“Wealth consists not in having great possessions, but having few wants.” – Epictetus

Jobs Update

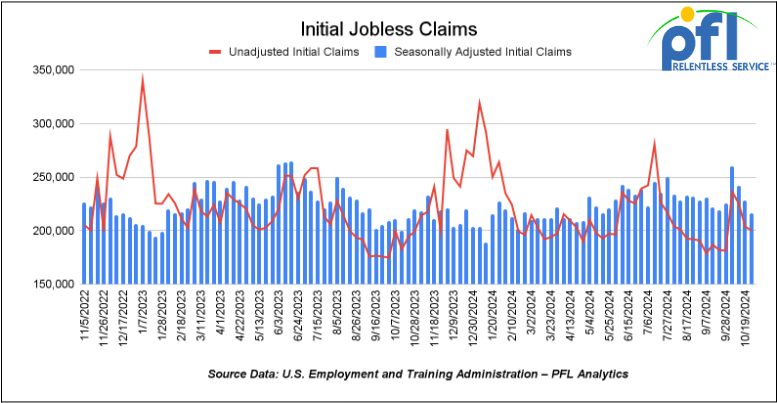

- Initial jobless claims seasonally adjusted for the week ending October 26th came in at 216,000, down -12,000 people week-over-week.

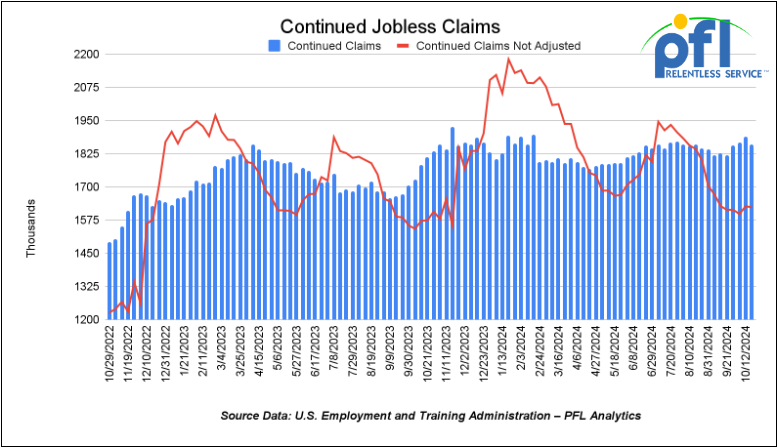

- Continuing jobless claims came in at 1.862 million people, versus the adjusted number of 1.888 million people from the week prior, down -26,000 people week-over-week.

Stocks closed higher on Friday of last week, but down week over week

The DOW closed higher on Friday of last week, up 288.73 points (0.69%) and closing out the week at 42,052.19, down -62.21 points week-over-week. The S&P 500 closed higher on Friday of last week, lower -23.35 points (0.41%) and closed out the week at 5,728.8, down -79.32 points week-over-week. The NASDAQ closed higher on Friday of last week, up 144.77 points (0.78%) and closed out the week at 18,239.92, down -278.7 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 42,249 this morning, up 40 points.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up $0.23 per barrel (0.3%) to close at $69.49 per barrel on Friday of last week, down -$2.29 per barrel week over week. Brent traded up $0.29 USD per barrel (0.4%) on Friday of last week, to close at $73.10 per barrel, down -$2.95 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for December delivery settled Friday on last week at US$12.10 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 56.59 per barrel.

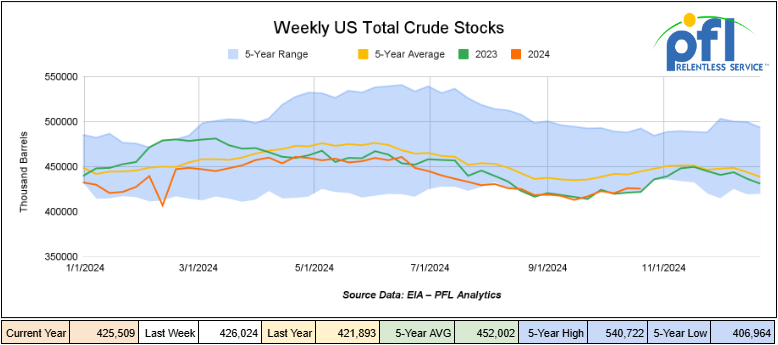

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 500,000 barrels week-over-week. At 425.5 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

