“ It is the mark of an educated mind to be able to entertain a thought without accepting it.“

— Aristotle

Jobs Update

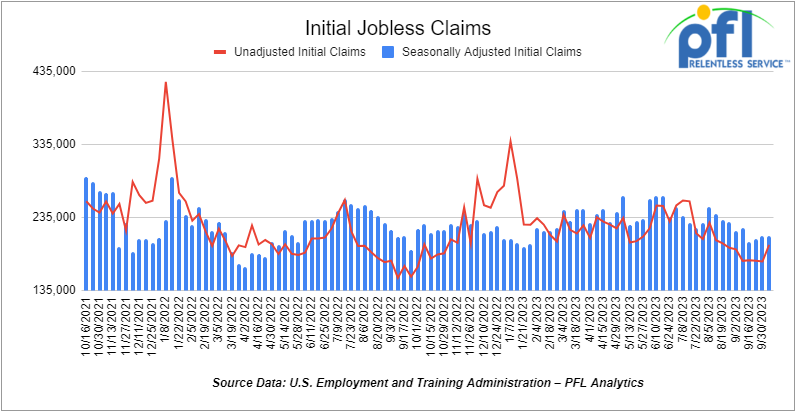

- Initial jobless claims for the week ending October 7th, 2023 came in at 209,000, flat week-over-week.

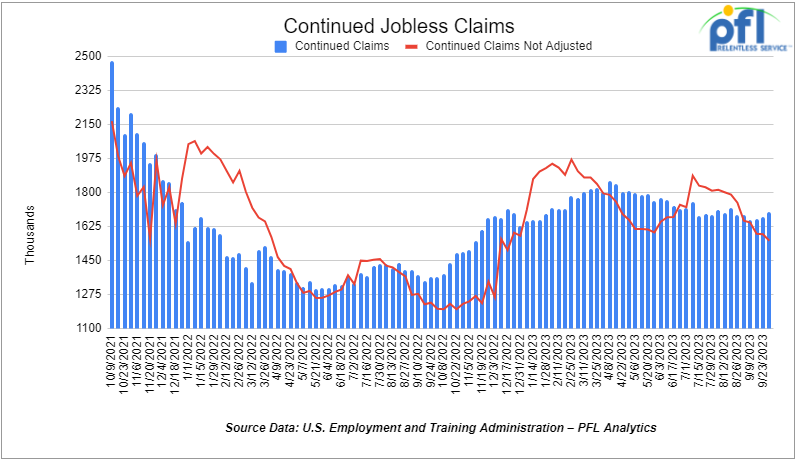

- Continuing jobless claims came in at 1.702 million people, versus the adjusted number of 1.672 million people from the week prior, up 30,000 people week-over-week.

Stocks close mixed on Friday of last week and mixed week over week

The DOW closed higher on Friday of last week, up 39.15 points (0.12%), closing out the week at 33,670.29, up 262.71 points week-over-week. The S&P 500 closed lower on Friday of last week, down -21.83 points (-0.5%) and closed out the week at 4,327.78, up 19.28 points week-over-week. The NASDAQ closed lower on Friday of last week, down -166.99 points (-1.24%), and closed the week at 13,407.23, down -24.11 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 33,920 this morning up 93 points.

Crude oil closed higher on Friday of last week and up week over week

WTI traded up $4.89 per barrel (+5.7%) to close at $90.89 per barrel on Friday of last week, up $8.10 per barrel week-over-week. Brent traded up US$4.78 per barrel (+5.8%) on Friday of last week, to close at US$87.69 per barrel, up US$3.11 per barrel week-over-week.

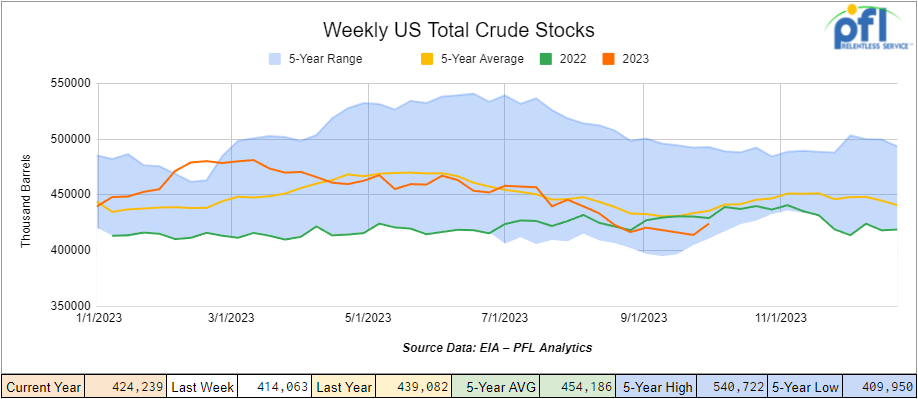

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 10.2 million barrels week-over-week. At 424.2 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

