“You become what you think about”

– Napoleon Hill

Jobs Update

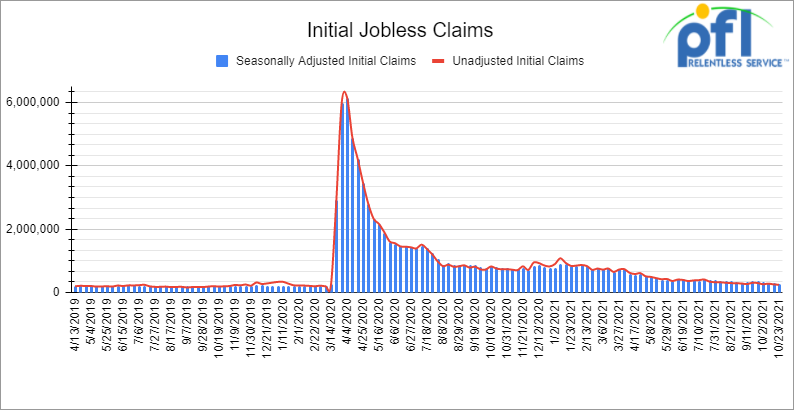

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending October 23rd came in at 281,000, down -10,000 people week over week.

- Continuing claims came in at 2.243 million people versus the adjusted number of 2.480 million people from the week prior, down -237,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed higher on Friday of last week – higher week over week

The DOW closed higher on Friday of last week, up 89.08 points (+0.25%), closing out the week at 35,819.56 points, up 142.54 points week over week. The S&P 500 closed higher on Friday of last week, up 8.96 points (+0.19%) and closed out the week at 8,605.38, up 60.48 points week over week. The Nasdaq closed higher on Friday of last week, up 50.27 points (+0.33%) and closed out the week at 15,498.39, up 408.19 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 35,857 this morning up 153 points.

Oil up on Friday of last week and up week over week yet again

Oil posted a monthly gain of 11% on signs that consumption is outpacing supply and draining stockpiles. Oil’s advance last month was a result of an ongoing shortage of natural gas, which has boosted demand for oil products such as heating oil, bunker fuels and even coal. At the same time, rising margins for finished products such as heating oil and gasoline bodes that crude consumption will remain strong as refiners continue to process more to meet demand. At this point, as we head into November, the official start of the heating season for Natural Gas (if you are in LPG’s that already started on October 1) is going to be all about the weather in determining where pricing and inventory levels take us. We touch more on the weather later on in this report and what you can expect at least according to government officials. OPEC’s next meeting is November 4 – let’s see if they decide to increase production. On the natural gas front, Russia, as predicted, has come to Europe’s rescue. Prices were simply too good to resist! WTI for December delivery rose 76 cents to settle at $83.57 a barrel on Friday of last week. Brent for December settlement, which expired Friday, climbed six cents to $84.38 a barrel. The more active January contract added 6 cents to end the session at $83.72 a barrel.

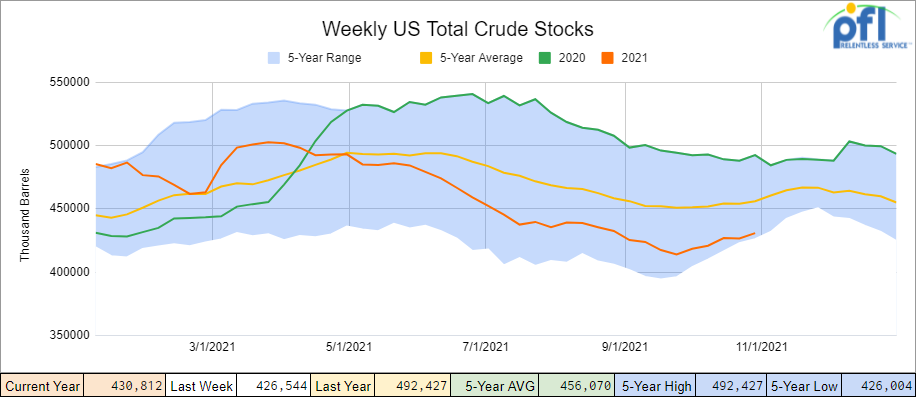

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.3 million barrels week over week. At 430.8 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

