“If we are to guard against ignorance and remain free, it is the responsibility of every American to be informed.”

-Thomas Jefferson

Jobs Update

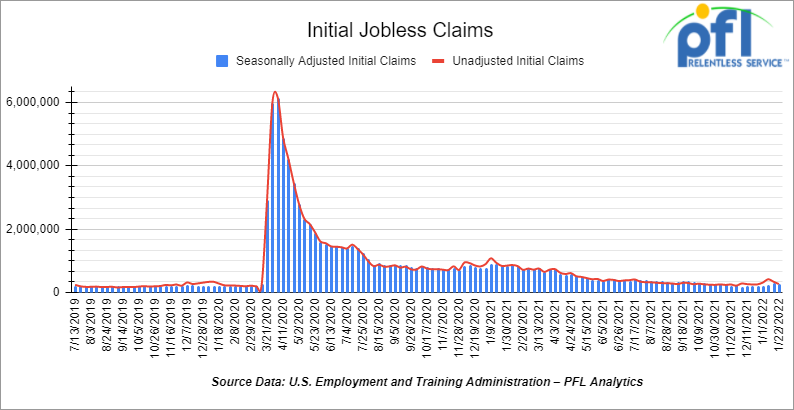

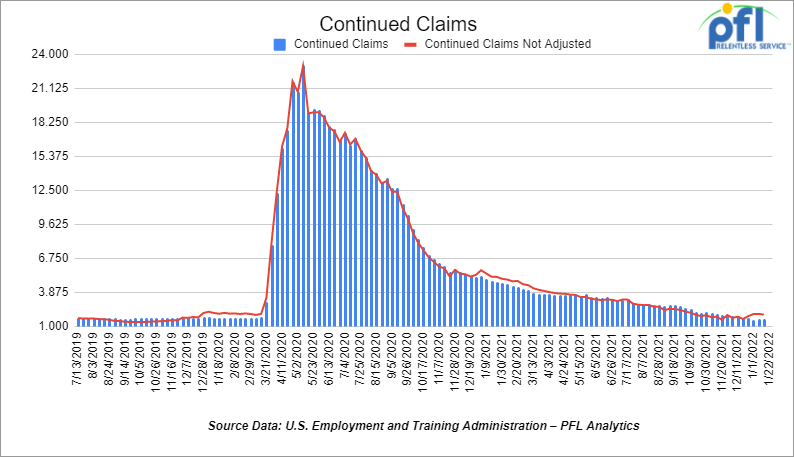

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending January 22nd came in at 286,000, down -30,000 people week over week.

- Continuing claims came in at 1.675 million people versus the adjusted number of 1.624 million people from the week prior, up 51,000 people week over week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 564.69 points (1.65%), closing out the week at 34,725.47 points, up 460.1 points week over week. The S&P 500 closed higher on Friday of last week, up 105.34 points and closed out the week at 4,431.85, up 33.91 points week over week. The Nasdaq closed higher on Friday of last week, up 417.79 points (3.13%) and closed out the week at 13,770.57, up 1.65 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,474 this morning down -121 points.

Oil hits seven-year peak on political risks, supply crunch.

Oil prices rose to a more than seven-year peak on Friday and recorded their sixth straight weekly gain as geopolitical turmoil exacerbated concerns over tight energy supply. West Texas Intermediate (WTI) crude closed up 21 cents a barrel on Friday of last week to settle at $86.82 per barrel, up $1.68 per barrel week over week. Brent futures rose 69 cents to settle at US $90.03 per barrel, after hitting US $91.70 per barrel, up $2.14 cents per barrel week over week, the highest level since October 2014.

