“What is now proved was once only imagined.” ― William Blake

Jobs Update

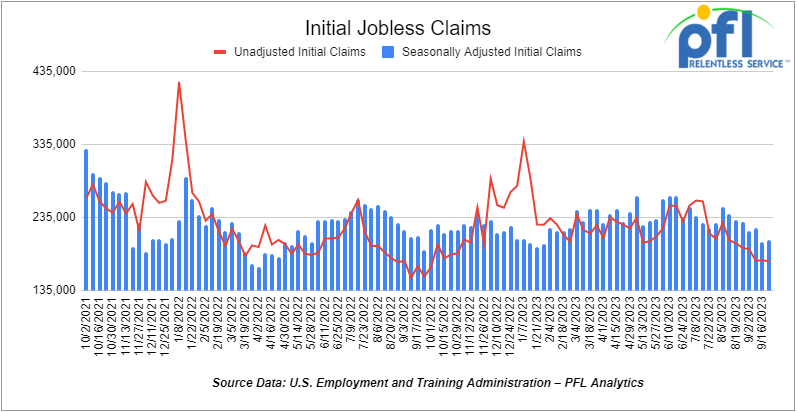

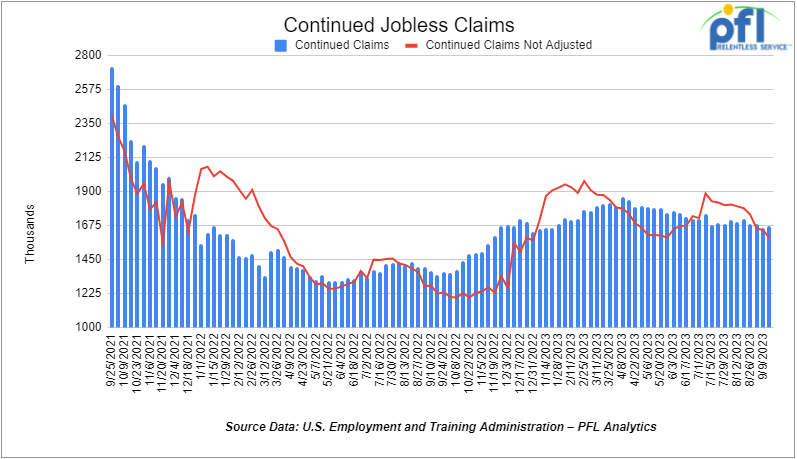

- Initial jobless claims for the week ending September 23rd, 2023 came in at 204,000, up 2,000 people week-over-week.

- Continuing jobless claims came in at 1.67 million people, versus the adjusted number of 1.658 million people from the week prior, up 12,000 people week-over-week.

Stocks closed mixed on Friday of last week and mixed week over week

The DOW closed lower on Friday of last week, down -158.84 points (-0.47%), closing out the week at 33,507.5, down -456.34 points week-over-week. The S&P 500 closed lower on Friday of last week, down -11.65 points (-0.237%) and closed out the week at 4,288.05, down -144.01 points week-over-week. The NASDAQ closed higher on Friday of last week, up 18.05 points (0.14%), and closed the week at 13,219.32, up 7.51 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 33,820 this morning up 95 points.

Crude oil closed lower on Friday of last week, but higher week over week

WTI traded down -$0.92 per barrel (-1%) to close at $90.97 per barrel on Friday of last week but up $0.94 per barrel week-over-week. Brent traded down -US$0.07 per barrel (-0.97%) on Friday of last week, to close at US$95.31 per barrel, but up US$2.04 per barrel week-over-week.

Oil could be headed as high as $150 unless the U.S. boosts its output, says major exploration firm. Once crude oil output in the Permian Basin peaks with no new sources coming online, then a supply squeeze could see “$120 to $150” oil, Continental Resources CEO Doug Lawler told Bloomberg TV on Monday of last week.

