“Anyone can get angry — that is easy … but to do this to the right person, to the right extent, at the right time, with the right motive, and in the right way, that is not for everyone, nor is it easy.”

– Aristotle

Jobs Update

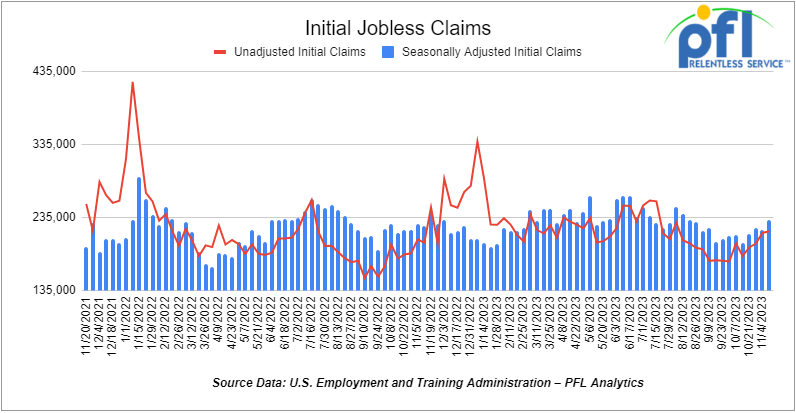

- Initial jobless claims for the week ending November 11th, 2023 came in at 231,000, up 13,000 people week-over-week.

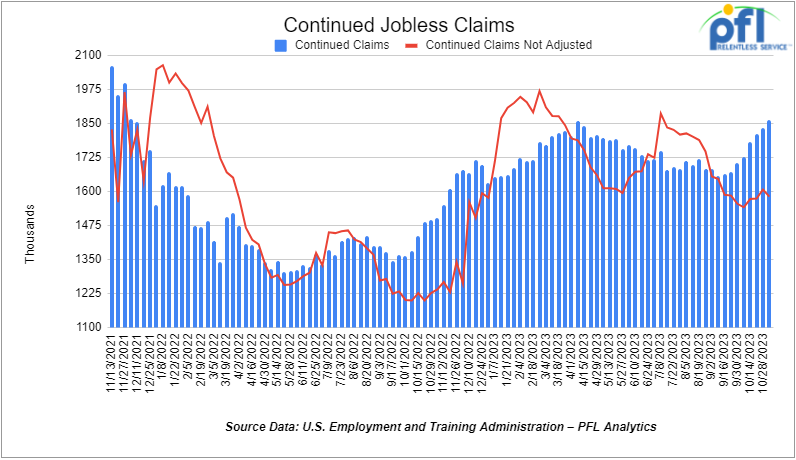

- Continuing jobless claims came in at 1.865 million people, versus the adjusted number of 1.833 million people from the week prior, up 32,000 people week-over-week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 1.81 points (+0.01%), closing out the week at 34,947.23, up 664.18 points week-over-week. The S&P 500 closed higher on Friday of last week, up 5.78 points (+0.13%) and closed out the week at 4,514.02, up 98.78 points week-over-week. The NASDAQ closed higher on Friday of last week, up 11.81 points (+0.09%), and closed out the week at 14,125.48, up 327.37 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 35,052 this morning up 40 points.

Crude oil closed higher on Friday of last week, but lower week over week

WTI traded up $2.99 per barrel (4.1%) to close at $75.89 per barrel on Friday of last week, down -$1.28 per barrel week-over-week. Brent traded up US$3.19 per barrel (4.1%) on Friday of last week, to close at US$80.91 per barrel, down -US$0.52 per barrel week-over-week.

In Canada, One Exchange WCS for January delivery settled Friday of last week at US$23.75 below the WTI-CMA. The implied value was US$52.31 per barrel. On Thursday of last week, it settled at US$23.25 below the WTI-CMA for January delivery. The implied value was US$49.88/bbl. Producers in Canada are desperately awaiting line fill on Trans Mountain Pipeline expansion, which should begin in January. It is estimated that it will take 11 million barrels to fill the pipeline and that actual shipments (an incremental 500,000 barrels per day) will begin towards the end of Q1 2024.