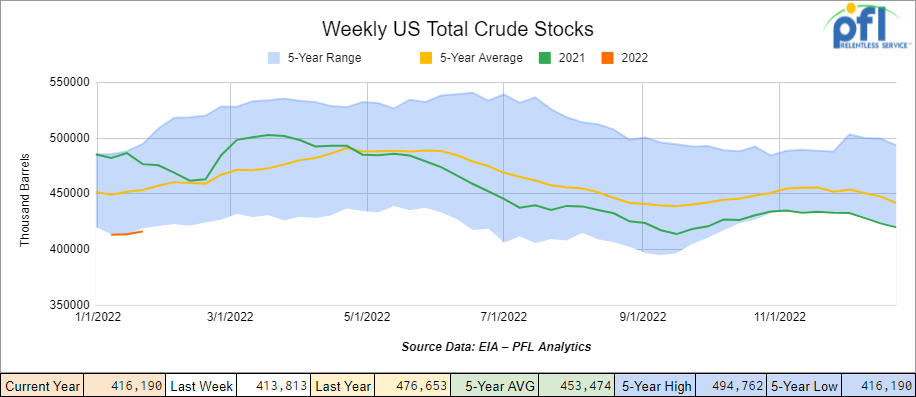

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.4 million barrels week over week. At 416.2 million barrels, U.S. crude oil inventories are 8% below the five-year average for this time of year.

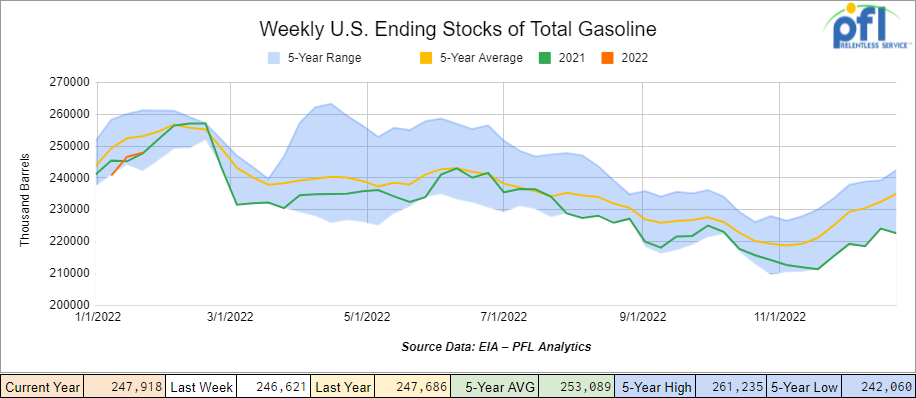

Total motor gasoline inventories increased by 1.3 million barrels week over week and are 2% below the five-year average for this time of year.

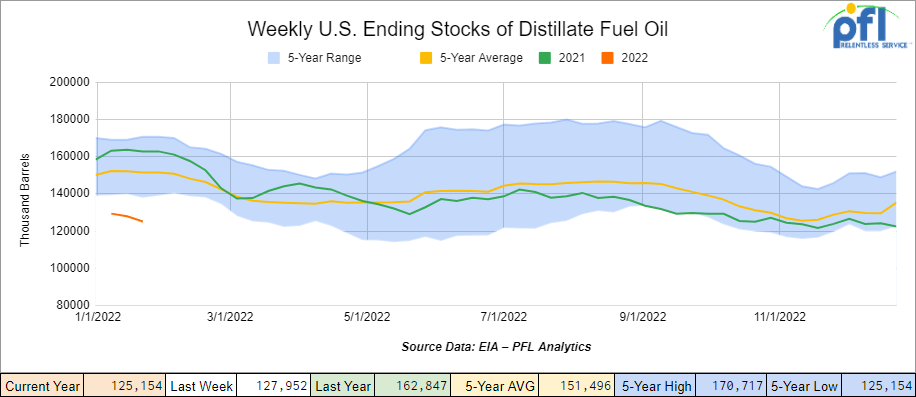

Distillate fuel inventories decreased by 2.8 million barrels week over week and are 17% below the five-year average for this time of year.

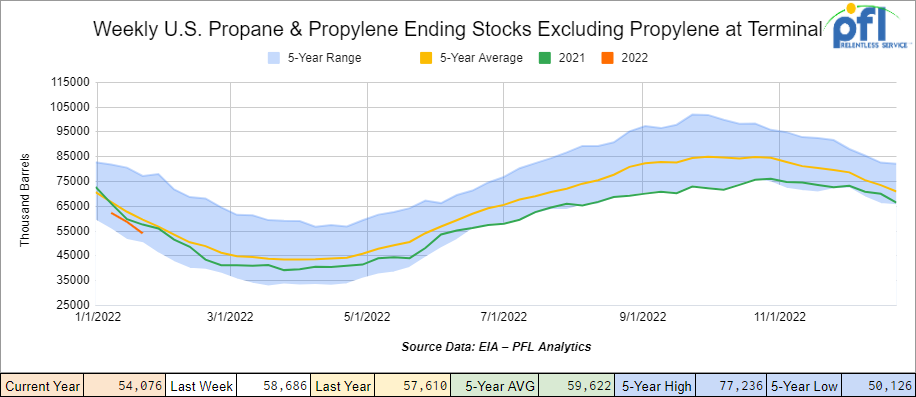

Propane/propylene inventories decreased by 4.6 million barrels week over week and are 9% below the five-year average for this time of year.

