“Instead of looking at things, look between things”

– John Boldessari

Jobs Update

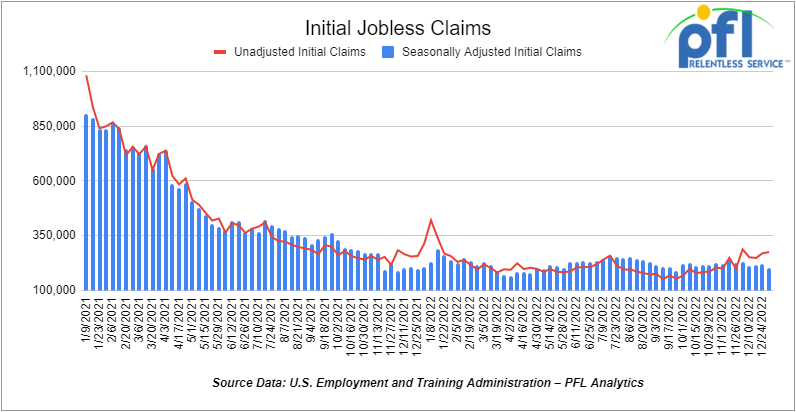

- Initial jobless claims for the week ending December 31st, 2022 came in at 204,000, down -19,000 people week-over-week.

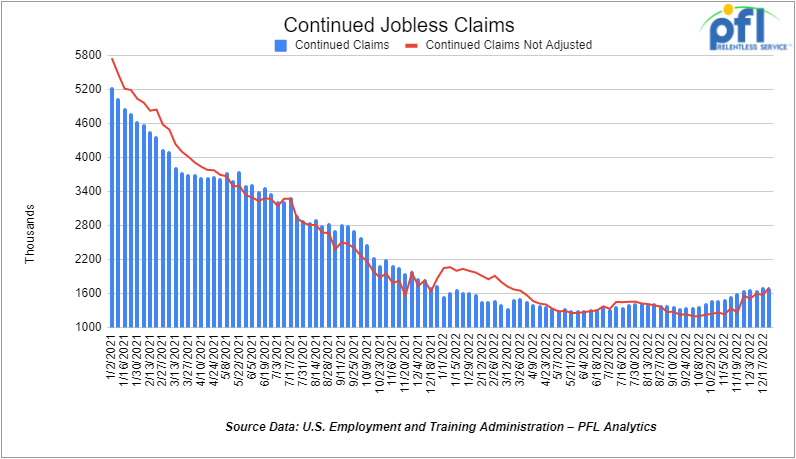

- Continuing jobless claims came in at 1.694 million people, versus the adjusted number of 1.718 million people from the week prior, down -24,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up +700.53 points (+2.13%), closing out the week at 33,630.61, up 483.36 points week over week. The S&P 500 closed higher on Friday of last week, up 86.98 points (2.28%) and closed out the week at 3,895.08, up 55.58 points week over week. The NASDAQ closed higher on Friday of last week, up 264.05 points (2.52%), and closed the week at 10,569.29, up 102.81 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,881 this morning up 109 points.

WTI closed higher on Friday of last week but down week over week

WTI traded up $0.10 per barrel (+0.1%) to close at $73.77 per barrel on Friday, down -$6.49 per barrel week over week. Brent traded down US$0.12 per barrel (-0.2%) on Friday of last week, to close at US$78.57 per barrel, down -$7.34 per barrel week over week. For the week, both Brent and WTI were down over 8%, their biggest weekly losses to start the year since 2016. Both benchmarks had gained 13% during the prior three weeks.

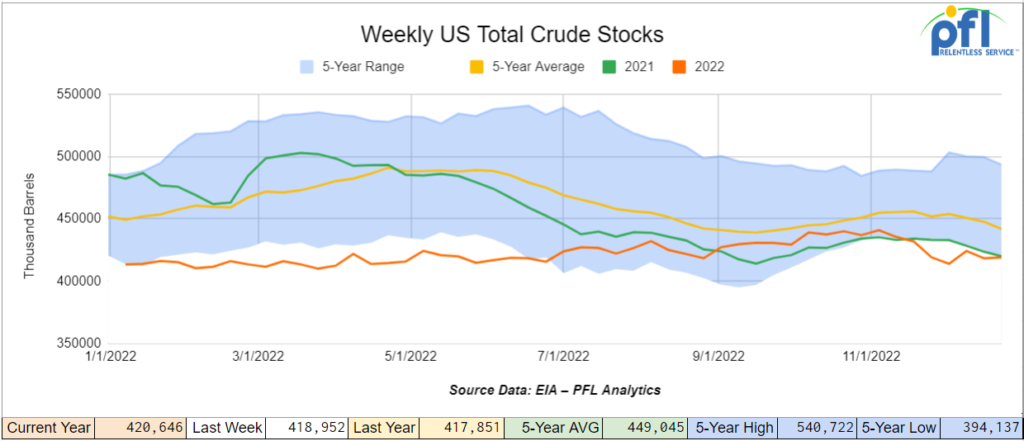

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.7 million barrels week over week. At 420.6 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

