“Many of life’s failures are people who did not realize how close they were to success when they gave up.”

– Thomas Edison

Jobs Update

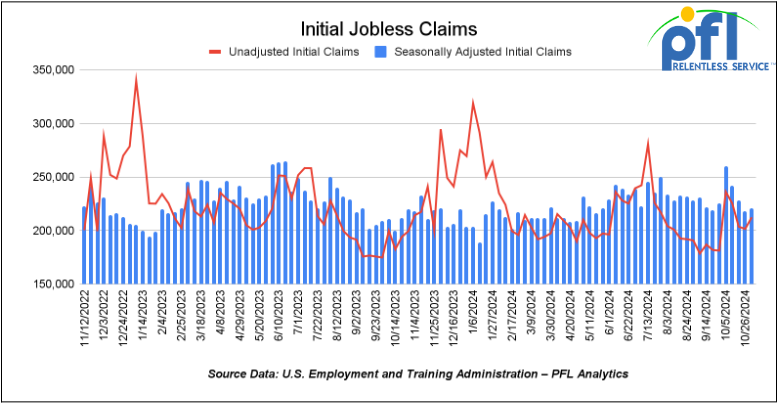

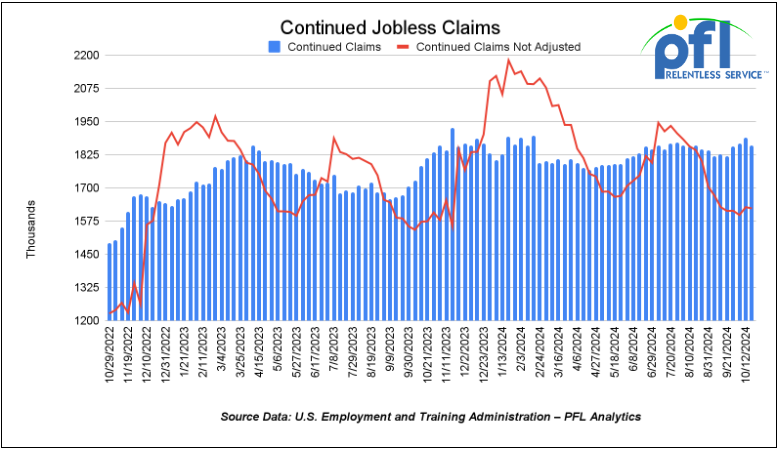

- Initial jobless claims seasonally adjusted for the week ending November 2nd came in at 221,000, up 3,000 people week-over-week.

- Continuing jobless claims came in at 1.892 million people, versus the adjusted number of 1.853 million people from the week prior, up 39,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 259.65 points (0.59%) and closing out the week at 43,988.99, up 1,936.8 points week-over-week. The S&P 500 closed higher on Friday of last week, up 22.44 points (0.38%) and closed out the week at 5,995.54, up 266.74 points week-over-week. The NASDAQ closed higher on Friday of last week, up 17.32 points (0.09%) and closed out the week at 19,286.78, up 1,046.86 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 44,295 this morning up 154 points.

Crude oil closed lower on Friday of last week, but higher week over week.

West Texas Intermediate (WTI) crude closed down -$1.98 per barrel (-2.7%) to close at $70.35 per barrel on Friday of last week, up $0.86 per barrel week over week. Brent traded down -$1.76 USD per barrel (-2.3%) on Friday of last week, to close at $73.87 per barrel, up $0.77 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for December delivery settled Friday of last week at US$11.85 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 59.98 per barrel.

