“Success is peace of mind, which is a direct result of self-satisfaction in knowing you made the effort to become the best of which you are capable.” —John Wooden

Jobs Update

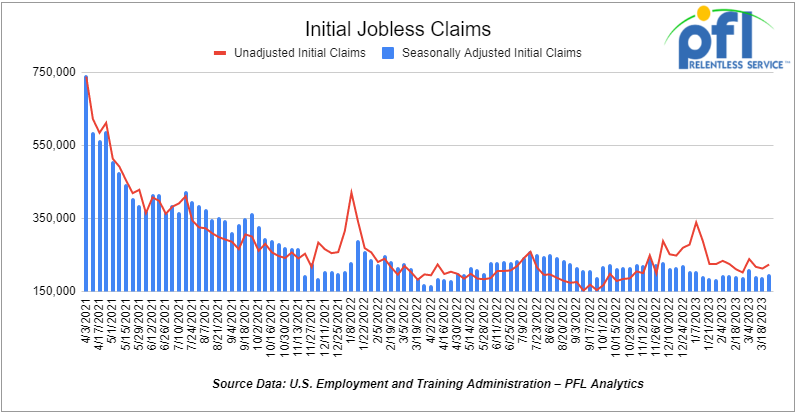

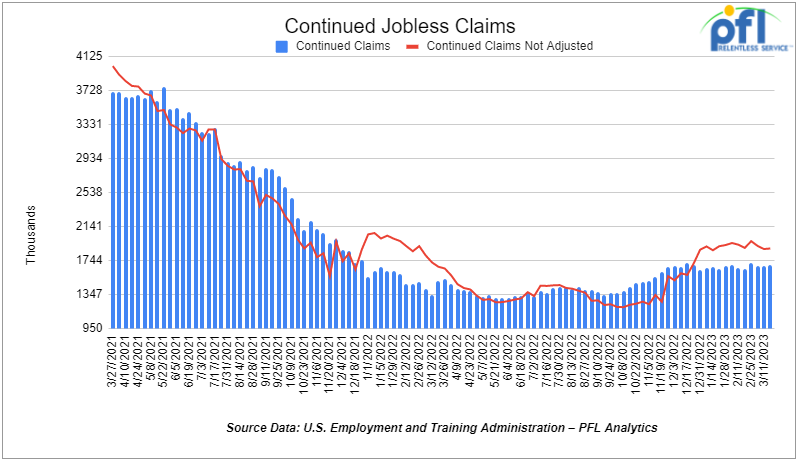

- Initial jobless claims for the week ending March 25th, 2023 came in at 198,000, up 7,000 people week-over-week.

- Continuing jobless claims came in at 1.689 million people, versus the adjusted number of 1.680 million people from the week prior, up 9,000 people week over week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 415.12 points (+1.26%), closing out the week at 33,274.15 up 1,168.9 points week over week. The S&P 500 closed higher on Friday of last week, up 58.48 points (+1.44%) and closed out the week at 4,109.31, up +138.32 points week over week. The NASDAQ closed higher on Friday of last week, up +208.43 points (+1.76%), and closed the week at 12,221.91, up +397.95 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,559 this morning up +99 points.

WTI closed higher on Friday of last week and up week over week

WTI traded up $1.30 per barrel (1.8%) to close at $75.67 per barrel on Friday of last week, and up $6.41 per barrel week over week. Brent traded up $1.29 per barrel (1.6%) on Friday of last week, to close at US$79.89 per barrel, up US$4.90 per barrel week over week.

