“All life is an experiment. The more experiments you make, the better.”

– Ralph Waldo Emerson

Jobs Update

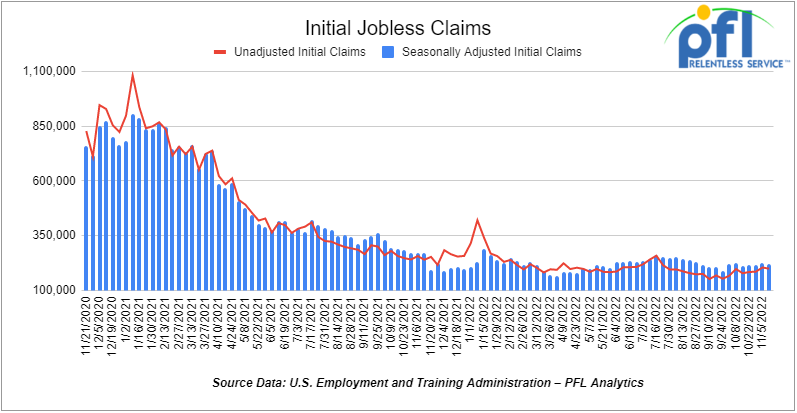

- Initial jobless claims for the week ending November 12th, 2022 came in at 222,000, down -4,000 people week-over-week.

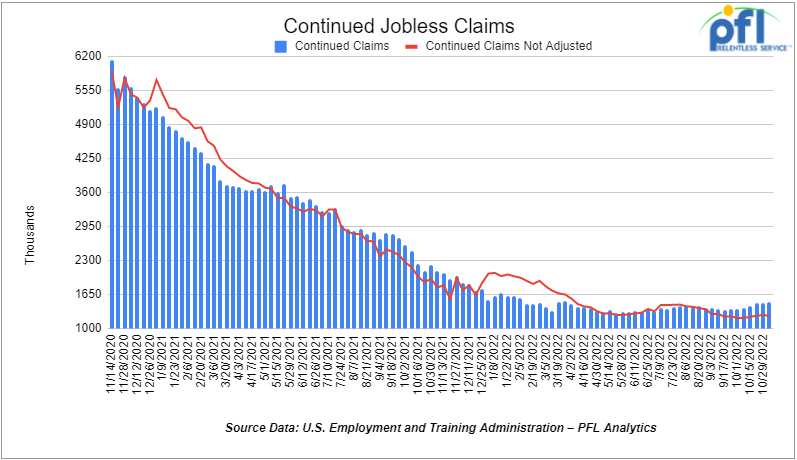

- Continuing jobless claims came in at 1.507 million people, versus the adjusted number of 1.494 million people from the week prior, up +13,000 people week over week.

Stocks closed higher on Friday of last week, but lower week over week

The DOW closed higher on Friday of last week, up 199.37 points (+0.59%), closing out the week at 33,745.63, down -2.17 points week over week. The S&P 500 closed higher on Friday of last week, up +18.78 points (+0.48%), and closed out the week at 3,965.34, down -27.59 points week over week. The NASDAQ closed higher on Friday of last week, up 1.1 points (+0.01%), and closed the week at 11,146.06, down -177.27 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,694 this morning down -81 points.

Oil closed lower on Friday of last week and lower week over week

WTI traded down -3.95 per barrel (-4.6%) to close at $81.64 per barrel on Friday of last week, down -$7.32 per barrel week over week. Brent traded down -US$3.08 per barrel (+3.3%) on Friday of last week to close at US$89.78 per barrel, down -$6.21 per barrel week over week.

