“The ignorance of one voter in a democracy impairs the security of all”

John F. Kennedy

COVID 19 and Markets Update

The United States currently has 8,889,577 confirmed COVID 19 cases and 230,510 confirmed deaths.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 787,000 initial jobless claims. The number of first-time filers for unemployment benefits were lower than expected and finally broke 800,000.

DOW and NASDAQ

The DOW closed lower on Friday, down -28.08 points (-0.10%) to finish out the week at 28,335.57 28, down 270.74 points week over week. The S&P 500 traded higher 11.90 points (0.34%) on Friday, closing at 3,465.39, down 18.42 points week over week. The Nasdaq finished Friday’s session higher, gaining 42.28 points (-.37%) and closing out the week at 11,548.28, down 123.28 points week over week. In overnight trading, DOW futures traded lower and are expected to open down this morning -244 points.

Oil Markets

Oil prices declined on Friday of last week WTI traded down 79 cents to close at $39.85, a loss of $1.03 (-2.5%) per barrel week over week.

Brent traded down 69 cents on Friday of last week to close at $41.77, a loss of $1.16 (-2.7%) per barrel week over week.

U.S. crude inventories decreased by -1.002M/bbls last week and now stand at 489.101 MM/bbls, according to the EIA. Consensus was in line with forecasts, however, production fell 600K bpd. Refinery utilization was also down 2% to 72.9%. U.S. gasoline inventories increased by 1.895M/bbls last week and now stand at 257.016 MM/bbls. Consensus was for a draw of -1.520M/bbls. U.S. gasoline demand is weakening, prompting refineries to additionally cut capacity utilization and crude processing in a sign that resurging coronavirus cases are derailing fuel demand recovery. Demand fell to 8.289 mb/d for the week ending on October 16, down from 8.576 mb/d a week earlier and 8.896 mb/d two weeks earlier. U.S. distillate inventories were down by -3.832MM/bbls and now stand at 160.719 MM/bbls. Consensus was for a draw of -1.720MM/bbls.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $38.84, down $1.01 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 2.6% year over year in week 42 (U.S. +2.2%, Canada +7.9%, Mexico -13.0%), resulting in quarter to date volumes that are up 1.8% and year to date volumes that are down 9.2% (U.S. -9.8%, Canada -6.7%, Mexico -10.8%). 7 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+10.0%) and grain (+19.2%). The largest decrease came from coal (-20.4%).

In the East

CSX’s total volumes were up 5.0%, with the largest increase coming from intermodal (+11.9%). The largest decrease came from coal (-10.3%). NS’s total volumes were down 1.5%, with the largest decreases coming from coal (-27.2%) and petroleum (-52.0%). The largest increase came from intermodal (+5.2%).

In the West

BN’s total volumes were up 1.8%, with the largest increases coming from intermodal (+15.4%) and grain (+23.0%). The largest decreases came from coal (-23.2%), petroleum (-30.5%) and stone sand & gravel (-41.3%). UP’s total volumes were up 1.8%, with the largest increases coming from intermodal (+10.9%) and grain (+25.8%). The largest decreases came from coal (-23.9%), petroleum (-38.9%) and chemicals (-8.7%).

In Canada

CN’s total volumes were up 8.8% with the largest increases coming from intermodal (+18.9%) and metallic ores (+33.7%). The largest decrease came from petroleum (-23.8%). RTMs were up 8.3%. CP’s total volumes were up 4.8%, with the largest increases coming from grain (+35.5%) and farm products (+64.0%). The largest decrease came from petroleum (-29.0%). RTMs were up 8.9%.

Kansas City Southern

KCS’s total volumes were down 5.8%, with the largest decrease coming from intermodal (-14.3%).

Source: Stephens

Folks, if rail is any indication of economic indicators, which we believe it is, we are getting very bullish on the economy and think we could be in for a ride in 2021. If you take crude and coal out of the equation rail is doing fantastic. Consumers are spending and business spending continues to move higher. Here at PFL we have seen subleases extremely active, which is a great sign. It is our belief post election no matter who wins blue states will have no choice, but to reopen their economies as the American people are done with it – COVID has been used as a political weapon and everyone knows it. Once this happens one may want to fasten their seatbelt we should be on the road again!

