“Never argue with stupid people, they will drag you down to their level and then beat you with experience.”

– Mark Twain

Jobs Update

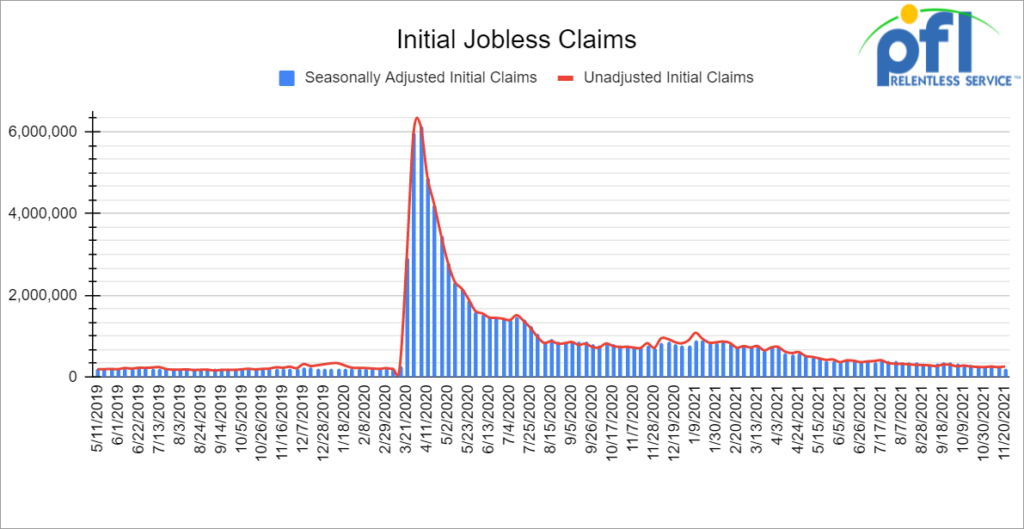

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending November 20th came in at 199,000, down 71,000 people week over week.

- Continuing claims came in at 2.049 million people versus the adjusted number of 2.109 million people from the week prior, down 60,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed lower on Friday of last week and lower week over week

The Markets sold off hard on Friday of last week on demand destruction fears. Apparently there is another new COVID-19 strain out there that has been detected in South Africa named “Omicron” (by the World Health Organization). Dr. Angelique Coetzee, a practicing doctor for 30 years, who chairs the South African Medical Association (SAMA), said she believed she had found a new strain of the virus after COVID-19 patients at her private practice in Pretoria exhibited strange symptoms.“Their symptoms were so different and so mild from those I had treated before,” Coetzee told The London Telegraph.

She called South Africa’s vaccine advisory committee on Nov. 18 after a family of four all tested positive for the virus with symptoms that included extreme fatigue. “It presents mild disease with symptoms being sore muscles and tiredness for a day or two not feeling well,” Coetzee told the paper. “So far, we have detected that those infected do not suffer the loss of taste or smell. They might have a slight cough. There are no prominent symptoms. Despite the findings or lack thereof the U.S. is restricting flights beginning today from South Africa and seven other countries in that region. This could be an overreaction, we shall see.

The DOW closed lower on Friday of last week, down -905.04 points (-2.53%), closing out the week at 34,899.24 points, down -702.74 points week over week. The S&P 500 closed lower on Friday of last week, down -106.84 points (-2.27%) and closed out the week at 4,594.62, down -103.34 points week over week. The Nasdaq closed lower on Friday of last week, down -353.57 points (-2.23%) and closed out the week at 15,491.56, down -565.78 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 35,065 this morning up 207 points.

Oil posts fifth straight weekly loss as new COVID concerns emerge

Folks, in case you missed it, West Texas Intermediate (WTI) for January fell $10.24 a barrel, or 13.1 per cent, from Wednesdays of last week’s close to settle at $68.15 in New York on Friday of last week. The decline was the largest since April 2020. There was no settlement Thursday due to the Thanksgiving holiday. Brent settlement for January tumbled $9.50 to settle at $72.72 on the ICE Futures Europe Exchange.