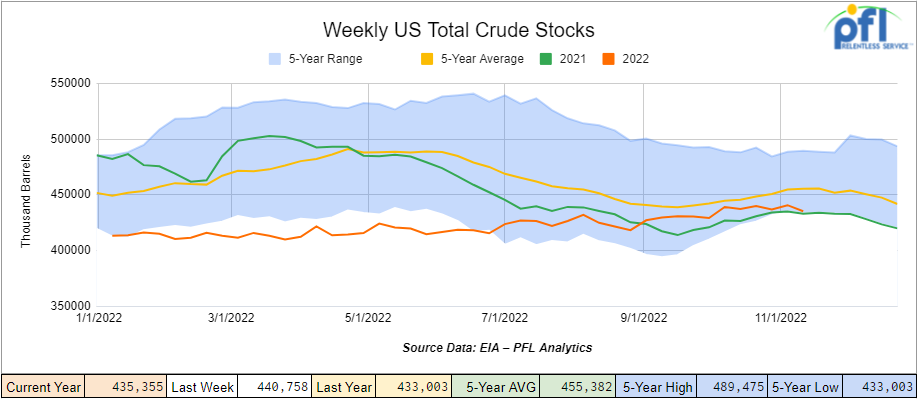

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.4 million barrels week over week. At 435.4 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

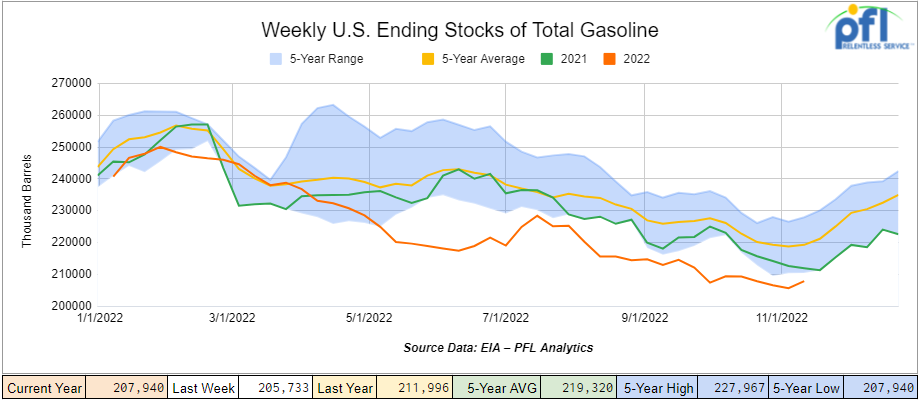

Total motor gasoline inventories increased by 2.2 million barrels week over week and are 5% below the five-year average for this time of year.

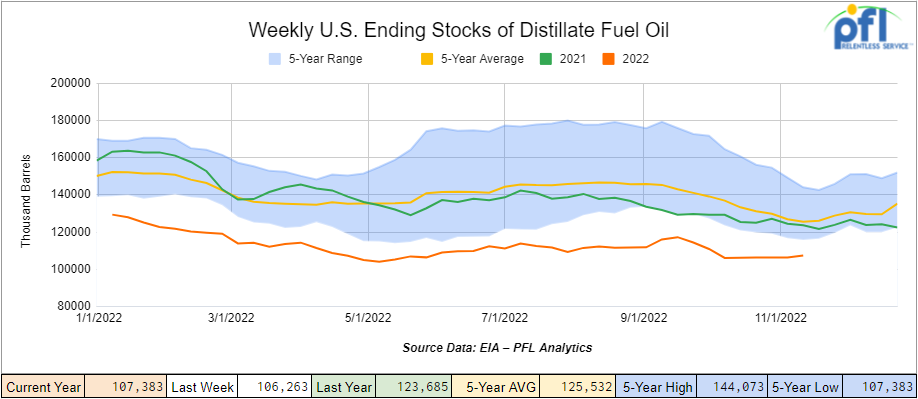

Distillate fuel inventories increased by 1.1 million barrels week over week and are 15% below the five-year average for this time of year.

