The post Petroleum Daily Report 3-5-2026 appeared first on PFL Petroleum Services LTD.

]]>The rally comes as shipping through the Strait of Hormuz has effectively stalled, raising concerns that prolonged disruptions could force producers across the region to cut output. Roughly one-fifth of global oil supply normally passes through the chokepoint.

Analysts warn the impact could grow if the closure persists. JPMorgan estimates crude exports from Iraq and Kuwait could begin shutting within days, potentially removing 3.3 million barrels per day from global supply by the eighth day of the conflict. Iraq has already reduced output by nearly 1.5 million bpd due to limited storage and blocked export routes.

Energy infrastructure across the region is also facing mounting pressure. Qatar declared force majeure on LNG exports, with sources indicating normal production may take at least a month to restore.

Meanwhile, tanker attacks continued in the Gulf. The Bahamas-flagged crude tanker Sonangol Namibe reported hull damage following an explosion near Iraq’s Khor al Zubair port. Vessel traffic in and out of the Strait of Hormuz has nearly halted, leaving roughly 300 tankers stranded inside the passage, according to ship-tracking data.

Tightening supply expectations have also pushed refined product prices higher. U.S. diesel futures jumped about 10% during the session, briefly rising above $3.60 per gallon, as traders priced in the loss of Middle Eastern exports and refinery shutdowns in parts of the region, China, and India.

With the conflict continuing to widen and energy shipments constrained, analysts expect crude markets to remain highly sensitive to developments surrounding the Strait of Hormuz and regional production levels.

On Mobile? Click here to download the PDF

The post Petroleum Daily Report 3-4-2026 appeared first on PFL Petroleum Services LTD.

]]>Brent crude settled at $81.40 per barrel, unchanged from Tuesday and its highest close since January 2025. U.S. West Texas Intermediate rose 10 cents, or 0.1%, to settle at $74.66, marking its highest finish since June for a second straight session.

Earlier in the day, Brent climbed more than $3 to an intraday peak of $84.48 before paring gains after reports that Iranian intelligence officials had signaled openness to talks with U.S. counterparts about ending the conflict.

Despite the flat close, prices remain elevated as traders assess the risk of a prolonged war and continued supply disruption. The Strait of Hormuz — which handles roughly one-fifth of global oil flows — has been effectively shut for five days, severely constraining shipping. The region accounts for just under one-third of global oil production.

Iraq, OPEC’s second-largest producer, has cut nearly 1.5 million barrels per day due to storage constraints and blocked export routes. Officials warned output could be reduced by as much as 3 million bpd within days if exports do not resume.

U.S. President Donald Trump said the Navy could begin escorting oil tankers through the strait if needed and ordered political risk insurance and financial guarantees for Gulf maritime trade. The Pentagon and Energy Department are also drafting plans to secure tanker passage.

Meanwhile, some countries and refiners are seeking alternative supplies. India and Indonesia are looking for replacement cargoes, while certain Chinese refineries are shutting units or advancing maintenance schedules.

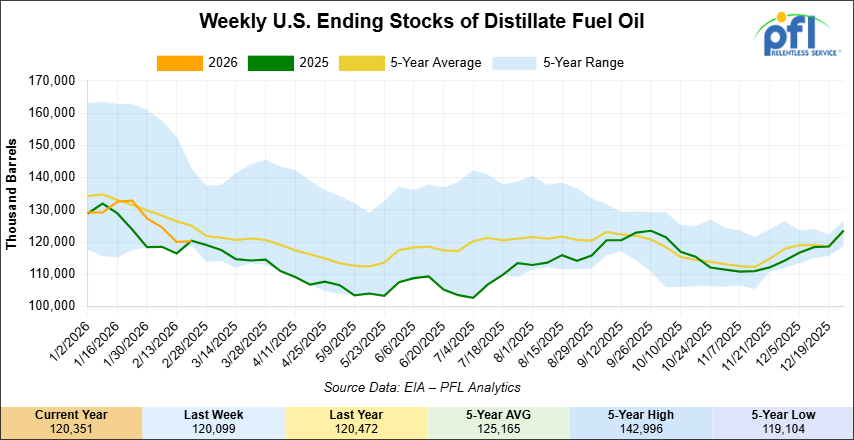

On the data front, U.S. crude inventories rose by 3.5 million barrels last week to their highest level in three-and-a-half years, exceeding expectations for a 2.3 million-barrel build. Gasoline stocks fell by 1.7 million barrels, while distillate inventories increased by 429,000 barrels.

Although global crude supply remains ample, including near-record volumes held in floating storage, traders expect continued volatility until energy shipments can move freely and geopolitical risk subsides.

On Mobile? Click here to download the PDF

The post Petroleum Daily Report 3-3-2026 appeared first on PFL Petroleum Services LTD.

]]>During the session, Brent touched an intraday high of $85.12, the strongest level since July 2024, before trimming gains after President Donald Trump said many Iranian naval and air assets had been destroyed and suggested Tehran’s capacity to sustain attacks would weaken.

The conflict widened on Tuesday as Israeli and U.S. forces struck targets across Iran, prompting Iranian retaliation around the Gulf and in Lebanon. Iraq — OPEC’s second-largest producer behind Saudi Arabia — cut output by nearly 1.5 million barrels per day, with reductions potentially doubling as storage fills due to export disruptions.

Iran has targeted regional energy infrastructure and vessels in the Strait of Hormuz, the chokepoint that handles about one-fifth of global oil and LNG trade. Tankers are avoiding the passage after insurers withdrew coverage, sending global shipping rates sharply higher. Iranian media reported that Tehran would fire on ships attempting to transit the strait, further unnerving markets.

Energy disruptions are spreading. Qatar has halted LNG production, Israel has shut some offshore gas fields, and Saudi Arabia closed its largest refinery. Saudi Aramco is attempting to reroute crude exports via the Red Sea to bypass Hormuz, according to sources.

Refined products rallied sharply. U.S. diesel futures jumped about 10% to their highest since October 2023, while gasoline futures climbed nearly 4% to $2.46 per gallon, the strongest since July 2024. Refining crack spreads surged to their highest levels since 2023.

