Winston Churchill once remarked that “success is not final, failure is not fatal — it is the courage to continue that counts.” Let’s continue to rock on America!

Jobs Update

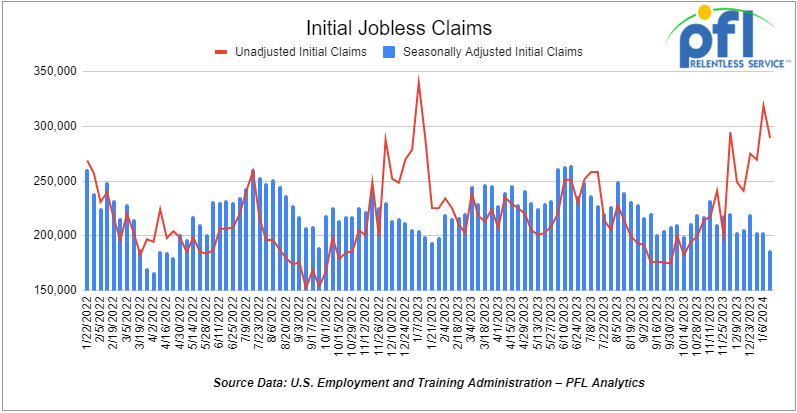

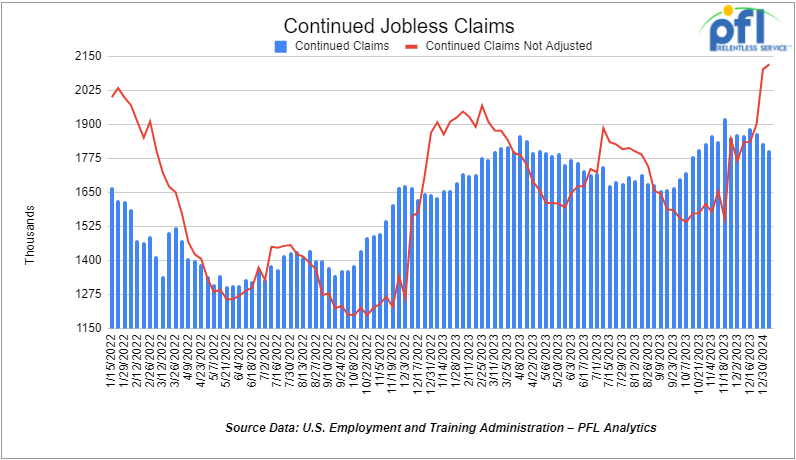

- Initial jobless claims seasonally adjusted for the week ending January 13th, 2023 came in at 187,000, down -16,000 people week-over-week.

- Continuing jobless claims came in at 1.806 million people, versus the adjusted number of 1.832 million people from the week prior, down -26,000 people week-over-week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 395.19 points (1.05%), closing out the week at 37,863.8, up 270.82 points week-over-week. The S&P 500 closed higher on Friday of last week, up 58.87 points (1.23%), and closed out the week at 4,839.81, up 55.98 points week-over-week. The NASDAQ closed higher on Friday of last week, up 256.32 points (1.72%), and closed out the week at 15,310.97, up 338.21 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 38,093 this morning, up 48 points.

Crude oil closed lower on Friday of last week, but up week over week

WTI traded down -$0.67 per barrel (-.9%) to close at $73.41 per barrel on Friday of last week, up $0.73 per barrel week-over-week. Brent traded down -US$0.54 per barrel (-0.68%) on Friday of last week, to close at US$78.56 per barrel, up US$0.24 per barrel week-over-week.

One Exchange WCS for March delivery settled on Friday of last week at US$18.20 below the WTI-CMA (WTI – Calendar Month Average). The implied value was US$54.88 per barrel. On Thursday of last week, it settled at US$18.30 below the WTI-CMA for March delivery. The implied value was US$55.61 per barrel.

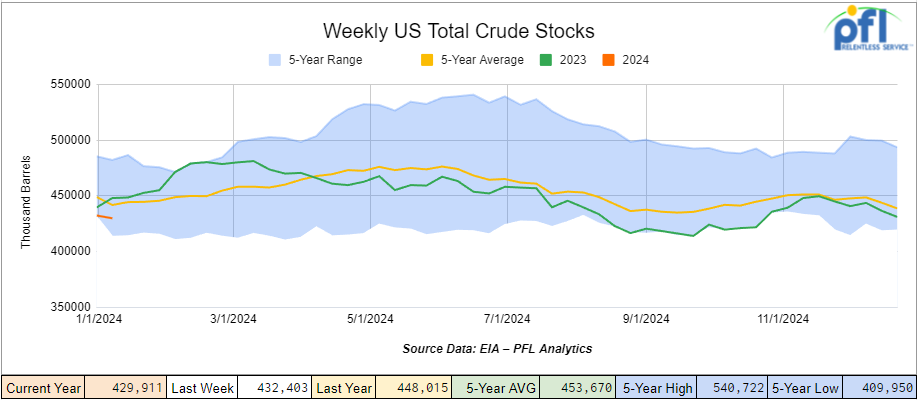

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.5 million barrels week-over-week. At 429.9 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