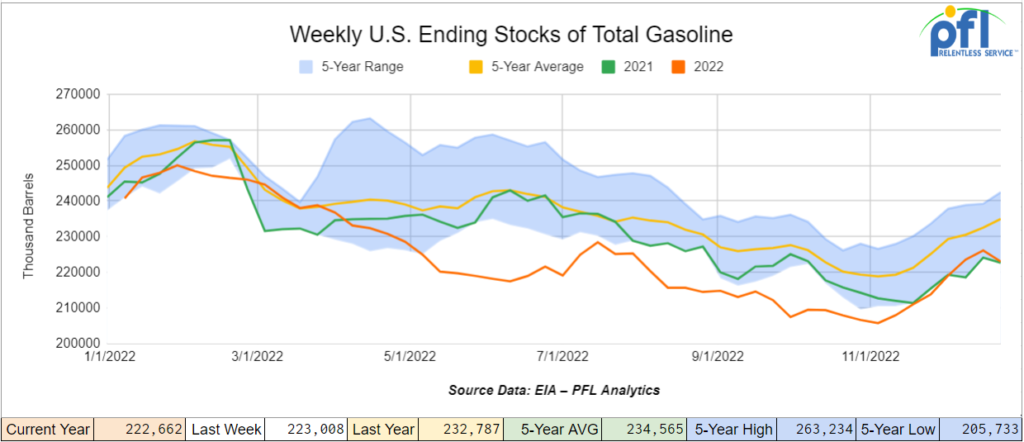

Total motor gasoline inventories decreased by 3 million barrels week over week and are 6% below the five-year average for this time of year.

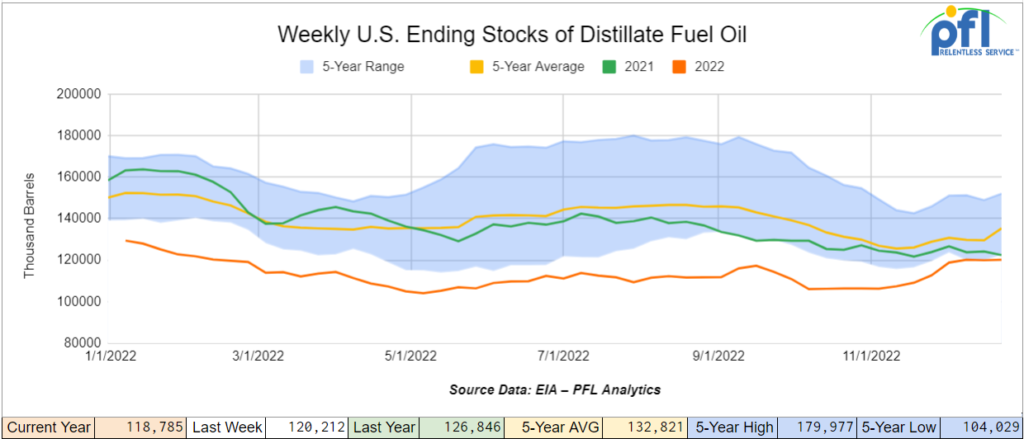

Distillate fuel inventories decreased by 1.4 million barrels week over week and are 14% below the five-year average for this time of year.

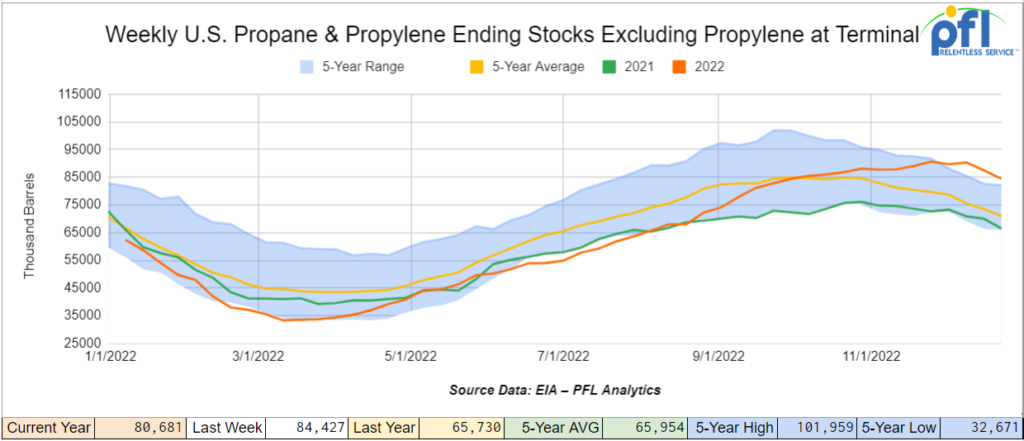

Propane/propylene inventories decreased by 3.7 million barrels week over week and are 15% above the five-year average for this time of year.

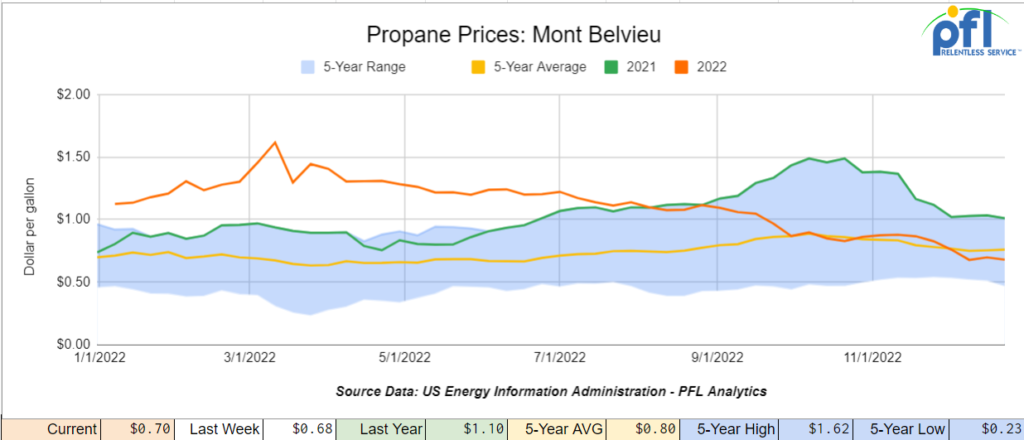

Propane prices were up 2 cents per gallon week over week, closing at 70 cents per gallon down 40 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 3.1 million barrels last week.