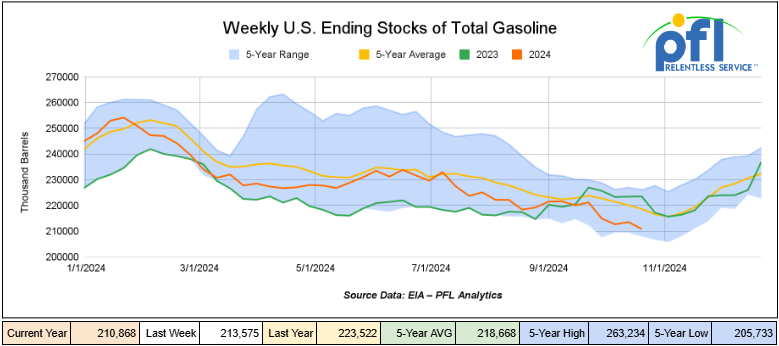

Total motor gasoline inventories decreased by 2.7 million barrels week-over-week and are 3% below the five-year average for this time of year.

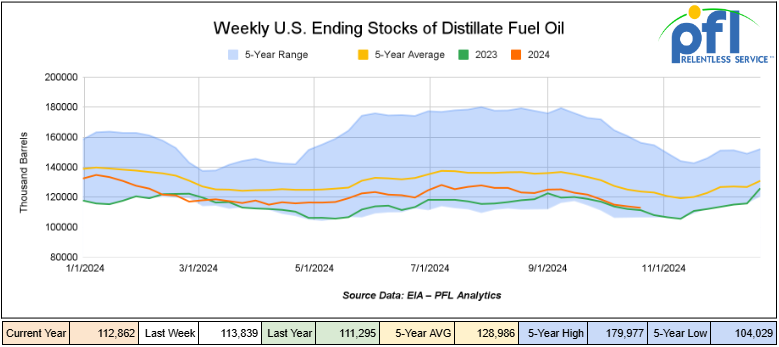

Distillate fuel inventories decreased by 1.0 million barrels week-over-week and are 9% below the five-year average for this time of year.

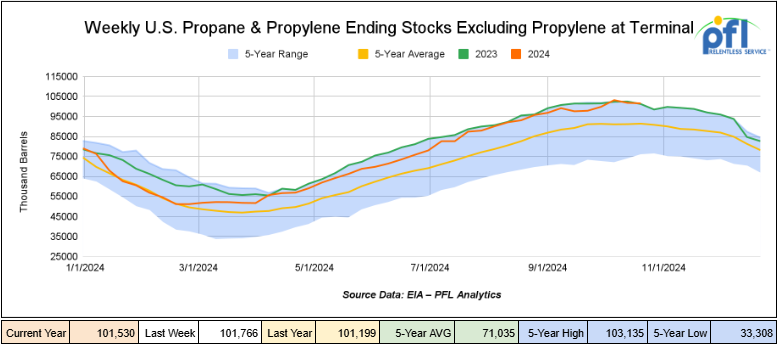

Propane/propylene inventories decreased by 200,000 barrels week-over-week and are 11% above the five-year average for this time of year.

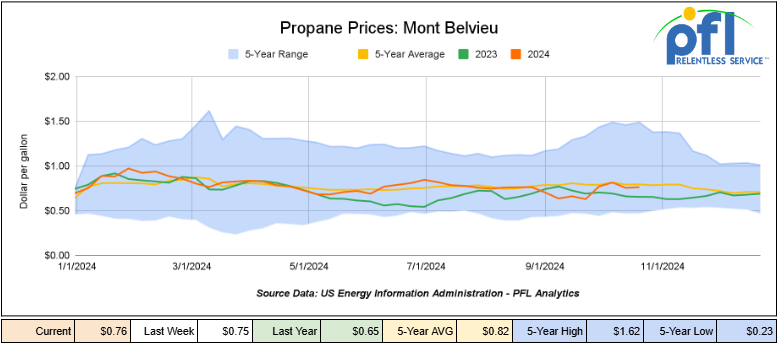

Propane prices closed at 76 cents per gallon on Friday of last week, up 1 cent per gallon week-over-week and up 11 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 9.5 million barrels during the week ending October 25th, 2024.

