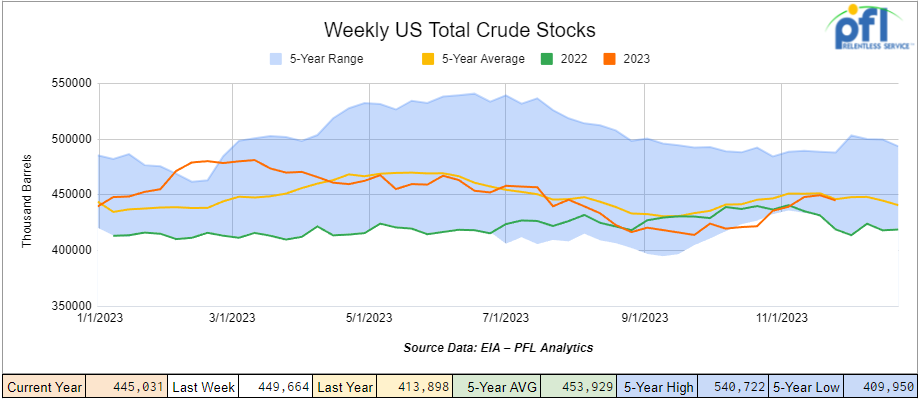

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by -4.6 million barrels week-over-week. At 445.0 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

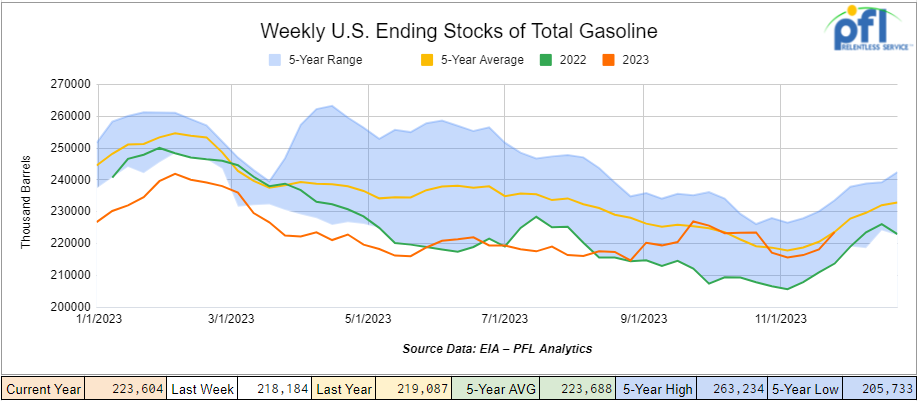

Total motor gasoline inventories increased by +5.4 million barrels week-over-week and are 1% below the five-year average for this time of year.

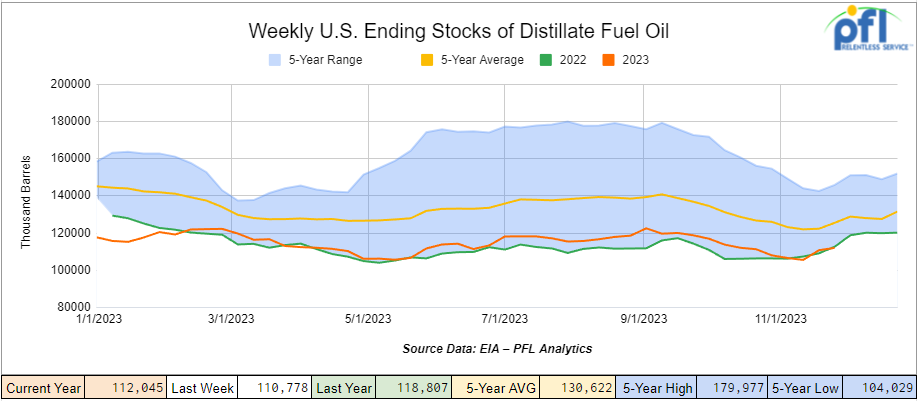

Distillate fuel inventories increased by +1.3 million barrels week-over-week and are 13% below the five-year average for this time of year.