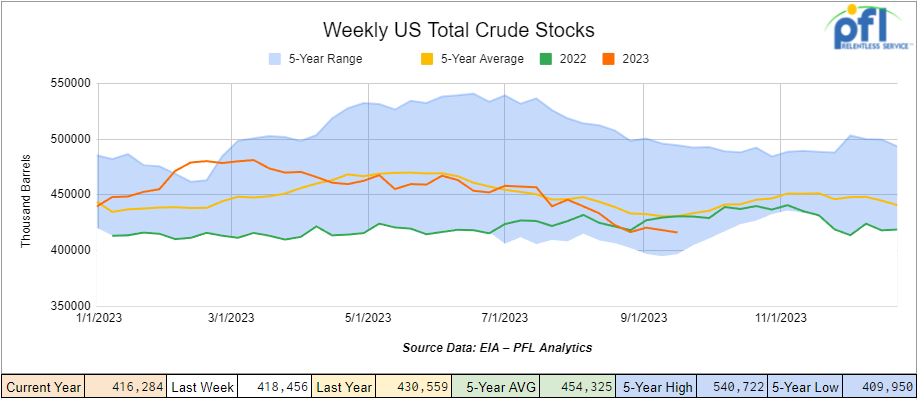

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.2 million barrels week-over-week. At 416.3 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

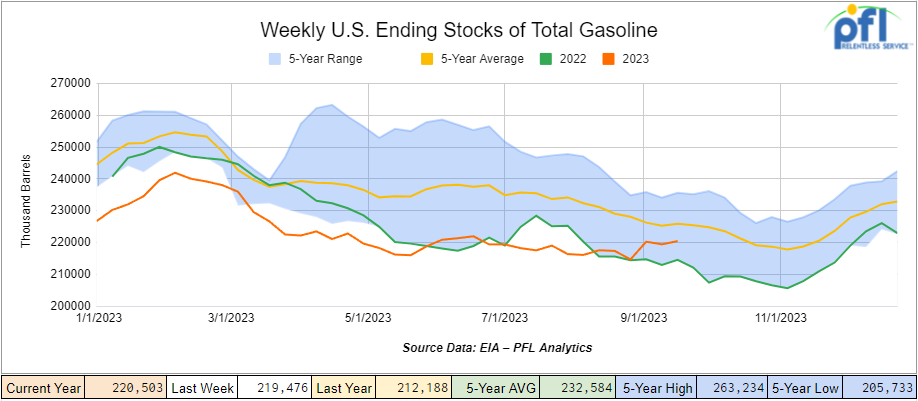

Total motor gasoline inventories increased by 1 million barrels week-over-week and are 2% below the five-year average for this time of year.

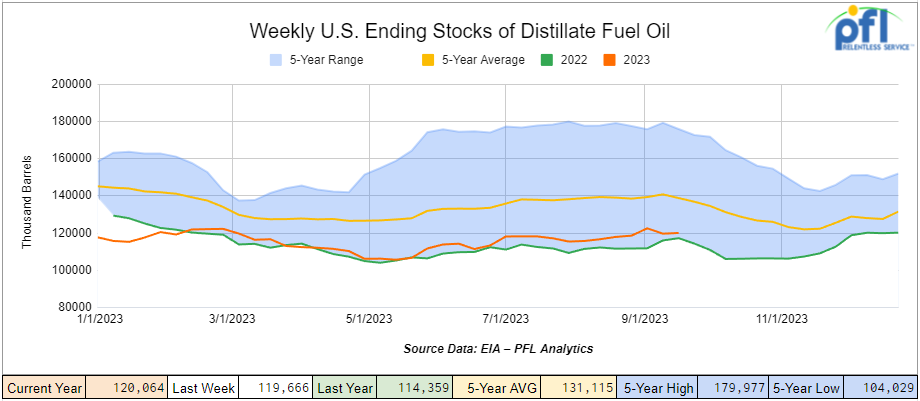

Distillate fuel inventories increased by 400,000 barrels week-over-week and are 13% below the five-year average for this time of year.

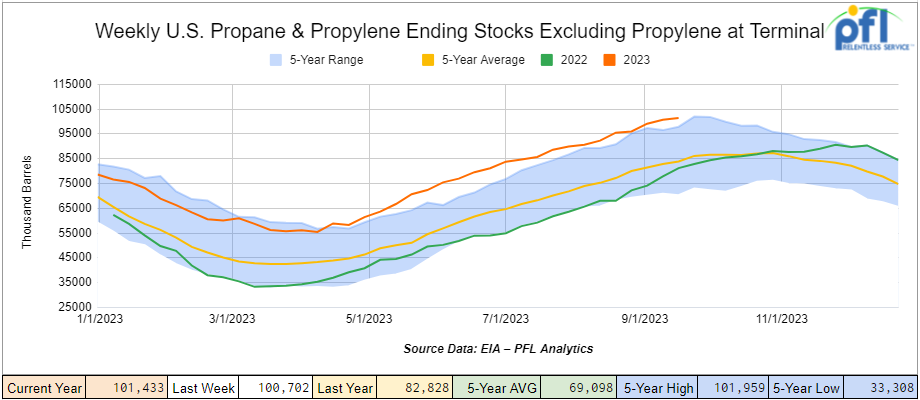

Propane/propylene inventories increased 700,000 barrels week-over-week and are 19% above the five-year average for this time of year.

