“Before anything else, preparation is the key to success.” — Alexander Graham Bell

Jobs Update

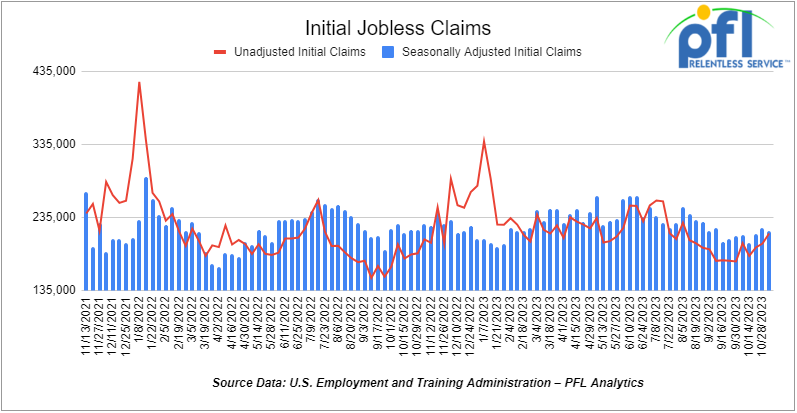

- Initial jobless claims for the week ending November 4th, 2023 came in at 217,000, down -3,000 people week-over-week.

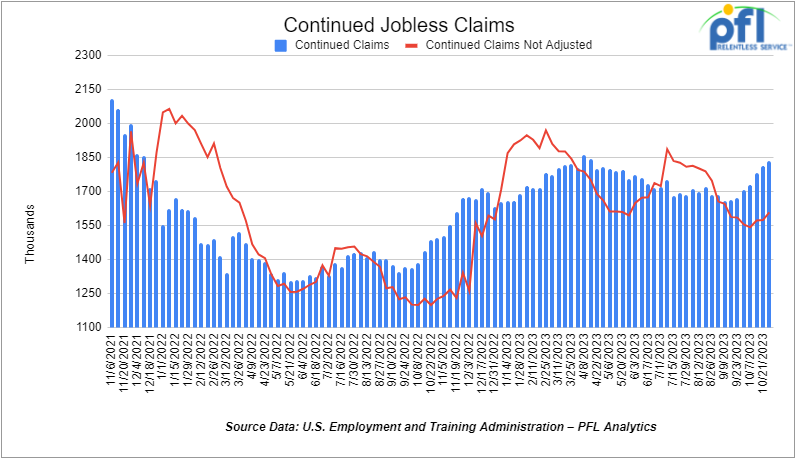

- Continuing jobless claims came in at 1.834 million people, versus the adjusted number of 1.811 million people from the week prior, up 23,000 people week-over-week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 391.16 points (+1.15%), closing out the week at 34,283.1, up 221.79 points week-over-week. The S&P 500 closed higher on Friday of last week, up 67.89 points (+1.56%), and closed out the week at 4,415.24, up 56.90 points week-over-week. The NASDAQ closed higher on Friday of last week, up 276.66 points (+2.05%), and closed out the week at 13,798.11, up 319.83 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 34,321 this morning down -17 points.

Crude oil closed higher on Friday of last week, but lower week over week

WTI traded up $1.43 per barrel (1.9%) to close at $77.17 per barrel on Friday of last week, down -$3.34 per barrel week-over-week. Brent traded up US$1.42 per barrel (1.8%) on Friday of last week, to close at US$81.43 per barrel, down -US$3.46 per barrel week-over-week.

