“There is nothing impossible to him who will try.”

-Alexander the Great

Jobs Update

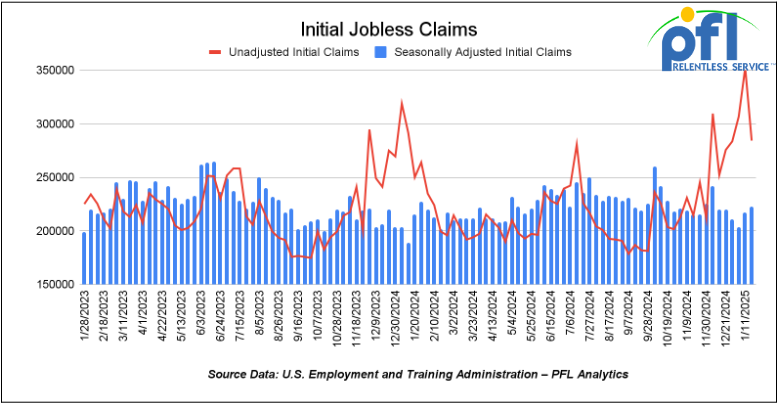

- Initial jobless claims seasonally adjusted for the week ending January 18th came in at 223,000, up 6,000 people week-over-week.

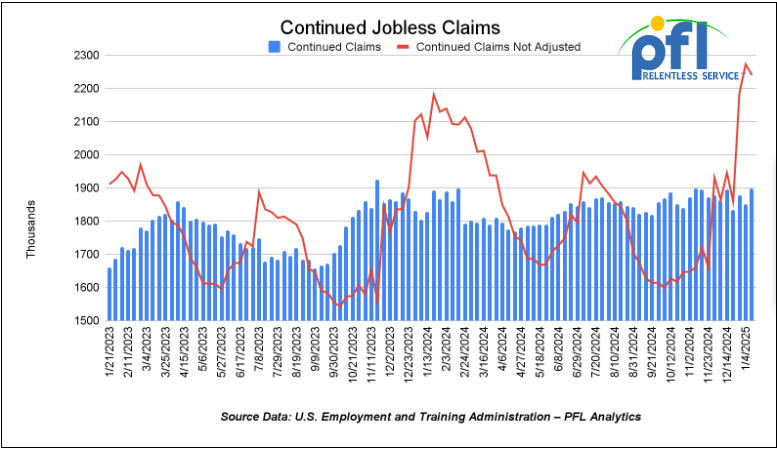

- Continuing jobless claims came in at 1.899 million people, versus the adjusted number of 1.853 million people from the week prior, up 46,000 people week-over-week.

Stocks closed lower on Friday of last week, but mixed week over week

The DOW closed lower on Friday of last week, down -140.82 points (-0.32%) and closing out the week at 44,424.25, up 936.42 points week-over-week. The S&P 500 closed lower on Friday of last week, down 17.47 points, and closed out the week at 6,101.24, down -895.42 points week-over-week. The NASDAQ closed lower on Friday of last week, down 99.38 points (0.51%), and closed out the week at 19,954.3, up 324.1 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 44,223 this morning down -379 points.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up $0.04 cents per barrel (0.05%) to close at $74.66 per barrel on Friday of last week, down -$3.22 per barrel week over week. Brent traded up $0.21 cents USD per barrel (0.27%) on Friday of last week, to close at $78.50 per barrel, down -$2.29 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for March delivery settled on Friday of last week at US$13.20 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$60.83 per barrel.

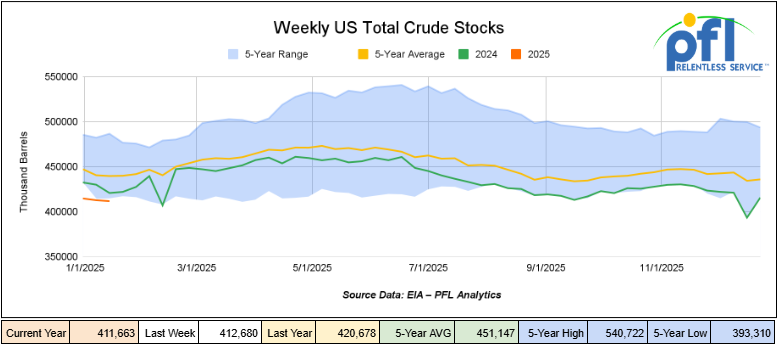

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.0 million barrels week-over-week. At 411.7 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