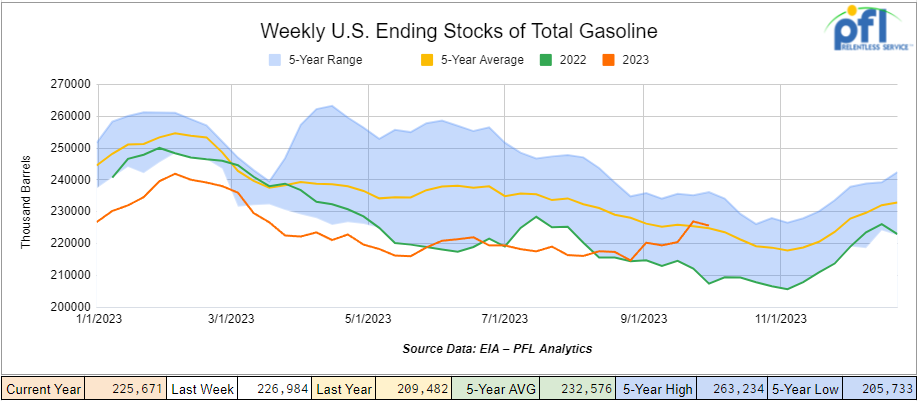

Total motor gasoline inventories decreased by 1.3 million barrels week-over-week and are 1% above the five-year average for this time of year.

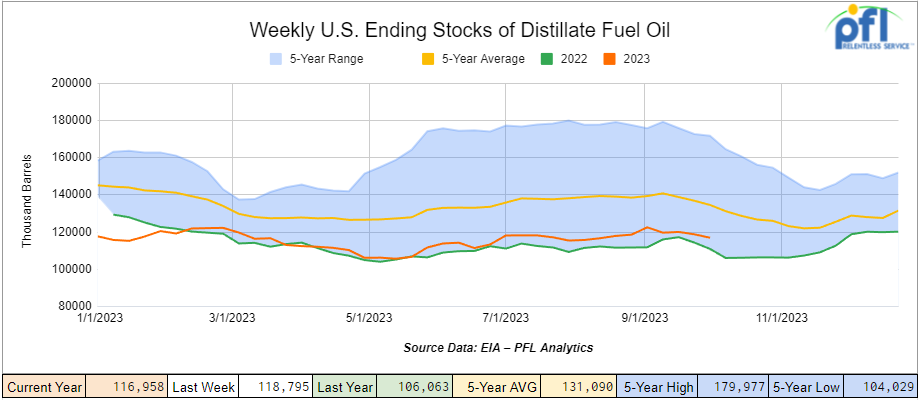

Distillate fuel inventories decreased by 1.8 million barrels week-over-week and are 11% below the five-year average for this time of year.

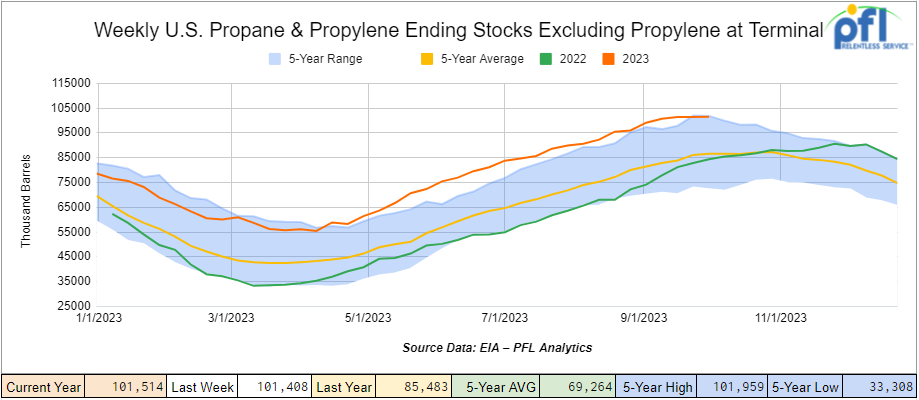

Propane/propylene inventories slightly decreased week-over-week and are 18% above the five-year average for this time of year.

