“Our lives begin to end the day we become silent about things that matter.“

– Martin Luther King

Jobs Update

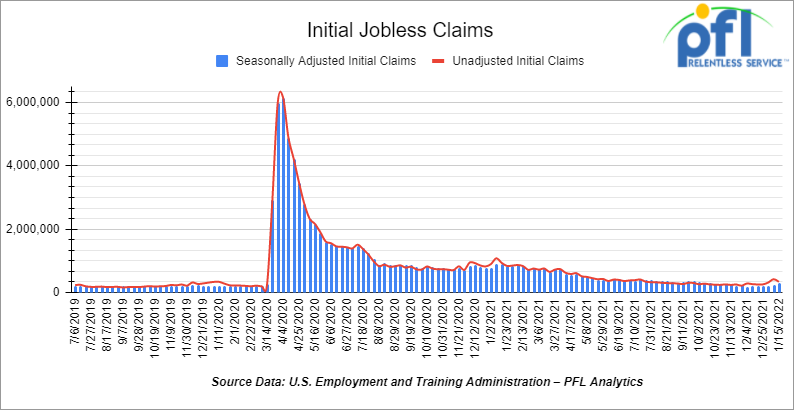

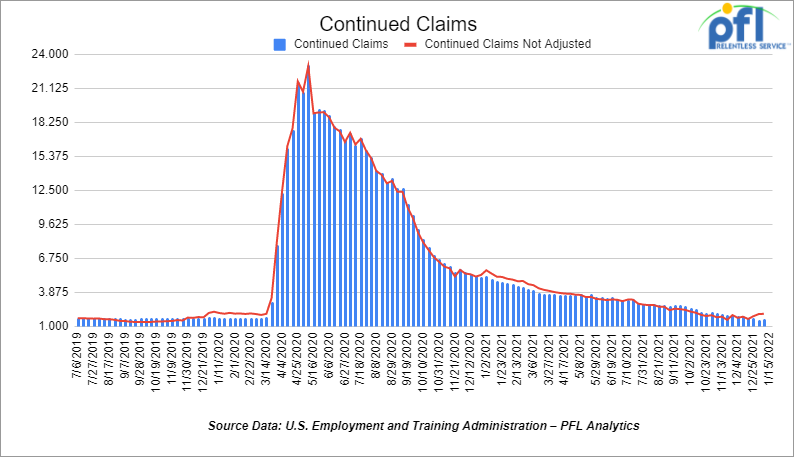

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending January 15th came in at 286,000, up +55,000 people week over week.

- Continuing claims came in at 1.635 million people versus the adjusted number of 1.551 million people from the week prior, up 84,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -450.02 points (-1.3%), closing out the week at 34,265.37 points, down –1,646.44 points week over week. The S&P 500 closed lower on Friday of last week, down -84.79 points (-1.89%) and closed out the week at 4,397.94, down -264.91 points week over week. The Nasdaq closed lower on Friday of last week, down -385.1 points (-2.72%) and closed out the week at 13,768.92, down -1,124.93 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,997 this morning down -160 points.

Oil closed lower on Friday of last week and up week over week on Continued Geopolitical Concerns