Global natural gas markets also spiked, with benchmark Dutch, British, European and Asian LNG prices all rising strongly.

The Brent premium over WTI widened to nearly $8 per barrel — the largest gap since November 2022 — a level analysts say supports U.S. crude exports when it exceeds $4.

Traders are also watching U.S. inventory data. The American Petroleum Institute was due to release figures Tuesday, followed by the Energy Information Administration on Wednesday. Analysts expect a 2.3-million-barrel build in U.S. crude stocks for the week ended February 27.

With supply outages mounting and shipping constrained, markets remain highly sensitive to headlines as the conflict threatens deeper and more prolonged disruption to global energy flows.

On Mobile? Click here to download the PDF

The post Petroleum Daily Report 3-2-2026 appeared first on PFL Petroleum Services LTD.

]]>U.S. crude settled up $4.21, or 6.28%, at $71.23 a barrel. Brent crude finished at $77.74 per barrel, gaining $4.87, or 6.68%.

Qatar halted liquefied natural gas production on Monday after Iranian drone strikes hit facilities at the Ras Laffan industrial complex, escalating energy supply risks across the Gulf. Qatar accounts for roughly 20% of global LNG supply, and state-owned QatarEnergy was preparing to declare force majeure on shipments.

The widening U.S.–Israeli conflict with Iran triggered precautionary shutdowns across the region. Saudi Aramco suspended operations at its 550,000 barrels-per-day Ras Tanura refinery after drones were intercepted nearby, though officials said domestic fuel supplies were unaffected. In Iraqi Kurdistan, producers halted about 200,000 bpd of output exported via Turkey as a precaution. Offshore Israel, Chevron temporarily shut the Leviathan gas field, while Energean suspended output at smaller fields.

Oil prices jumped as much as 13% intraday to above $82 per barrel — the highest since January 2025 — amid near paralysis of shipping through the Strait of Hormuz, which handles roughly one-fifth of global oil supply. European gas prices surged 46% at the Dutch TTF hub.

Explosions were also reported at Iran’s Kharg Island export terminal, which processes about 90% of the country’s crude exports, though the extent of damage remains unclear. Iran produces roughly 3.3 million barrels per day of crude plus 1.3 million bpd of condensate, accounting for about 4.5% of global supply.

With multiple supply hubs under threat, markets are bracing for further volatility as the conflict deepens and energy infrastructure increasingly becomes a direct target.

On Mobile? Click here to download the PDF

The post RIN Recap 3-2-2026 appeared first on PFL Petroleum Services LTD.

]]>On Mobile? Click here to download the PDF

The post PFL Railcar Report 3-2-2026 appeared first on PFL Petroleum Services LTD.

]]>Jobs Update

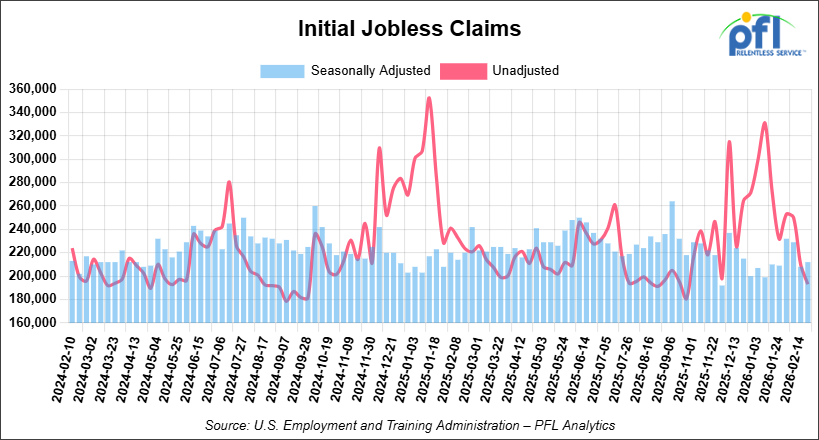

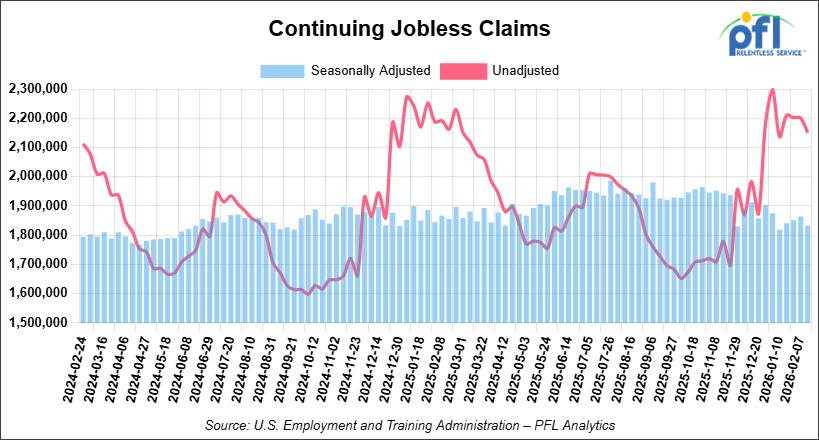

- Initial jobless claims seasonally adjusted for the week ending February 21, 2026 came in at 212,000, versus the adjusted number of 208,000 people from the week prior, up 4,000 people week over week.

- Continuing jobless claims came in at 1,833,000, versus the adjusted number of 1,864,000 people from the week prior, down 31,000 week-over-week.

Stocks closed lower on Friday of last week and lower week-over-week

The DOW closed lower on Friday of last week, down -521.28 points (-1.05%), closing out the week at 48,997.92, down -628.05 points week-over-week. The S&P 500 closed lower on Friday of last week, down -29.98 points (-0.43%), and closed out the week at 6,878.88, down -30.63 points week-over-week. The NASDAQ closed lower on Friday of last week, down -210.17 points (-0.92%), and closed out the week at 22,668.21, down -217.86 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 48,487 this morning, down 503 points from Friday’s close.

Crude oil closed higher on Friday of last week and higher week-over-week

West Texas Intermediate (WTI) crude closed up $1.81 per barrel (2.78%), to close at $67.02 on Friday of last week, and up $0.63 week-over-week. Brent crude closed up $1.73 per barrel (2.45%), to close at $72.48, and up $0.72 week-over-week.

