“Be at war with your vices, at peace with your neighbors, and let every new year find you a better man.”

– Benjamin Franklin

Jobs Update

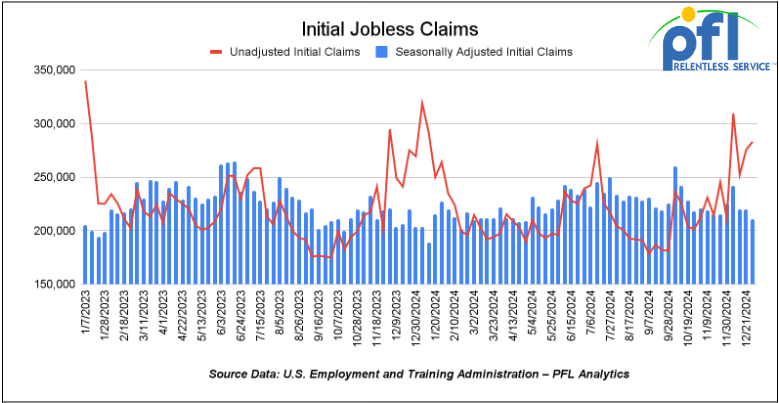

- Initial jobless claims seasonally adjusted for the week ending December 28th came in at 211,000, down -9,000 people week-over-week.

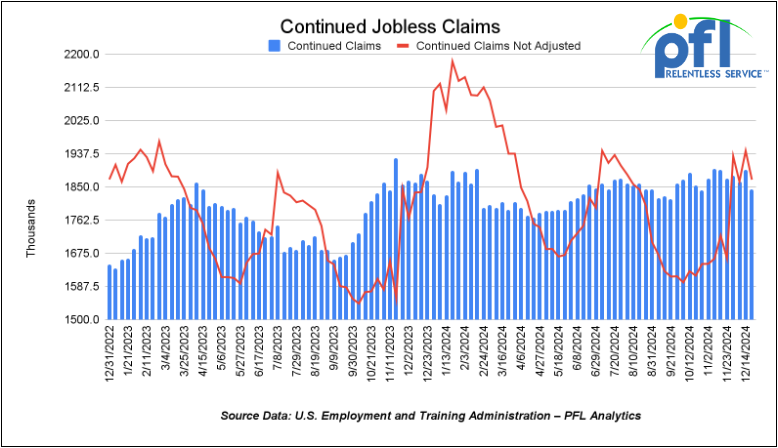

- Continuing jobless claims came in at 1.844 million people, versus the adjusted number of 1.896 million people from the week prior, down -52,000 people week-over-week.

Stocks closed higher on Friday of last week, but lower week over week

The DOW closed higher on Friday of last week, up 339.86 points (-0.8%) and closing out the week at 42,732.13, down -260.09 points week-over-week. The S&P 500 closed higher on Friday of last week, up 73.92 points, and closed out the week at 5,942.47, down -28.37 points week-over-week. The NASDAQ closed higher on Friday of last week, up 340.88 points (1.73%), and closed out the week at 19,621.68, down -100.35 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 43,075 this morning up 54 points.

Crude oil closed higher on Friday of last week, and higher in the U.S. week over week.

West Texas Intermediate (WTI) crude closed up 1.11 cents per barrel (1.5%) to close at $74.24 per barrel on Friday of last week, up $3.64 per barrel week over week. Brent traded up 69 cents USD per barrel (0.9%) on Friday of last week, to close at $76.62 per barrel, up $5.45 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for February delivery settled Friday on last week at US$12.20 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$60.14 per barrel.