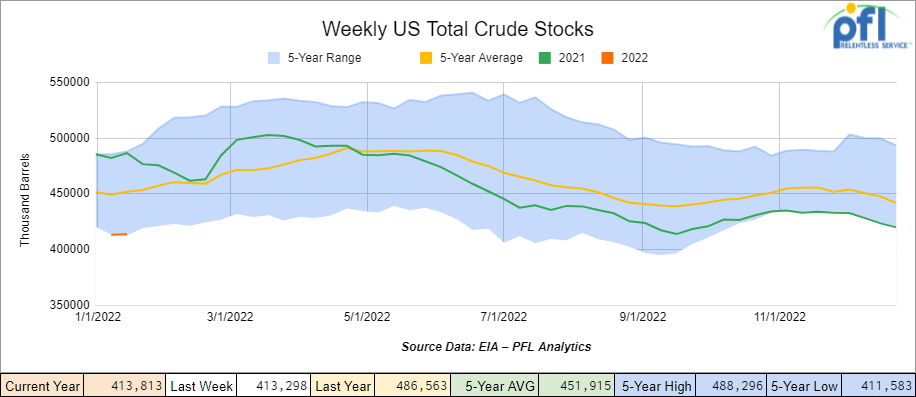

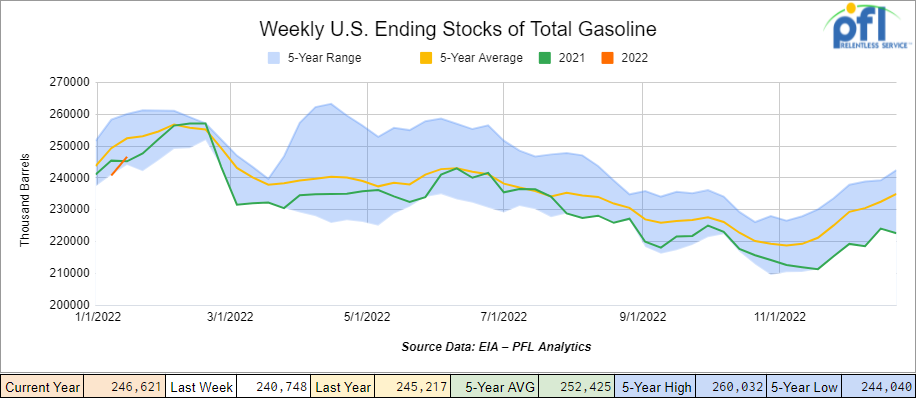

Oil prices slid for a second day in a row on Friday of last week, pressured by an unexpected rise in U.S. crude and fuel inventories while investors took profits after the benchmarks touched seven-year highs earlier last week.

West Texas Intermediate (WTI) crude closed down 41 cents (-0.5%) a barrel on Friday of last week to settle at $85.14 per barrel, up $1.32 per barrel week over week, while Brent futures closed down 49 cents (-0.6%) per barrel to settle at $87.89 per barrel, up $1.83 per barrel week over week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 500,000 barrels week over week. At 413.8 million barrels, U.S. crude oil inventories are 8% below the five-year average for this time of year.

Total motor gasoline inventories increased by 5.9 million barrels week over week and are 2% below the five-year average for this time of year.

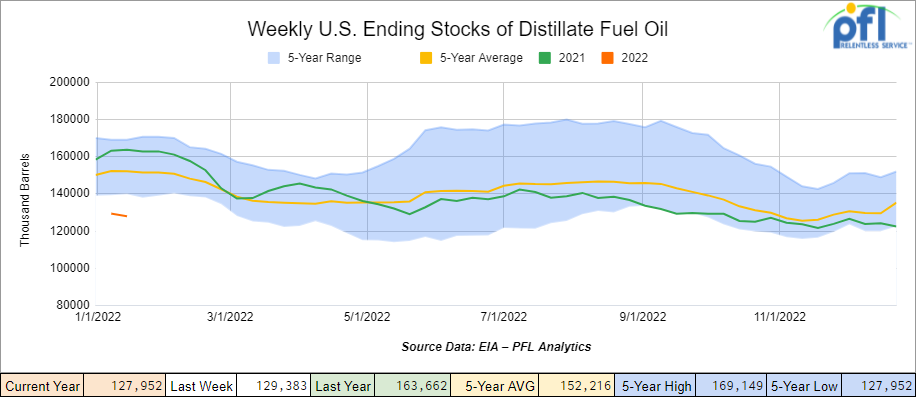

Distillate fuel inventories decreased by 1.4 million barrels week over week and are 16% below the five-year average for this time of year.

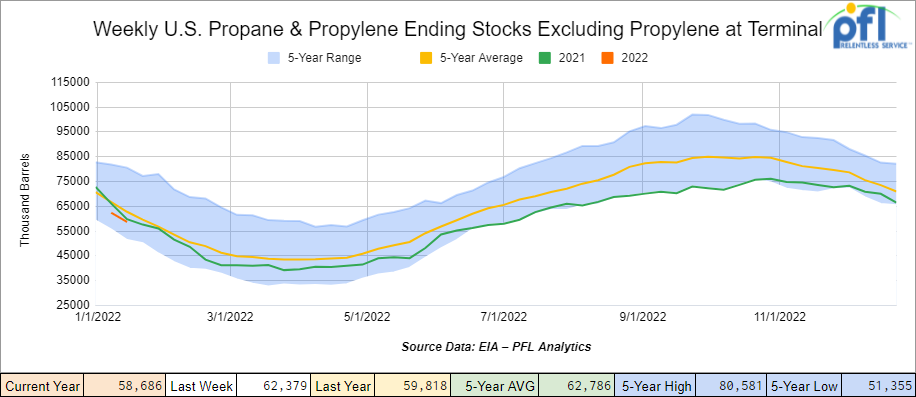

Propane/propylene inventories decreased by 3.7 million barrels week over week and are 7% below the five-year average for this time of year.

