“Tell me and I forget. Teach me and I remember. Involve me and I learn.”

‐Benjamin Franklin

Jobs Update

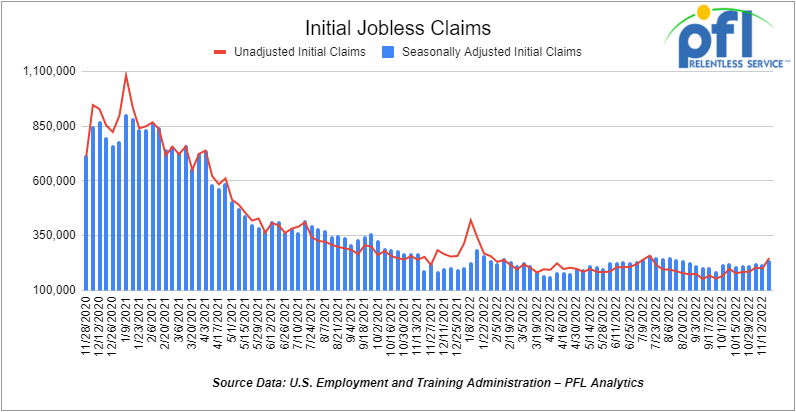

- Initial jobless claims for the week ending November 19th, 2022 came in at 240,000, up +17,000 people week-over-week.

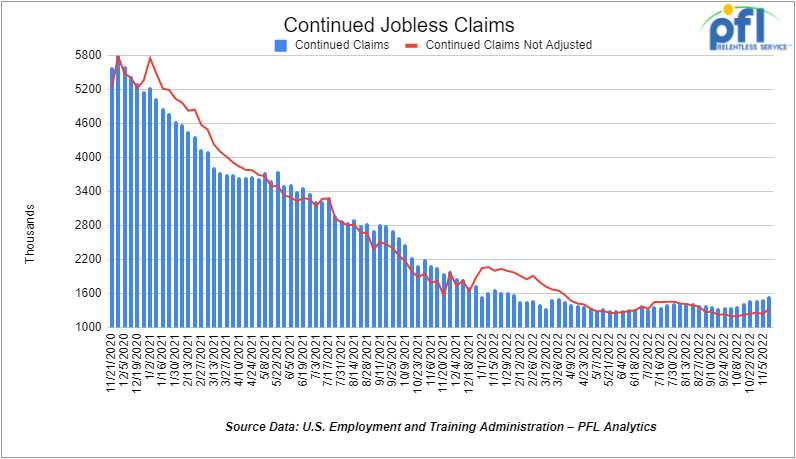

- Continuing jobless claims came in at 1.551 million people, versus the adjusted number of 1.503 million people from the week prior, up +48,000 people week over week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 152.97 points (+0.45%), closing out the week at 34,347.03, up 601.34 points week over week. The S&P 500 closed lower on Friday of last week, down -1.14 points (-0.03%), and closed out the week at 4,026.12, up 60.78 points week over week. The NASDAQ closed lower on Friday of last week, down -58.96 points (-0.53%), and closed the week at 11,226.36, up 80.3 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,167 this morning down -189 points.

Oil closed lower on Friday of last week and lower week over week

WTI traded down -1.66 per barrel (-2.1%) to close at $76.28 per barrel on Friday of last week, down -$1.66 per barrel week over week. Brent traded down -US$1.71 per barrel (-2%) on Friday of last week to close at US$83.63 per barrel, down -$6.15 per barrel week over week.

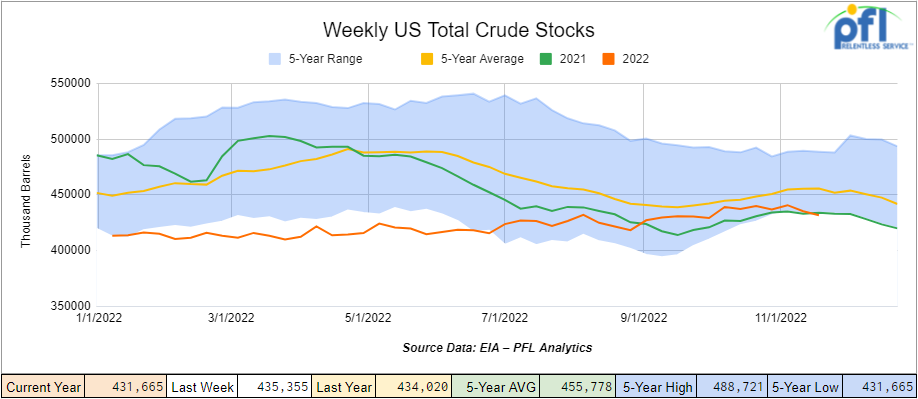

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.7 million barrels week over week. At 431.7 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