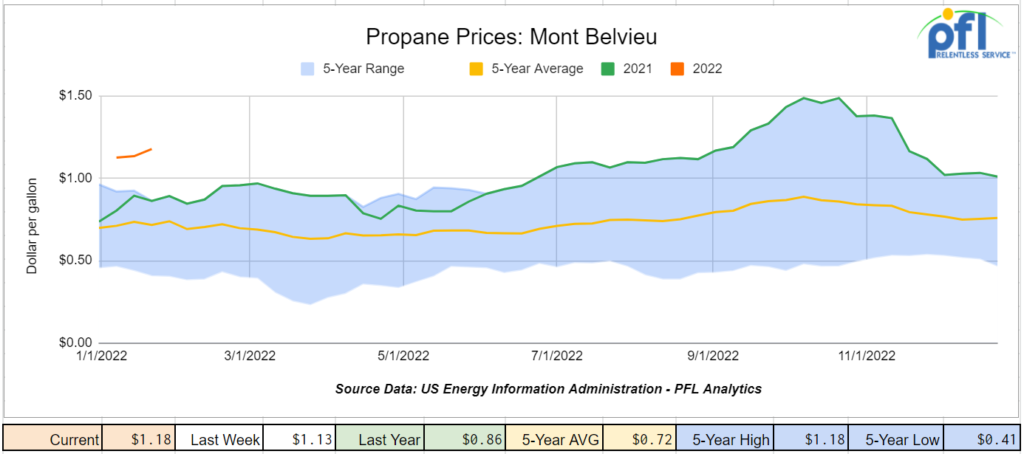

Propane prices continued to move higher as a result of increased demand, up 5 cents per gallon week over week and 32 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 4.1 million barrels week over week.

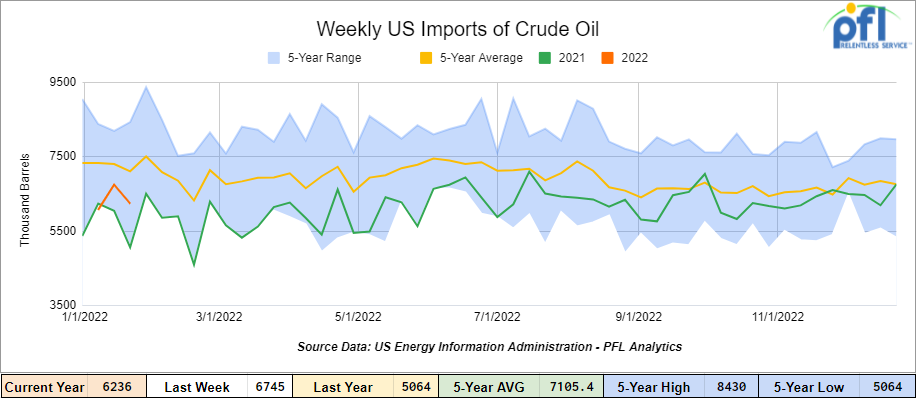

U.S. crude oil imports averaged 6.2 million barrels per day for the week ending January 21st, a decrease of 500,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 9.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 314,000 barrels per day, and distillate fuel imports averaged 226,000 barrels per day.