North Dakota output is the highest since early 2020 – crude production in North Dakota rose for the 6th consecutive month in September. North Dakota operators pumped out 1.3 million barrels per day of oil in September, up by 58,000 barrels per day according to the Department of Energy. The state has benefited from operators working through an inventory of drilled, but uncompleted wells this year along with cooperative weather through October.

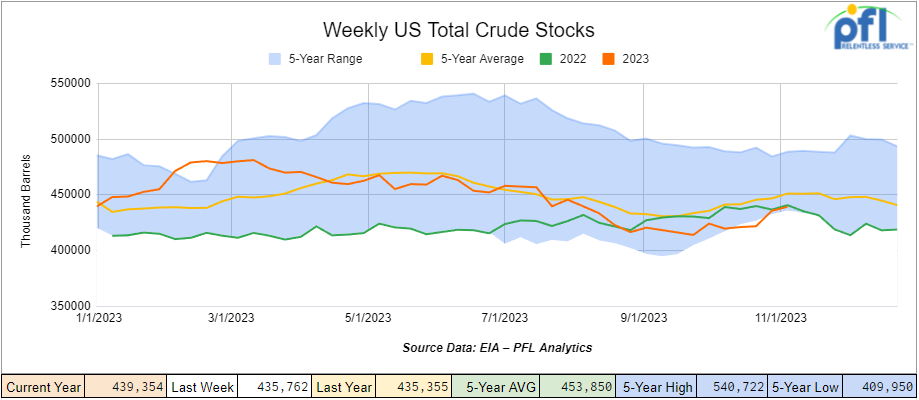

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.6 million barrels week-over-week. At 439.4 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

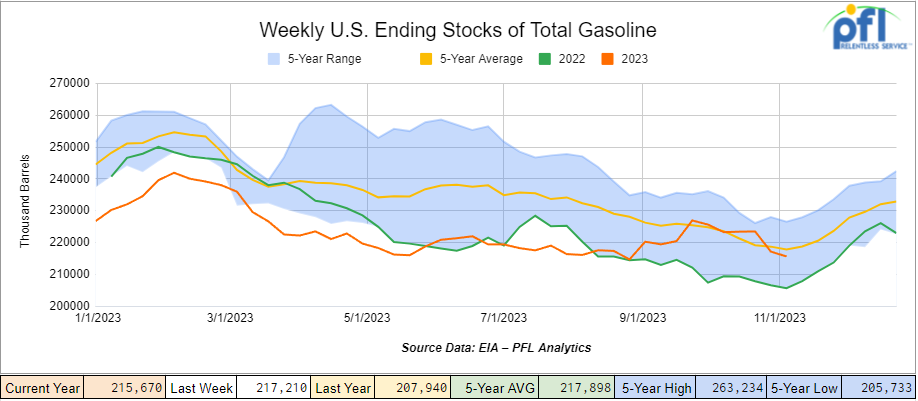

Total motor gasoline inventories decreased by 1.5 million barrels week-over-week and are 1% below the five-year average for this time of year.

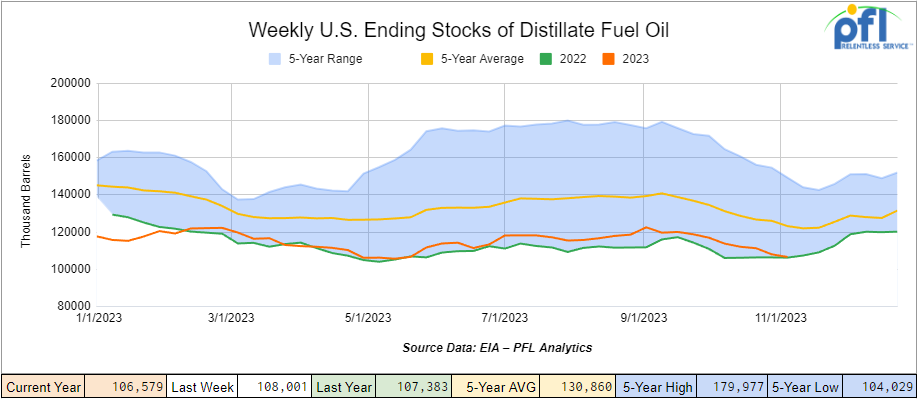

Distillate fuel inventories decreased by 1.4 million barrels week-over-week and are 13% below the five-year average for this time of year.

