A smooth sea never made a skilled sailor.” – English Proverb

Jobs Update

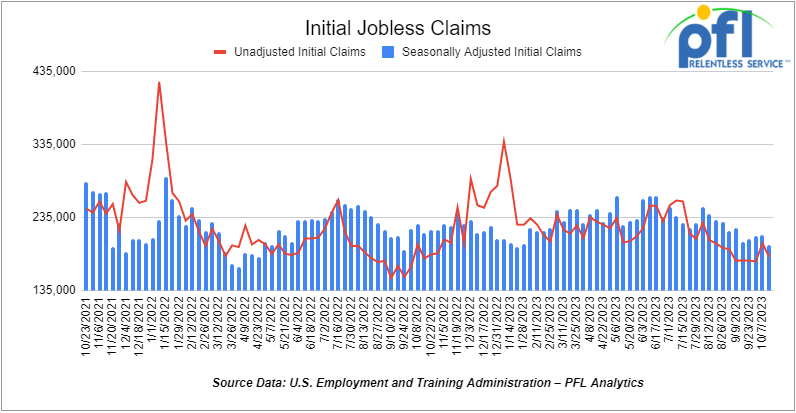

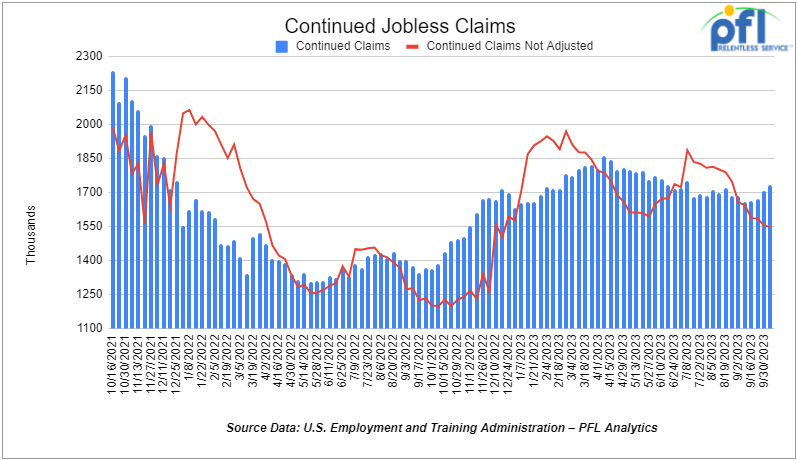

- Initial jobless claims for the week ending October 14th, 2023 came in at 198,000, flat week-over-week.

- Continuing jobless claims came in at 1.734 million people, versus the adjusted number of 1.705 million people from the week prior, up 30,000 people week-over-week.

Stocks close lower on Friday of last week, but mixed week over week

The DOW closed lower on Friday of last week, down -286.89 points (-0.86%), closing out the week at 33,127.28, down -543.01 points week-over-week. The S&P 500 closed lower on Friday of last week, down -53.84 points (-1.26%) and closed out the week at 4,224.16, down -103.62 points week-over-week. The NASDAQ closed lower on Friday of last week, down -202.37 points (-1.63%), and closed the week at 12,983.81, up 576.58 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 33,047 this morning down -211 points.

Crude oil closed lower on Friday of last week

WTI traded down $0.62 per barrel (-0.7%) to close at $88.75 per barrel on Friday of last week, down -$2.14 per barrel week-over-week. Brent traded down -US$0.22 per barrel (-0.2%) on Friday of last week, to close at US$92.16 per barrel, up US$4.47 per barrel week-over-week.

The United States issued new sanctions Wednesday of last week on people and companies based in Iran, Hong Kong, China and Venezuela for enabling Iran’s ballistic missile and drone programs, the Treasury Department said.

The sanctions target those who have supported the Islamic Revolutionary Guard Corps (IRGC) and the defense ministry in the production and proliferation of the missiles and drones, the Treasury said in a statement.11 individuals, 8 companies and 1 vessel were targeted, it said.

“Iran’s reckless choice to continue its proliferation of destructive UAVs and other weapons prolongs numerous conflicts in regions around the world,” said Brian Nelson, undersecretary for Terrorism and Financial Intelligence.