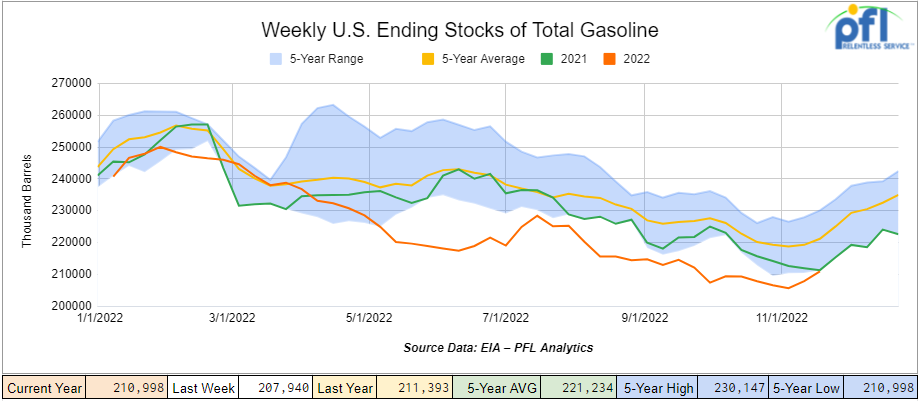

Total motor gasoline inventories increased by 3.1 million barrels week over week and are 4% below the five-year average for this time of year.

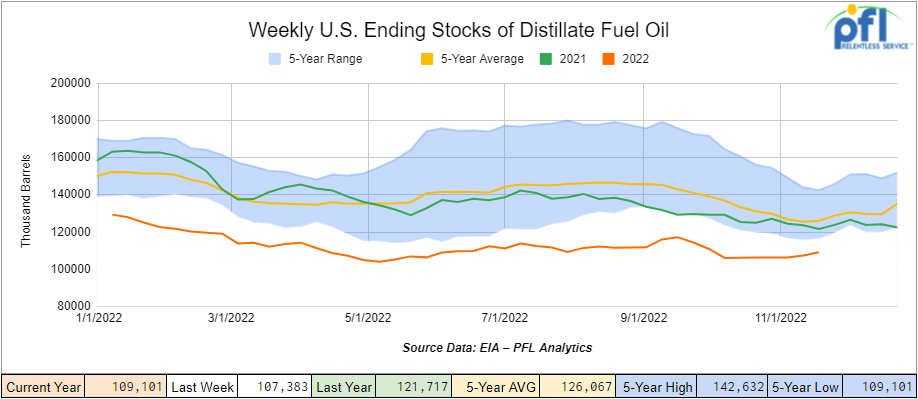

Distillate fuel inventories increased by 1.7 million barrels week over week and are 13% below the five-year average for this time of year.

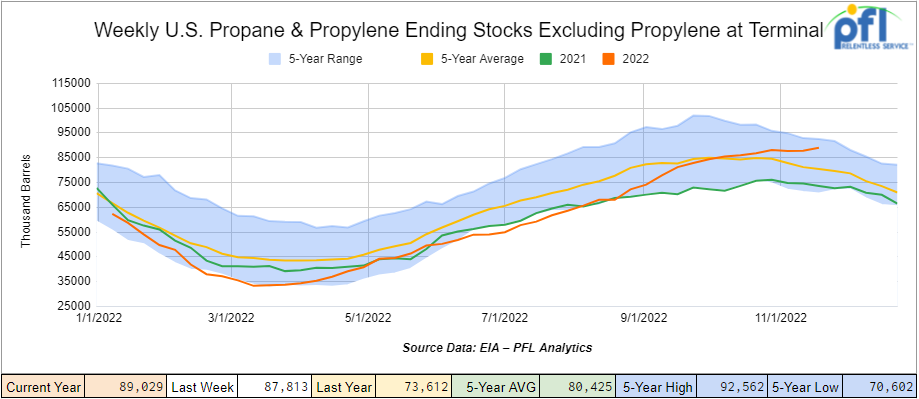

Propane/propylene inventories increased by 1.2 million barrels week over week and are 10% above the five-year average for this time of year.

