“Remembering that the real meaning of Thanksgiving is gratitude and not food will bring the focus back there.”

-Joshua Rosenthal

Jobs Update

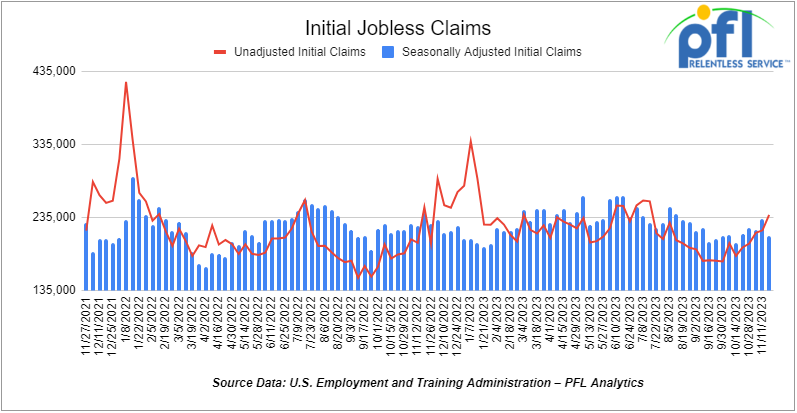

- Initial jobless claims for the week ending November 18th, 2023 came in at 233,000, down -24,000 people week-over-week.

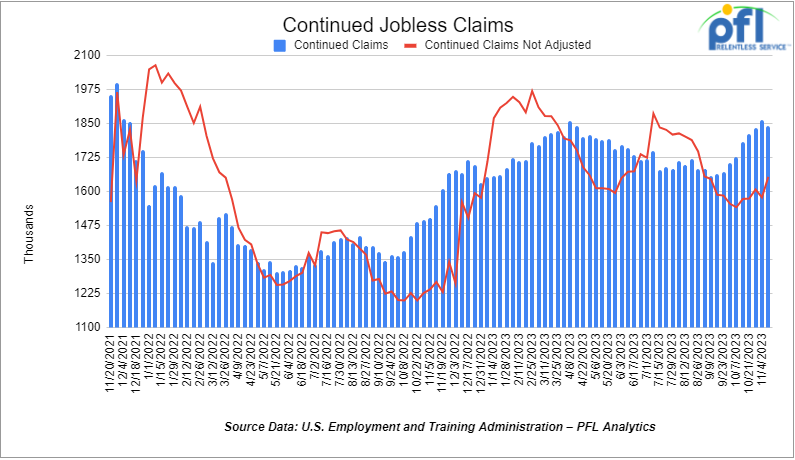

- Continuing jobless claims came in at 1.84 million people, versus the adjusted number of 1.862 million people from the week prior, down -22,000 people week-over-week.

Stocks closed mixed on Friday of last week, but up week over week

The DOW closed higher on Friday of last week, up 117.12 points (+0.33%), closing out the week at 35,390.15, up 442.92 points week-over-week. The S&P 500 closed higher on Friday of last week, up 2.72 points (+0.06%) and closed out the week at 4,559.34, up 45.32 points week-over-week. The NASDAQ closed lower on Friday of last week, down -15 points (-0.11%), and closed out the week at 14,250.85, up 125.37 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 35,381 this morning down -49 points.

Crude oil closed lower on Friday of last week and down week over week

WTI traded down -$1.56 per barrel (-1%) to close at $75.54 per barrel on Friday of last week, down -$.35 per barrel week-over-week. Brent traded down -US$0.84 per barrel (-2%) on Friday of last week, to close at US$80.58 per barrel, down -US$0.33 per barrel week-over-week.