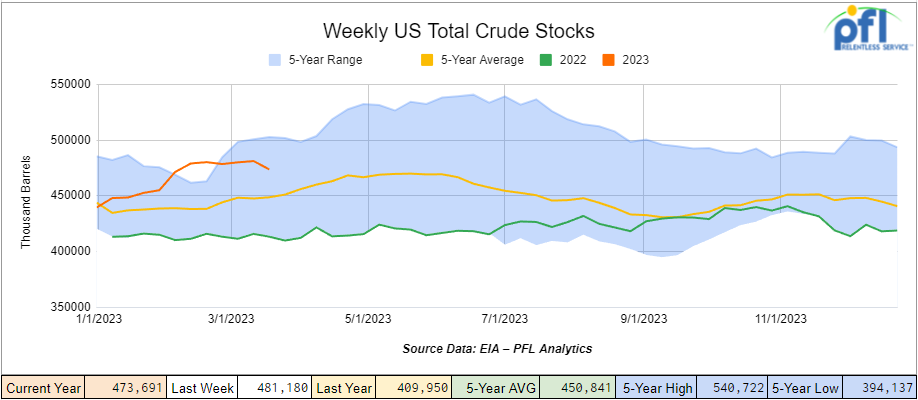

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 7.5 million barrels week over week. At 473.7 million barrels, U.S. crude oil inventories are 6% above the five-year average for this time of year.

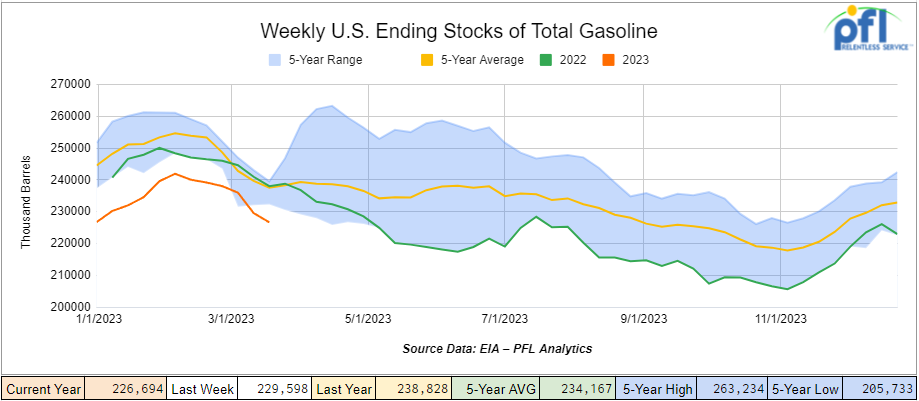

Total motor gasoline inventories decreased by 2.9 million barrels week over week and are 4% below the five-year average for this time of year.

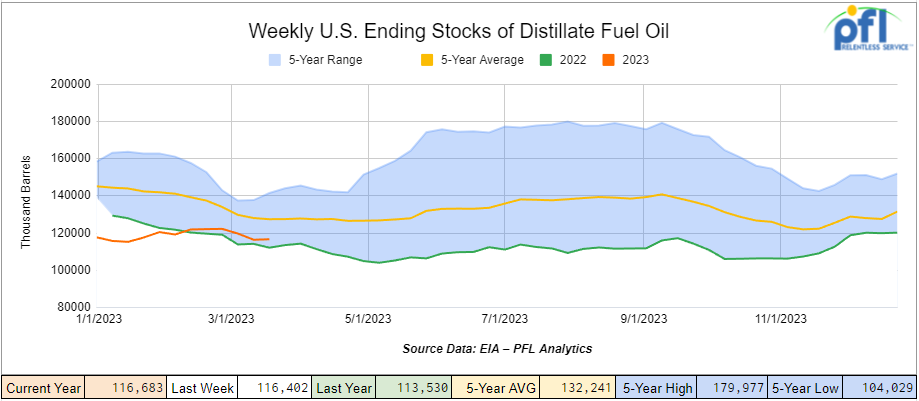

Distillate fuel inventories increased by 300,000 barrels week over week and are 9% below the five-year average for this time of year.