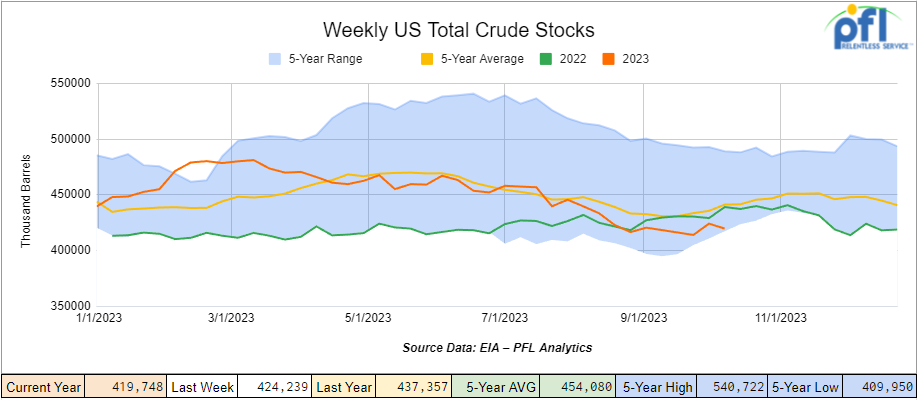

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.5 million barrels week-over-week. At 419.7 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

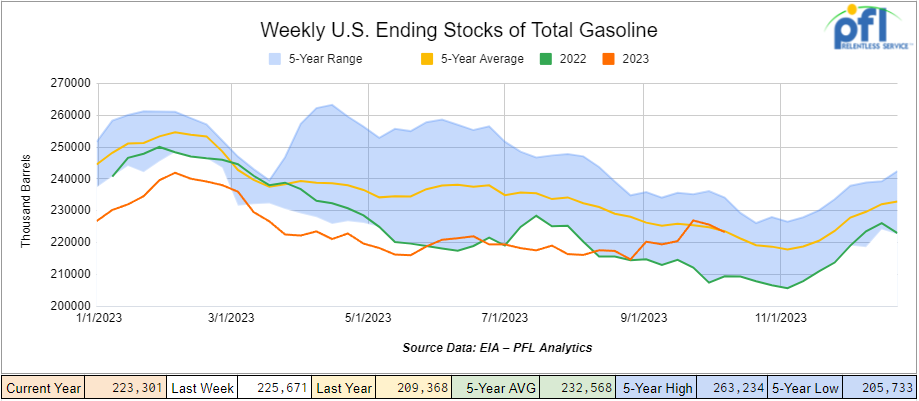

Total motor gasoline inventories decreased by 2.4 million barrels week-over-week and are slightly above the five-year average for this time of year.

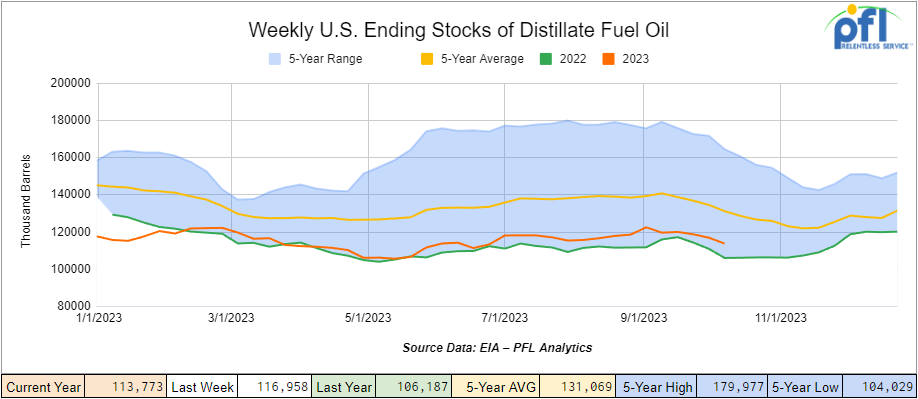

Distillate fuel inventories decreased by 3.2 million barrels week-over-week and are 12% below the five-year average for this time of year.