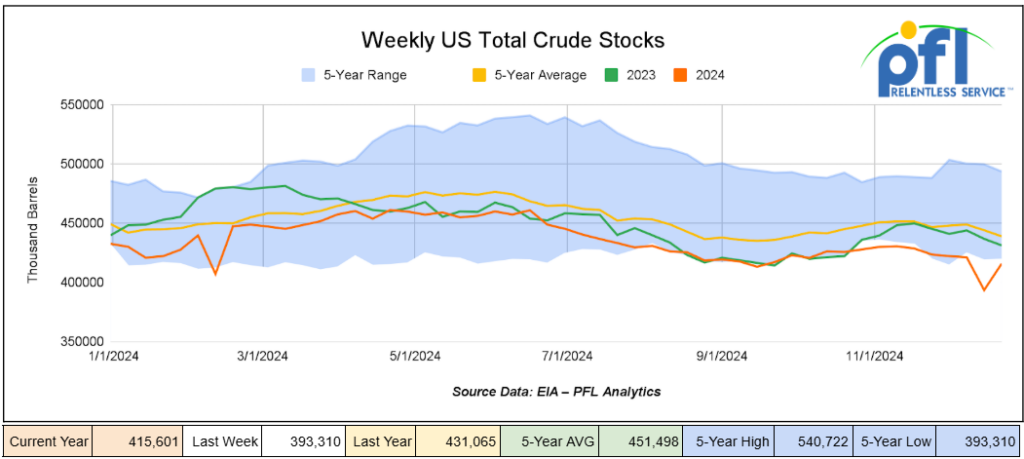

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.2 million barrels week-over-week. At 415.6 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

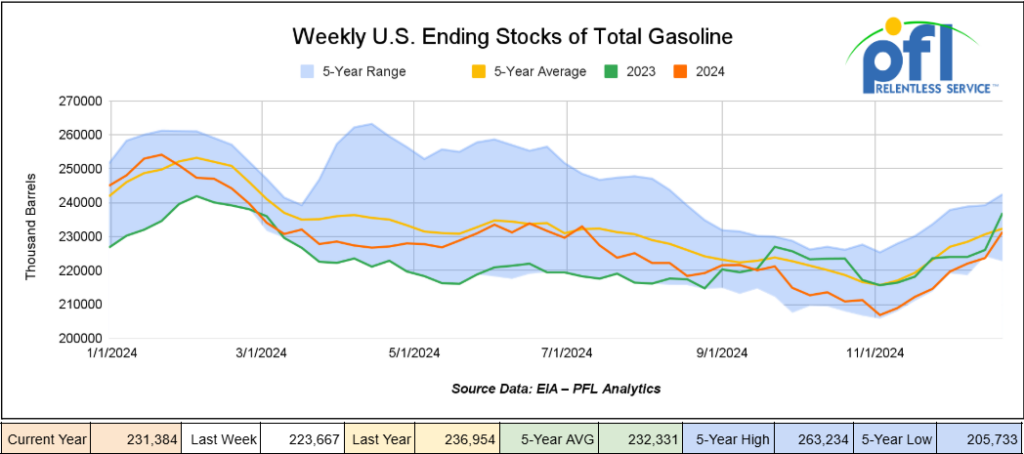

Total motor gasoline inventories increased by 7.7 million barrels week-over-week and are slightly below the five-year average for this time of year.

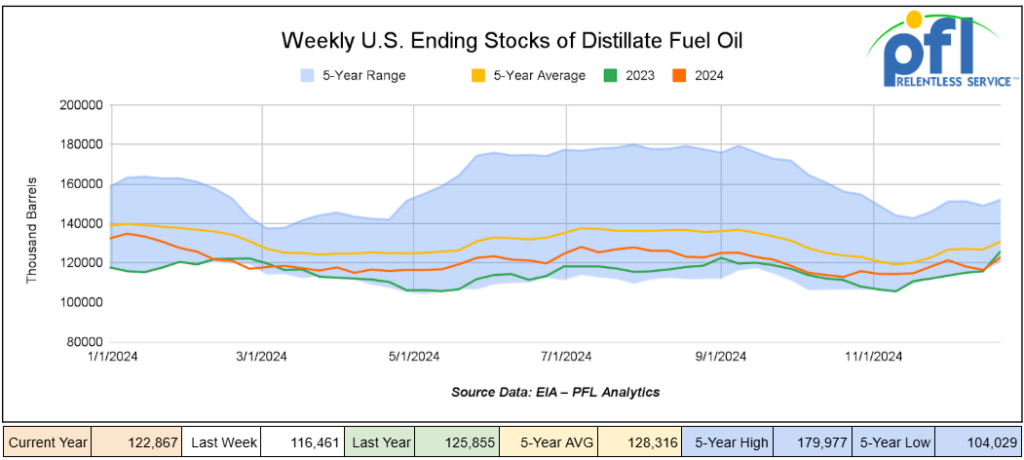

Distillate fuel inventories increased by 6.4 million barrels week-over-week and are 6% below the five-year average for this time of year.