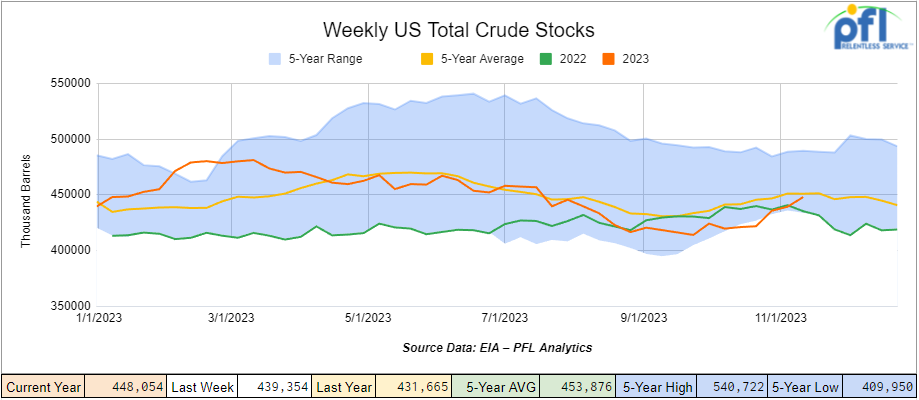

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.7 million barrels week-over-week. At 448.1 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

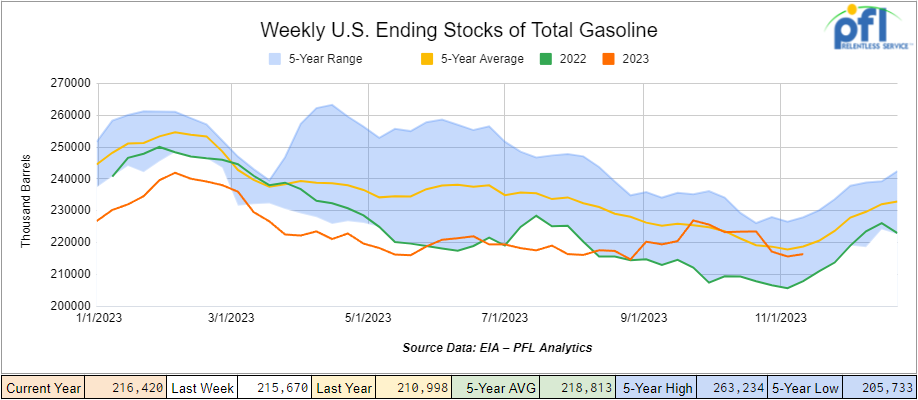

Total motor gasoline inventories increased by 700,000 barrels week-over-week and are 2% below the five-year average for this time of year. Both finished gasoline and blending components inventories increased week over week

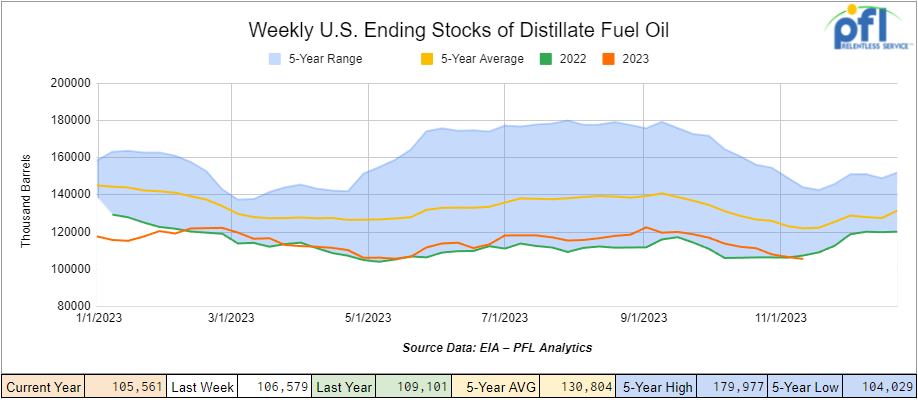

Distillate fuel inventories decreased by 1.0 million barrels week-over-week and are 13% below the five-year average for this time of year.