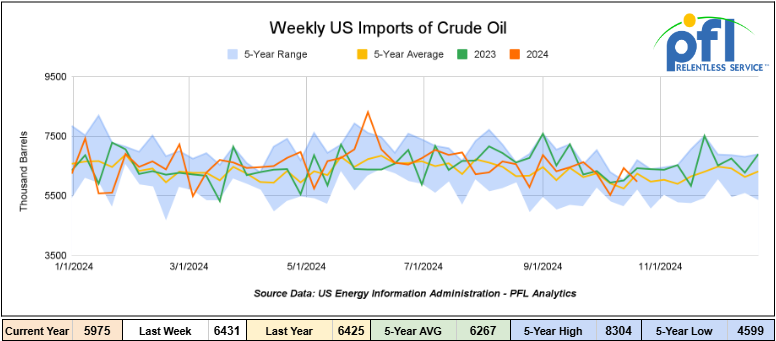

U.S. crude oil imports averaged 6 million barrels per day during the week ending October 25th, 2024, a decrease of 456,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6 million barrels per day, 2.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 495,000 barrels per day, and distillate fuel imports averaged 158,000 barrels per day during the week ending October 25th, 2024.

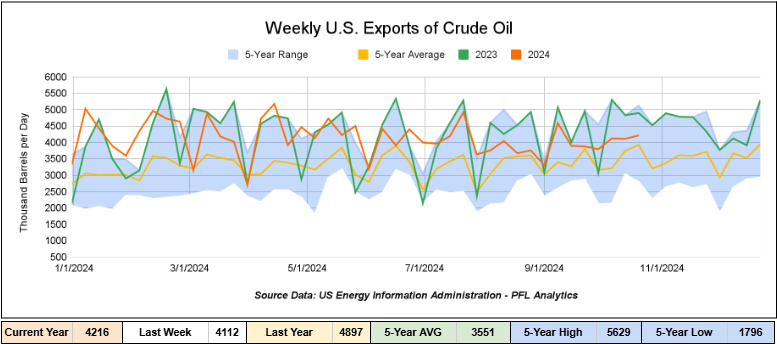

U.S. crude oil exports averaged 4.216 million barrels per day during the week ending October 25th, 2024, a decrease of 104,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4,601 million barrels per day.

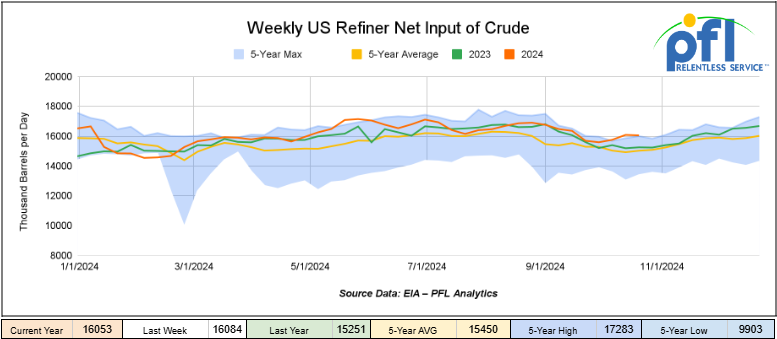

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending October 25, 2024, which was 30,000 barrels per day less than the previous week’s average.

WTI is poised to open at $71.31, up $1.82 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 30th, 2024.

Total North American weekly rail volumes were up (3.3%) in week 44, compared with the same week last year. Total carloads for the week ending on October 30th were 354,958, up (0.01%) compared with the same week in 2023, while weekly intermodal volume was 359,625, up (6.76%) compared to the same week in 2023. 9 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-10.52%). The most significant increase came from Motor Vehicles and Parts, which was up (+8.7%).

In the East, CSX’s total volumes were up (0.82%), with the largest decrease coming from Coal (-12.91%) while the largest increase came from Petroleum and Petroleum Products (+22.06%). NS’s volumes were up (6.32%), with the largest increase coming from Other (+17.35%), while the largest decrease came from Farm Products (-1.46%).

In the West, BN’s total volumes were up (+7.06%), with the largest increase coming from Farm Products (+11.04%) while the largest decrease came from Metallic Ores and Metals, down (-10.21%). UP’s total rail volumes were up (2.2%) with the largest decrease coming from Coal, down (-20.76%), while the largest increase came from Grain, which was up (+17.12%).