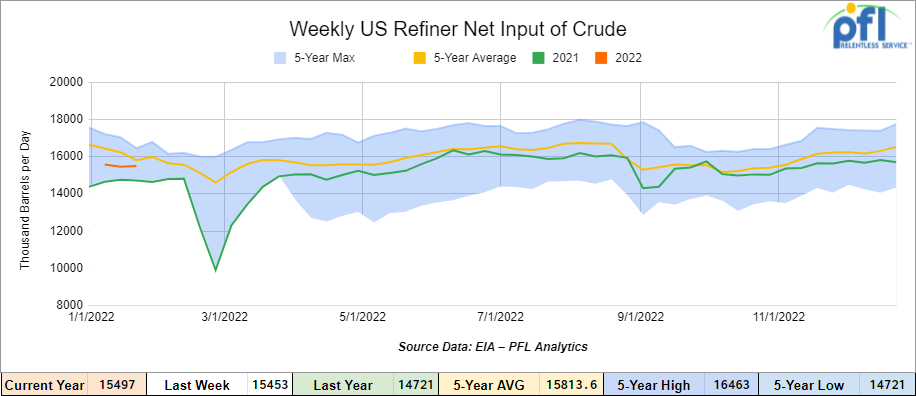

U.S. crude oil refinery inputs averaged 15.5 million barrels per day during the week ending January 14, 2022 which was 120,000 barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $87.67, up 85 cents per barrel from Thursday’s close.

North American Rail Traffic

Total North American rail volumes were down 11.2% year over year in week 3 (U.S. -9.8%, Canada -16.3%, Mexico -9.6%) resulting in quarter to date volumes that are down 12.4% year over year (U.S. -10.8%, Canada -18.9%, Mexico -8.9%). Ten out of the AAR’s eleven major traffic categories posted year over year declines with the largest decreases coming from intermodal (-15.0%), grain (-17.3%) and motor vehicles & parts (-20.1%). The only increase came from coal (+2.8%).

In the East, CSX’s total volumes were down 8.9%, with the largest decreases coming from intermodal (-7.0%), motor vehicles & parts (-26.2%) and coal (-14.9%). NS’s total volumes were down 14.7%, with the largest decreases coming from intermodal (-19.7%) and motor vehicles & parts (-20.9%).

In the West, BN’s total volumes were down 12.2%, with the largest decreases coming from intermodal (-17.0%), grain (-23.9%) and petroleum (-25.8%). The largest increase came from coal (+5.1%). UP’s total volumes were down 0.4%, with the largest decreases coming from intermodal (-8.4%) and motor vehicles & parts (-18.7%). The largest increases came from coal (+14.8%) and chemicals (+8.0%).

In Canada, CN’s total volumes were down 14.4%, with the largest decrease coming from intermodal (-22.1%). The largest increase came from coal (+61.0%). Revenue per ton miles was down 18.5%. CP’s total volumes were down 13.3%, with the largest decreases coming from chemicals (-22.4%) and petroleum (-30.4%). Revenue per ton miles was down 18.7%.

KCS’s total volumes were down 5.4%, with the largest decreases coming from petroleum (-39.0%) and intermodal (-6.0%).

Source: Stephens

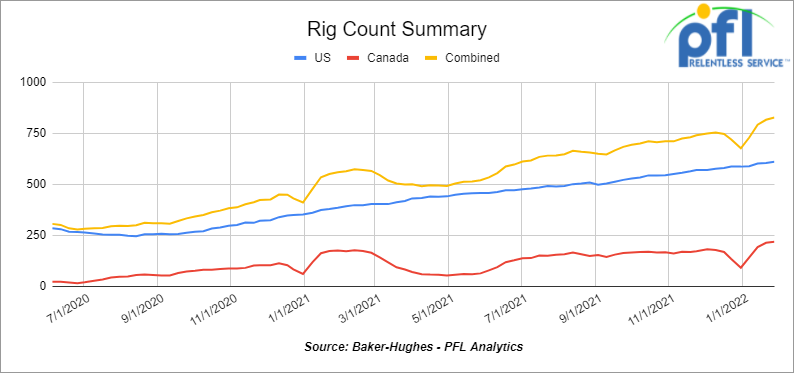

Rig Count

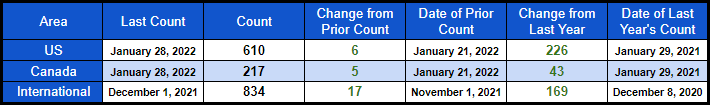

North American rig count is up by 11 rigs week over week. The U.S. rig count was up by 6 rigs week over week and up by 226 rigs year over year. The U.S. currently has 620 active rigs. Canada’s rig count was up by 5 rigs week over week and up by 43 rigs year over year and Canada’s overall rig count is 217 active rigs. Overall, year over year, we are up 269 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 22,882 from 22,654, a gain of 228 rail-cars week over week. Canadian volumes were down: CP volumes were down by 22.9% and CN volumes were down 5.7% week over week. U.S. volumes were mixed with the BN having the largest percentage increase (up by 9.3%). The NS had the largest percentage decrease down by 5.3%