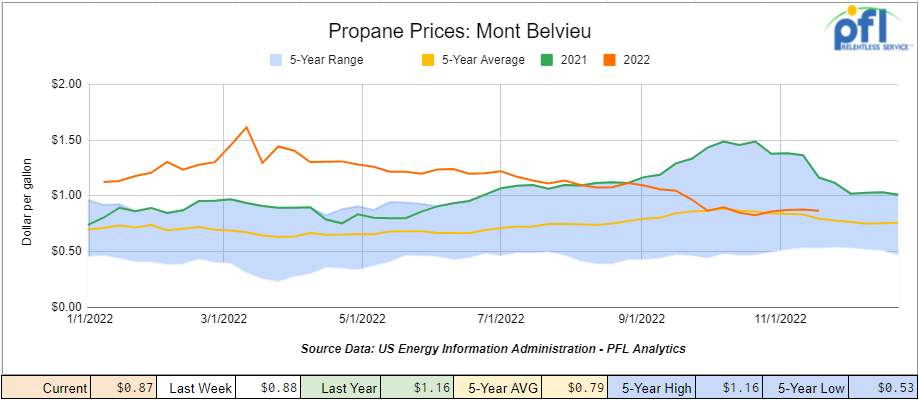

Propane prices were down 1 cent per gallon week over week, closing at 87 cents per gallon, down 29 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 3.3 million barrels during the week ending November 18th, 2022.

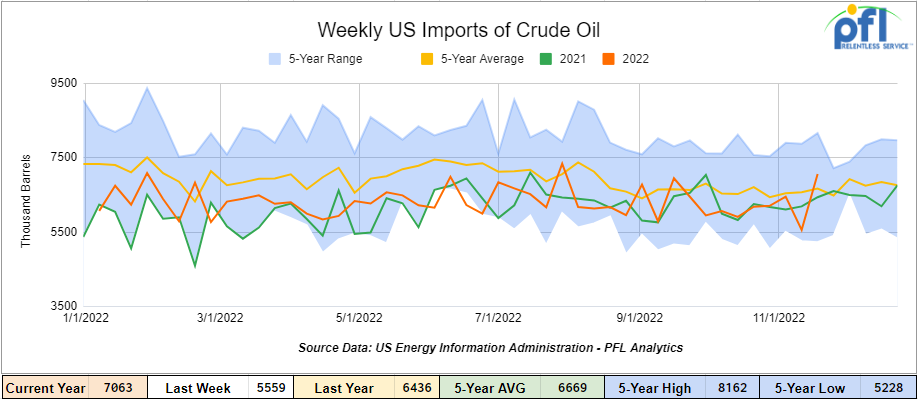

U.S. crude oil imports averaged 7.1 million barrels per day during the week ending November 18th, 2022, an increase of 1.5 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 1.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 585,000 barrels per day, and distillate fuel imports averaged 122,000 barrels per day during the week ending November 18th, 2022.

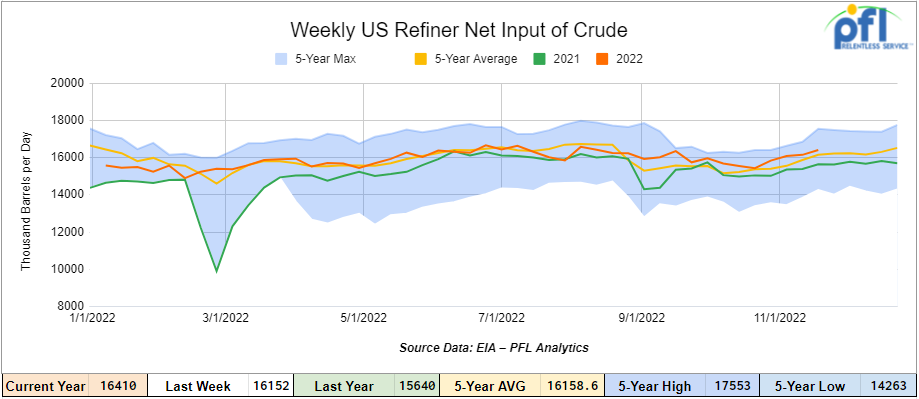

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending November 18, 2022, which was 258,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $74.20, down -$2.08 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 19th, 2022.

