“Have the end in mind and every day make sure you’re working towards it”

– Ryan Allis

Jobs Update

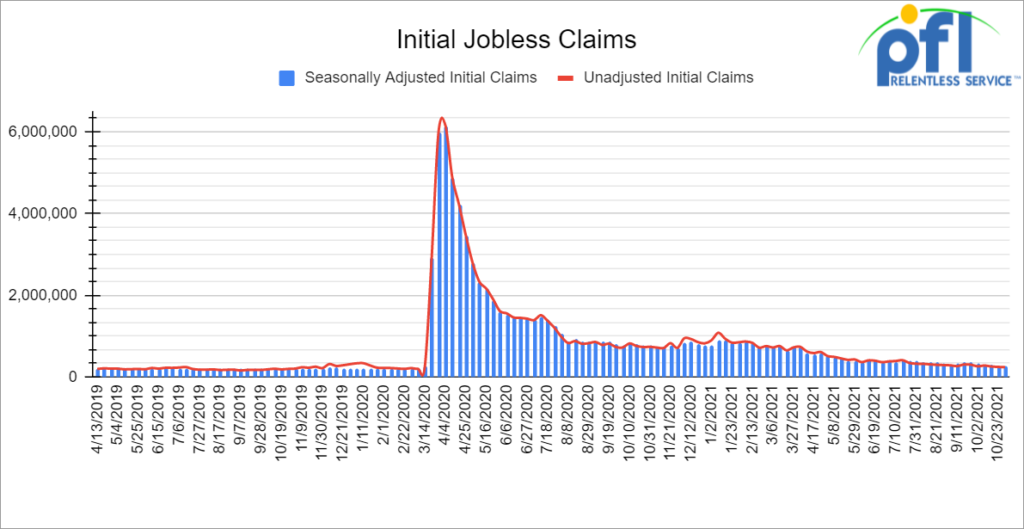

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending October 30th came in at 269,000, down 14,000 people week over week.

- Continuing claims came in at 2.105 million people versus the adjusted number of 2.239 million people from the week prior, down 134,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

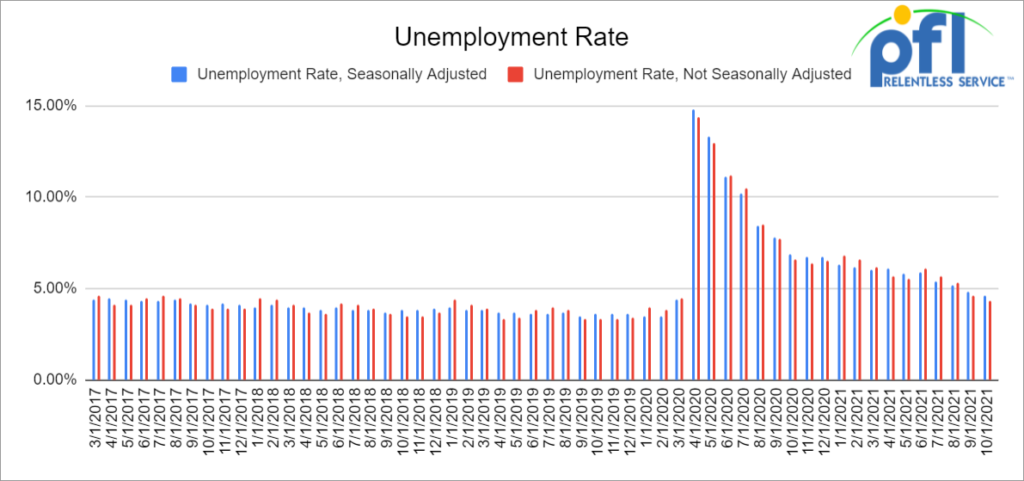

Unemployment Rate Down Month over Month

- The Bureau of Labor Statistics (BLS) announced on Friday of last week that a preliminary and seasonally adjusted 531,000 net new jobs were created in October 2021.