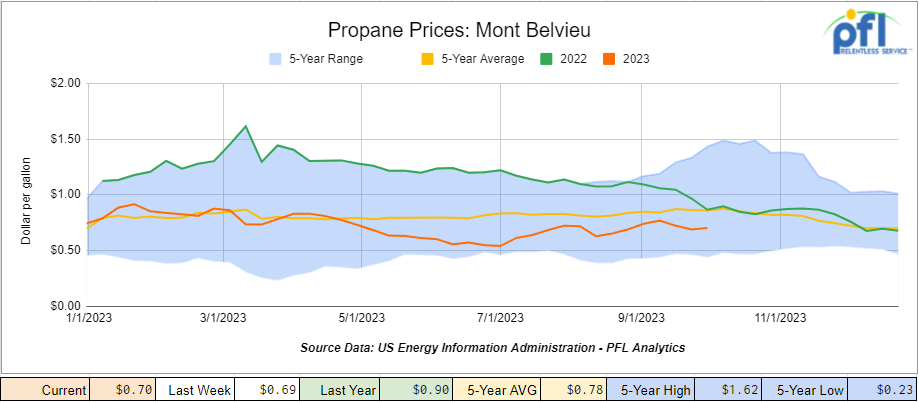

Propane prices closed at 70 cents per gallon, up 1 cent per gallon week-over-week, but down -20 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 6.3 million barrels during the week ending October 6th, 2023.

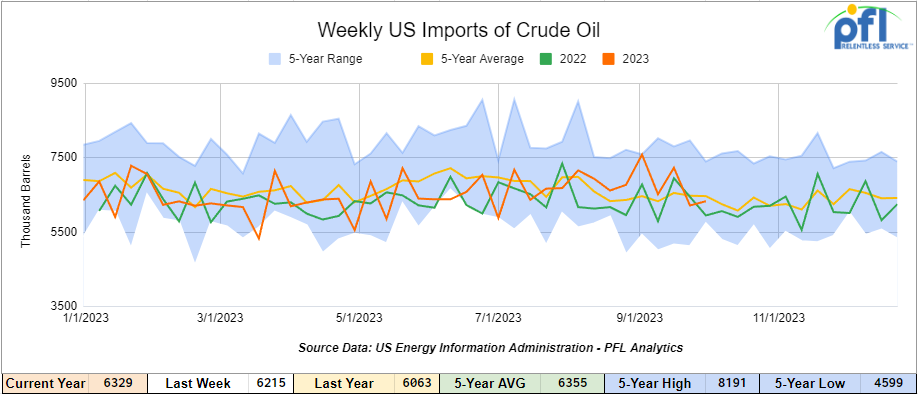

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending October 6th, 2023, an increase of 115,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 3.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 589,000 barrels per day, and distillate fuel imports averaged 120,000 barrels per day during the week ending October 6th, 2023.

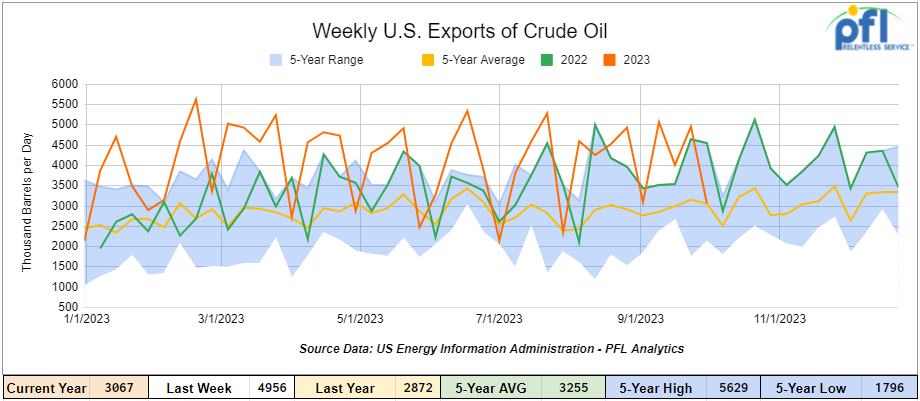

U.S. crude oil exports averaged 3.067 million barrels per day for the week ending September 29th, a decrease of -1.889 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.276 million barrels per day.