Things we are keeping an eye on

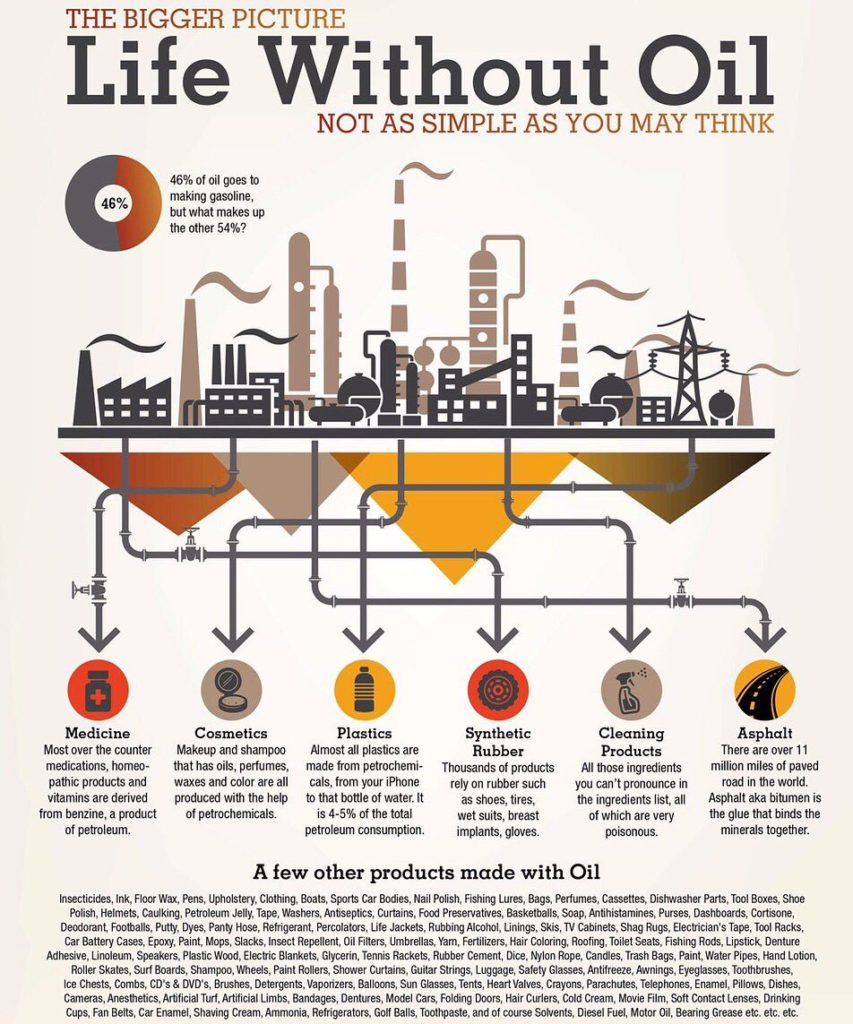

- We are watching the election folks – it’s hard not to and we think America is ready for it to be over no matter your leaning. Last week was certainly an interesting one with the Hunter Biden scandal and in a surprising statement in last Thursday’s Presidential debate the former Vice President Joe Biden said to the American people “I would transition away from the oil industry, yes.” Biden added “The oil industry pollutes, significantly. … It has to be replaced by renewable energy over time.” After flip flopping back and forth as to whether or not he would ban fracking he ended the debate with that statement – obviously a headwind for crude by rail if we do away with oil and natural gas. The reality is it is impossible to do so – oil and natural gas is just not used for transportation, home heating and clean electrical generation but there is over 6,000 consumer products made from oil and natural gas including panty hose, petroleum jelly, soap, plastics, shoe polish and nail polish for the ladies. (see below)