- Job gains in September 2021 were revised up to 312,000 from the 194,000 announced last month.

- Private-sector jobs rose by 603,000 and government jobs fell by 73,000 in September.

- October’s numbers included 35,000 new jobs in retail trade, 54,000 in transportation and warehousing, 119,000 in food services, 60,000 in manufacturing, and 44,000 in construction.

- In October, the official unemployment rate fell to 4.6%, down from 4.8% in September.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed higher on Friday of last week – higher week over week

The DOW closed higher on Friday of last week, up 203.72 points (+0.56%), closing out the week at 36,327.95 points, up 508.39 points week over week. The S&P 500 closed higher on Friday of last week, up 14.47 points (+0.37%) and closed out the week at 4,697.53, up 92.15 points week over week. The Nasdaq closed higher on Friday of last week, up 31.28 points (+0.2%) and closed out the week at 15,971.59, up 473.2 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 36,288 this morning up 73 points.

Oil up on Friday of last week but down week over Week

Crude oil futures rebounded strongly on Friday as President Biden stopped short of announcing a release of strategic petroleum reserves (SPR) to counter the OPEC+ decision to stick with a planned 400,000 bpd output hike in December when he has been asking for more to reduce gas prices here in the U.S. In our opinion, it would be a waste and only a short term bandage so to speak. The SPR was set up for emergencies and should be not used for short term price control. OPEC+ knows this and they are thinking long term. Adding fuel to the fire, Chinese inventories have fallen to a 4-year low amid weak buying on behalf of the Chinese. With Chinese refiners hitting three consecutive month-on-month declines in overall seaborne crude imports, down to 8.3 million barrels per day in October, utilization of nationwide inventories have dropped to their lowest since 2018, at 58%. The bottom line is, a short term burst of oil out of the SPR really is not going to accomplish too much – if we want price control we have to produce more here at home, it is that simple. We believe that despite all the headwinds facing the oil patch, that increased production is inevitable and will happen sooner than you think.

West Texas Intermediate (WTI) crude closed up $2.46 cents on Friday of last week to settle at $81.27, down $2.30 per barrel week over week. Brent futures closed up $2.20 cents, to settle at $82.74 per barrel, down $1.64 per barrel week over week.

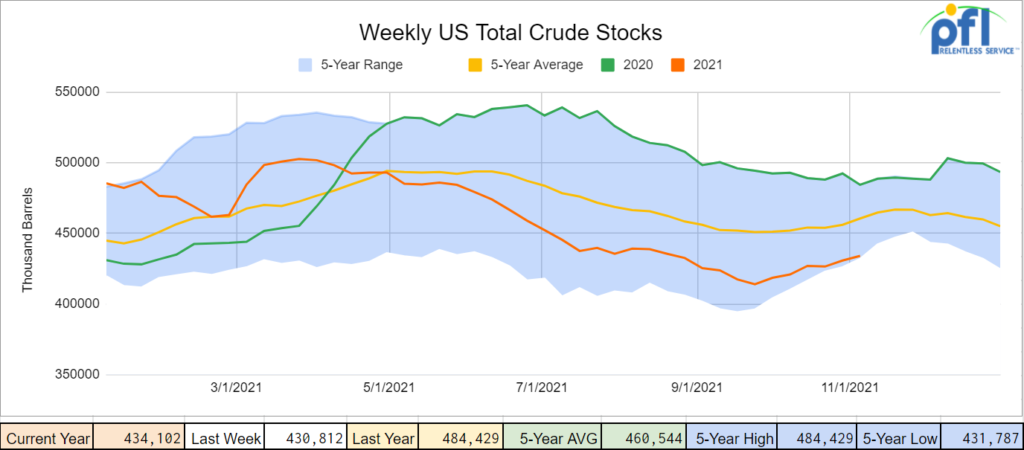

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.3 million barrels week over week. At 434.1 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