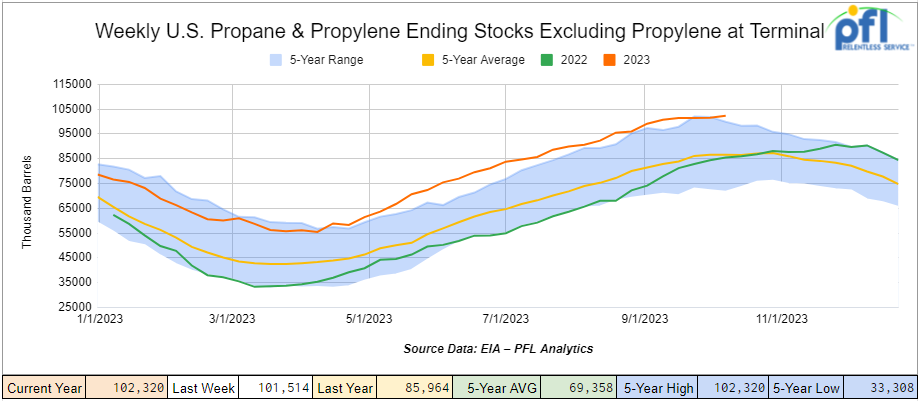

Propane/propylene inventories increased by 800,000 barrels week-over-week and are 18% above the five-year average for this time of year.

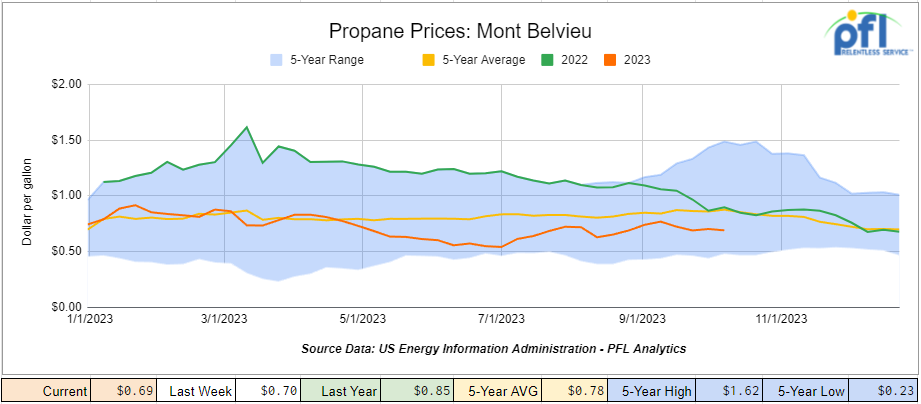

Propane prices closed at 69 cents per gallon, down 1 cent per gallon week-over-week, but down -16 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 11.9 million barrels during the week ending October 13, 2023.

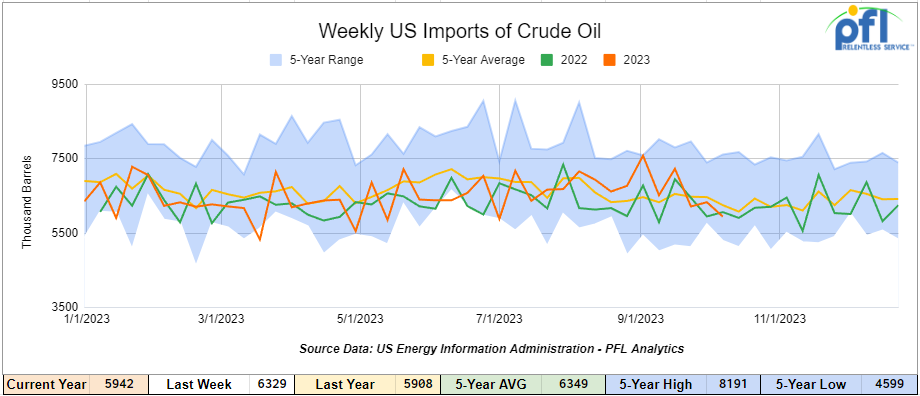

U.S. crude oil imports averaged 5.9 million barrels per day during the week ending October 13, 2023, a decrease of 387,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 5.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 706,000 barrels per day, and distillate fuel imports averaged 77,000 barrels per day during the week ending October 13, 2023.