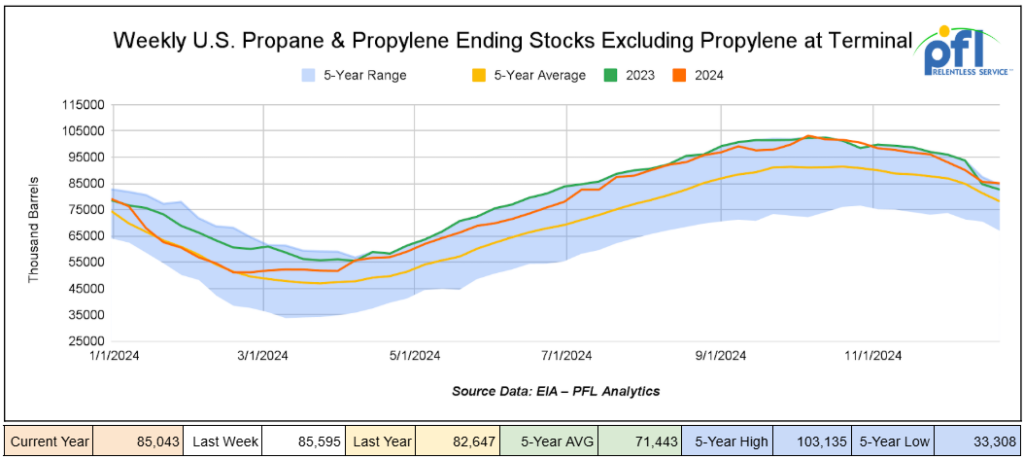

Propane/propylene inventories decreased by 600,000 barrels week-over-week and are 10% above the five-year average for this time of year.

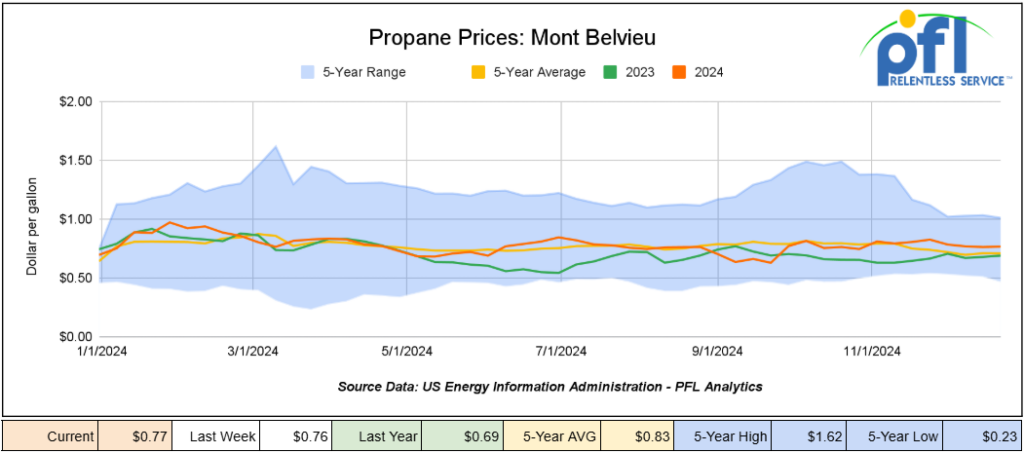

Propane prices closed at 77 cents per gallon on Friday of last week, up 1 cent per gallon week-over-week, and up 8 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 9.3 million barrels during the week ending December 27th, 2024.

