“Nothing is a waste of time if you use the experience wisely.”

-Auguste Rodin

Jobs Update

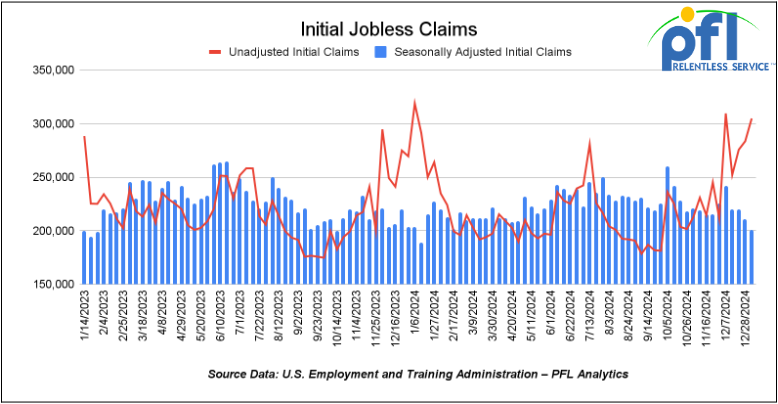

- Initial jobless claims seasonally adjusted for the week ending January 4th came in at 201,000, down -10,000 people week-over-week.

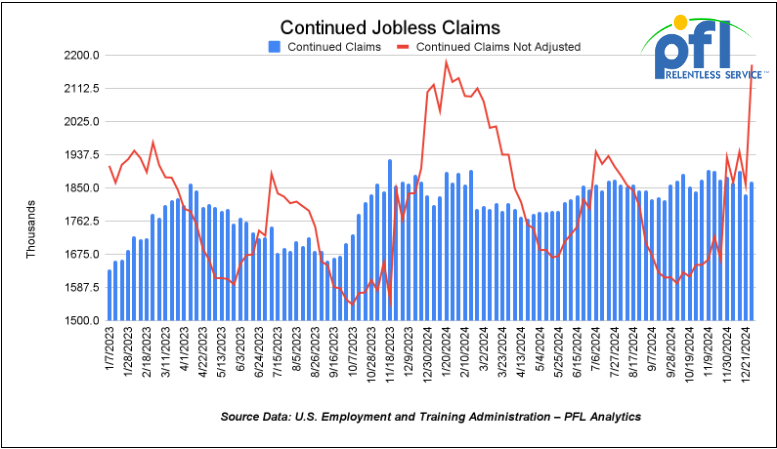

- Continuing jobless claims came in at 1.867 million people, versus the adjusted number of 1.834 million people from the week prior, up 33,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -696.75 points (-1.63%) and closing out the week at 41,938.45, down -793.68 points week-over-week. The S&P 500 closed lower on Friday of last week, down -91.21 points, and closed out the week at 5,827.04, down -115.43 points week-over-week. The NASDAQ closed lower on Friday of last week, down -317.25 points (-1.62%), and closed out the week at 19,161.63, down -460.05 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 41,993 this morning down -167 points from Friday’s close.

Crude oil closed higher on Friday of last week, and higher week over week.

West Texas Intermediate (WTI) crude closed up 2.38 cents per barrel (3.2%) to close at $76.30 per barrel on Friday of last week, up $2.06 per barrel week over week. Brent traded up 2.53 cents USD per barrel (3.3%) on Friday of last week, to close at $79.45 per barrel, up $2.83 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for February delivery settled Friday on last week at US$12.20 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$60.14 per barrel.

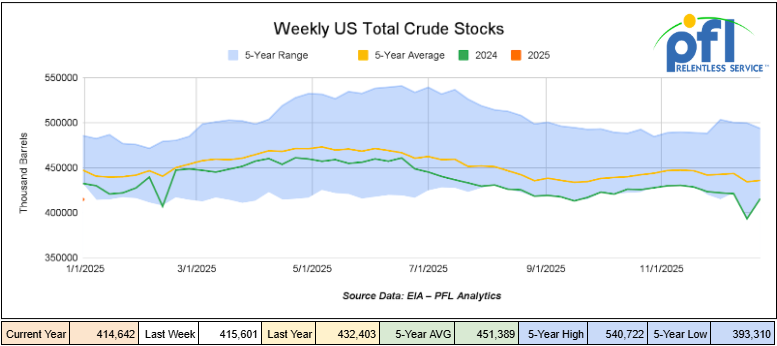

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1 million barrels week-over-week. At 414.6 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