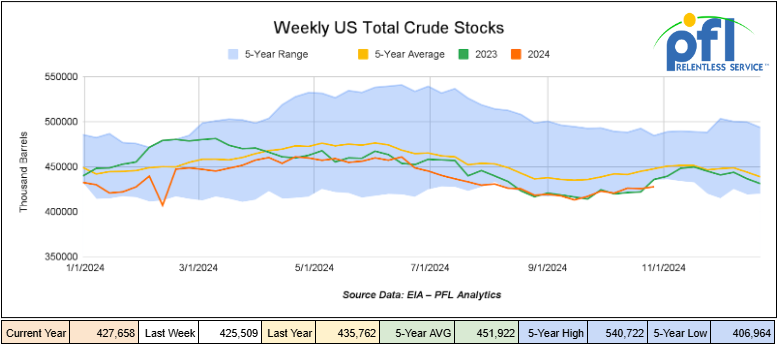

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.1 million barrels week-over-week. At 427.7 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

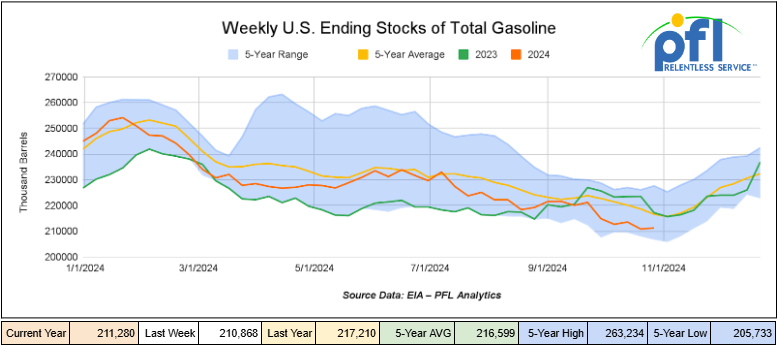

Total motor gasoline inventories increased by 400,000 barrels from last week and are 2% below the five-year average for this time of year.

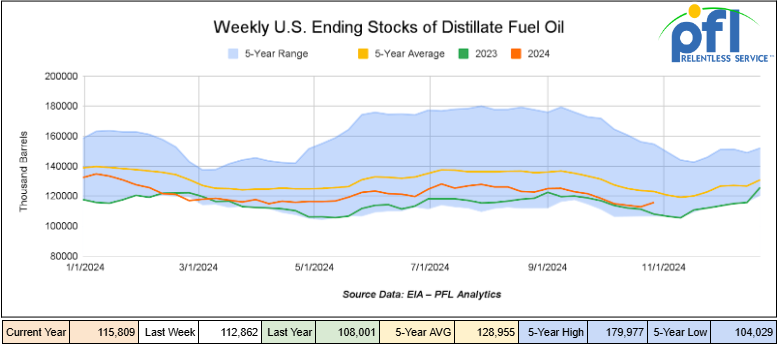

Distillate fuel inventories increased by 2.9 million barrels week-over-week and are 6% below the five-year average for this time of year.

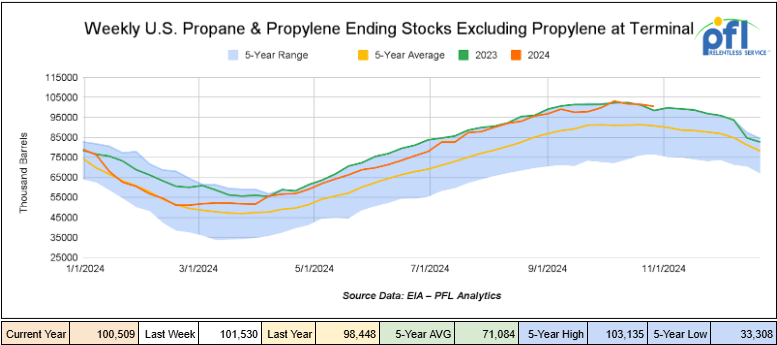

Propane/propylene inventories decreased by 1.0 million barrels week-over-week and are 11% above the five-year average for this time of year.