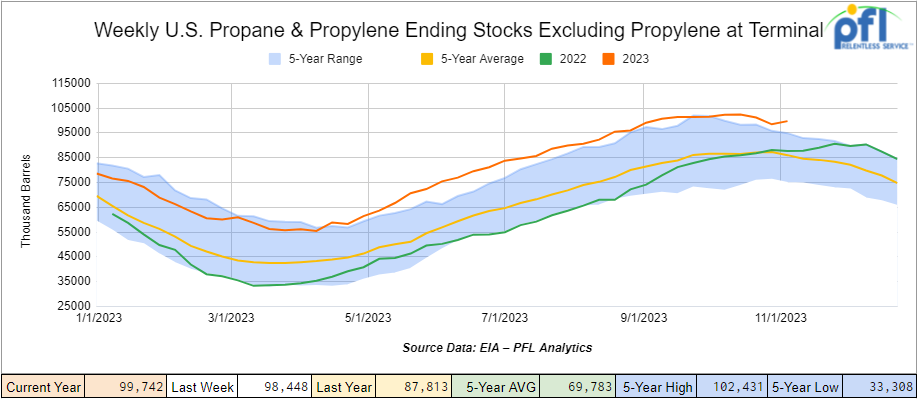

Propane/propylene inventories increased by 1.3 million barrels week-over-week and are 17% above the five-year average for this time of year.

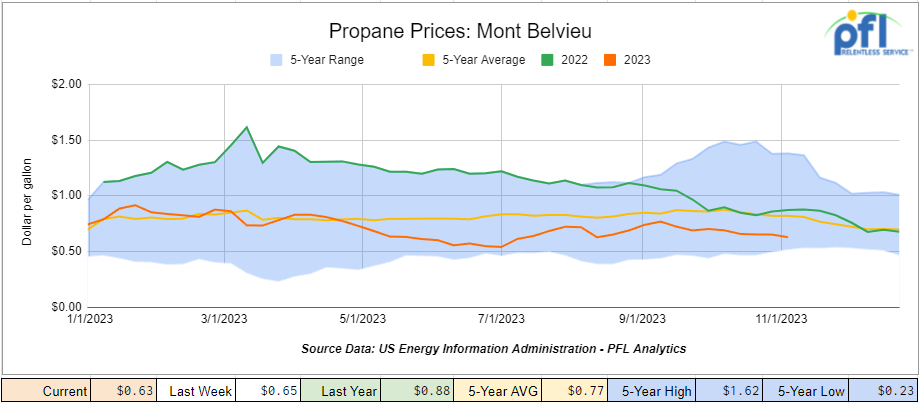

Propane prices closed at 63 cents per gallon, down 2 cents per gallon week-over-week, and down 25 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 100,000 barrels week-over-week.

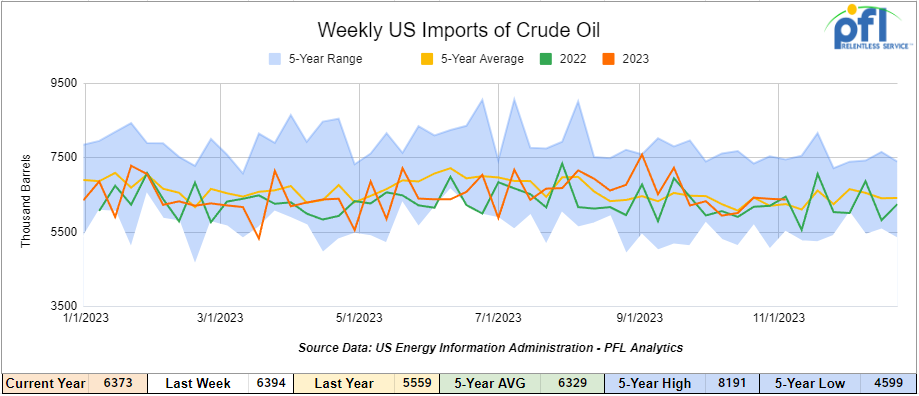

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending November 10th, 2023, a decrease of 21,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 3.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 514,000 barrels per day, and distillate fuel imports averaged 152,000 barrels per day.