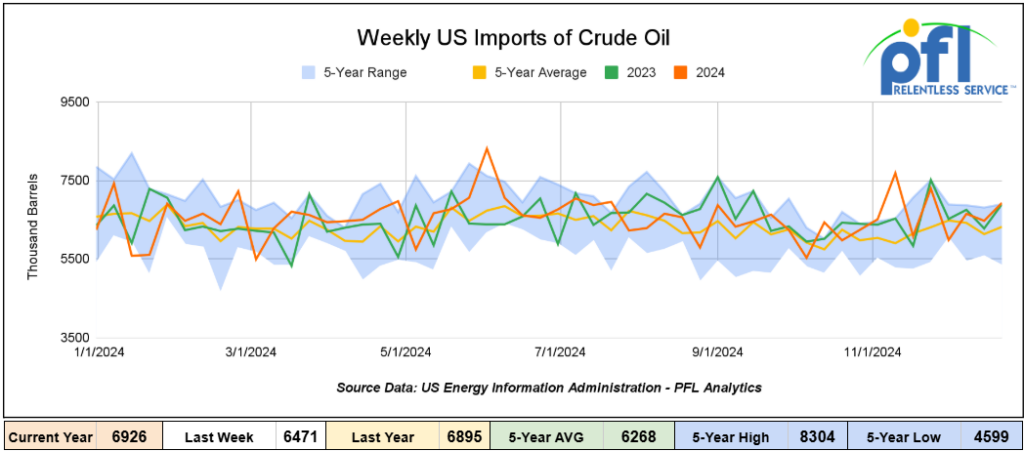

U.S. crude oil imports averaged 6.9 million barrels during the week ending December 27th, 2024, an increase of 455,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 1.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 665,000 barrels per day, and distillate fuel imports averaged 197,000 barrels per day during the week ending December 27th, 2024.

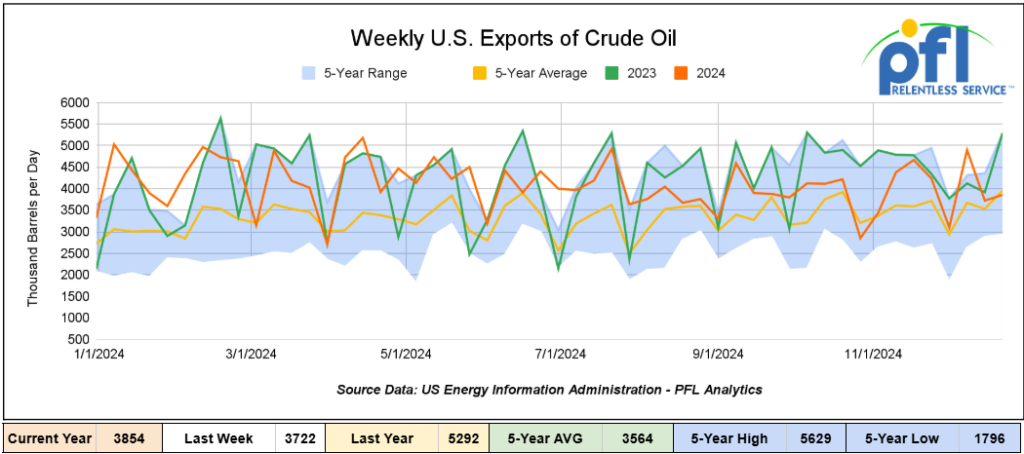

U.S. crude oil exports averaged 3.854 million barrels per day during the week ending December 27, 2024, an increase of 132,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.893 million barrels per day.

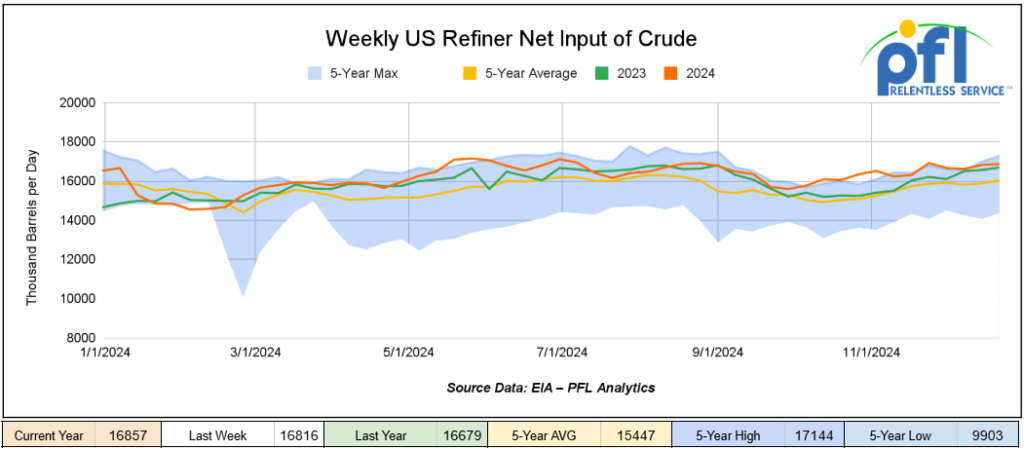

U.S. crude oil refinery inputs averaged 16.9 million barrels per day during the week ending December 27, 2024, which was 41,000 barrels per day more week-over-week.

WTI is poised to open at $73.75, down -21 cents per barrel from Friday’s close.