Total North American weekly rail volumes were down (-2.42%) in week 46 compared with the same week last year. Total carloads for the week ending on November 19th were 354,224, up (+0.13%) compared with the same week in 2021, while weekly intermodal volume was 322,461, down (-2.42%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Chemicals (-9.95%). The largest increase was from Grain (+10.12%).

In the east, CSX’s total volumes were down (-2.31%), with the largest decrease coming from Nonmetallic Minerals (-12.17%) and the largest increase from Coal (+9.69%). NS’s volumes were down (-1.65%), with the largest decrease coming from Motor Vehicles and Parts (-20.50%) and the largest increases from Grain (+47.99%).

In the West, BN’s total volumes were down (-6.04%), with the largest decreases coming from Chemicals (-18.48%), and the largest increase coming from Grain (+11.58%). UP’s total rail volumes were down (-0.16%) with the largest decrease coming from Forest Products (-9.65%) and the largest increase coming from Petroleum and Petroleum Products (+8.67%).

In Canada, CN’s total rail volumes were down (-2.37%) with the largest decrease coming from Other (-16.06%) and the largest increase coming from Petroleum and Petroleum Products (+28.15%). CP’s total rail volumes were up (+2.97%) with the largest decreases coming from Chemicals (-14.07%) and the largest increase coming from Other (+86.49%).

KCS’s total rail volumes were up (+5.13%) with the largest decrease coming from Forest Products (-14.42%) and the largest increase coming from Coal (+27.96%).

Source Data: AAR – PFL Analytics

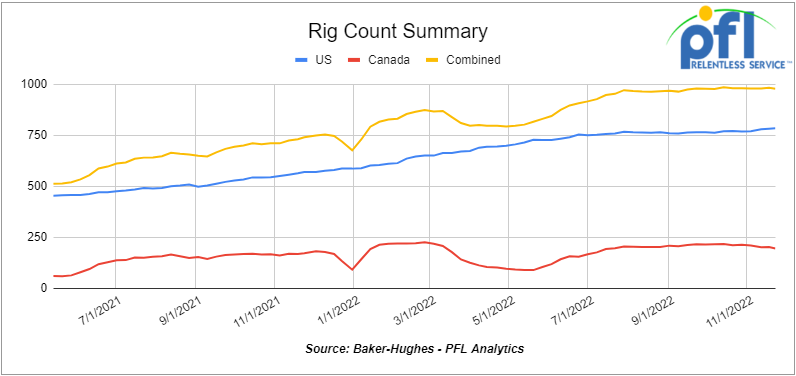

Rig Count

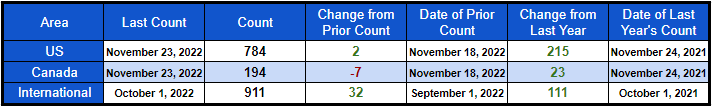

North American rig count was down by -5 rigs week over week. U.S. rig count was up by +2 rigs week-over-week and up by +215 rigs year over year. The U.S. currently has 784 active rigs. Canada’s rig count was down by -7 rig week-over-week, and up by +23 rigs year-over-year. Canada’s overall rig count is 194 active rigs. Overall, year over year, we are up +238 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

