“Even if you are on the right track, you’ll get run over if you just sit there.”

Will Rodgers

COVID 19 and Markets Update

In the United States, we currently have 1.83 million confirmed COVID 19 cases and 105,770 confirmed deathsOn Thursday of last week, according to the Labor Department, U.S. workers filed an additional 2.1 million jobless claims, bringing the total losses since the coronavirus pandemic to over 41 million.

As we all are aware, riots exploded throughout the nation over the weekend threatening more job losses as some mom and pop businesses have been destroyed just as they were preparing to reopen on the back of the obvious killing of George Floyd – a terrible situation and bad timing for the country just as we are struggling to get things back to some sort of normalcy. West Texas Intermediate (WTI) crude for July delivery closed up $1.78, or 5.3%, to settle at $35.49 a barrel on the New York Mercantile Exchange on Friday of last week. Front-month U.S. benchmark WTI futures rose 88.4% for May, for its best month on record, based on data going back to 1983, according to Dow Jones Market Data.

Brent saw its July contract rise 4 cents, or 0.1%, to end at $35.33 a barrel on ICE Futures Europe Friday. Front-month prices rose 39.8% for the month, which was the strongest monthly rise since March 1999. The new front-month August contract settled at $37.84, up $1.81, or 5% last Friday.

Oil is lower in overnight trading and as of the writing of this report, WTI is poised to open at $35.53 down 16 cents per barrel from Friday’s close.

The DOW traded down slightly on Friday -17.3 points (or 0.07%) to close out the week at 25,383.11. In overnight trading, DOW futures traded higher and as of the writing of this report is expected to open up 57 points.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

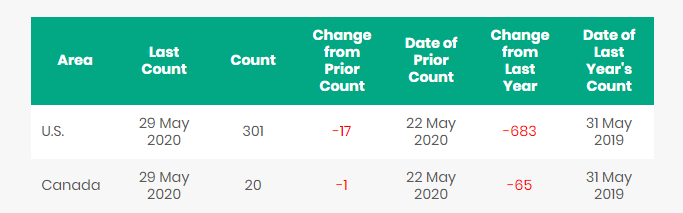

North American Rig Count

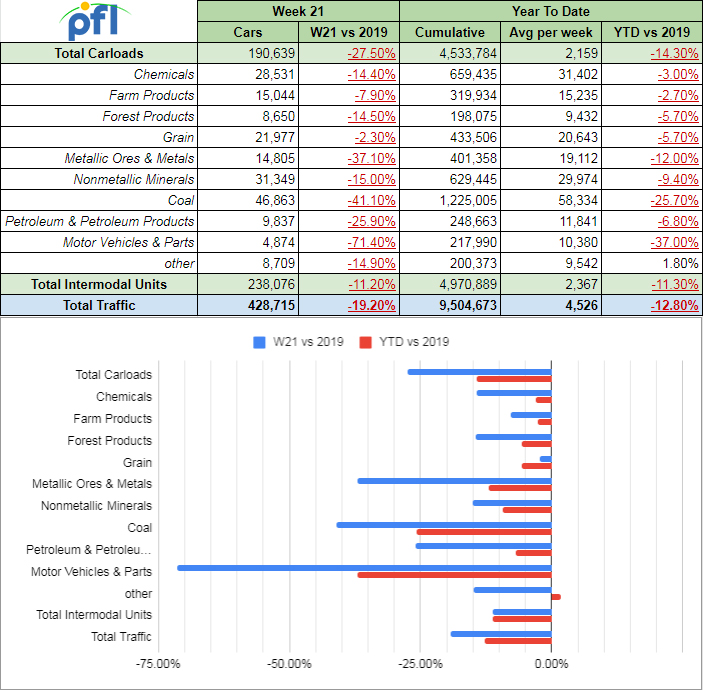

Total North American rail volumes were down 18.7% year over year in week 21 (U.S. -19.2%, Canada -15.2%, Mexico -24.7%), resulting in QTD volumes that are down 19.7% and year to date volumes that are down 11.4% (U.S. -12.8%, Canada -7.1%, Mexico -8.7%). Ten of the AAR’s eleven major traffic categories posted year over year declines with the largest decreases coming from intermodal (-10.8%), coal (-39.6%), motor vehicles & parts (-77.4%) and metallic ores & metals (-25.3%). The largest increase came from grain (+10.3%).In the East, CSX’s total volumes were down 21.2%, with the largest decreases coming from coal (-48.9%), motor vehicles & parts (-77.2%) and intermodal (-11.4%). NS’s total volumes were down 27.8%, with the largest decreases coming from intermodal (-13.5%), coal (-67.4%), motor vehicles & parts (-82.8%) and metals & products (-45.4%).

In the West, BN’s total volumes were down 17.5%, with the largest decreases coming from coal (-34.7%), intermodal (-7.7%), petroleum (-42.4%) and motor vehicles & parts (-66.5%). UP’s total volumes were down 21.4%, with the largest decreases coming from intermodal (-18.6%), motor vehicles & parts (-88.0%), coal (-27.2%), chemicals (-17.3%) and stone sand & gravel (-27.1%).

In Canada, CN’s total volumes were down 19.0% with the largest decreases coming from intermodal (-10.6%), motor vehicles & parts (-83.1%), petroleum (-39.2%) and stone sand & gravel (-68.6%). The largest increase was grain (+31.9%). RTMs were down 23.0%. CP’s total volumes were down 12.8%, with the largest decreases coming from petroleum (-48.7%), chemicals (-24.0%), motor vehicles & parts (-83.4%) and coal (-27.4%). RTMs were down 17.3%.

