“In three words I can sum up everything I’ve learned about life: it goes on.”

-Robert Frost

Folks, welcome back from Thanksgiving. We hope no one got arrested for hanging out with friends and family! I know everyone at PFL had a great Thanksgiving and no one on our end is in jail, for now!

COVID 19

The United States currently has 13,750,608 confirmed COVID-19 cases and 273,077 confirmed deaths.

Folks, as you know Pfizer came out with a vaccine that has to be super chilled while transported which creates a logistical nightmare. You may be wondering how this will be done. Well, PFL did some research and turns out that on Tuesday of last week, UPS said it has invested in machines to produce dry ice for transport and storage of frozen COVID-19 vaccines, while Switzerland-based SkyCell revealed a new ultra cold container that enables larger vaccine shipments by air because less dry ice is required.

The new investments come as governments and the overall industry are racing to prepare for a massive logistics campaign to distribute billions of vaccine doses around the world, with early candidates requiring robust cold-chain capabilities because of their extreme temperature sensitivity.

UPS, one of a handful of top-tier logistics companies involved in the initial delivery rush of vaccines, said its health care supply chain unit can now produce up to 1,200 pounds of dry ice per hour at the company’s Worldport package hub in Louisville, Kentucky.

Spokesman, David Graves, said the manufacturing equipment represents UPS’ first production capacity of dry ice and that additional needs will be supplemented by third parties in Louisville, Toronto, Canada; and Dallas. “After thorough analysis, it was determined those locations represent the best logistics options for our air and ground networks, enabling us to reach populations most efficiently,” he said in an email. UPS is helping Pfizer get its vaccine to hospitals and other administration sites and participating in the U.S. government’s Operation Warp Speed program to deliver other vaccines and kits with related supplies. Get ready for the nightmare to be over folks!

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 778,000 initial jobless claims. The number of first-time filers for unemployment benefits were higher than expected and were estimated to come in at 730,000. Continuing claims, for the week ended November 14th were 6.07 million vs. the 6 million expected and 6.37 million during the prior week. All told, new unemployment claims have held below the 1 million for over 3 months, and remain well below the pandemic-era peak of nearly 7 million. The total number of people claiming benefits in all programs in the latest week was 20,452,223, which increased by over 135,000 from the prior period and exponentially higher than the 1,487,844 people year over year.

The rising COVID-19 count has led some states and localities to close schools and restrict what they feel as nonessential businesses, all of which had just begun to reopen. Meanwhile, a range of big companies have announced layoffs.

Despite COVID Concerns Markets End the Week Strong

The Dow closed higher on Friday, up +37.9 points (+0.13%) closing out the week at 29,910.37 points up 646.89 points week over week. The S&P 500 closed higher on Friday as well, up 8.70 points (+0.24%) closing out the week at 3,638.35 points, up 80.81 points week over week. The Nasdaq Composite closed higher as well on Friday of last week, up 111.44 points (+0.92%) closing out the week at 12,205.85 11,854.97 points up 350.88 points week over week..

In overnight trading, DOW futures traded lower and are expected to open down this morning 163 points.

Oil gains for fourth straight week ahead of OPEC+ output meeting

Oil rose for a fourth straight week, buoyed by optimism over Covid-19 vaccine progress ahead of an OPEC+ ministerial gathering next week.

West Texas Intermediate (WTI) crude for January delivery lost 18 cents to settle at US$45.53/bbl on Friday of last week. Brent for the same month gained 38 cents to end last Friday’s session at US$48.18/bbl. Brent rose 7.2 per cent last week while WTI traded higher 8 per cent. The shape of the oil futures curve is turning contango and is a sign of how the market has re-priced the increased likelihood of a vaccine rollout jumpstarting a stronger demand rebound next year.

Meanwhile, informal talks between an OPEC+ panel took place on Sunday after previously being scheduled for this past Saturday. That will precede the formal ministerial meetings scheduled for today and Tuesday, where producers will decide whether to postpone a planned output hike. No agreement among OPE+ members as a result of Sunday’s meetings was achieved. The markets are expecting OPEC+ will postpone the planned increase by three months to March, oil’s recent rally may further complicate the decision amid growing tension with some member countries. Stay tuned to PFL.