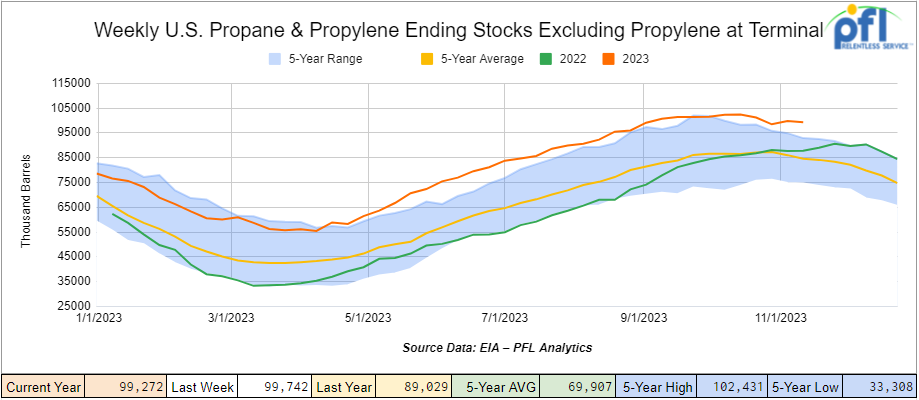

Propane/propylene inventories decreased by 500,000 barrels from last week and are 17% above the five-year average for this time of year.

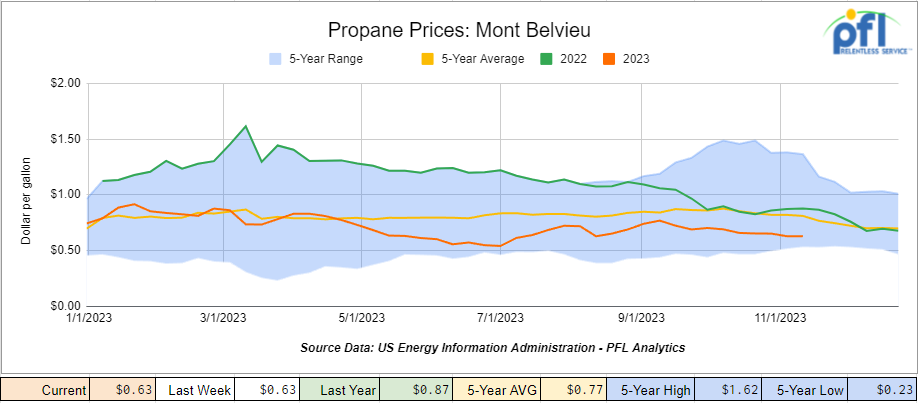

Propane prices closed at 63 cents per gallon, flat week-over-week, and down 14 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 4.5 million barrels during the week ending November 17th, 2023.

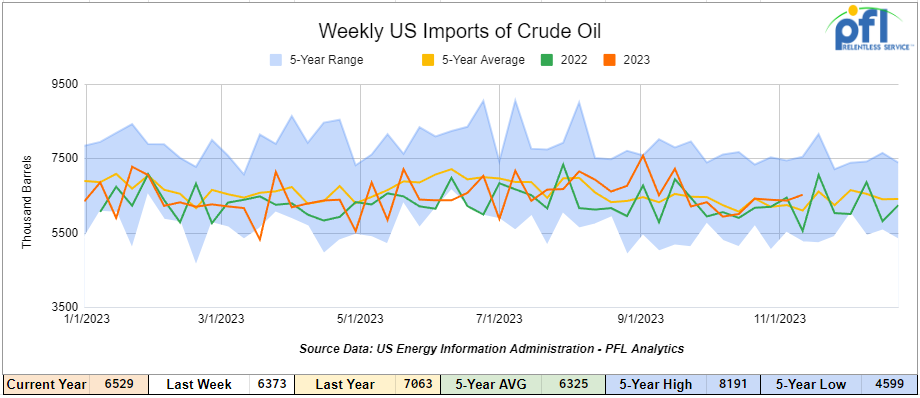

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending November 17th, 2023, an increase of 156,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 1.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 593,000 barrels per day, and distillate fuel imports averaged 75,000 barrels per day during the week ending November 17th, 2023.