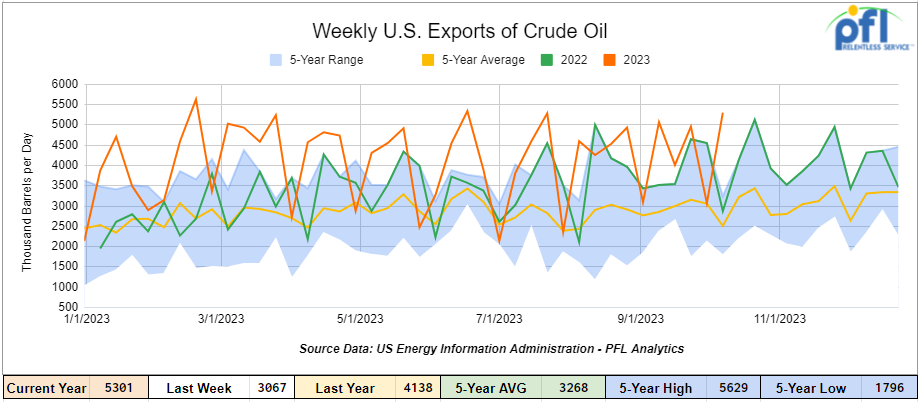

U.S. crude oil exports averaged 5.301 million barrels per day for the week ending October 13th, an increase of 2.234 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.334 million barrels per day.

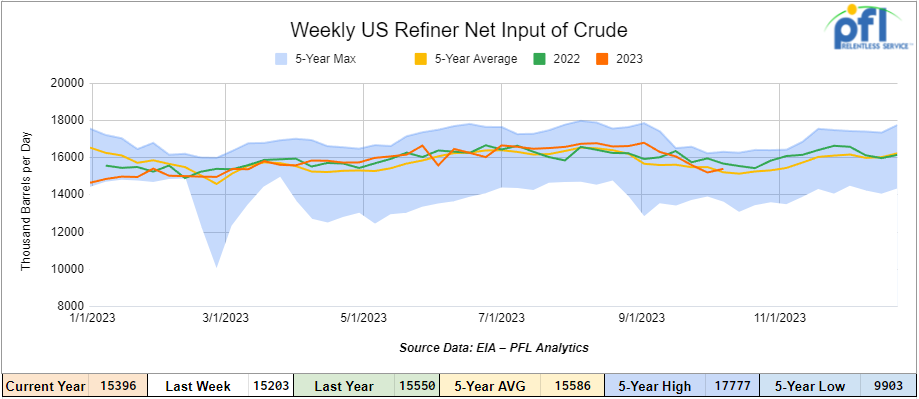

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending October 13, 2023, which was 192,000 barrels per day more week-over-week.

WTI is poised to open at 87.98, down -0.10 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 18th, 2023.

Total North American weekly rail volumes were down (-0.46%) in week 41, compared with the same week last year. Total carloads for the week ending on October 18th, 2023 were 353,598, down (-0.7%) compared with the same week in 2022, while weekly intermodal volume was 333,979, down (-0.87%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Metallic Ores and Minerals (-6.78%). The largest increase came from Petroleum and Petroleum Products (+13.99%).

In the East, CSX’s total volumes were down (-0.45%), with the largest decrease coming from Metallic Ores and Metals (-7.4%) and the largest increase from Coal (12.78%). NS’s volumes were up (+3.58%), with the largest decrease coming from Petroleum and Petroleum Products (-11.28%) and the largest increase from Coal (+21.03%).

In the West, BN’s total volumes were down (-0.23%), with the largest decrease coming from Coal (-16.98%), and the largest increase coming from Motor Vehicles and Parts (+31.26%). UP’s total rail volumes were up (+0.22%) with the largest decrease coming from Coal (-12.71%) and the largest increase coming from Petroleum and Petroleum products (+28.77%).