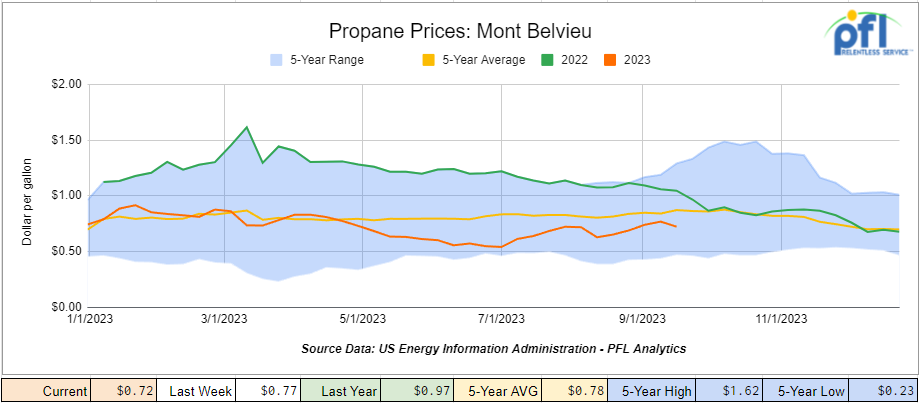

Propane prices closed at 72 cents per gallon, down -5 cents per gallon week-over-week, and down -20 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 1.5 million barrels. during the week ending September 22, 2023.

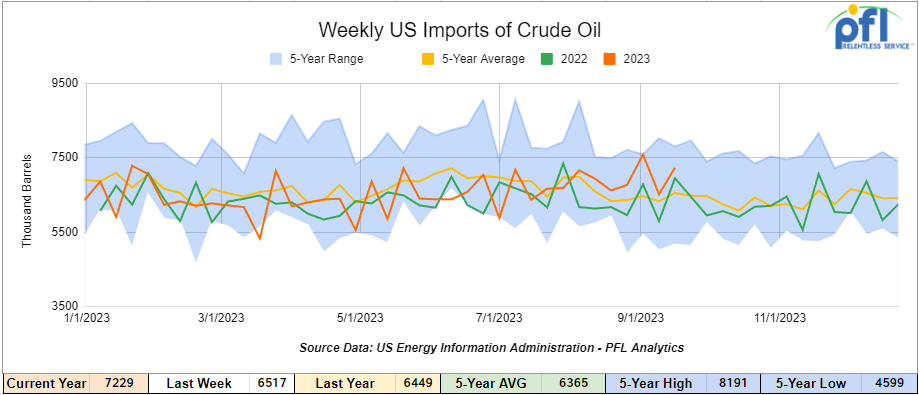

U.S. crude oil imports averaged 7.2 million barrels per day during the week ending September 22, 2023, an increase of 711,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 7 million barrels per day, 8.2% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 710,000 barrels per day, and distillate fuel imports averaged 114 thousand barrels per day during the week ending September 22, 2023.

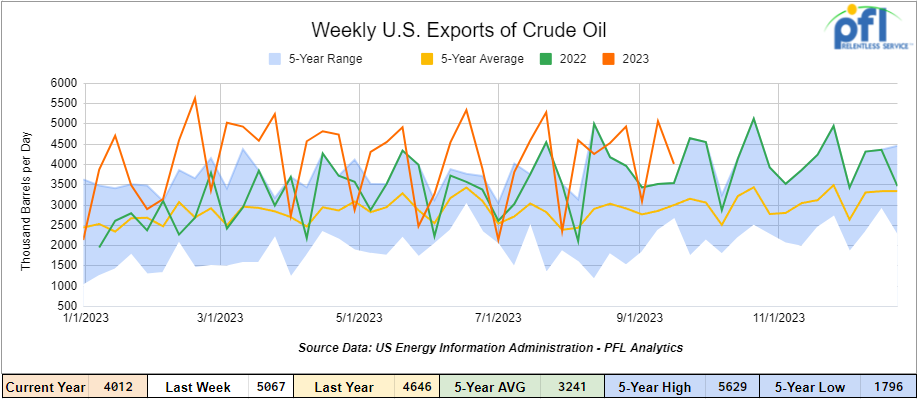

U.S. crude oil exports averaged 4.012 million barrels per day for the week ending September 15th, a decrease of -1.055 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.275 million barrels per day.