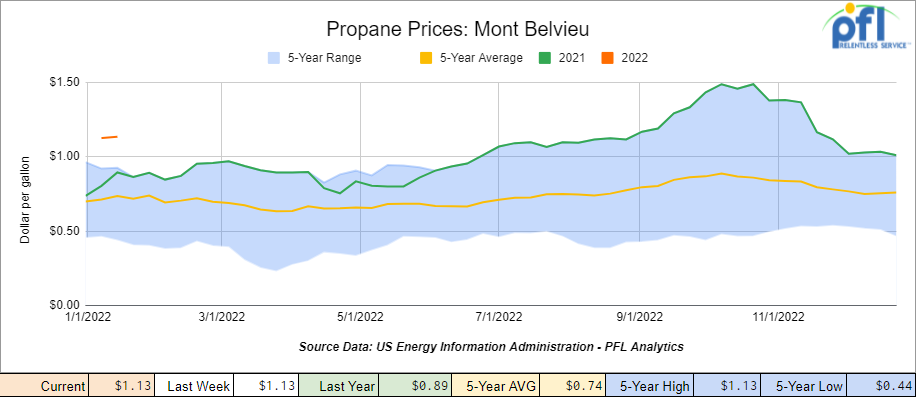

Propane prices were flat week over week but up 24 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 1.5 million barrels week over week.

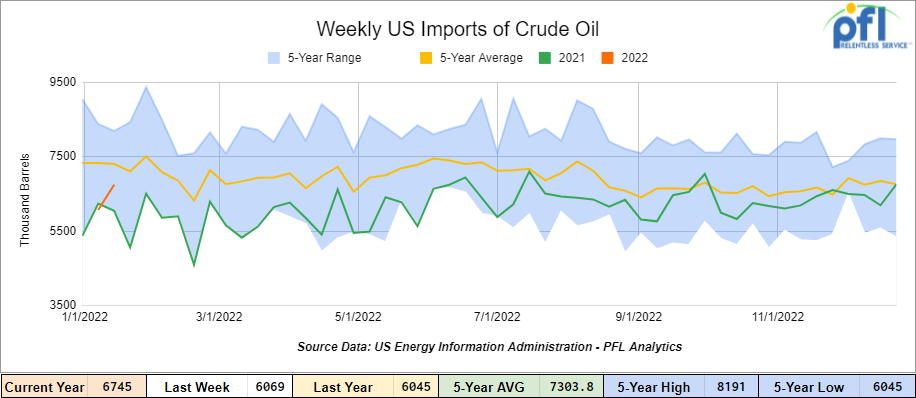

U.S. crude oil imports averaged 6.7 million barrels per day for the week ending January 14, 2022, an increase of 700,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 10.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 391,000 barrels per day and distillate fuel imports averaged 306,000 barrels per day for the week ending January 14, 2022..

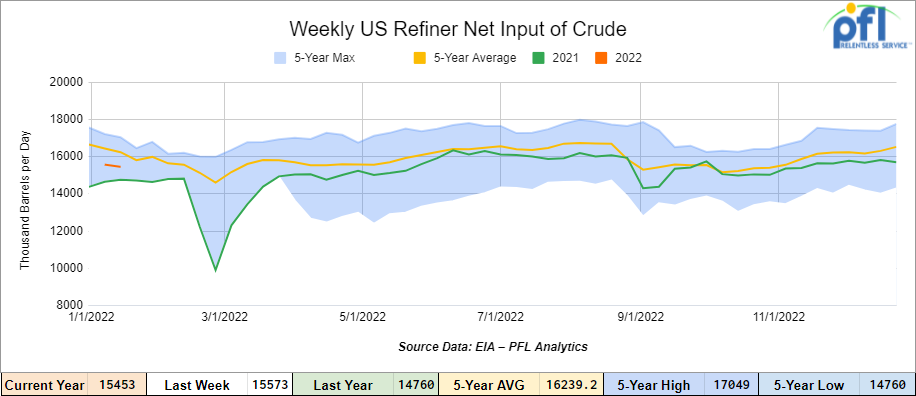

U.S. crude oil refinery inputs averaged 15.5 million barrels per day during the week ending January 14, 2022 which was 120,000 barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $84.86 , down -0.28 per barrel from Thursday’s close.

