“You are always free to change your mind and choose a different future, or a different past.”

– Richard Bach

Jobs Update

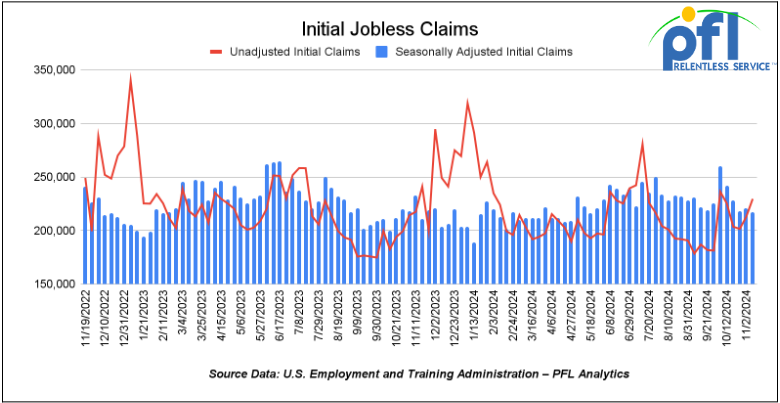

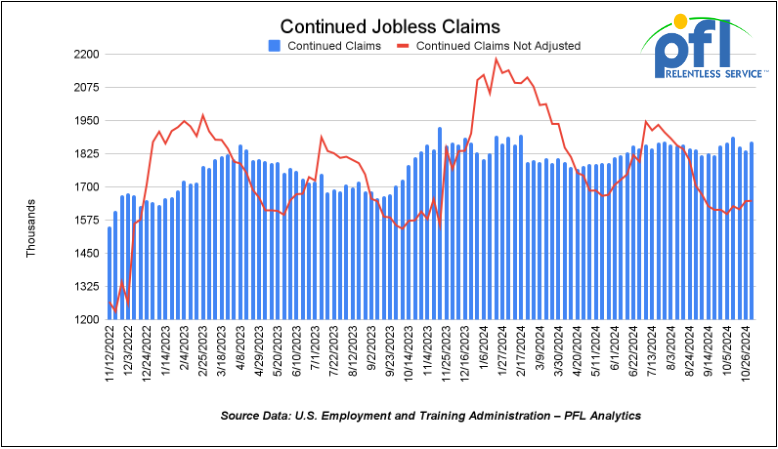

- Initial jobless claims seasonally adjusted for the week ending November 9th came in at 217,000, down -4,000 people week-over-week.

- Continuing jobless claims came in at 1.873 million people, versus the adjusted number of 1.84 million people from the week prior, up 33,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -305.87 points (-0.7%) and closing out the week at 43,444.99, down -544 points week-over-week. The S&P 500 closed lower on Friday of last week, down -78.55 points (-1.32%) and closed out the week at 5,870.62, down -124.92 points week-over-week. The NASDAQ closed lower on Friday of last week, down -429.11 points (-2.22%), and closed out the week at 18,678.54, down -608.24 points week over week.

Wall Street posted its worst weekly performance since the start of September and has now notched a negative week in three of the last four. It was still a historic week for the gauge, which on Monday closed above 6,000 points for the first time ever. Most likely over the Euphoria of the election results. The focus over the rest of last week quickly shifted back to economic data and the Federal Reserve. Slightly hot consumer and producer inflation data, along with a comment from Federal Reserve chair Jerome Powell on Thursday that the central bank would not be “in a hurry to lower rates” weighed on markets, especially on Friday of last week.

In overnight trading, DOW futures traded lower and are expected to open at 43,494 this morning down 74 points.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed down -$1.68 per barrel (-2.45%) to close at $67.02 per barrel on Friday of last week, down $3.33 per barrel week over week. Brent traded down -$1.52 USD per barrel (-2.9%) on Friday of last week, to close at $71.04 per barrel, down -$2.83 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for December delivery settled Friday of last week at US$11.45 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 56.99 per barrel.