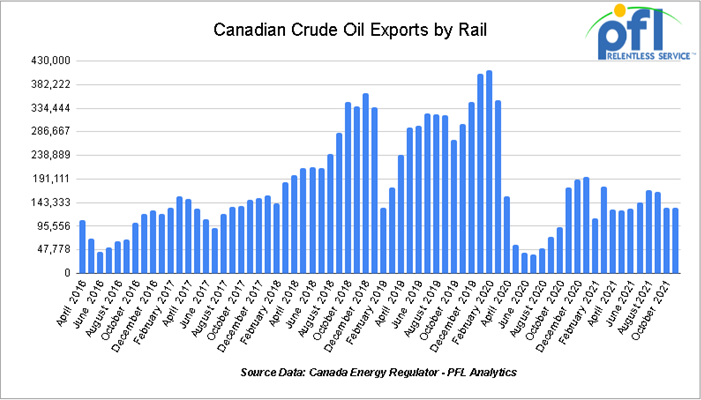

Canadian Crude by Rail Numbers down Slightly Month over Month

On January 24th the Canadian Energy Regulator published the latest and greatest crude by rail numbers. In November, Canada shipped on average 132,296 barrels a day compared to October at 132,587 barrels per day. Crude by rail out of Canada has been struggling despite higher oil prices. Enbridge that brought on Line 3 replacement has been online since October added 370,000 barrels a day of take away capacity out of Alberta.

Canadian Trucker’s descended over Ottawa this past weekend as their Fearless Leader Fled for Safety Reasons

Folks, we called it last week. COVID restrictions may be over! Take a look at Great Britain who have dropped all COVID restrictions. Denmark to follow suit for February 1. Canadians, once a sleepy nation and confirmative to government whims, are lashing out and have had enough.

Thousands of protesters entered Ottawa this past weekend and Canadian Prime Minister Justin Trudeau and his family were moved from their home to an undisclosed location somewhere in the city on Saturday afternoon due to security concerns. We believe he should face the people like a good leader would and do the right thing. Elon Musk, the world’s richest man tweeted: “Canadian trucker’s rule” to his more than 71 million followers – we agree with Elon, rock on Canadian truckers, god bless you guys!.

A “Freedom Convoy” of thousands of trucks entered the Canadian capital city of Ottawa Saturday to protest Trudeau’s COVID-19 policies. Apparently, 100 big rigs blockaded a main street running past the Canadian parliament building.

The convoy, which approached the capital from all sides, began as a protest against a vaccine mandate for Canadian truckers crossing the U.S.-Canada border, but grew into a wider expression of discontent with the government’s COVID-19 policies.

It’s been dubbed the Freedom Convoy, and it’s got the country talking. The movement was sparked by a vaccine mandate for truckers crossing the US-Canada border, implemented by Prime Minister Justin Trudeau’s Liberal government earlier this month.

Upset with the new measure that would require unvaccinated Canadian truckers crossing the two nations’ boundary to quarantine once they’ve returned home, a loose coalition of truckers and conservative groups began to organize the cross-country drive that began in western Canada. It picked up steam and gathered support as it drove east. Many supporters that have already opposed Mr Trudeau and his politics have grown frustrated with pandemic measures they see as political overreach.

Social media and news footage showed trucks and companion vehicles snaking along highways, cheered on by people gathered on roadsides and overpasses, often waving Canadian flags and signs disparaging Mr Trudeau.