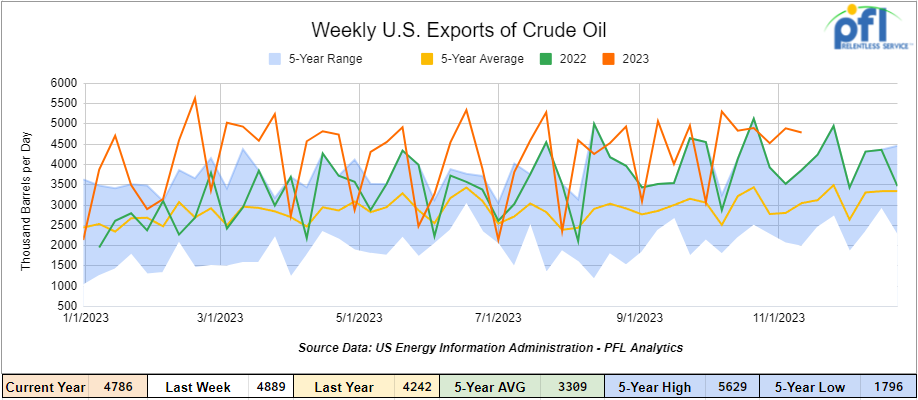

U.S. crude oil exports averaged 4.786 million barrels per day for the week ending November 17th, a decrease of 103,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.774 million barrels per day.

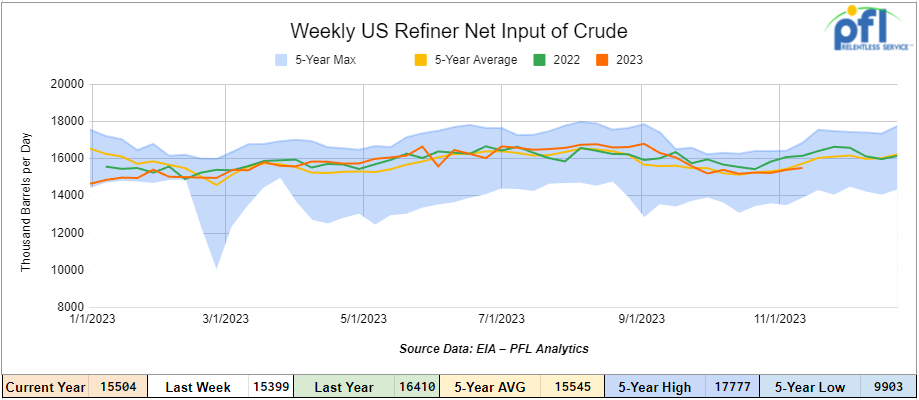

U.S. crude oil refinery inputs averaged 15.5 million barrels per day during the week ending November 17, 2023, which was 106,000 barrels per day more week-over-week.

WTI is poised to open at 74.16, down -1.38 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 22nd, 2023.

Total North American weekly rail volumes were up (2.83%) in week 46, compared with the same week last year. Total carloads for the week ending on November 22nd, 2023 were 367,982, up (3.87%) compared with the same week in 2022, while weekly intermodal volume was 327,872, up (1.68%) compared to the same week in 2022. 10 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Grain (-3.35%). The largest increase came from Motor Vehicles and Parts (+11.58%).

In the East, CSX’s total volumes were up (3.59%), with the largest decrease coming from Intermodal (-3.06%) and the largest increase from Nonmetallic Minerals (+19.07%). NS’s volumes were up (+5.3%), with the largest decrease coming from Farm Products (-7.94%) and the largest increase from Motor Vehicles and Parts (+10.19%).

In the West, BN’s total volumes were up (+1.7%), with the largest decrease coming from Nonmetallic Minerals (-14.26%), and the largest increase coming from Chemicals (+11.88%). UP’s total rail volumes were up (4.87%) with the largest decrease coming from Other (-13.43%) and the largest increase coming from Farm Products (+14.52%).

In Canada, CN’s total rail volumes were down (-2.88%) with the largest increase coming from Other (+31.62%) and the largest decrease coming from Intermodal Units (-23.72%). CP’s total rail volumes were up (4.16%) with the largest decrease coming from Other (-76.81%) and the largest increase coming from Motor Vehicles and Parts (+65.81%).