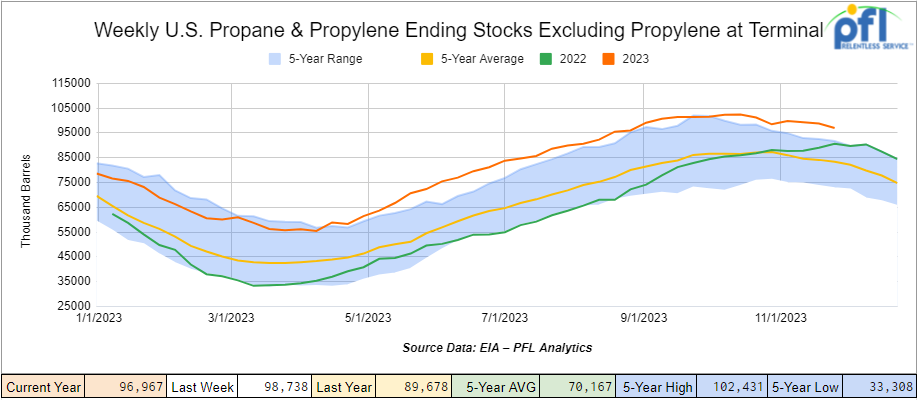

Propane/propylene inventories decreased by -1.8 million barrels week-over-week and are 18% above the five-year average for this time of year.

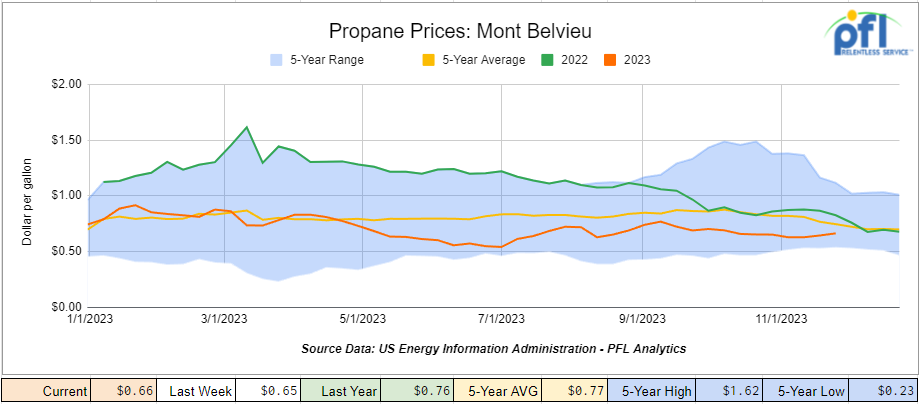

Propane prices closed at 66 cents per gallon, up +1 cent week-over-week, but down -10 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 1.7 million barrels during the week ending December 1st, 2023.

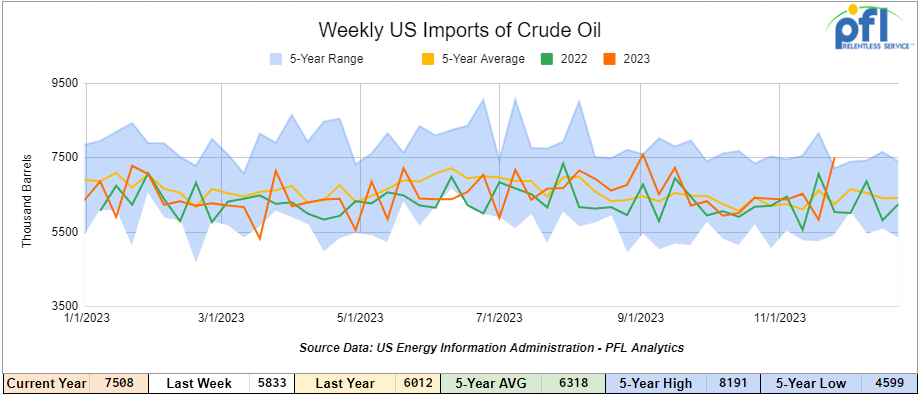

U.S. crude oil imports averaged 7.5 million barrels per day during the week ending December 1st, 2023, an increase of 1.7 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 6.4% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 689,000 barrels per day, and distillate fuel imports averaged 82,000 barrels per day during the week ending December 1st, 2023

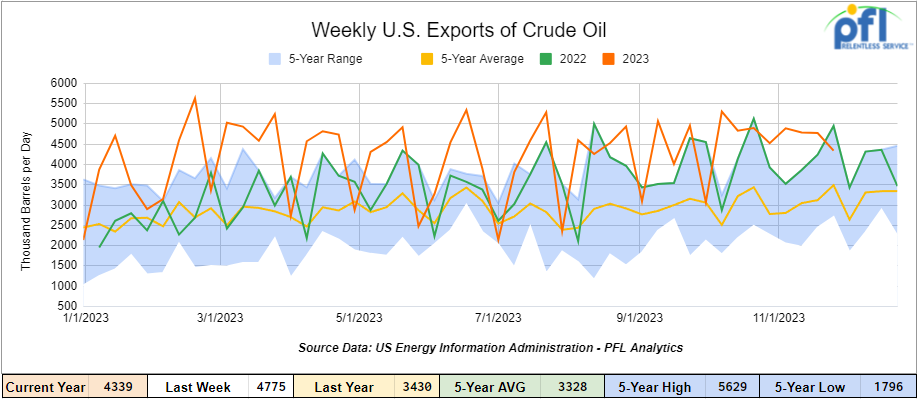

U.S. crude oil exports averaged 4.339 million barrels per day for the week ending December 1st, a decrease of 436,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.697 million barrels per day.

