“While you are overthinking and overplanning, someone else is achieving.”

― Jon Luvelli

Jobs Update

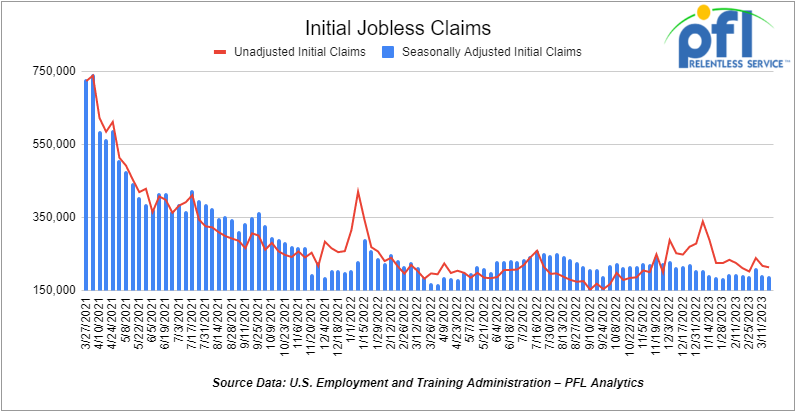

- Initial jobless claims for the week ending March 18th, 2023 came in at 191,000, down -1,000 people week-over-week.

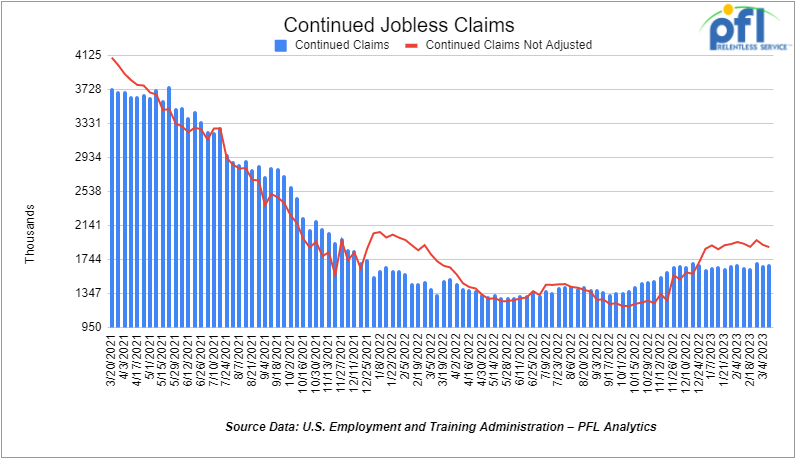

- Continuing jobless claims came in at 1.694 million people, versus the adjusted number of 1.684 million people from the week prior, up 10,000 people week over week.

Stocks closed higher on Friday of last week and mixed week over week

The DOW closed higher on Friday of last week, up 132.28 points (+0.41%), closing out the week at 32,237.53 down -9.02 points week over week. The S&P 500 closed higher on Friday of last week, up 22.27 points (+0.56%), and closed out the week at 3,970.99, up +54.35 points week over week. The NASDAQ closed higher on Friday of last week, up +36.56 points (+0.31%), and closed the week at 11,823.96, up +193.45 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 32,565 this morning up 131 points.

WTI closed lower on Friday of last week, but up week over week

WTI traded down -$0.70 per barrel (-1%) to close at $69.26 per barrel on Friday of last week, but up $2.52 per barrel week over week. Brent traded down -US$0.93 per barrel (-1.2%) on Friday of last week, to close at US$74.99 per barrel, up US$2.02 per barrel week over week.