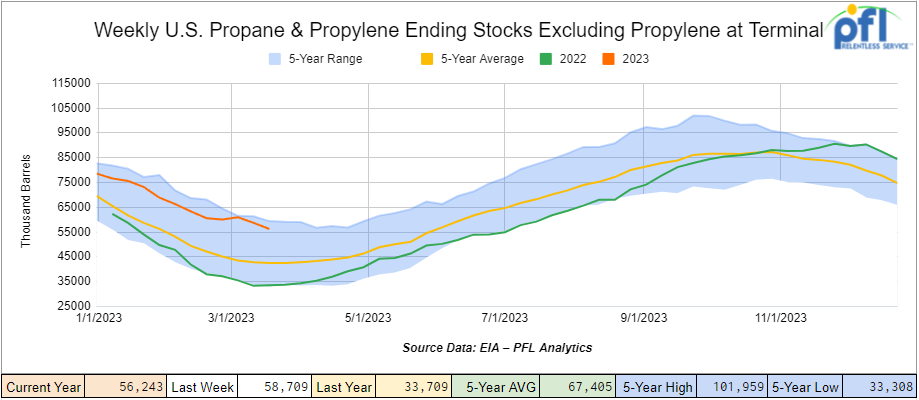

Propane/propylene inventories decreased by 2.5 million barrels week over week and are 34% above the five-year average for this time of year.

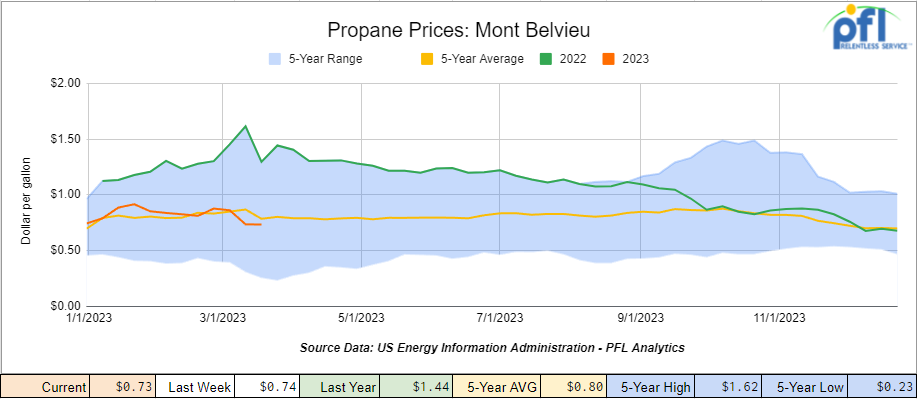

Propane lost 1 cent per gallon week over week, closing at 73 cents a gallon, down 71 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 10.7 million barrels during the week ending March 24th, 2023.

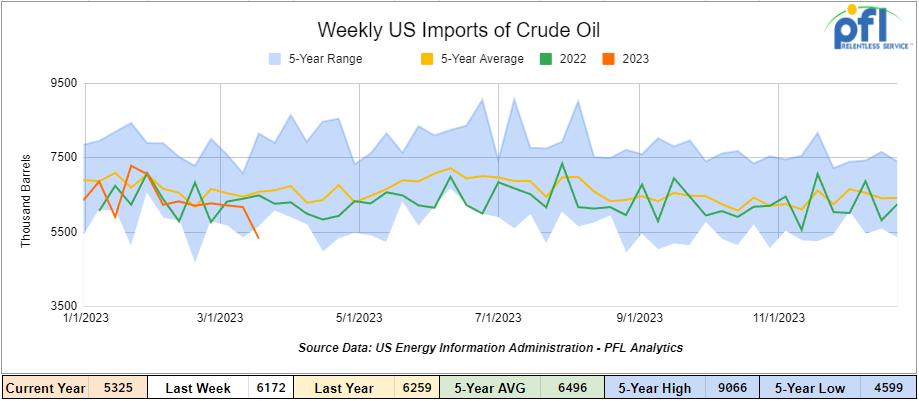

U.S. crude oil imports averaged 5.3 million barrels per day during the week ending March 24th, 2023, a decrease of 847,000 barrels per day from week over week. Over the past four weeks, crude oil imports averaged 6.0 million barrels per day, 5.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 873,000 barrels per day, and distillate fuel imports averaged 146,000 barrels per day during the week ending March 24th, 2023.