In Canada, CN’s total rail volumes were down (-7.93%) with the largest increase coming from Other (+108.74%) and the largest decrease coming from Intermodal (-24.58%). CP’s total rail volumes were up (+2.77%) with the largest decrease coming from Forest Products (-47.16%) and the largest increase coming from Motor Vehicles and Parts (+47.45%).

KCS’s total rail volumes were down (-9.67%) with the largest decrease coming from Intermodal (-26.05%) and the largest increase coming from Motor Vehicles and Parts (+44.2%).

Source Data: AAR – PFL Analytics

Rig Count

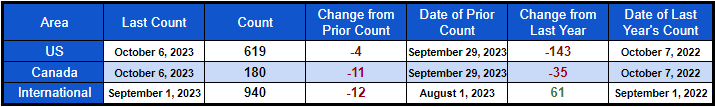

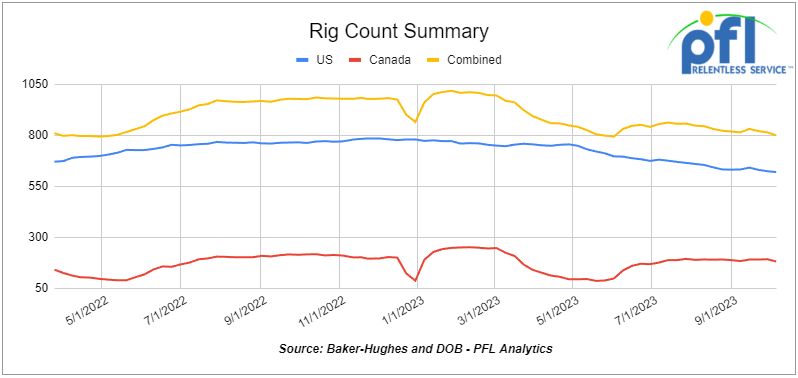

North American rig count was up by 7 rigs week-over-week. U.S. rig count was up by 2 rigs week-over-week but down by –147 rigs year-over-year. The U.S. currently has 624 active rigs. Canada’s rig count was up by 5 rigs week-over-week but down by -12 rigs year over year. Canada’s overall rig count is 198 active rigs. Overall, year-over-year, we are down -159 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,919 from 27,711, which was a gain of +208 rail cars week-over-week. Folks, this is the seventh consecutive week-over-week increase! Canadian volumes rose. CPKC’s shipments increased by +3.7% week over week, and CN’s volumes were higher by +1.3% week-over-week. U.S. shipments were higher as well. The UP had the largest percentage increase and was up by +7.0% week-over-week.

We are watching Energy – a few bits and pieces in case you missed

Folks, If we had an energy policy here is what it would look like – taking into account the environment:

- We would increase natural gas production;

- Increased NGL production on the back of it;

- We would increase coal production and capture carbon from new larger coal facilities strategically placed near depleted oil reservoirs for enhanced oil recovery. Other facilities close by, such as refineries, would participate in carbon recapture and injection into depleted oil reservoirs for increased oil production;

- We would fill up our strategic oil reserves (we would have never depleted them to begin with);

- We would encourage more drilling producing more oil right here in the United States creating energy independence and peace.

These are not only sound economic decisions that should be made, but great for the rail, the economy, the environment and the U.S. consumer. Despite kicking and screaming from the left who seem to think that we are going to power the economy with batteries and wind, which have proved to be a failed policy and environmentally unfriendly, some very small baby steps are being made.

