“The smallest deed is better than the greatest intention.” – John Burroughs

Jobs Update

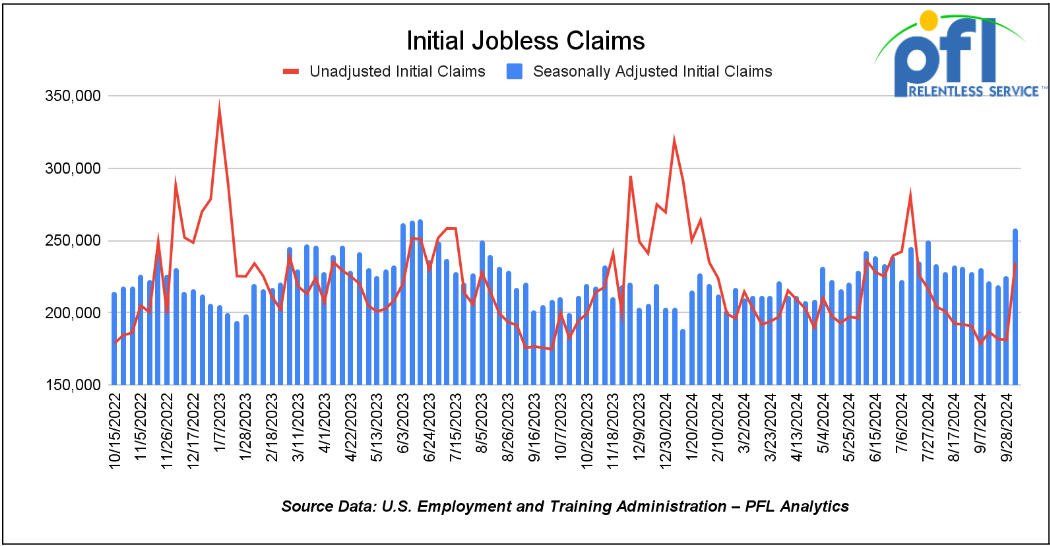

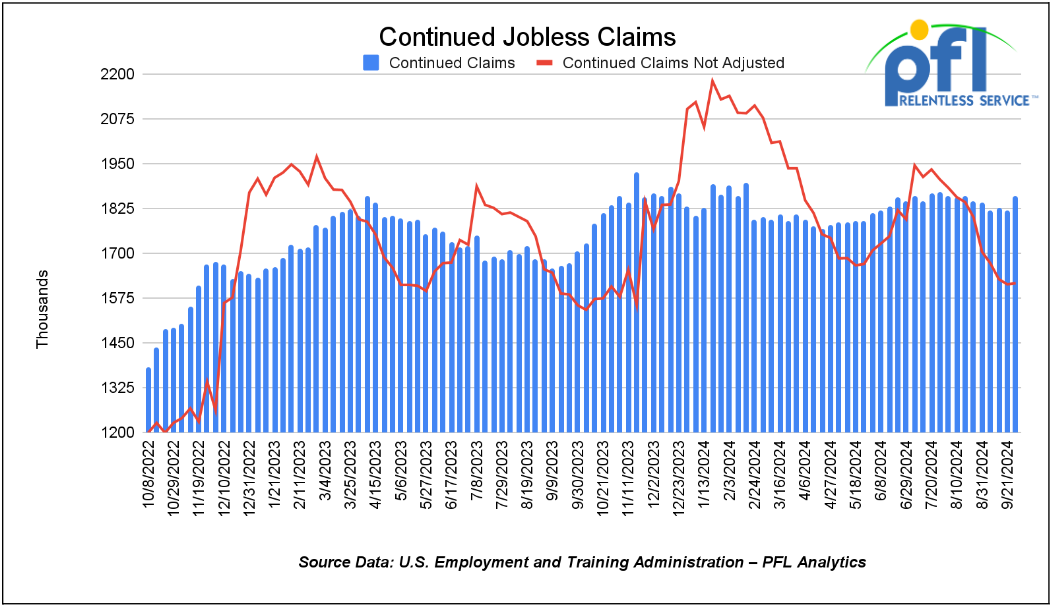

- Initial jobless claims seasonally adjusted for the week ending October 5th came in at 258,000, up 33,000 people week-over-week.