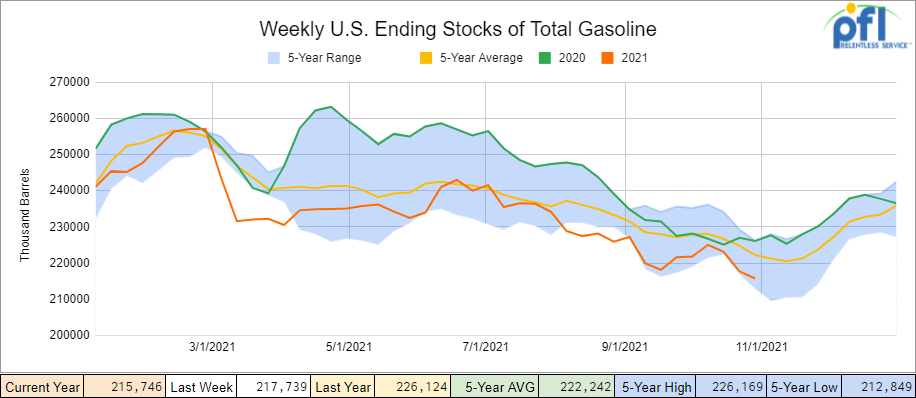

Total motor gasoline inventories decreased by 2.0 million barrels week over week and are 3% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

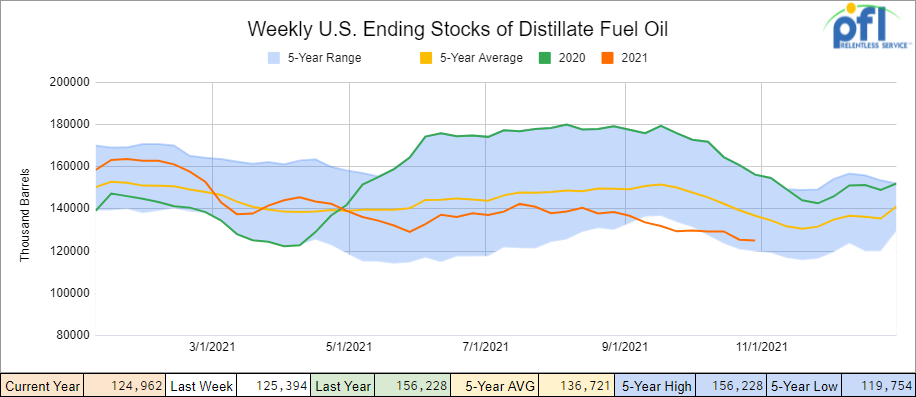

Distillate fuel inventories decreased by 400,000 barrels week over week and are 8% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

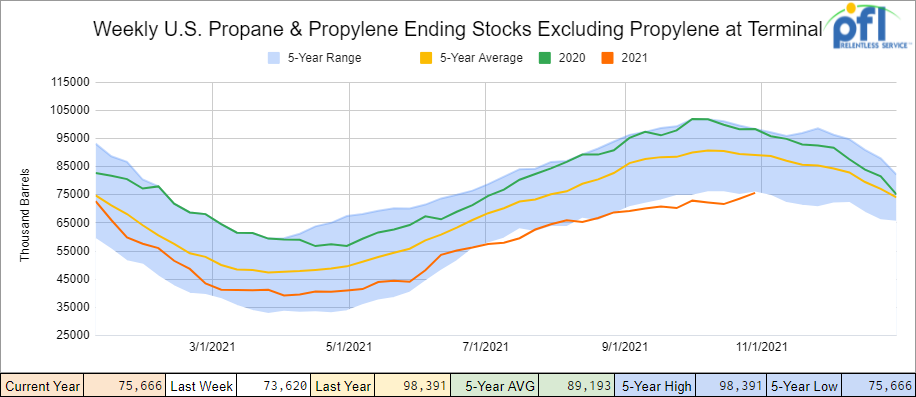

Propane/Propylene inventories increased by 2.0 million barrels week over week and are 15% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