One Exchange WCS (Western Canadian Select) for April delivery settled on Friday of last week at US$13.95 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$53.07 per barrel.

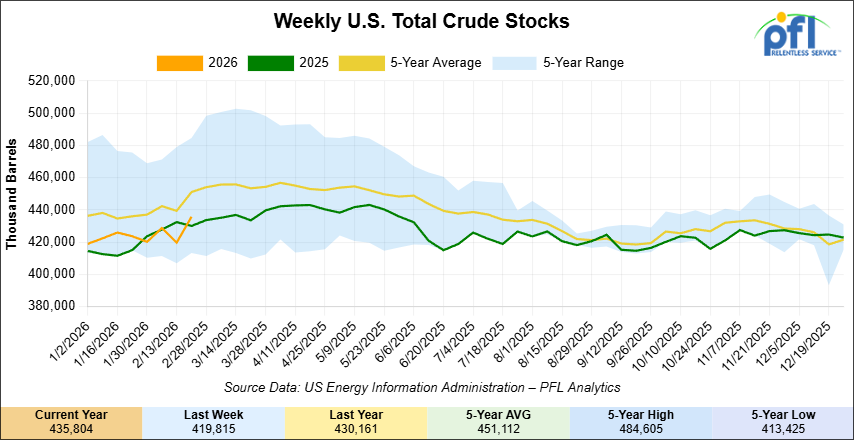

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 16 million barrels week-over-week. At 435.8 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

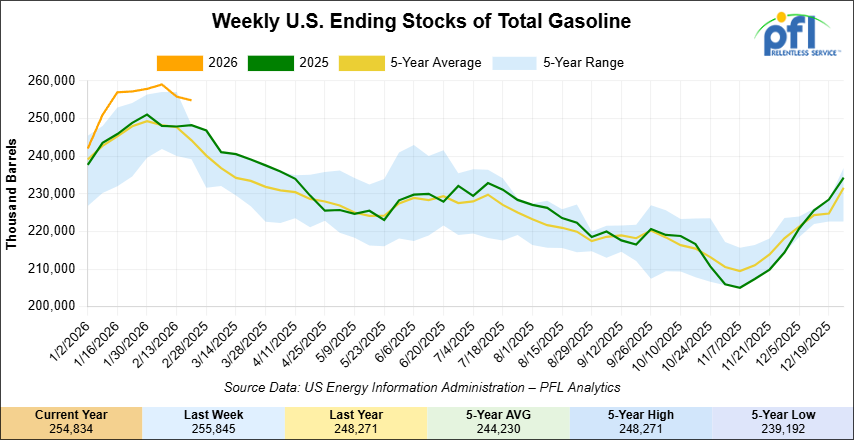

Total motor gasoline inventories decreased by 1 million barrels week-over-week and are 3% above the five-year average for this time of year.

Distillate fuel inventories increased by 300,000 barrels week-over-week and are 5% below the five-year average for this time of year.

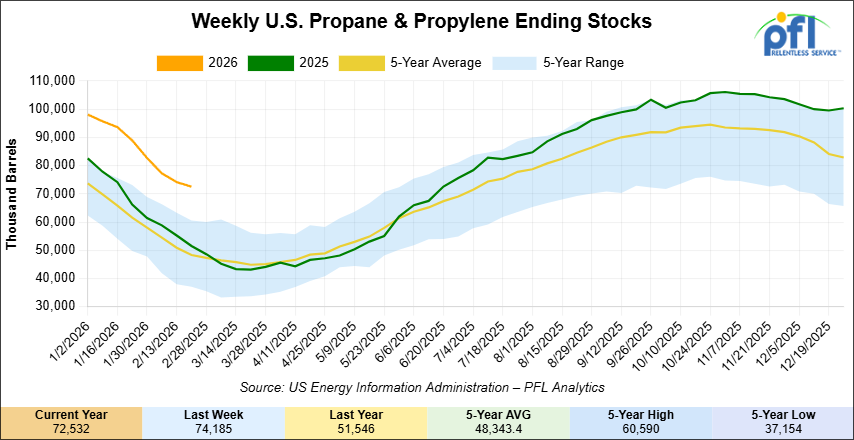

Propane/propylene inventories decreased by 1.7 million barrels week-over-week and are 46% above the five-year average for this time of year

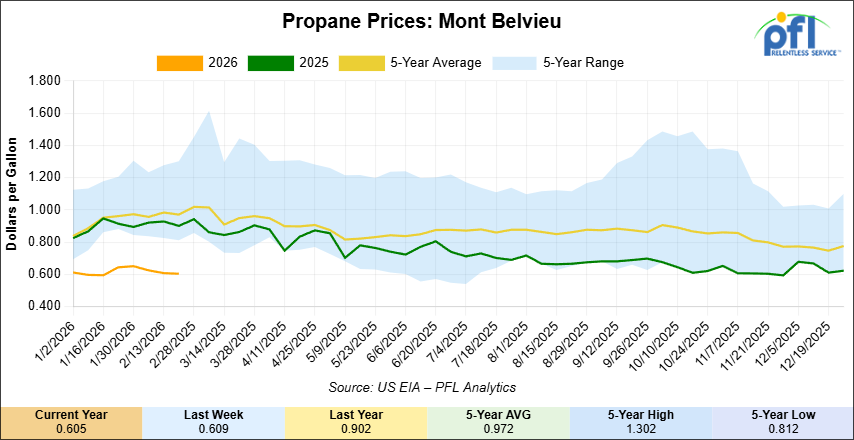

Propane prices closed at 60.5 cents per gallon on Friday of last week, down 0.4 cents per gallon week-over-week, and down 29.7 cents year-over-year.

Overall, total commercial petroleum inventories increased by 11.2 million barrels week-over-week, during the week ending February 20, 2026.