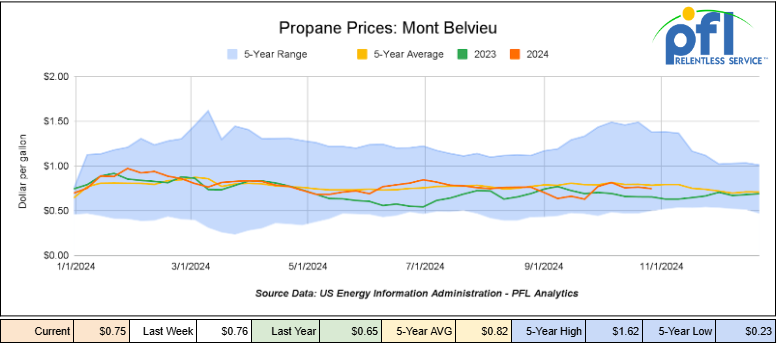

Propane prices closed at 75 cents per gallon on Friday of last week, down 1 cent per gallon week-over-week, but up 10 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 1.1 million barrels during the week ending November 1st, 2024.

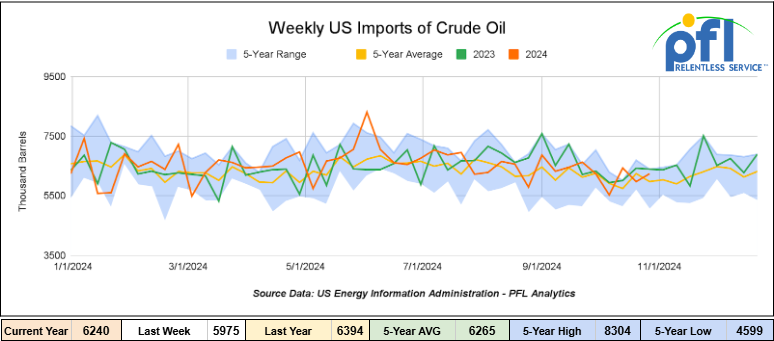

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending November 1st, 2024, an increase of 265,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.0 million barrels per day, 2.4% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 229,000 barrels per day, and distillate fuel imports averaged 162,000 barrels per day during the week ending November 1st, 2024.

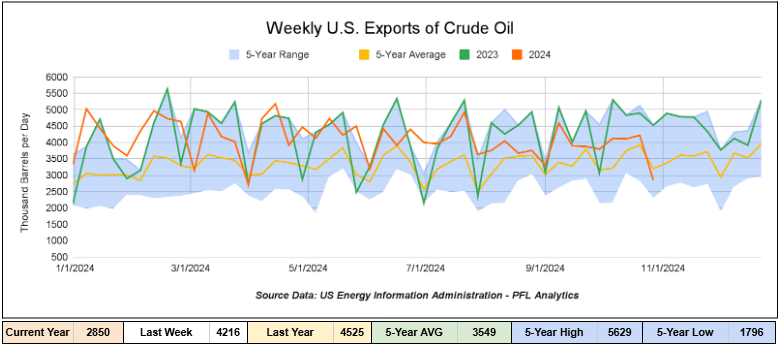

U.S. crude oil exports averaged 2.85 million barrels per day during the week ending November 1st, 2024, a decrease of 1.366 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.825 million barrels per day.

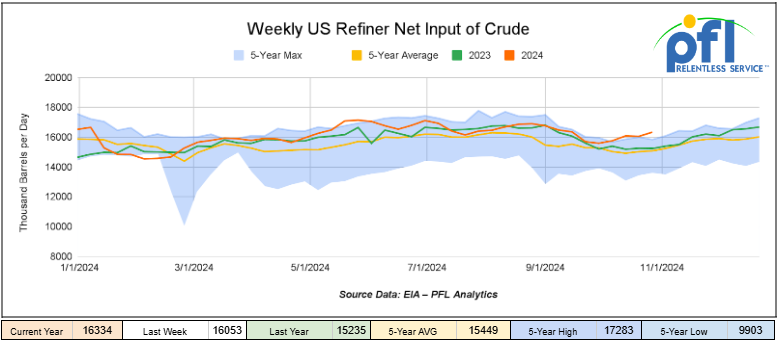

U.S. crude oil refinery inputs averaged 16.3 million barrels per day during the week ending November 1, 2024, which was 281,000 barrels per day more week-over-week.