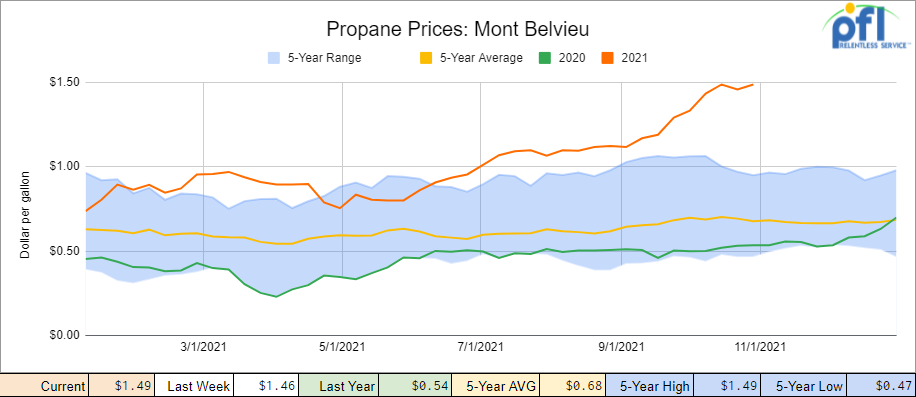

Propane prices did increase week over week gaining back the 3 cents per gallon that it lost the week prior and we had another significant increase in stocks week over week. The world energy crisis may be calming from the last couple of weeks of hysteria – here is what we know:

- Asia LNG prices fell for a second straight week, tracking losses in European wholesale gas prices after Russia’s president said Gazprom could start pumping gas into European storage soon, easing competition for Asia. European gas prices fell on Thursday of last week after Russian President Vladimir Putin told the head of Kremlin-controlled energy giant Gazprom, to start pumping natural gas into European gas storage once Russia finishes filling its own stocks, which may happen as early as November 8th.

- The average LNG price for December delivery into Northeast Asia fell to $31 per mmBtu, down $3.50 per mmBtu, or roughly 10% week over week.

- Lower demand was seen from China and India for LPG’s and LNG where buyers have mostly remained on the sidelines. China has been ramping up crude refining production and using more coal fired generation to dig itself out of the hole.

- Some LNG cargoes were offered or sold from Australia and Oman, which helped dampen further price spikes last week.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories increased by 4.4 million barrels week over week.

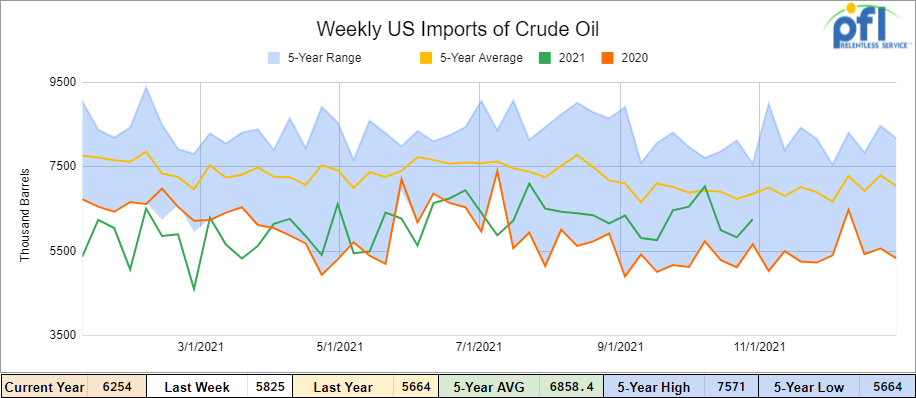

U.S. crude oil imports averaged 6.3 million barrels per day for the week ending October 22, 2021, up by 430,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 15.2% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) for the week ending October 22, 2021 averaged 493,000 barrels per day, and distillate fuel imports averaged 325,000 barrels per day.