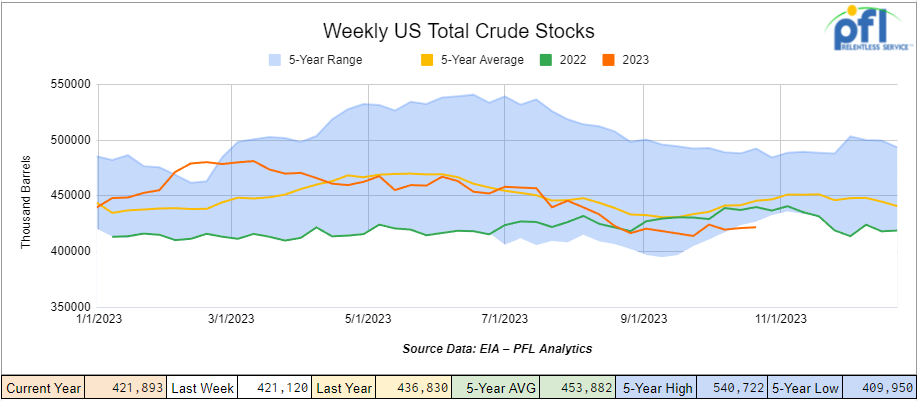

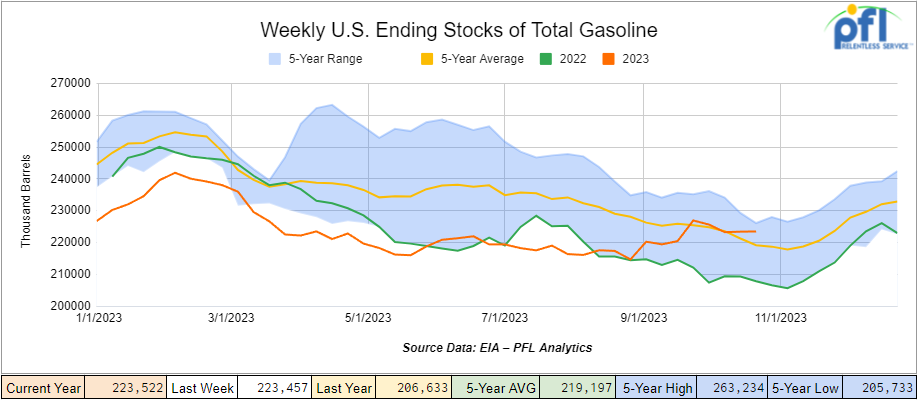

PLEASE NOTE ALL EIA DATA DID NOT CHANGE FOR THIS WEEK, AS THE EIA IS DOWN FOR SYSTEM MAINTENANCE UNTIL NOVEMBER 15th

Total motor gasoline inventories increased by 100,000 barrels week-over-week and are 2% above the five-year average for this time of year.

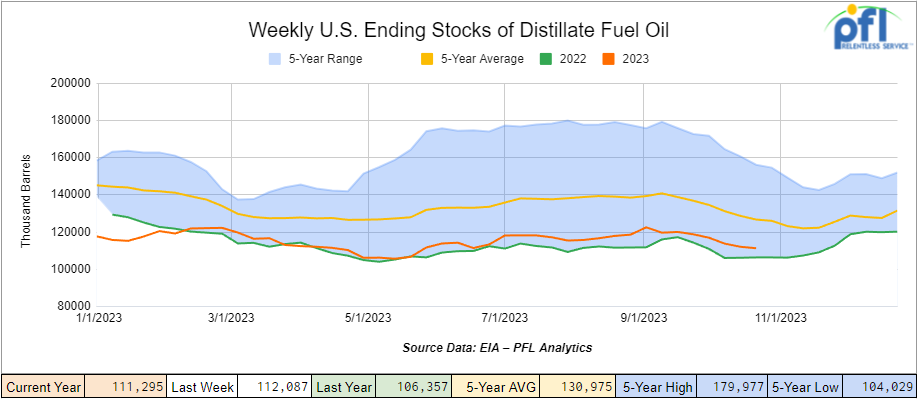

Distillate fuel inventories decreased by 800,000 barrels week-over-week and are 12% below the five-year average for this time of year.