Oil prices crashed more than 10 percent as a new coronavirus strain sparked fears that renewed lockdowns will threaten a global recovery in demand. It seems to us that the new COVID scare did what President Biden couldn’t do – lower oil prices. OPEC’s Economic Commission found that the SPR releases carried out by the United States and its partners (if they even participate at all) will only inflate the global surplus over Q1 2022 and potentially pave the way for a slower than assumed OPEC + production increase. As we have said many times, the only way to get back into the driver’s seat as far as prices go is to increase domestic production.

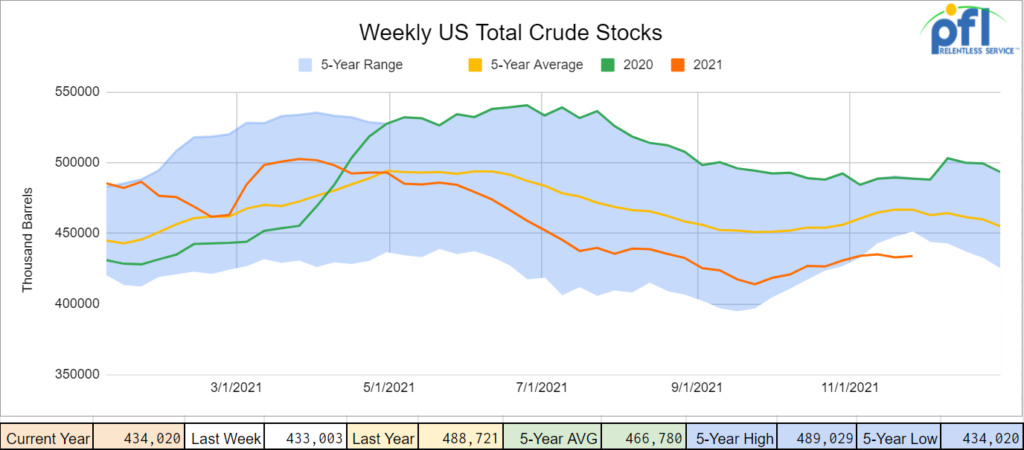

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1 million barrels week over week. At 434 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

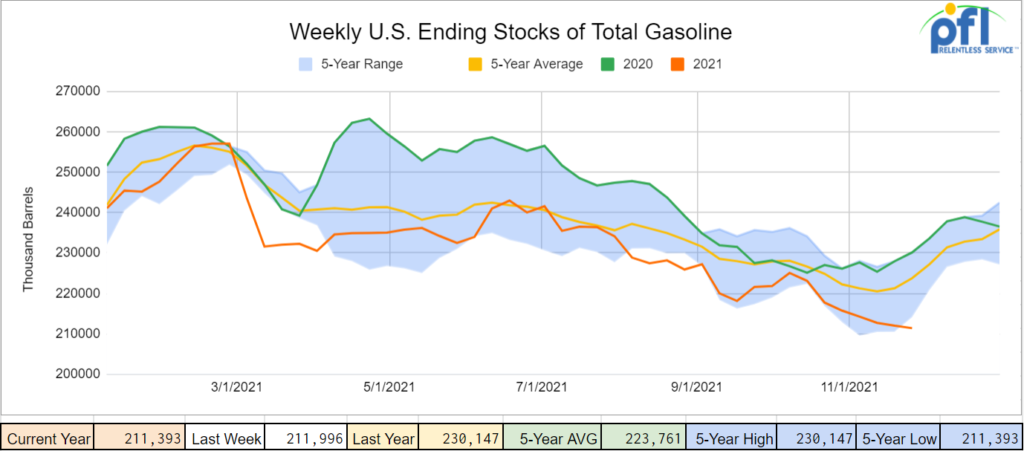

Total motor gasoline inventories decreased by 600,000 barrels week over week and are 6% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