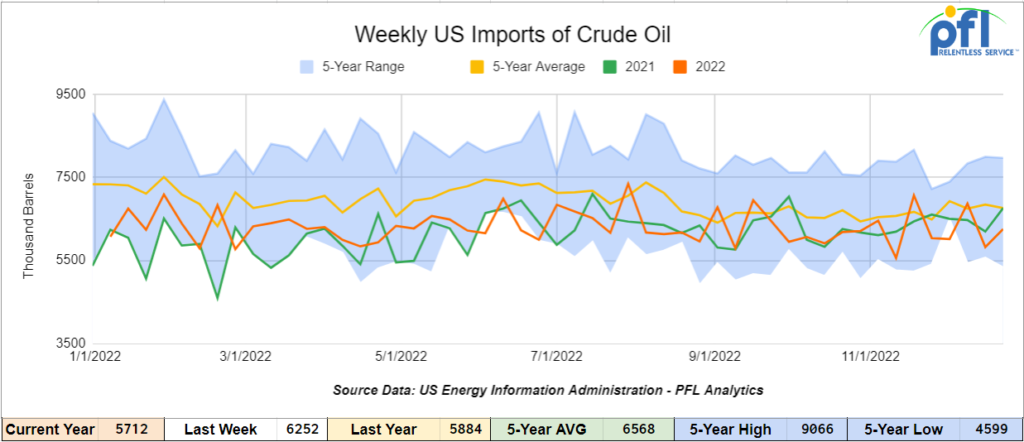

U.S. crude oil imports averaged 5.7 million barrels per day during the week ending December 30th, 2022, a decrease of 540,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 2.6% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 551,000 barrels per day, and distillate fuel imports averaged 113,000 barrels per day during the week of December 30th, 2022.

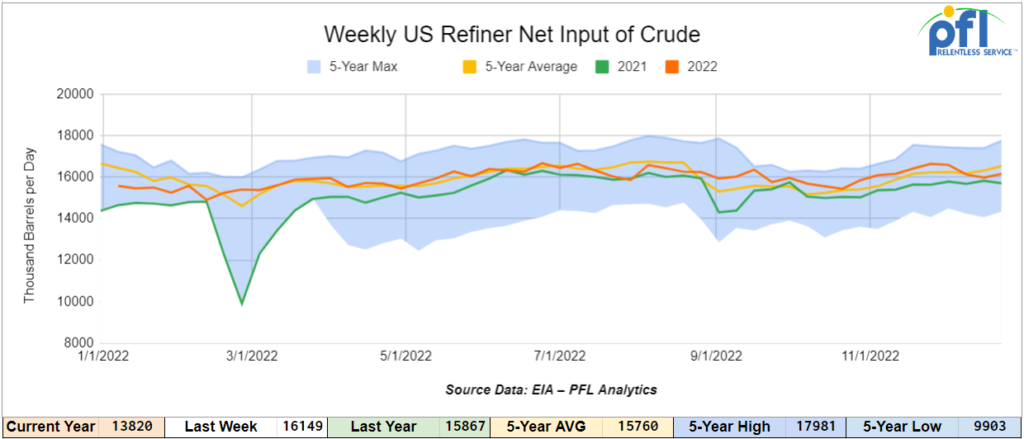

U.S. crude oil refinery inputs averaged 13.8 million barrels per day during the week ending December 30, 2022 which was 2.3 million barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $76.25, up +$2.48 per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 31st, 2022.

Total North American weekly rail volumes were down (-6.81%) in week 52 compared with the same week last year. Total carloads for the week ending on December 31st were 276,871, down (-10.46%) compared with the same week in 2021, while weekly intermodal volume was 240,130, down (-2.23%) compared to 2021. 9 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant increase coming from Motor Vehicles and Parts (+5.19%). The largest decrease was from Forest Products (-20.37%).

In the east, CSX’s total volumes were down (-9.17%), with the largest decrease coming from Chemicals (-26.33%) and the largest increase from Motor Vehicles and Parts (+19.79%). NS’s volumes were down (-4.86%), with the largest decrease coming from Forest Products (-23.16%) and the largest increase from Grain (+49.76%).

In the West, BN’s total volumes were down (-10.79%), with the largest decreases coming from Chemicals (-25.71%), and the largest increase coming from Farm Products (+8.34%). UP’s total rail volumes were up (+1.01%) with the largest decrease coming from Forest Products (-27.79%) and the largest increase coming from Intermodal (+22.38%).

In Canada, CN’s total rail volumes were down (-10.69%) with the largest decrease coming from Farm Products (-16.40%) and the largest increase coming from Petroleum and Petroleum Products (+29.66%). CP’s total rail volumes were down (-14.99%) with the largest decrease coming from Grain (-42.06%) and the largest increase coming from Petroleum and Petroleum Products (+138.1%).