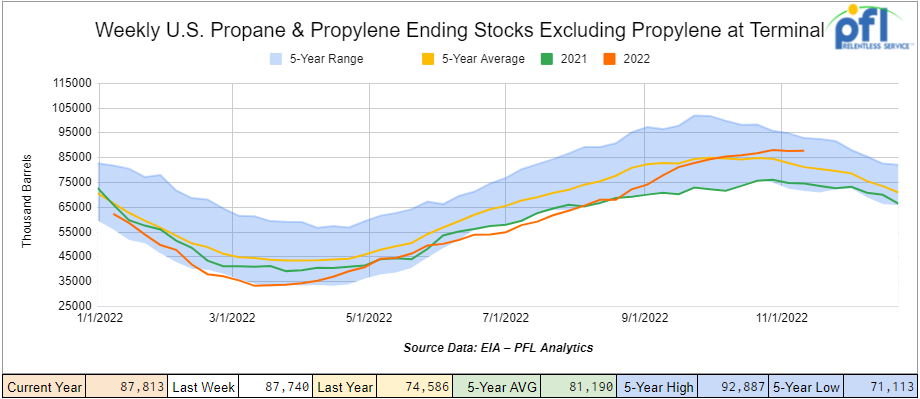

Propane/propylene inventories increased by 100,000 barrels week over week and are 7% above the five-year average for this time of year.

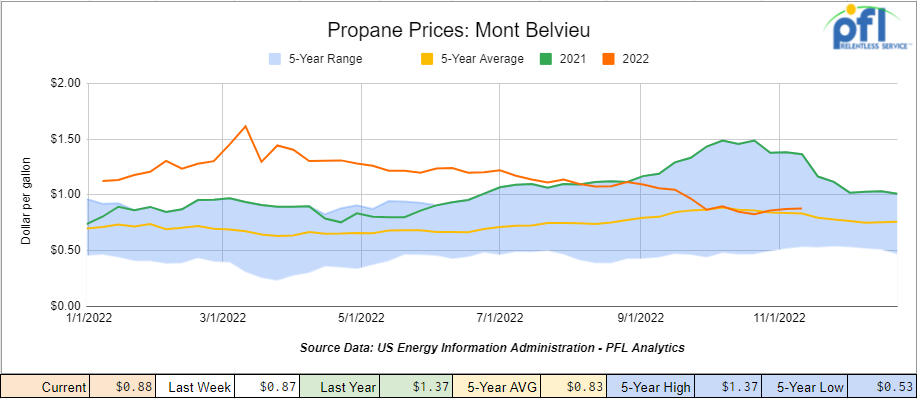

Propane prices increased a penny week over week to close at 88 cents per gallon but down 49 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 6.5 million barrels for the week ending November 11, 2022.

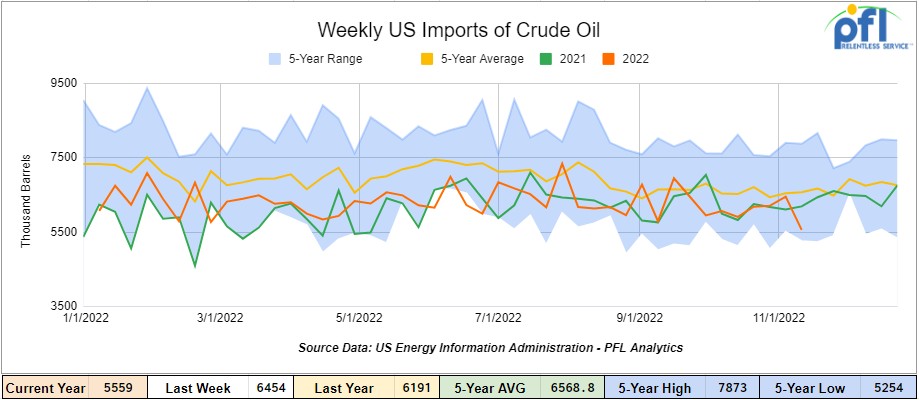

U.S. crude oil imports averaged 5.6 million barrels per day during the week ending November 11th, 2022, a decrease of 895,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 1.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 572,000 barrels per day, and distillate fuel imports averaged 110,000 barrels per day during the week ending November 11th, 2022.