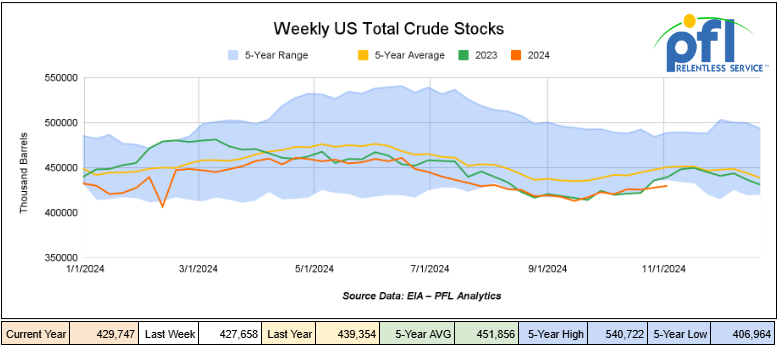

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.1 million barrels week-over-week. At 429.7 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

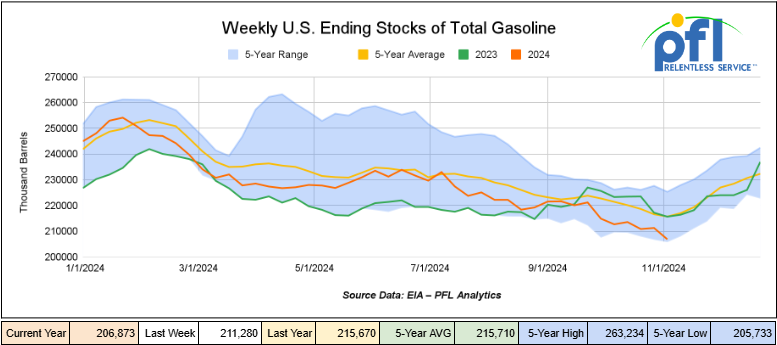

Total motor gasoline inventories decreased by 4.4 million barrels week-over-week and are 4% below the five-year average for this time of year.

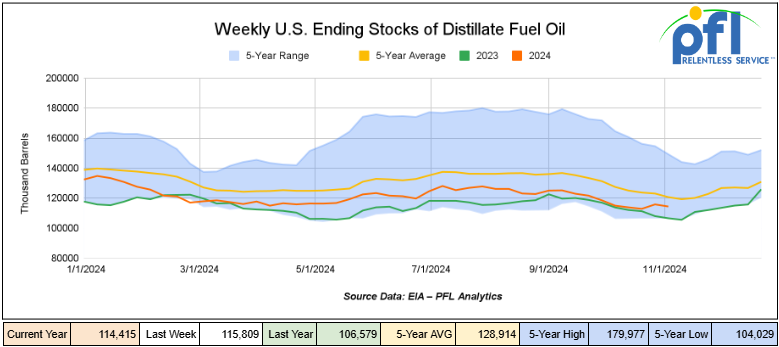

Distillate fuel inventories decreased by 1.4 million barrels week-over-week and are 5% below the five-year average for this time of year.

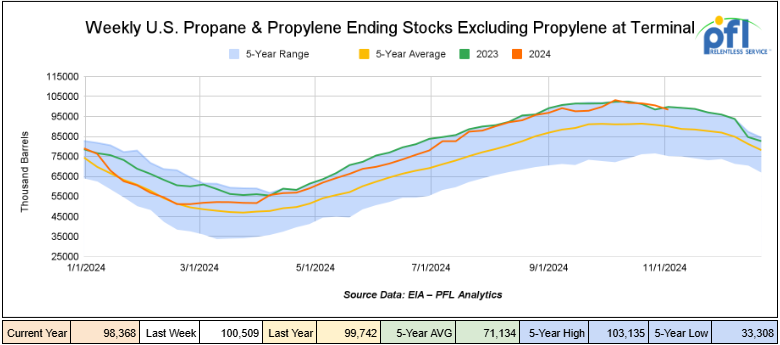

Propane/propylene inventories decreased by 2.1 million barrels week-over-week and are 9% above the five-year average for this time of year.

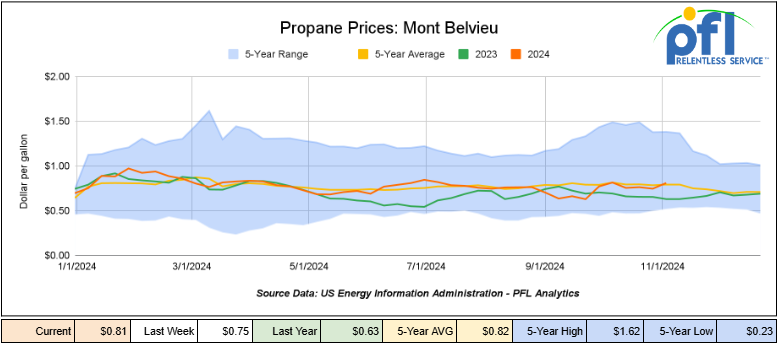

Propane prices closed at 81 cents per gallon on Friday of last week, up 6 cents per gallon week-over-week, but up 18 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 6.5 million barrels during the week ending November 8th, 2024.