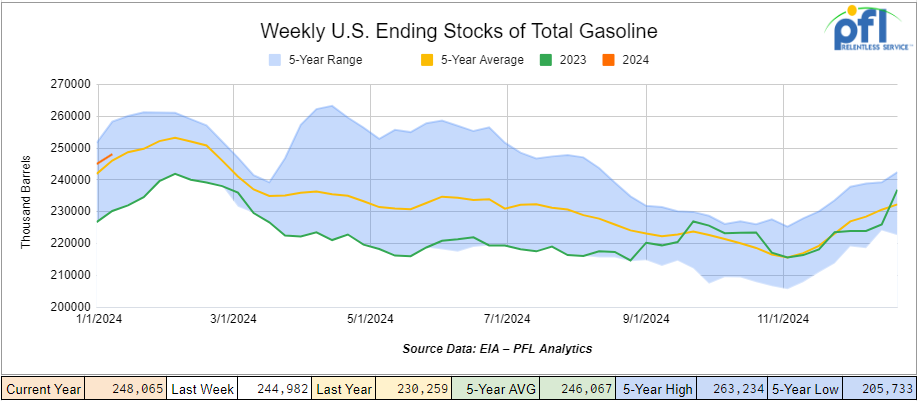

Total motor gasoline inventories increased by 3.1 million barrels week-over-week and are slightly above the five-year average for this time of year.

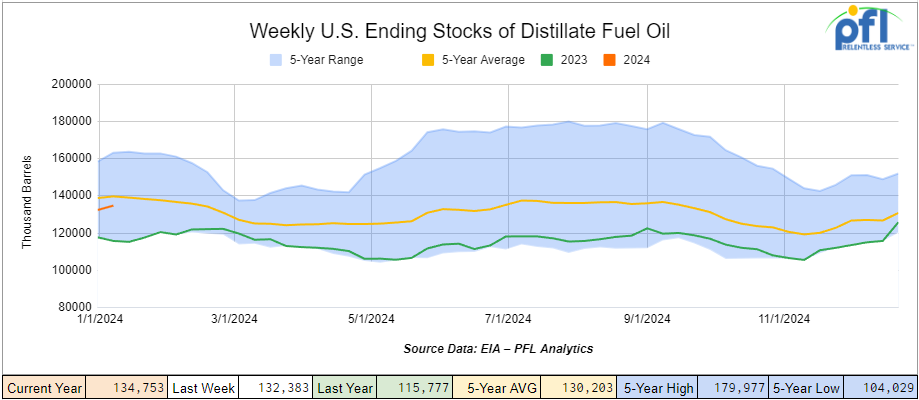

Distillate fuel inventories increased by 2.4 million barrels week-over-week and are 3% below the five-year average for this time of year.

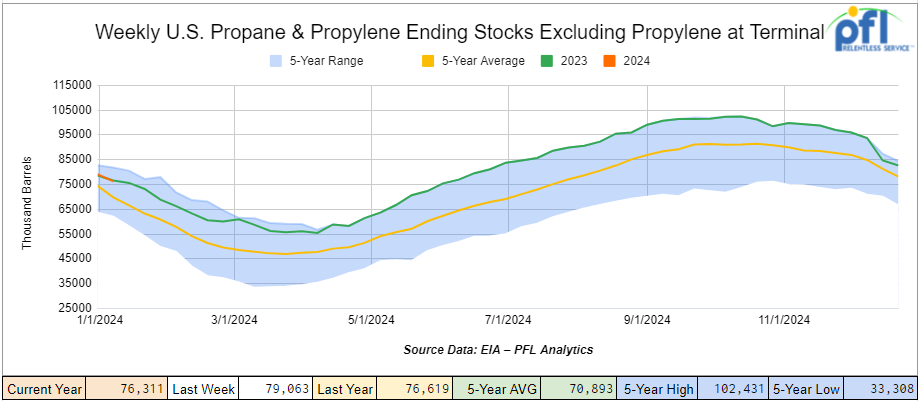

Propane/propylene inventories decreased by 2.8 million barrels week-over-week and are 13% above the five-year average for this time of year.