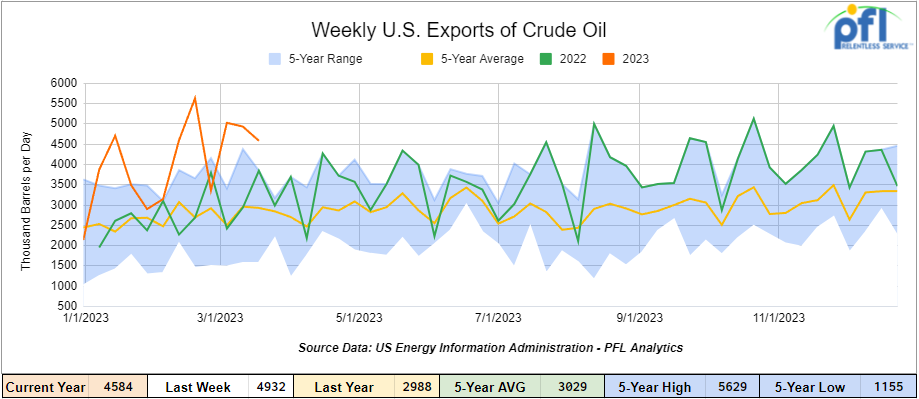

U.S. crude oil exports averaged 4.584 million barrels per day for the week ending March 24th, 2023, a decrease of -348,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.476 million barrels per day.

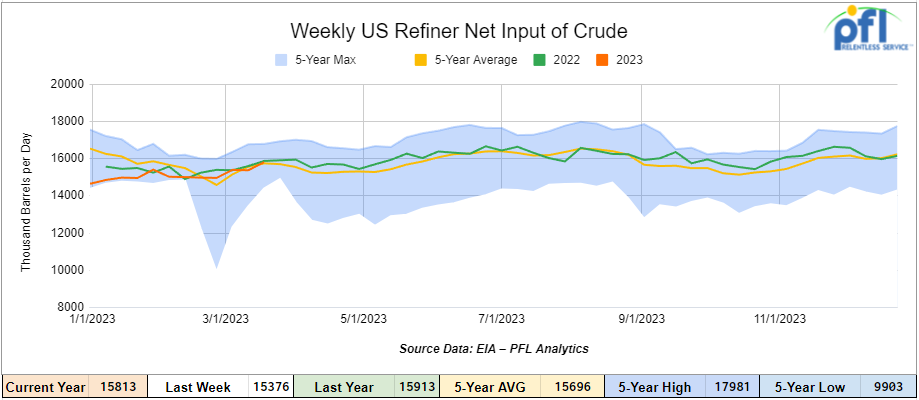

U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ending March 24, 2023 which was up 437,000 barrels per day week over week.

As of the writing of this report, WTI is poised to open at $79.66 up $3.99 per barrel from Monday’s close.

North American Rail Traffic

Week Ending March 29th, 2023.

Total North American weekly rail volumes were down (-7.71%) in week 12 compared with the same week last year. Total carloads for the week ending on March 29th were 353,733, down (-0.25%) compared with the same week in 2022, while weekly intermodal volume was 292,168, down (-15.37%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Intermodal (-15.37%). The largest increase was from Petroleum and Petroleum Products (+10.68%).

In the east, CSX’s total volumes were down (-3.53%), with the largest decrease coming from Intermodal (-14.76%) and the largest increase Metallic Ores and Minerals (+39.12%). NS’s volumes were down (-6.79%), with the largest decrease coming from Forest Products (-12.62%) and the largest increase from Nonmetallic Minerals (+6.63%).

In the West, BN’s total volumes were down (-14.47%), with the largest decrease coming from Intermodal (-21.81%), and the largest increase coming from Farm Products (+15.32%). UP’s total rail volumes were down (-0.95%) with the largest decrease coming from Other (-38.48%) and the largest increase coming from Petroleum and Petroleum Products (+19.81%).