- Continuing jobless claims came in at 1.826 million people, versus the adjusted number of 1.861 million people from the week prior, up 42,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher, on Friday of last week up 409.74 points (0.97%), closing out the week at 42,863.86, up 538.12 points week-over-week. The S&P 500 closed higher on Friday of last week, up 34.98 points and closed out the week at 5,815.03, up 63.96 points week-over-week. The NASDAQ closed higher on Friday of last week, up 60.89 points (0.34%) and closed out the week at 18,342.94, up 205.09 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 43,115 this morning down -28 points.

Crude oil closed down on Friday of last week, but up week over week.

West Texas Intermediate (WTI) crude closed down -$0.29 per barrel (-0.38%) to close at $75.56 per barrel on Friday of last week, up $1.18 per barrel week over week. Brent traded down -$0.04 USD per barrel (-0.45%) on Friday of last week, to close at $79.04 per barrel, up $0.99 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for November delivery settled Friday on last week at US$10.95 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 63.97 per barrel.

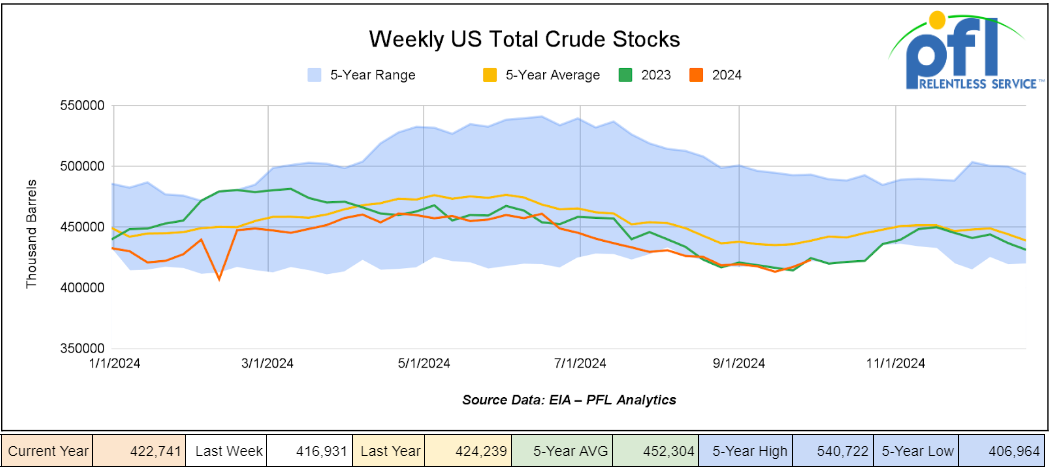

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 5.8 million barrels week-over-week. At 422.7 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

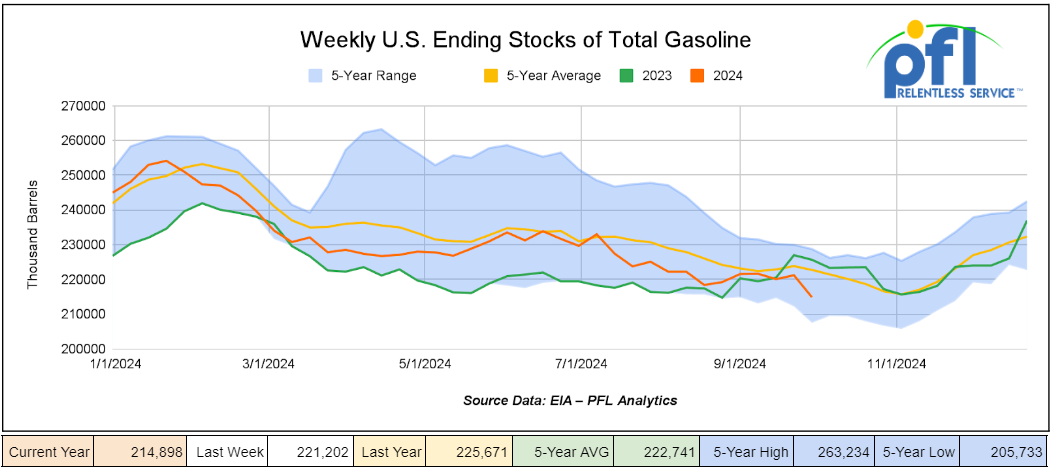

Total motor gasoline inventories decreased by 6.3 million barrels week-over-week and are 4% below the five-year average for this time of year.