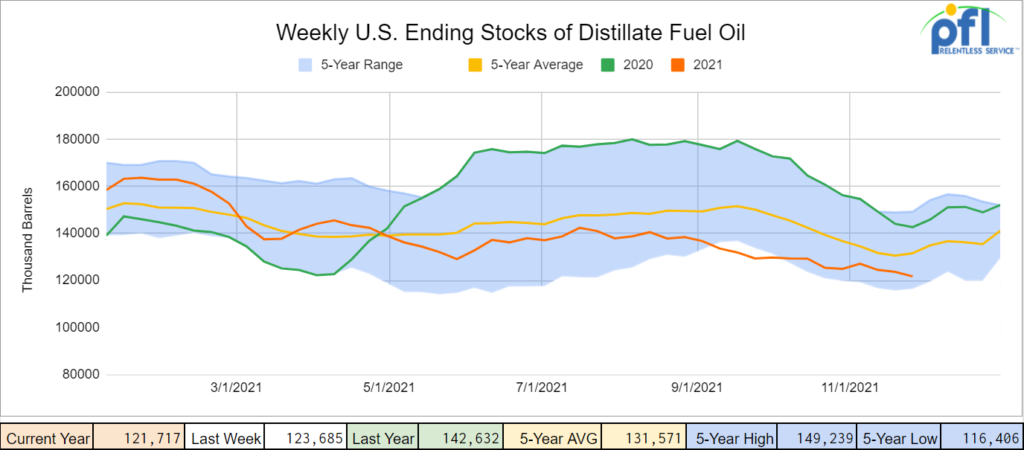

Distillate fuel inventories decreased by 2 million barrels week over week and are 8% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

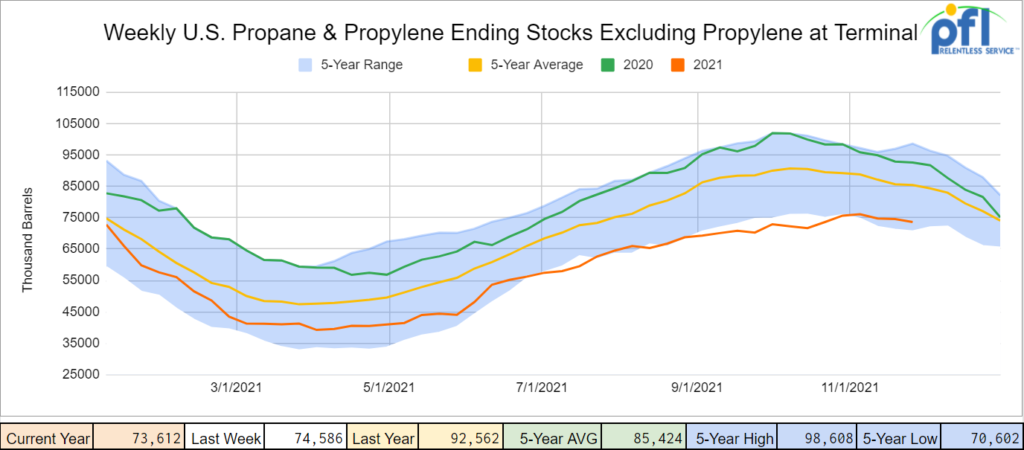

Propane/propylene inventories decreased by 1 million barrels week over week and are 13% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

