“If you can’t explain it simply, you don’t understand it well enough.”

Albert Einstein

COVID 19 and Markets Update

The United States currently has 8,388,013 confirmed COVID 19 cases and 224,732 confirmed deaths.

Concern is mounting in Europe as countries smash records for daily COVID 19 cases and the World Health Organization warns that the daily death toll on the continent could reach five times its April peak within the next few months. Countries that managed to contain infection rates through spring lockdowns and that began relaxing measures are now watching the virus return with a vengeance, with Germany, France and the Czech Republic all reporting record case numbers in the past two days. European nations have instituted curfews and are considering other lockdown measures. Here in the U.S., our cases are rising and expected to do so, as cooler weather is forcing people inside. Lockdowns are not the answer as they have adverse effects on society as a whole. Be safe out there, folks!

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 898,000 initial jobless claims. The number of first-time filers for unemployment benefits were higher than expected. The 4-week moving average was 866,250, an increase of 8,000 from the previous week’s revised average. The previous week’s average was revised up by 1,250 from 857,000 to 858,250.

DOW and NASDAQ

The DOW closed higher on Friday, up 112.11 points (0.39%) to finish out the week at 28,606.31, up 19.41 points week over week. The S&P 500 traded higher 0.47 points (0.01%) on Friday, closing at 3,483.81, up 6.68 points week over week. The Nasdaq finished Friday’s session lower, losing 42.31 points (-.39%) and closing out the week at 11,671.56, up 91.62 points week over week. In overnight trading, DOW futures traded higher and are expected to open up this morning 200 points.

Oil Markets

Oil prices declined on Friday of last week WTI traded down 8 cents to close at $40.88, a gain of $.36 (+.7%) per barrel week over week.

Brent traded down 23 cents on Friday of last week to close at $42.93, a gain of $.08 (+.2%) per barrel week over week.

U.S. crude inventories decreased by -3.818MM/bbls last week and now stand at 489.101 MM/bbls, according to the EIA. Consensus was for a draw of -2.290MM/bbls. Record crude production was shut-in in the gulf totaling , which is largely attributed to the large draw down in inventory levels. U.S. gasoline inventories decreased by -1.626MM/bbls last week and now stand at 255.121 MM/bbls. Consensus was for a draw of -1.494MM/bbls. U.S. distillate inventories were down by -7.245MM/bbls and now stand at 164.551 MM/bbls. Consensus was for a draw of -1.931MM/bbls. This was the largest weekly draw for distillates in nearly 17 years aided by falling U.S. production due to hurricane activity in the gulf and export demand. Despite the drop in inventories last week, current levels remain above normal.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $40.61, down 27 cents per barrel from Friday’s close.

ConocoPhillips said on Monday it will buy Permian-focused driller Concho Resources for $9.7 billion, the largest shale deal this year as oil and gas producers turn to consolidation to survive a lull in oil prices and demand.

North American Rail Traffic

Total North American rail volumes were up 1.8% year over year in week 41 (U.S. +1.9%, Canada +4.7%, Mexico -10.7%), resulting in quarter to date volumes that are up 1.4% and year to date volumes that are down 9.5% (U.S. -10.1%, Canada -7.0%, Mexico -10.7%). 6 of the AAR’s 11 major traffic categories posted y/y increases with the largest increases coming from intermodal (+6.9%) and grain (+23.3%). The largest decrease came from coal (-15.9%).

In the East

CSX’s total volumes were up 1.8%, with the largest increase coming from intermodal (+7.0%). The largest decrease came from coal (-7.7%). NS’s total volumes were down 2.1%, with the largest decreases coming from coal (-18.9%) and petroleum (-47.7%). The largest increase came from intermodal (+2.5%).

In the West

BN’s total volumes were flat, with the largest increases coming from intermodal (+8.3%) and grain (+24.0%). The largest decreases came from coal (-22.6%), petroleum (-30.9%) and stone sand & gravel (-31.1%). UP’s total volumes were up 5.9%, with the largest increases coming from intermodal (+9.7%) and grain (+74.0%). The largest decreases came from petroleum (-35.2%), stone sand & gravel (-19.3%) and coal (-8.9%).

In Canada

CN’s total volumes were up 2.0% with the largest increases coming from intermodal (+8.8%) and grain (+55.2%). The largest decrease came from coal (-43.0%). RTMs were up 7.8%. CP’s total volumes were up 8.2%, with the largest increases coming from intermodal (+10.1%), farm products (+60.6%) and chemicals (+21.2%). The largest decrease came from petroleum (-25.4%). RTMs were up 9.3%.

Kansas City Southern

KCS’s total volumes were down 1.3%, with the largest decrease coming from intermodal (-4.8%).

Things we are keeping an eye on

- Petroleum by Rail –The four-week rolling average of petroleum carried on the largest North American railroads rose to 22,459 compared with 22,093 the prior week. CP shipments rose by 17.3% and CN volumes fell by 7%. In the U.S., NS had the largest percentage increase at 14.4% while the BN had the largest percentage loss at -3.5%.