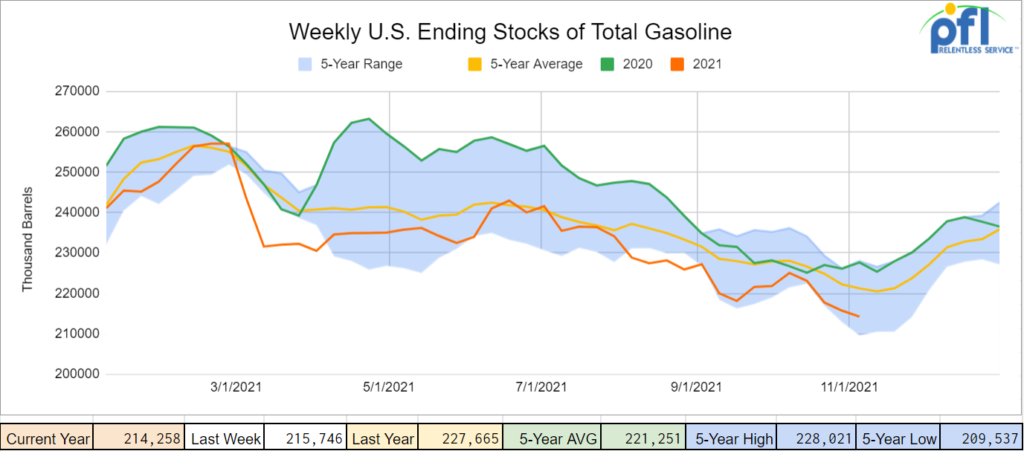

Total motor gasoline inventories decreased by 1.5 million barrels week over week and are 3% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

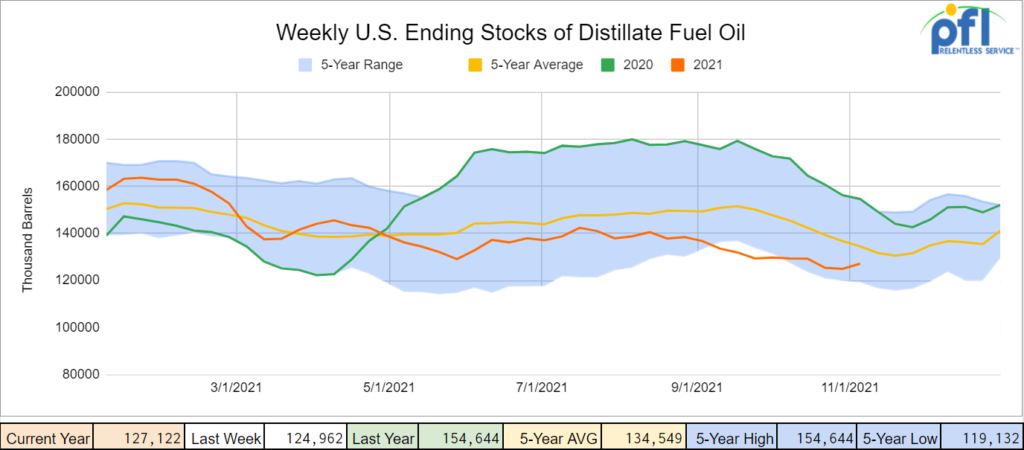

Distillate fuel inventories increased by 2.2 million barrels week over week and are 5% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

