“We have two ears and one mouth so that we can listen twice as much as we speak.” -Epictetus

Jobs Update

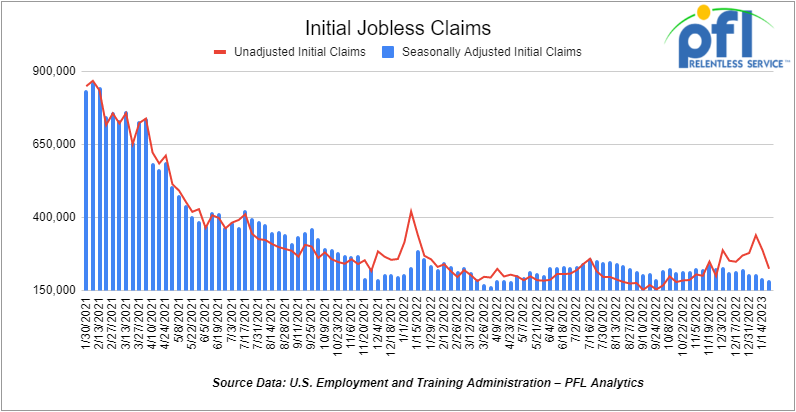

- Initial jobless claims for the week ending January 21st, 2023 came in at 186,000, down -6,000 people week-over-week.

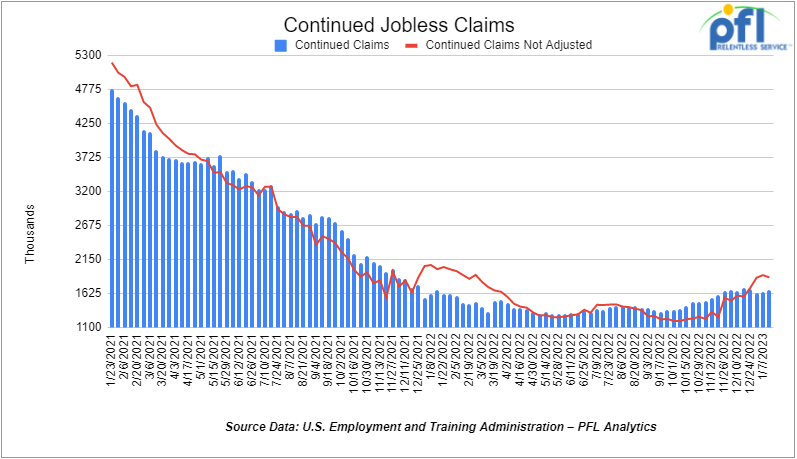

- Continuing jobless claims came in at 1.675 million people, versus the adjusted number of 1.655 million people from the week prior, up +20,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up +28.67 points (+0.08%), closing out the week at 33,978.08, up 348.52 points week over week. The S&P 500 closed higher on Friday of last week, up +10.13 points (0.25%), and closed out the week at 4070.56, up 50.75 points week over week. The NASDAQ closed higher on Friday of last week, up +109.3 points (0.96%), and closed the week at 11,621.71, up 257.3 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,854 this morning down -192 points.

WTI closed lower on Friday of last week and lower week over week

WTI traded down -$1.33 per barrel (-1.33%) to close at $79.681 per barrel on Friday of last week, down -$1.63 per barrel week over week. Brent traded down -US$0.81 per barrel (-0.09%) on Friday of last week, to close at US$86.66 per barrel, down -$0.97 per barrel week over week.

A couple of critical meetings that will affect the current complex this week include:

1) OPEC+ delegates will meet this week to review crude production levels, with the industry expecting no change to the current output policy – let’s see what OPEC+ says!

2) The U.S. Federal Reserve’s next decision on interest rates will be made at meetings over Jan. 31 (tomorrow) and Feb. 1 against a backdrop of a dip to inflation and gross domestic product that grew by a faster than expected 2.9% in the fourth quarter.