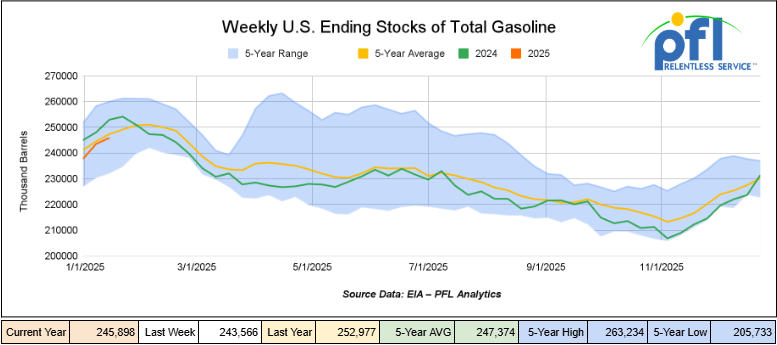

Total motor gasoline inventories increased by 2.3 million barrels week-over-week and are 1% below the five-year average for this time of year.

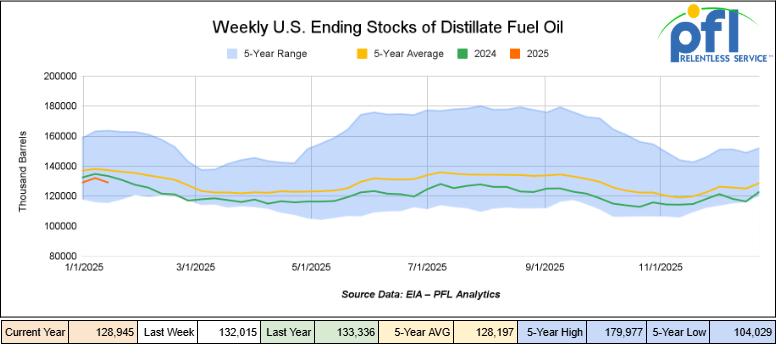

Distillate fuel inventories decreased by 3.1 million barrels week-over-week and are about 6% below the five-year average for this time of year.

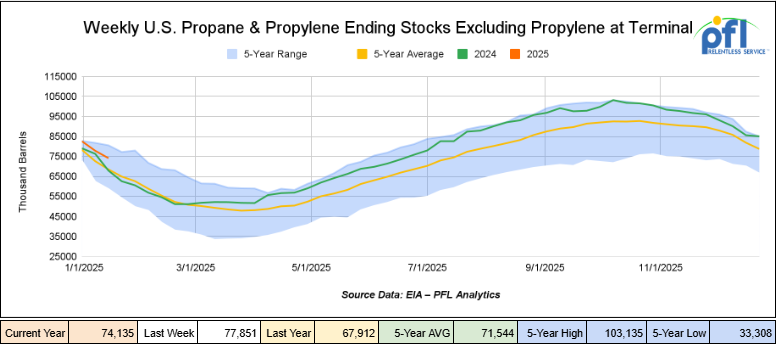

Propane/propylene inventories decreased by 3.7 million barrels week-over-week and are 8% above the five-year average for this time of year.

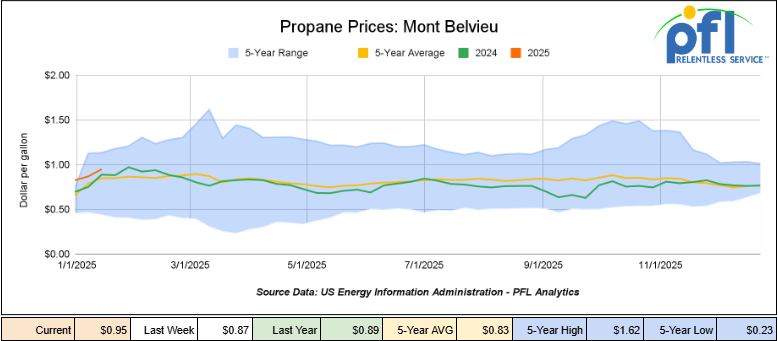

Propane prices closed at 95 cents per gallon on Friday of last week, up 8 cents per gallon week-over-week, and up 6 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 4.1 million barrels during the week ending January 17th, 2025.