Source Data: EIA – PFL Analytics

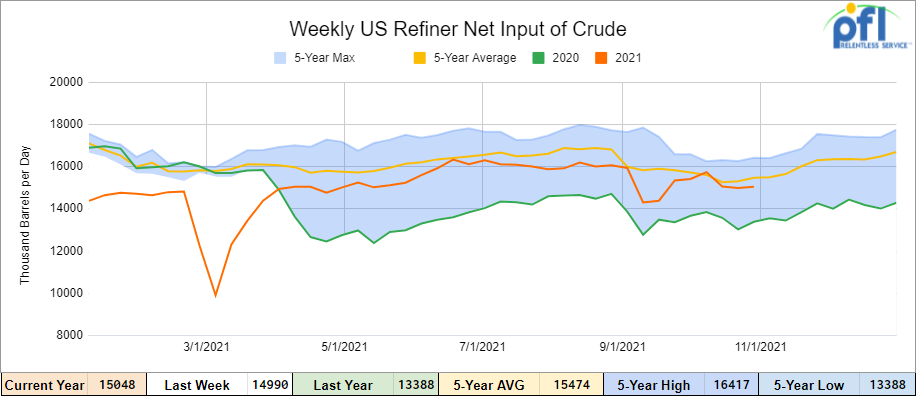

U.S. crude oil refinery inputs averaged 15.0 million barrels per day during the week ending October 22, 2021 which was 58,000 barrels per day more than the previous week’s average. Refineries operated at 85.1% of their operable capacity last week.

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at $84.19, up 62 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.4% year over year in week 42 (U.S. -2.3%, Canada -6.5%, Mexico -6.4%) resulting in quarter to date volumes that are down 4.0% and year to date volumes that are up 6.9% year over year (U.S. +8.0%, Canada +4.1%, Mexico +3.6%). 4 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decline coming from intermodal (-8.3%). The largest increase came from coal (+12.8%).

In the East, CSX’s total volumes were down 0.6%, with the largest decreases coming from motor vehicles & parts (-25.8%) and intermodal (-3.5%). NS’s total volumes were down 3.2%, with the largest decrease coming from intermodal (-6.6%).

In the West, BN’s total volumes were up 2.6%, with the largest increase coming from coal (+23.1%). The largest decrease came from intermodal (-4.8%). UP’s total volumes were down 5.4%, with the largest decrease coming from intermodal (-13.9%). The largest increase came from coal (+22.1%).

In Canada, CN’s total volumes were down 5.7%, with the largest decrease coming from intermodal (-14.5%). The largest increases came from coal (+41.0%) and stone sand & gravel (+78.1%). Revenue per ton miles was down 5.5%. CP’s total volumes were down 3.4%, with the largest decreases coming from farm products (-55.5%), motor vehicles & parts were down (-42.4%) and intermodal was down (-4.6%). Revenue per ton miles was up 1.3%.

KCS’s total volumes were down 7.6%, with the largest decrease coming from intermodal (-13.9%).