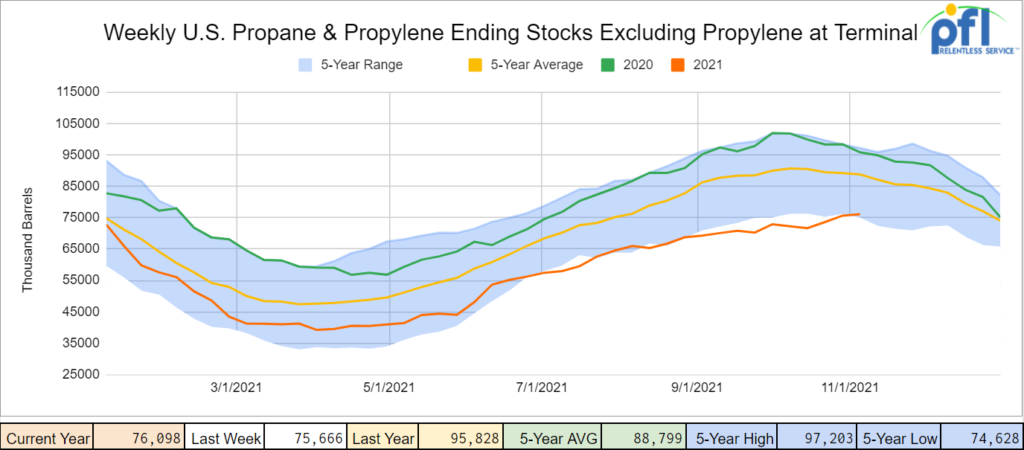

Propane/propylene inventories increased by 400,000 barrels week over week and are 14% below the five- year average for this time of year.

Source Data: EIA – PFL Analytics

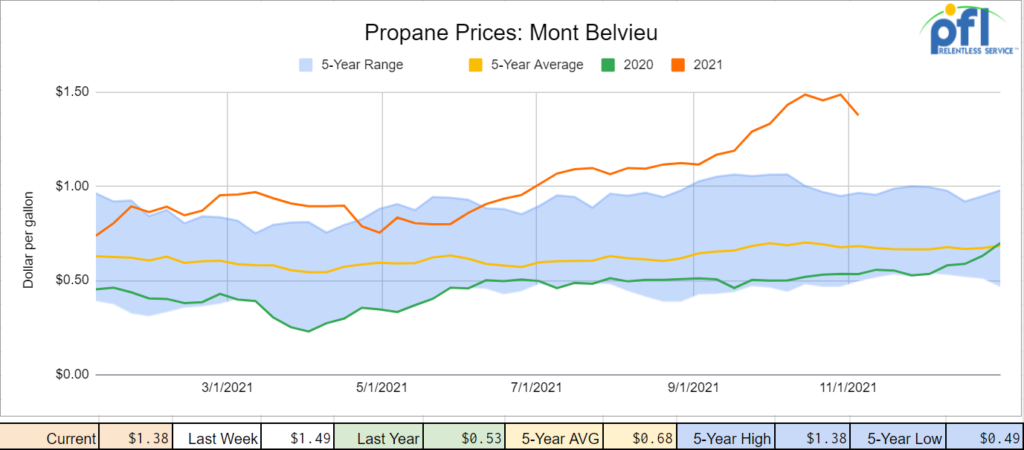

Propane prices continue to decline week over week (down 11 cents per gallon) as we continue to build stocks when we would normally be reducing stocks. This is good news, but stocks are still historically low for this time of year. On the LNG front prices fell for a third week in a row trading below $30 per MMBTU in Asia and natural gas prices here at home also closed lower week over week.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories increased by 600,000 thousand barrels week over week.