- Coal Shipments on rail came back last week – U.S. railroad coal loadings rose to their highest levels since the end of August, but remained down compared with 2019 levels. Railroads last week loaded 62,229 railcars with coal but still down 15% year over year.

- Dakota Access Pipeline – Illinois regulators late on Wednesday of last week approved an expansion of the Dakota Access oil pipeline, the largest pipeline running out of North Dakota’s Bakken shale basin, rejecting a bid by environmental groups to block the project despite the pipeline facing legal hurdles for its continued operations. The Dakota Access Pipeline can transport about 570,000 barrels per day (bpd) of crude oil from North Dakota to the Midwest, with connections to the Gulf Coast. It had been a source of controversy prior to its completion in 2017, and there is an ongoing legal challenge over whether the line should remain operational after a federal court earlier this year scrapped a key permit. The Illinois Commerce Commission (ICC) said additional pumping stations and equipment needed for the pipeline’s capacity to be nearly doubled to 1.1 million bpd are necessary and would promote the security and convenience of the public.

- U.S. Trucking Trends – With strong demand, dry-van TL rates are up 35% year over year. Pricing strength is supported by strong demand related to inventory replenishment and capacity dislocation (COVID). As a result, 2020 contract rates are likely trending near 2019 levels after experiencing mid-cycle rate increases during the last 90 days. Freight volumes increased month over month but remain below year-ago levels.

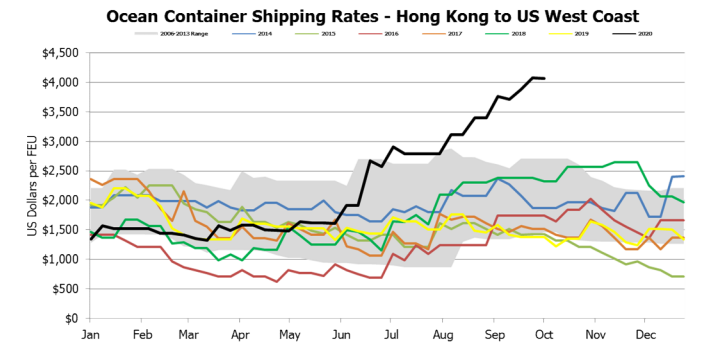

- Global Airfreight, Containerized Ocean Traffic. Total US and Canadian container imports were up 13% year over year in September, according to PIERS . Volumes are likely trend higher into 4Q driven by improving organic demand (inventory restocking, consumer demand), and PPE shipments (converted from airfreight). During the past 45 days, spot market rates from Asia to the U.S. West Coast rose from $3,400 to $3,900 due to capacity scarcity and volume growth. FAK (spot rates with fuel) rates are now 181% above year ago levels according to the Shanghai Containerized Freight Index. (See chart below)

Source: Drewry Shipping, CRC Analysis - Airlines are getting creative cashing in on in global freight increases and the surge in exports. South Korea’s Asiana Airlines is the first airline to modify an A350 twin-aisle plane with a mini-pallet system developed by Airbus to increase the efficiency of cabin loading amid a supply shortage for cargo airlift. Engineers removed 283 seats and installed the cargo pallet system on the floor to firmly secure cargo loads. The reconfigured A350 was deployed in late September to fly IT and electronic equipment, as well as online orders for items such as clothing, from Seoul to Los Angeles. More than 150 aircraft worldwide have had seats removed this year to increase space for light shipments. (See picture below)

Source: American Shipper

Rig Count

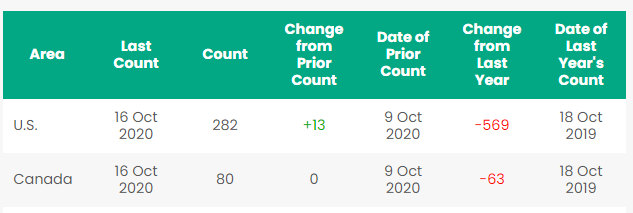

North America rig count is up 13 Rigs week over week. The U.S. gained 13 rigs week over week with 282 active rigs. U.S. oil rigs were up 12 to 205, gas rigs were up one to 74, and miscellaneous rigs were unchanged at three. Canada held steady week over week and Canada’s overall rig count is still at 80 active rigs. Year over year we are down 632 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- 20 117R’s 30,000 gallon cars needed for alcohol service cars have to be non -lined

- 340W’s LPG pressure cars for various locations and lease terms,

- 17 30.3 gal for lease in New Mexico 1 year crude

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 200 117Rs 30K plus Diesel or Gas Houston dirty – negotiable

- 100 CPC 1232 31.8 prior gasoline service for 3-6 month lease (extendable with mutual agreement) in Texas.

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 200 1232 25.5K Gal Texas UP BN 2 years fuel oil

- 19 117R 28.3 Gal Texas Class One Open 2-5 years Diesel

- 6 31.8 Gal tanks Ohio 3-5 years Noneno

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 60 340W Pressure cars in VA – last Ammonia dirty 12-18 mos NS or CSX

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- 10-20 340W pressure cars in Miss. – last butane – dirty lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 30 340W dirty propane or butane west coast negotiable

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

A sign of things getting better – leasing activity and inquiries have continued to be strong

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|