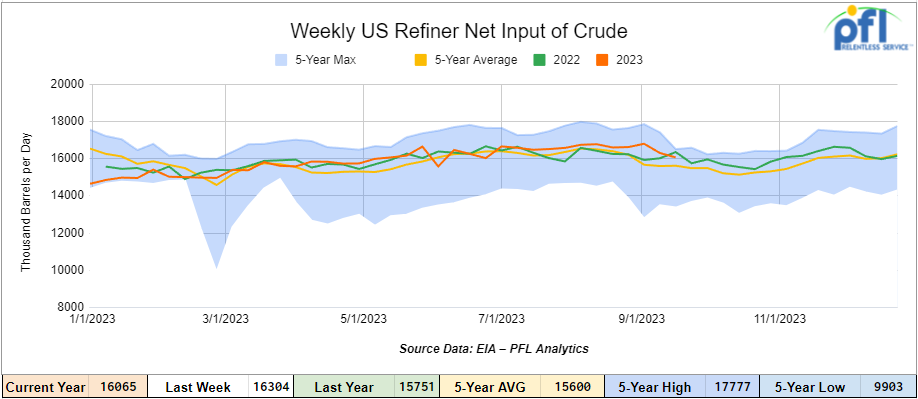

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending September 22, 2023, which was 239,000 barrels per day less week-over-week.

WTI is poised to open at $91.17, up 38 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 27th, 2023.

Total North American weekly rail volumes were up (1.39%) in week 38, compared with the same week last year. Total carloads for the week ending on September 27th, 2023 were 356,932, up (+3.17%) compared with the same week in 2022, while weekly intermodal volume was 322,716, down (-0.52%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year over year increases with the most significant decrease coming from Forest Products (-3.96%). The largest increase came from Motor Vehicles and Parts (+21.26%).

In the East, CSX’s total volumes were down (-0.77%), with the largest decrease coming from Grain (-25.21%) and the largest increase from Motor Vehicles and Parts (+28.56%). NS’s volumes were up (0.88%), with the largest decrease coming from Petroleum and Petroleum Products (-17.98) and the largest increase from Motor vehicles and Parts (+8.06%).

In the West, BN’s total volumes were up (4.35%), with the largest decrease coming from Grain (-0.95%), and the largest increase coming from Metallic Ores and Metals (+48.02%). UP’s total rail volumes were up (+0.96%) with the largest decrease coming from Other (-13.4%) and the largest increase coming from Petroleum and Petroleum Products (+26.14%).

In Canada, CN’s total rail volumes were down (-0.85%) with the largest increase coming from Grain (+95.37%) and the largest decrease coming from Intermodal (-15.3%). CP’s total rail volumes were up (+3.75%) with the largest decrease coming from Other (-29.41%) and the largest increase coming from Motor Vehicles and Parts (+225.58%).

KCS’s total rail volumes were down (-0.48%) with the largest decrease coming from Other (-33.55%) and the largest increase coming from Motor Vehicles and Parts (+87.8%).

Source Data: AAR – PFL Analytics

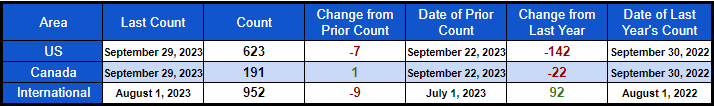

Rig Count

North American rig count was down by -6 rigs week-over-week. U.S. rig count was down by -7 rigs week-over-week and down by –142 rigs year-over-year. The U.S. currently has 623 active rigs. Canada’s rig count was up by 1 rig week-over-week, but down by -22 rigs year over year. Canada’s overall rig count is 191 active rigs. Overall, year-over-year, we are down -164 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,103 from 26,788, which was a gain of +315 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments decreased by -0.4% week over week, and CN’s volumes were higher by +4.3% week-over-week. U.S. shipments were mostly lower. The UP was the sole gainer and was up by +1.9% week-over-week. The NS had the largest percentage decrease and was down by -12.4% week-over-week.