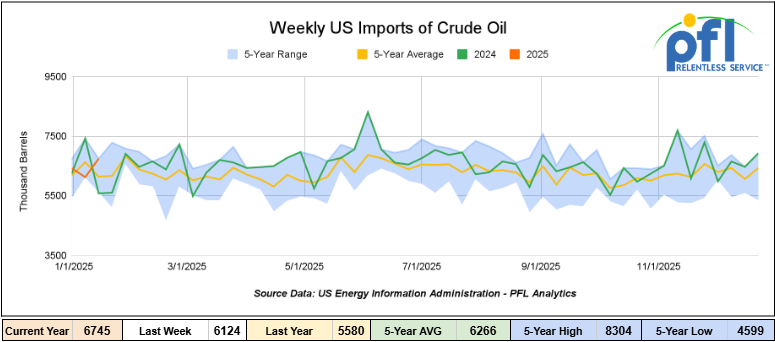

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending January 17th, 2025, an increase of 621,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 0.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 340,000 barrels per day, and distillate fuel imports averaged 289,000 barrels per day, during the week ending January 17th, 2025.

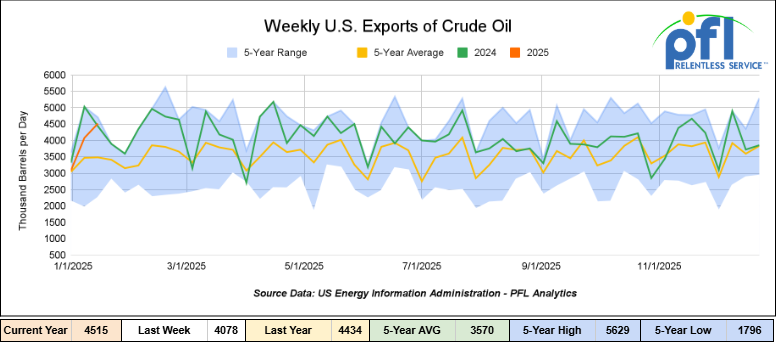

U.S. crude oil exports averaged 4.515 million barrels per day during the week ending January 17th, 2025, an increase of 437,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3,881 million barrels per day.

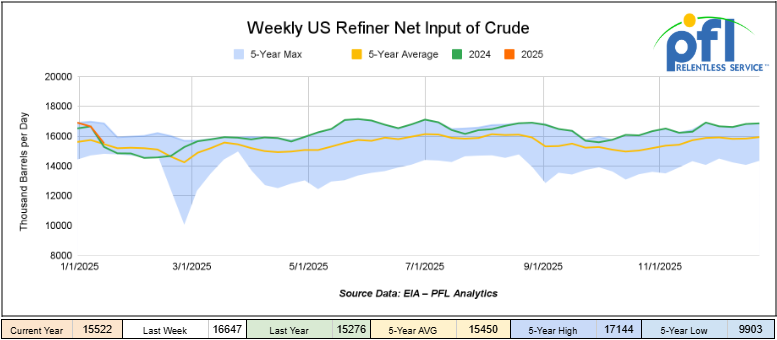

U.S. crude oil refinery inputs averaged 15.5 million barrels per day during the week ending January 17, 2025, which was 1.125 million barrels per day less week-over-week.

WTI is poised to open at $74.70, down 12 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending January 22, 2025.

Total North American weekly rail volumes were up (25.99%) in week 4, compared with the same week last year. Total carloads for the week ending on January 22 were 337,676, up (24.72%) compared with the same week in 2024, while weekly intermodal volume was 351,291, up (27.24%) compared to the same week in 2024.

11 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest increase came from Grain which was up (38.16%).

In the East, CSX’s total volumes were up (26.24%), with the largest increase coming from Grain (67.05%). NS’s volumes were up (19.13%), with the largest increase coming from Motor Vehicles and Parts (25.44%).

In the West, BN’s total volumes were up (28.73%), with the largest increase coming from Motor Vehicles and Parts (58.81%). UP’s total rail volumes were up (31.99%) with the largest increase coming from Nonmetallic Minerals (49.66%).

In Canada, CN’s total rail volumes were up (12.59%) with the largest increase coming from Grain, up (+151.62%). CP’s total rail volumes were up (26.75%) with the largest increase coming from Other (+96.77%), while the largest decrease came from Petroleum and Petroleum Products (-2.99%).

KCS’s total rail volumes were up (33%) with the largest increase coming from Nonmetallic Minerals (+114.88%).