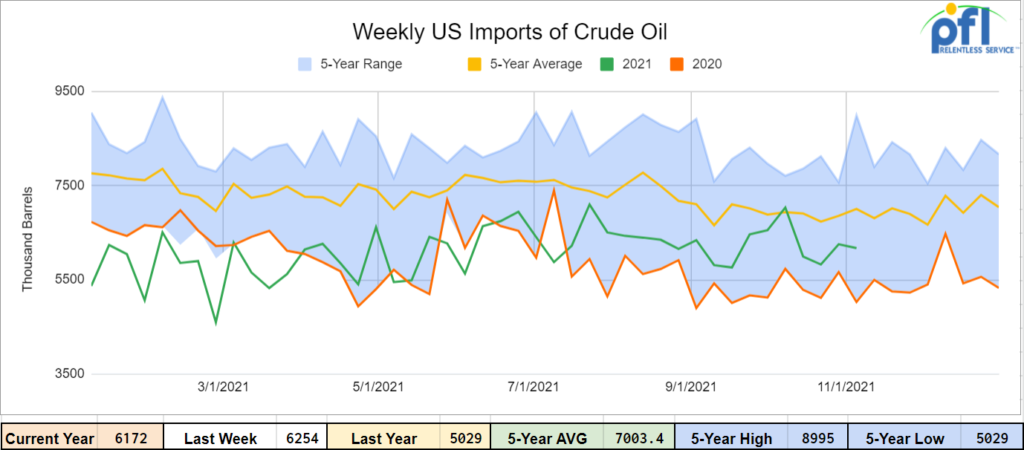

U.S. crude oil imports averaged 6.2 million barrels per day for the week ending October 29th, down by 83,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 14.9% more than the same four-week period last year. For the week ending October 29th, total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 667,000 barrels per day, and distillate fuel imports averaged 190,000 barrels per day

Source Data: EIA – PFL Analytics

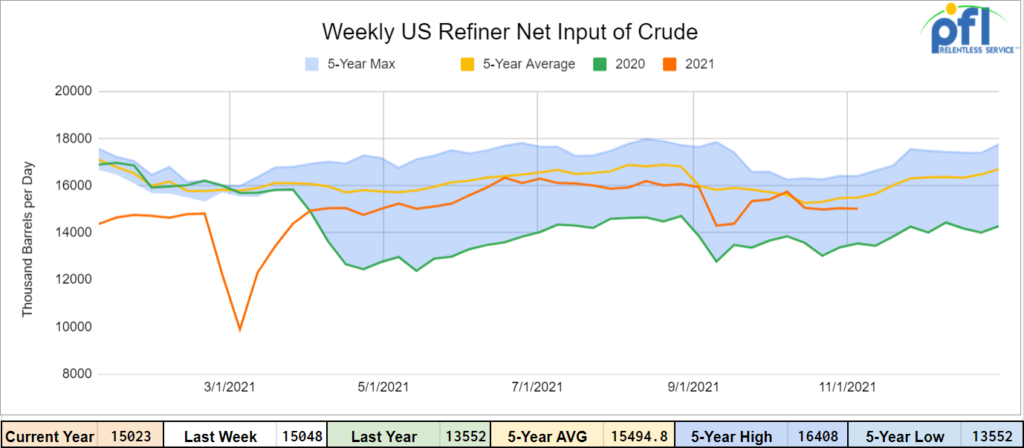

U.S. crude oil refinery inputs averaged 15.0 million barrels per day during the week ending October 29, 2021 which was 25,000 barrels per day less than the previous week’s average. Refineries operated at 86.3% of their operable capacity last week.

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at 82.46 , up $1.19 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.0% year over year in week 43 (U.S. -2.0%, Canada -5.6%, Mexico -6.3%) resulting in quarter to date volumes that are down 3.8% and year to date volumes that are up 6.7% year over year (U.S. +7.8%, Canada +3.9%, Mexico +3.3%). 5 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decline coming from intermodal (-8.7%). The largest increases came from metallic ores & metals (+26.2%) and coal (+13.2%).

In the East, CSX’s total volumes were up 1.2%, with the largest increases coming from chemicals (+12.8%) and intermodal (+1.8%). The largest decrease came from motor vehicles & parts (-25.4%). NS’s total volumes were down 2.7%, with the largest decrease coming from intermodal (-8.2%). The largest increase came from petroleum (+67.1%).

In the West, BN’s total volumes were up 0.9%, with the largest increase coming from coal (+17.0%). The largest decreases came from intermodal (-3.0%) and grain (-10.0%). UP’s total volumes were down 2.3%, with the largest decrease coming from intermodal (-13.6%). The largest increase came from coal (+32.5%) and chemicals (+12.9%).