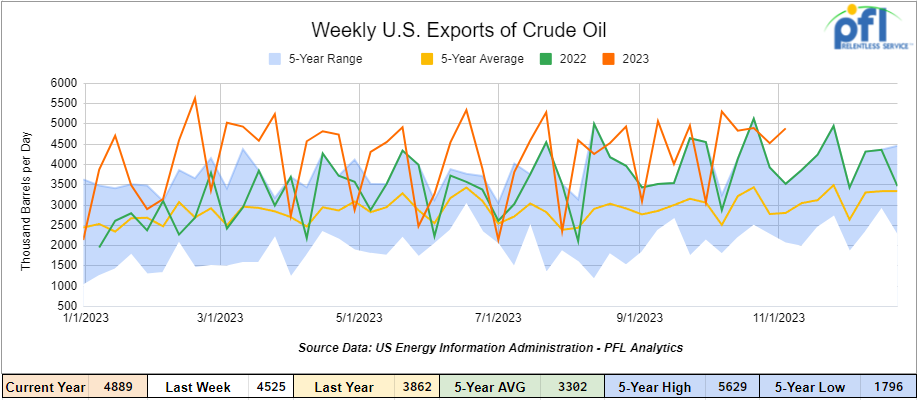

U.S. crude oil exports averaged 4.897 million barrels per day for the week ending October 27th, an increase of 64,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.525 million barrels per day.

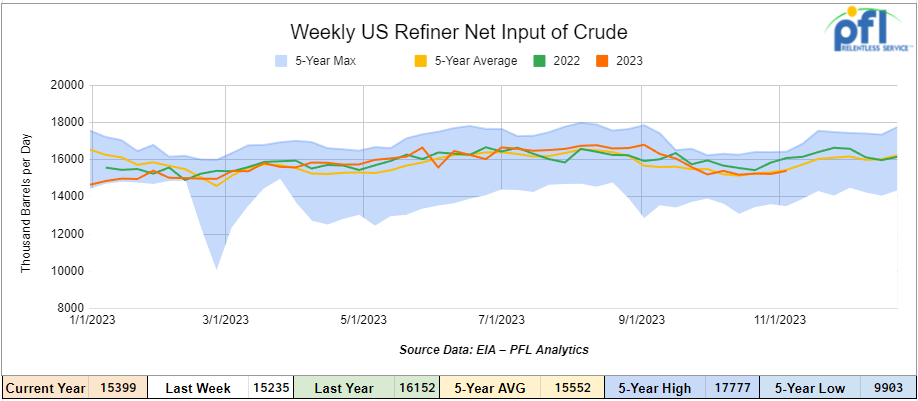

U.S. crude oil refinery inputs averaged 15.3 million barrels per day during the week ending October 27, 2023, which was 62,000 barrels per day more week-over-week.

WTI is poised to open at $76.31, up $0.42 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 15th, 2023.

Total North American weekly rail volumes were up (1.81%) in week 45, compared with the same week last year. Total carloads for the week ending on November 15th, 2023 were 362,973, up (2.75%) compared with the same week in 2022, while weekly intermodal volume was 327,740, up (0.79%) compared to the same week in 2022. 8 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Nonmetallic Minerals (-3.78%). The largest increase came from Motor Vehicles and Parts (+14.96%).

In the East, CSX’s total volumes were up (1.88%), with the largest decrease coming from Chemicals (-8.08%) and the largest increase from Motor Vehicles and Paris (+16.57%). NS’s volumes were up (+3.55%), with the largest decrease coming from Grain (-21.33%) and the largest increase from Motor vehicles and Parts (+20.98%).