North American Rail Traffic

Total North American rail volumes were down -8.9% year over year in week 2 (U.S. -6.6%, Canada -17.6%, Mexico -3.8%) resulting in quarter to date volumes that are down 13.1% year over year (U.S. -11.3%, Canada -20.2%, Mexico -8.4%). 9 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-12.1%), grain (-23.6%) and metallic ores & metals (-14.8%). The largest increase came from coal (+13.5%).

In the East, CSX’s total volumes were down -4.6%, with the largest decreases coming from motor vehicles & parts (-30.8%), intermodal (-2.9%) and coal (-8.6%). NS’s total volumes were down -11.0%, with the largest decrease coming from intermodal (-14.0%).

In the West, BN’s total volumes were down -7.2%, with the largest decreases coming from intermodal (-14.8%), petroleum (-30.9%) and grain (-11.8%). The largest increases came from coal (+22.9%) and stone, sand, and gravel (+59.9%). UP’s total volumes were down -0.5%, with the largest decreases coming from intermodal (-8.5%) and grain (-26.1%). The largest increase came from coal (+69.5%).

In Canada, CN’s total volumes were down -16.9%, with the largest decreases coming from intermodal (-18.7%), metallic ores (-32.7%), and grain (-50.3%). RTMs were down 19.7%. CP’s total volumes were down -12.1%, with the largest decreases coming from grain (-48.8%) and farm products (-69.4%). RTMs were down 19.0%.

KCS’s total volumes were down -4.9%, with the largest decrease coming from petroleum (-39.6%).

Source Data: Stephens

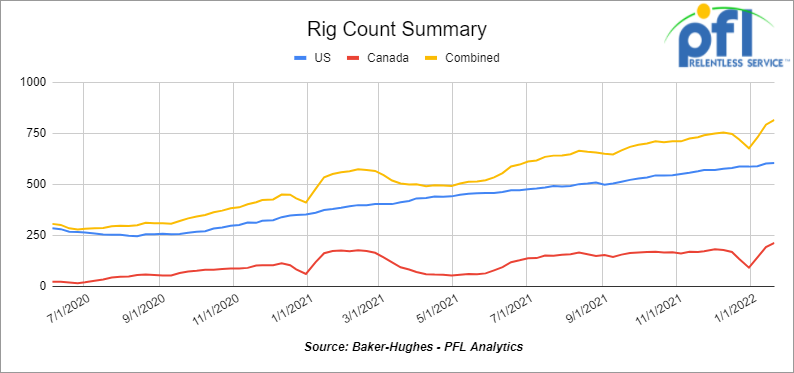

Rig Count

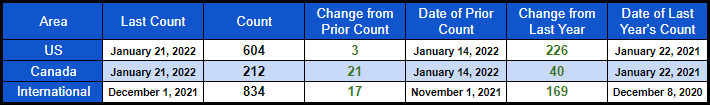

North American rig count is up by 17 rigs week over week. The U.S. rig count was up by 3 rigs week over week and up by 226 rigs year over year. The U.S. currently has 604 active rigs. Canada’s rig count was up by 21 rigs week over week and up by 40 rigs year over year and Canada’s overall rig count is 212 active rigs. Overall, year over year, we are up 266 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads declined to 22,654 from 22,782, a loss of 128 rail-cars week over week. Canadian volumes were up: CP volumes were up by 46.1% and CN volumes were up by 26.9% week over week. U.S. volumes were up across the network with the BN having the largest percentage increase (up by 17.6%).