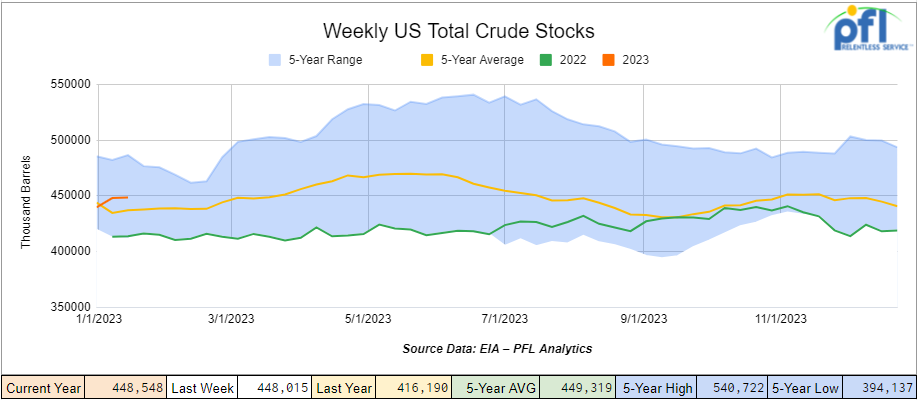

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 500,000 barrels week over week. At 448.5 million barrels, U.S. crude oil inventories are 3% above the five-year average for this time of year.

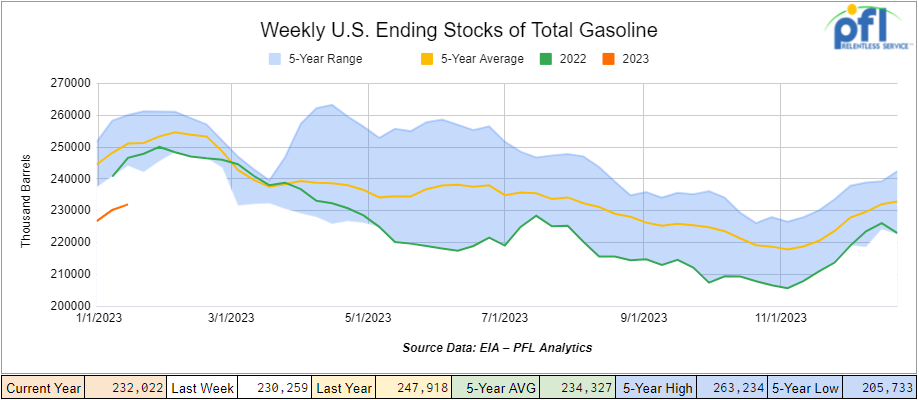

Total motor gasoline inventories increased by 1.8 million barrels week over week and are 8% below the five-year average for this time of year.

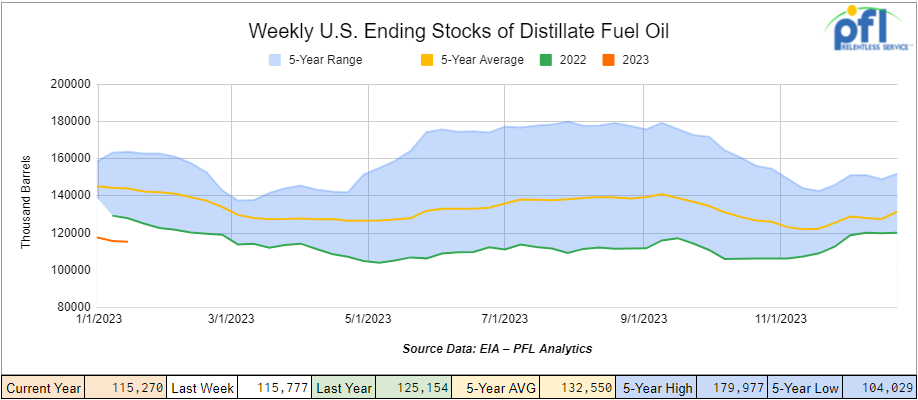

Distillate fuel inventories decreased by 500,000 barrels week over week and are 20% below the five-year average for this time of year.