In Canada, CN’s total volumes were down 2.8%, with the largest decrease coming from intermodal (-18.4%). The largest increase came from metallic ores (+90.1%). Revenue per ton miles was down 5.9%. CP’s total volumes were down 4.0%, with the largest decreases coming from farm products (-49.9%) and motor vehicles & parts (-34.1%). Revenue per ton miles was down 3.6%.

KCS’s total volumes were down 6.3%, with the largest decrease coming from petroleum (-23.2%).

Source: Stephens

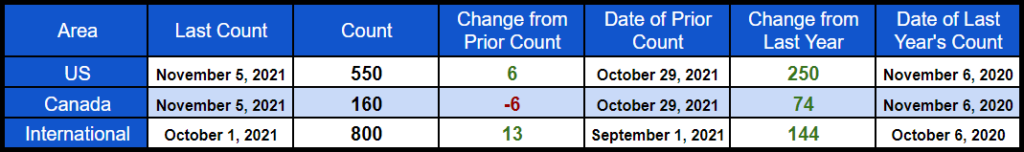

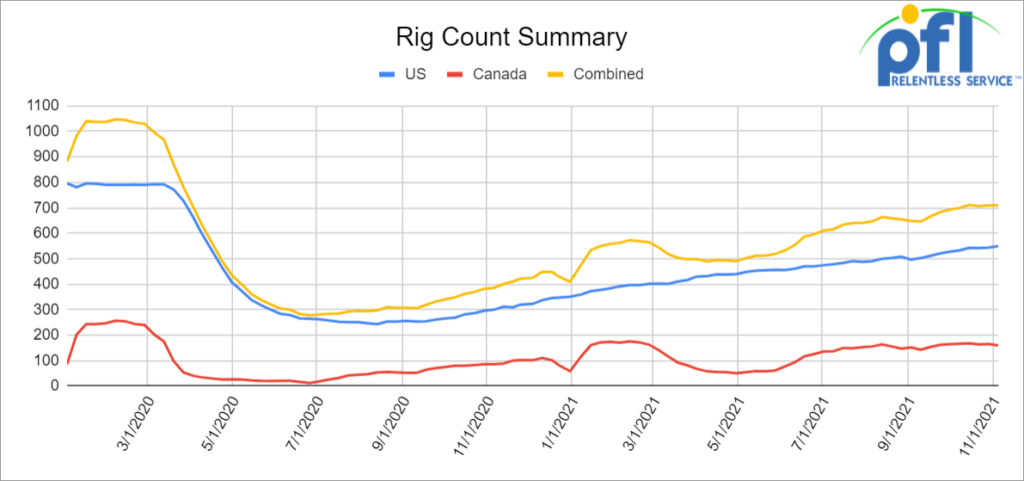

Rig Count

North American rig count is flat week over week. The U.S. rig count was up by 6 rigs week over week and up by 250 rigs year over year. The U.S. currently has 550 active rigs. Canada’s rig count was down by 6 rigs week over week, and up by 74 rigs year over year and Canada’s overall rig count is 160 active rigs. Overall, year over year, we are up 324 rigs collectively.

International Rig Count is up by 13 rigs month over month and up 144 rigs year over year. Internationally, there are 800 active rigs.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,040 from 23,033, a gain of a mere 7 rail cars week over week. Canadian volumes were mixed – CP volumes were down 7.5% and CN volumes were up roughly 1%.. U.S. volumes were also mixed with the NS having the largest percentage increase up by 18.5% and the BN having the largest percentage decrease, down by 8.1%.