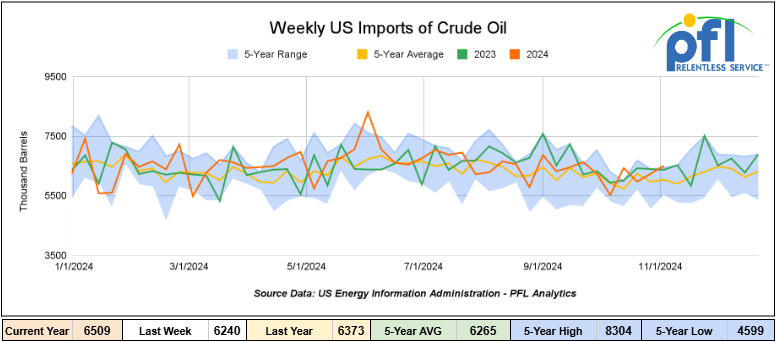

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending November 8th, 2024, an increase of 269,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 0.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 628,000 barrels per day, and distillate fuel imports averaged 108,000 barrels per day during the week ending November 8th, 2024.

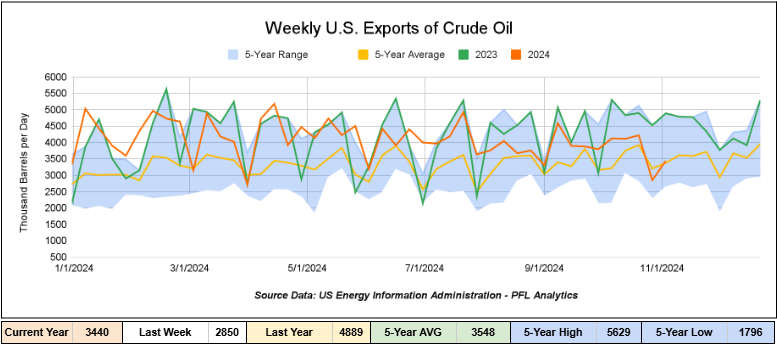

U.S. crude oil exports averaged 3.44 million barrels per day during the week ending November 8th, 2024, an increase of 590,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.655 million barrels per day.

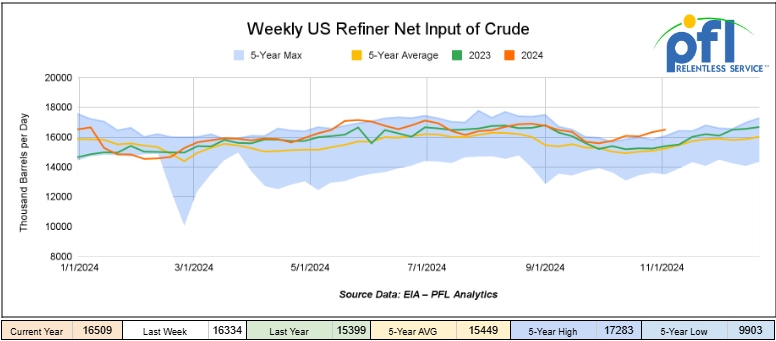

U.S. crude oil refinery inputs averaged 16.5 million barrels per day during the week ending November 8th, 2024, which was 175,000 barrels per day more week-over-week.

WTI is poised to open at $67.50, up 48 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 13th, 2024.

Total North American weekly rail volumes were up (2.45%) in week 46, compared with the same week last year. Total carloads for the week ending on November 13th were 348,569, down (-3.97%) compared with the same week in 2023, while weekly intermodal volume was 359,036, up (9.55%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-18.07%). The most significant increase came from Intermodal, which was up (+9.55%).

In the East, CSX’s total volumes were up (2.67%), with the largest decrease coming from Coal (-10.49%) while the largest increase came from Petroleum and Petroleum Products (+19.6%). NS’s volumes were up (1.77%), with the largest increase coming from Grain (+17.48%), while the largest decrease came from Petroleum and Petroleum products (-14.25%).

In the West, BN’s total volumes were up (+7.71%), with the largest increase coming from Petroleum and petroleum Products (+27.14%) while the largest decrease came from Coal, down (-19.55%). UP’s total rail volumes were up (6.65%) with the largest decrease coming from Coal, down (-22.15%), while the largest increase came from Intermodal, which was up (+15.98%).

In Canada, CN’s total rail volumes were down (-19%) with the largest decrease coming from Intermodal, down (-53.57%) while the largest increase came from Grain, up (+15.72%). CP’s total rail volumes were down (-13.92%) with the largest increase coming from Other (+90.57%), while the largest decrease came from Coal (-45.47%).