WTI is poised to open at $69.38, down $1 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 6th, 2024.

Total North American weekly rail volumes were up (4.97%) in week 45, compared with the same week last year. Total carloads for the week ending on November 6th were 353,801, up (0.55%) compared with the same week in 2023, while weekly intermodal volume was 357,154, up (9.74%) compared to the same week in 2023. 8 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-14.21%). The most significant increase came from Grain, which was up (+10.74%).

In the East, CSX’s total volumes were up (6.25%), with the largest decrease coming from Coal (-10.48%) while the largest increase came from Petroleum and Petroleum Products (+26.3%). NS’s volumes were up (7.97%), with the largest increase coming from Grain (+39.26%), while the largest decrease came from Chemicals (-7.92%).

In the West, BN’s total volumes were up (+7.62%), with the largest increase coming from Nonmetallic Minerals (+15.88%) while the largest decrease came from Other, down (-23.13%). UP’s total rail volumes were up (2.65%) with the largest decrease coming from Coal, down (-25.13%), while the largest increase came from Other, which was up (+20.44%).

In Canada, CN’s total rail volumes were down (-1.54%) with the largest decrease coming from Other, down (-21.83%) while the largest increase came from Nonmetallic Minerals, up (+28.74%). CP’s total rail volumes were down (-6.12%) with the largest increase coming from Other (+33.33%), while the largest decrease came from Coal (-37.76%). KCS’s total rail volumes were down (-4.5%) with the largest decrease coming from Coal (-43.05%) and the largest increase coming from Forest Products (+41.76%).