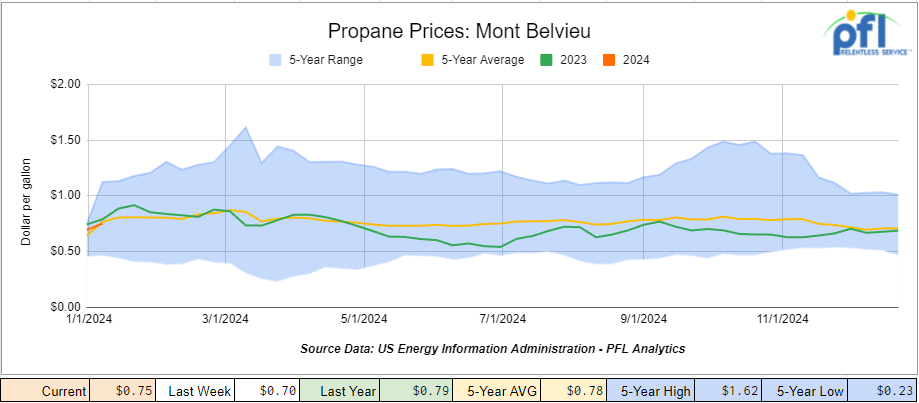

Propane prices closed at 75 cents per gallon, up 5 cents per gallon week-over-week, but down 4 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 2.8 million barrels for the week ending January 12, 2024.

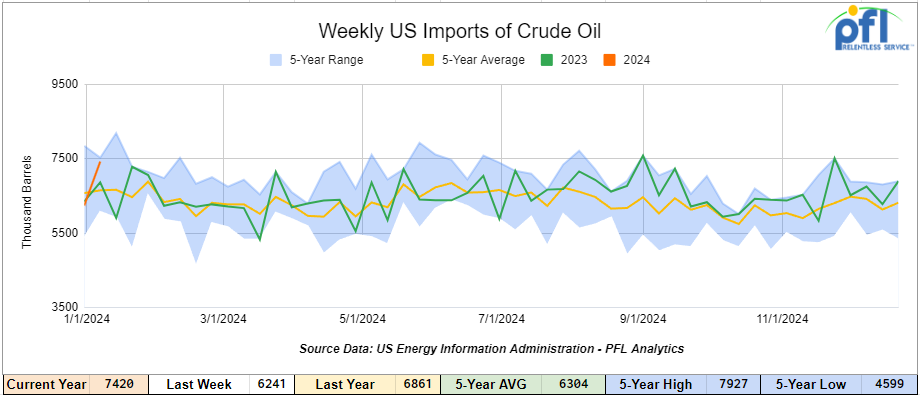

U.S. crude oil imports averaged 7.4 million barrels per day for the week ending January 12, 2024, an increase of 1.2 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 6.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 549,000 barrels per day, and distillate fuel imports averaged 115,000 barrels per day during the week ending January 12, 2024.

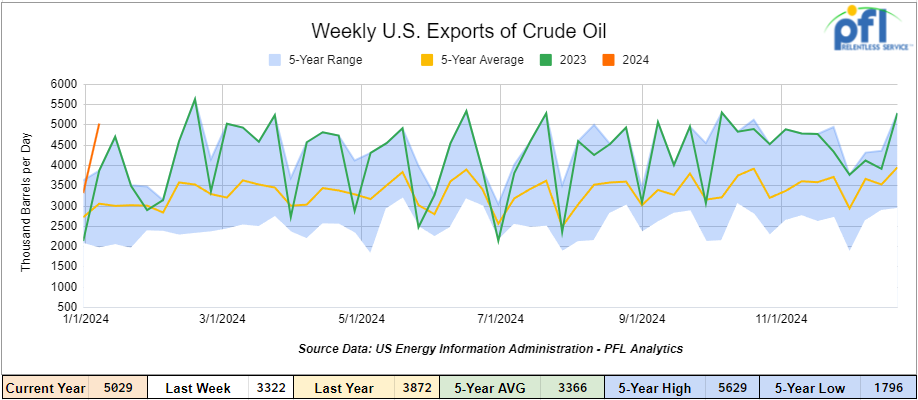

U.S. crude oil exports averaged 5.292 million barrels per day for the week ending January 12, 2024, an increase of 1.377 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.275 million barrels per day.