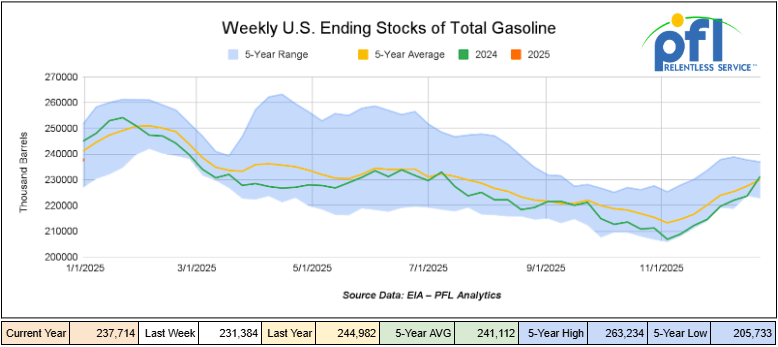

Total motor gasoline inventories increased by 6.3 million barrels week-over-week and are 1% below the five-year average for this time of year.

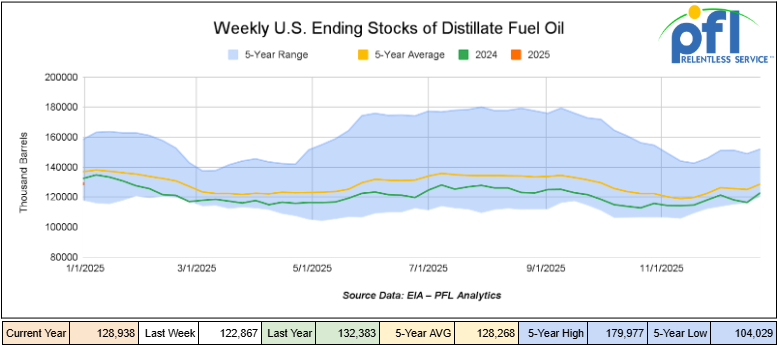

Distillate fuel inventories increased by 6.1 million barrels week-over-week and are 4% below the five-year average for this time of year.

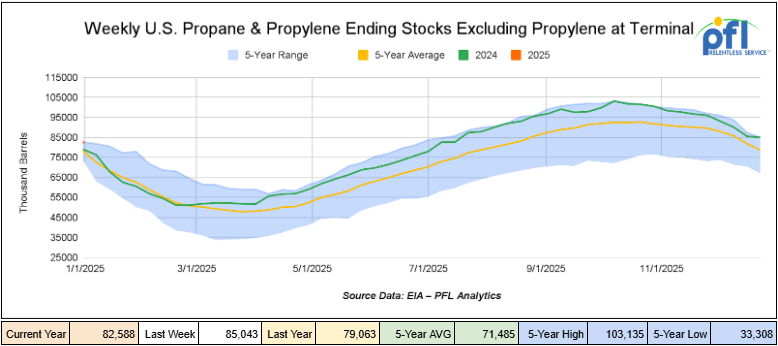

Propane/propylene inventories decreased by 2.5 million barrels week-over-week and are 9% above the five-year average for this time of year.

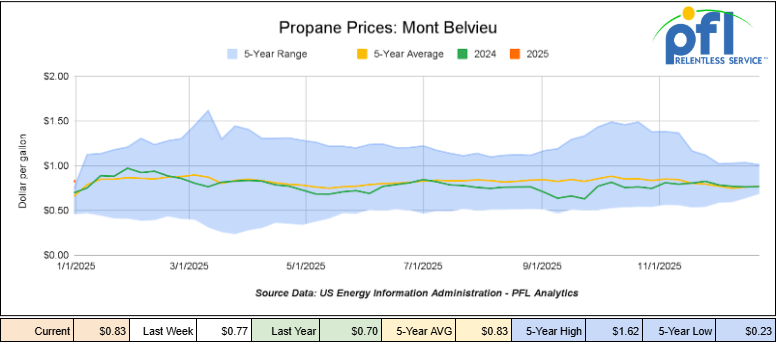

Propane prices closed at 83 cents per gallon on Friday of last week, up 6 cents per gallon week-over-week, and up 13 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 5 million barrels during the week ending January 3rd, 2025.