In the West, BN’s total volumes were up (3.39%), with the largest decrease coming from Nonmetallic Minerals (-6.92%), and the largest increase coming from Other (+33.35%). UP’s total rail volumes were up (0.89%) with the largest decrease coming from Metallic Ores and Metals (-10.89%) and the largest increase coming from Petroleum and Petroleum products (+23.14%).

In Canada, CN’s total rail volumes were down (-1.48%) with the largest increase coming from Other (+70.22%) and the largest decrease coming from Grain (-32.92%). CP’s total rail volumes were up (2.24%) with the largest decrease coming from Chemicals (-27.12%) and the largest increase coming from Coal (+64.60%).

KCS’s total rail volumes were down (-6.6%) with the largest decrease coming from Intermodal (-231.13%) and the largest increase coming from Motor Vehicles and Parts (+4158.96%).

Source Data: AAR – PFL Analytics

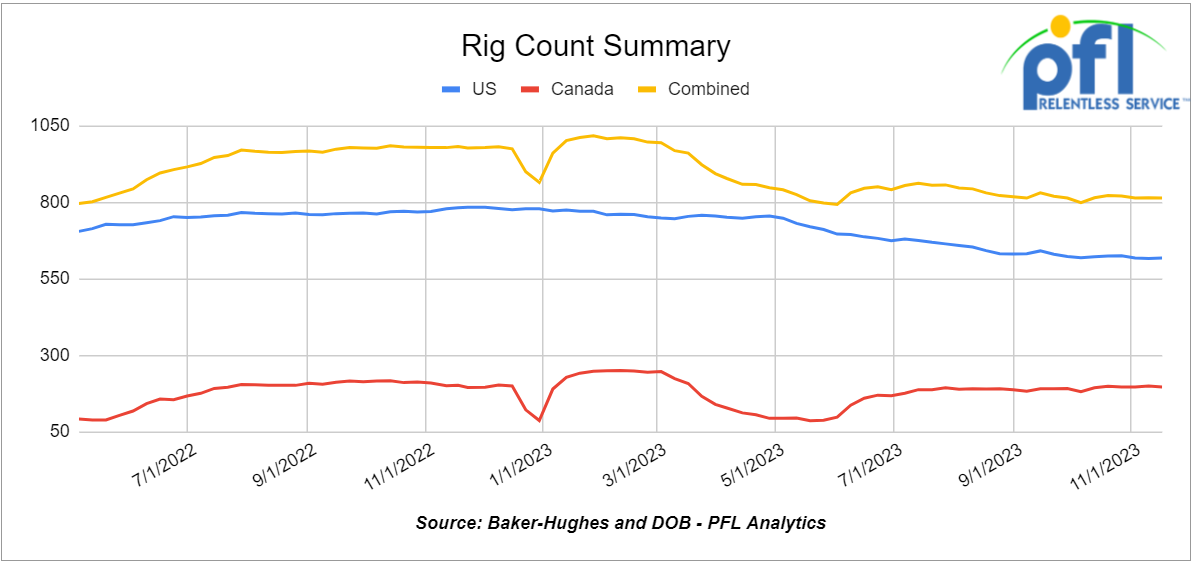

Rig Count

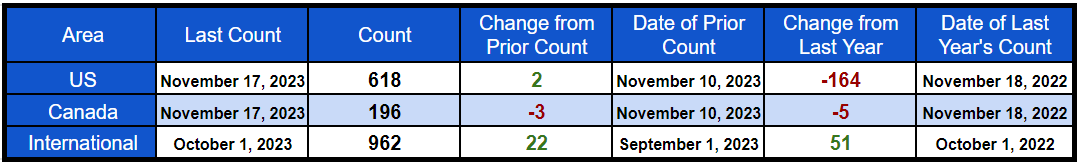

North American rig count was down by -1 rig week-over-week. U.S. rig count was up by 2 rigs week-over-week but down by –164 rigs year-over-year. The U.S. currently has 618 active rigs. Canada’s rig count was down by -3 rigs week-over-week and down by -5 rigs year over year. Canada’s overall rig count is 196 active rigs. Overall, year-over-year, we are down -169 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,397 from 28,244, which was a gain of +153 rail cars week-over-week. The eleventh consecutive week-over-week increase! Canadian volumes were up. CPKC’s shipments rose by +7.0% week over week, and CN’s volumes were higher by +5.0% week-over-week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +23.0%. The BN was the sole decliner and was down by 4.6%.