The Canadian Energy Regulator Approves Trans Mountain Route Deviation

Maybe some level of sanity has crept back into the market, folks. The Commission of the Canada Energy Regulator (CER) approved Trans Mountain’s application for a route deviation in the Pípsell (Jacko Lake) area. The Commission will release its reasons for the decision in the coming weeks. The hearing was held two weeks ago, and the CER rendered its decision on Monday of last week.

On Aug. 10, 2023, Trans Mountain submitted an application to revise the route and method of construction for a 1.3 kilometer section of the pipeline route, in the Pípsell (Jacko Lake) area. The company indicated that it had encountered significant technical challenges while attempting to complete micro-tunnelling along the previously approved route. In response to these issues, Trans Mountain proposed a combined approach of horizontal directional drilling and conventional open trenching along the revised route.

Stk’emlúpsemc te Secwépemc Nation (SSN) responded to the application, as the area holds profound spiritual and cultural significance to the Nation and Peoples. An oral hearing was held in Calgary on Sept. 18, 19, and 20, 2023, to hear submissions from both parties on the application.

The hearing included the provision of Indigenous knowledge by SSN, as well as cross-examination and final argument.

Source: Canadian Energy Regulator – PFL Analytics

Source: Canadian Energy Regulator – PFL Analytics

On Tuesday of last week, Stk’emlúpsemc te Secwépemc Nation submitted a request to the CER, asking that the Commission deliver its reasons underlying the decision on an expedited basis “in order to allow SSN to assess the options available to it.” They were unhappy with the decision.

“SSN may either request a reconsideration of the decision or pursue an appeal of the decision to the Federal Court of Appeal,” it stated in a letter via counsel Miller Titerle Law Corporation. On Friday of last week Trans Mountain responded and said amongst other things “At present, there is no certainty that Trans Mountain will adhere to this previous process for engagement given its desire to move forward with construction at an accelerated rate,” the letter stated. “To the contrary, Trans Mountain has advised of its intention to break ground on Monday, October 2 (today) with limited to no engagement in advance that it is consistent with the level of input from SSN that has occurred in the past.” I guess the battle continues, folks. Stay tuned to PFL for further updates. We are watching this one!

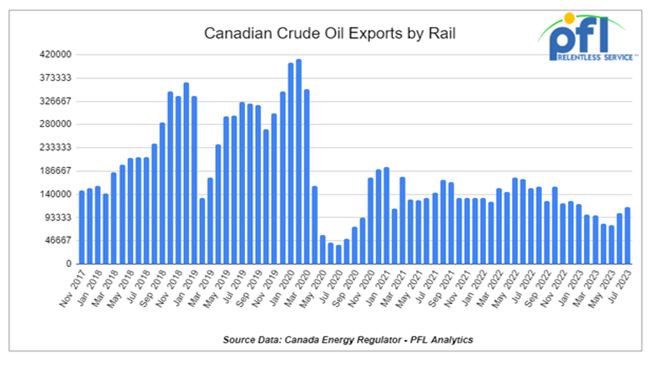

We are watching Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on September 25, 2023. For July 2023, Canada exported 113,784 barrels per day by rail (up by +11,049 barrels per day month over month) and continues to move higher.

We were expecting to see volumes increase as we headed into the month of July, as the weather warmed up and producers started to build inventory. Basis numbers look favorable for Rail at least for the time being. One Exchange’s Western Canadian Select Contract (Link) (WCS) settled on Friday of last week at US$18.50 per barrel below the WTI-CMA. (“West Texas Intermediate – Calendar Month Average”) The implied value was US$69.69 per barrel. On Thursday, it settled at US$18.20 per barrel below the WTI-CMA for October delivery. The implied value was US$72.84 per barrel.

We were at SWARS Last Week and a Proud Sponsor

585 people made it to beautiful San Diego last week to gather for the SWARS Semi-Annual meeting – PFL was there and was a proud sponsor. There were lots of meetings and lots of deals being cut. Activity is brisk at almost every level in rail. If we can keep the government open, stop the strikes, and stop the Green New Deal we are going to be in good shape.

The Speakers were great and included Katie Farmer, President of BN, Alan Shaw President of the NS, and Samuel Kyei, Chief Economist, of SAK Economics LLC. It is always interesting to listen to the economist to see what they think. PFL will be in Portland, Maine this week attending NEARS and if you are heading up there please call the desk 239-390-2885 for a meeting. Otherwise for more information on SWARS please call the desk.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined prodcuts service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|