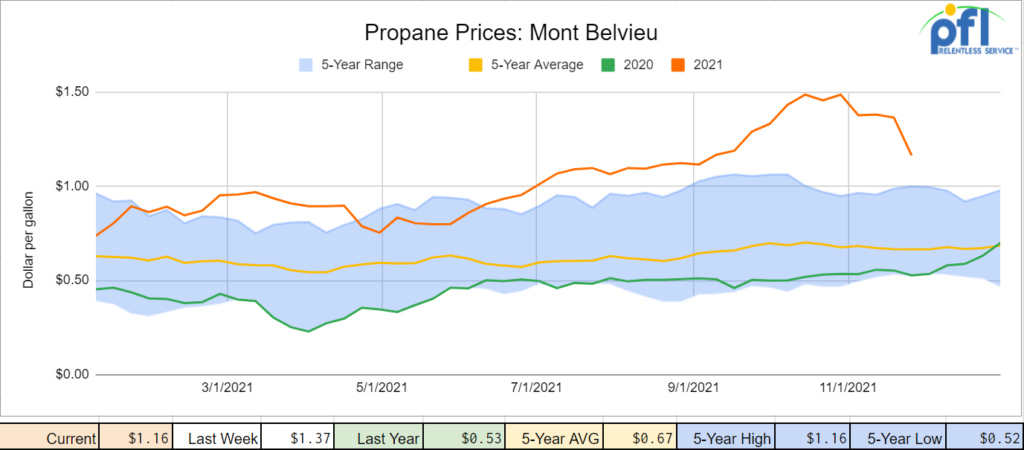

Propane prices continue to decrease week over week falling sharply down 21 cents per gallon.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories decreased by 6 million barrels week over week.

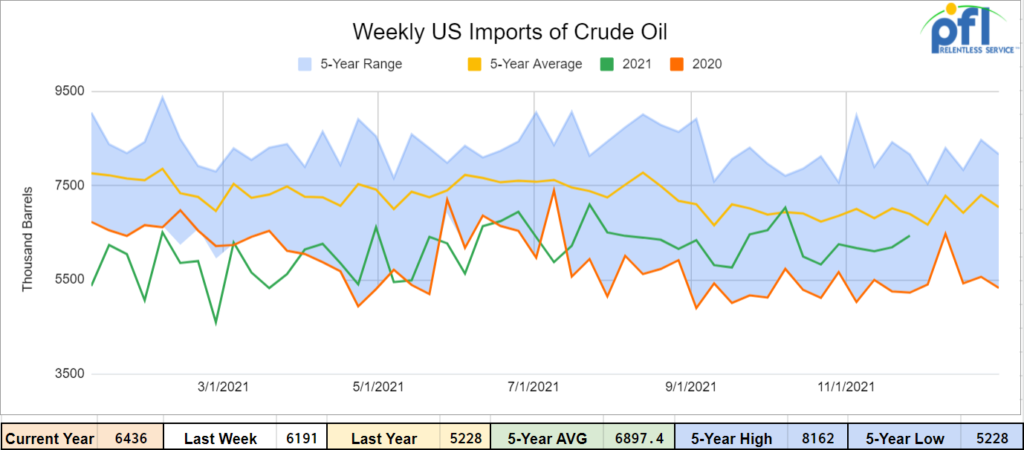

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending November 19th, up by 245,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 18.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 483,000 barrels per day, and distillate fuel imports averaged 332,000 barrels per day.

Source Data: EIA – PFL Analytics

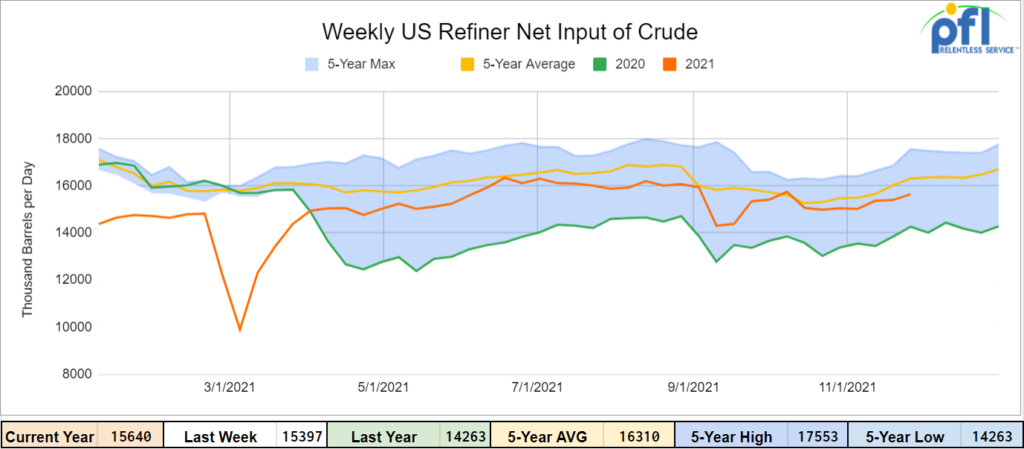

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending November 19, 2021 which was 243,000 barrels per day more than the previous week’s average. Refineries operated at 88.6% of their operable capacity for the week ending November 19th

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at 71.36 , up $3.21 per barrel from Friday’s close.