KCS’s total rail volumes were down (-7.49%) with the largest decrease coming from Metallic Ores and Minerals (-42.54%) and largest increase coming from Petroleum and Petroleum Products (+23.4%).

Source Data: AAR – PFL Analytics

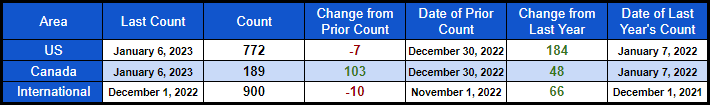

Rig Count

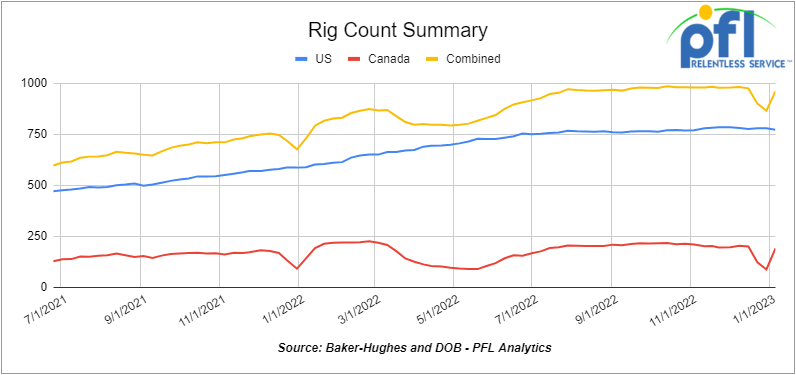

North American rig count was up by 96 rigs week over week. U.S. rig count was down by -7 rigs week-over-week but up by +184 rigs year over year. The U.S. currently has 772 active rigs. Canada’s rig count was up by 103 rigs week-over-week, and up by 48 rigs year-over-year. Canada’s overall rig count is 189 active rigs. Overall, year over year, we are up +232 rigs collectively.

International rig count was down by -10 rigs month-over-month and up +66 rigs year-over-year. Internationally, there are 900 active rigs.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,656 from 24,325, which was a loss of 669 railcars week-over-week Canadian volumes were up; CP’s shipments increased by +26.4% week over week, and CN’s volumes were up by +16.5% week over week. U.S. shipments were lower on all class 1’s. The UP had the largest percentage decline and was down by -13%.