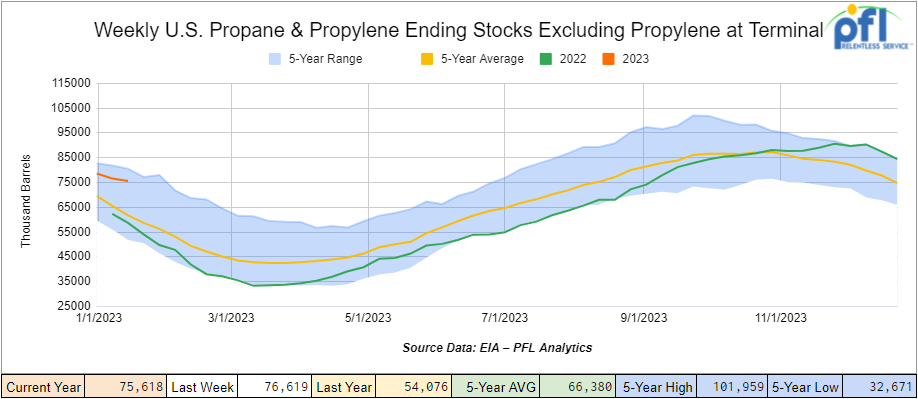

Propane/propylene inventories decreased by 1.0 million barrels week over week and are 25% above the five-year average for this time of year.

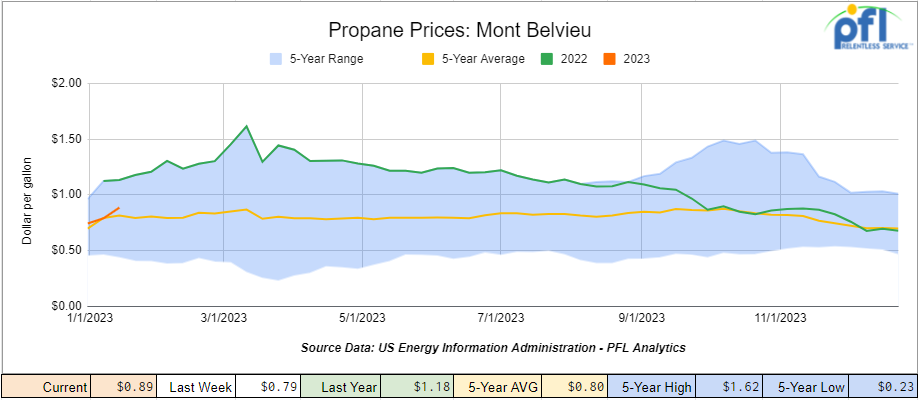

Propane prices were up 10 cents per gallon week over week on the back of excessive fog in Houston slowing exports in a tight LPG ship market closing out the week at 89 cents per gallon, down 29 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 4.0 million barrels during the week ending January 20th, 2023.

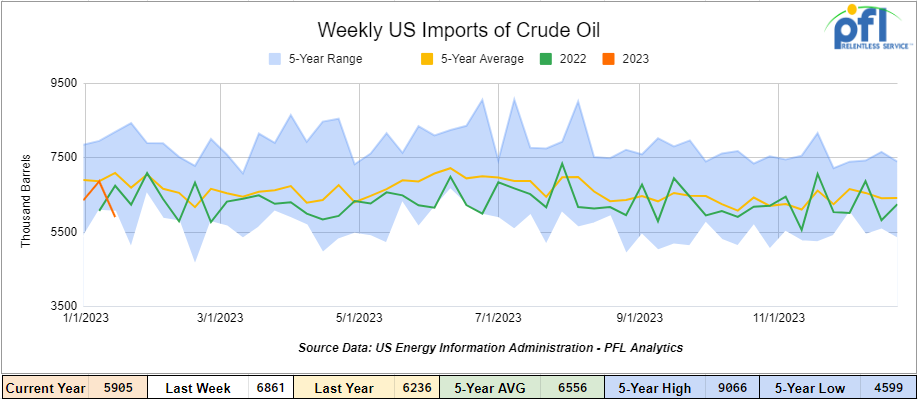

U.S. crude oil imports averaged 5.9 million barrels per day during the week ending January 20th, 2023, a decrease of 956,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 0.4% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 453,000 barrels per day, and distillate fuel imports averaged 320,000 barrels per day during the week ending January 20th, 2023.