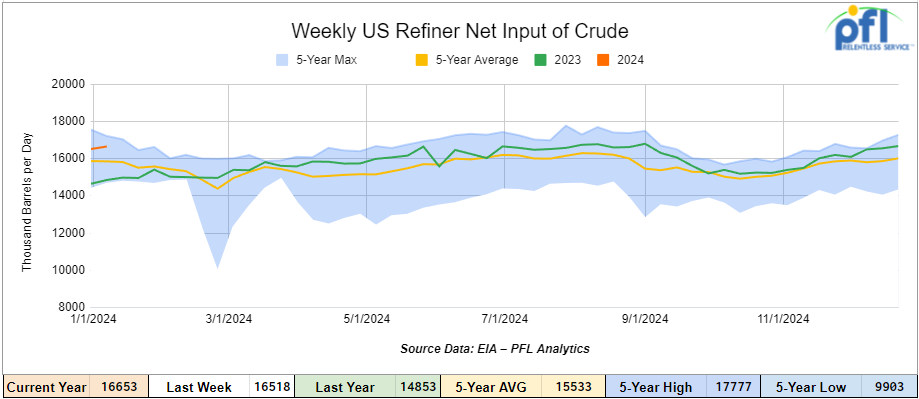

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending January 12, 2024, which was 135,000 barrels per day more week-over-week.

WTI is poised to open at $73.49, up $0.05 per barrel from Friday’s close.

North American Rail Traffic

Week Ending January 17th, 2023.

Total North American weekly rail volumes were down (5.29%) in week 3, compared with the same week last year. Total carloads for the week ending on January 17th were 331,234, down (-8.73%) compared with the same week in 2023, while weekly intermodal volume was 300,073, down (1.18%) compared to the same week in 2023. 8 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant increase from Chemicals (+6.44%) while the largest decrease came from Grain, down (-27.41%).

In the East, CSX’s total volumes were down (-1.26%), with the largest increase coming from Petroleum and Petroleum Products (+10.8%) and the largest decrease coming from Nonmetallic Minerals, down (-12.99%). NS’s volumes were down (-3.21%), with the largest increase coming from Metallic ores and Metals (+9.62%) while the largest decrease came from Other, down (-16.64%).

In the West, BN’s total volumes were down (-3.13%), with the largest increase coming from Chemicals (+16.17%) while the largest decrease came from Grain, down (-40.58%). UP’s total rail volumes were down (-7.9%) with the largest increase coming from Petroleum and Petroleum Products (+25.23%) while the largest decrease came from Grain, down (-36.31%).

In Canada, CN’s total rail volumes were down (-12.81%) with the largest increase coming from Nonmetallic Minerals (+9.52%) and the largest decrease coming from Motor Vehicles and Parts (-43.55%). CP’s total rail volumes were down (-0.07%) with the largest increase coming from Coal (+47.37%) while the largest decrease came from Other, down (-43.90%).

KCS’s total rail volumes were down (-19.70%) with the largest decrease coming from Motor Vehicles and Parts (-39.35%) and the largest increase coming from Grain (+12.83%).

Source Data: AAR – PFL Analytics

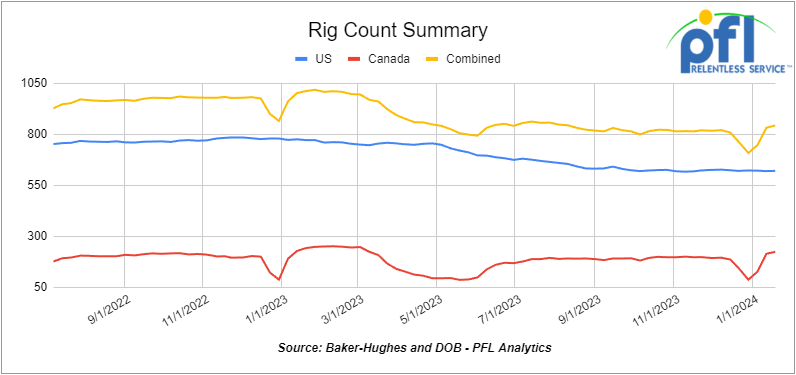

Rig Count

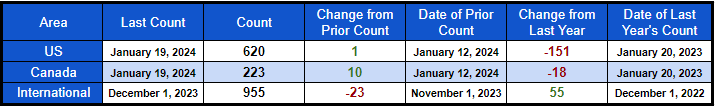

North American rig count was up by 11 rigs week-over-week. U.S. rig count was up by 1 rig week-over-week, but down by -151 rigs year-over-year. The U.S. currently has 620 active rigs. Canada’s rig count was up by 10 rigs week-over-week, but down by -18 rigs year-over-year. Canada’s overall rig count is 223 active rigs. Overall, year-over-year, we are down -169 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,605 from 29,937, which was a loss of -332 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments fell by -6.6% week over week, CN’s volumes were higher by +7% week-over-week. U.S. shipments were higher across the board. The UP had the largest percentage increase and was up by +11%.