U.S. commercial crude oil inventories decreased by 0.8 million barrels from the previous week. At 488.7 million barrels, U.S. crude oil inventories are 6% above the five year average for this time of year. Total motor gasoline inventories increased by 2.2 million barrels last week and are 4% above the five year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories decreased by 1.4 million barrels last week and are 8% above the five year average for this time of year. Propane/propylene inventories decreased by 0.3 million barrels last week and are 6% above the five year average for this time of year. Total commercial petroleum inventories decreased by 1.1 million barrels last week.

U.S. crude oil refinery inputs averaged 14.3 million barrels per day during the week ending November 20, 2020 which was 422,000 barrels per day more than the previous week’s average. Refineries operated at 78.7% of their operable capacity last week. Gasoline production decreased last week, averaging 8.9 million barrels per day. Distillate fuel production increased last week, averaging 4.6 million barrels per day. Oil is lower in overnight trading, WTI is poised to open at $44.74, down 79 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 5.2% year over year in week 47 (U.S. +2.5%, Canada +19.6%, Mexico -9.9%), resulting in quarter to date volumes that are up 2.4% and year to date volumes that are down 7.9% (U.S. -8.5%, Canada -5.2%, Mexico -10.2%). 6 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+11.9%) and grain (+14.9%). The largest decrease came from coal (-12.8%).

In the East

CSX’s total volumes were up 1.7%, with the largest increase coming from intermodal (+11.2%). The largest decrease came from coal (-17.9%). NCS’s total volumes were down 0.6%, with the largest decreases coming from coal (-23.4%) and petroleum (-52.7%). The largest increase came from intermodal (+6.2%).

In the West

BN’s total volumes were up 0.8%, with the largest increase coming from intermodal (+13.1%). The largest decrease came from coal (-20.4%). UP’s total volumes were up 4.4%, with the largest increases coming from intermodal (+12.1%) and grain (+51.6%). The largest decreases came from coal (-8.4%) and petroleum (-19.1%).

In Canada

CN’s total volumes were up 28.5% with the largest increases coming from intermodal (+27.1%), coal (+73.6%), petroleum (+48.1%), chemicals (+30.3%) and grain (+40.6%). RTMs were up 55.7%, and we would note the substantial increase is partially due to last year’s blockades on the network (easy comps). CP’s total volumes were up 2.1%, with the largest increase coming from intermodal (+9.1%). The largest decrease came from petroleum (-38.2%). RTMs were down 3.2%.

Kansas City Southern

KCS’s total volumes were down 9.7%, with the largest decrease coming from intermodal (-15.1%) and coal (-28.5%).

Source: Stephens

Rig Count

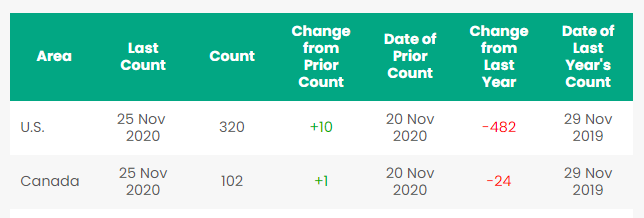

North America rig count is up by 11 Rigs week over week. The U.S. gained 10 rigs week over week with 320 active rigs. Canada’s rig count was up 1 rig week over week and Canada’s overall rig count is 102 active rigs. Year over year we are down 506 rigs collectively.

North American Rig Count Summary

Things we are keeping an eye on

- Despite U.S. sanctions on Venezuela, China started purchasing crude from them last month waving a red flag at the Trump administration. The direct shipments come ahead of January’s transition of power in the United States from Republican President Donald Trump to Democratic President-elect Joe Biden, whose advisers have said he would retain sanctions but shift the focus of U.S. strategy. The resumption of direct imports by China comes after Washington earlier this year took action against units of Russia’s Rosneft and later went after shipping firms that continued to do business with Petroleos de Venezuela (PDVSA) following trade sanctions first imposed in early 2019. With Trump to leave the White House in the near future, the world could look very different come February 1, 2021.