North American Rail Traffic

Welcome to the year 2025. The new year will surely bring its share of railroad drama – strikes are still looming at East Coast ports and up in Canada as well. The “can”: like everything else was kicked down the road for later – hopefully this year we tackle our problems. Terrorists are seemingly liking railroads as targets. There was a failed plot on a UP yard last week that didn’t make national headlines but security is definitely something on everyone’s mind as we dive into 2025. In 2024, North America’s railroads did manage to increase their traffic volume modestly. They did so despite a sharp decline in coal business. 2024 was fraught with labor unrest, disruptive weather, manufacturing weakness, housing weakness, steel market weakness, and unwelcome regulatory developments. Despite the headwinds, traffic did grow, albeit from subdued levels in 2023. 2024 volumes were still below 2022 levels and far below the industry’s 2018 peak.

Week Ending January 1st, 2025.

Total North American weekly rail volumes were up (3.47%) in week 1, compared with the same week last year. Total carloads for the week ending on January 1st were 291,684, up (0.56%) compared with the same week in 2024, while weekly intermodal volume was 256,759, up (7%) compared to the same week in 2024. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Petroleum and Petroleum Products, which was down (-6.02%) while the largest increase came from Grain which was up (12.69%).

In the East, CSX’s total volumes were up (3.34%), with the largest decrease coming from Metallic Ores and Metals (-23.81%), while the only increase came from Nonmetallic Minerals (13.7%). NS’s volumes were up (4.91%), with the largest decrease coming from Metallic Ores and Metals (-12.44%), while the largest increase came from Grain (59.94%).

In the West, BN’s total volumes were up (4.75%), with the largest decrease coming from Other, down (-18.37%), while the largest increase came from Motor Vehicles and Parts (18.63%). UP’s total rail volumes were down (-0.22%) with the largest decrease coming from Forest Products, down (-15.71%), while the largest increase came from Grain (11.04%).

In Canada, CN’s total rail volumes were down (-2.44%) with the largest decrease coming from Other, down (-38.32%), while the largest increase came from Grain, up (+81.11%). CP’s total rail volumes were down (-9.81%) with the largest increase coming from Other (+104.76%), while the largest decrease came from Coal (-43.94%).

KCS’s total rail volumes were up (5.91%) with the largest decrease coming from Nonmetallic Minerals (-44.13%) and the largest increase coming from Grain (+66.77%).

Source Data: AAR – PFL Analytics

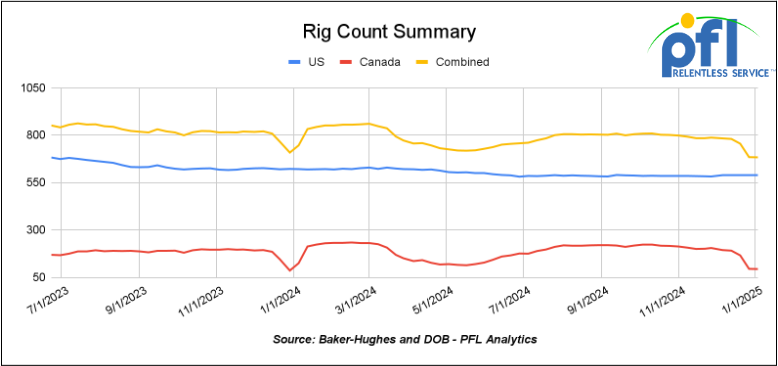

Rig Count

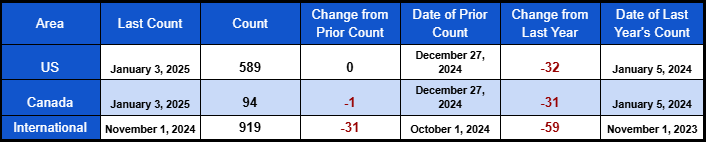

North American rig count was down -1 rigs week-over-week. U.S. rig count was flat for the fifth week in a row, but down by -32 rigs year-over-year. The U.S. currently has 589 active rigs. Canada’s rig count was down -1 rig week over week, and down by 31 rigs year-over-year, and Canada’s overall rig count is 94 active rigs. Overall, year over year we are down by -63 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Canada – Canadian Prime Minister is set to resign

Good news for Canada – Canadian Prime Minister Justin Trudeau is expected to announce as early as today that he will step down as leader of the ruling Liberal Party, according to Canadian media reports, ahead of a general election to be held later this year that he is widely expected to lose.