Source Data: AAR – PFL Analytics

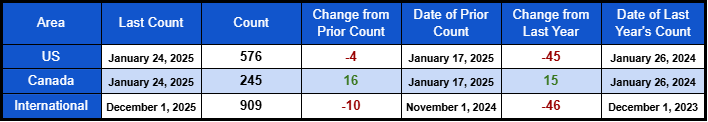

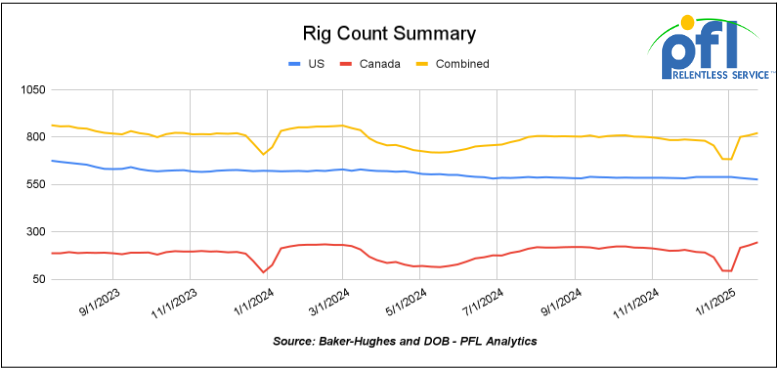

Rig Count

North American rig count was up by 12 rigs week-over-week. U.S. rig count was down -4 rigs week over week and down by -45 rigs year-over-year. The U.S. currently has 576 active rigs. Canada’s rig count was up 16 rigs week-over-week, and up by 15 rigs year-over-year, and Canada’s overall rig count is 245 active rigs. Overall, year over year we are down by -30 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are Watching Crude by Rail out of Canada

The Canadian Energy regulator reported on January 23, 2025, that 94,188 barrels were exported per day during the month of November 2024, up from 85,279 barrels in October of 2024, an increase of 8,909 barrels per day month over month. This is the highest level since April of 2024.

Assuming the status quo will remain in place, no tariffs on Canadian oil and gas exports will occur. Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines. Raw Bitumen, shipped as a non-haz product, is not able to flow in pipelines but is competitive with pipeline tolls and is a growing market to keep an eye on. Other factors would be existing long-term contractual commitments with Class 1’s, or refiners not served by pipelines. Basis is always a significant factor for Canadian crude by rail. We really need to see One Exchange basis WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to -17 per barrel for sustained periods of time to make rail economic sense. That may come sooner than we think.

Canadian producers are resilient, and we are seeing more production than anticipated. In fact, Enbridge continued to reject some nominations along its mainline system for the fourth month in a row. Enbridge notified shippers that 8% of heavy crude nominations and 12% of light crude nominations flowing through Kerrobert Saskatchewan would be appropriated for February. In the meantime, Trans Mountain pipeline continues to fill up and all else being equal will hit a wall at some point.

Alberta’s Premier Danielle Smith last week, in an effort to create more markets for Canadian crude oil, called on the Canadian Federal government to “fast track “ the Northern Gateway pipeline which would add another 525,000 barrels per day of export capacity to Canada’s west coast. She also called for the conversion of a natural gas pipeline to oil that would add 1.1 million barrels per day of crude oil to Canada’s east coast. Both projects were killed by the Canadian Federal government under the leadership of Justin Trudeau due to environmental concerns.

We Are Watching the Surface Transportation Board

Patrick Fuchs has been named chairman of the Surface Transportation Board.

The appointment of Fuchs, a Republican, was announced Monday of last week. He was confirmed to his second five-year term that ends on the board on January 14, 2029. Prior to his appointment to the STB in 2019, Fuchs was senior professional staff member working on surface transportation and maritime issues for the Senate Committee on Commerce, Science, and Transportation.

“I am grateful to President Trump for the honor of this appointment,” Fuchs said in a statement today. “I look forward to engaging with all those affected by the Board’s work to promote transparency, accountability, and collaboration to help strengthen our nation’s transportation network.”

He replaces Democrat Robert E. Primus, who became chairman in May after the retirement of fellow Democrat Martin J. Oberman.

On January 22nd, Schultz was named the agency’s vice chair, a position that rotates among the members annually. Hedlund served as vice chair last year.

Fuchs has said he would like to streamline STB processes, make better use of the voluminous data the board collects, and ensure that the board meets its own regulatory deadlines when issuing decisions.

In a statement, the Association of American Railroads said the industry looks forward to working with Fuchs.