Source Data: AAR – PFL Analytics

Rig Count

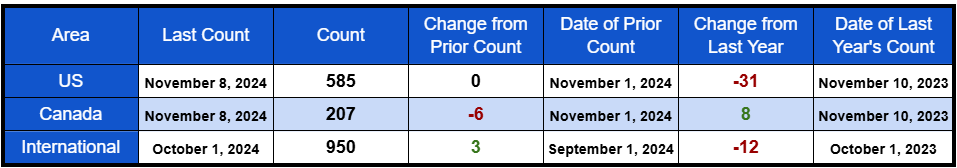

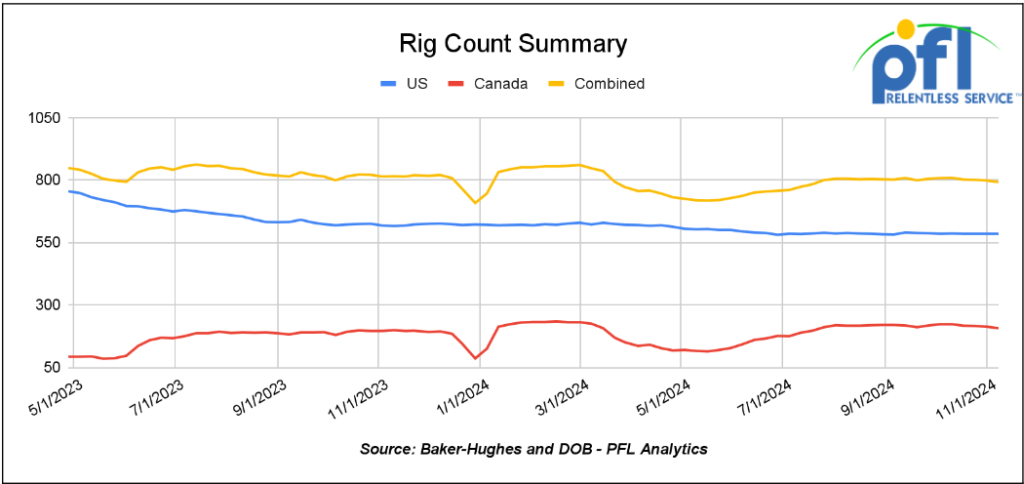

North American rig count was down by -6 rigs week-over-week. U.S. rig count was flat week-over-week, but down by -31 rigs year-over-year. The U.S. currently has 585 active rigs. Canada’s rig count was down -6 rigs week over week, but up by 8 rigs year-over-year and Canada’s overall rig count is 207 active rigs. Overall, year over year we are down by -23 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,140 from 29,097, which was a gain of 43 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments were higher by +1.6% week over week, CN’s volumes were higher by +2.0% week-over-week. U.S. shipments were down across the board. The CSX had the largest percentage decrease and was down by -7.8%.

We are Watching the Green Agenda

It is a true battle out there! North of the border in Canada, Prime Minister Justin Trudeau continues with the green agenda. While down here in the United States, it is about to change with the decisive victory of President Trump in last week’s election.

Cap and Trade in Canada:

On Monday of last week, the federal government of Canada introduced draft regulations to put a limit on greenhouse gas emissions from the oil and gas sector.

The proposed regulations involve a cap-and-trade system that works in three-year periods. The first compliance period of 2030 to 2032 is set at 35 percent below 2019 emissions. Ottawa expects final regulations for this cap in 2025, and reporting and verification requirements for large operators to begin in 2026.

“Our analysis shows production of oil and gas, GDP growth, and jobs in the sector will all continue to grow substantially from today with the emissions cap in place,” said a senior official from the federal government during a technical briefing on the cap on Monday of last week.

“For example, our modeling suggests oil and gas production is expected to grow by 16 per cent from 2019 levels in the 2030 to ’32 period, while still leading to emission reductions.”

While the federal government said the proposed regulations put a limit on emissions, not production, many vehemently disagree.

Alberta immediately fought back! “Make no mistake, this cap violates Canada’s constitution,” said the Alberta government, upon immediate release of the feds’ plan.“ Section 92A clearly gives provinces exclusive jurisdiction over non-renewable natural resource development yet this cap will require a one million barrel a day production cut by 2030.”

Alberta Premier Danielle Smith, during a press conference on Monday, said bluntly “I’m pissed,” and Smith replied “I’m absolutely angry.“ “Because we have been working with these guys for two years, because we have a plan that would reduce emissions responsibly by 2050.”

Smith went on to say “they continue to act like they are working collaboratively with us and then they come out with exactly the same policy they put forward a year ago, with no changes whatsoever. And then they are trying to mislead the public about its intent and mislead the public about our true record.”

Smith was asked to respond to a comment by Steven Guilbeault, Minister of Environment and Climate Change of Canada, at a press event in which he and other ministers announced the draft regulations. He responded to a question about the Alberta government’s Scrap the Cap campaign.

“It’s more hot air and disinformation on the part of the conservative movement in Canada,” he said.

“Whether it is (Conservative Party of Canada Leader) Pierre Poilievre, whether it is Danielle Smith, whether it is (Saskatchewan Premier) Scott Moe, pretending climate change isn’t happening in the face of mounting climate impacts and dramatic impacts on the lives of Canadians — also the costs to the Canadian economy. They will continue doing stupid things and we will continue focusing on helping Canadians to create a robust economy, good jobs, and work to protect the environment.”

The federal minister is not helping Canadians, replied Smith, he’s “harming” them, noting corresponding job and revenue losses, among other impacts from the cap.

We are watching this one, folks – there is an election in Canada next year, we will see what the people decide.

The Green Agenda in the U.S.:

Does the Green Agenda continue here in the U.S.? It is our belief it will to a certain extent, but it will be more localized to a certain degree depending on your beliefs, and individual and state beliefs and objectives.