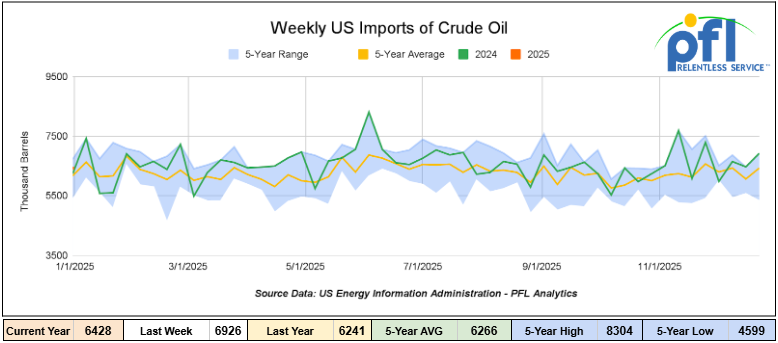

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending January 3rd, 2025, a decrease of 497,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 1.4% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 455,000 barrels per day, and distillate fuel imports averaged 200,000 barrels per day during the week ending January 3rd, 2025.

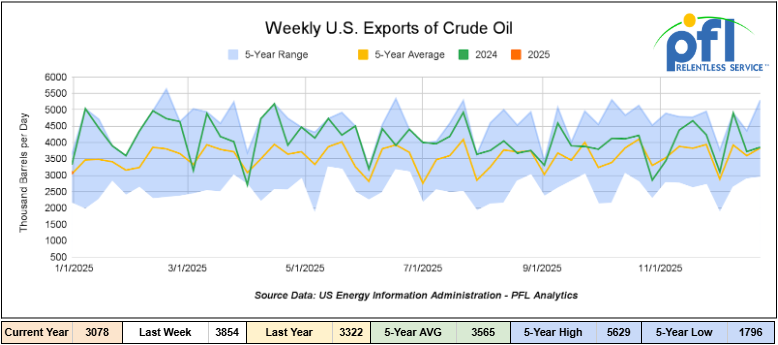

U.S. crude oil exports averaged 3.078 million barrels per day during the week ending January 3rd, 2025, a decrease of 776,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.887 million barrels per day.

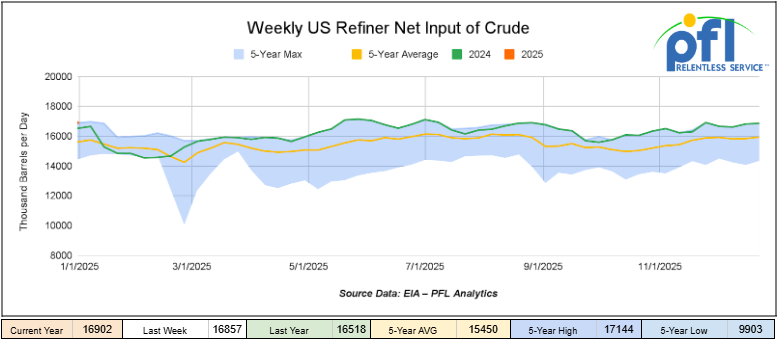

U.S. crude oil refinery inputs averaged 16.9 million barrels per day during the week ending January 3, 2025, which was 44,000 barrels per day more week-over-week.

WTI is poised to open at $77.50, up 93 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending January 8th, 2025.

Total North American weekly rail volumes were up (3.47%) in week 2, compared with the same week last year. Total carloads for the week ending on January 8th were 315,438, down (-1.45%) compared with the same week in 2024, while weekly intermodal volume was 272,556, up (4.98%) compared to the same week in 2024.

6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Metallic Ores and Metals, which was down (-8.53%) while the largest increase came from Chemicals which was up (7.68%).

In the East, CSX’s total volumes were down (-3.24%), with the largest decrease coming from Motor Vehicles and Parts (-22.94%), while the only increase came from Grain (20.47%). NS’s volumes were down (-0.87%), with the largest decrease coming from Motor Vehicles and Parts (-22.14%), while the largest increase came from Coal (9.56%).

In the West, BN’s total volumes were up (3.3%), with the largest decrease coming from Coal, down (-7.23%), while the largest increase came from Chemicals (12.17%). UP’s total rail volumes were up (6.87%) with the largest decrease coming from Coal, down (-14.46%), while the largest increase came from Intermodal Units (17.94%).

In Canada, CN’s total rail volumes were down (-9.22%) with the largest decrease coming from Other, down (-37.31%), while the largest increase came from Nonmetallic Minerals, up (+45.741%). CP’s total rail volumes were down (-13.68%) with the largest increase coming from Motor Vehicles and Parts (+56.75%), while the largest decrease came from Farm Products (-28.86%).