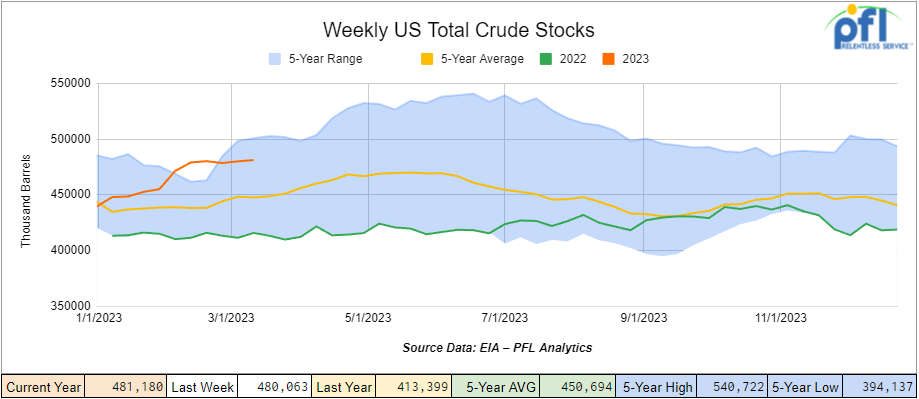

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.1 million barrels week over week. At 481.2 million barrels, U.S. crude oil inventories are 8% above the five-year average for this time of year.

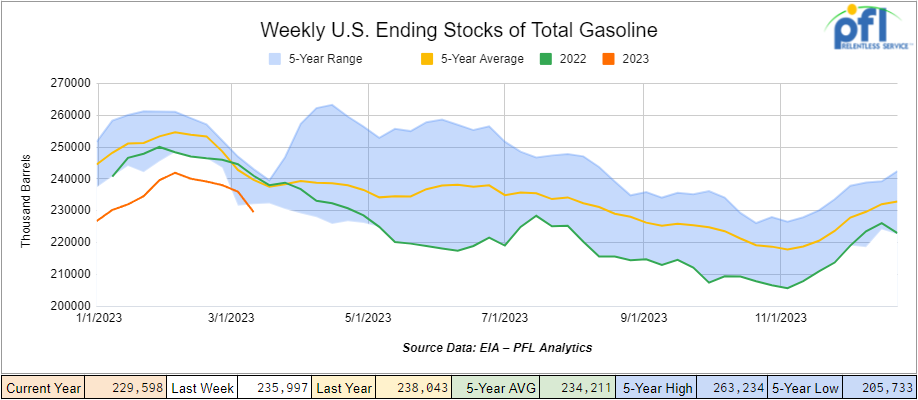

Total motor gasoline inventories decreased by 6.4 million barrels week over week and are 4% below the five-year average for this time of year.

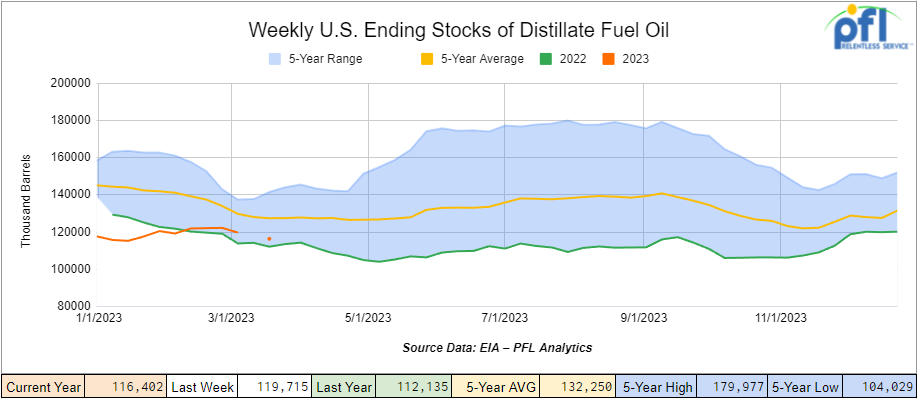

Distillate fuel inventories decreased by 3.3 million barrels week over week and are 9% below the five-year average for this time of year.