Source: Stephens

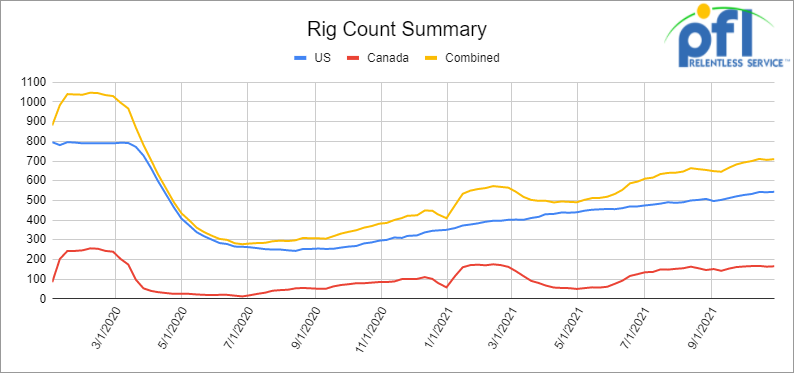

Rig Count

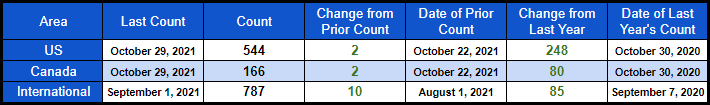

North American rig count is up by 4 rigs week over week. The U.S. rig count was down by 2 rig week over week but up by 248 rigs year over year. The U.S. currently has 544 active rigs. Canada’s rig count was down up 4 rigs week over week, and up by 80 rigs year over year and Canada’s overall rig count is 166 active rigs. Overall, year over year we are up 328 rigs collectively.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,033 from 24,016, a loss of 983 rail cars week over week. Canadian volumes were vertically flat with both CN and CP shipments were up by less than 1%. U.S. volumes were mostly lower week over week. The BN had the largest percentage increase, up by 7.8% while the NS had the biggest percentage decline down by 13.6%.

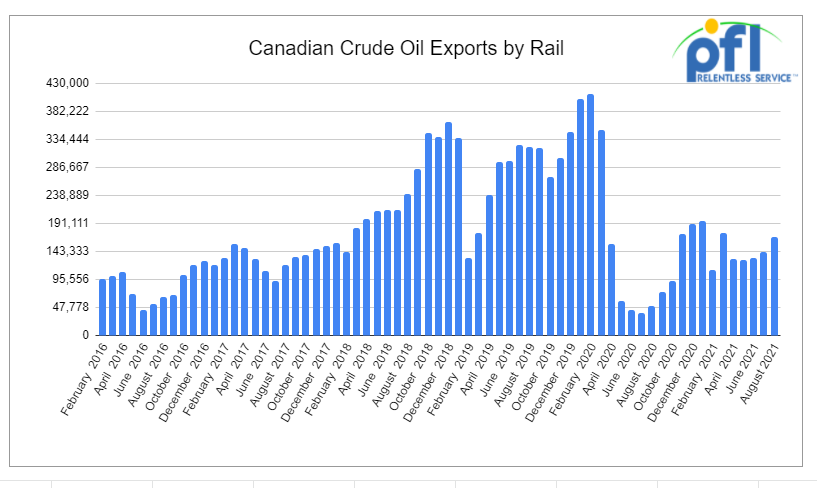

Canadian Crude Oil Exports by Rail

According to the Canadian Energy Regulator, crude by rail exports averaged 168,659 barrels per day for the month ending August 2021. Volumes exported out of Canada have been steadily increasing since May of 2021, but are a far cry from the peak of January 2019 where crude by rail exports averaged 403,767 barrels per day.

Source Data: Canadian Energy Regulator – PFL Analytics

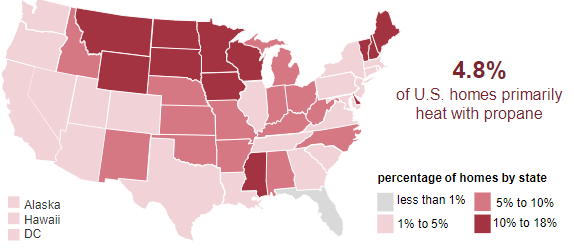

Domestic Propane Hitting Consumers Hard

According to the EIA, the average U.S. residential price of propane reached $2.59 per gallon as of October 4, 2021, the highest price reported for the first week of the winter heating season since 2011. The winter heating season for propane runs from October 1st through March 31st. Prices during the first four weeks of the current winter heating season were 49% higher than the same time last winter.

This year retail propane prices have risen with wholesale propane spot prices that reflect greater global demand and tight global supply. That tightness is reflected in inventory levels in the United States. U.S. propane and propylene inventories started this winter season lower than in recent years; weekly U.S. inventories are averaging 28% lower than the same time last year and 21% lower than their recent five-year (2015–2020) average although as indicated earlier in today’s rail report we did have a nice build for the week ending October 22, 2021, adding 2 million barrels to the stockpile.

According to the U.S. Census Bureau’s 2019 American Community Survey, propane is the primary home heating fuel in 5% of U.S. homes and tends to be more common in the Northeast and Midwest. At least 14% of homes in Vermont, New Hampshire, South Dakota, North Dakota, and Montana use propane as the primary heating fuel.