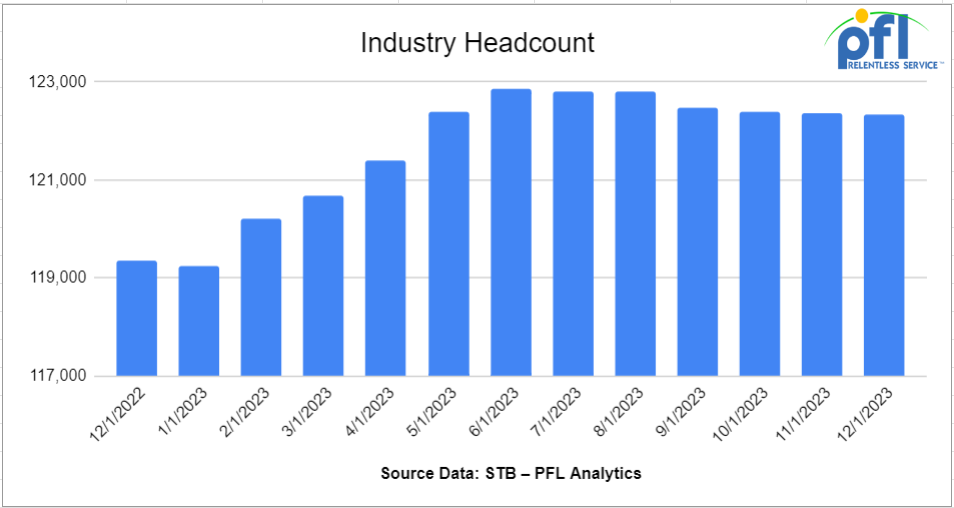

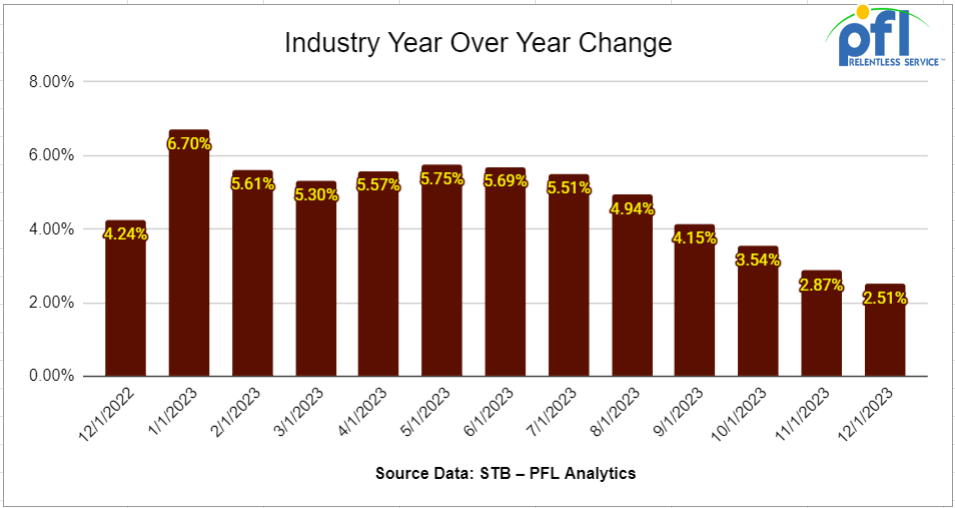

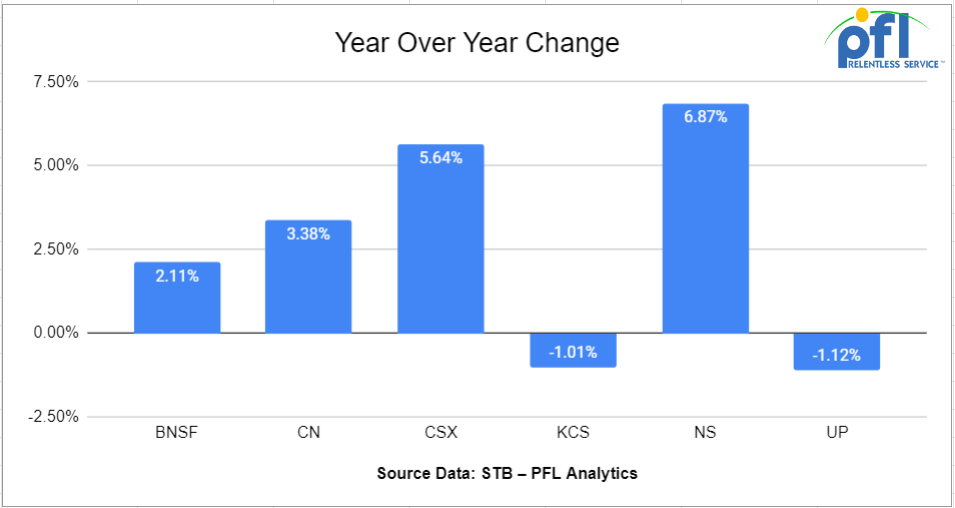

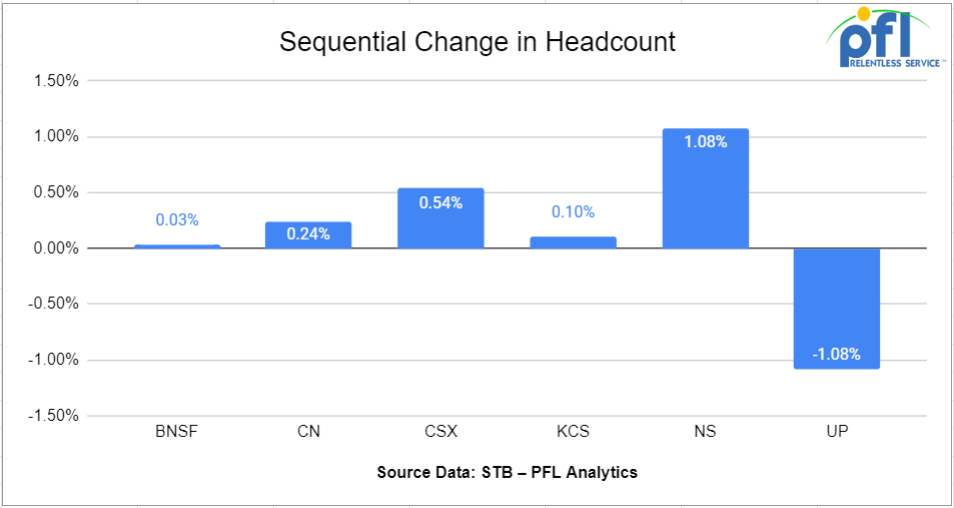

We are watching Class 1 Industry Headcount

Class 1’s employed 122,343 workers in the United States in mid-December 2023, a 0.01% decrease from November’s count but a 2.51% increase over December 2022’s level, according to Surface Transportation Board data.

Four of six employment categories logged increases between November and December 2023. They were transportation (other than train and engine), up 1.32% to 4,895 employees; maintenance of equipment and stores, up 0.67% to 18,066; transportation (train and engine), up 0.19% to 52,419; and professional and administrative, up 0.09% to 10,310.

The two employment categories that posted month-over-month decreases were maintenance of way and structures, down 1% to 28,413 people; and executives, officials and staff assistants, down 0.23% to 8,150.

Year over year, five of the six categories registered increases: transportation (train and engine), up 4.47%; transportation (other than train and engine), up 3.08%; professional and administrative, up 2.81%; executives, officials and staff assistants, up 1.91%; and maintenance of equipment and stores, up 1.41%.

The number of employees working in maintenance of way and structures declined 0.38% between December 2022 and December 2023.

We Continue to Watch Crude Oil Flows in Canada