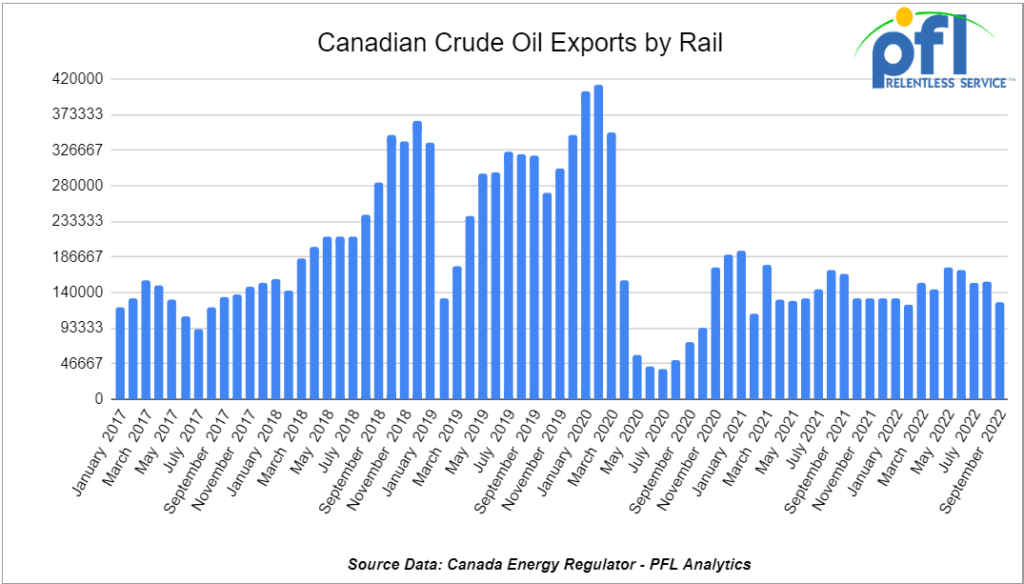

We are eyeing Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on November 21, 2022. For September 2022, Canada exported 127,060 barrels per day by rail (down by 28,086 barrels per day month over month) which is the weakest showing of the year other than February that was 124,781 barrels per day. Crude by rail out of Alberta has been popular of late for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. We were hoping to see future month-over-month increases, but with competition from the U.S. government releasing heavy crude from the SPR it continues to be difficult to get a handle on the fundamentals – Let’s see what happens after the U.S. government stops selling our strategic reserves into the gulf which has now stretched beyond the elections and into November and December. Crude by rail is also popular for off-spec products that can be blended here in the United States and in areas where there is no pipeline access. Before crude by rail out of Canada can come back in a meaningful way, supply needs to exceed pipeline capacity and we need to see a much wider basis for a sustained period of time (or at least predictable). We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins.

We have been Watching Renewables

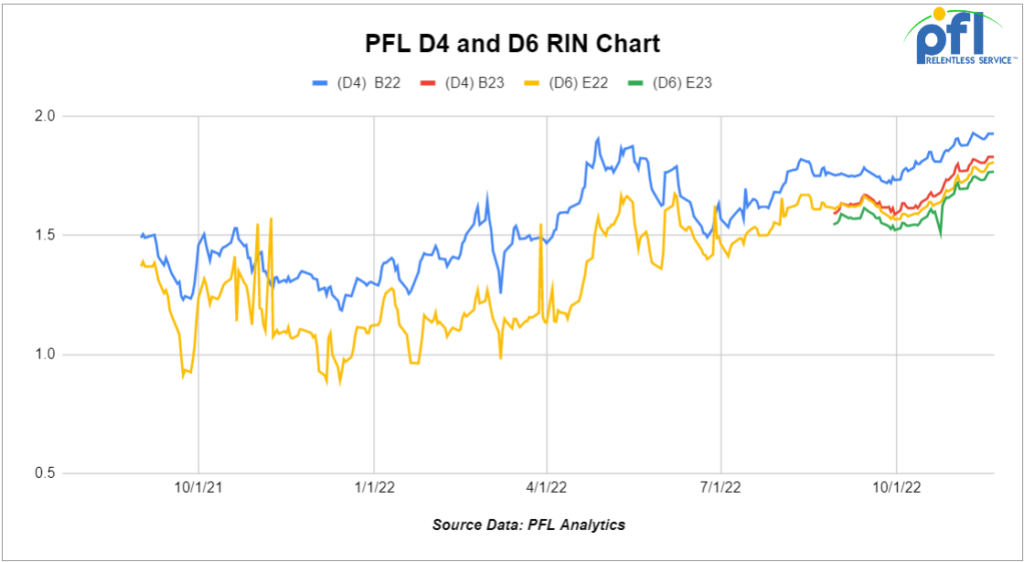

Folks, RINS have been steadily rising to almost record levels this year causing obligated parties to pass on 22 cents per gallon to the end users in what is a hidden tax that no one really talks about. It looks as though we could be near the top or a breakout to the upside is possible. The most heavily traded vintages are D6 RINS (Ethanol) and D4 RINS (Biodiesel) See below chart – you decide:

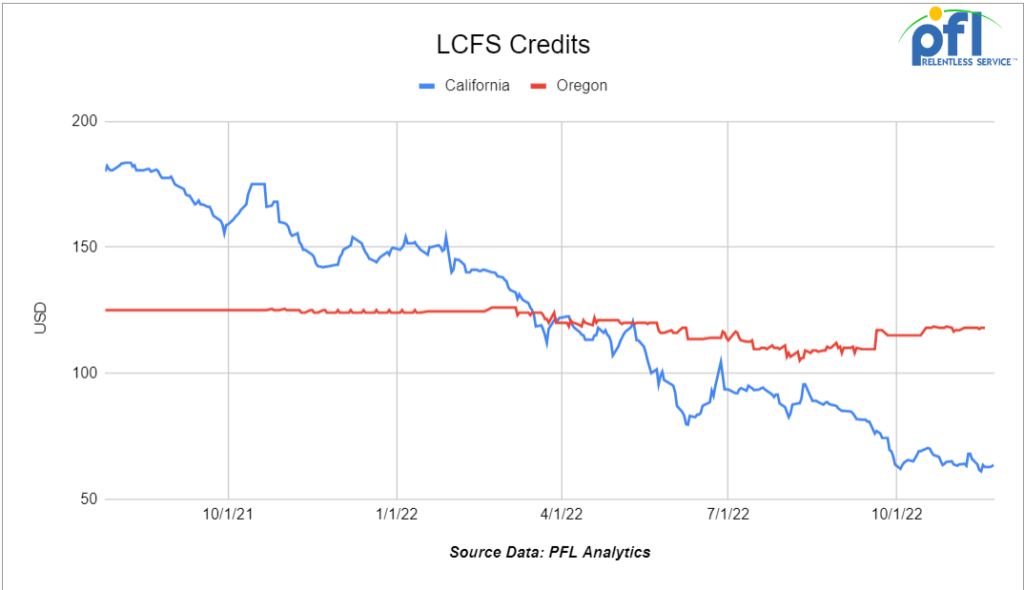

As it relates to LCFS credits in California and Oregon, the exact opposite is true. The credits in California have been falling as more people bring on biodiesel and renewable diesel to the market. Obligated parties have entered the market in full force which has led to an increase in rail traffic for the coiled and insulated car not only for biodiesel but for feedstock that feeds renewable diesel facilities. Renewable diesel facilities on the other hand have increased demand for non-coiled cars. The chart is impressive to the downside and shows that the programs in California and Oregon are working as intended whether right or wrong – forcing more obligated parties to purchase or produce more renewables in their supply chain. The effect has been less demand to buy credits outside of their own supply structure for the fuels.

The Latest and Greatest on a Potential Rail Strike.

The rail industry once again finds itself on strike watch. Union members of the International Association of Sheet Metal, Air, Rail, and Transportation Workers (SMART-TD) voted to reject ratification of the tentative agreement reached with the Class Ones that staved off a rail strike in September. The SMART-TD joins the Brotherhood of Maintenance of Way-Employees Division (BMWED), the Brotherhood of Railroad Signalmen (BRS) and the International Brotherhood of Boilermakers (IBB) in rejecting the TAs. So far, seven unions have ratified the agreements SMART-TD, IBB and BMWED have a status quo provision in place lasting until December 8th, while the BRS’ lasts until December 4th. A single union initiating a strike could prompt peers to follow suit, generating a scenario (though unlikely) in which a rail strike could commence as soon as Dec 5 (unless the BRS extends their status quo date to match peers).

Benefits and working conditions continue to be the sticking point in the dispute. In early November, the International Association of Machinists District 19 ratified a renegotiated TA and reportedly secured a cap on healthcare costs/premiums in the second round of negotiations. We note that the IAM ratification passed by a very slim margin, highlighting the extent of discontent among rail labor in our view. Turnout among the SMART-TD and BLET unions was also at a record high. While the SMART-TD has not yet disclosed precisely what additional benefits are desired, the IAM has previously expressed dismay that the Class I’s have made no concessions on sick leave.

We continue to believe that Congress is motivated to intervene if a strike commences given the $2bn per day costs estimated by AAR. Additionally, an estimated 400K trucks would be needed to pick up the slack; a number that is just not feasible. Both unions and Class Ones have indicated that a strike would only take place if Congress weren’t in session and available to halt a stoppage. It is our view that cooler heads will prevail, however, some customers are preparing fleets just in case. Stay tuned to PFL for further updates.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 8, 23.5 tanks CSX in the east for polyacryamide for 2 years plus

- 35, 5400-6300 Covered hoppers for lease off the BN needed in Iowa for 3-5 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 20, CPC 1232s last in Gasoline. On the UP in Texas, Short term.

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|