KCS’s total rail volumes were down (-7.8%) with the largest decrease coming from Coal (-24.85%) and the largest increase coming from Motor Vehicles and Parts (+19.12%).

Source Data: AAR – PFL Analytics

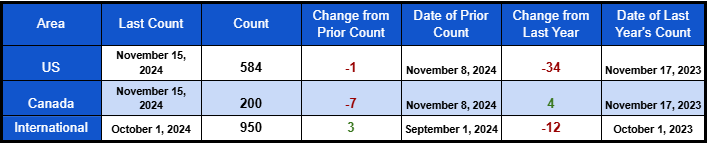

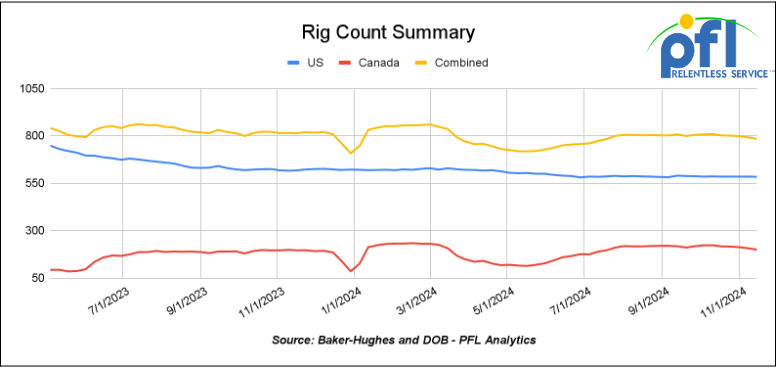

Rig Count

North American rig count was down by -8 rigs week-over-week. U.S. rig count was down -1 rig week-over-week and down by -34 rigs year-over-year. The U.S. currently has 584 active rigs. Canada’s rig count was down -7 rigs week over week, but up by 4 rigs year-over-year and Canada’s overall rig count is 200 active rigs. Overall, year over year we are down by -30 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,457 from 29,140, which was a gain of 317 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were lower by -1.5% week over week, CN’s volumes were higher by +6.4% week-over-week. U.S. shipments were mostly higher. The NS was the sole decliner and was down by -1.2%. The BN had the largest percentage increase and was up by 7.5%

We are watching Enbridge Line 5

Folks, we have not talked about this one in a while Enbridge Line 5. Remember the pipeline that Governor Whitmer from Michigan desperately shut down? It seems the tide has turned in a positive way for Enbridge. Enbridge’s contentious plan to reroute around a northern Wisconsin tribal reservation moved closer to reality on Thursday last week after the company won its first permits from state regulators in Wisconsin.

The Wisconsin Department of Natural Resources (“DNR”) state officials announced they have issued construction permits for the Line 5 reroute around the Bad River Band of Lake Superior Chippewa’s reservation. Enbridge still needs discharge permits from the DNR as well as the U.S. Army Corps of Engineers but it is certainly a step in the right direction. See the reroute below:

Enbridge Line 5 Reroute in Wisconsin

Source: Enbridge – PFL Analytics

The project has generated fierce opposition. The tribe wants the pipeline off its land, but tribal members and environmentalists maintain rerouting construction will damage the region’s watershed and perpetuate the use of fossil fuels. They just don’t give up!

The DNR issued the construction permits with more than 200 conditions attached. The company must complete the project by November 14, 2027, hire DNR-approved environmental monitors, and allow DNR employees to access the site during reasonable hours.

The company also must notify the agency within 24 hours of any permit violations or hazardous material spills affecting wetlands or waterways; can’t discharge any drilling mud into wetlands, waterways, or sensitive areas; keep spill response equipment at workspace entry and exit points; and monitor for the introduction and spread in invasive plant species.

Bad River tribal officials warned in their own statement on Thursday of last week that the project calls for blasting, drilling, and digging trenches that would devastate area wetlands and streams and endanger the tribe’s wild rice beds.

“I’m angry that the DNR has signed off on a half-baked plan that spells disaster for our homeland and our way of life,” Bad River Chairman Robert Blanchard said in the statement. “We will continue sounding the alarm to prevent yet another Enbridge pipeline from endangering our watershed.”

Line 5 transports approximately 23 million gallons of oil and natural gas daily from Superior, Wisconsin, through Michigan to Sarnia, Ontario. People in Michigan rely on propane deliveries from line 5. Roughly 12 miles of the pipeline run across the Bad River reservation.