His resignation would be seen as the PM choosing to jump ship before he is pushed out.

The move would leave the Liberal Party without a permanent leader before the general election, where polls show it is set to lose badly to the opposition Conservative Party, led by the firebrand Pierre Poilievre. The election must be held on or before October 20 but could be brought forward any day.

Trudeau took the Liberals to power in 2015, promising “sunny ways” for Canada. He championed progressive issues like combating climate change and addressing historic abuses against Indigenous peoples, but the latter years of his premiership have been marked by rising economic discontent.

A viral confrontation with a steelworker, who criticized Trudeau for not addressing the high cost of living, captured the growing discontent among Canadians.

“You’re not really doing anything for us, Justin,” the worker remarked, highlighting a sentiment that resonated widely.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,256 from 29,609, which was a loss of 353 rail cars week-over-week. Canadian volumes were down. CPKC’s shipments were lower by -8.1% week over week, CN’s volumes were lower by -6.7% week-over-week. U.S. shipments were lower across the board. The UP had the largest percentage decrease and was down by -18.8%.

We are watching the Whitehouse – Biden is set to block offshore drilling before Trump arrives

Well, if it’s not handing out last-minute grants for the Green New Deal the Whitehouse is trying to make it difficult to “drill baby drill.” President Joe Biden is preparing to issue a decree permanently banning new offshore oil and gas development in some U.S. coastal waters during his final weeks in the White House.

Biden is set within days to issue the executive order barring the sale of new drilling rights in portions of the country’s outer continental shelf.

The move is certain to complicate President-elect Donald Trump’s ambitions to drive more domestic energy production. Unlike other executive actions that can be easily undone, Biden’s planned declaration is rooted in a 72-year-old law that gives the White House wide discretion to permanently protect U.S. waters from oil and gas leasing without explicitly empowering presidents to revoke the designations.

Trump is expected to order a reversal of the protections, but it’s not clear if he will be successful. During his first term in office, Trump sought to revoke former President Barack Obama’s order to protect more than 125 million acres (50.6 million hectares) of the Arctic and Atlantic Oceans, which was rejected by a federal district court in 2019.

Supporters of the 1953 Outer Continental Shelf Lands Act, which governs offshore oil and gas development, note that Congress gave presidents wide discretion to permanently protect waters from leasing, but it didn’t explicitly grant them the authority to undo those designations. Biden has already curtailed new offshore oil and gas development opportunities in the short term. His administration created a program for selling offshore leases that allows just three auctions over the next five years, a record low. However, Trump is expected to rewrite that leasing plan using an administrative process that could take at least a year, and Republican lawmakers are considering ways to expand offshore oil lease sales as a way to raise revenue to offset the cost of extending tax cuts. Stay tuned to PFL, we are watching this one.

We are watching Economic Indicators

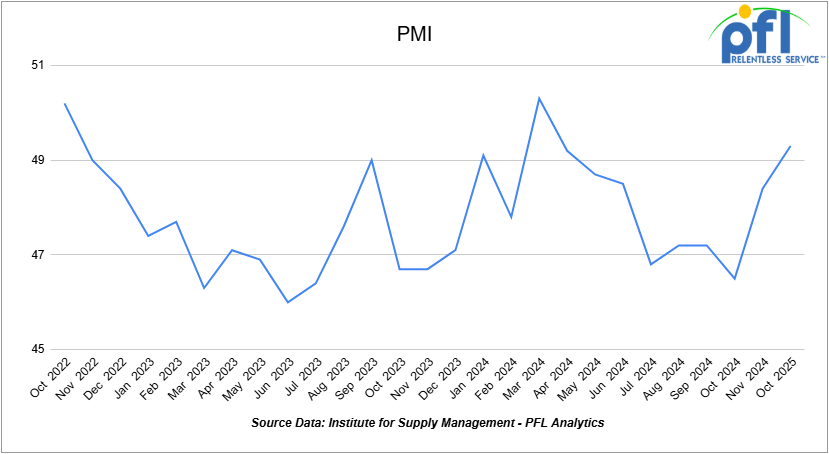

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50.

The Manufacturing PMI in December was 49.3%, up from 48.4% in November and 46.5% in October.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. up to 5 Years; Mid 2029 Return

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|