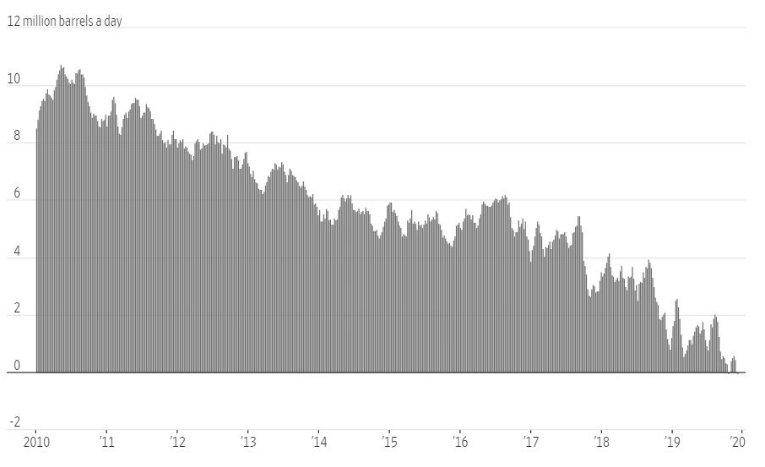

The list goes on and on folks! We at PFL don’t think we want to go back to a position where we are relying on foreign oil. In 2010 just 10 years ago we were importing nearly 11 MMbpd of foreign oil – today the U.S. still needs foreign oil but exports as much crude and fuels as it imports (see chart below)

Imports of Crude Oil per Day into the U.S. 2010 – Present Day (MMbpd)

Folks Biden can flip flop back and forth as much as he wants but the reality is Democrats do want to do away with crude and natural gas as soon as possible. A new bill from House Democrats turns to the oceans as a way to fight climate change, proposing to expand offshore wind while barring drilling along America’s coasts.

The more than 300-page legislation is broadly billed as a “blue carbon” bill — a way to harvest clean energy while protecting fisheries and resources like marshes and wetlands that can store carbon and protect eroding shorelines.

The Ocean Based Climate Solutions Act, introduced Tuesday of last week, comes as the ocean is rapidly warming and acidifying, a result of climate change and absorbing carbon from the atmosphere. If we cannot drill on the coast and if we cannot frac where does that leave America? PFL is taking a stand. The concept of getting rid of natural gas and oil is ridiculous. Don’t get us wrong here we love wind and we love solar and we love renewable fuels including ethanol and Biodiesel and the principals of PFL have all been involved in all of the above. We believe we should continue to pursue these opportunities but not bring America to their knees in the interim.

2. We are watching the oil patch as consolidation continues – In a press release on Sunday October 25, 2020 – Cenovus Energy Inc. and Husky Energy Inc. announced a transaction to create a new integrated Canadian oil and natural gas company with an advantaged upstream and downstream portfolio that is expected to provide enhanced free funds flow generation and superior return opportunities for investors. The companies have entered into a definitive arrangement agreement under which Cenovus and Husky will combine in an all-stock transaction valued at CAD $23.6 billion, inclusive of debt. The combined company will operate as Cenovus Energy Inc. and remain headquartered in Calgary, Alberta. The transaction has been unanimously approved by the Boards of Directors of Cenovus and Husky and is expected to close in the first quarter of 2021. Canadian companies have been under stress for six years, dating back to the last downturn, due to congested pipelines and the flight by foreign oil companies and investors due to Canada’s high production costs and emissions. Cenovus expects free funds flow break-even at West Texas Intermediate (WTI) pricing of US$36 per barrel (bbl) in 2021, and less than WTI US$33/bbl by 2023.

3. Petroleum by Rail –The four-week rolling average of petroleum carried on the largest North American railroads fell to 22,412 compared with 22,459 the prior week. CP shipments rose by 1.0% and CN volumes rose by 3.6%. In the U.S., CSX had the largest percentage increase at 4.0% while the NS had the largest percentage loss at -7.9%.

4. Rail car orders and backlog – The Railway Supply Institute published its railcar industry order, delivery and backlog statistics for the third quarter Friday of last week. Orders in the quarter declined 21% year over year to 5,783 railcars versus 7,315 cars last year. The industry delivered 7,953 railcars in the quarter, lower than the 8,441 railcars delivered in the second quarter ot this year. Backlog now stands at 37,417 railcars, down 6% from last quarter’s level of 39,612 cars and is the lowest backlog figure since 2010. Orders in the third quarter totaled 5,783 railcars, which is down 21% year over year. Deliveries are down 45% year over year and down 6% from the second quarter of 2020. Deliveries totaled 7,953 railcars in the third quarter (3,492 tank cars and 4,461 freight cars).