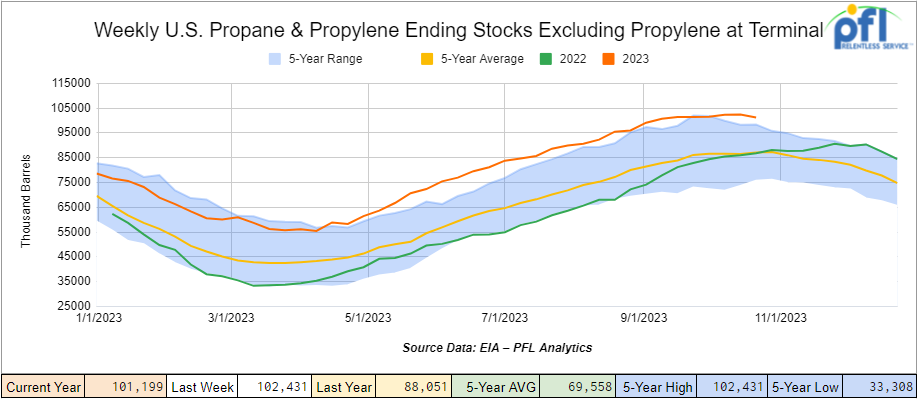

Propane/propylene inventories decreased by 1.2 million barrels week-over-week and are 16% above the five-year average for this time of year.

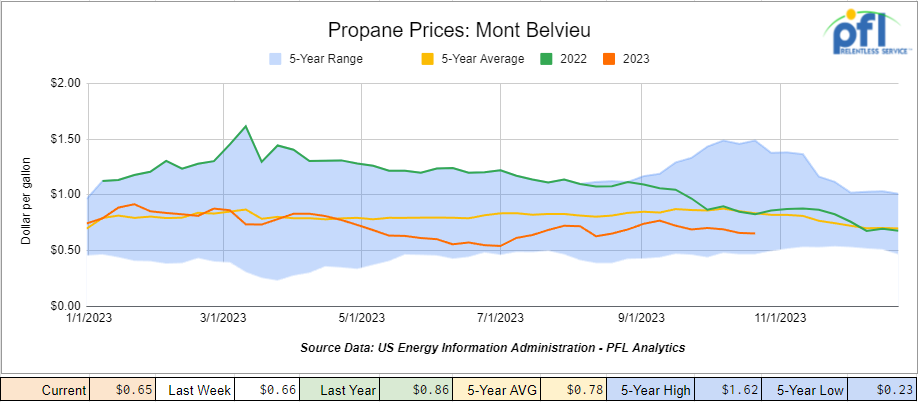

Propane prices closed at 65 cents per gallon, down 1 cent per gallon week-over-week, and down -21 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 3.1 million barrels during the week ending October 27, 2023.

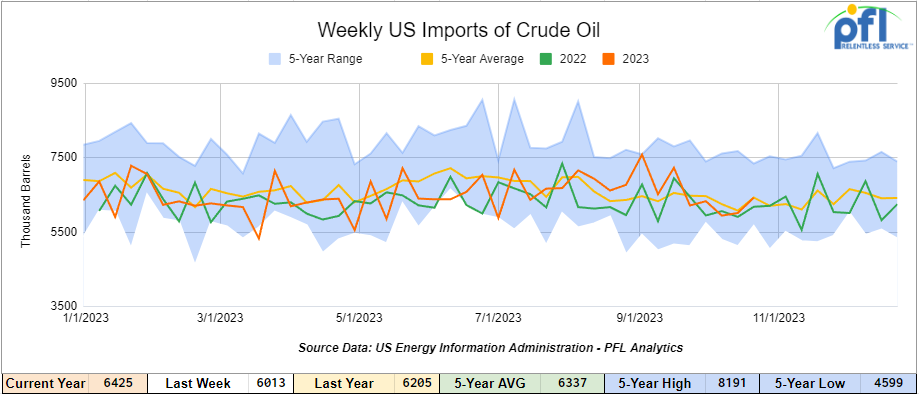

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending October 27, 2023, an increase of 412,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 1.4% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 557,000 barrels per day, and distillate fuel imports averaged 71,000 barrels per day during the week ending October 27, 2023.