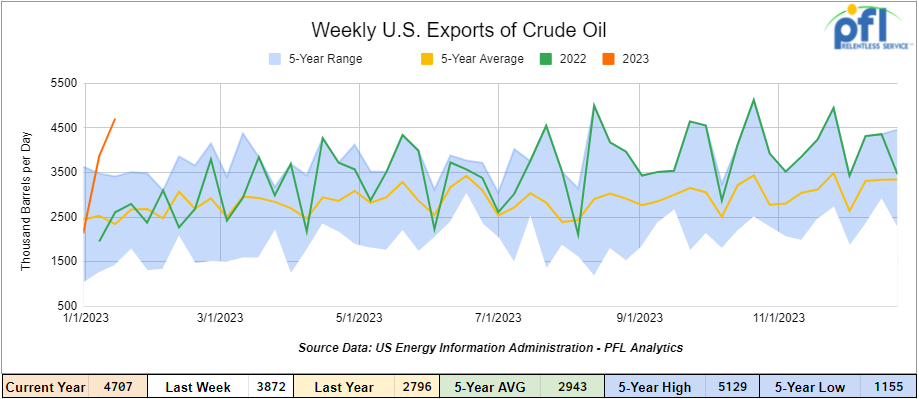

U.S. crude oil exports averaged 4.7 million barrels per day for the week ending January 20th an increase of 835,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.7 million barrels per day, 50.5% more than the same four-week period last year.

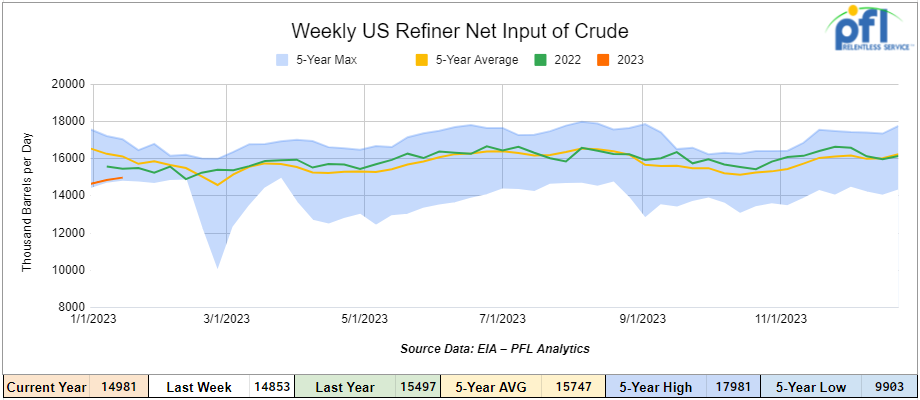

U.S. crude oil refinery inputs averaged 15 million barrels per day during the week ending January 20, 2023, which was 127 thousand barrels per day more week over week.

As of the writing of this report, WTI is poised to open at $79.24 down -$0.44 per barrel from Monday’s close.

North American Rail Traffic

Week Ending January 25th, 2022.

Total North American weekly rail volumes were down (-1.27%) in week 3 compared with the same week last year. Total carloads for the week ending on January 25th were 353,470, up (+5.13%) compared with the same week in 2022, while weekly intermodal volume was 295,991, down (-7.97%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant increase coming from Nonmetallic Minerals (+20.72%). The largest decrease was from Intermodal (-7.97%).

In the east, CSX’s total volumes were up (+0.61%), with the largest decrease coming from Intermodal (-9.26%) and the largest increase from Coal (+26.26%). NS’s volumes were up (8.88%), with the largest decrease coming from Other (-9.59%) and the largest increase from Grain (+46.29%).

In the West, BN’s total volumes were down (-9.22%), with the largest decrease coming from Chemicals (-19.96%), and the largest increase coming from Motor Vehicles and Parts (+25.08%). UP’s total rail volumes were down (-0.17%) with the largest decrease coming from Other (-24-50%) and the largest increase coming from Motor Vehicles and Parts (+27.38%).

In Canada, CN’s total rail volumes were down (-3.89%) with the largest decrease coming from Intermodal (-30.15%) and the largest increase coming from Metallic Ores and Metals (+25.50%). CP’s total rail volumes were up (+2.07%) with the largest decrease coming from Farm Products (-20.14%) and the largest increase coming from Motor Vehicles and Parts (+85.11%).

KCS’s total rail volumes were down (-2.44%) with the largest decrease coming from Grain (-29-19%) and the largest increase coming from Motor Vehicles and Parts (+51.79%).