KCS’s total rail volumes were up (23.94%) with the largest decrease coming from Other (-28.28%) and the largest increase coming from Motor Vehicles and Parts (+180.61%).

Source Data: AAR – PFL Analytics

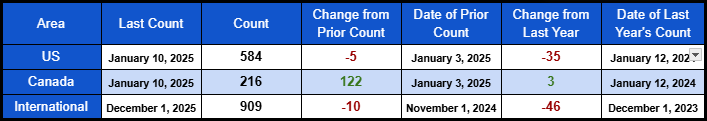

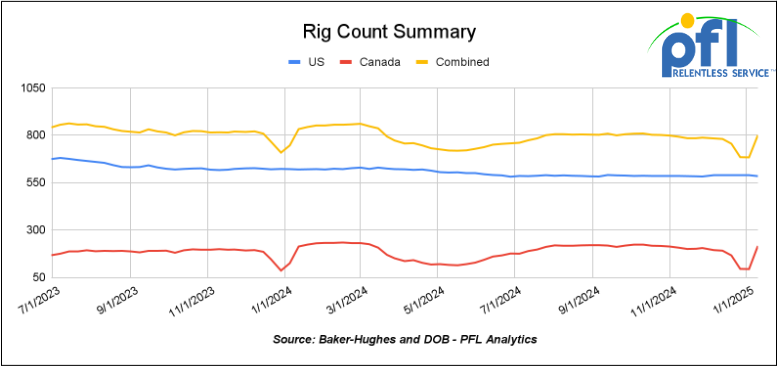

Rig Count

North American rig count was up by 117 rigs week-over-week. U.S. rig count was down -5 rigs week over week and down by -35 rigs year-over-year. The U.S. currently has 584 active rigs. Canada’s rig count was up 122 rigs week over week, and up by 3 rigs year-over-year, and Canada’s overall rig count is 216 active rigs. Overall, year over year we are down by -32 rigs collectively.

International rig count was down by -10 rigs month-over-month and down -46 rigs year-over-year. Internationally there are 909 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching Alberta

Premier Danielle Smith of Alberta, Canada was busy last week, and over the weekend, visiting Trump in Mar-a-Lago:

Source: X – PFL Analytics

As posted on X on Sunday “Over the last 24 hours I had the opportunity to meet President @realdonaldtrump at Mar-a-Lago last night and at his golf club this morning.

We had a friendly and constructive conversation during which I emphasized the mutual importance of the U.S. – Canadian energy relationship, and specifically, how hundreds of thousands of American jobs are supported by energy exports from Alberta.

I was also able to have similar discussions with several key allies of the incoming administration and was encouraged to hear their support for a strong energy and security relationship with Canada.

On behalf of Albertans, I will continue to engage in constructive dialogue and diplomacy with the incoming administration and elected federal and state officials from both parties, and will do all I can to further Alberta’s and Canada’s interests.

The United States and Canada are both proud and independent nations with one of the most important security alliances on earth and the largest economic partnership in history. We need to preserve our independence while we grow this critical partnership for the benefit of Canadians and Americans for generations to come.

In other Alberta news, and in complete defiance of what the Federal Liberal leaderless Canadian Government wants for Canada, the Alberta government signed a letter of intent with Enbridge Inc. to work to increase oil export capacity on its Mainline system into the U.S., Premier Danielle Smith said Monday on of last week. Ironically, the same day Justin Trudeau finally resigned as leader of Canada!

The working group, which also includes the Alberta Petroleum Marketing Commission (APMC), will evaluate future egress, transport, storage, and market access opportunities across the more than 29,000 kilometers of the Enbridge network in support of moving more Alberta oil and gas to Canadian and American partners.

The effort is part of the province’s ambition to double oil and gas production, said Smith.

“We have to have the ability to get to markets to spur growth,” she said, adding a lack of egress “has been one of the major bottlenecks in the past.”

“Our objective of doubling oil production aligns with Enbridge’s plans to enhance its existing pipeline systems and we look forward to partnering with them to enhance cross-border transport solutions.”

The working group will also assess opportunities for leveraging BRIK (Bitumen-Royalty-In-Kind) barrels to encourage pipeline investment. Contracting BRIK barrels will help de-risk projects, hopefully speeding development, Smith said.

“We could use in-kind barrels or act as an aggregator for smaller producers to send a message to the market that this is a pipeline that is going ahead without putting up any taxpayer dollars,” she said.

“We’re not looking for dollars and cents from government,” said Enbridge president and chief executive officer Greg Ebel.