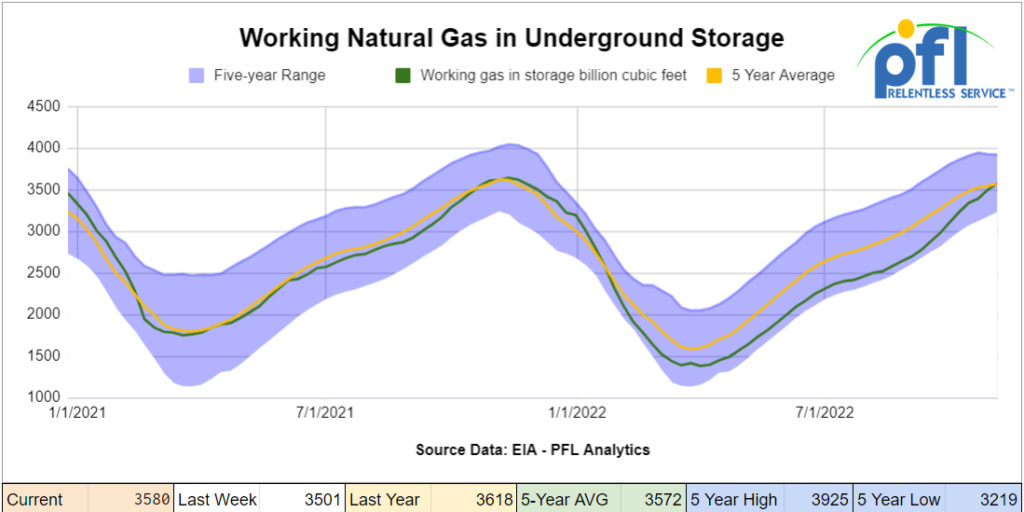

We are watching Natural Gas and LPG’s

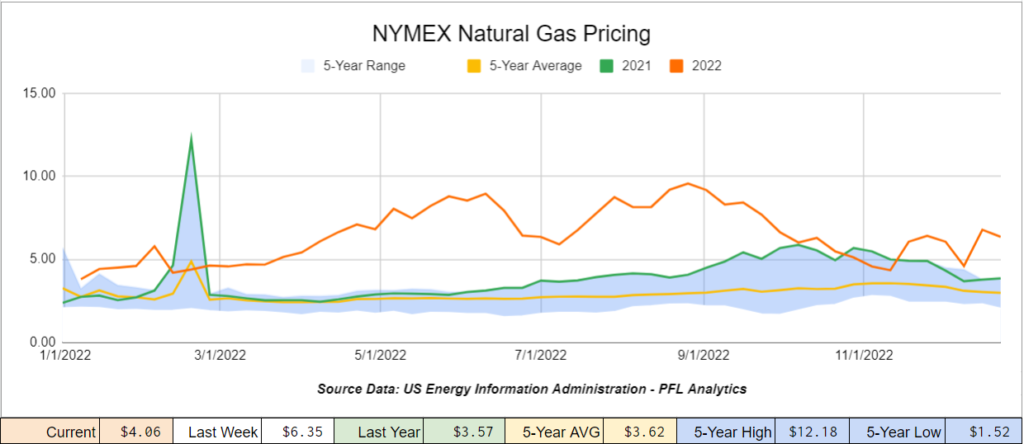

Folks, we did not see this one coming. Nat-gas prices plunged as unseasonably warm weather has set in. There has been a sudden thaw across the Northern Hemisphere that crushed natural-gas prices, upending dire forecasts of energy shortages and putting a wrinkle in Vladimir Putin‘s plan to short squeeze Europe this winter. Natural-gas futures for February delivery dropped 11% on Tuesday to of last week closing at $3.988 per mmbtu and the selloff continued all week with Nat gas closing out the week on Friday of last week at $3.710 per mmbtu. Prices are now down more than 50% from summer highs and are about what Nat-gas cost a year ago, when temperatures were also warmer than normal and before Russia’s invasion of Ukraine jolted energy markets. The plunge is a bad omen for drillers, whose shares were among the stock market’s few winners last year. Cheaper gas is good news for households and manufacturers whose budgets have been busted and profit margins pinched by high fuel prices. Falling natural gas prices should help to cool inflation in the months ahead. What does this mean for rail? Well to make a long story short the lower natural gas consumption the lower LPG production, which will have a direct correlation with decreased rail movement. With propane inventories as detailed above 15% above the five-year average for this time of year it’s going to get interesting. (See below NYMEX weekly chart ending 12/30/22)

Natural Gas Producers are waiting for Freeport’s 2 bcf per day LNG facility to start up now for the end of January. The Freeport LNG export terminal, located in Quintana Island, Texas, has been offline and not producing LNG since June 2022 due to an explosion. Freeport has changed its estimated restart date multiple times. In early December, Freeport said that it would begin to return to service by the end of 2022. Rumor on the street on Friday was the government was going to require more training of staff before they are allowed to reopen. We are watching this one closely. Storage levels are building here in the U.S.

European NatGas got crushed as well (albeit still expensive by American standards). The Dutch Title Transfer Facility (TTF) February contract fell to nearly $22/MMBtu on Tuesday of last week. That’s a low not seen since November 2021 before Russia invaded Ukraine and sent natural gas prices soaring to record highs on supply fears. Unseasonably warm weather has weighed down TTF in recent weeks, giving the market a chance to replenish storage inventories during the heating season, which is a good thing for Europe who has been conserving Energy.

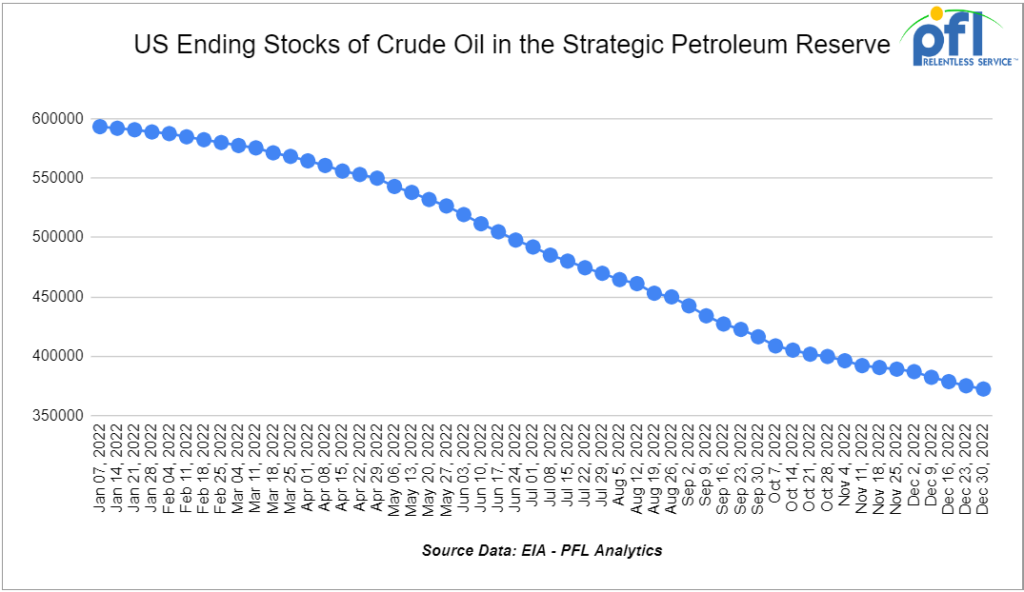

We are watching our SPR Reserves Dwindle

U.S. emergency oil stockpiles have dropped to the lowest level since 1983 according to federal data released Wednesday of last week by the Department of Energy (DOE). The level of the SPR declined to 375.1 million barrels, marking the first time it has fallen below 378 million barrels since December 1983, according to the Energy Information Administration. Prior to last week, the reserve’s lowest level since 1983 was recorded on Dec. 30, 1983, when it hit 378.3 million barrels.