Enbridge has rejected 31% of its heavy crude nominations for February delivery and 37% of its light or sweet crude nomination for February delivery as supply continues to build in Western Canada. Trans Mountain pipeline is now 98% complete and is expected to be completed by the end of Q1 when line pack will begin. Stay tuned to PFL for further details – the market is expected to change and basis is expected to tighten.

We continue watch The Green New Deal and Electric Vehicles

Folks, we wrote a piece on it last week where we pointed out that consumers don’t seem to want electric cars causing Hertz to sell 1/3 of its EV fleet. Few people want to rent electric cars and the repair costs are higher than anticipated. We could not resist adding to the story this week. Why you ask? Well, the deep freeze happened last week raising new concerns about EV’s.

With colder temperatures electric vehicles are facing issues including decline in performance, weaker battery life, increased charge times and long lines. Last weekend charging stations essentially turned into car graveyards as temperatures dropped to the negative double digits. Batteries were freezing up and charging stations were not working and some have reported that when you have your heater on your range drops by 40% and it takes longer for the battery to charge itself when it is cold out. To put icing on the cake, Ford announced last week that they are laying off 1,400 employees reducing the number of workers making its F-150 Lightning truck as demand for electric vehicles continues to weaken. Employees that will be impacted are located at Ford’s Rouge Electric Vehicle Center as it transitions to one shift from three beginning April 1, 2024.