KCS’s total rail volumes were down (-6.47%) with the largest decrease coming from Other (-27.61%) and the largest increase coming from Motor Vehicles and Parts (+44.94%).

Source Data: AAR – PFL Analytics

Rig Count

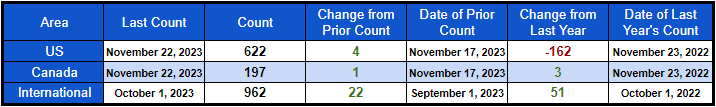

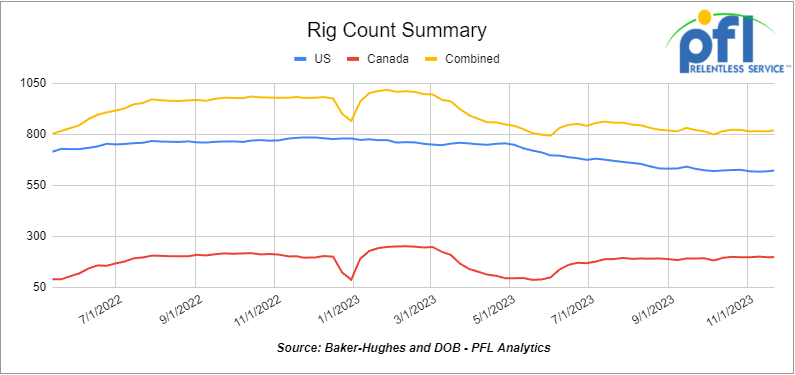

North American rig count was up by 5 rig week-over-week. U.S. rig count was up by 4 rigs week-over-week, but down by –162 rigs year-over-year. The U.S. currently has 622 active rigs. Canada’s rig count was up by 1 rigs week-over-week and up by 3 rigs year over year. Canada’s overall rig count is 197 active rigs. Overall, year-over-year, we are down -159 rigs collectively.

North American Rig Count Summary

A few things we are watching:

Trans Mountain Pipeline

Canada continues to wait for Trans Mountain completion for line pack fill as prices remain depressed in Edmonton. We talked to Trans Mountain on Friday of last week and several shippers. Here is what we know:

- Line pack fill should happen sometime in January;

- Producers shipping on the pipeline are basically donating the line pack – contrary to popular belief Trans Mountain will not be purchasing line pack;

- It is going to take 4.5 million barrels to fill TMX expansion. We were thinking more crude would be required, but that’s all folks;

- Commercial full operations should be completed towards the end of Q12024 at 500,000 barrels per day.

Producers are getting anxious as a bunch of plant turnarounds in Canada have been completed and production continues to swell. One Exchange WCS for January delivery settled Friday of last week at US$24.40 below the WTI-CMA. The implied value was US$51.39 per barrel. On Wednesday of last week, it settled at US$24.40 below the WTI-CMA for January delivery. The implied value was US$52.84 per barrel.

Another headwind for Canadian crude is the Venezuela factor – importers of Canadian crude are displacing or thinking of displacing the Canadian barrel for a cheaper heavier grade from Venezuela – even Columbia and Brazil are in the equation. It will be interesting to see how this one plays out – could get worse before it gets better for the Canadian producer and how this affects crude by rail is anyone’s guess and at this point, we do not have an opinion due to not only the crude factor, but also the demand for the same coiled and insulated car for tallow and other oils to feed renewable diesel refineries – not to mention all the tank car re-qualifications that are happening now and for the next two years. We do believe that we will know the true supply and demand for the coiled and insolated car and the true value for two years – we could be long then again we could be short!

We Have Been and Continue To Watch the Nation’s Shops

Railcar repair firms: Keeping up with a busy cycle – folks, full credit to Progressive Rail Roading on this one- we at PFL decided to repost for this article for this week’s Thanksgiving end-of-week report!