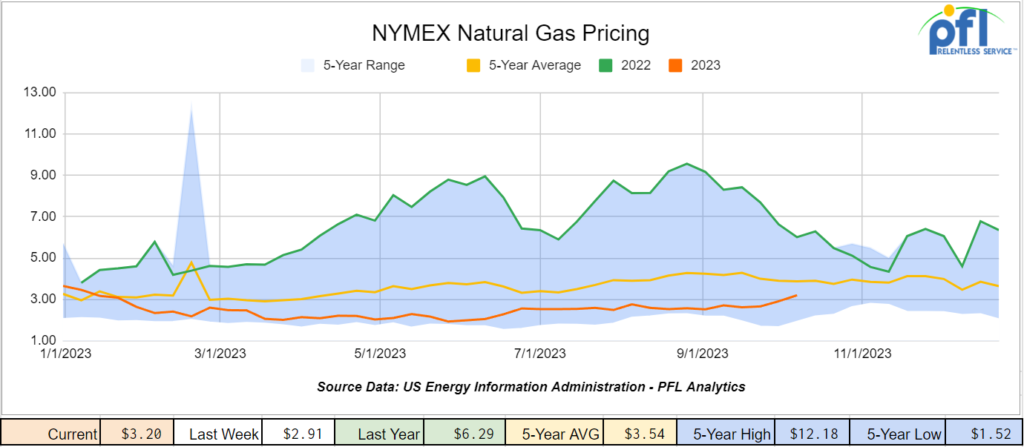

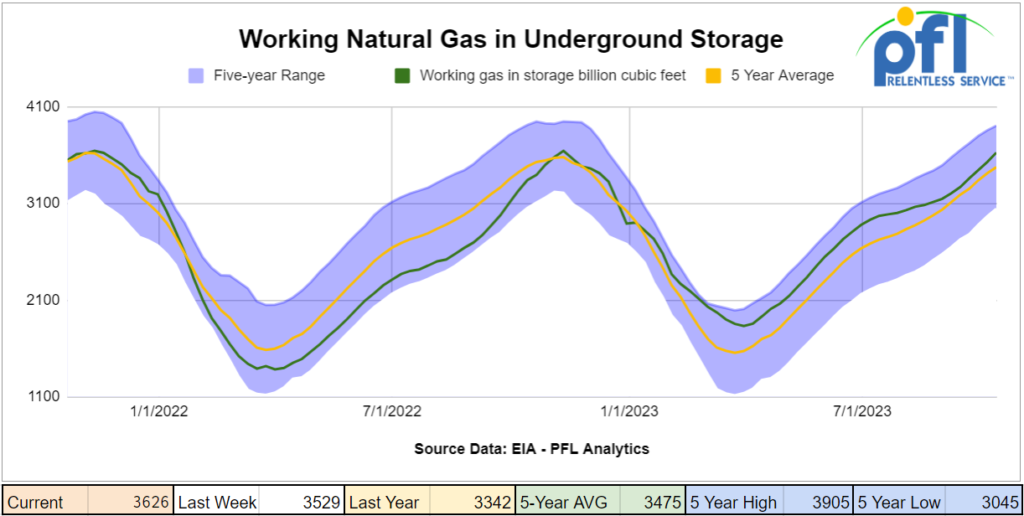

Natural Gas and NGL’s

Natural Gas is a cheap cleaning burning fuel and should be exploited – Natural gas futures declined on Friday of last week amid expectations of mild weather this season, even as U.S. inventories decrease. “EIA Natural Gas storage has been narrowing the gap on the big surplus we had since the summer,” Mizuho’s Robert Yawger said in a report, “but there is very little confidence that winter weather is on the way anytime soon.” The front-month natural gas contract for November delivery declined $0.057 per mmBtu, to close out the day and the week at $2.899 per mmBtu.

A couple of minor wins in natural gas – The Mountain Valley Pipeline is set for completion in 2024. Despite many delays, the Mountain Valley pipeline is expected to be completed next year. Its costs will exceed $7 billion, the project’s lead developer said Wednesday of last week. The updates from Equitrans Midstream mark the latest twist in the saga of the controversial natural gas project, which received Congress’ blessing earlier this year. Mountain Valley won’t come online in 2023 as planned because of “unforeseen factors” that slowed the pace of construction and boosted costs, Equitrans said in a regulatory filing. That disclosure arrives after the Supreme Court handed developers of the Mountain Valley pipeline a critical win in July, undoing a construction freeze and allowing work on the gas project to restart.

West Virginia Senator Joe Manchin vowed the Mountain Valley Pipeline would be completed after the project’s owner Equitrans Midstream Corp. announced the new delays and cost overruns. “It will be built,” said Manchin, who inserted language approving the project into a must-pass debt law. “The quicker we can get this done, that is going to help our country.”