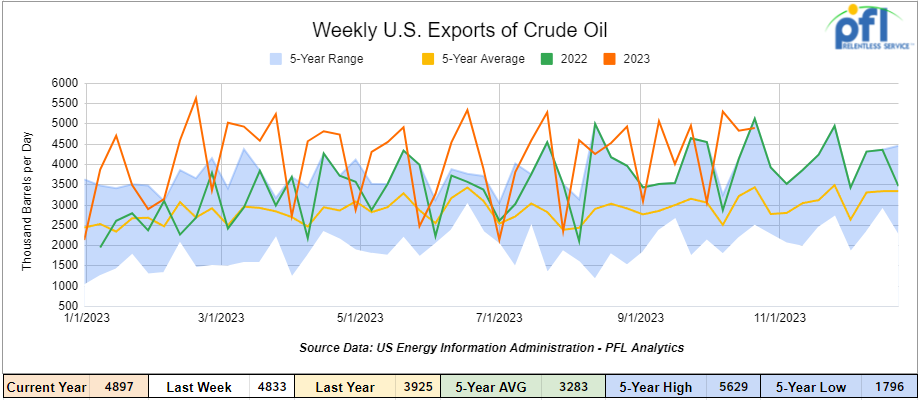

U.S. crude oil exports averaged 4.897 million barrels per day for the week ending October 27th, an increase of 64,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.525 million barrels per day.

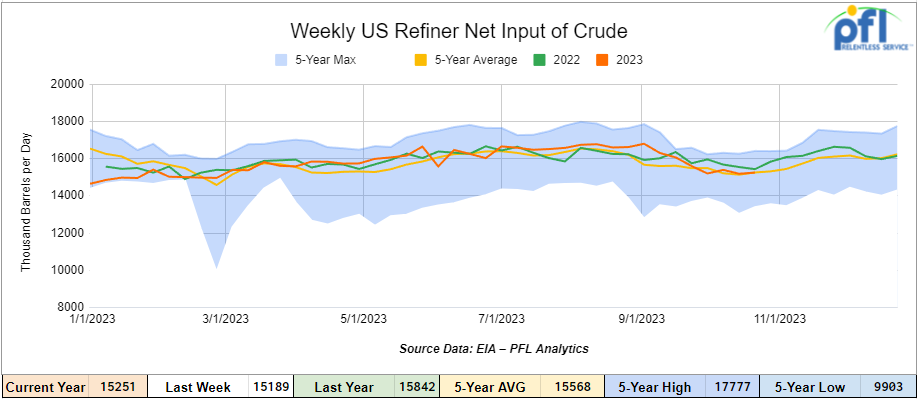

U.S. crude oil refinery inputs averaged 15.3 million barrels per day during the week ending October 27, 2023, which was 62,000 barrels per day more week-over-week.

WTI is poised to open at 77.13, down -0.04 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 8th, 2023.

Total North American weekly rail volumes were down (-1.58%) in week 44, compared with the same week last year. Total carloads for the week ending on November 8th, 2023 were 351,857, down (-2.61%) compared with the same week in 2022, while weekly intermodal volume was 325,449, down (-0.44%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-14.87%). The largest increase came from Other (+10.10%).

In the East, CSX’s total volumes were down (-0.44%), with the largest decrease coming from Grain (-27.85%) and the largest increase from Coal (+12.15%). NS’s volumes were up (+1.37%), with the largest decrease coming from Grain (-18.77%) and the largest increase from Chemicals (+10.45%).

In the West, BN’s total volumes were down (-2.5%), with the largest decrease coming from Grain (-16.09%), and the largest increase coming from Other (+68.93%). UP’s total rail volumes were down (-0.5%) with the largest decrease coming from Grain (-12.83%) and the largest increase coming from Petroleum and Petroleum Products (+12.36%).

In Canada, CN’s total rail volumes were down (-7.76%) with the largest increase coming from Other (+263.03%) and the largest decrease coming from Intermodal (-29.57%). CP’s total rail volumes were down (-5.72%) with the largest decrease coming from Nonmetallic Minerals (-37.62%) and the largest increase coming from Coal (+28.54%).

KCS’s total rail volumes were down (-9.88%) with the largest decrease coming from Intermodal (-24.44%) and the largest increase coming from Motor Vehicles and Parts (+40.93%).