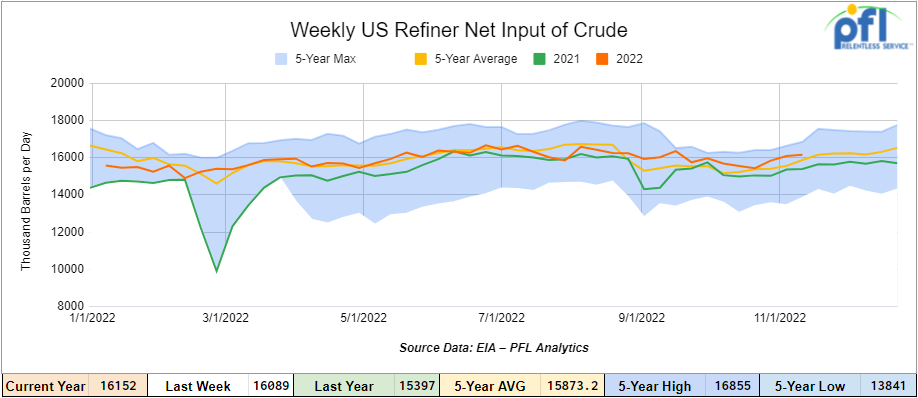

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending November 11, 2022, which was 63,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $79.86, down -$0.22 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 5th, 2022.

Total North American weekly rail volumes were down (-2.34%) in week 45 compared with the same week last year. Total carloads for the week ending on November 12th were 353,244, up (+0.22%) compared with the same week in 2021, while weekly intermodal volume was 325,186, down (-4.97%) compared to 2021. 8 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Other (-13.54%). The largest increase was from Motor Vehicles and Parts (+11.77%).

In the east, CSX’s total volumes were down (-1.37%), with the largest decrease coming from Other (-9.66%) and the largest increase from Coal (+20.5%). NS’s volumes were up (+0.72%), with the largest decrease coming from Other (-3.24%) and the largest increases from Grain (+33.16%).

In the West, BN’s total volumes were down (-6.94%), with the largest decreases coming from Other (-33.31%), and the largest increase coming from Motor Vehicles and Parts (+16.56%). UP’s total rail volumes were up (+1.07%) with the largest decrease coming from Forest Products (-16.65%) and the largest increase coming from Nonmetallic Minerals (+30.08%).

In Canada, CN’s total rail volumes were down (-5.69%) with the largest decrease coming from Other (-40.48%) and the largest increase coming from Grain (+46.95%). CP’s total rail volumes were down (-6.48%) with the largest decreases coming from Coal (-27.98%) and Intermodal (-27.30%) and the largest increase coming from Nonmetallic Minerals (+43.15%).

KCS’s total rail volumes were up (+1.19%) with the largest decrease coming from Motor Vehicles and Parts (-41.41%) and the largest increase coming from Grain (+32.23%).

Source Data: AAR – PFL Analytics

Rig Count

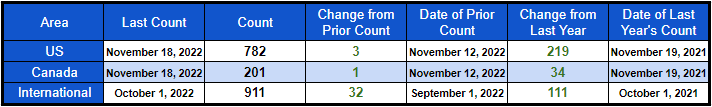

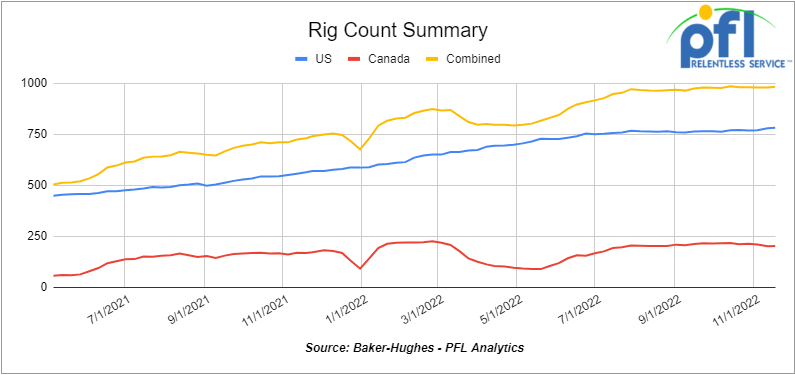

North American rig count was up by 4 rigs week over week. U.S. rig count was up by +3 rigs week-over-week and up by +219 rigs year over year. The U.S. currently has 782 active rigs. Canada’s rig count was up by +1 rig week-over-week, and up by +34 rigs year-over-year. Canada’s overall rig count is 201 active rigs. Overall, year over year, we are up +253 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,802, from 23,682, which was a gain of 120 railcars week-over-week ending two weeks of back-to-back declines. Canadian volumes were mixed; CP’s shipments increased by +7% week over week, and CN’s volumes were unchanged week over week. U.S. shipments were mostly higher. The NS had the largest percentage increase, up by +5.7%, and the UP was the sole decliner down by less than 1% week over week.