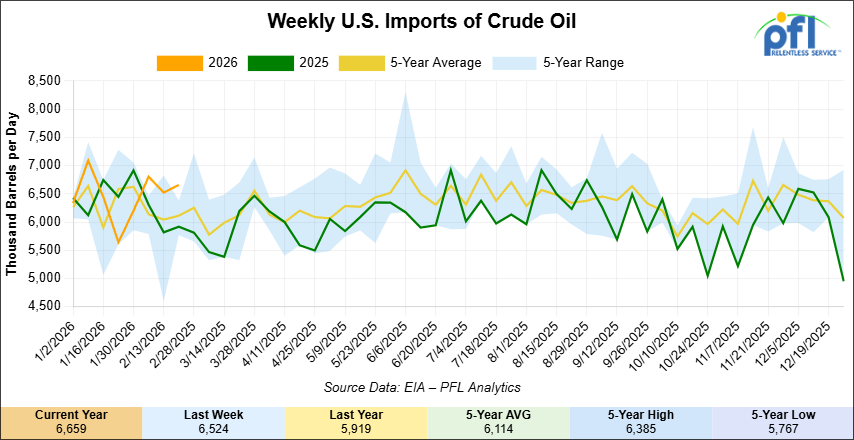

U.S. crude oil imports averaged 6.7 million barrels per day last week, an increase of 136,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 4.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 563,000 barrels per day, and distillate fuel imports averaged 411,000 barrels per day during the week ending February 13, 2026.

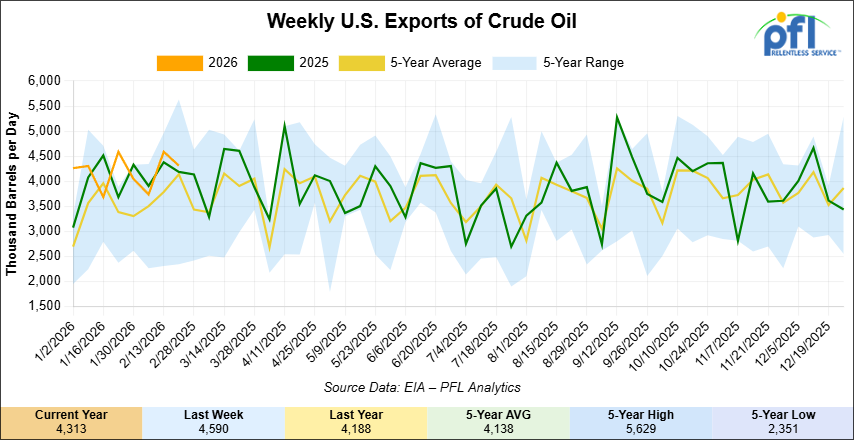

U.S. crude oil exports averaged 4.313 million barrels per day during the week ending February 20, 2026, a decrease of 277,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.172 million barrels per day.

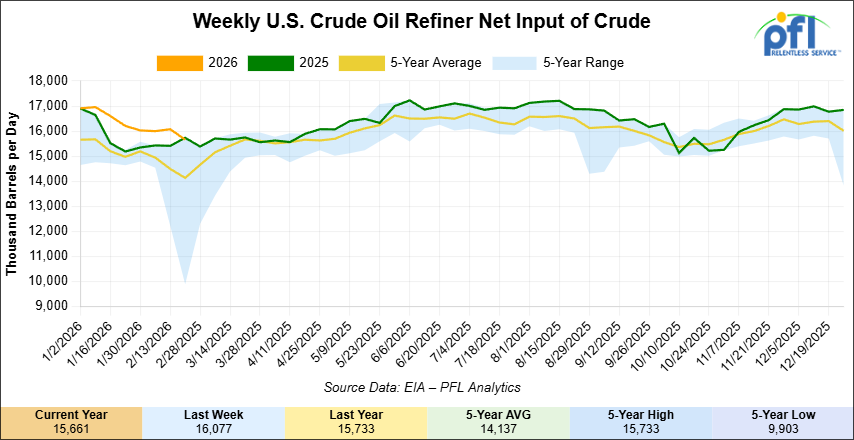

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending February 20, 2026, which was 416,000 barrels per day less week-over-week.

WTI is poised to open at $71.88, up $4.86 per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 25, 2025:

Total North American weekly rail volumes were up (+7.88%) in week 9, compared with the same week last year. Total Carloads for the week ending February 25, 2025 were 329,929, up (+13.32%) compared with the same week in 2025, while weekly Intermodal volume was 339,155, up (+3.07%) year over year. 10 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest decrease came from Forest Products (-15.82%). The largest increase was Grain (+43.90%).

In the East, CSX’s total volumes were up (+11.86%), with the largest decrease coming from Forest Products (-5.80%), while the largest increase came from Grain (+44.65%). NS’s total volumes were up (+6.28%), with the largest increase coming from Coal (+44.67%), while the largest decrease came from Other (-4.88%).

In the West, BNSF’s total volumes were up (+12.76%), with the largest increase coming from Grain (+76.15%), while the largest decrease came from Chemicals (-3.01%). UP’s total volumes were up (+5.48%), with the largest increase coming from Grain (+43.54%), while the largest decrease came from Intermodal Units (-3.18%).

In Canada, CN’s total volumes were up (+18.18%), with the largest increase coming from Grain (+80.56%), while the largest decrease came from Forest Products (-6.11%). CPKCS’s total volumes were down (-20.51%), with the largest increase coming from Nonmetallic Minerals (+36.19%), while the largest decrease came from Forest Products (-68.06%).