“These demonstrations are national in scope, they’re massive in scale,” Ottawa Police Chief Peter Sloly said Friday, expressing concern about the possibility of violent “lone wolf” individuals carrying out violent acts. Of course the authorities would say that. Canada used to be a democracy and you used to be able to protest! A few clips below:

Source: Reuters

Source: Reuters

Source: Reuters

We Have our Eyes on Russia

Folk’s, volatility in the markets has been insane this past week and expect more of the same this week as the world is on edge. We have all been wondering what Russia is going to do with Ukraine and the only one that really knows is Putin himself. Our two cents: An invasion by Russia on Ukraine could have sweeping ramifications and change the world once again as we know it. Military action could cause ship fuel prices to spike, creating a tanker wild card market. The U.S., EU and U.K. have warned of severe consequences if Russia attacks, which the U.S. believes could happen at any moment. No one really knows what this means – one can only speculate. The first potential consequence, which would affect all shipping segments, would be higher fuel costs. The price of marine bunker fuel follows the price of Brent crude. As crude prices rise, so does the cost of getting goods to you, the consumer, who will have to pay even higher prices for the basic needs of life! If Russian exports are targeted by sanctions, the oil price effect would be extreme – $100 oil could be a bargain at that point. JP Morgan said on Friday of last week that oil prices could rise as high as $150 per barrel. If sanctions target Russian exports, Europe will need to find alternative sources of crude oil and/or products. Although there may be a transition period, one would expect that European countries will boost product purchases to prevent shortfalls. This will provide a significant short-term boost to the trans-Atlantic product tanker markets.

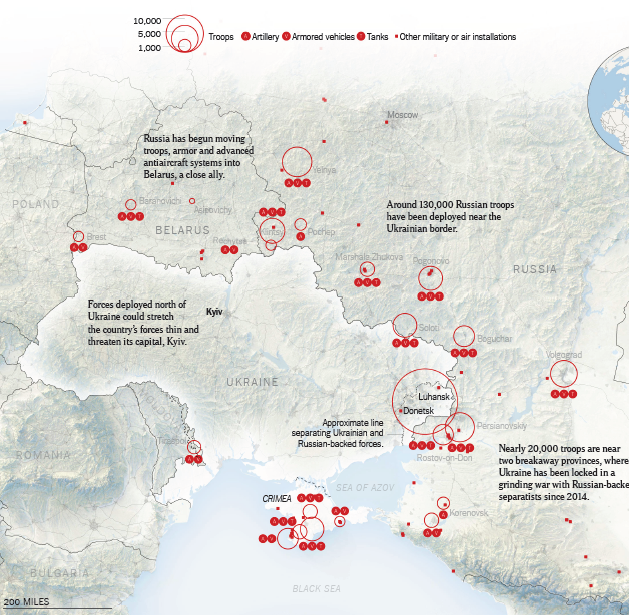

Most feel it is unlikely that Russian energy would be targeted due to the fact that Europe’s dependence on Russian natural gas is so great. 35%-40% of Europe’s natural gas comes from Russia, including gas in pipelines through the Ukraine. Germany obtains around 50% of its natural gas from Russia. The new Nord Stream 2 pipeline connecting Russia and Germany has yet to be certified; its future flows have become a bargaining chip in the Ukraine crisis. Military action in the Ukraine would increase the European spot price for liquefied natural gas (LNG), drawing more U.S. export cargos to Europe. Multiple media outlets have also reported that the U.S. is in talks with LNG exporter Qatar about shifting more supply to Europe in the case of a Russian invasion of Ukraine. It seems to us that the West really does not have any bullets in its gun right now, has let things go little too far and has not supported Ukraine in a meaningful way. Germany has sent the Ukraine 5,000 helmets and does want to upset Russia in any way. With the West pretty much unengaged it seems to us that it is going to be up to Putin whether or not he wants the bloodshed. If I was a betting man I would think an invasion is more likely than not. See buildup of Russian troops on Ukraine border below:

Source: NY Times

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 50 25.5 Tanks C&I for heavy fuel oil in Texas dirty to dirty 1-2 years negotiable

- 300 5800 Covered hoppers needed for plastic – 5 year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 20 pressure cars 340’s in SE clean or last in butane or propane 1-2 years Immediate Need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 100 117Js Coiled and Insulated dirty to dirty service BNSF CN or CP

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10 25-28K C&I tanks for veg oil needed in the south for 2 years negotiable

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- Unit Train of 28.3K 117Js for use in Crude service off the CN or BN in MT, ND, or Alberta.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- 150 117R’s 31.8 clean for lease in Texas – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 25 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars sale or lease

- 20 20K Stainless cars in 3 locations in the south – sale or lease – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude – available Feb 2022

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape..

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|