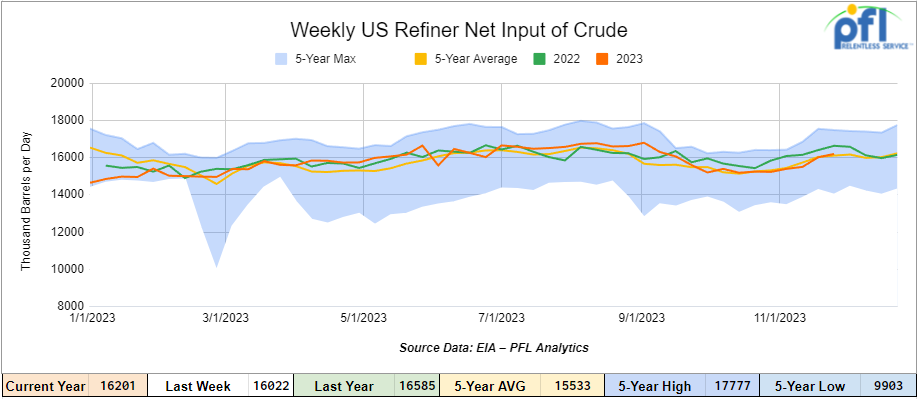

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending December 1, 2023, which was 179,000 barrels per day higher week-over-week.

WTI is poised to open at 70.56, down -0.67 per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 6th, 2023.

Total North American weekly rail volumes were up (3.48%) in week 48, compared with the same week last year. Total carloads for the week ending on December 6th, 2023 were 364,345, up (3.48%) compared with the same week in 2022, while weekly intermodal volume was 332,526, up (6.61%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-11%). The largest increase came from Chemicals (+17.6%).

In the East, CSX’s total volumes were up (1.36%), with the largest decrease coming from Grain (-18.58%) and the largest increase from Metallic Ores and Minerals (+23.85%). NS’s volumes were down (-2.12%), with the largest decrease coming from Nonmetallic Minerals (-10.59%) and the largest increase from Petroleum and Petroleum Products (+11.92%).

In the West, BN’s total volumes were up (+9.53%), with the largest decrease coming from Other (-24.70%), and the largest increase coming from Chemicals (+340%). UP’s total rail volumes were down (-2.13%) with the largest decrease coming from Other (-23.13%) and the largest increase coming from Petroleum and Petroleum Products (+16.86%).

In Canada, CN’s total rail volumes were down (-4.21%) with the largest increase coming from Chemicals (+28.65%) and the largest decrease coming from Grain (-40.70%). CP’s total rail volumes were up (-6.17%) with the largest decrease coming from Nonmetallic Minerals (-22.17%) and the largest increase coming from Intermodal Units (+38.73%).

KCS’s total rail volumes were down (-11.3%) with the largest decrease coming from Farm Products (-26.71%) and the largest increase coming from Motor Vehicles and Parts (+28.95%).

Source Data: AAR – PFL Analytics

Rig Count

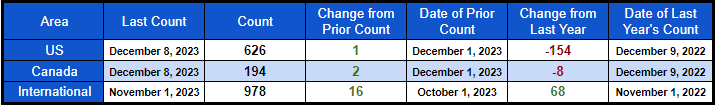

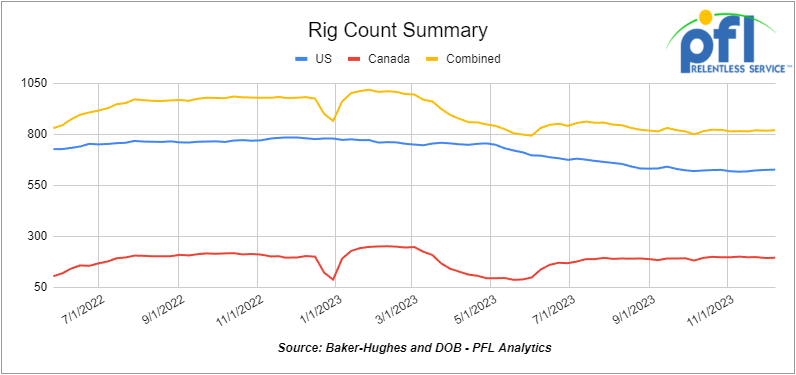

North American rig count was up by 3 rigs week-over-week. U.S. rig count was up by 1 rig week-over-week, but down by -154 rigs year-over-year. The U.S. currently has 626 active rigs. Canada’s rig count was up by 2 rigs week-over-week but down by -8 rigs year over year. Canada’s overall rig count is 194 active rigs. Overall, year-over-year, we are down -162 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,769 from 28,127, which was a gain of +642 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments rose by +4.8% week over week, CN’s volumes were higher by +0.5% week-over-week. U.S. shipments were up across the board. The NS had the largest percentage increase and was up by 47.9%.