Some Key Economic Indicators

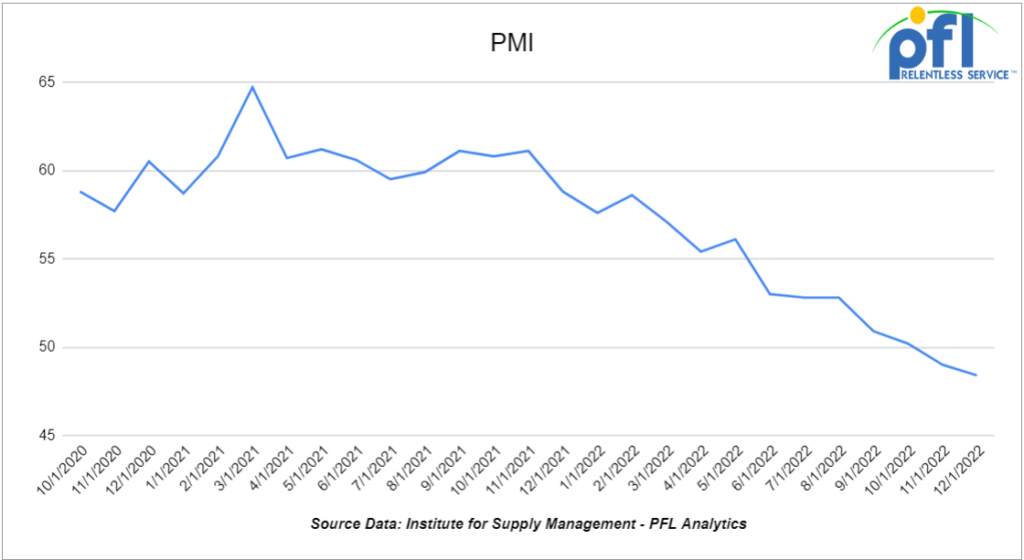

Purchasing Managers Index (“PMI”) – The PMI (which covers manufacturing) and the Services PMI (covering services) are both from the Institute for Supply Management. They are based on surveys of supply managers around the country. The surveys track the direction of changes in business activity. An index reading above 50% indicates expansion; below 50% means contraction. The more above or below 50, the faster the pace of change. The PMI was down month over month at 48.4% in December, versus 49% in November. November and December are the first two readings below 50% for the PMI since May 2020, when the pandemic was in its infancy. Including December, the PMI has fallen for seven straight months. The new orders component was 45.2% in December, down from 47.2% in November.

Just two of the 18 manufacturing sectors tracked in the PMI grew in December. Services are a much larger share of the U.S. economy than manufacturing. The ISM produces its ISM Services PMI. Unexpectedly, that index fell from a solid 56.5% in November to a not-so-solid 49.6% in December.

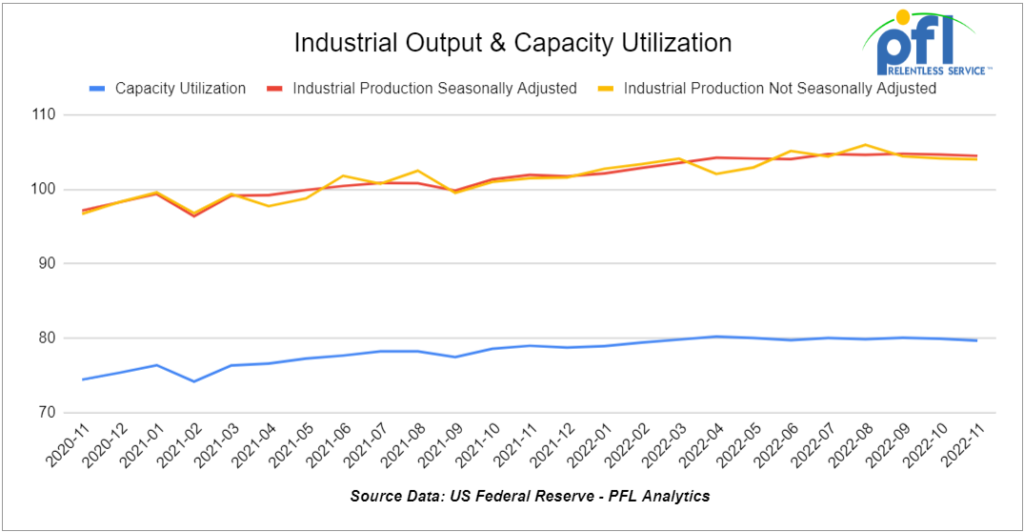

Industrial Output and Capacity Utilization-U.S. industrial output has been essentially stagnant since the Federal Reserve began raising interest rates in the spring of 2022. On a scale of 2017=100, total industrial output in April 2022 was 104.3. In November 2022, it was 104.5. In between, it bounced around from a low of 103.9 in June to a high of 104.8 in September. Output in November was down 0.2% from October, which in turn was down 0.1% from September. Total output in November 2022 was 2.5% higher than in November 2021. That’s the smallest year-over-year gain for total output since March 2021.

Manufacturing output was down 0.6% in November, its first month-over-month decline after four straight increases. Combined with the sub-50% PMI in November and December it appears to signal a slowdown in the manufacturing sector.

The 25% of total output that isn’t manufacturing comes from utilities and mining firms. Because of weather impacts, utility output tends to fluctuate more than other components of total output. In November, utility output rose 3.6% from October. Mining includes traditional activities like coal and ore mining, as well as oil and gas extraction. Mining output was down 0.7% in November, largely because oil and gas well drilling fell for the first time since August 2020.

Overall capacity utilization fell to a seasonally adjusted 79.7% in November from 79.9% in October. This is the lowest total capacity utilization in five months. Manufacturing capacity utilization in November was 78.94%, down -0.54% from October’s 79.48%.