AITX Rail Services LLC recently completed an expansion of its tank-car facility in Brookhaven, Mississippi. The facility’s repair shop is now operational.

Railcar repair services are in the middle of a high-demand cycle that directly favors those committed to customer value and growth, AITX officials said in an email.

“We’re seeing freight shippers want more focused partnerships. They want more than just availability and uptime, but also predictability and planning to stay one step ahead, regardless of the cycle,” they said.

That requires more integrated solutions, as in a full-service, flexible service offering across fleet management, leasing and repairs, directly reinforced through product scale, capabilities and industry expertise, AITX officials believe.

Heightened demand is driven by new business growth and greater regulatory compliance. As new rail-car projects come online, more cars are prepped to enter the market to offset retiring ones and to support growth.

As tank cars near required 10-year inspection dates, there’s an influx of regulatory tank qualification requirements that will continue into 2025, with a focus on tank-car lining work to mitigate against potential interior corrosion, company officials said.

In response to those trends, AITX analyzed current volumes and invested in an expansion. The second phase of its expanded facility in Brookhaven, Mississippi, is primed for tank qualification business, AITX officials said.

With two new M1003 facilities, the company has a more regional presence: the AITX Clinton facility in southern Indiana on a CSX line and the AITX Milton facility in central Pennsylvania on a Norfolk Southern Railway line.

The company works with customers on proactive car-flow planning so that their needs are prioritized, repair shops are scheduled and timelines are transparently clear, AITX officials said. As part of the planning, the company works with parts vendors on material scheduling to help mitigate potential inventory delays to turn times.

At Genesee & Wyoming’s Railcare Inc., business has been steady for the past 18 months. There have been consistent and elevated levels of bad order cars arriving at the Hamilton, Ontario, shop for medium- to heavy-damage repairs, Railcare officials said.

Established in 2002 and directly served by CN and Canadian Pacific Kansas City, Railcare is a full-service freight-car repair shop that provides mobile and onsite car repair and inspection, cleaning, welding and fabrication, and dismantling and scrapping services for shippers in Canada and the United States.

The demand for Railcare’s services has diversified across most car types and customers, company officials said.

“General confidence in the economy, coupled with the economics and delivery of securing new rolling stock, seem to have most car owners willing to take on repair spend,” they said. “Expecting this trend to continue into 2024, [we] will focus on strategic purchasing to minimize the impact that the parts supply-chain delays can have on shop throughput and cycle time.”

Also in 2024, Railcare leaders — in facing the labor shortage that’s been affecting businesses across North America — plan to emphasize talent recruitment and retention to ensure the company has enough trained and motivated personnel to continue exceeding customer expectations.

Greenbrier Rail Services is a railcar maintenance services provider with a nationwide network of full-service car repair centers. GRS can service all rail car types, company officials said. Its services include certified tank-car cleaning, repairs, retrofits, and recertifications; auto rack repairs and recertifications; lease returns; routine maintenance; and program work. The company also can handle wreck and mobile repairs, and custom-engineered projects.

Northern Plains Rail leaders expect the mobile car repair market to remain strong next year. Within Northern Plains Rail Services’ upper Midwest geographic area, shop car flow has been “relatively steady but could be stronger,” according to Ted Jakubiak, the company’s senior sales and marketing representative. At the same time, mobile car repairs have significantly increased in volume this year, he added. “To remain competitive, third-party providers must offer more servicing options to not only meet demand but deliver on efficient turnaround times,” said Jakubiak. “We’ve also noticed a decrease in requests for traditional program work and/or lease return activity. This may be a direct result of a busy freight-car usage market.” Northern Plains Rail leaders expect the mobile car repair market to remain strong next year. They anticipate more mobile and shop repair business due to recently adding M1002 tank-car certification to the company’s service capabilities. “In 2024, … the market demand will challenge us to not only increase our servicing capabilities but also seek expansion within our strategic regional geography,” said Jakubiak. “In doing so, we’ll work toward effectively meeting and improving expected customer needs for faster repair response and turnaround times.” Cars used to move agriculture products and aggregates represent a significant part of Northern Plains’ repair business. “Pre- and post-harvest cycles directly impact car repair volumes, so we tend to experience high demand when cars are not as actively in service,” said Jakubiak. “We do anticipate that the trend toward expansion of the biofuels industry will have a positive impact on our car repair business.”