Source Data: AAR – PFL Analytics

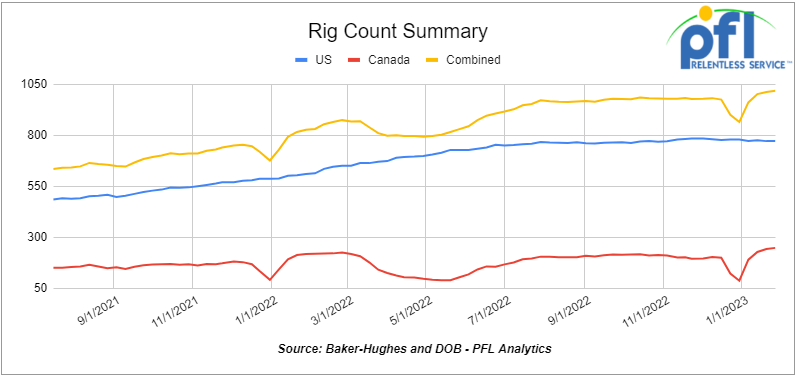

Rig Count

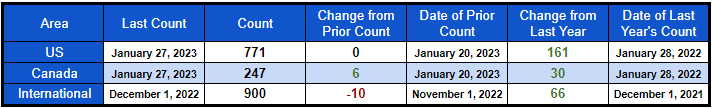

North American rig count was up by 6 rigs week over week. U.S. rig count was flat week-over-week and up by +161 rigs year over year. The U.S. currently has 771 active rigs. Canada’s rig count was up by 6 rigs week-over-week and up by 30 rigs year-over-year. Canada’s overall rig count is 247 active rigs. Overall, year over year, we are up +191 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,993 from 23,836, which was a gain of 1,157 railcars week-over-week. Canadian volumes were mixed; CP’s shipments decreased by -4% week over week, and CN’s volumes were up by +2.0% week over week. U.S. shipments were mostly higher. CSX had the largest percentage increase and was up by +16%. The BN was down by -8.2%.

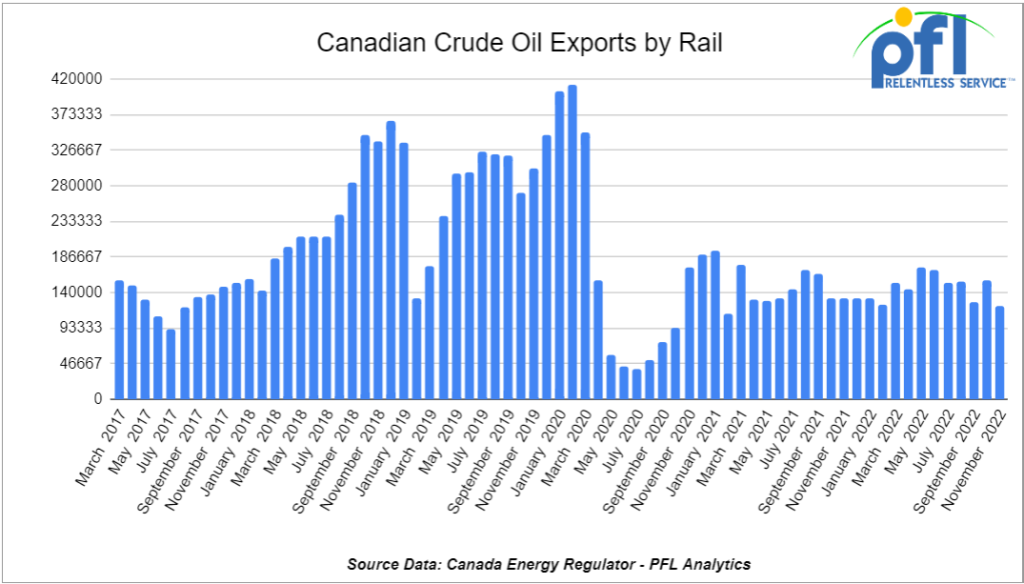

We are eyeing Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on January 25, 2023. For November 2022, Canada exported 121,907 barrels per day by rail (down by -18,008 barrels per day month over month) which is an eight-month low. Crude by rail out of Alberta is popular for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. We were expecting to see volumes significantly increase in November and into December with the rupture of the Keystone Pipeline, but it seems Keystone became operational sooner than we expected and the play fizzled out quickly with only a few trains that got moved after a flurry of panic. Putting a hamper on crude by rail out of Canada is heavy Venezuela crude now hitting the shores of the U.S. competing for those barrels. WCS basis in Edmonton has held steady this past week +/- $US-25 per barrel in Edmonton with WCS for March delivery closing at US-$23.75 below the WTI-CMA for March delivery. The implied value was US$57.59/bbl. Before crude by rail out of Canada can come back in a meaningful way, supply needs to exceed pipeline capacity and we need to see a much wider basis for a sustained period of time (or at least predictable). We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins. Although congestion remains on Canadian pipelines as production in Canada continues to rise, Canada’s Trans Mountain expansion is 75% complete and will add 590,000 barrels a day of additional pipeline capacity from Edmonton to Canada’s west coast by Q4.