In Canada, CN’s total rail volumes were down (-1.34%) with the largest decrease coming from Intermodal, down (-6.98%) while the largest increase came from Grain, up (+14.02%). CP’s total rail volumes were down (12.09%) with the largest increase coming from Other (+39.62%), while the largest decrease came from Coal (-37.15%).KCS’s total rail volumes were down (-4.86%) with the largest decrease coming from Coal (-44.21%) and the largest increase coming from Motor Vehicles and Parts (+49.32%).

Source Data: AAR – PFL Analytics

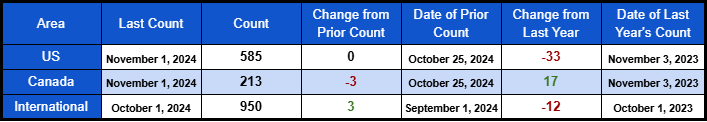

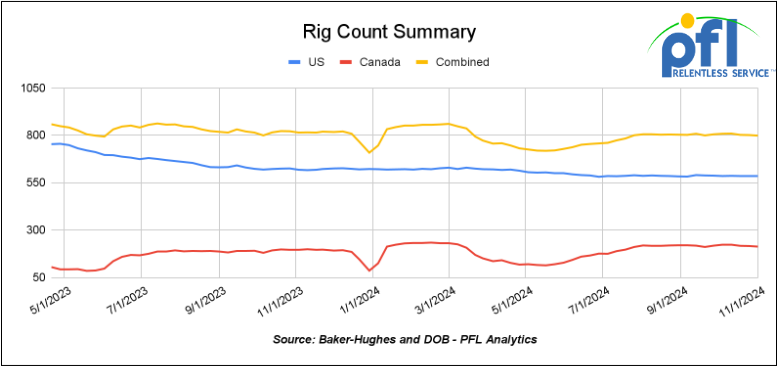

Rig Count

North American rig count was down by -3 rigs week-over-week. U.S. rig count was flat week-over-week, but down by -33 rigs year-over-year. The U.S. currently has 585 active rigs. Canada’s rig count was down -3 rigs week over week, but up by 17 rigs year-over-year and Canada’s overall rig count is 213 active rigs. Overall, year over year we are down by -16 rigs collectively.

International rig count was up by 3 rigs month-over-month, but down by -12 rigs year-over-year. Internationally there are 950 active rigs.

North American Rig Count Summary

You, the reader, are probably wondering why Canada’s rig count is up year over year when the rest of the world, including the U.S., are down year over year? We have seen record-low natural gas pricing and, if it was not for geopolitical risk and the current administration in power here in the U.S. (we will see what tomorrow brings), oil prices fundamentally would be much lower than they are today. The world sees that, but Canada has some catching up to do to fill its pipeline capacity.

The start-up of the TMX pipeline in early May resulted in a rapid boost in demand for drilling rigs as operators increased activity to fill the line, Precision Drilling Corporation president and chief executive officer Kevin Neveu said during the company’s third-quarter conference. Trans Mountain Expansion (“TMX”) added 590,000 barrels per day of new pipeline capacity.

“We were surprised by how quickly industry responded to the increased takeaway capacity on TMX,” said Neveu, with activity about 15 percent higher than Precision expected.

Demand for Precision’s high specification Super Single and Super Triple rigs is at “historic highs,” he said. Precision has 75 rigs operating in Canada, with its high specification rigs nearly fully utilized.

“It’s looking like a very busy 2025, with the pace of activity exceeding 2024,” he said.

Demand for Super Single rigs is being driven by multilateral well development in conventional heavy oil plays like the Clearwater and increased oilsands SAGD development as operators take advantage of the 590,000 bbls/d of additional oil egress out of the basin provided by the TMX.

“Drilling operations are the key cost driver in heavy oil,” he said. “In the Clearwater, wells are complex multilaterals where accurate placement of wellbores is critical.”

The Super Singles are ideal for this application, said Neveu. They also come equipped with the pad walking system and other automated features needed to drill multiple wells from the same pad efficiently.

Demand for Super Triples has increased as operators target condensate-rich areas in the Montney to provide diluent needed for heavy oil to flow down the TMX, Neveu said. There is a current shortfall of around 270,000 bbls/d of diluent in Canada, keeping prices near or above WTI oil prices, which makes wells economic despite low natural gas prices.