In Michigan – Michigan’s Democratic attorney general, Dana Nessel, filed a lawsuit in 2019 seeking to shut down twin portions of Line 5 that run beneath the Straits of Mackinac, the narrow waterways that connect Lake Michigan and Lake Huron. Nessel argued that anchor strikes could rupture the line, resulting in a devastating spill. That lawsuit is still pending in a federal appellate court. See below:

Enbridge Line 5 Straits of Mackinac – Michigan

Source: Enbridge – PFL Analytics

Meanwhile Michigan regulators in December of this year approved the company’s $500 million plan to encase the portion of the pipeline beneath the straits in a tunnel to mitigate risk. The plan is awaiting approval from the U.S. Army Corps of Engineers. We have been watching this one for years and continue to do so. The shuttering of Line 5 would be a disaster from an energy perspective for consumers but a bonanza for rail.

We are watching North America’s Ports

East Coast port contract talks will resume

Negotiations on a new labor contract covering workers at 36 East and Gulf Coast ports are set to resume this week between employers and their longshore union.

Representatives of the United States Maritime Alliance (USMX) and the International Longshoremen’s Association (ILA) will meet in northern New Jersey, where both organizations have offices.

The USMX and ILA earlier declared a media blackout during negotiations.

Biden administration officials in October ended a three-day strike by the ILA and both sides agreed to extend the current contract until January 15 while negotiations resumed, five days before President Trump is sworn back into office! Let’s hope they get a deal done as it is not good for rail and the economy. The work stoppage shut down container handling and threatened a log jam of billions of dollars of imports ranging from pharmaceuticals, auto parts, apparel, and fresh fruits and vegetables.

At the time of the extension, USMX and ILA agreed to a 62% pay hike over the six years of a new pact covering 45,000 union workers. Automation remains a key sticking point as the union has adamantly opposed the introduction of new port technology that could replace longshore jobs.

North of the border in Canada

B.C. port operations resumed – the British Colombia Maritime Employers Association (“BCMEA”) says port operations resumed Thursday afternoon last week, following orders from the Canadian federal government after a lockout.

On Wednesday of last week, a statement from the BCMEA said it would comply with the order from the Canada Industrial Relations Board directing it to resume and continue operations “until the board makes a final determination.”

It said the BCMEA was committed to working closely with the union and supply chain partners “to safely and efficiently resume operations at Canada’s West Coast ports.”

It comes over a week after the BCMEA locked out more than 700 unionized workers, stating it had made the “difficult decision” after International Longshore and Warehouse Union (ILWU) Local 514 issued a 72-hour strike notice for job action.

An estimated $800 million worth of trade flows through Canada’s West Coast ports each day.

The BCMEA also said the board has a hearing scheduled for today between both parties in the contract dispute “on certain questions raised with respect to the ministerial direction.”

Again, not a good situation for rail or the economy, so let’s hope some deals are cut and we move forward. There are quite a few cars parked in Western Canada that need to get moving and quite a bit intermodal trains destined for the U.S. to utilize Canadian West Coast ports.

Meanwhile in Montreal as a result of an order from the Canada Industrial Relations Board (CIRB), the Montreal Port Authority (MPA) the Port of Montreal confirms that operations resumed at all Port of Montreal terminals on Saturday, November 16, at 7 a.m.

Its teams were fully mobilized, and the MPA is working closely with all its port and intermodal partners to implement a recovery plan enabling us to return to normal operations as quickly as possible. It may take a few weeks to re-establish the fluidity of the supply chain and process all goods, both imports, and exports, currently at the Port of Montreal or in transit and due to arrive in the next few days. With over 5,000 TEU (twenty-foot equivalent unit) containers currently on the ground, 55,000 linear feet of rail to handle, and 22 vessels on their way or waiting at anchor, every effort will be made to handle these volumes quickly according to the Port.

We are watching Key Economic Indicators

Producer Price Index

In October 2024, the Producer Price Index (PPI) for final demand increased by 0.2%. The index for final demand goods edged up 0.1%, reflecting a 0.3% rise in goods less foods and energy, which offset declines in energy (-0.3%) and food (-0.2%). Meanwhile, the index for final demand services rose by 0.3%, with increases in trade services (0.1%), transportation and warehousing (0.5%), and services less trade, transportation, and warehousing (0.3%). Over the past 12 months, final demand prices increased by 1.7%, marking steady inflation compared to September.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Prodcuts service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. Winter Lease

- 90, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Fuel OIl. 2-3 Year Term

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 30K, 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of Multiple in All over. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 50, 17K, DOT 111 Tanks located off of Multiple in All over.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website