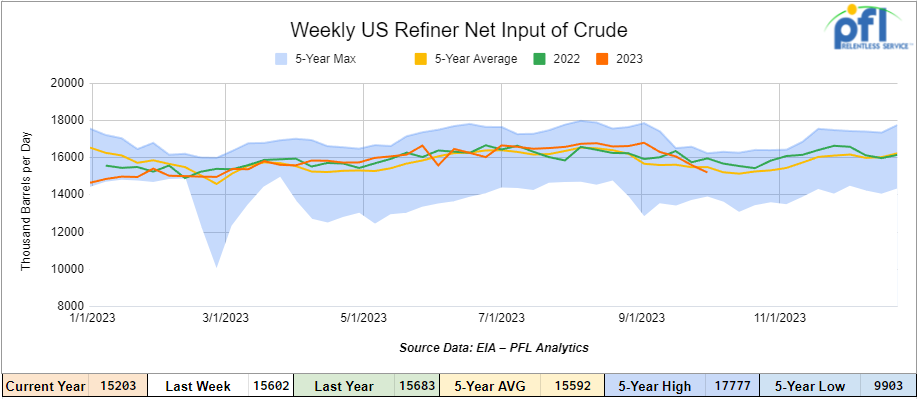

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending October 6, 2023, which was 399,000 barrels per day less week-over-week.

WTI is poised to open at $87.52, down -0.17 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 11th, 2023.

Total North American weekly rail volumes were up (1.52%) in week 40, compared with the same week last year. Total carloads for the week ending on October 11th, 2023 were 361,419, up (+3.57%) compared with the same week in 2022, while weekly intermodal volume was 331,422, down (-0.62%) compared to the same week in 2022. 8 of the AAR’s 11 major traffic categories posted year over year increases with the most significant decrease coming from Forest Products (-6.34%). The largest increase came from Motor Vehicles and Parts (+14.19%).

In the East, CSX’s total volumes were up (+2.32%), with the largest decrease coming from Farm Products (-6.25%) and the largest increase from Grain (+30.68%). NS’s volumes were up (+2.64%), with the largest decrease coming from Petroleum and Petroleum Products (-22.97) and the largest increase from Grain (+30.90%).

In the West, BN’s total volumes were up (2.15%), with the largest decrease coming from Nonmetallic Minerals (-13.87%), and the largest increase coming from Motor Vehicles and Parts (+22.22%). UP’s total rail volumes were up (+1.91%) with the largest decrease coming from Other (-26.44%) and the largest increase coming from Grain (+17.45%).

In Canada, CN’s total rail volumes were down (-2.79%) with the largest increase coming from Nonmetallic Minerals (+42.08%) and the largest decrease coming from Intermodal (-30.59%). CP’s total rail volumes were up (+12.39%) with the largest decrease coming from Other (-25.23%) and the largest increase coming from Motor Vehicles and Parts (+78.03%).

KCS’s total rail volumes were down (-7.49%) with the largest decrease coming from Other (-29.06%) and the largest increase coming from Coal (+40.39%).

Source Data: AAR – PFL Analytics

Rig Count

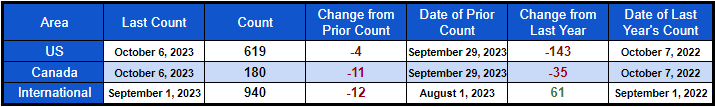

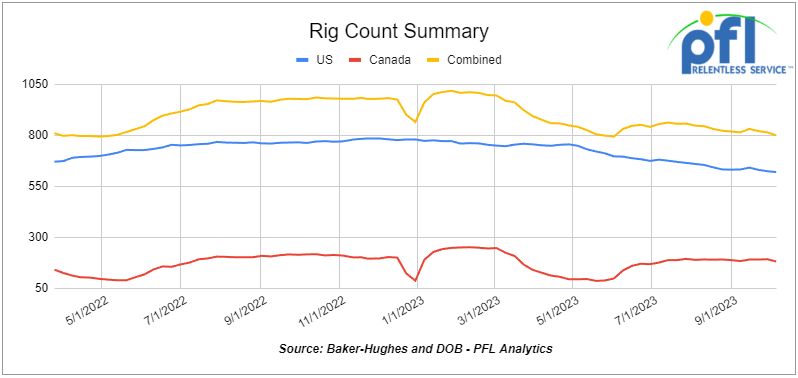

North American rig count was up by 16 rigs week-over-week. U.S. rig count was up by 3 rigs week-over-week and down by –147 rigs year-over-year. The U.S. currently has 622 active rigs. Canada’s rig count was up by 13 rigs week-over-week and down by -23 rigs year over year. Canada’s overall rig count is 193 active rigs. Overall, year-over-year, we are down -170 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,711 from 27,389, which was a gain of +386 rail cars week-over-week. Folks, this is the sixth consecutive week-over-week increase! Canadian volumes were mixed. CPKC’s shipments decreased by -6.3% week over week, and CN’s volumes were higher by +7.7% week-over-week. U.S. shipments were mostly lower. The UP was the sole gainer and was up by +2.8% week-over-week. The NS had the largest percentage decrease and was down by -9.1% week-over-week.