In 2025, he expects demand for high performance triple rigs to increase by an additional two to five rigs when LNG Canada comes online in the second quarter.

Increased pad drilling is allowing operators to extend the drilling season into spring breakup, keeping utilization rates higher for both the Super Single and Super Triple rigs, he added.

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,097 from 28,850, which was a gain of 247 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -9.3% week over week, CN’s volumes were lower by -1.3% week-over-week. U.S. shipments were up across the board. The NS had the largest percentage increase and was up 11.7%.

We are watching Canadian Crude by Rail

Crude by rail out of Canada continued to decrease month over month. The Canadian Energy regulator reported on October 28th, 2024, that 79,200 barrels per day were exported during the month of August 2024 from 83,201 barrels per day in July of 2024 a decrease of 4,001 barrels per day month over month.

Despite crude oil production in western Canada reaching record highs, Canadian crude oil volumes exported by rail have declined by 31% overall in 2023, averaging 98,300 barrels per day in 2023, which is down from 143,300 barrels per day in 2022 and so far in 2024, we have averaged a little over 90,000 barrels per day. This drop is largely due to crude oil increasingly being exported by pipelines instead of rail after additional pipeline capacity was brought online in recent years.

In 2019, crude exports by rail reached an annual historical high because pipelines in western Canada were operating near or at full capacity. This trend continued into early 2020, with February 2020 hitting a record monthly high of 412,000 barrels per day.. Since then, annual average volumes exported by rail have been dropping, first from the COVID-19 pandemic where oil demand declined. The decline of crude by rail out of Canada continued as additional pipeline capacity became available for oil exports out of western Canada. In October 2021 the completion of the Enbridge Mainline Line 3 replacement program, added 370,000 barrels per day of capacity and of course, the recent completion of the Trans Mountain Expansion (“TMX”) that added 590,000 barrels per day of capacity has caused producers to shift away from crude by rail. Crude by rail is more than twice the cost of pipelines.

Despite the setback, crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines, and raw bitumen shipped as a non-haz product, as it is not able to flow in pipelines and is competitive with pipeline tolls. This is a growing market to keep an eye on. Other factors include existing long-term contractual commitments and basis. Frankly, we really need to see basis, the WTI-CMA (West Texas Intermediate – Calendar Month Average) blows out to -17 per barrel for sustained periods of time to make economic sense, and right now seems to be stable at -12 per barrel. Stay tuned to PFL for further details, we watch this one every day!

We are watching Key Economic Indicators

Consumer Confidence

In October 2024, The Conference Board’s Consumer Confidence Index increased to 108.7 from 99.2 in September, marking the largest monthly gain since 2021. Key improvements include higher consumer optimism about current and future business conditions, job availability, and stock prices. Inflation concerns remain, although grocery prices showed a slight decline according to government data (we don’t see it). Consumers also expect slightly higher interest rates in the coming year, but the overall recession risk perceived by consumers is at its lowest since July 2022 – we will see what happens.

The University of Michigan’s Index of Consumer Sentiment showed an unexpected increase, revising upwards from an initial estimate of 68.9 to 70.5 for October, marking the highest level in six months. This rise reflects modestly improved buying conditions, likely influenced by slight reductions in interest rates. While consumer expectations remained mostly stable, current economic conditions saw an uptick, moving from 63.3 in September to 64.9 in October. Despite these positive shifts, inflation expectations remain cautiously monitored, with long-term expectations slightly edging down to 3.0% from 3.1%

U.S. Unemployment

Total non-farm payroll employment was essentially unchanged in October (+12,000 jobs), and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported on Friday of last week. Employment continued to trend up in health care and government. Temporary help services lost jobs. That’s all, we need more government jobs!

Meanwhile, employment declined in manufacturing due to what the U.S. Bureau of Labor Statistics attributes to “strike activity.”

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Prodcuts service.

- 10, 25.5K-29K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117R/117J Tanks needed off of CN/CP in Western Canada for 2 Years. Cars are needed for use in Refined Fuels service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 90, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Fuel OIl. 2-3 Year Term

- 50, 28.3K, 117R Tanks located off of All Class 1s in St. Louis. Cars are clean 1 Year Term

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. Winter Lease

- 50, 30K, 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of Multiple in All over. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations. Will take 90K

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 50, 17K, DOT 111 Tanks located off of Multiple in All over.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website