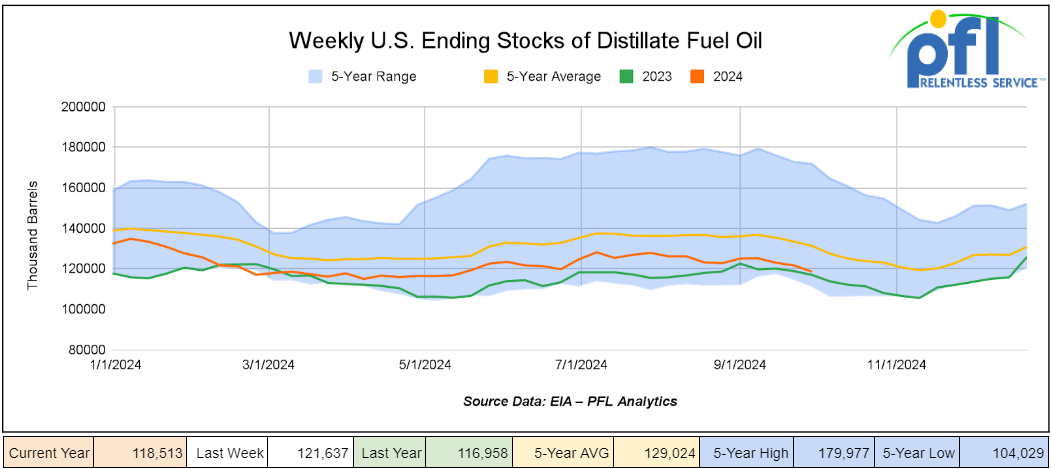

Distillate fuel inventories decreased by 3.1 million barrels week-over-week and are 9% below the five-year average for this time of year.

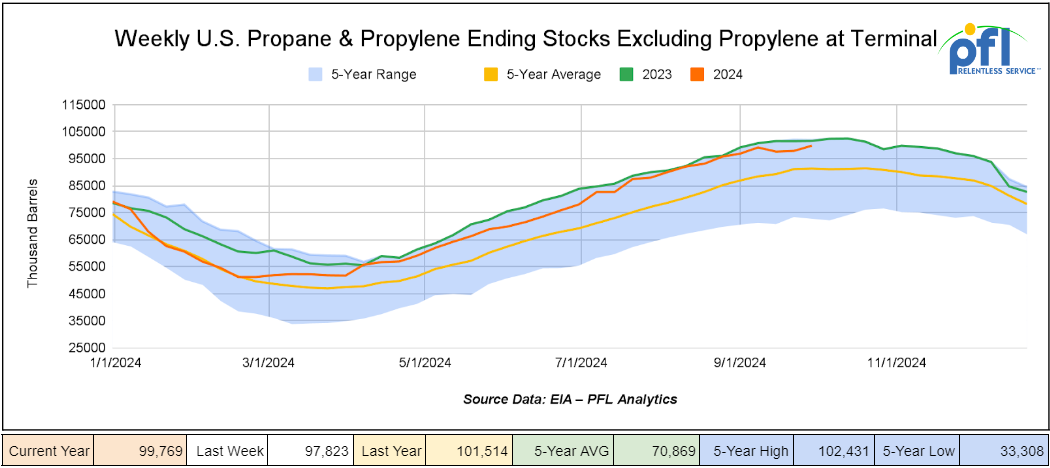

Propane/propylene inventories increased by 1.9 million barrels week-over-week and are 9% above the five-year average for this time of year.

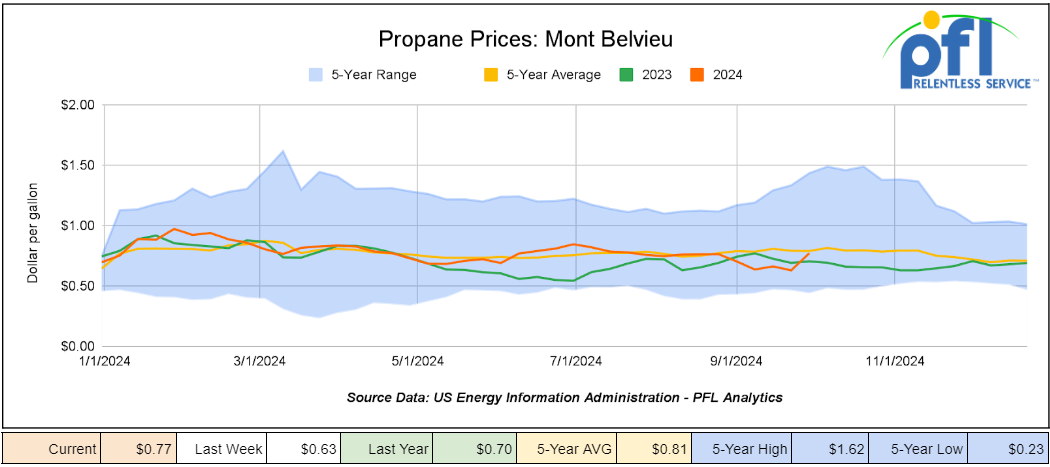

Propane prices closed at 77 cents per gallon on Friday of last week, up 14 cents per gallon week-over-week and up 7 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 8.1 million barrels during the week ending October 4th, 2024.