Source Data: AAR – PFL Analytics

North American Rig Count Summary

Rig Count

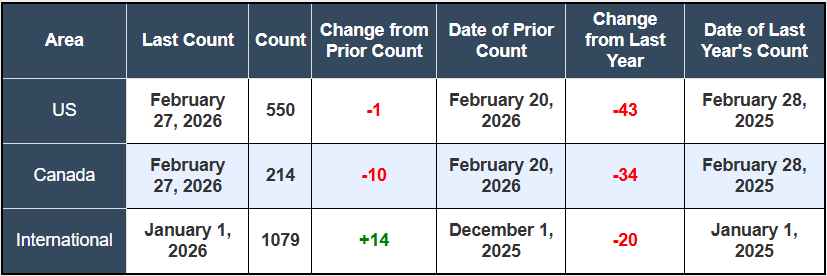

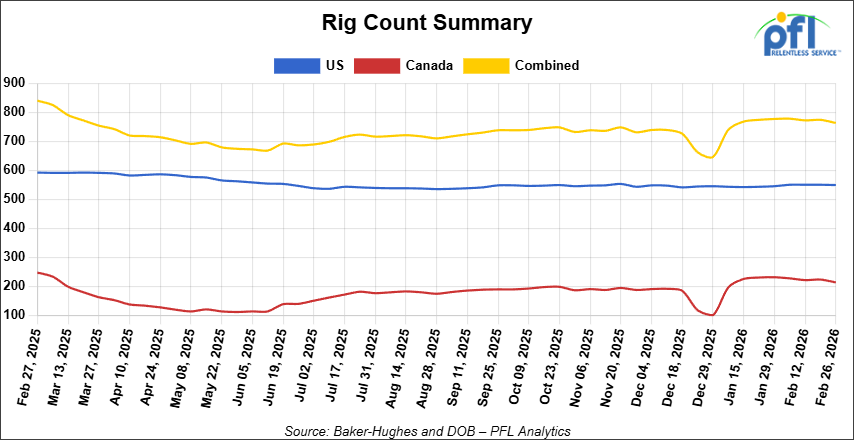

North American rig count was down by -11 rigs week-over-week. The U.S. rig count was down by -1 rig week-over-week, and down by -43 rigs year-over-year. The U.S. currently has 550 active rigs. Canada’s rig count was down by -10 rigs week-over-week and down by -34 rigs year-over-year. Canada currently has 214 active rigs. Overall, year-over-year we are down by -77 rigs collectively.

We are watching a few things out there for you:

We are Watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,874 from 29,673 which was an increase of +201 rail cars week-over-week. Canadian volumes fell. CN’s shipments were lower by -2.0% week-over-week, CPKC’s volumes were lower by -11.0% week-over-week. U.S. shipments were mixed. The UP had the largest percentage increase and was up by +4.0%. The BN had the largest percentage decrease and was down by -5.0%.

We are Watching the Middle East

Early Saturday morning, the United States and Israel launched what President Trump called “major combat operations” against Iran, under the name Operation Epic Fury. Strikes have been reported across multiple Iranian cities including Tehran, Isfahan, Qom, Tabriz, and Bushehr, targeting military infrastructure, nuclear facilities, and senior leadership. Iran responded quickly, launching ballistic missiles and drones against U.S. military bases in Bahrain, Qatar, and the UAE. The UN Security Council convened an emergency session Saturday. As of this writing, the conflict is live and its scope and duration remain unknown. New leadership has emerged in Iran and vows to strike back, shutting down an oil refinery in Saudi Arabia and civilian targets across gulf state countries.

The crude market was moving before the bombs fell. Three rounds of nuclear talks in Geneva broke down last week over Iran’s refusal to remove its enriched uranium stockpile from the country. WTI settled Friday at $67.02/bbl, its highest close since August, while Brent closed at $72.87/bbl. Both benchmarks had already gained 6-8% over the prior two weeks as U.S. military assets concentrated in the region. Oil is already up 5% in premarket trading. Worth noting: a 16 million barrel build in U.S. commercial crude inventories last week would normally be a bearish fundamental that geopolitics is currently steamrolling

Roughly one-quarter of the world’s seaborne oil trade passes through the Strait of Hormuz daily. Iran has the capability to create serious disruption through tanker harassment, mining, and anti-ship missiles even without a full closure. UBS has publicly flagged a spike to $100/bbl as plausible in a sustained escalation scenario. Some Gulf producers, notably Abu Dhabi, are already ramping crude exports to cushion supply concerns, though that covers a fraction of the exposure.

For our readers, this changes the framework immediately. Prior to Saturday, the narrative was oversupplied markets, soft WCS differentials, and marginal CBR economics. A sustained WTI move above $70-75/bbl reshapes that calculus fast. Higher flat price improves crude-by-rail margins, and any tightening of global heavy sour supply improves the competitive position of Canadian WCS with U.S. Gulf Coast refiners. The Monday morning NYMEX open is the first real read on how the market is pricing this.

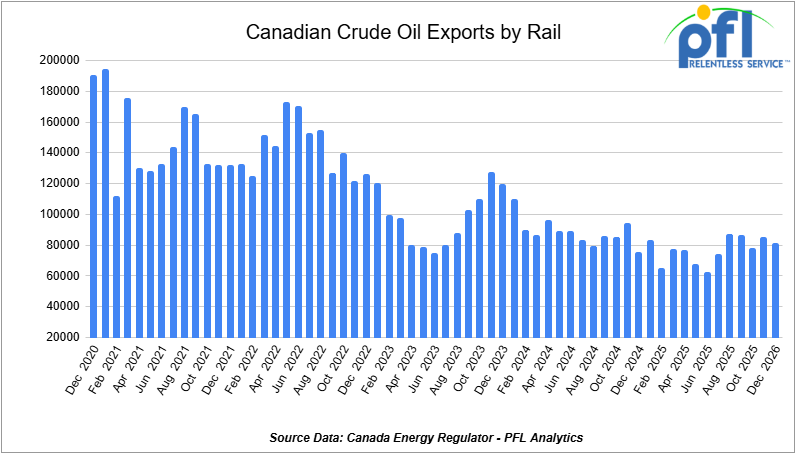

We are Watching Canadian Crude Oil Exports by Rail

The Canadian Energy regulator reported on February 24, 2026, that 81,189 barrels were exported during the month of December 2025 down from 85,055 barrels in November of 2025, a decrease of 3,866 barrels per day month-over-month.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines. Raw bitumen, which is shipped as a non-haz product and is not able to flow in pipelines, is competitive with pipeline tolls and is a growing market to keep an eye on, particularly in light of Strathcona and Gibson announcing new projects. Other factors would be existing long-term contractual commitments and basis – we really need to see the basis WTI-CMA (West Texas Intermediate – Calendar Month Average) blowout to -18 per barrel for sustained periods of time to make economic sense. Current rail rates from Alberta to the U.S. Gulf Coast have averaged $15.36 per barrel, making rail competitive whenever WCS-WTI spreads exceed $18 per barrel, including quality adjustments.