5. We are keeping an eye on rail car storage – We are looking forward to analyze data at the end of this month. We are seeing storage free up in the east. There are a fair number of cars being scrapped as the overall North American fleet continues to down size. Storage operators have had a bonanza this past year with crude by rail coming to its knees and COVID related plant turnarounds that were forced to idle due to temporary demand destruction. Storage operators on the back of this bonanza have expanded facilities to accommodate more traffic that they may not realize if the current trend continues. Furthermore, those that have taken advantage of their customers by charging extraordinary prices during COVID may regret their decisions. More to come at the end of the month – stay tuned to PFL.

Rig Count

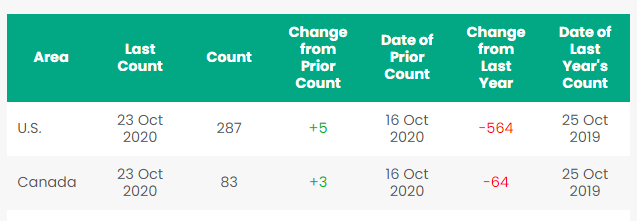

North America rig count is up 8 Rigs week over week. The U.S. gained 5 rigs week over week with 287 active rigs. Oil rigs were up six to 211, gas rigs were down one to 73, and miscellaneous rigs were unchanged at three, according to Baker Hughes. Canada gained 3 rigs week over week and Canada’s overall rig count is 83 active rigs. Year over year we are down 628 rigs collectively.

North American Rig Count Summary

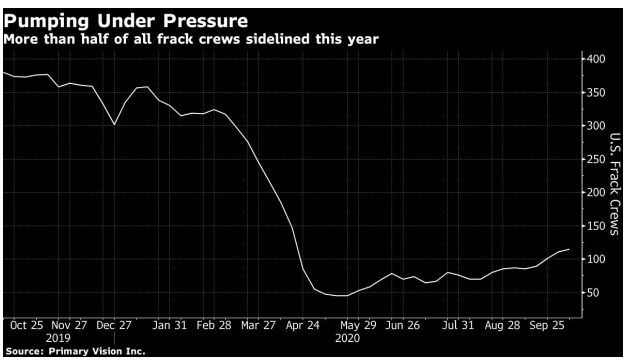

With oil and gas markets as they are, many shale companies have essentially taken a “frac holiday” throughout this year’s second and third quarters, and while U.S. shale prices have now recovered to a level hovering around their breakeven price of $40 per barrel, that may not be enough to pay off a mountain of debt that’s coming due in the next couple of years. Quite a bit of debt is going to have to be restructured that’s for sure. With that said it looks as though fracking of wells hit bottom and is slowing recovering. Shale gas producers are starting to open up idled wells and chewing into a backlog of partially finished wells that were halted before they were fracked. Expect this to continue into 2021 as the oil patch is frantically trying to complete all wells started given a potential change in government policy and the lack of private sector funding to take on new projects. (See chart below)

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- 20 117R’s 30,000 gallon cars needed for alcohol service cars have to be non -lined

- 340W’s LPG pressure cars for various locations and lease terms,

- 17 30.3 gal for lease in New Mexico 1 year crude

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 200 117Rs 30K plus Diesel or Gas Houston dirty – negotiable

- 100 CPC 1232 31.8 prior gasoline service for 3-6 month lease (extendable with mutual agreement) in Texas.

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 200 1232 25.5K Gal Texas UP BN 2 years fuel oil

- 19 117R 28.3 Gal Texas Class One Open 2-5 years Diesel

- 6 31.8 Gal tanks Ohio 3-5 years Noneno

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 60 340W Pressure cars in VA – last Ammonia dirty 12-18 mos NS or CSX

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- 10-20 340W pressure cars in Miss. – last butane – dirty lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 30 340W dirty propane or butane west coast negotiable

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

A sign of things getting better – leasing activity and inquiries have continued to be strong

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|