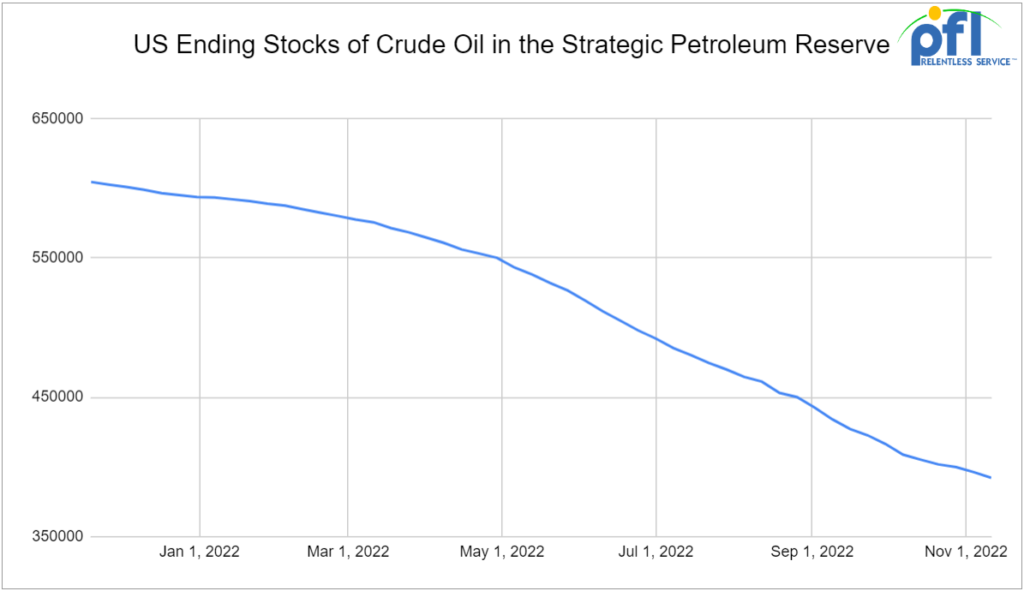

President Biden Asks Congress for $500M of Emergency Funding for Strategic Petroleum Reserve

The request is part of an emergency funding request from the Office of the President to Speaker Pelosi “to fund the Government for the rest of the fiscal year and invest in critical national priorities before the December 16 funding deadline.” The stated reason for the emergency requests is to “protecting the American people from COVID-19 and saving lives globally; supporting the people of Ukraine, and helping communities across the Nation recover from devastating natural disasters.”

The request states that the $500 million would allow the SPR to maintain operational readiness levels and alleviate anticipated shortfalls due to supply chain issues, the Covid-19 pandemic, and related schedule delays.

President Biden began releasing oil from the SPR in March after Russia invaded Ukraine. President Biden originally authorized 180 million barrels to be released. The SPR had 609.40 million barrels one year ago. As of the week ending November 11, 2022, the SPR had 392.12 million barrels. The drawdown represents the most significant drawdown of SPR ever. The SPR contains 35.65% fewer reserves than one year ago. The U.S. consumes 19.89 million oil barrels per day. The 392.12 million barrels only represent 19.7 days of American emergency usage.

President Biden said the U.S. would refill the depleted SPR if oil prices reach $72 a barrel. The current Brent price is $89.90. Goldman Sachs predicts the price will climb to $104 before the end of the year. It looks like we are not going to meet our price target and the operating costs of getting the oil out of the SPR were not taken into consideration. It looks like the American people will pay for that somehow! We do not even want to guess the all-in per barrel price of replacement of each barrel together with the operating costs and the fact that we were releasing SPR crude into the market and turned away other cheaper crudes such as Canadian heavy. Another example of a total waste of taxpayer dollars.