We are Watching Canadian Crude Economics

An important dynamic surfaced on Par Pacific’s fourth quarter earnings call last week. The company’s CEO described Par Pacific as an “indirect beneficiary” of Venezuelan crude returning to the Gulf Coast market. More Venezuelan heavy sour barrels at the Gulf Coast push Canadian barrels back into the midcontinent, where Par Pacific can process 40,000 to 50,000 b/d of Western Canadian Select across its Rocky Mountains and Washington refineries. The company quantified it directly: for every $1/bbl improvement in WCS differentials, Par Pacific estimates a $15-16 million annual benefit.

The Iran situation changes this math immediately if WTI moves higher, as the rail rate is largely fixed while WCS differentials and WTI flat price can reprice overnight.

Pembina Pipeline sanctioned its Taylor-to-Gordondale condensate expansion last week at C$115 million, targeting a Q1 2027 in-service date. Its Birch-to-Taylor expansion adds another C$310 million for 120,000 b/d of propane-plus and condensate capacity in northeast BC, coming online Q4 2027. The condensate story and the crude egress story are two sides of the same coin: Alberta production is growing, and the infrastructure supporting it is still playing catch-up.

We are Still Watching Line 5

Folks, we have been watching this one forever. The Governor of Michigan Gretchen Whitmer still wants this pipeline shut down for whatever reason and the battle continues. On Tuesday, the U.S. Supreme Court heard oral arguments in Enbridge Energy LP v. Nessel, the years-long battle over whether Michigan Attorney General Dana Nessel’s lawsuit to decommission Line 5 should be heard in state or federal court. The pipeline carries 540,000 barrels per day of light crude and natural gas liquids through the Straits of Mackinac, serving refineries in Michigan, Ohio, Pennsylvania, Ontario, and Quebec.

The question before the court is technically narrow but strategically enormous. Enbridge missed the mandatory 30-day deadline to remove Nessel’s 2019 state court lawsuit to federal court by over two years. Enbridge argues the deadline should be flexible given the international treaty implications of a cross-border pipeline. Michigan’s solicitor general called that position an “atextual escape hatch.” The distinction matters because a federal court has already ruled in a separate proceeding that federal pipeline safety law pre-empts Michigan’s authority to order a shutdown, while a state court applying Michigan’s public trust doctrine would be far more sympathetic to Nessel’s closure case. A ruling is expected before June.

If Line 5 is ultimately forced into prolonged uncertainty or shutdown proceedings, crude-by-rail out of Alberta becomes materially more attractive overnight (problem is there is not enough rail cars to even put a dent in that type of volume). Loss of that 540,000 b/d artery forces barrels onto the rail network. Enbridge’s proposed tunnel replacement has Army Corps permitting expected in coming weeks and faces a Michigan Supreme Court challenge scheduled for March 11th. This situation has multiple fronts and none of them are near resolution.

We are Watching a New Pipeline Proposal

Privately held Bridger Pipeline has filed applications with Montana regulators and the U.S. Bureau of Land Management for a 645-mile, 550,000 b/d pipeline running from the U.S.-Canada border in Phillips County, Montana to Guernsey, Wyoming. The details should look familiar: the border entry point is the same one designated for the cancelled Keystone XL line, it uses the same 36-inch pipe diameter, and Bridger says it would leverage existing infrastructure on the Canadian side. Construction could begin as early as July 2027, with an in-service target of mid-2030, assuming a presidential permit clears.

Keystone XL owner South Bow says it is evaluating an expansion that could link Canadian volumes to the Bridger line at Guernsey, though it offered no details ahead of its March 6 quarterly results. From Guernsey, multiple routing options reach downstream markets including a looped Pony Express pipeline to Cushing, or a revival of the shelved Liberty Pipeline route where Bridger and Tallgrass still hold right-of-way. Tallgrass is simultaneously running an open season for Bakken-to-Cushing capacity on the Pony Express, which typically runs near capacity.

The urgency is real. South Bow projects that Western Canadian Sedimentary Basin production will exceed pipeline takeaway capacity by mid-2027. Enbridge is planning a two-phase Mainline expansion adding 400,000 b/d. Trans Mountain is weighing 90,000 b/d of additional capacity through drag reducing agents by January 2027 with a further 210,000 b/d expansion possible by 2029-30. Until any of these pipes are in the ground, crude-by-rail remains the pressure valve for Alberta producers running into the capacity wall.

We are Watching Rail Terminal Consolidation

Canadian rail terminal operator Cando Rail & Terminal announced last week it is acquiring the rail terminal assets of U.S. based Savage Enterprises for an undisclosed sum. The combined company creates a coast-to-coast network of 36 railcar terminals, three short-line railways, and 80 first-and-last-mile operations with connections to all six Class I railroads. This is Cando’s fourth acquisition in two years, bringing its total investment to approximately $1 billion. Closing is expected in the second quarter subject to regulatory approval.

Savage brings a substantial Houston Ship Channel energy footprint, handling hundreds of thousands of railcars of chemical and petrochemical products annually, including petroleum liquids, petroleum coke, sulfur, and polymers. It also has Bakken exposure through a two-mile crude pipeline connecting its Trenton, North Dakota terminal to Energy Transfer’s 750,000 b/d Dakota Access system. Combined with Cando’s October acquisition of the Channelview terminal, which can stage and transload 900 railcars with Class I connections to BNSF, CPKC, and UP, the combined entity becomes a significant player in North American energy logistics. The scale of this consolidation reflects the ongoing view that terminal infrastructure is a durable long-term asset in the rail sector.

We are Watching the Canola Rush

March 1st arrived, and China delivered on half the deal. Beijing’s Finance Ministry issued a formal statement on Friday of last week confirming the suspension of 100% tariffs on Canadian canola meal, peas, lobster, and crab, effective today through year-end 2026. What was conspicuously absent from that statement: any mention of canola seed. The $4 billion seed market, and the headline commitment from Carney’s January Beijing visit to cut seed tariffs from 84% to 15%, went unconfirmed by Chinese authorities as of press time. Ottawa’s response was measured: a statement from the Minister of International Trade’s office said the seed tariff reduction is “on track as officials work on implementation details” and that “more information will be available in due course.” That is not the same as confirmation from Beijing.