We are Watching Renewable and Government Incentives that are dwindling

Folks, there has been a huge driver for the rail economy and it has been renewables and the incentives that come with it. In essence, all renewables come with a hidden tax in the fuel supply chain the higher the incentive to make renewables the more the private sector is motivated to produce – it is really that simple and the incentives to do so have dwindled over the past year. What the outcome will be is anyone’s guess – at the end of the day, it is what the governments of today’s world decide to do! Do they increase current blending requirements? There is a huge farm lobby to keep the train running while others are saying enough is enough – no more taxes, please!

Under a 2007 law, there was a mandate that 36 billion gallons of biofuels needed to be blended into the nation’s fuel supplies by 2022. No more than 15 billion gallons of that can be corn-based ethanol, and 21 billion gallons must be from advanced biofuels. After 2022, the EPA was granted authority to set annual targets. The current policy is to gradually increase the mandatory ethanol blending percentage beyond the current target of 20% by 2025. This creates a guaranteed market for ethanol producers, biodiesel producers and new to the party renewable diesel producers which we believe is a threat to the biodiesel producer in the long term.

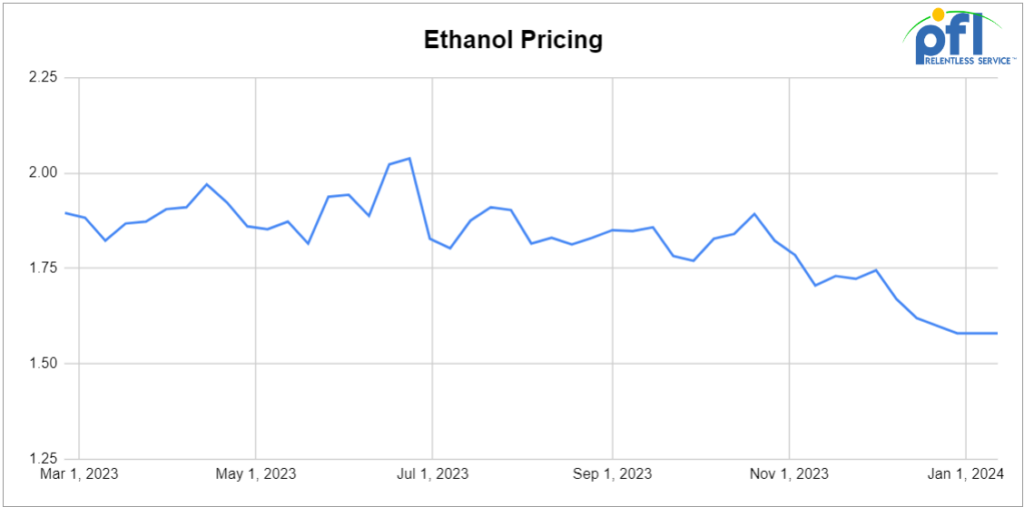

What is Ethanol? – Ethanol is a member of a class of organic compounds that are given the general name alcohols,its molecular formula is C2H5OH. Ethanol is an important industrial chemical; it is used as a solvent, in the synthesis of other organic chemicals, and as an additive to automotive gasoline. The value of ethanol has been declining. See chart:

What Is Biodiesel? – Biodiesel is an alternative fuel similar to conventional or ‘fossil’ diesel. Biodiesel can be produced from straight vegetable oil, animal oil/fats, tallow and waste cooking oil.

What is Renewable Diesel? – Renewable Diesel is a fuel made from fats and oils, such as soybean oil, canola oil and waste oils and is processed to be chemically the same as petroleum diesel. The difference between Biodiesel is Biodiesel is blended with regular diesel while Renewable diesel is refined taking the fats and oils directly into a refined process. Biodiesel normally correlates price wise with heating oil.