Canada’s Top Court Sides With Alberta and the Canadian People Over Trudeau’s Environmental Impact Law

Finally, some sanity in Canada! Canada’s Supreme Court on Friday of last week ruled a Federal law assessing how major infrastructure projects like coal mines and oilsands plants impact the environment is largely unconstitutional, in a blow to Prime Minister Justin Trudeau’s dictatorship government.

The decision is a victory for Alberta, Canada’s main fossil fuel-producing province, which opposed the Impact Assessment Act (IAA), formerly known as Bill C-69, on the grounds it gave the federal government too much power to kill natural resource projects.

The Supreme Court said the federal government had over-reached its authority by making the scope of its environmental assessment process too broad and including, or “designating,” major projects that typically fall under provincial jurisdiction.

Although the court is technically only issuing an opinion on the IAA, governments tend to treat that opinion as binding and Ottawa will now have to rewrite parts of the act, Wright said. So the battle may continue, but for the time being a victory for all of Canada who just want cheap energy.

The IAA was drafted by Trudeau’s Liberal government in 2019 in a bid to streamline and restore trust in the environmental approval process for major projects.

The court case is the latest flashpoint between the federal Liberals and Alberta’s conservative provincial government, whose Premier Danielle Smith has clashed repeatedly with Trudeau over climate policies. Industry associations also welcomed the ruling.

“We are delighted with the decision. This is a big win for provincial jurisdiction over the development of its own resources,” said Mike Martens, president of the Independent Contractors and Businesses Association Alberta.

Major proposed projects in Alberta that fall under the IAA include Suncor Energy Inc.’s plan to expand its oilsands Base Mine, and privately held Coalspur Mine Ltd.’s Vista coal mine expansion.

Last year, the federal government warned Suncor that the environmental impact from expanding Base Mine would be “unacceptable” under the IAA because expected carbon emissions were too high.

Suncor, on the other hand, claims that its operations and land reclamation and the environment is a priority – “For as long as we’ve been developing the oil sands, reclaiming land disturbed by our operations has been a priority” Some interesting facts on Suncor’s operations:

- 11% is the percentage of land that Suncor has reclaimed;

- 300 – Is the number of bison that graze on three reclaimed areas within areas of Syncrude operations;

- 9+ million seedlings have been planted since Suncor began operations in 1967;

- 9,185 hectares of land have been reclaimed since 1967;

- Suncor says that 94% of its water is recycled at Base plant and its other facilities, in addition 44% of its water used in their Edmonton refinery was recycled waste water.

Below is Sucor’s Energy Pond 1 in 2002 – Pond 1 operated from 1967 to 1997. Dykes were built to create a wider and deeper basin until eventually the pond was lifted about 100 meters above the Athabasca River.

Source: Suncor – PFL Analytics

Below is a picture of Pond 1 after its reclamation. A cover crop of native grasses and oats were planted on Pond 1 as part of its reclamation.

Source: Suncor – PFL Analytics

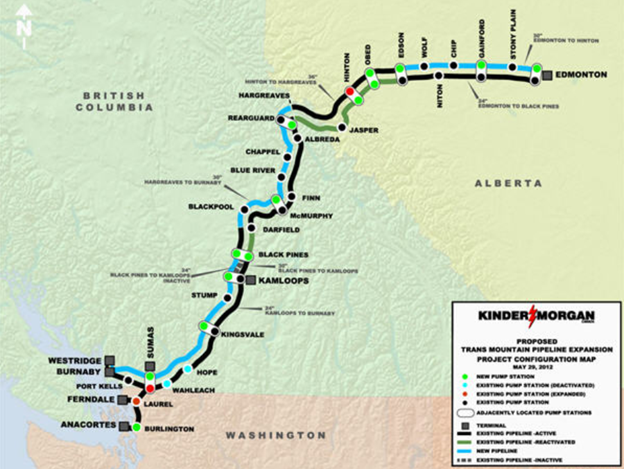

We are continually watching another environmental battle in Canada TMP

Minister of Energy and Natural Resources Jonathan Wilkinson said last week the Trans Mountain oil pipeline is mostly complete and will be done in the months ahead.