Nord Stream Leaks Confirmed as Sabotage, Sweden Says

Investigators have found traces of explosives at the site of the damaged Nord Stream gas pipelines, confirming sabotage had taken place, Sweden said on Friday of last week. Swedish and Danish authorities are investigating four holes in the Nord Stream 1 and 2 pipelines that link Russia and Germany via the Baltic Sea and have become a flashpoint in the Ukraine crisis as gas supplies in Europe are short. Hopefully, they can figure out who did it and be truthful about the outcome – you never know what to believe these days.

In other natural gas news, Freeport LNG announced in a press release that they will be starting their 2 BCF per day facility soon. They said as of November 14th, the reconstruction work necessary to commence initial operations, including utilization of all three liquefaction trains, two LNG storage tanks and one dock, was 90% complete, with all reconstruction work anticipated to be completed by the end of November. Proposed remedial work activities for a safe restart of initial operations have been submitted to the relevant regulatory agencies for review and approval. Subject to the Freeport LNG meeting, its regulatory requirements, it is targeting initial production at the facility in mid-December.

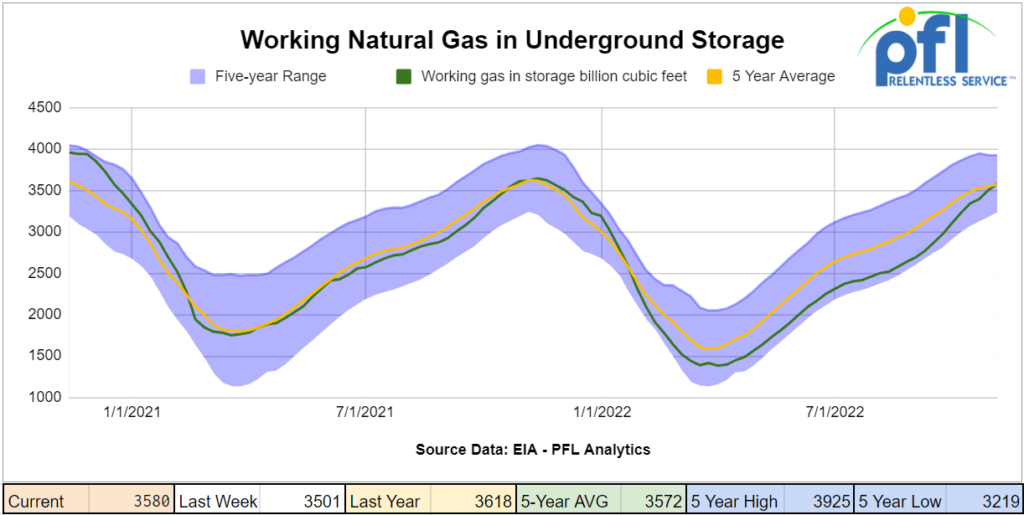

In a statement, Michael Smith (founder, Chairman and CEO) said “Our teams have worked diligently over the last several months alongside regulators to ensure the safe restart of our facility. I am immensely grateful for their efforts,” “We are committed to moving forward with an uncompromising safety focus and enhanced operational processes that will enable us to chart a safe, sustainable path forward to serve our customers and the broader LNG market as a whole. “It is expected that approximately 2 BCF per day of production will be achieved in January 2023. Full production utilizing both docks remains anticipated to commence in March 2023 and is expected to put a strain on U.S. supply but for now here in the U.S. we are looking good for Natural gas this winter – officially 8 BCF above the five-year average for this time of year.

Natural gas pricing is off its highs closing at $6.303 per MMBTU for December delivery on Friday of last week. On Wednesday of last week, the EIA said U.S. dry natural gas production has been generally increasing throughout 2022 and has averaged more than 98 BCF per day every month since June. The EIA expects dry natural gas production to continue to grow, averaging 99.4 BCF per day this winter and 99.7 BCF per day in 2023. They forecast natural gas prices to decline in the spring of 2023 as production growth continues and winter demand for heating subsidies. For 2023, the EIA forecasts the annual Henry Hub price to average $5.46 per MMBtu for the year. The growth of natural gas is great for rail and pressure cars (which are in very short supply!)

Shell Commenced Operations of Polyethylene Facility in PA last week

Shell Chemical commenced operations at its Shell Polymers Monaca (SPM) site last week. This world-class facility uses low-cost ethane from shale gas to produce polyethylene. Great project for the region.