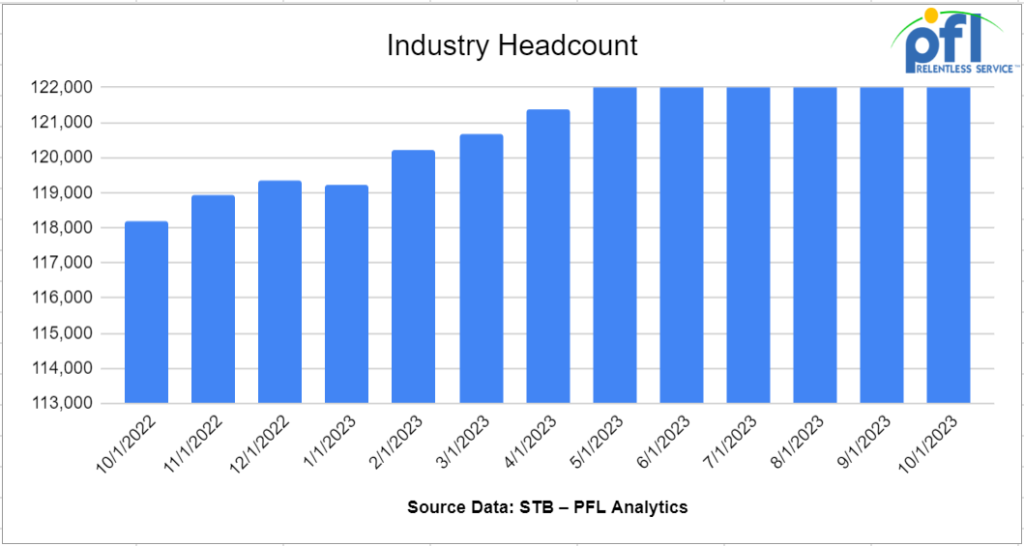

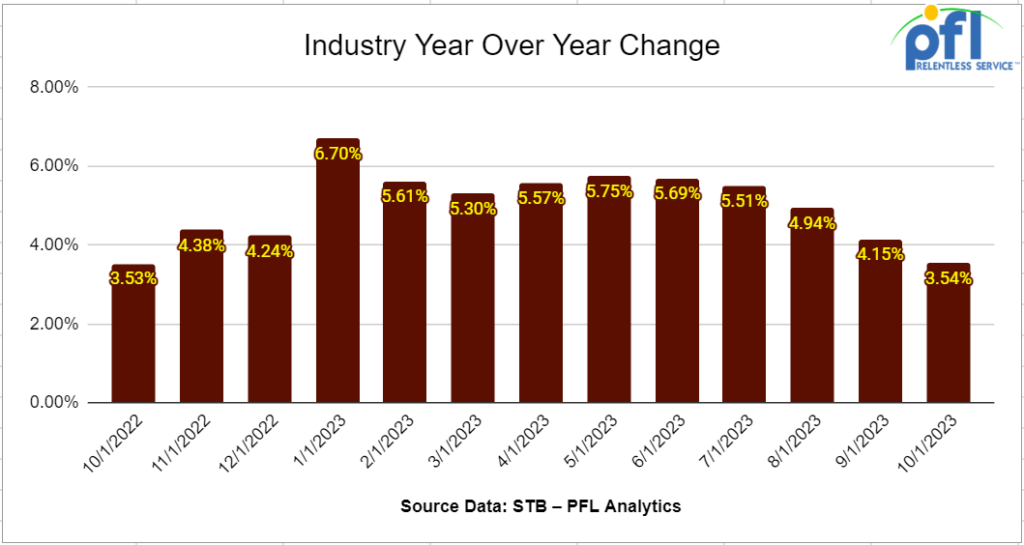

We are watching Class 1 Industry Headcount

Headcount at the Class 1’s was mostly higher in October while rail traffic has recently turned positive for this time of year compared to that of last year – we, at least in the short term, have seen increased levels of service. Hopefully, the trend continues although some are talking about potential layoffs due to a lack of a perceived increase in flows – don’t think we need to go back there. Below is the latest and greatest:

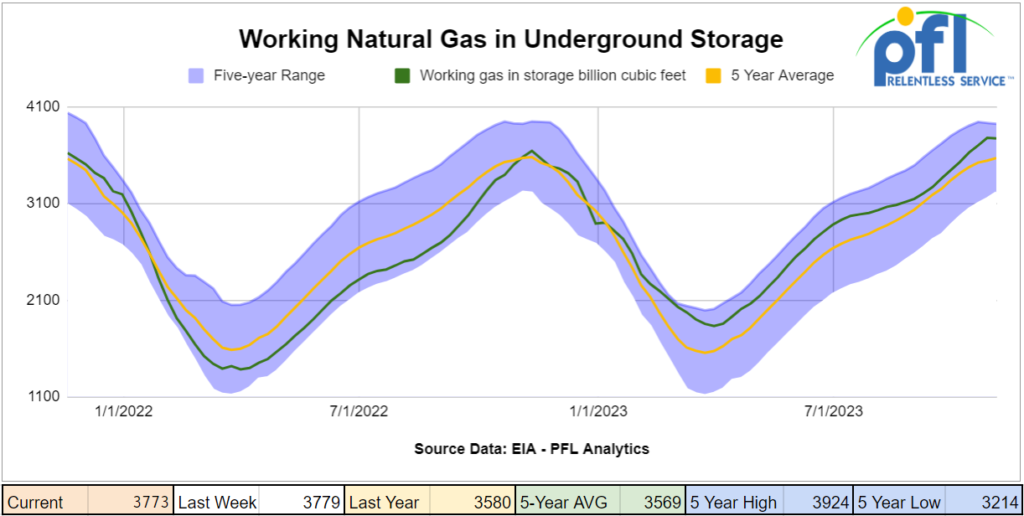