Source Data: AAR – PFL Analytics

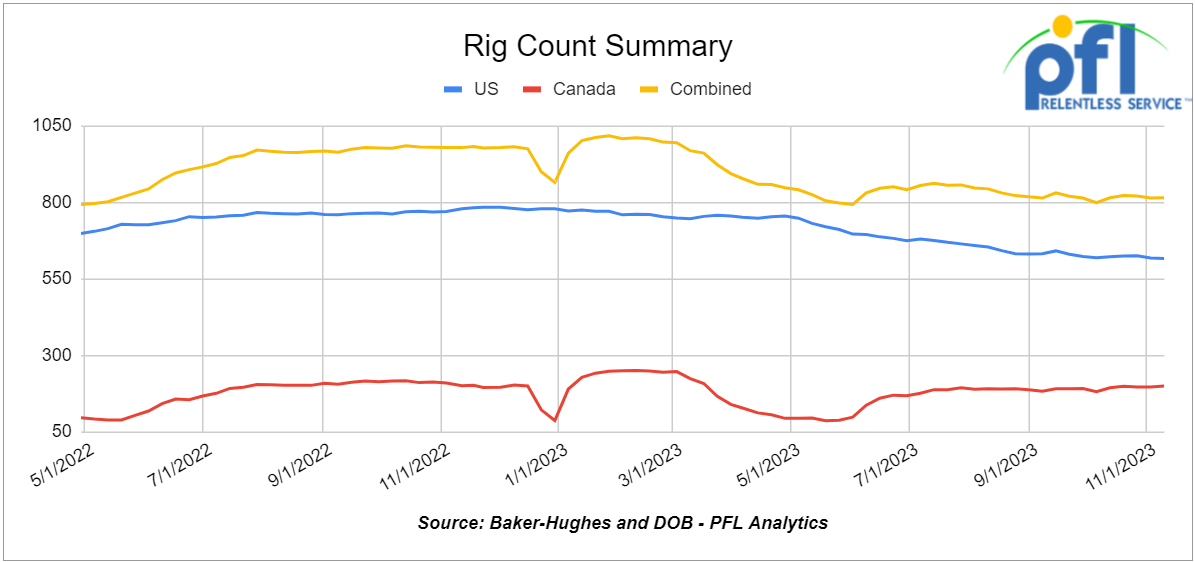

Rig Count

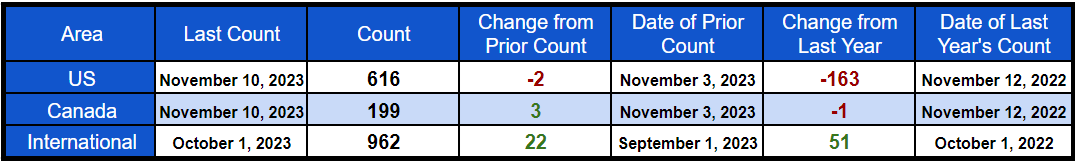

North American rig count was up by 1 rig week-over-week. U.S. rig count was down by -2 rigs week-over-week and down by –163 rigs year-over-year. The U.S. currently has 616 active rigs. Canada’s rig count was up by 3 rigs week-over-week but down by -1 rigs year over year. Canada’s overall rig count is 199 active rigs. Overall, year-over-year, we are down -164 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,244 from 28,226, which was a gain of +18 rail cars week-over-week. A slim gain week over week, but nevertheless the tenth consecutive week-over-week increase! Canadian volumes were mixed. CPKC’s shipments rose by +4.1% week over week, and CN’s volumes were lower by -0.5% week-over-week. U.S. shipments were lower across the board. The CSX had the largest percentage decrease and was down by -10.9%

We are watching Mexico

The problem with trying to manage a business today is no one really knows what the government is going to do to you and with a stroke of a pen, executive order, and in what it feels is in the public’s best interest or in their own interest. Those decisions as we know can be radical, not make sense, and can change your life overnight! Mexico is no exception to this unfortunate reality.

Mexican President Andrés Manuel López Obrador said Wednesday that he will issue a decree requiring the nation’s freight rail operators to offer passenger service or to allow government-operated passenger trains to run on their routes.

Lopez Obrador made this announcement at a press conference on Wednesday of last week. A clause in the concession agreements for CPKC de Mexico and Grupo Mexico allows for the railways to be used for passenger service and gives the concession holders preference to operate the service. The Associated Press reports he disputed a suggestion that the move amounted to expropriation of private property: “This is not an expropriation, it is in the Constitution and the law,” he said. “According to the law, passenger trains have priority.”

