The latest and greatest on Coronavirus

Health officials in China have published the first details on nearly 45,000 cases of the coronavirus that originated there, saying more than 80% have been mild cases and new ones seem to be falling since early this month, although it’s far too soon to tell whether the outbreak has peaked.

Yesterday’s report from the Chinese Center for Disease Control and Prevention gives the World Health Organization a “clearer picture of the outbreak, how it’s developing and where it’s headed,” WHO’s director-general said at a news conference.

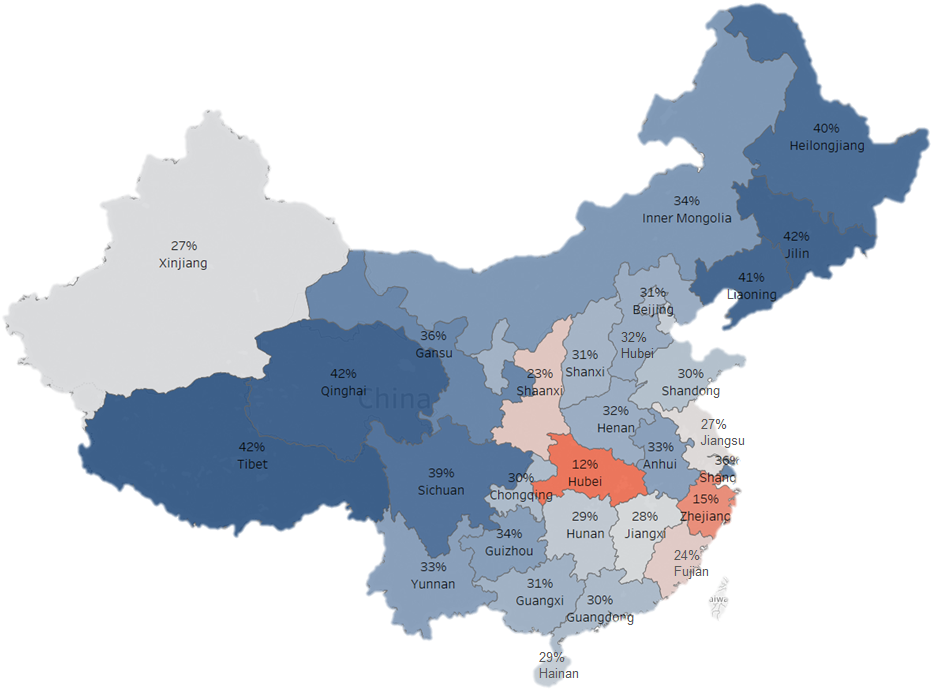

China Return to Work Levels by Province- Source: Cleveland Research

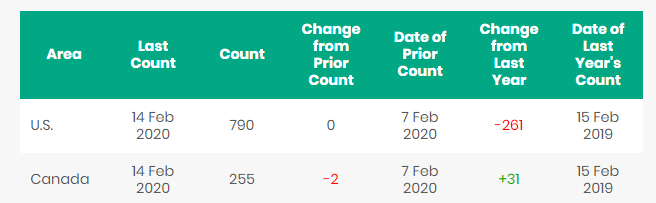

Total North American Rail Volumes

Total North American rail volumes were down 3.8% year over year in week 6 (U.S. -6.6%, Canada +3.5%, Mexico +9.9%), resulting in quarter to date volumes that are down 3.9% (U.S. -5.8%, Canada -0.7%, Mexico +12.0%). 5 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-6.3%), coal (-15.9%) and nonmetallic minerals (-4.2%). The largest increases came from petroleum (+26.6%), farm products & food (+10.1%) and metallic ores & metals (+2.8%).

In the East

CSX’s total volumes were down 4.0%, with the largest decreases coming from coal (-21.3%) and nonmetallic minerals (-31.1%). NS’s total volumes were down 11.5%, with the largest decreases coming from intermodal (-12.8%) and coal (-26.4%).

In the West

BN’s total volumes were down 2.0%, with the largest decreases coming from intermodal (-6.2%) and stone sand & gravel (-36.9%). The largest increases came from grain (+10.4%) and chemicals (+11.7%). UP’s total volumes were down 7.8%, with the largest decreases coming from intermodal (-14.9%) and coal (-27.3%). The largest increase came from petroleum (+48.3%).

In Canada

CN’s total volumes were up 2.1% with the largest increases coming from petroleum (+52.9%) and metallic ores (+10.9%). RTMs were up 9.2%. CP’s total volumes were up 7.5%, with the largest increase coming from petroleum (+87.6%). The largest decrease came from coal (-27.7%). RTMs were up 10.6%.

CN is effectively shut down

Folk’s the biggest story of last week is what is going on in Canada. CN is on their knees begging Ottawa and the Justin Trudeau government to do something quickly. CN is effectively shut down because protesters are putting themselves in harm’s by blocking the railroad over an approved pipeline project. Why pick on the railroad – why not protest at JC Penny? It makes no sense!

The Blockades on CN began on February 6

The blockades on CN began on February 6 in response to the government’s approved plan to build a $5 billion Coastal GasLink natural gas pipeline that crosses the traditional territory of the Wet’suwet’en First Nation near Houston, British Columbia. The protests at railway came in response to the Royal Canadian Mounted Police (RCMP) raiding camps set up by the Wet’suwet’en Nation at the pipeline construction site. Dozens were arrested in that raid.

CN announced Thursday of last week a progressive and orderly shutdown of its lines in eastern Canada. This came after authorities failed to enforce court orders to end “illegal” blockades across Ontario, Manitoba, and British Columbia.

CN said – “This situation is regrettable for its impact on the economy and on our railroaders as these protests are unrelated to CN’s activities, and beyond our control.”

Passenger Trains were Also Affected

VIA Rail, the passenger train service that relies on CN’s infrastructure, subsequently suspended service on 150 trains that traveled between Toronto, Ottawa and Montreal, the Globe and Mail reported. About 250,000 passengers had already faced cancellations after a massive demonstration blocked VIA Rail’s major line in the Montreal-Toronto-Ottawa triangle, the Wall Street Journal reported.

“In addition to preventing access to public transportation for tens of thousands of individual Canadians, these disruptions severely limit the movement of perishable foods and other consumer items such as grain, construction materials and propane for Quebec, Atlantic Canada, and the U.S. N.E.” President and CEO of the Canadian Chamber of Commerce Hon. Perrin Beatty wrote in the letter last Wednesday addressed to the country’s ministers of transport and innovation, science and industry.

“A rail disruption of this magnitude constitutes an emergency for the Canadian economy,” it said.

The impact to rail traffic is going to be huge in the days to come and the impact on the Canadian economy is going hit hard. This situation needs to get resolved quickly and has already gone on for far too long.

Kansas City Southern

KCS’s total volumes were up 5.9%, with the largest increases coming from intermodal (+17.0%) and petroleum (+28.3%). The largest decrease came from coal (-27.4%).

North American Rig Count

North American Rig count is down 2 rigs week over week with the U.S. flat and Canada losing 2 rigs week over week. Year over year we are down 230 Rigs collectively.

North American Rig Count Summary

Hot Markets

PFL is offering:

- 340Ws for long and short term lease,

- 117Rs last in diesel service, various box cars for lease,

- 31.8’s clean and last in refined products

- 25.5K 117Js.

PFL is seeking:

- 23.5Ks and 25.5Ks for fuel oil products

- 117s with magnetic gauging devices for lease

- 89 ft flat cars for purchase

- 100 mil gondolas for short term lease

- 117Js last in ethanol

- 4750s for use in coke service.

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|