We are Watching the Canadian Government

Here we go again, folks. The federal government in Canada announced on Thursday of last week a proposal to cap 2030 emissions from the oil and gas sector at 35 to 38 percent below 2019 levels, while providing “compliance flexibilities” to emit up to a level at 20 to 23 percent below 2019 levels, through a cap-and-trade system.

Another tax is the way we look at it!

The proposed target requires that the sector reduce emissions from 171 Mt in 2019 to 106-112 Mt in 2030, but allows companies to defer some direct reductions by buying offsets and allows companies to pay into a fund as an alternative to reducing emissions.

The cap was promised by the Liberals in the 2021 election and claims it is more than a year behind schedule!

It requires a smaller cut to emissions than initially estimated in the government’s emissions reduction plan last year. That plan, which laid out a sector-by-sector list of what each industry needs to do to help reach that goal, wanted oil and gas to cut its emissions by more than 42 percent from 2021 levels, to 110 Mt.

The Canadian oil patch has been clear that it cannot achieve these reductions without also cutting production.

“Despite the federal government’s stated objective that the emission cap should not put a limit on Canadian oil and natural gas production, the unintended consequences of the draft framework announced last week of a cap-and-trade system with an interim target of a 35 to 38 percent emissions reductions below 2019 by 2030 could result in significant curtailments — making this draft framework effectively a cap on production,” Lisa Baiton, President and CEO of the Canadian Association of Petroleum Producers, said in a prepared statement.

The government proposes to implement the national cap-and-trade system through regulations to be made under the Canadian Environmental Protection Act, 1999. The government is planning to publish draft regulations by mid-2024.

The cap-and-trade system would cover all direct greenhouse gas emissions, while also accounting for indirect emissions related to the production of oil and gas and carbon storage.

The greenhouse gasses covered would include carbon dioxide, methane, nitrous oxide, and others. Each emission allowance will be equivalent to one tonne of carbon dioxide equivalent emissions (CO2e).

The greenhouse gas cap would regulate upstream oil and gas facilities, including offshore facilities, and would also apply to LNG facilities. These sub sectors represent the majority of emissions from the oil and gas sector — the upstream sub sector represented 85 percent of sector emissions in 2021.

The emissions cap will cover activities such as oilsands and conventional oil production, natural gas production, processing, and production of LNG.

The greenhouse gas cap puts a limit on the amount that the sector can emit and will “be key to making sure we reduce our emissions as a country, on the road to reaching net zero by 2050,” the government of Canada said.

Facilities will be able to buy a limited amount of carbon offset credits or contribute to a decarbonization fund, which would hold them accountable for a limited volume of emissions above the greenhouse gas cap.

The compliance flexibility options will both help reduce emissions — offsets will result in reductions in other sectors, and proceeds from the decarbonization fund will be reinvested to support emissions reductions within the oil and gas sector, the government of Canada said.

The federal government of Canada said it will continue engaging with industry, Indigenous groups, provinces, territories, and all other stakeholders “to get this system right.”

According to the government of Canada written comments in response to the framework should be submitted by February 5, 2024.

Earlier last week, Canada also outlined new regulations specifically to cut methane from the oil and gas sector by at least 75 percent over 2012 levels by 2030. Those cuts will be a key part of the overall emissions cap.

Alberta is fighting back – Alberta Premier Danielle Smith said Wednesday of last week on CTV News that she will wait to hear the details of the government’s emissions cap but added, “If an emissions cap is so stringent that it will shut in production, we won’t let that happen.”

Producers are also fighting back – according to the Daily Oil Bulletin Tristan Goodman, president and chief executive officer of the Explorers and Producers Association of Canada, said “It is unnecessary, and it is unnecessary because the industry is actually moving forward on reducing its emissions — according to the federal government’s own data.”

On top of that, Goodman said the government of Canada will face constitutional problems.

“Regardless of how they have positioned it, this over time … could end up as a production cap, which is clearly unconstitutional. It is actually very unhelpful that they have gone down this route, especially since they are having such trouble putting in place the incentives to support GHG reduction that they have been talking about for two and a half years now.”