PFL’s 2022 Predictions – You Heard it Here First

Folks, as you know PFL prides itself in reporting the news that we feel you need the most and that is most relevant to rail. We try to give you the most up to date and reliable current information that will hopefully guide you in any decision making that you need to make that would affect you and your company. Once a year we go out on a limb and make some predictions and this year is no different. As we enter 2022 here is what we are thinking:

1) COVID 19 – We are declaring COVID -19 this year to be over. It seems to us that it is going to be just another flu-like virus. COVID has ripped through PFL’s office and throughout the industry and people are ready to move on. While it is a terrible virus that has claimed many lives’, it continues to mutate its way out of existence. Governments around the world will need convincing but seems to us these are the facts that we now seem to see unfolding. Great Britain just dropped all of its COVID Mandates!

2) Inflation and Interest Rates – Basic economics 101 would tell us that inflation at 8% cannot support interest rates close to 0. Interest rates cannot and will not continue to be as low as they are right now with inflation at current levels. A large increase in interest rates would lead to other problems – folks are already struggling with the increases of the basic needs of life and the economy would be further strained if interest rates rise too high quickly as people would have to shell out even more money to satisfy their mortgage payments. Look for rate hikes this year.

3) Rail Traffic and Supply Chain – We are off to a little bit of a rough start as noted in today’s report for week 2, and week 1 was worse year over year. We expect to see traffic to wane in Q1 but to pick up significantly as the supply chain gets sorted out. The problem with the supply chain is that it is as we know it (or used to know it) is broken and the big reset is ongoing. Even within PFL’s network of customers and plants, we are finding that some plants slow down which creates the need for empty railcar storage and then when they speed back up again cars are pulled from storage and put back into service, filled back up, and in some instances placed back into storage loaded due to slowdowns at factories that process raw materials into finished goods due to transportation difficulties of all kinds whether it be rail, trucking or air. It has been a vicious cycle that has put a strain on all industry participants. If COVID is declared over and all are allowed to go on with life as they see fit, expect the supply chain to sort itself out. Until then, expect to see more of the same, daily crisis management.

4) Crude by Rail – Folks, this is the biggest wild card of them all! As we know, DAPL’s expansion to 1 Million barrels a day was denied recently by an IL court and the Army Corp. of engineers is still doing an environmental assessment on the pipeline. Crude by rail out of ND has certainly been impacted by some additional volume getting out of the state (DAPL currently running at 750,000 Barrels per day). If the price of oil remains as strong as it has, don’t be surprised to see more crude by rail out of ND. Remember if you are a producer of crude, the transportation component only affects your net back and any basis differential is not as important if you own the underlying barrel.

Enbridge for February delivery only apportioned 10% of all their pipeline nominations. Crude by rail out of Canada seems to be picking up, but certainly not back to the levels they once were. As Canada’s production continues to rise expect to see crude by rail numbers continue to increase although we do not expect to see a massive resurgence unless a pipeline is told to shut down. Remember Transmountain Pipeline expansion is taking hold in December of this year that is going to add 590,000 barrels per day of crude capacity out of Alberta.

There are constant and continuous legal battles to either shut down existing pipelines and certainly new ones that don’t seem to have a hope of ever getting approved particularly if they have to run through a Blue State so the jury is out. This is a tough one to predict but we are calling for an increase of crude by rail year over year.

5) Lease Rates – Expect them to move higher. It is impossible for them not to. With the high scrap prices we have seen as of late companies have been scrapping and retooling their fleet at levels not seen for a long time. We are back down to 2016 levels with cars in storage – sure a lot have been put back into service but quite a few have been taken out of service permanently. The jury is still out on coiled and insulated tank cars as we have a bit of inventory.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 50 25.5 Tanks C&I for heavy fuel oil in Texas dirty to dirty 1-2 years negotiable

- 300 5800 Covered hoppers needed for plastic – 5 year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 20 pressure cars 340’s in SE clean or last in butane or propane 1-2 years Immediate Need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 100 117Js Coiled and Insulated dirty to dirty service BNSF CN or CP

- 50, 5800cuft or larger Covered Hopper for the use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10 25-28K C&I tanks for veg oil needed in the south for 2 years negotiable

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- Unit Train of 28.3K 117Js for use in Crude service off the CN or BN in MT, ND, or Alberta.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- 150 117R’s 31.8 clean for lease in Texas – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 25 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars sale or lease

- 20 20K Stainless cars in 3 locations in the south – sale or lease – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude – available Feb 2022

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|