North American Rail Traffic

North American rail volume for the week ending November 20, 2021, on 12 reporting U.S., Canadian, and Mexican railroads totaled 329,398 carloads, down 2.3 percent compared with the same week last year, and 338,380 intermodal units, down 14.2 percent compared with last year. Total combined weekly rail traffic in North America was 667,778 carloads and intermodal units, down 8.7 percent. North American rail volume for the first 46 weeks of 2021 was 31,833,619 carloads and intermodal units, up 5.8 percent year over year.

For week 46, total U.S. weekly rail traffic was 508,309 carloads and intermodal units, down 4.9 percent compared with the same week last year.

Total carloads for the week ending November 20 were 237,244 carloads, up 1.6 percent year over year, while U.S. weekly intermodal volume was 271,065 containers and trailers, down 10 percent year over year.

Six of the ten carload commodity groups posted year over year increases. They included metallic ores and metals, up 1,838 carloads, to 21,524; coal, up 1,780 carloads, to 64,719; and chemicals, up 1,437 carloads, to 34,174. Commodity groups that posted year over year decreases included miscellaneous carloads, down 1,009 carloads, to 9,064; motor vehicles and parts, down 887 carloads, to 14,690; and grain, down 710 carloads, to 24,494.

For the first 46 weeks of 2021, U.S. railroads reported cumulative volume of 10,665,348 carloads, up 7.1 percent from the same point last year; and 12,695,960 intermodal units, up 6.7 percent from last year. Total combined U.S. traffic for the first 46 weeks of 2021 was 23,361,308 carloads and intermodal units, an increase of 6.9 percent compared to last year.

Canadian railroads reported 73,037 carloads for the week, down 12 percent, and 52,947 intermodal units, down 32.7 percent compared with the same week in 2020. For the first 46 weeks of 2021, Canadian railroads reported cumulative rail traffic volume of 6,804,271 carloads, containers and trailers, up 2.8 percent.

Mexican railroads reported 19,117 carloads for the week, down 7.2 percent compared with the same week last year, and 14,368 intermodal units, down 0.6 percent. Cumulative volume on Mexican railroads for the first 46 weeks of 2021 was 1,668,040 carloads and intermodal containers and trailers, up 3.8 percent from the same point last year.