- A new report by Sproule and Associates out of Calgary, Alberta Canada takes a look at President – Elect Biden and the Clean Energy Revolution – key points are as follows and how it could affect shipments of oil and the probabilities of outcomes as follows:

i) In the report, the firm noted that a Biden presidency could put long-term Canadian and Williston Basin excess pipeline capacity “at risk” but that the impact of cancelling Keystone XL for Canadian producers is “likely minimal”. Keystone XL has obviously been in the forefront of a lot of peoples’ minds in terms of what the impact will be of a Biden administration, especially considering he has already come out in opposition to the project, And vice-president elect Kamala Harris has been vocal in her opposition on both Keystone and Dakota Access (DAPL). From a political perspective, with Republicans retaining their Senate majority and gaining seats in the House of Representatives, implementing “contentious campaign promises” like cancelling the Keystone XL project will prove challenging for Biden. Cancelling a project that is set to provide over 8,000 union jobs is unlikely to sit well with the traditionally Democratic U.S. trade unions.

ii) The report suggests that with Enbridge Inc.’s Line 3 and TMX set to add almost one million bbls/d of new oil leaving Western Canada and limited green and brownfield oilsands projects in the hopper, Western Canadian production “should remain at or below” pipeline capacity over the near-term. Canada is in a much more optimistic position than we were two or three years ago in terms of actually achieving excess pipeline capacity leaving Western Canada, especially with the most recent approval of Line 3 that came a few weeks ago. Trans Mountain, which is under construction and still on track for a late-2022 commissioning, is another positive.

iii) DAPL is operating near capacity while undergoing a revised environmental impact and permitting process. As of Q3 2020, Energy Transfer (owner of DAPL), announced plans to expand DAPL by up to an additional 500,000 bbls/d by the end of 2021. At this point, according to the report, it “seems unlikely that the expansion will receive approval” and there is “uncertainty around” whether the existing DAPL system will be allowed to continue operating during and/or after the environmental review. The report also points out that Biden has been clear that no new drilling leases will be granted on federal lands under his administration. “One of Biden’s climate plan objectives is ‘…banning new oil and gas permitting on public lands and waters…’. It is unclear whether this means eliminating the permitting of new leases only or if the plan also includes banning any future drilling on existing leases,” the report states.

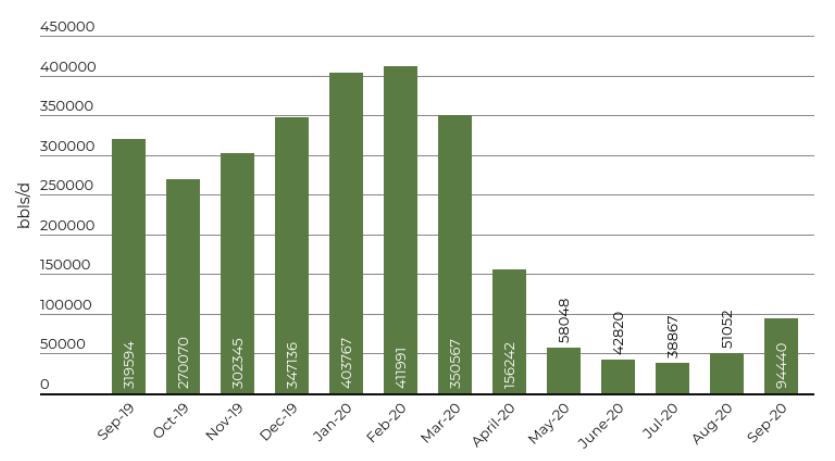

iv) PFL concludes from its reading of the report that it seems for the most part few if any pipelines will be cancelled and crude by rail may not make the comeback that we all have hoped – DAPL being the wild card. However time will tell – it is a wait and see situation. - Canadian Energy Regulator (CER) issued crude by rail numbers out of Canada for September last week. While there may be increased rail volumes in the cards going forward they are likely to be minimal compared to the lofty heights witnessed early this year. In fact, some industry experts say a large-scale resurgence in shipments is unlikely. Canadian crude-by-rail exports climbed in September, new data from CER showed. Exports averaged 94,440 bbls/d in September 2020, up from 51,052 bbls/d in August, and 38,867 bbls/d in July. Volumes in September 2019 averaged 319,594 bbls/d. (See Chart below)

Canadian Crude Oil Exports by Rail

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

A sign of things getting better – leasing activity and inquiries have continued to be strong

PFL is seeking:

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase

- 50-60 Sulfuric acid cars 13.6 for purchase

- 40-50 molten Sulfur Cars 13.8 for purchase

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

- 30 5400-5800 286 Hoppers needed in Texas off the BN for grain 2 years negotiable

- 10 Veg Oil tanks 30K needed in Mexico off the BN for 2 years negotiable

- 6 Tank Cars 25.5K needed in NY off the NS for wastewater up to 5 years negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- 140 117R 30.3 Dirty Ethanol located east and Midwest, lease negotiable

- 25 117J 25.5 New Texas UP and BN lease negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

A sign of things getting better – leasing activity and inquiries have continued to be strong

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|