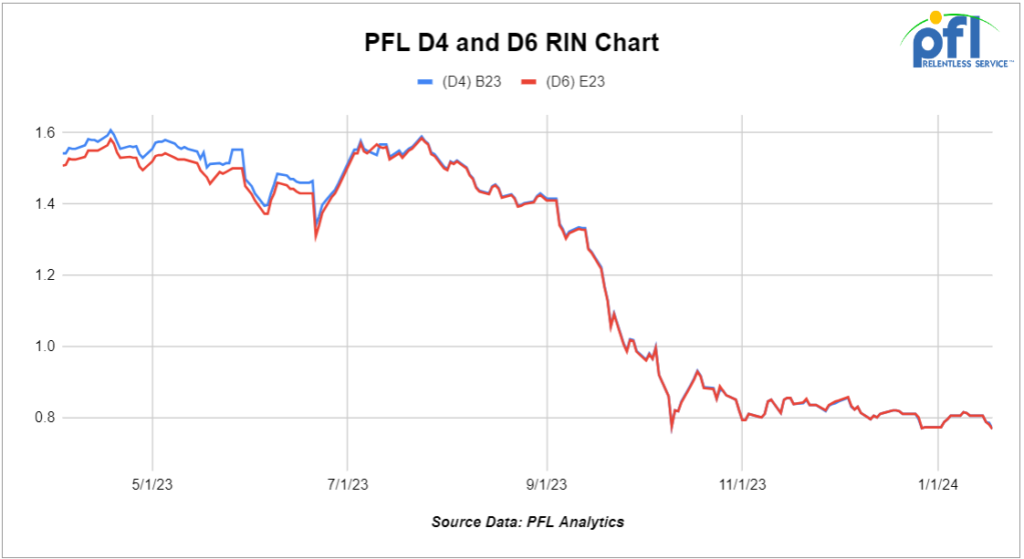

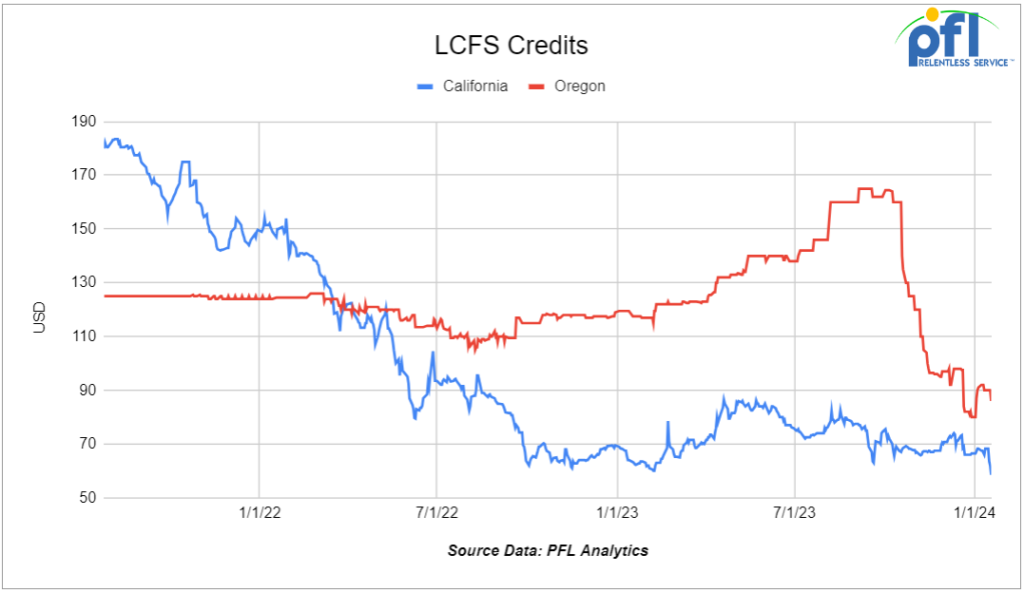

What is the bottom line?- It is our current opinion that we will be status quo for the short term for political reasons – no one is going out on a limb right now which will lead the private sector to hold steady on investment decisions until after November’s election. However, there are a number of projects coming on stream in 2024 and we could see an erosion in future values in Credits (California, Oregon), RINS, Ethanol, Biodiesel, and other renewables. See below charts:

Why are we watching this one closely? Renewables are so important to rail – there are no pipelines for either the inputs or outputs in the supply chain!

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K DOT117R, DOT117J, DOT111 Tanks needed off of UP in Iowa for 2-3 years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 years. Cars are needed for use in Crude service.

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 years. Cars are needed for use in Propane service. Q1

- 25-50, 30K DOT111, DOT117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 years. Cars are needed for use in Diesel service. Q2-Q3

- 10, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Iowa for 2 years. Cars are needed for use in Biodiesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 80, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Long-term Lease.

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-200, 31.8K, CPC1232 Tanks located off of BN in Chicago. Mix of dirty and clean cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

- 120, 31.8K, CPC1232 Tanks located off of various class 1s in multiple locations.

- 300-500, 3250s, Covered Hoppers located off of various class 1s in multiple locations.

- 140, 60ft, Boxcars located off of various class 1s in multiple locations.

- 150, 29.2K, DOT117R Tanks located off of various class 1s in multiple locations.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website