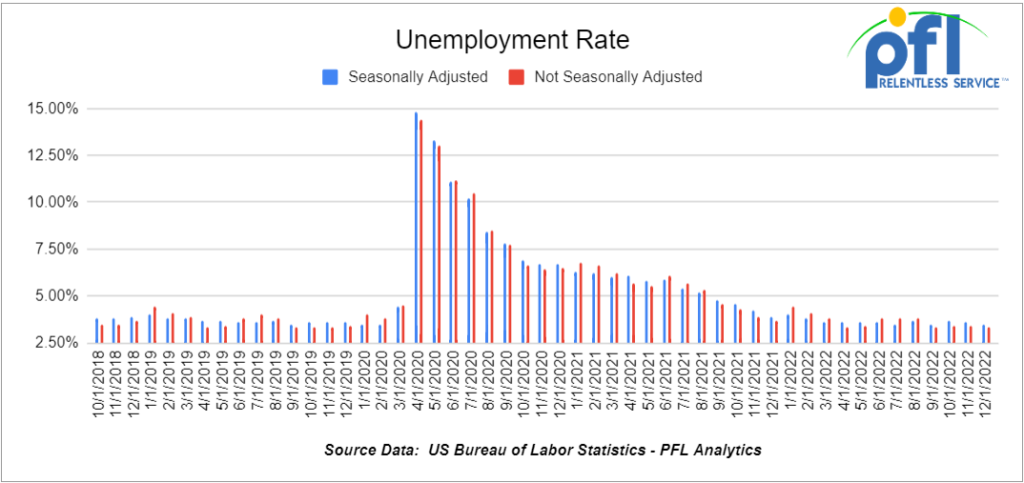

U.S. Unemployment Rate – The Bureau of Labor Statistics reported on January 6th that 223,000 net new jobs were created in December which is down from November’s 263,000. The official unemployment rate was down slightly in December at 3.5%.

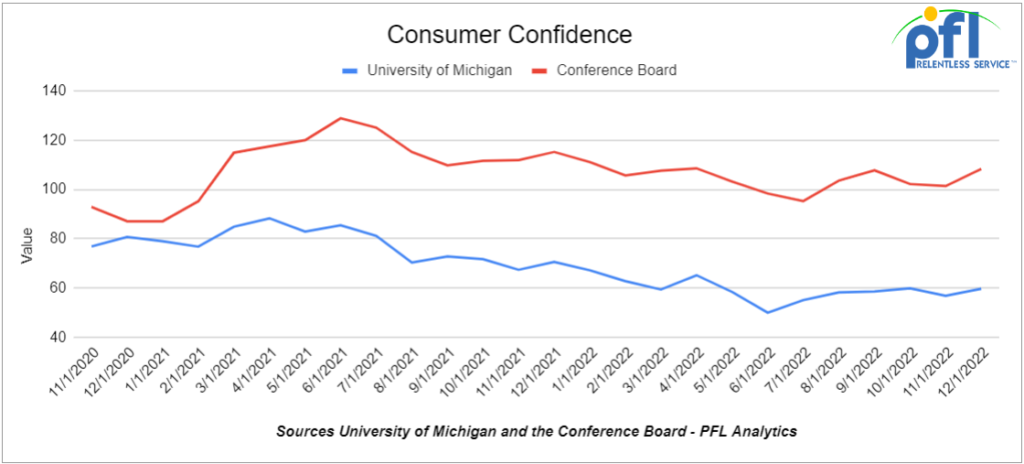

Consumer Confidence was 108.3 in December, up from 101.4 in 2022 and down from 111.9 in November 2021. We are puzzled by the uptick in consumer confidence month over month and don’t know why, but it is the highest rating since November 2022.

The University of Michigan’s Index of Consumer Sentiment rose in December, to 59.7 from 56.8 in November. The economist in charge of the Michigan index credited lower inflation.