The rail market had already been pricing in the full deal. According to the Globe and Mail, canola shipments in the final two weeks of February surged far above 2025 levels as exporters pushed product toward Vancouver ahead of the deadline. The Canadian Grain Commission’s weekly data showed the surge was real, with grain carloads for the week of February 21 hitting 24,463, up 8,121 week-over-week according to the AAR data. Those shipments are now crossing the Pacific, a 20-21 day voyage from Vancouver, and will arrive in Chinese ports expecting a 15% tariff. If Beijing doesn’t formally confirm the seed reduction in the coming days, there is going to be a very uncomfortable conversation at the dock.

The canola meal confirmation is genuinely meaningful, China was importing nearly 2 million metric tonnes annually before the 2025 tariff surprise gutted the trade, and restoring that flow is a real covered hopper tailwind on CN and CPKC corridors heading west. But the seed story is the one to watch. Six million tonnes annually and $4 billion in trade doesn’t come back until Beijing puts it in writing. We will be updating readers as this develops.

We are Watching a Rail Safety Bill Reintroduced

Three years after the Norfolk Southern derailment in East Palestine, Ohio, a bipartisan group of eight U.S. senators led by Sen. Maria Cantwell (D-WA) reintroduced the Bipartisan Railway Safety Act of 2026 on February 24. The original bill stalled in Congress in 2023-24 due to industry opposition and Republican resistance.

The bill mandates expanded deployment of wayside hotbox detectors, the temperature sensors that flagged the NS East Palestine train’s overheating bearings but under existing railroad policy did not compel a stop in time. It requires all railcars to undergo a full inspection at least once every five years, expands the hazardous chemicals list to include vinyl chloride, and mandates speed restrictions, improved braking technology, and route risk analysis for hazmat movements. The maximum civil penalty for safety violations would jump from $100,000 to $10 million per violation. Carriers would also face new requirements to notify states about hazardous materials crossing their borders.

The legislation has union support. The Association of American Railroads has historically pushed back on prescriptive mandates, and passage in a Republican-controlled Senate is far from certain. Regardless of this bill’s fate, the trajectory toward greater compliance obligations and increased hazmat scrutiny is a durable trend. Operators moving crude, ethanol, and LPG by rail should track this closely.

We are Watching Key Economic Indicators

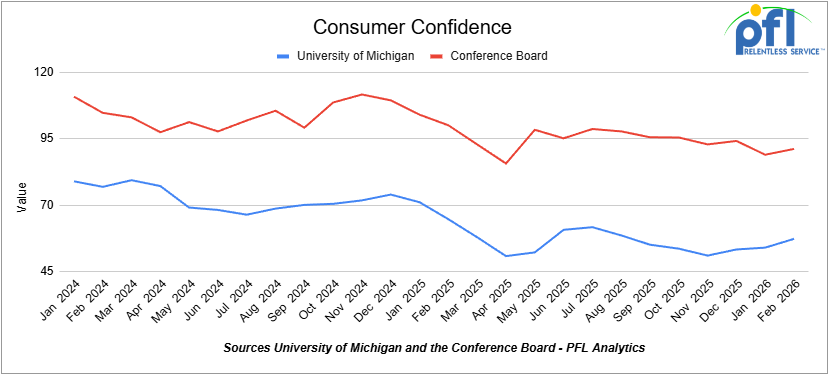

Consumer Confidence

The Index of Consumer Sentiment from the University of Michigan increased from 54.0 in January to 57.3 in February.

The Conference Board Consumer Confidence Index increased from 89.0 in January to 91.2 in February.

Lease Bids

- 100, 21.9K 117J Tanks located off of All Class 1s in Midwest. For use in CO2 service. Period: 6 months.

- 30-50, 30K 117J Tanks located off of NS or CSX in Northeast. For use in C5 service. Period: 1 year.

- 20-50, 4000-5000 Covered Hoppers located off of UP or BN in Houston. For use in Urea, Potash, Ammonium Sulfate service. Period: 6-12 Months.

- 200, 33K Pressure Tanks located off of CSX or NS in Ohio. For use in Propylene service. Period: 18 Months.

- 30-50, 25.5K Dot 111 Tanks located off of All Class 1s in Anywhere. For use in Asphalt service. Period: 1-3 Years.

Sales Bids

- 28, 3400CF Covered Hoppers located off of UP BN in Texas. For use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks located off of various class 1s in various locations. For use in corn syrup service.

- 120, Various Open-Top Aluminum Rotary Gondolas located off of various class 1s in various locations. For use in Sulphur service. Built 2004 or later.

- 30, 29K DOT111 Tanks located off of various class 1s in Chicago. For use in Veg Oil service.

Lease Offers

- 100, 30K CPC1232 Tanks located off of UP or BN in Texas. Last used in Diesel.

- 100, 30K DOT117R Tanks located off of UP or BN in Texas. Last used in Gasoline.

- 100, 29K DOT117R Tanks located off of UP or BN in Texas. Last used in Gasoline. Coiled and Insulated.

- 21, 6351 Covered Hoppers located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 29, 6500 Covered Hoppers located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 50, 20K DOT117J Tanks located off of All Class 1s in Moving. Last used in Styrene.

- 29, 25.5K DOT117J Tanks located off of UP or BN in Texas. Cars are currently clean. Cars are currently clean.

- 90, 30K DOT117J Tanks located off of UP or BN in Corpus Christie. Last used in Diesel.

- 200, 340W DOT 112J Tanks located off of All Class 1s in Multiple Locations. Last used in Propane and Butane. Cars are currently clean.

- 15, 6200CF Covered Hoppers located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

- 30, 6500CF Covered Hoppers located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

- 50, 30K DOT117J Tanks located off of UP or BN in Corpus Christie. Last used in Gasoline.

- 24, 21K Stainless Steel Tanks located off of UP in Texas / Mexico Border. Last used in SULFACTANT. Cars are currently clean.

- 34, 30K DOT 111 Tanks located off of UP in Texas / Mexico Border. Last used in Veg Oil. Cars are currently clean.

Sales Offers

- 50, 31.8K CPC1232 Tanks located off of UP or BN in TX. Last used in Multiple. Requal Due in 2025.