KCS’s total volumes were down 28.1%, with the largest decreases coming from intermodal (-36.4%), motor vehicles & parts (-94.8%) and petroleum (-27.8%).

See year to date summaries by commodity type:

North American Rig Count Summary

Recent Events and Impact on Supply Chains

Increasing trade tensions with China since the latter part of 2019 coupled with the question on how China’s COVID-19 will impact global supply chains has been on the minds of those who work in the rail industry in addition to many other industries that currently rely on products that are exported from China. Just like the predictions made by weathermen, it is hard to predict what the end results will be. PFL has done some research on the subject matter and while there is not one answer – this is what we knowWhat has been affected so far?

According to a March 11th study on the COVID-19 impacts on global supply chains, nearly 75% of companies reported supply chain disruptions in some capacity. The data supplied implies that businesses are faced with a long recovery before they can resume their normal operations. Lead times were doubled and the shortages are compounded by the air and ocean freight options.Primary Supply Chain Impacts

A survey was conducted by Institute for Supply Management, which revealed the following:

- 57% of those surveyed mentioned longer lead times for tier-1 China sourced components with acreage lead times over double compared to the end of 2019.

- Chinese manufacturers have reported operating at 50% with only 56% of their normal staff.

- More than 44% of those who responded to the survey do not have a plan in place to address the supply disruption from China with 23% of those reporting current disruptions.

- The companies that are expecting interruptions expect the severity to increase after the first quarter of 2020.

- 62% are already experiencing delays in receiving orders from China.

- 53% are having difficulties getting information regarding their orders or when orders will become available.

- 48% are experiencing delays in regards to moving goods within China.

- 46% are reporting delays loading goods at the Chinese ports.

What is the outlook?

There are three scenarios for when we would see a rebound in the supply chains as follows:

- The first is the most optimistic, with a quick recovery and the economic impact was kept to just the first quarter of 2020. We know that did not happen and we are now in the last month of the second quarter.

- The more likely scenario is a global slowdown with direct impacts through the third quarter of 2020 as supply chains switch to friendlier countries or right here at home.

- The final scenario is pessimistic due to the low consumer confidence and air travel restrictions. This scenario would go through till the end of the fourth quarter of 2020.

The Rail Impact

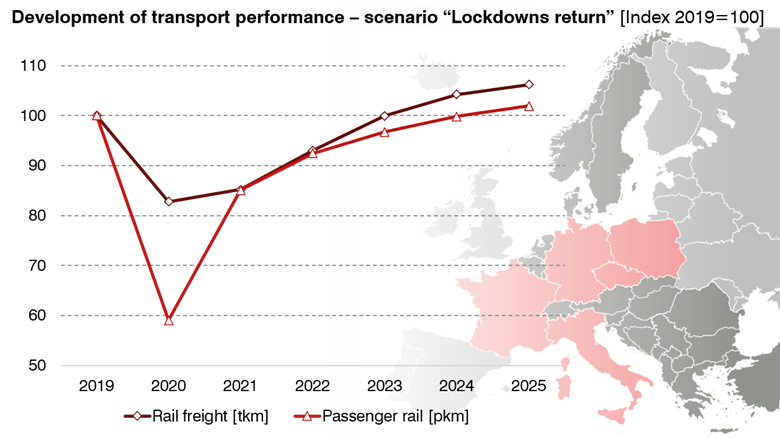

From a long term standpoint, we will see a reduction of freight by rail and anticipate it slowly recovering taking up to 5 years to fully rebound. (See chart below)

The obvious impact is the international intermodal traffic, especially from China. China has held a dominant role in supply chains as they are able to quickly produce raw materials or finished products. 200 out of the Fortune 500 companies have a presence in Wuhan.

Imports by sea will slow down due to container availability being imbalanced. Ports may become congested with empty boxes that are waiting to be shipped back to China while full containers would become delayed due to the Chinese market becoming depressed. When imports are able to pick back up ships will seek to off-load at ports with capacity which may change the lanes for intermodal traffic.

Class 1 Railroads will need to become extra resilient and agile, shifting man-power and resources to ports and terminals that were not traditionally used to handle increased traffic. Shippers will be looking to pre-book space earlier than ever and with larger proportions.

If the recovery continues onto the buying periods such as back to school, Black Friday or Christmas shippers will have to look for the most flexible routes to get the goods to the consumer markets. Due to the limits of trucking capacity, this would be an opportune time for rail to become a major player. Transit times and reliability will be paramount meaning shippers would be more inclined to pay more for reliable service.

The Need to Modernize Supply Chains

Global Supply Analyst, Jim Kilpatrick, suggested that one solution to prevent another supply chain interruption would be to leverage advanced technologies. These technologies, such as IoT, artificial intelligence, robotics, 5G networks and DSNs would allow users to connect to their supply networks and enable end to end visibility, collaboration and optimization. This would allow users to predict some of the future challenges such as another pandemic, labor disputes, demand spikes or supplier bankruptcy.

Companies will need to, if they haven’t already, create supply chain management teams who will try to manage risks or mitigate their impact.

Railcar Markets

PFL is offering: Various tank cars for lease with potential dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Sand cars, Box cars, coal cars and hoppers. A number of cars are available for sale.

PFL is seeking: Older DOT 111 cars 25,000 to 26,000 – can be either coiled or non-coiled on a 3-5 year lease – must be clean. 15-20 5200 Cuft hoppers for grain service, Plate C boxcars for purchase, lined cars suitable for propylene glycol service

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|