In September, the Canada Energy Regulator approved an application from Trans Mountain Corp. to modify the pipeline’s route. In an interview with BNN Bloomberg on Friday, Wilkinson gave an update on the project.

“The expectation is that the project is going to be completed in the coming months,” he said. “I don’t have the specific date in front of me in terms of when the corporation expects to complete it, but the project is over 90 per cent complete.”

Wilkinson said the project has taken “some time” for various reasons, which include the importance of engaging Indigenous communities.

The Trans Mountain Expansion Project, which twins the existing pipeline from Edmonton to Burnaby, B.C., will increase Canada’s crude capacity by 300,000 barrels per day.

The federal government bought the pipeline from Kinder Morgan for $4.5 billion in 2018 and the project has since faced a series of delays and cost overruns.

Latest estimates show the project may cost the federal government more than $30 billion, while the Parliamentary Budget Officer suggests the government may never turn a profit on the pipeline. The Commission of the Canada Energy Regulator (CER) is reviewing the interim tolling application from Trans Mountain.

Interim tolling allows a company to charge shippers to use a pipeline until a final tolling decision is made.

The Commission outlined a process to handle the interim tolling application to ensure fairness and efficiency. The first step is a preliminary decision, expected in the fall of 2023 to ensure tolling is in place when the line becomes operational.

The second step is the final interim tolls hearing that will unfold in 2024. As part of this hearing, the Commission will look at several issues including:

- appropriateness of the allocation of TMEP costs to capped and uncapped costs;

- fairness and reasonableness of the existing tolling agreements; and

- potential repercussions on Trans Mountain’s financial standing and any possible impacts to the market.

In its application, Trans Mountain proposed an increase in tolls on the expanded Trans Mountain system and the existing pipeline. After service begins on the TMEP and final costs are known, Trans Mountain can request approval from the Commission of the CER for final tolls.

Interested parties who want to participate in the hearing process can register at www.cer-rec.gc.ca/participate on or before Oct. 19, 2023.

Trans Mountain Pipeline

Source: Kinder Morgan – PFL Analytics

We are watching Service and the Class 1’s combined with certain states’ New Mandates

Folks, we do not know how this is going to work out – we have a complicated situation on our hands. As you know, ALL class 1’s are struggling to hire new people and keep up with current demand let alone grow their service offering and compete with trucks. We highlighted this in last week’s rail report and the theme at NEARS. It is a great objective and great for our industry. However, the recent move of States to require two-person train crews may make us take a couple of steps back.

Kansas Gov. Laura Kelly announced last week that a rule mandating a minimum of two-person train crews will take effect in the state on Nov. 3.

In May, Kelly directed the Kansas Department of Transportation to propose a rule that would require railroads operating in the state to have at least two crew members on board a train’s lead locomotive. When the rule takes effect, Kansas will become the 10th state in the nation to mandate a train-crew minimum.

“Kansans’ safety and security must always come first, and that includes the safety of our railroad crew members,” Kelly said in a press release. “This requirement will protect workers from the effects of fatigue, prevent train derailments, and reduce risks in the many Kansas communities along our railroad tracks.”

After the rule was proposed, it was subject to at least a 60-day public comment period. Organizations including the International Association of Sheet Metal, Air, Rail, and Transportation Workers (SMART) have supported the rule.

SMART leaders praised Kelly’s action to implement the train-crew minimum.

“It still takes a minimum of two individuals, regardless of train size, to safely move and respond to emergencies as they arise throughout the state; an on-scene crew to mitigate emergencies as they arise the second an accident happens is paramount,” said SMART Transportation Division Kansas State Legislative Director Ty Dragoo. “This regulation ensures Kansas communities and citizens have the already widely accepted industry-wide minimum standard in place for their safety.”

The Association of American Railroads is opposed to mandatory train-crew rules, saying crew size should be determined by contract negotiations between the railroads and labor unions.

“Regulatory efforts to mandate crew staffing such as the latest in Kansas lack a safety justification,” AAR spokesperson Jessica Kahanek said in a statement to the Associated Press.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 3, 23.5-25.5 Any Tanks needed off of Any in Port Allen, LA for 90 Days. Cars are needed for use in Fuel Oil service.

- 3, 23.5-25.5 Any Tanks needed off of Any in Nachaz, MS for 90 Days. Cars are needed for use in Fuel Oil service.

- 100, 30K Any Tanks needed off of Any in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined products service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|