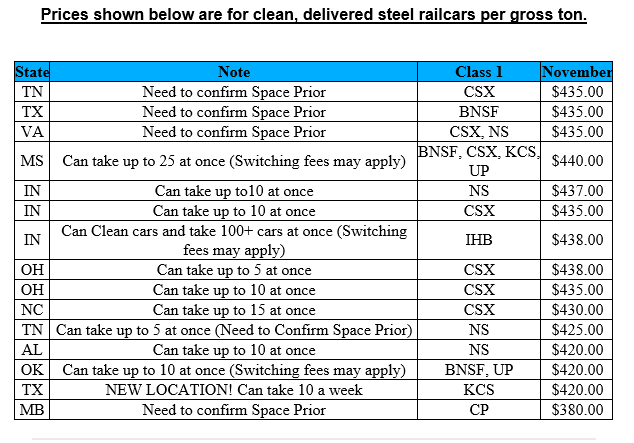

Scrap Prices

Folks, in case you missed it, scrap prices came out on Friday of last week for November and they were way up. What this means is that PFL can pay more for your rail car delivered at key locations across the country. See below and call PFL for further information

Defunding of Coal and Oil Continues

The U.S. and the UK, along with another 18 nations, will no longer finance oil, gas and coal projects abroad as part of their COP26 commitments, a resolution significantly weakened by the complete lack of Asian support for the motion. Also South Africa is getting $8.5 Billion in “Coal Shift Funds”. In a rare move of solidarity, the governments of Great Britain, France, Germany and the United States agreed to provide South Africa with $8.5 billion to finance its moving away from coal in power generation. Where is all the money coming from? Well maybe from the House $1.2 trillion infrastructure bill that passed late Friday in case you missed it.

Alberta Crude

Well, we have rising inventories once again in Alberta as CNRL and Cenovus both announced record production in Q3. Despite Enbridge’s expansion of line 3 that added 340,000 barrels of crude per day, there seems to be incremental supply as basis blew out last week trading to a low of -22.75 before settling at -20 going home on Friday of last week. We are starting to see signs of commercial midstream folks potentially looking to move trains once again but it is early day’s let’s see if these numbers hold or if basis widens. Stay tuned to PFL for the latest and greatest.

Some Key Economic Indicators

Gross Domestic Product (“GDP”) – U.S. GDP rose an annualized and seasonally adjusted 2.0% in Q3 2021 from Q2 2021, according to the first preliminary estimate released by the Bureau of Economic Analysis (BEA) on October 28. The 2.0% growth in Q3 is the slowest since the recovery began in mid-2020 and follows growth of 6.3% in Q1 2021 and 6.7% in Q2 2021. In Q3 2021, consumer spending — which accounts for about 70% of GDP — rose a preliminary 1.6% over Q2.Spending on goods, the spending fell 9.2% while the spending on services rose 7.9%. This is not so good for rail as supply chain disruptions are in play

Source Data: Bureau of Economic Analysis – PFL Analytics

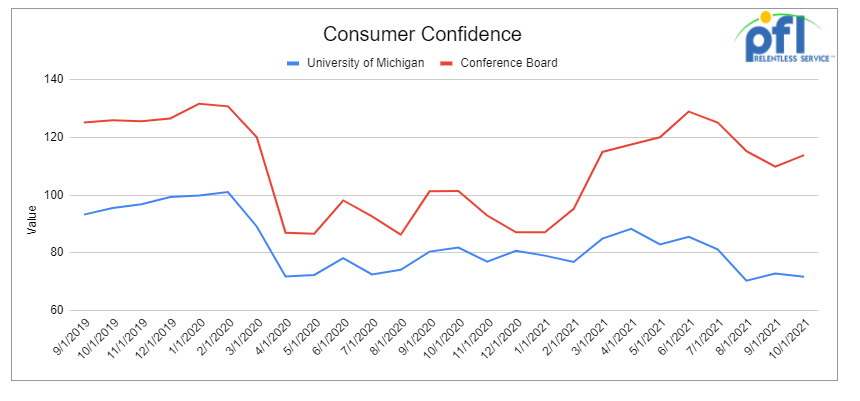

Consumer Confidence – The Conference Board’s index of consumer confidence was 113.8 in October, up from 109.3 in September. Although an improvement month over month, it is still lower than it has been for most of the year. The University of Michigan’s confidence index fell to 71.7 in October from 72.8 in September. Higher inflation is reportedly weighing down confidence numbers and we don’t see any end in sight in the short term for inflation to start easing.