- 35, 3400CF Covered Hoppers located off of UP or BN in Midwest. Last used in Sand.

- 25, 30K 117J Tanks located off of CSX in Jackson, TN. Last used in Fuels. Newly Requalified.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website

The post PFL Railcar Report 3-2-2026 appeared first on PFL Petroleum Services LTD.

]]>The post Petroleum Daily Report 2-27-2026 appeared first on PFL Petroleum Services LTD.

]]>Although U.S. and Iranian officials agreed to extend indirect negotiations into next week following talks in Geneva, market skepticism grew over the likelihood of a breakthrough. President Donald Trump has demanded that Iran halt uranium enrichment, setting a short deadline for a deal, while Tehran has resisted key U.S. conditions.

Crude prices initially spiked during Thursday’s talks on reports that discussions had stalled, before easing slightly after Oman’s foreign minister said progress had been made and technical-level discussions would resume next week in Vienna. Still, traders appear increasingly focused on the risk that diplomacy could fail.

Geopolitical risk premiums of roughly $8 to $10 per barrel are estimated to be embedded in current prices, reflecting fears that any military confrontation could disrupt flows through the Strait of Hormuz — a chokepoint that handles about 20% of global oil supply.

To offset potential disruptions, Gulf producers are preparing contingency measures. Abu Dhabi is expected to boost exports of its flagship Murban crude in April, while Saudi Arabia has signaled it could raise output and may increase its official selling prices to Asia for the first time in five months, supported by stronger Indian demand replacing Russian supplies.

Meanwhile, OPEC+ is widely expected to consider increasing output by around 137,000 barrels per day at its March 1 meeting as it begins unwinding a pause in supply hikes.

On Mobile? Click here to download the PDF

The post Petroleum Daily Report 2-26-2026 appeared first on PFL Petroleum Services LTD.

]]>Prices later pared those gains after Oman’s foreign minister said “significant progress” had been made and that discussions would resume soon, with technical-level talks scheduled in Vienna next week. Traders said developments in the negotiations are likely to remain the dominant driver of price action in the coming sessions.

The market has embedded a geopolitical risk premium amid fears that a breakdown in talks could lead to military escalation in the Middle East. An extended conflict could disrupt exports from Iran — OPEC’s third-largest producer — and potentially affect other regional suppliers.

However, a constructive diplomatic outcome could unwind much of that premium. Analysts estimate that up to $10 per barrel of geopolitical risk could be priced into crude at current levels.

On the supply side, bearish U.S. inventory data capped gains. The U.S. Energy Information Administration reported on Wednesday that crude stocks surged by 16 million barrels last week, a much larger-than-expected build driven by lower refinery utilization and higher imports.

Meanwhile, Saudi Arabia is reportedly preparing a contingency plan to increase production and exports if a U.S. strike on Iran disrupts regional supplies. Separately, OPEC+ is expected to consider raising output by about 137,000 barrels per day in April as the group prepares for peak summer demand while prices remain firm.

On Mobile? Click here to download the PDF

The post Petroleum Daily Report 2-25-2026 appeared first on PFL Petroleum Services LTD.

]]>The U.S. Energy Information Administration reported that crude inventories surged by 16 million barrels last week, far exceeding analyst expectations for a 1.5-million-barrel build. The increase was driven by lower refinery utilization and higher imports. The report also showed a record adjustment factor of 2.7 million barrels per day, reflecting unaccounted-for supply changes.

Despite the bearish data, the impact on prices was limited as traders remain focused on Middle East tensions. In recent sessions, Brent and WTI have climbed to multi-month highs as the U.S. bolstered its military presence in the region in an effort to pressure Iran to curb its nuclear and ballistic missile programs.

President Donald Trump reiterated during his State of the Union address that Washington would not allow Iran to develop a nuclear weapon, keeping the threat of military action in play. A third round of talks between U.S. envoys and an Iranian delegation is scheduled for Thursday in Geneva. Iran’s foreign minister said a deal was “within reach” if diplomacy takes priority.

The key market question remains whether any escalation would materially disrupt Iranian oil production or exports. Iran is OPEC’s third-largest crude producer, and a significant disruption could tighten global supplies. However, traders note that Saudi Arabia could potentially raise output quickly to offset lost barrels, and a strong U.S. naval presence could help keep the Strait of Hormuz open.

In preparation for possible disruption, Saudi Arabia has reportedly activated contingency plans to temporarily boost output and exports. Meanwhile, OPEC+ is expected to consider increasing production by about 137,000 barrels per day in April as it begins unwinding a pause in supply hikes. Eight key OPEC+ producers are set to meet on March 1.

Adding to the uncertainty, U.S. trade policy remains in flux after a Supreme Court ruling reshaped elements of President Trump’s tariff program. A temporary 10% global tariff has taken effect, with signals that it could rise to 15% or higher for some countries, clouding the outlook for global growth and oil demand.

On Mobile? Click here to download the PDF

The post Petroleum Daily Report 2-24-2026 appeared first on PFL Petroleum Services LTD.

]]>The retreat came ahead of a third round of indirect nuclear talks scheduled for Thursday in Geneva between U.S. and Iranian delegations, with Iran’s deputy foreign minister saying Tehran was prepared to take necessary steps to reach a deal. While this does not guarantee a comprehensive agreement, it tempered immediate fears of a conflict that might disrupt supply from the Middle East.

Oil markets remain sensitive to the U.S.–Iran dynamic, as heightened tensions have lifted crude toward multi-month highs in recent sessions. Traders are watching closely for diplomatic signals that could either calm or exacerbate geopolitical risk around the Strait of Hormuz, through which a significant share of global crude exports transit.

Several broader market themes also influenced sentiment on Tuesday. U.S. trade policy uncertainty — including the implementation of new global import tariffs — added an element of macroeconomic risk that has weighed on demand expectations. In addition, steps to boost Venezuelan crude exports under a supply deal are expected to increase flows from South America, while U.S. forces seized another sanctioned oil tanker carrying Venezuelan cargo, highlighting enforcement of energy sanctions and floating storage shifts.

On the inventory front, analysts were awaiting weekly crude stockpile data from U.S. reporting agencies, with forecasts pointing to a modest build that would add to existing ample supplies.