Source: AAR

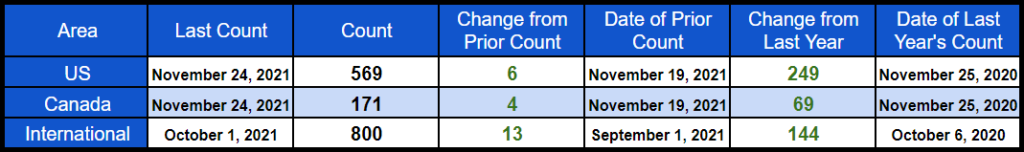

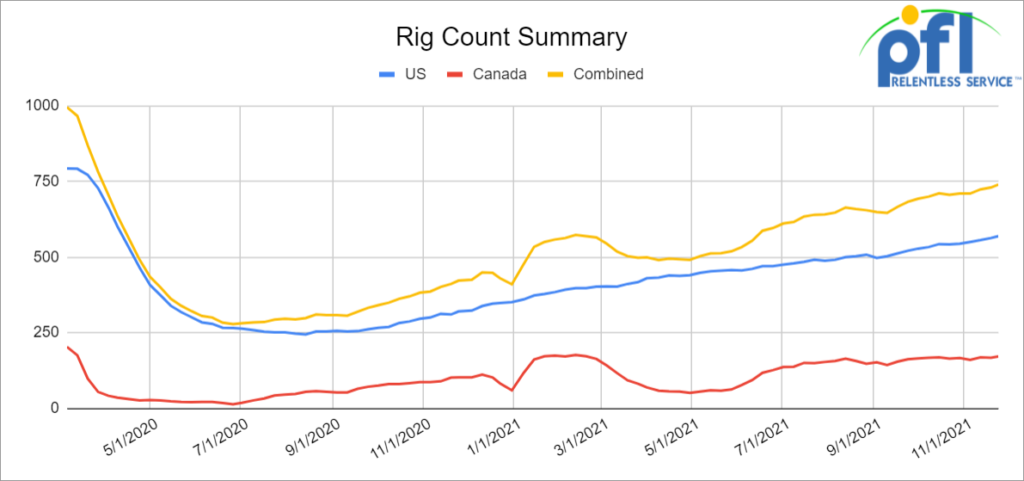

Rig Count

North American rig count is up by 10 rigs week over week. The U.S. rig count was up by 6 rigs week over week and up by 249 rigs year over year. The U.S. currently has 569 active rigs. Canada’s rig count was up by 4 rigs week over week, and up by 69 rigs year over year and Canada’s overall rig count is 171 active rigs. Overall, year over year, we are up 318 rigs collectively.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Weather in British Columbia Continues to Create Havoc for Rail

CN’s main link to Port of Vancouver remains closed – CN’s main link to the Port of Vancouver remained closed as of Thursday of last week, nearly two weeks after devastating flooding and landslides shut it down. CN had expected to resume limited service on the Vancouver-Kamloops corridor on Wednesday of last week, however, it now will remain out of service “until all work is completed” due to new weather-related issues, CN reported.

CN has resumed service between Prince George and Vancouver on Thursday of last week. However, the continued shutdown of the Kamloops corridor will slow the resumption of normal operations at the port. Congestion at the Port of Vancouver remained high Friday of last week. Forty-three vessels were waiting to dock, including eight container ships.

Canadian Pacific began limited service between Vancouver and Kamloops on Wednesday of last week.

At the same time, Port of Vancouver truckers threaten to strike. Drivers at 2 carriers voted to authorize a walkout as the port recovers from the rail shutdown, threatening another major disruption at Canada’s busiest port as it tries to recover from the shutdown of rail service. Drivers for Aheer Transportation and Prudential Transportation “voted overwhelmingly to strike if necessary” to secure a new agreement, their union, Unifor, said in a statement on Tuesday of last week. The drivers are seeking health and dental benefits and increased pay for waiting times. A strike would affect about 200 of the roughly 1,700 drivers serving the port. A strike could come as early as this week.

Trans Mountain Pipeline hopes to Resume Operations This Week

The Trans Mountain Pipeline could restart at a reduced capacity in the middle of this week, the company said in a statement on Friday of last week. The pipeline has been shut down voluntarily since Sunday, November 14, when an atmospheric river struck British Columbia, Canada. What is an atmospheric river? – we were wondering as well – according to NOAA atmospheric rivers are relatively long, narrow regions in the atmosphere – like rivers in the sky – that transport most of the water vapor outside of the tropics. These columns of vapor move with the weather, carrying an amount of water vapor roughly equivalent to the average flow of water at the mouth of the Mississippi River. When the atmospheric rivers make landfall, they often release this water vapor in the form of rain or snow. If you are interested in learning more about atmospheric rivers please Click here. In any event, the pipeline was forced to temporally shut down as the pipe was exposed near Hope, British Columbia. (See below:)

Source: Trans Mountain Pipeline

The pipeline was operating at 300,000 barrels per day before the shutdown.