Propane as Primary Heating Fuel by State

It’s not just propane that is going to hurt, it is estimated that winter energy bills will cost at least $13.6B more this year than last year according to a Consumer Energy Alliance Analyst. American consumers will pay at least $13.6 billion more for energy this winter as prices for gasoline, natural gas, and propane surge due to poorly conceived energy policies, rising inflation, and a political environment that discourages investment in energy production and infrastructure, according to analysis by Consumer Energy Alliance (CEA), the leading energy and environmental advocate for families and businesses.

We Are Watching the Weather

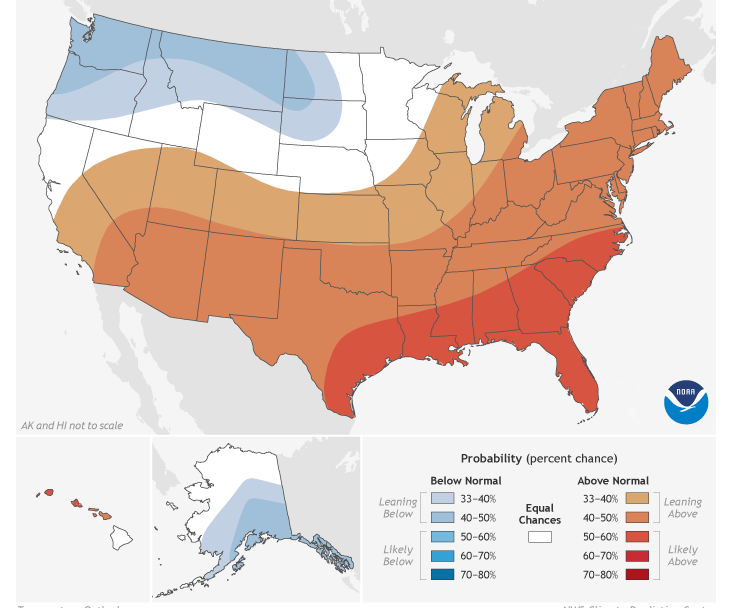

A lot of customers have been asking and/or talking about what the weather will do this winter and we quite frankly have been taking one day at a time here at PFL, but decided to do a little research on it and provide our readers with some insight. According to the National Oceanic and Atmospheric Administration (NOAA) in a news release issued on October 21, 2021 the winter here in the U.S. is expected to be warmer but wetter in certain areas as we see a return of La Nina.

Above-average temperatures are favored across the South and most of the Eastern U.S. In NOAA’s 2021 Winter Outlook — which extends from December 2021 through February 2022 — wetter-than-average conditions are anticipated across portions of the Northern U.S., primarily in the Pacific Northwest, Northern Rockies, Great Lakes, Ohio Valley and Western Alaska.

“Consistent with typical La Nina conditions during winter months, we anticipate below-normal temperatures along portions of the northern tier of the U.S. while much of the South experiences above-normal temperatures,” said Jon Gottschalck, chief, Operational Prediction Branch, NOAA’s Climate Prediction Center. “The Southwest will certainly remain a region of concern as we anticipate below-normal precipitation where drought conditions continue in most areas.” (See below)

Winter 2021 -2022 Temperature Outlook

Source: NOAA

Minimum Global Corporate Tax Heading our Way

In case you missed it, leaders of the world’s 20 biggest economies endorsed a US proposal for a global minimum corporate tax of 15% in Rome over the weekend. The G20 plans to have the rules in force in 2023. The proposal will still need to be ratified by participating countries. In the US, given the route treaties must take, that could require two-thirds approval in a Senate. G20 nations include: Argentina, Australia, Brazil, Canada, China, France, Germany, Japan, India, Indonesia, Italy, Mexico, Russia, South Africa, Saudi Arabia, South Korea, Turkey, the United Kingdom, the United States, and the European Union. Spain is also invited as a permanent guest.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 30-50 340 Pressure cars for propane starting Nov 3 month lease in Alberta CP or CN

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|