In Canada, CN’s total rail volumes were down (-13.07%) with the largest increase coming from Other (+9.41%) and the largest decrease coming from Intermodal (-31.23). CP’s total rail volumes were down (-10.72%) with the largest decrease coming from Grain (-58.85%) and the largest increase coming from Coal (+105.07%).

KCS’s total rail volumes were down (-9.45%) with the largest decrease coming from Nonmetallic Minerals (-36.55%) and the largest increase coming from Petroleum and Petroleum Products (+47.81%).

Source Data: AAR – PFL Analytics

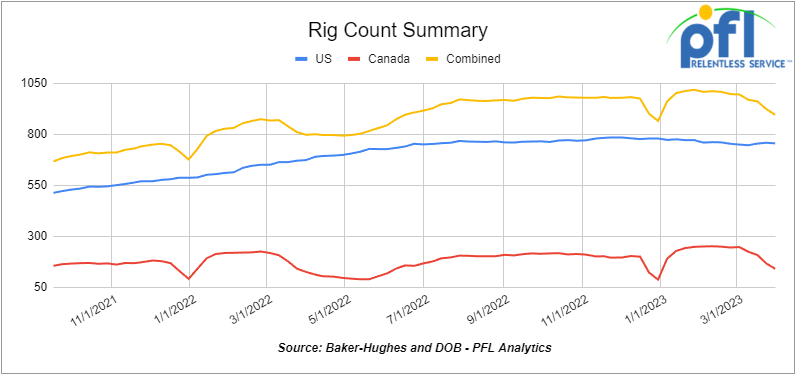

Rig Count

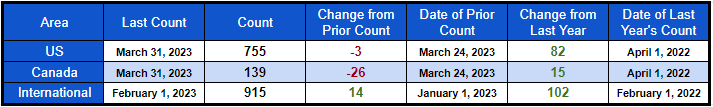

North American rig count was down by -29 rigs week over week. U.S. rig count was down -3 rigs week over week and up by +82 rigs year over year. The U.S. currently has 755 active rigs. Canada’s rig count was down by -26 rigs week-over-week and up by +15 rigs year over year. Canada’s overall rig count is 139 active rigs. Overall, year over year, we are up +97 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,106 from 24,217, which was a loss of -111 rail cars week-over-week. Canadian volumes were mixed; CN’s shipments decreased by -0.3% week over week, and CP’s volumes were higher by +17.7% week over week. U.S. shipments were up across the board. The BN had the largest percentage increase and was up by +23.9%.

South West Rail Shippers (SWARS) Conference

We were in San Antonio along with 900 other people in what was a sold-out event. A great venue for networking and a tremendous amount of deal-making was going on – and it was one of the best events PFL has been to and was a proud sponsor of. The speakers were great. We particularly enjoyed Chris DeSantis – speaker consultant and Author who spoke on generational gaps – the speech was entitled “Why I find you irritating-Navigating Generational Friction at work”. Baby Boomers and Gen X generally find Millennials and Gen Z folks irritating in the workplace and he explains why and the differences in the way each generation thinks and what they value – was a worthwhile forum to assist all in the workplace on how to get along and find some middle ground. For more information on conference details and the venue please do not hesitate to reach out to PFL and if we missed you in San Antonio we will see you at SWARS in San Diego in September.

We are Watching Congress – Passes Sweeping Energy Bill

The U.S. House of Representatives on Thursday of last week approved a bill packed with energy priorities meant to counteract the Biden administration’s approach (the “Green New Deal”) and boost U.S. oil and gas production for the benefit of energy security, jobs here in the U.S. and for the U.S. consumer.

Numbered H.R. 1 as a signal that energy policy is the House majority’s top legislative priority, the bill includes a package of GOP proposals, ranging from reforming the process for gaining federal approvals for energy projects to condemning President Joe Biden’s cancellation of the Keystone XL crude oil pipeline.