Source Data: Conference Board – PFL Analytics

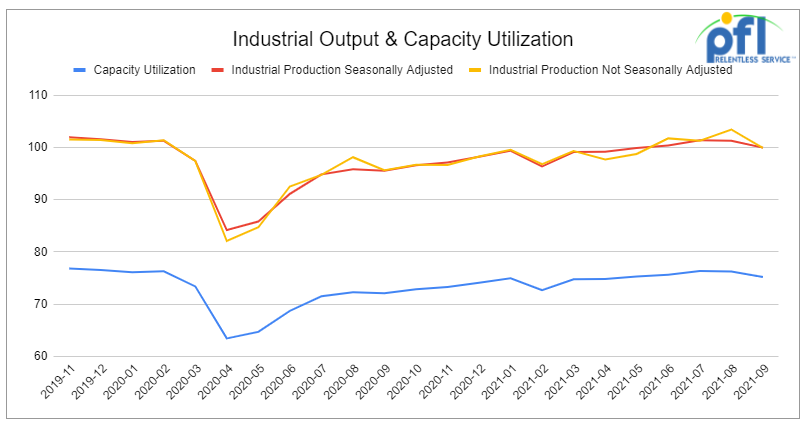

Industrial Output and Capacity Utilization – Total U.S. industrial output fell a preliminary and seasonally adjusted 1.3% in September 2021 from August 2021, according to the Federal Reserve. August’s output was revised to be down 0.1% after previously being reported to have risen 0.4%. That means output has fallen for the past two months after five straight monthly increases. If it holds after revisions, September’s 1.3% decline will be the biggest month-to-month decline since the 3.0% decline in February 2021 caused by severe winter storms in Texas and surrounding regions.

Source Data: Federal Reserve – PFL Analytics

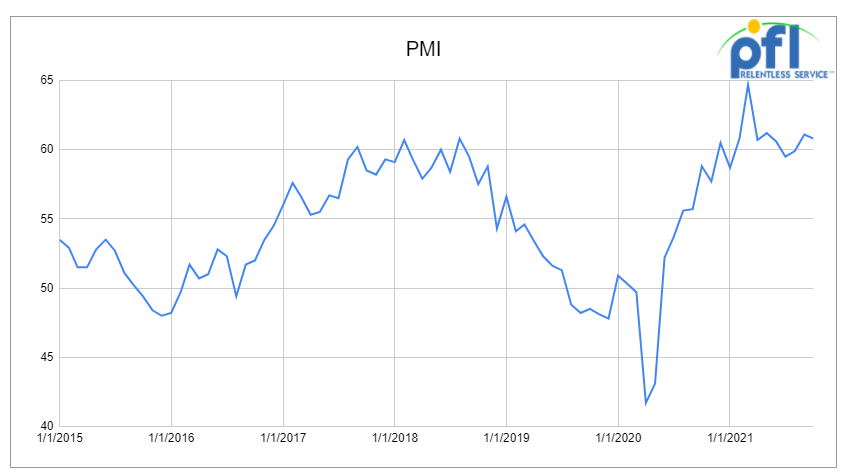

Purchasing Managers Index (“PMI”) – The PMI was 60.8% in October, down slightly from September’s 61.1%. The new orders component of the PMI fell to 59.8% in October, the lowest it’s been since June 2020. Again, supply chain bottlenecks are weighing on the country’s manufacturers.

Source Data: PMI – PFL Analytics

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 30-50 340 Pressure cars for propane starting Nov 3 month lease in Alberta CP or CN

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|