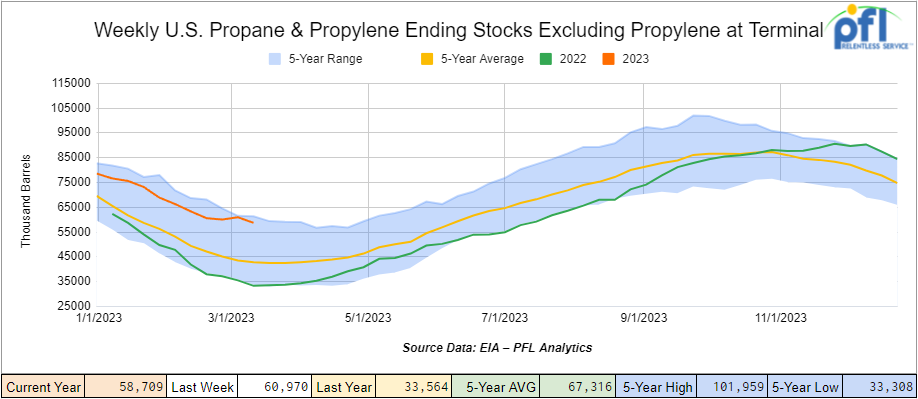

Propane/propylene inventories decreased by 2.3 million barrels week over week and are 37% above the five-year average for this time of year.

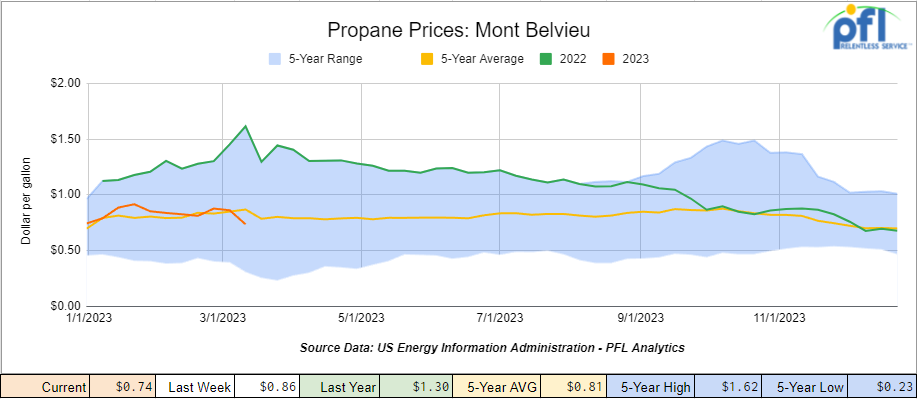

Propane lost 12 cents per gallon week over week, closing at 74 cents a gallon, down 56 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 10.4 million barrels for the week ending March 17th, 2023.

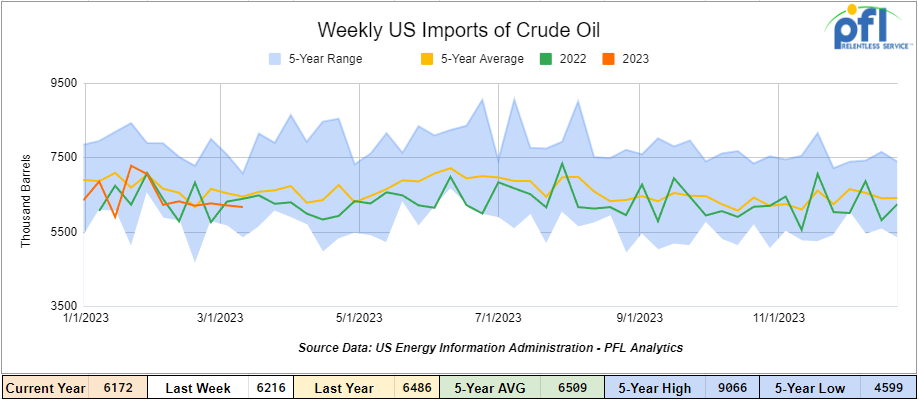

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending March 17th, 2023, a decrease of 45,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 0.4% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 471,000 barrels per day, and distillate fuel imports averaged 222,000 barrels per day during the week ending March 17th, 2023.