In June 2016, Shell Chemical Appalachia LLC took the final investment decision to build a major petrochemicals plant near Pittsburgh. Last week Shell commenced operations at the plant which consists of an ethylene cracker with a polyethylene derivatives unit.

The plant uses low-cost ethane from shale gas producers in the Marcellus and Utica basins and has a designed output of 1.6 million tonnes of polyethylene annually. Polyethylene is used in a wide variety of products like common household goods; consumer and food packaging; as well as industrial and utility products.

SPM sits on 384 acres adjacent to the Ohio River in Beaver County, Pennsylvania. The advantages of proximity are not limited to production; according to Shell “SPM can also offer customers shorter supply chains, which translates to unprecedented flexibility and access to polyethylene pellets”. A big plus for rail in many ways!

Source: Shell – PFL Analytics

Big EarthQuake in the Permian last Week

An earthquake last week in the Permian could cause major problems in the region. The earthquake in the epicenter of U.S. oil production adds risk for drillers says analysts. The 5.4-magnitude earthquake that rattled West Texas on Wednesday of last week is the latest in a growing number of temblors emanating from America’s premier oil patch, posing a risk to drillers, says Truist Securities analyst Neal Dingmann. He counts more than 1,000 quakes so far this year in Texas and New Mexico of a magnitude greater than 2, which is the lowest intensity that can be felt by humans. That compares with 260 in 2020 in the region known as the Permian Basin. Hydraulic fracturing, particularly the injection back underground of wastewater from the rock-cracking process, has been blamed for increased seismic activity in shale-drilling regions. Whether or not it is true or not is anyone’s guess but as earthquakes get more frequent, there could be the possibility of increasing regulation throughout Texas and New Mexico. There are roughly 300 rigs active in the Permian according to Baker Hughes. There is a potential risk for drillers, producers and pipeline companies and at the end of the day U.S. production.

We are watching the Climate Talks in Egypt

In what was a surprise to us, Canada won’t back a call at COP27 To ‘Phase Down’ Oil and Gas Production and won’t agree to add language calling for the phase-out of all fossil fuels — including oil and gas — to the final agreement at this year’s United Nations climate talks in Egypt, Canadian Environment Minister Steven Guilbeault said in a statement on Thursday of last week. It should not be a surprise, but the Federal Government in Canada is punitive on their domestic producers and makes ridiculous deals – this time they didn’t.

The agreement from the UN conference in Scotland last year called for countries to move faster to get rid of coal-fired electricity plants that are not abated with technology to capture emissions. It was the first time a COP pact included any reference to reducing any kind of fossil fuel use.

The European Union said it was supportive of the idea as long as it does not weaken the language on coal. The United States climate guru John Kerry said the U.S. was on board as long as it applies only to “unabated” oil and gas.

India spent the last two weeks of COP27 negotiations pushing to add oil and gas to that paragraph in this year’s final pact. Don’t know if India would take this position – they are consuming lots of crude oil and are buying as much Russian crude they can get their hands on.

There was no sign of any such language in the draft text of the COP27 pact released Thursday. The final draft was still being negotiated as the two-week climate talks came to their final day on Friday of last week. Stay tuned to PFL for further details.

Train Thieves caught in L.A.

Folks, they finally caught the train thief’s in L.A. Nearly two dozen arrests were made in a yearlong investigation into train burglaries, the Los Angeles Police Department announced Thursday of last week. (remember this)

The Train Burglary Task Force arrested the suspects who police say were members of a criminal enterprise targeting and burglarizing cargo containers moving through L.A. County. Authorities say the arrests of 22 suspects linked to a lion’s share of the thefts succeeded in shutting down the operation. LAPD Capt. Alfonso Lopez said that stolen cargo valued at more than $18 million was recovered.

The task force also included the UP, Police and other law enforcement agencies. The UP said that it has seen a 160% year-over-year increase in thefts across the U.S.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 8, 23.5 tanks CSX in the east for polyacryamide for 2 years plus

- 35, 5400-6300 Covered hoppers for lease off the BN needed in Iowa for 3-5 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 20, CPC 1232s last in Gasoline. On the UP in Texas, Short term.

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|