“Voters awarded House Republicans with the majority in Congress to fight President Biden’s radical energy policies and lower costs for American families, and today, we are working to make that a reality,” House Majority Leader Steve Scalise, a Louisiana Republican who was the bill’s lead sponsor, said in a statement following the vote.

Four Democrats, Jared Golden of Maine, Marie Gluesenkamp Perez of Washington state, Henry Cuellar and Vicente Gonzalez of Texas, joined almost all Republicans present in voting for the bill. Pennsylvania’s Brian Fitzpatrick was the sole Republican to oppose the bill. The final tally was 225-204.

President Biden promised to Veto the Bill and has little chance in getting through the U.S. Senate.

We are Watching the U.S. Senate – the new “Railroad Accountability Act”

Three senators introduced new legislation on Thursday last week in a bid to address what they say as long-standing rail safety concerns, after the aftermath of last month’s derailment of a Norfolk Southern train near the Ohio-Pennsylvania border.

The new Railway Accountability Act – introduced by Democratic Sens. John Fetterman, Bob Casey both of Pennsylvania and Sherrod Brown of Ohio – would build on provisions of the bipartisan Railway Safety Act. Brown and his fellow senator from Ohio, Republican J.D. Vance introduced that measure earlier this month. Norfolk Southern CEO, Alan Shaw, endorsed parts of the bipartisan bill.

The Feb. 3 derailment in East Palestine, Ohio, released toxic chemicals into the environment. Shaw said Norfolk Southern would continue to support cleanup efforts in the area. He and government officials have said it’s safe to live in the town, but residents and workers on the cleanup site have complained about illnesses. The state of Ohio has also sued the company.

The new measure would direct the Federal Railroad Administration to study wheel-related failures and derailments, as well as mechanical defects. It would also enact new brake safety measures and improve switchyard safety practices, in addition to ensuring railways provide sufficient reporting and safety equipment to its workers. A preliminary report from the National Transportation Safety Board pointed to an overheated wheel bearing on the Norfolk Southern train that derailed, but did not offer an exact cause.

The bill, which has received support from major labor unions, would also require large freight railroad companies to participate in a confidential reporting system where close calls and unsafe events will be evaluated.

As of Thursday, the bill had no Republican sponsors, which could complicate its path through the GOP-controlled House. Some Republican politicians and conservative advocacy groups have argued that more regulations would not prevent derailments and would instead by costly. Stay tuned to PFL for further details as it relates to this matter.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 20, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of Any in Bakersfield, CA for Month to Month. Cars are needed for use in Biodiesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of Any in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of Any in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

- 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of Any in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

- 25-50, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

- 40, 30K 117R or 117J Tanks needed off of CP in MN for 2 Years. Cars are needed for use in Ethanol service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000-5100 Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 10-20, 20-25 CPC 1232 or 117J Tanks needed off of UP CN in Illinois for 3-5 years. Cars are needed for use in Liquid feed service.

- 100-150, 4000CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

- 25, 30K 117Rs or Js Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Diesel service.

- 25, 340W Pressure Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Propane service.

- 25, 30K 117Rs or Js Tanks needed off of Any Class One in Midwest for 2-3 years. Cars are needed for use in Ethanol service.

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 50-100, 25.5K CPC1232 or 117J Tanks needed off of Any in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

- 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

- 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

- 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

- 10, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 5, 3200 Covered Hoppers needed off of UP or BN in Texas.

- 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

- 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 100-200, 31.8, 1232 Tanks located off of BN in Chicago. Cars are clean Sale or Lease

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 50, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

- 100, 6400CF, Covered Hoppers located off of NS or CSX in NY. Cars are clean, Brand New and available for Sublease for 6-7 Months

- 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean/UAN.

- 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer/Corn Syurp. Free Move

- 20, 20k, Dot 111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, Dot 111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, Dot 111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located off of CN in Canada. Cars were last used in Crude. Free Move, Dirty to Dirty

Sales Offers

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

- 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

- 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|