“Once restarted, delivery of oil and refined products currently in the line will continue as they progress to their delivery points at either Kamloops, Sumas, or Burnaby. According to Trans Mountain after initial start-up, a sustained effort will continue to return the system to its full capacity as soon as possible,” Transportation Minister Rob Fleming said Friday of last week that a full update on the pipeline will be forthcoming today but he said even without the pipeline, the province’s fuel supply is “holding steady.” He said fuel is being brought in by barge and rail with 12 westbound trains and 12 eastbound trains running between the Lower Mainland and the Interior on Thursday alone. “Best case scenario, we’re not going to see anything until the first or second week of December and possibly into Christmas before everything gets back into what we consider normal,” he said, adding that the Parkland Refinery in Burnaby B.C. still has to resume operations as well. Parkland Refining is a 57,000 barrel per day facility located in Burnaby British Columbia who was forced to shut down as well but is in hot “ready mode” to resume operations as soon as possible. Parkland is a key refinery for Vancouver’s gasoline market and supplies Vancouver’s Airport 30% of its Jet Fuel demand.

Trans Mountain is currently expanding its capacity to 890,000 barrels per day on schedule to be completed by December 31, 2022.

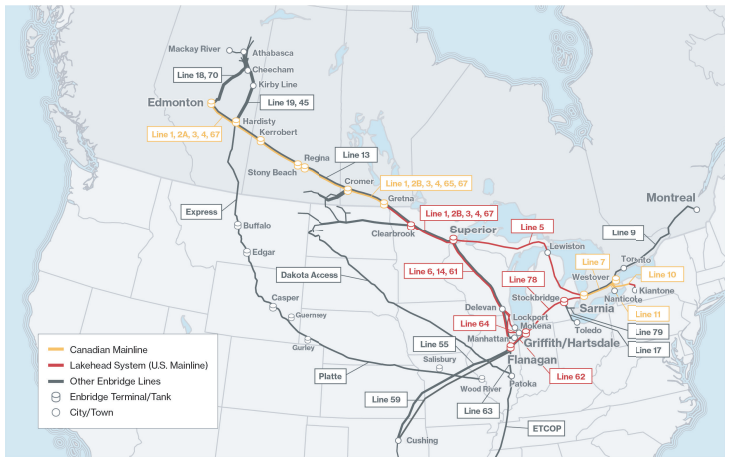

Canadian Regulator shoots down Enbridge Mainline Contracting Proposal

In what was a relief for many shippers on Enbridge – The Commission of the Canada Energy Regulator (CER) did not approve Enbridge Inc.’s application to enter into long-term contracts on the Canadian Mainline pipeline for 90 per cent of the system’s capacity. For more information as it relates to CER decision please click here

The Mainline is Canada’s largest oil pipeline system, moving over three million barrels per day of petroleum products to market. The pipeline provides approximately 70 percent of the total oil pipeline transportation capacity out of Western Canada. Several parties supported the application because the pipeline’s demand has exceeded available capacity over the past few years. (See Enbridges mainline system below).

Source: Enbridge

Enbridge highlighted that firm contracts would give them more predictable access to the pipeline,” said the Board.

Others, including many Canadian oil producers, argued that the proposed change would worsen the existing capacity constraints and have other negative consequences such as lower oil prices.

The Commission found that the proposal would dramatically change access to the Mainline.

“The Commission noted that while certain companies would benefit from long-term stability, others would lose access to the pipeline. This would not meet the CER Act’s common carriage obligation. This means that a pipeline company must provide service to anyone who wants to ship their products on the pipeline, within reason,” said the CER.

The Canadian Mainline will continue to operate on existing interim tolls.

CP and KCS Update

On November 23rd, the STB announced that it accepts the CP’s-KCS merger application as complete. In its decision, following public comment, the STB has adopted a procedural schedule that sets deadlines for comments, responsive applications, final briefs and other filings, the release stated. Notices of intent to participate are due Dec. 13. Subsequent deadlines are contained in the decision. The procedural schedule provides that any necessary public hearing will be taking place after the filing of final briefs, which are due on July 1, 2022.

“We look forward to moving forward with a robust regulatory review of this historic combination that will add capacity to the U.S. rail network, create new competitive transportation options, support North American economic growth, and deliver other important benefits to customers, employees, and the environment,” said CP President and CEO Keith Creel in a press release. The board’s decision can be viewed and downloaded Click here

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 30-50 340 Pressure cars for propane starting Nov 3 month lease in Alberta CP or CN

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food-grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|