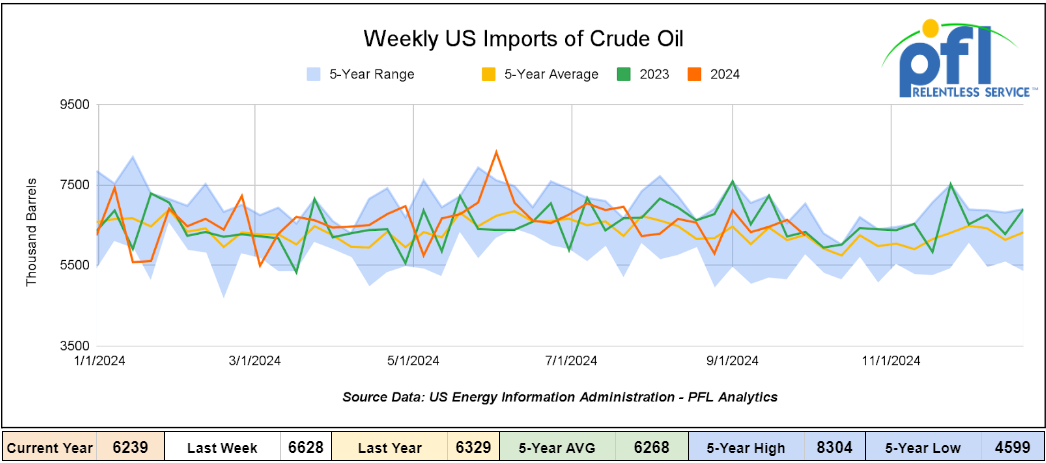

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending October 4th, 2024, a decrease by 389,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 2.5% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 48,000 barrels per day, and distillate fuel imports averaged 104,000 barrels per day during the week ending October 4th, 2024.

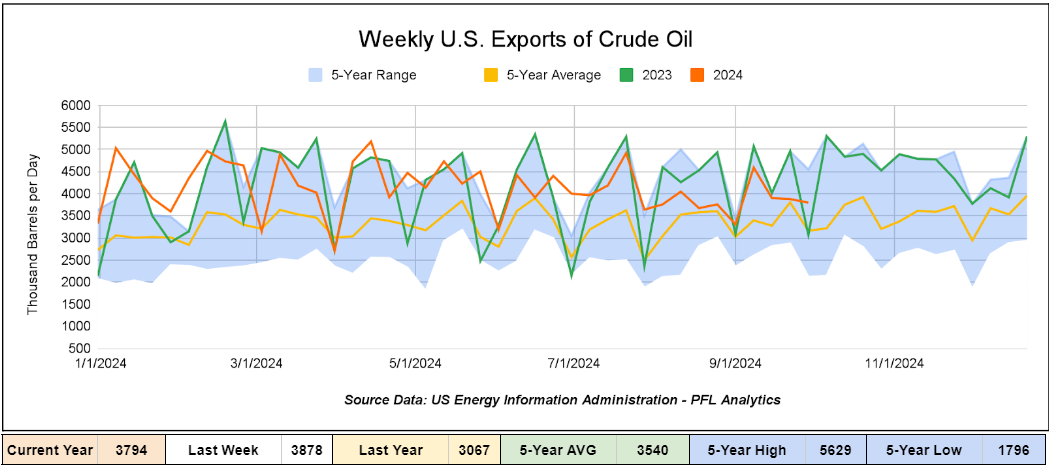

U.S. crude oil exports averaged 3.794 million barrels per day during the week ending October 4th, 2024, a decrease of -84,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.04 million barrels per day.