“Chairman Fuchs has proven to be a thoughtful, solutions-oriented leader who lets data drive the decision-making process,” the AAR said. “Throughout his career, he has been committed to maintaining the balanced regulatory framework that allows railroads to invest while also offering appropriate remedies for rail customers.”

We are Watching Class 1 Industry Head Count

Class I railroads employed 120,169 workers in the United States in December 2024, a -0.15% decrease from November 2024’s count of 120,354 and a -1.78% year-over-year decrease from December 2023’s total of 122,343, according to Surface Transportation Board data.

Three of the six employment categories posted month-over-month increases between November and December. These were Professional and Administrative, up 0.02% to 9,632 workers; Maintenance of Equipment and Stores, which rose +0.24% to 17,157 workers; and Transportation (train and engine), which increased +0.05% to 51,803 workers.

The categories that posted month-over-month decreases were Executives, officials, and staff assistants, down -0.22% to 7,843 workers; Maintenance of Way and Structures, down -0.76% to 28,691 workers; and Transportation (other than train and engine), down -0.36% to 5,043 workers.

Year over year, two categories posted an employment gain, which was Maintenance of Way and Structures, up 0.98%, and Transportation (other than train and engine), up 1.16%.

Categories that registered year-over-year decreases in December were Executives, officials, and staff assistants, down -3.77%; Professional and Administrative, down -6.58%; Maintenance of Equipment and Stores, down -5.03%; and Transportation (train and engine), down -1.18%.

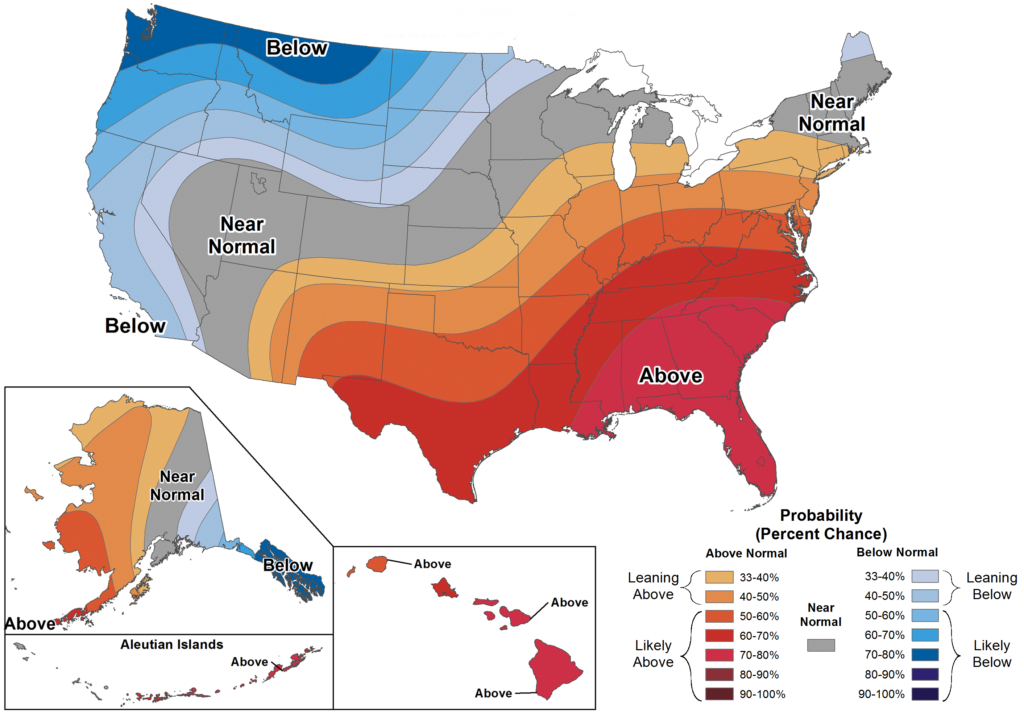

We Are Watching the Weather

Folks, it has been cold out there which is driving up natural gas, heating oil and propane prices. Propane prices closed on Friday of last week at their highest level since September 2022. The cold weather has led to fatalities, well-freeze offs – in Texas and North Dakota. Not to mention, record power and natural gas consumption – PJM set a record last week, peaking at 145 Gigawatts. Expect a higher power and natural gas bill in the mail! At the end of the day, weather seems to have a way of balancing itself out and warmer temperatures are on the way:

6-10 Day Temperature Outlook

Issued: January 26, 2025

Source NOAA: – PFL Analytics

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Round Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website