In another small win for natural gas, the Federal Energy Regulatory Commission (FERC) issued a certificate Thursday of last week for the Gas Transmission Northwest XPress Project (GTNXP), which will upgrade three existing compressor stations and increase capacity on an existing system that has transported natural gas for decades. GTNXP developer TC Energy; GOP lawmakers in Oregon, Idaho and Washington; and labor unions have all called on FERC to issue the certificate.

“The GTN XPress project will play a critical role in keeping energy affordable and reliable for consumers in California and the Pacific Northwest,” TC Energy spokesperson Michael Tadeo said “We appreciate FERC’s bipartisan action today to approve the project and will work diligently to place it into service as soon as possible.”

According to TC Energy’s application filed with FERC in October 2021, the $75 million project will leverage existing infrastructure to increase GTN’s incremental mainline capacity by 150,000 dekatherms per day — enough to power roughly 500,000 additional homes in the region. The operational GTN pipeline travels through Idaho, Washington and Oregon and serves California customers.

The project, which mainly consists of software and other upgrades to TC Energy’s existing infrastructure, comes as demand for natural gas transportation on the GTN pipeline system has increased 26% in recent years while nearby natural gas production has dwindled. The pipeline feeds key gas supplies to utility companies which, in turn, provide energy to residential, commercial and industrial customers.

The letter came after FERC, which is chaired by Willie Phillips, a Democrat appointed by President Biden, opted to delay approval for the project multiple times without offering an explanation amid pressure from Democrats and environmental groups to reject its application.

In July, FERC removed the project from its open-meeting agenda without explanation. One day before the meeting, Democrat Oregon Sens. Jeff Merkley and Ron Wyden wrote to the regulator, imploring it to reject the project and arguing that states through which the pipeline travels are “moving away from fossil fuels.”

The commission again opted against discussing the proposal during its following meeting on Sept. 21, which earned a pointed rebuke from TC Energy.

“The Commission’s continued inaction has almost certainly exposed GTN’s customers, who serve residential and commercial natural gas and electricity users, to more expensive supply sources to meet their load demands this winter,” Stanley Chapman III, TC Energy’s executive vice president and chief operating officer of natural gas pipelines division, wrote in a letter to FERC commissioners after the September meeting.

“As experience in California and elsewhere shows, delaying natural gas infrastructure projects hurts energy reliability and affordability and burdens families, small businesses, and other energy users,” Chapman added. “These types of delays in Commission action also erode the kind of certainty and predictability that gas infrastructure developers rely on for planning, financing, and constructing projects that are in the public’s interest.”

As we all know increased Natural Gas production leads to increased LPG production – great for rail and great for the environment – problem is we need more of them and need to unleash drilling.

What is Enhanced Oil Recovery (EOR) Utilizing CO2?

CO2-EOR is a technique used to recover oil, typically from mature fields that are no longer productive using traditional oil recovery methods, which can leave up to two-thirds of the original oil in place. In conventional oilfields, the CO2-EOR process is not only effective in increasing ultimate oil recovery, but also in its ability to geologically store CO2 emissions through the recovery process. Following the CO2-EOR operations, the captured CO2 remains permanently underground in the geologic formation, thereby preventing it from entering the atmosphere. EOR can be used by taking coal emissions, refining emissions you name it. Yes, we can produce greenish oil and we are. For more information on EOR, call PFL’s desk.