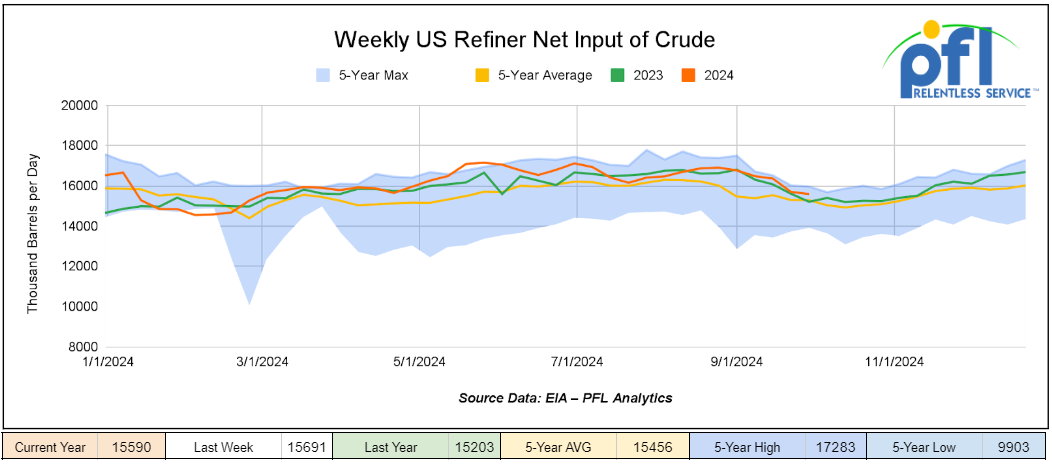

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending October 04, 2024, which was 101,000 barrels per day less week-over-week.

WTI is poised to open at $73.57, down $1.99 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 9th, 2024.

Total North American weekly rail volumes were down (-2.15%) in week 41, compared with the same week last year. Total carloads for the week ending on October 9th were 348,322, down (-3.62%) compared with the same week in 2023, while weekly intermodal volume was 329,611, down (-0.55%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Nonmetallic Minerals, which was down (-8.63%). The most significant increase came from Farm Products which was up (+6.96%).

In the East, CSX’s total volumes were down (-12.63%), with the largest decrease coming from Intermodal (-20.94%) while the largest increase came from Petroleum and Petroleum Products (+30.18%). NS’s volumes were down (-9.05%), with the largest increase coming from Other (+14.68%), while the largest decrease came from Intermodal (-14.29%).

In the West, BN’s total volumes were up (+5.21%), with the largest increase coming from Intermodal (+11.13%) while the largest decrease came from Forest Products, down (-7.47%). UP’s total rail volumes were up (+7.05%) with the largest decrease coming from Grain, down (-18.76%), while the largest increase came from Intermodal, which was up (+18.86%).

In Canada, CN’s total rail volumes were down (-10.92%) with the largest decrease coming from Coal, down (-36.14%) while the largest increase came from Other, up (+13.35%). CP’s total rail volumes were down (-2.93%) with the largest increase coming from Other (+50%), while the largest decrease came from Motor Vehicles and Parts (-17.87%). KCS’s total rail volumes were down (-8.96%) with the largest decrease coming from Other (-39.76%) and the largest increase coming from Grain (+67.7%).