The Federal Canadian government thinks we live in a bubble here in North America – there are so many ways we can have an environmentally positive impact – it seems that both the government of Canada and here in the U.S. does not want to listen to common sense solutions and have their minds set for for the green new deal that is not even green (solar and wind). Even if we went to Net Zero here in North America no one else around the world will. In fact, China is adding a coal plant every two weeks and as reported in this week’s rail report while RIG count is down year over year here in North America it is up year over year in the rest of the world. We are simply draining what little wealth we have here to the rest of the world and will have no more energy security or freedom of mobility, unless we the people stop this madness!

We are Watching Trans Mountain Pipeline

Trans Mountain Expansion (TMX) project faces yet another delay following the Canada Energy Regulator (CER) decision to deny the company’s request for a variance on a section of the oil pipeline under construction in British Columbia, potentially delaying the 590,000 barrel-per-day (bpd) expansion.

Trans Mountain sought permission to install a smaller diameter pipe in a 1.4-mile (2.3-km) section due to “very challenging” drilling conditions caused by hard rock formations in a mountainous area between Hope and Chilliwack.

CER denied this request. The funny thing is the government of Canada owns the pipeline – it is the government turning down the government (LOL).

During a November 27th hearing, Trans Mountain representatives argued that using a smaller diameter pipe would save 59 days of construction time, allowing the project to maintain its target start date in late Q1 2024. Drilling a wider section for the larger diameter pipeline was deemed “unpredictable” by Trans Mountain, further emphasizing the potential benefits of the variance.

This latest setback adds to the troubled history of the TMX project, designed to triple crude shipments from Alberta to Canada’s Pacific Coast, ultimately reaching 890,000 bpd upon completion. We don’t know what to say about this one anymore except stay tuned to PFL for further updates.

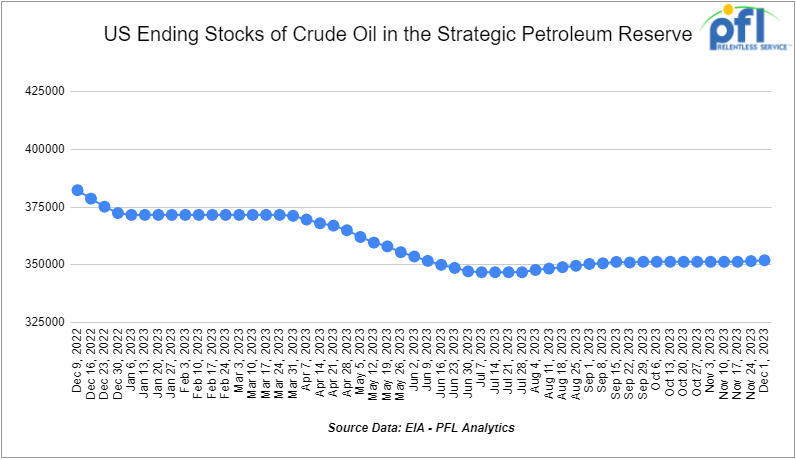

We are watching The Strategic Oil Reserves

The U.S. government plans to hold monthly tenders to buy oil for its strategic petroleum reserve through at least May as the Biden administration moves ahead with plans to refill the caverns that currently sit near the lowest levels in 40 years.

The Energy Department on Friday of last week issued a solicitation to buy 3 million barrels of sour oil for delivery in March, according to the Department of Energy. That comes on top of a previous tender to buy the same amount for February.

The government has so far bought close to 9 million barrels of oil at an average price of $75 per barrel and secured nearly 4 million barrels in accelerated exchange returns.

The efforts to refill come after the historic release of 180 million barrels which the Biden administration claims was to stabilize prices. They seem to be on the winning side of this trade for now, let’s hope we fill up soon while prices are low. Here is where we sit today folks:

We are Watching Some Key Economic Indicators

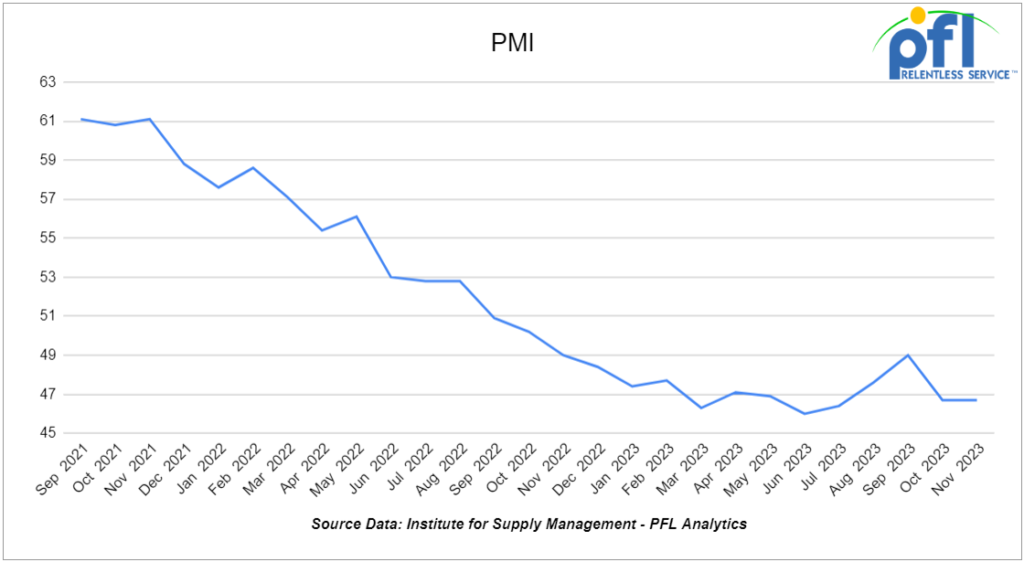

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50. In November 2023, the same as October and the 13th straight month it was below 50%. The new orders subindex in November was 48.3%, up from 45.5% in October. The new orders sub-index was slightly higher (49.2%) in September 2023.

The ISM’s Services PMI is like the Manufacturing PMI except it covers the much larger services economy. The Services PMI was 52.7% in November, up from 51.8% in October and the first month-to-month gain in the index in three months.

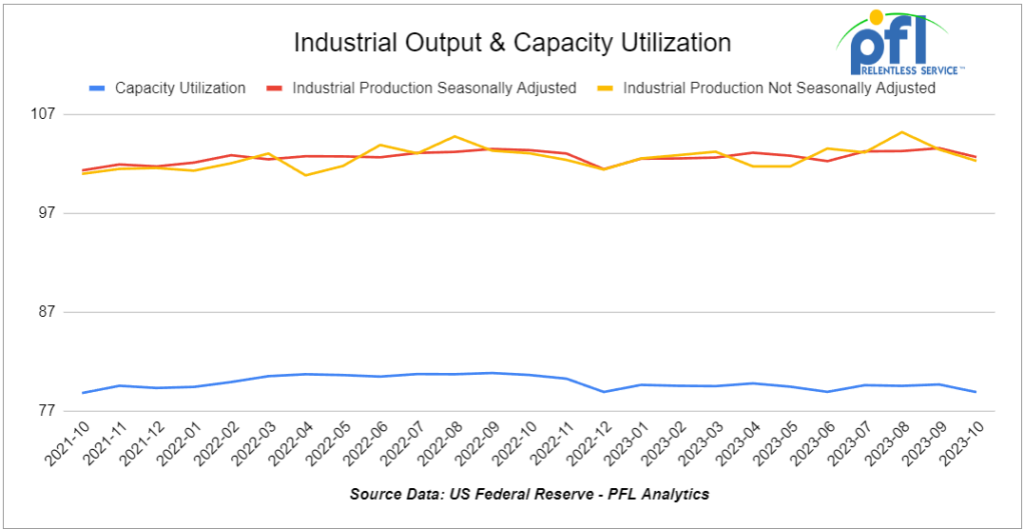

Industrial Output & Capacity Utilization

The Federal Reserve reported that total U.S. industrial output rose a preliminary 0.6% in October 2023 over September 2023. Total output in October 2023 was down a preliminary 0.7% from October 2022, the largest year-over-year decline since February 2021. Manufacturing output, which is 75% of total output, fell a preliminary 0.7% in October 2023 from September 2023 (the largest month-over-month decline in seven months) and was down 1.7% year over year (its eighth straight year-over-year decline). A 10.0% decline in motor vehicle output — a result of a six-week campaign by the United Auto Workers against GM, Ford, and Stellantis that ended in late October — explains most of October’s output decline. Manufacturing output excluding motor vehicles and parts rose 0.1% in October from September.

The overall industrial capacity utilization rate — which measures how much “slack” is available in the industrial economy — was a preliminary 78.97% in October, down from 79.5% in September and its lowest level in two years.