TM Track Machines modifies, repairs, and rebuilds rail cars for its parent company Omaha Track, as well as for Union Pacific Railroad and Amtrak. Business in the North American rail-car segment has been good for Omaha Track’s TM Track Machines business, which provides rail-car and locomotive maintenance services, according to Shane Stalford, the company’s chief operating officer. “We are busy, our customers are investing in their existing fleets and also purchasing new equipment — these are all good signs of healthy railroads and healthy service providers,” Stalford said. TM Track Machines can house over 30 rail cars at its facility in Parsons, Kansas, which enables its experienced mechanics and electricians to work in a protected environment. TM Track Machines modifies, repairs, and rebuilds rail cars for its parent company Omaha Track, as well as for Union Pacific Railroad and Amtrak. Last year, TM Track repaired or modified nearly 300 cars for UP alone. “We have rebuilt their side dump fleet, modified flat cars to haul specialized equipment, and fabricated and installed blast doors on their rail trains,” said Stalford. “We also conduct routine maintenance on their fleet. This year we began working on one of UP’s largest gang trains.” TM Track officials expect this year’s level of steady work to continue into 2024. “We have built good relationships with our customers and are able to be responsive and supportive when they adjust their inventory by investing in new equipment and/or retiring others,” Stalford said. “We are part of that conversation. The type of equipment may vary, but we will always be there to meet their needs.” Customers’ recent investments in new equipment means TM Track can anticipate more general car repairs in addition to usual maintenance-of-way work in 2024, he added. “We are also looking into locomotive work as customers strive to modernize and upgrade existing engines to meet U.S. Environmental Protection Agency standards,” Stalford said. “TM Track can support customers’ green initiatives by retrofitting locomotives to be compliant.”

We are Watching Suncor – A Small Victory for The Company

The Alberta Energy Regulator (AER) says it won’t reconsider approvals for Suncor Energy Inc. to expand an oil sands mine into a wetland once considered for environmental protection.

The regulator released its ruling in response to a request that was made last spring by the Alberta Wilderness Association.

Suncor had been given the “OK” to expand its Fort Hills mine into the McClelland Lake wetland complex, a large intact wetland that lies partly within the company’s lease.

The regulator paused those approvals while it examined the association’s concerns over Suncor’s plans to mine half the wetland and protect the rest with a 14-kilometre underground wall up to 70 metres deep.

The decision allows the original approvals to stand.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 Years. Cars are needed for use in Flyash service.

- 20, 30K 117R or 117J Tanks needed off of UP or BN in Midwest for 6 Months. Cars are needed for use in Ethanol service.

- 150, 29.2K 117R, 117J, DOT 111 Tanks needed off of CN or CP in Sarnia for 1 Year. Cars are needed for use in Fuel Oil service.

- 50, 23.5-25.5 Dot 111 Tanks needed off of Any Class 1 in USA for 5 Years. Cars are needed for use in Asphalt service.

- 3, 23.5-25.5 Any Tanks needed off of Any Class 1 in Port Allen, LA for 90 Days. Cars are needed for use in Fuel Oil service.

- 3, 23.5-25.5 Any Tanks needed off of Any Class 1 in Natchez, MS for 90 Days. Cars are needed for use in Fuel Oil service.

- 100, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined product services.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Years. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

Lease Offers

- 10, 28.3K, 117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 75, 29.2K, DOT 111 Tanks located off of BN, CP in Moving In Midwest. Cars were last used in Bio. Free Move

- 30, 31.8K, CPC 1232 Tanks located off of UP, BN in Texas. Cars were last used in Diesel. Call 239-390-2885 for more information

- 25, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Heavy Fuel Oil. Call 239-390-2885 for more information

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|