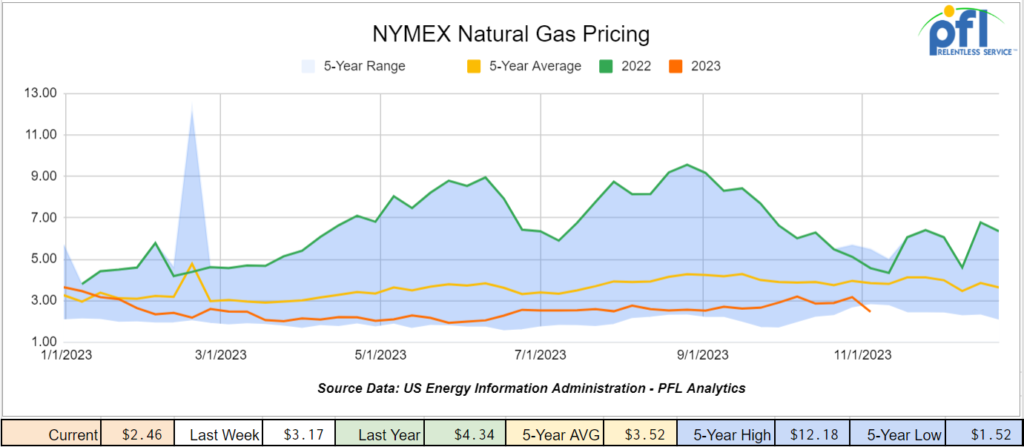

We are watching Natural Gas

Why is Natural Gas pricing so low? Working natural gas stocks ended the injection season above five-year average. Working natural gas in storage in the U.S. Lower 48 states as of October 31 totaled 3,776 billion cubic feet (Bcf), according to the EIA. This total represents the second-highest end-of-injection-season inventory during the past five years. Total inventory as of October 31 was 5% (178 Bcf) more than the five-year (2018–22) end-of-October average and 6.8% (239 Bcf) higher than last year at this time.