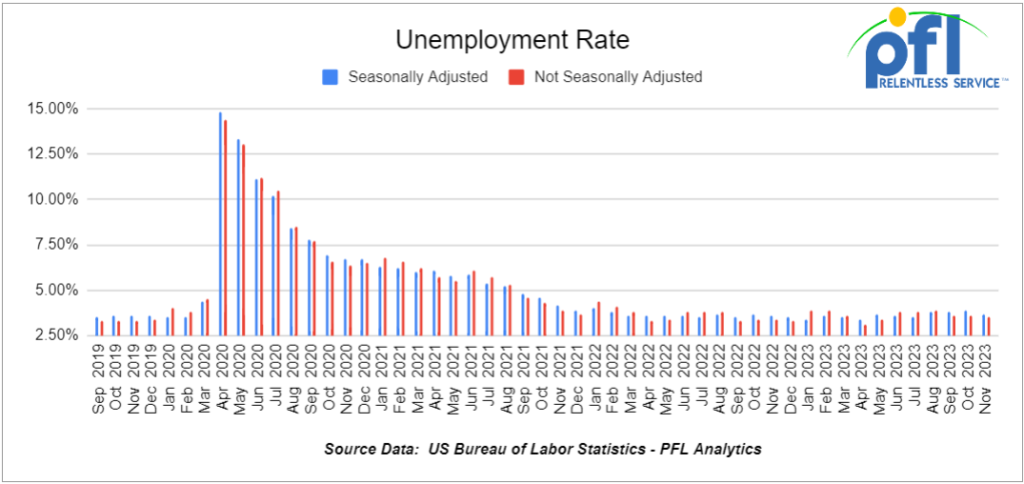

U.S. Unemployment Rate

According to the Bureau of Labor Statistics (BLS), a preliminary 199,000 net new jobs were created in November 2023. That’s up from 150,000 in October. Job growth in three of the past four months has been below 200,000. The official overall unemployment rate fell to 3.7% in November from 3.9% in October.

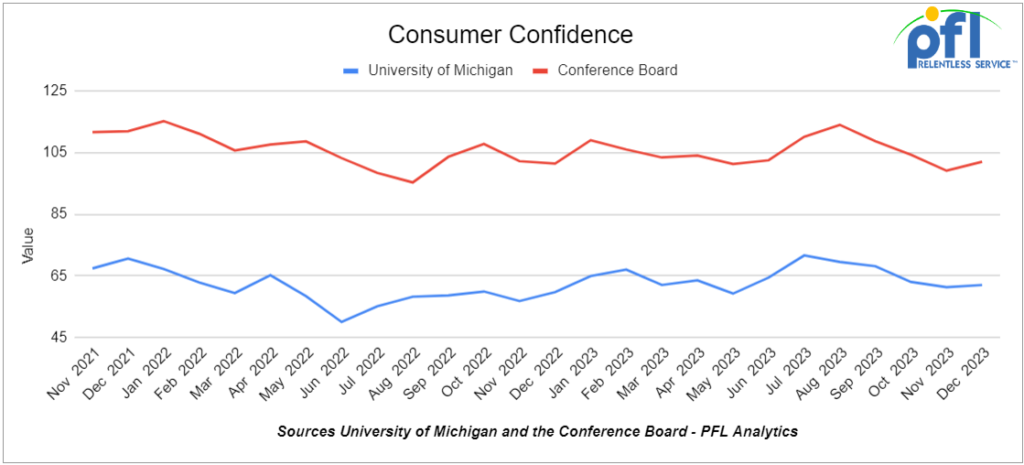

Consumer Confidence

The Conference Board’s Index of Consumer Confidence rose to 102.0 in November from a revised 99.1 in October. The index remains at its second-lowest point for 2023, behind October.

The University of Michigan’s index of consumer sentiment fell from 63.8 in October to 61.3 in November, marking four consecutive month-over-month declines. The economist behind the Michigan index said, “Younger and middle-aged consumers exhibited strong declines in economic attitudes.”