Virtually no regular passenger service currently operates in Mexico.

Earlier this year, the government seized a line operated by Grupo Mexico’s Ferrosur, saying it needed the line to complete a route connecting ports on the Pacific Coast and the Gulf of Mexico. The government later extended Ferrosur’s concession for eight years in compensation for the move. Good luck with this one CPKC!

We are watching Transportation

Folks, there are quite a few things happening right now outside of rail that ultimately affect our traffic:

Let’s take a look at the Panama Canal:

A record-setting drought has dramatically increased transit times through the Panama Canal, most of the focus has been on higher-capacity ships: the container vessels, liquefied natural gas carriers, and liquefied petroleum gas carriers that use the larger Neopanamax locks.

However, there’s another shipping segment that’s seeing major fallout: the dry bulk vessels carrying U.S. grain that use the smaller Panamax locks.

Trade patterns have already seen a major shift, with the majority of these dry bulk vessels now opting for the longer route via the Suez Canal.

Grain cargoes out of the U.S. Gulf to China and Asia is the typical trade historically, but now ships are being routed through the Suez, which adds about 10 days and is slightly more expensive in terms of canal dues ultimately costing our farmers more money. In addition, this shift has led to fewer vessels available to load American grain exports, pushing up freight rates and double whammy trapping grain here in the U.S. which untimely leads to less grain traffic on our railroads.

The heightened importance of the Suez Canal to U.S. agriculture in the wake of Panama Canal restrictions raises another concern: The Suez Canal itself faces risks on the geopolitical front. The Suez Canal has been shut due to military action involving Israel twice before, in 1956 and in 1967-1975.

Any restrictions to Suez Canal transits due to an escalation of the Israel-Hamas war would lead to even more rerouting of U.S. agribulk exports, and even longer voyages via the Cape of Good Hope.

USDA data on inspections of agribulk export cargoes shows year-to-date volumes through early November are down 22% versus the same period in 2022 and 27% versus the same period in 2021.

Let’s take a look at FedEx and UPS

With freight volumes at FedEx and UPS significantly lower, they are both making changes. Pilots that were once in high demand by Cargo carriers are shifting.

Pat DiMento, FedEx’s vice president of flight operations and training, said on Friday of last week in a memo to flight crews that the airline is “significantly overstaffed” and can’t guarantee pilots more than the minimum number of hours set in their contracts.

FedEx is encouraging pilots at its cargo airline to take jobs at a regional passenger carrier because there isn’t enough shipping demand to fill everyone’s flying schedules.

Meanwhile, nearly 200 senior pilots at UPS have accepted the company’s voluntary severance package, and regional passenger airline PSA Airlines is trying to recruit them to close a crew shortage.

The headcount reduction at UPS Airlines is much more limited than the one envisioned at FedEx Express, where management has acknowledged it has more than 700 excess pilots.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 Years. Cars are needed for use in Flyash service.

- 20, 30K 117R or 117J Tanks needed off of UP or BN in Midwest for 6 Months. Cars are needed for use in Ethanol service.

- 150, 29.2K 117R, 117J, DOT 111 Tanks needed off of CN or CP in Sarnia for 1 Year. Cars are needed for use in Fuel Oil service.

- 50, 23.5-25.5 Dot 111 Tanks needed off of Any Class 1 in USA for 5 Years. Cars are needed for use in Asphalt service.

- 3, 23.5-25.5 Any Tanks needed off of Any Class 1 in Port Allen, LA for 90 Days. Cars are needed for use in Fuel Oil service.

- 3, 23.5-25.5 Any Tanks needed off of Any Class 1 in Natchez, MS for 90 Days. Cars are needed for use in Fuel Oil service.

- 100, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined product services.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Years. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

Lease Offers

- 10, 28.3K, 117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 75, 29.2K, DOT 111 Tanks located off of BN, CP in Moving In Midwest. Cars were last used in Bio. Free Move

- 30, 31.8K, CPC 1232 Tanks located off of UP, BN in Texas. Cars were last used in Diesel. Call 239-390-2885 for more information

- 25, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Heavy Fuel Oil. Call 239-390-2885 for more information

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|