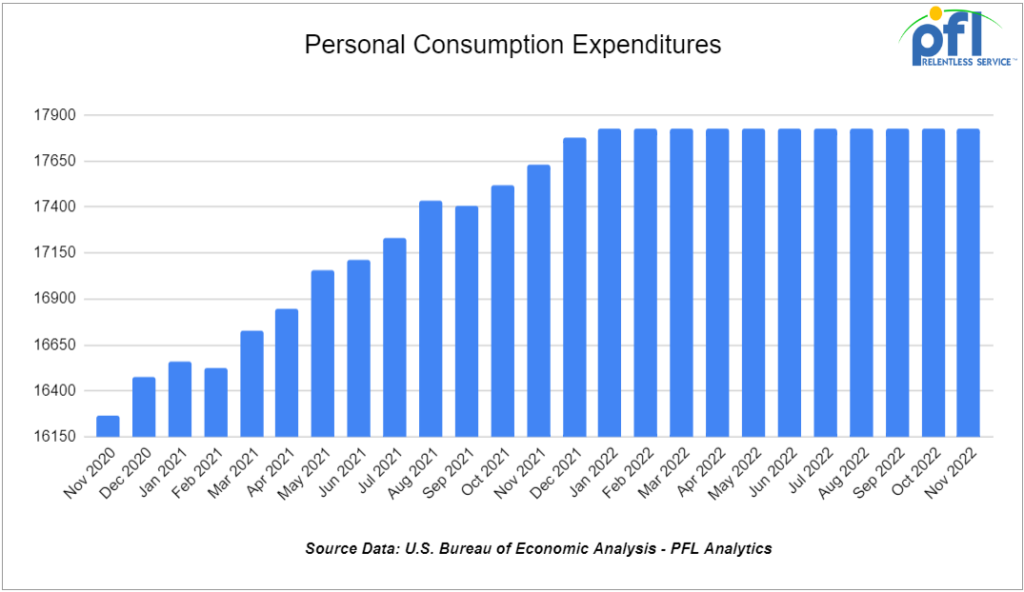

Total consumer spending in November 2022 was 0.1% higher than in October 2022, according to Bureau of Economic Analysis data just released. This is much worse than the 0.9% gain in October over September. Spending on services in November was up a preliminary 0.7%, but spending on goods fell a preliminary 1.0%, which is its largest decline in 2022.

Total spending in November 2022 was 7.7% higher than in November 2021, the smallest year-over-year gain since early 2021. Most of that increase was inflation. Adjusted for inflation, the year-over-year gain for total spending was up 2.0%.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 10-12, Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 50, CPC1232 or 117J Tanks needed off of UP or CSX in multiple locations for 3-5 Years. Cars are needed for use in Tall Oil service. Lined or Unlined

• 100-300, C&I Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, Any Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 2-4, Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 5, CPC1232 Tanks needed off of CSX in West Virginia for 2 years plus. Cars are needed for use in Polyacrylamide service. Unlined

• 10-15, 300W Pressures needed off of BNSF, KCS, or UP in Texas for 5-8 years. Cars are needed for use in Various service.

• 5, Tanks needed off of KCS in Texas for 5 years. Cars are needed for use in Calcium Chloride service. Need the cars for 5 years to load from Monterey MX to Corpus and transload to trucks. Need to be lined

• 50, Covered Hoppers needed off of BNSF, CN, CP, NS, orUP in the midwest for 5 years. Cars are needed for use in DDG service.

• 50-65, trough tops Covered Hoppers needed off of most class 1s in various locations for 2-3 years. Cars are needed for use in Fertilizer service.

• 25, gravity and pneumatic Covered Hoppers needed off of NS and others maybe in the east or south for Open. Cars are needed for use in Sugar service. Open to purchase as well.

• 15, 117J or R Tanks needed off of CN in the midwest for 1-5 Years. Cars are needed for use in Food Grade Ethanol service.

• 10-100, Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 20, Boxcars needed off of BNSF or UP in the west for 1-3 years. Requires sliding doors.

• 10, Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennesse & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• Up to 60, Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 25-50, Covered Hoppers needed off of various class 1s in Texas for 3-4 months. Cars are needed for use in Urea / Potash service. 3 hatch gravity dumps

• 20, Covered Hoppers needed off of BNSF, KCS in Texas for 3-5 years. Cars are needed for use in Potash service. 3-bay gravity dumps

• Up to 40, Covered Hoppers needed off of any class 1 in the east for 1-3 years. Cars are needed for use in Fertilizer service. Would consider a gondola as well. Call for details.

• 30, Covered Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• 30, any Boxcars needed off of CP, UP in any location for 3 years. Cars are needed for use in Barite Powder service. Call for details

• 30, any Gondolas needed off of CP, UP in any location for 3 years. Cars are needed for use in Barite Powder service. Call for details

• 40, Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 30-40, Mill Gondolas needed off of CSX, NS in the northeast for 3-5 Years. Call for details

• 20-30, Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

• 225, Covered Hoppers needed off of CSX, NS in the southeast for 5 years. Cars are needed for use in Plastic service. Call for details

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20-30, PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

• 100, Tanks needed off of CSX or NS in the east. Cars are needed for use in Molton Sulfer service.

• 20, Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 10, Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20, Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

PFL is offering:

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 150, 3250 CF, Sand Hoppers located off of various class 1s in multiple locations. For sale

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 100, 29K, 117R Tanks located off of UP in Washington. Cars are clean Built in 2014. Coiled and insulated.

• 100, 29K, 117R Tanks located off of UP in Washington State. 2014. Coiled and insulated clean

• 200, Sand Hoppers located off of various class 1s in multiple locations. Offered at a Great Price

• 150, 31.8, 117R Tanks located off of KCS in Texas. Cars are clean Currently being shopped. Call for info.

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 200, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 200, 29K, 117J Tanks located off of BNSF, UP in Oklahoma & Texas. Cars are clean Hempel 15500 Lining.

• 139, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Brand New Cars!

• 100, 5,700 – 5,800 CF, Hoppers located off of various class 1s in multiple locations. Pneumatic Covered Hopper

• 100, 5000 – 5001 CF, Hoppers located off of various class 1s in multiple locations. Pressureaide

• 100, 4200 CF, Hoppers located off of various class 1s in multiple locations. Aluminum Rotary Hopper

• 100, 4000 – 4999 CF, Hoppers located off of various class 1s in multiple locations. Steel Quad Hopper

• 100, 3000 CF, Covered Hoppers located off of various class 1s in multiple locations. Gravity

• 150, 31.8K, 117R Tanks located off of various class 1s in Texas.

• 32, 111A Tanks located off of various class 1s in multiple locations. Exterior Coiled & 4” Fiberglass Insulated; Full Head Shield; All cars are perfect for chemical as well as crude/oil service. All cars will qualify for DOT117R retrofit with the application of a removable bottom outlet valve the handle and are available for inspection.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|