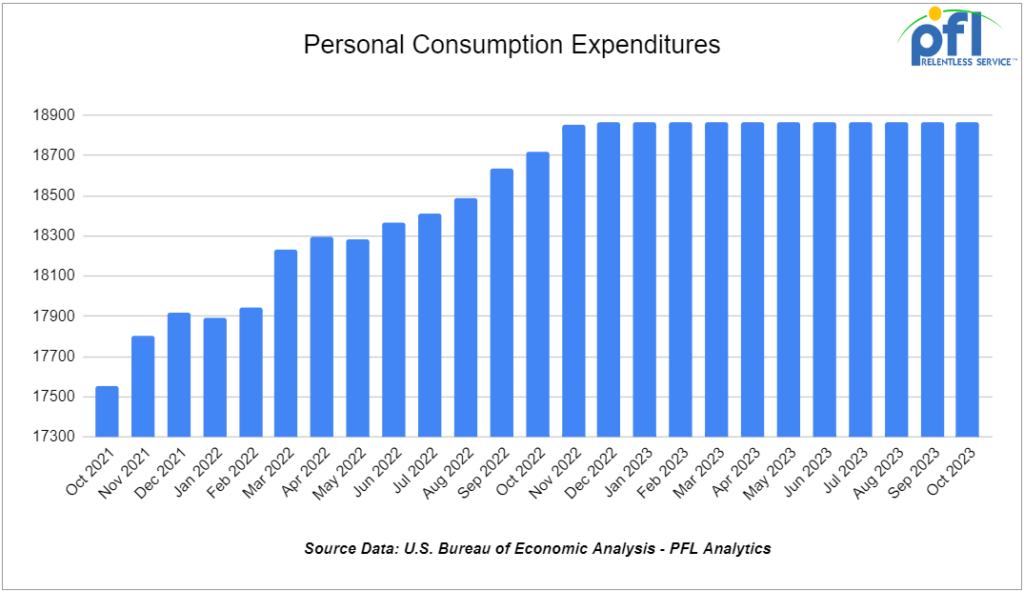

Consumer Spending

Not adjusted for inflation, total U.S. consumer spending rose a preliminary 0.2% in October over September, the slowest increase since May of this year. On a year-over-year basis, total spending in October was 5.3% higher than last year, the smallest year-over-year gain in 32 months.

Spending on goods fell a preliminary 0.2% in October from September, its worst performance in seven months. Spending on services rose 0.4% in October, down from a 0.7% gain in September.

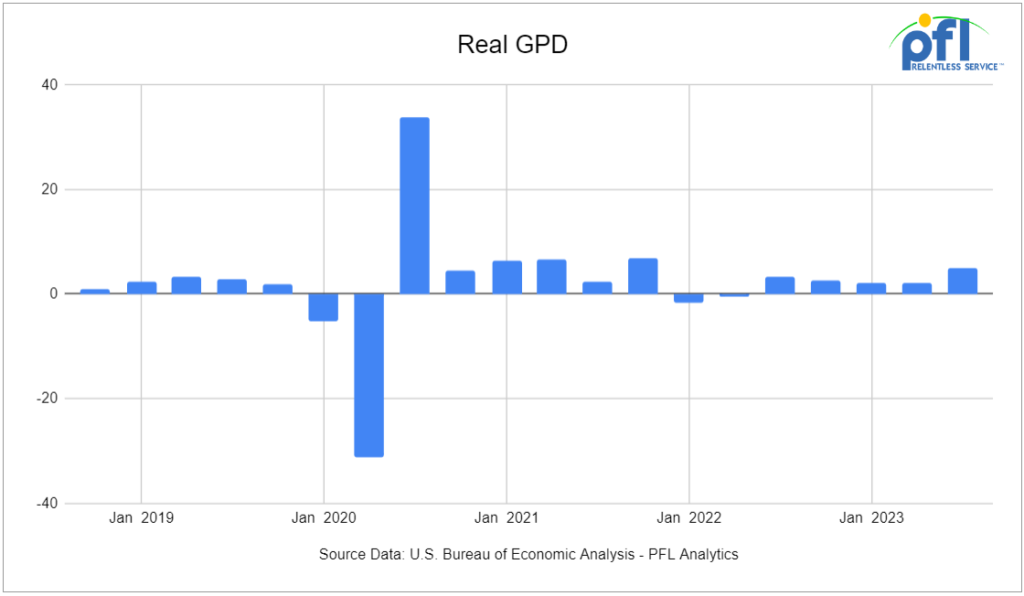

GDP

On November 29, the Bureau of Economic Analysis upgraded its initial estimate of Q3 2023 GDP growth, upping it to 5.2% from last month’s 4.9%. It’s the best quarterly GDP growth rate since Q4 2021. The consensus of the most recent quarterly survey of professional economists by the Federal Reserve Bank of Philadelphia says GDP will grow a mere 1.3% in Q4.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 30-40, 28.3K 117R, 117J, DOT 111 Tanks needed off of UP in Iowa for 2-3 Years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 Year. Cars are needed for use in Flyash service.

- 20, 30K 117R or 117J Tanks needed off of UP or BN in Midwest for 6 Months. Cars are needed for use in Ethanol service.

- 150, 29.2K 117R, 117J, DOT 111 Tanks needed off of CN or CP in Sarnia for 1 Year. Cars are needed for use in Fuel Oil service.

- 50, 23.5-25.5 Dot 111 Tank s needed off of Any Class 1 in USA for 5 Year. Cars are needed for use in Asphalt service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service. Q1

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service. Q2-Q3

- 10, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Iowa for 2 Years. Cars are needed for use in Biodiesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

Lease Offers

- 10, 28.3K, 117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 25, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Heavy Fuel Oil. Call 239-390-2885 for more information

- 13, 3915, PD Hoppers located off of UP in Kansas. Cars are clean Call 239-390-2885 for more information

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean Brand New. 2-5 Year Lease

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Mix of dirty and clean cars

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT-111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT-111 Tanks located off of various class 1s in multiple locations.

- 20, Refer, Box Boxcars located off of UP in ID.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|