Oil and Natural Gas Production:

Trump mentioned in his victory speech that “we have more liquid gold than any country in the world,” which ties in with previous comments from the President-elect that the U.S. will “Drill, baby, drill.” While the incoming administration will hold a more favorable view towards the oil and gas industry, ultimately the potential for production growth is going to be largely dictated by price.

According to the quarterly Dallas Fed Energy Survey, oil producers need US$64 per barrel to profitably drill a new well, and the Kansas Fed Energy Survey shows a similar number. This compares to 2025 and 2026 forward prices of around $70 per barrel and $67 respectively. Easing regulations will obviously have an impact on these break-even numbers.

Any upside in oil production would likely also provide an upside to natural gas output through associated production. A Trump presidency may also provide more certainty to the industry and provide comfort to them to invest in pipeline infrastructure, alleviating a persistent bottleneck for the U.S. natural gas market, particularly in the Permian Basin. Investment in natural gas pipeline capacity also leaves the potential for stronger crude oil output.

In addition, under Trump’s presidency, we are likely going to see a lifting of Biden’s pause on LNG export project approvals. While this does not change the short-to-medium-term outlook for the global LNG market, it will help remove some of the longer-term uncertainty around LNG supply.

Wind and Solar:

We expect any Federal subsidies given to these industries to end quickly because Trump said they would. There are many projects in play that have been promised loan guarantees and grants. We are watching this one.

Agriculture and waste Renewables:

There seems to be quite a bit of infrastructure set up already and this is good for farmers. Again, there will be more influence from individual states moving forward. However, on Friday of last week during the lame duck session, a bipartisan pair of legislators introduced a bill to the U.S. House of Representatives that would extend a tax credit for second-generation biofuels producers by a year, out to Dec. 31, 2025.

Adding another year to the tax credit would benefit industry stakeholders participating in the scheme, according to the bill’s sponsors, Reps. Mariannette Miller-Meeks (R-Iowa) and Sharice Davids (D-KS).

Biofuels producers are “lacking the market certainty they need to make critical investments” due to the federal government’s delay in issuing guidance for a separate biofuels tax credit scheme scheduled to begin on January 1, 2025, the representatives said in a joint news release.

That incoming scheme — known as the Clean Fuel Production Credit, or 45Z — was established in the Inflation Reduction Act of 2022 and aims to offer producers a credit ranging from 35cts to $1.75 per gallon for SAF and 20cts to $1/gal for all other fuels. That scaling credit amount will reward producers for their ability to reduce the carbon intensity of their product below the 50 kg of CO2/MMBtu baseline established in the IRA. That same bill extended the second-generation biofuels tax credit to Dec. 31, 2024.

We are watching Key Economic Indicators

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50.

The Manufacturing PMI in October 2024 was 46.5%, down from 47.2% in September and 47.2% in August. This marks the eighth month of contraction in 2024 and the sixth consecutive month below 50%. An ongoing manufacturing slump has dampened carload volumes. October also marked the seventh consecutive month of contraction in manufacturing, carload volumes for key industrial commodities — like metallic ores, crushed stone and metals — remain subdued, reflecting weaker demand in the sector. In a bit of better news, the new orders subindex showed signs of stability, indicating gradual adjustments in demand and production.

Consumer Spending

In September 2024, total consumer spending adjusted for inflation rose a preliminary 0.2% over August 2024. This follows a revised increase of 0.3% in August and a drop of 0.2% in July. Year-over-year inflation-adjusted total spending in September 2024 was up 2.3%.

Inflation-adjusted spending on goods rose a preliminary 0.4% in September, following the 0.5% decline in July 2024. Inflation-adjusted spending on services rose 0.1% in September, marking the thirteenth consecutive month-to-month increase.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Prodcuts service.

- 10, 25.5K-29K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 90, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Fuel OIl. 2-3 Year Term

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. Winter Lease

- 50, 30K, 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of Multiple in All over. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations. Will take 90K

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 50, 17K, DOT 111 Tanks located off of Multiple in All over.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website