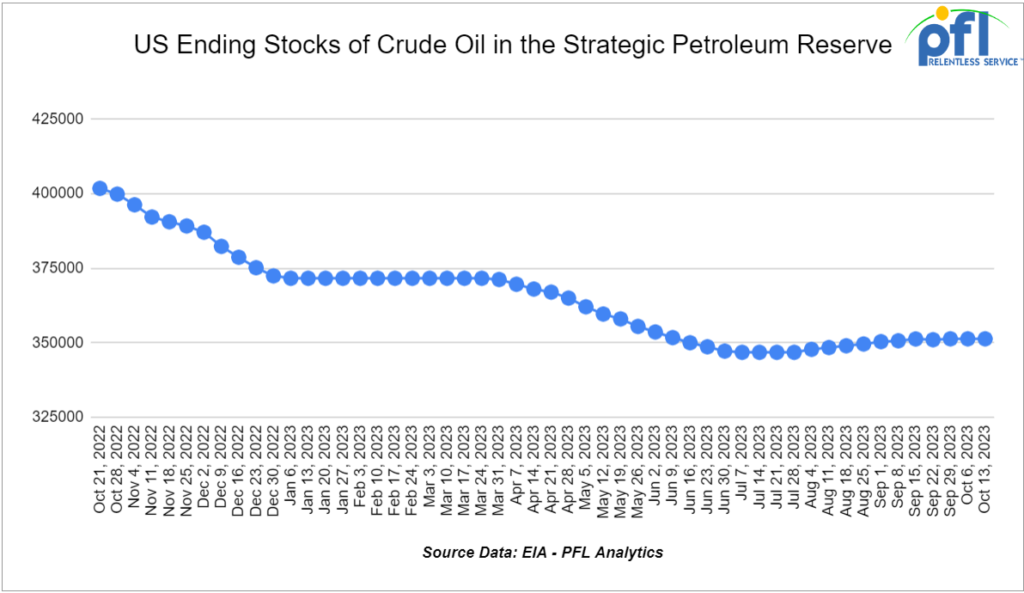

Strategic Petroleum Reserves Update

U.S. Department of Energy Announced Monthly Solicitations to Purchase Oil for Strategic Petroleum Reserve Replenishment on Wednesday of last week for 6 million barrels. To put that in perspective, that amount of oil equals less than ½ of one day’s supply of oil!

The DOE said it will purchase oil in those months where it can do so at a good deal it claims is good for taxpayers: a price of $79 dollars per barrel or below, less than the average $95 per barrel DOE received for 2022 for what it claimed to be emergency SPR sales. Don’t think they factored in all the repair work they had to do to the facilities.

According to the DOE, Wednesday’s announcement advances the President’s commitment to safeguard and replenish this critical energy security asset, following his historic release from the SPR to address the significant global supply disruption caused by Putin’s war on Ukraine and provide a wartime bridge to keep the domestic market well supplied, which ultimately helps bring down prices for American consumers and businesses. Analysis from the Department of the Treasury indicates that SPR releases last year, along with coordinated releases from international partners, reduced gasoline prices by as much as 40 cents per gallon.

Bids for the first solicitation for the purchase of up to 3 million barrels of crude oil, for December receipt, are due no later than 10:00 a.m. Central Time on October 24, 2023. Bids for the second solicitation for the purchase of up to 3 million barrels of crude oil, for January receipt, are due no later than 10:00 a.m. Central Time on November 1, 2023. Each delivery will be received by the Big Hill storage facility. DOE will continue to release monthly solicitations for any available capacity through at least May 2024. With crude oil closing at $88.75 on Friday of last week, we will have to see how this one works out.

Tank Car Committee Meeting

Folks, we were there last week in Dallas! It was a well attended meeting. We met some new folks and saw old friends. As normal in the tank world it is in a constant flux of change – it is important to keep on top of pending or new rules or changes in policy. Please call the desk if you want us to fill you in on any happening out there in the tank car world in case you missed it below are some interesting takeaways

- The NTSB is asking that gaskets be upgraded to handle fires since issues happened during the NS derailment in Palestine Ohio

- They may require DOT 111 cars to be phased out and new DOT 116 cars with more fittings protection be added.

- They also would like to get rid of 6 and 8 bolt manway covers.

- These are all long term things that will likely be for new cars only at some point.

- Car owners also need to do interval analysis and have it on file when the FRA audits you.

- See Agenda (Link)

With conferences and meetings over until year end we all get a rest. We will see you next at MARS in Chicago next year.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 3, 23.5-25.5 Any Tanks needed off of Any in Port Allen, LA for 90 Days. Cars are needed for use in Fuel Oil service.

- 3, 23.5-25.5 Any Tanks needed off of Any in Nachaz, MS for 90 Days. Cars are needed for use in Fuel Oil service.

- 100, 30K Any Tanks needed off of Any in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined products service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|