Source Data: AAR – PFL Analytics

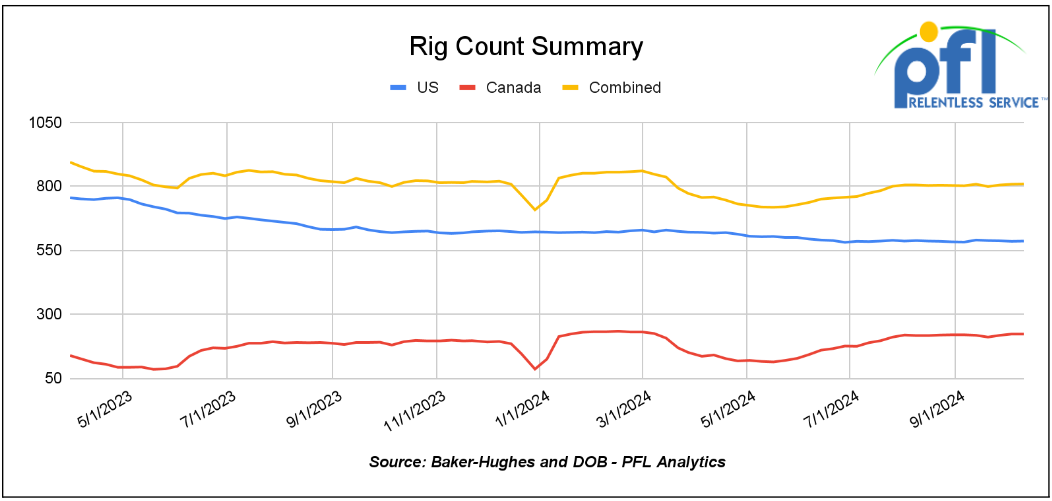

Rig Count

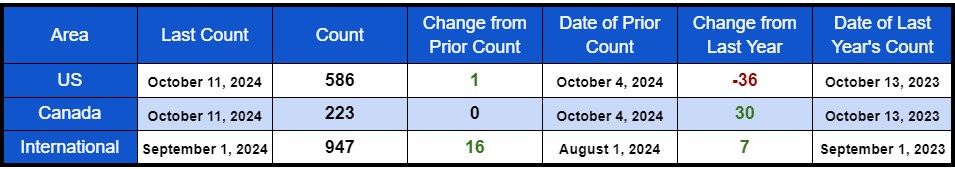

North American rig count was up by 1 rig week-over-week. U.S. rig count was up by 1 rig week-over-week, but down by -36 rigs year-over-year. The U.S. currently has 586 active rigs. Canada’s rig count was flat week over week but up by 30 rigs year-over-year and Canada’s overall rig count is 223 active rigs. Overall, year over year we are down by -6 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We continue to watch a lot out there for you folks. PFL and its staff were taken out by Hurricane Milton last week. We are pleased to inform our followers that all staff from our Naples Florida head office are safe. The office and staff did, however, face power interruptions, hence the shortened report this week. We are also pleased to inform you that we are all back up and running and will return to normal reporting this week and on a go-forward basis!

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,523 from 28,272, which was a gain of 252 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments fell by 4.9% week over week, and CN’s volumes were higher by 4.6% week-over-week. U.S. shipments were mixed higher. The CSX had the largest percentage increase, which was 17.7%. The UP had the largest percentage decrease and was down by +4.4%.

We Continue to Watch Key Economic Data

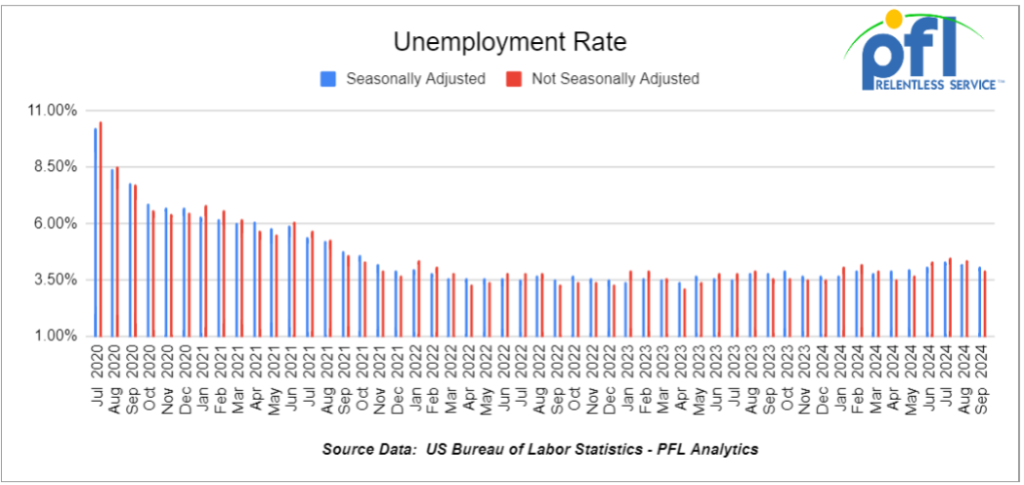

U.S Unemployment

The September 2024 jobs report from the Bureau of Labor Statistics showed a significant increase in employment, with 336,000 new jobs created, surpassing expectations. This marked the strongest job growth in several months. Notable sectors contributing to this increase included leisure and hospitality, health care, and government.

Meanwhile, the unemployment rate decreased 0.1% to 4.2% month over month. Additionally, job openings remained high, reflecting strong demand for labor across various sectors.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 90, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Fuel OIl. 2-3 Year Term

- 50, 28.3K, 117R Tanks located off of All Class 1s in St. Louis. Cars are clean 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations. Will take 90K

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 40, 33K, 340W Pressure Tanks located off of Multiple in All over.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website