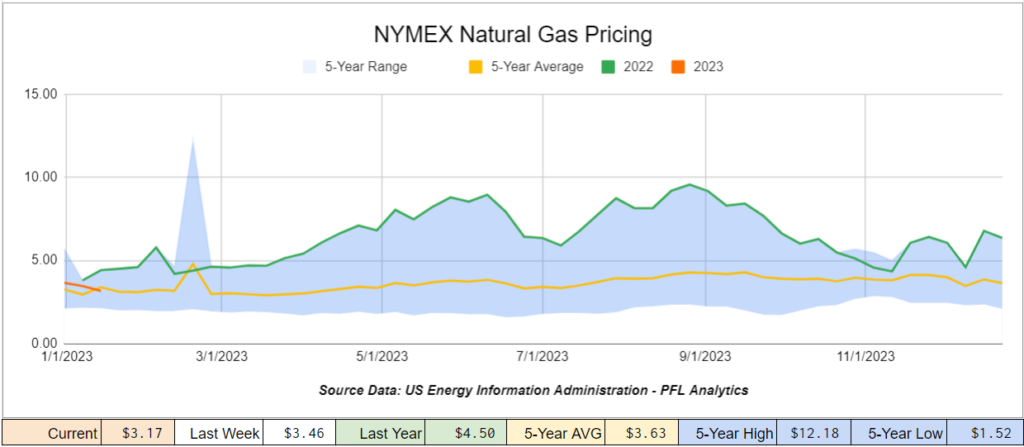

We are Watching Natural Gas and LPG’s

Rystad on Tuesday of last week said it expects “significant” growth in U.S. shale natural gas production, with an increase of 6.9 billion cubic feet per day representing a 7% increase from 2022, Federal data show the Appalachia basin – a reservoir spread out over West Virginia, New York, Pennsylvania, and Ohio – along with the Permian basin in Texas is the most lucrative shale natural gas reserves in the country. Rystad, however, sees the lack of pipelines inhibiting the rate of growth in production, singling out the Haynesville production in east Texas and Louisiana as the most promising for 2023 in terms of production growth. Increased Natgas production should lead to increased LPG rail movement- the problem is we are lacking pipeline infrastructure to get the much-needed product to market as the Biden administration wants to turn us into Europe and has stalled many projects and has made it harder for producers to operate. Meanwhile, Natural gas had a very rough week last week trading as low as $2.50 on Thursday of last week and closing out the week at $3.109 per MMBTU.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of Any in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

• 225, 5250cf-5800cf Covered Hoppers needed off of CSX, NS in the southeast for 5 years. Cars are needed for use in Plastic service. Call for details

• 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

• 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 30, 5200cf Covered Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennesse & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 5, 23.5K CPC1232 Tanks needed off of CSX in West Virginia for 2 years plus. Cars are needed for use in Polyacrylamide service. Unlined

• 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 100-200, 25.5K-28.3K 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 100-300, 31.8k CPC1232 or 117J Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , 340W Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 50, 25.5K CPC1232 or 117J Tanks needed off of UP or CSX in multiple locations for 3-5 Years. Cars are needed for use in Tall Oil service. Lined or Unlined

• 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

• 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

• 10, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, 3200 Covered Hoppers needed off of UP or BN in Texas.

• 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

• 10, 4000 Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location but prefers the west. Cars are needed for use in Cement service. C612

• 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 100, 15.7K Tanks needed off of CSX or NS in the east. Cars are needed for use in Molton Sulfer service.

PFL is offering:

• 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 150, 3250 CF, hopper Hoppers located off of various class 1s in multiple locations. For sale

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 100, 29K, 117R Tanks located off of UP in Washington. The cars are clean, built in 2014. Coiled and insulated.

• 100, 29K, 117R Tanks located off of UP in Washington State. 2014. Coiled and insulated clean

• 150, 31.8, 117R Tanks located off of KCS in Texas. Cars are clean Currently being shopped. Call for info.

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 100, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 200, 29K, 117J Tanks located off of BNSF, UP in Oklahoma & Texas. Cars are clean Hempel 15500 Lining.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|