Enbridge has identified numerous opportunities to increase egress out of Western Canada, Ebel said.

“We have several hundred thousand barrels per day of projects,” he said, adding they were all smaller brownfield projects “that we can ramp up as producers need them.”

“We can deliver incremental capacity in a phased manner. Pipes in ground are less impactful relative to greenfield expansion.” We will be watching this one folks, stay tuned to PFL.

Meanwhile, also in Canada Last Week – Conservative Party Leader Pierre Poilievre (most likely Canada’s next Prime Minister) held his first press conference since the resignation of Liberal Prime Minister Justin Trudeau early last week.

He said he would address the threat of tariffs from incoming U.S. president Donald Trump on Canadian energy by appealing to American businesses and unions about the costs they would incur, or by building Canadian energy infrastructure to “sell our energy to the world without going through the Americans.” (We don’t think he meant the latter, it would be impossible to rebuild the already existing infrastructure).

He also addressed the need to “go to the American tech companies, and say, ‘You could have access to our unmatched, totally reliable and clean electricity sources for your data centers.’”

This meant the possibility of turning to nuclear energy from Canada, a reliable ally, he added.

“We can do it for them here in Canada. Cold, dry climate, lots of energy, low cost, totally reliable, 100% ally, right next door. We can provide that to America.”

Poilievre condemned the U.S. need for Venezuelan oil, “instead of good, clean Canadian oil.”

“The Americans, our friends, want Canadian oil, not Venezuelan, not Iranian, and not other dirty-dictator oil from around the world,” Poilievre said.

We Are watching our Ports – East Coast Strikes Averted

The International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX) announced last week they’ve reached a tentative agreement on all items for a new six-year master contract.

The two sides agreed to continue to operate under the current contract until the union can meet with its full Wage Scale Committee and schedule a ratification vote, and USMX members can ratify the terms of the final contract, according to a joint statement issued by both organizations.

The tentative agreement puts an end to the ILA’s threat to stage a work stoppage at East and Gulf Coast ports as soon as January 15.

“We are pleased to announce that ILA and USMX have reached a tentative agreement on a new six-year ILA-USMX master contract, subject to ratification, thus averting any work stoppage on January 15th,” the two sides said in the joint statement. “This agreement protects current ILA jobs and establishes a framework for implementing technologies that will create more jobs while modernizing East and Gulf coasts ports — making them safer and more efficient and creating the capacity they need to keep our supply chains strong.”

Details of the new tentative agreement will not be released to allow ILA rank-and-file-members and USMX members to review and approve the final document, according to the joint statement.

On October 3, 2024, the parties announced they had reached a tentative agreement on wages and would extend the master contract until January 15, 2025, to return to the bargaining table to negotiate all other outstanding issues. That agreement followed the ILA’s three-day work stoppage at the ports.

The most recent 6-year agreement covering ILA port workers employed in container and roll-on/roll-off operations at ports on the U.S. East and Gulf Coasts ran from October 1, 2018, through September 30, 2024.

We are Watching the Green New Deal

Handouts and the loan guarantees for the Green New Deal never seem to stop. Just as L.A. was burning down and people’s homes were being destroyed, not to mention the human suffering, more funding was announced last week. Hydrostor, a developer of long-duration energy storage systems, said last week it has received a conditional commitment for a loan guarantee of up to $1.76 billion from the U.S. Department of Energy (DOE) for its 500 MW Willow Rock Energy Storage Center in Rosamond, California.

The facility it intends to build will use advanced compressed air energy storage (A-CAES) technology to provide over eight hours of backup power to California’s electric grid, Hydrostor said.

Hydrostor’s A-CAES technology works by using surplus electricity to compress air and store it in underground caverns during periods of low demand. When demand is high, the compressed air is released and pushed through a turbine to generate electricity.

The project is currently undergoing a permitting review with the California Energy Commission, with construction expected to begin in 2025 and commissioning planned for 2030.

As the state transitions to a carbon-neutral grid under SB 100, which mandates 100% of electricity from renewable and zero-carbon sources by 2045, the electrification of transportation and buildings is expected to dramatically increase electricity demand.

We will continue to keep California in our thoughts and prayers as they continue to battle the fires and aftermath.

We are Key Economic Indicators

Unemployment Rate

Total nonfarm payroll employment increased by 256,000 in December, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported. Employment trended up in health care, government, and social assistance. Retail trade added jobs in December, following a job loss in November.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. up to 5 Years; Mid 2029 Return

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website