Natural Gas Pricing has followed suit together with associated liquids that all closed the week lower on Friday of last week. Natural Gas closed at $2.96 per MMBTU on Friday of last week, down 11.5 cents per MMBTU day over day.

So You Want to buy an Electric Car

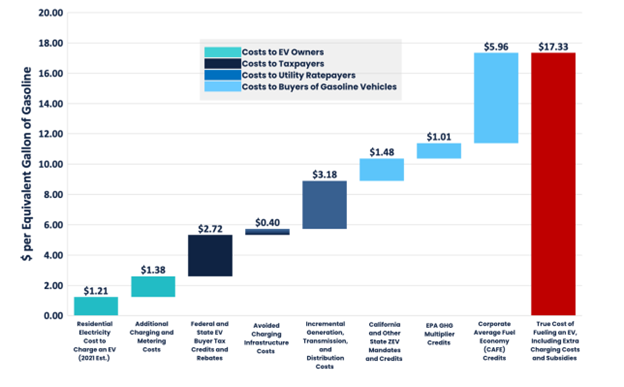

We continue to believe that electric cars are not a viable long-term solution for our transportation needs for a number of reasons. A new study from the Texas Public Policy Foundation finds that the actual hidden costs of fueling an electric vehicle, which some allege equates to $1.21 per gallon as it relates to that of gasoline, is more like $17.33 per gallon equivalent — In a new paper recently published called “Overcharged Expectations: Unmasking the True Costs of Electric Vehicles”, the study’s authors argue that while the direct cost of “fueling up” to an EV owner may appear low, the real costs and considerations add up to be significantly more. The wheels are beginning to fall off EV cars, as they should.

Subsidies and Excess Charging Costs Accrued by a MY2021 Electric Vehicle Over 10 Years, Expressed in Terms of the Cost per Equivalent Gallon of Gasoline

Source: The Texas Public Policy Foundation – PFL Analytics

To read the report for yourself please click the (link)

The Texas Public Policy Foundation is a 501(c)3 non-profit, non-partisan research institute.

The Foundation’s mission is to promote and defend liberty, personal responsibility, and free enterprise in Texas and the nation by educating and affecting policymakers and the Texas public policy debate with academically sound research and outreach.

Funded by thousands of individuals, foundations, and corporations, the Foundation does not accept government funds or contributions to influence the outcomes of its research.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 Years. Cars are needed for use in Flyash service.

- 20, 30K 117R or 117J Tanks needed off of UP or BN in Midwest for 6 Months. Cars are needed for use in Ethanol service.

- 150, 29.2K 117R, 117J, DOT 111 Tanks needed off of CN or CP in Sarnia for 1 Year. Cars are needed for use in Fuel Oil service.

- 50, 23.5-25.5 Dot 111 Tanks needed off of Any Class 1 in USA for 5 Years. Cars are needed for use in Asphalt service.

- 3, 23.5-25.5 Any Tanks needed off of Any Class 1 in Port Allen, LA for 90 Days. Cars are needed for use in Fuel Oil service.

- 3, 23.5-25.5 Any Tanks needed off of Any Class 1 in Natchez, MS for 90 Days. Cars are needed for use in Fuel Oil service.

- 100, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined product services.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Years. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

Lease Offers

- 10, 28.3K, 117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 75, 29.2K, DOT 111 Tanks located off of BN, CP in Moving In Midwest. Cars were last used in Bio. Free Move

- 30, 31.8K, CPC 1232 Tanks located off of UP, BN in Texas. Cars were last used in Diesel. Call 239-390-2885 for more information

- 25, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Heavy Fuel Oil. Call 239-390-2885 for more information

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|