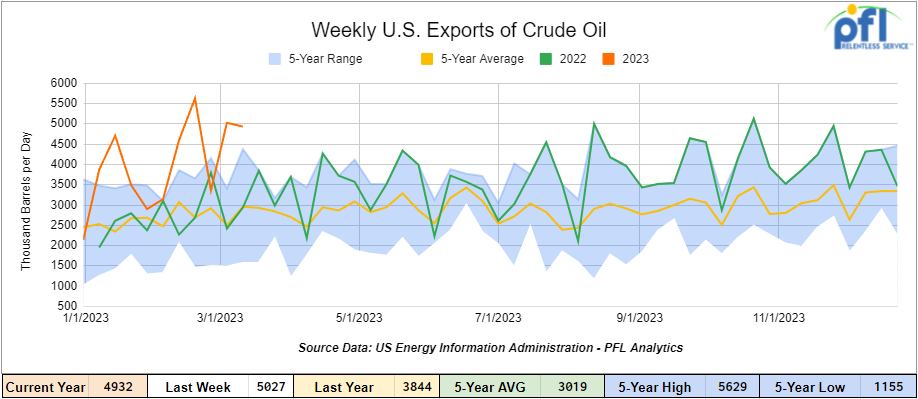

U.S. crude oil exports averaged 4.932 million barrels per day for the week ending March 17th, 2023, a decrease of -95 thousand barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.738 million barrels per day.

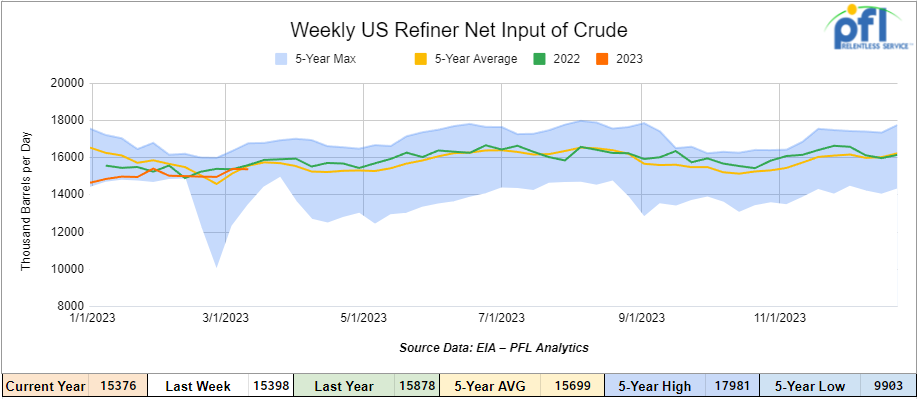

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending March 17, 2023 which was 21 thousand barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $69.60 up $0.34 per barrel from Monday’s close.

North American Rail Traffic

Week Ending March 22nd, 2023.

Total North American weekly rail volumes were down (-9.72%) in week 11 compared with the same week last year. Total carloads for the week ending on March 22nd were 340,100, down (-3.83%) compared with the same week in 2022, while weekly intermodal volume was 283,429, down (-15.91%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-17.54%). The largest increase was from Motor Vehicles and Parts (+5.26%).

In the east, CSX’s total volumes were down (-7.13%), with the largest decrease coming from Intermodal (-16.55%) and the largest increase from Grain (+15.27%). NS’s volumes were down (-8.71%), with the largest decrease coming from Petroleum and Petroleum Products (-17.14%) and the largest increase from Grain (+9.38%).

In the West, BN’s total volumes were down (-14.07%), with the largest decrease coming from Intermodal (-22.24%), and the largest increase coming from Motor Vehicles and Parts (+15.93%). UP’s total rail volumes were down (-4.68%) with the largest decrease coming from Grain (-22.13%) and the largest increase coming from Petroleum and Petroleum Products (+12.76%).

In Canada, CN’s total rail volumes were down (-12.17%) with the largest increase coming from Other (+22.35%) and the largest decrease coming from Intermodal (-29.78). CP’s total rail volumes were down (-24.87%) with the largest decrease coming from Grain (-60.18%) and the largest increase coming from Motor Vehicles and Parts (+39.09%).

KCS’s total rail volumes were down (-13.07%) with the largest decrease coming from Coal (-18.41%) and the largest increase coming from Motor Vehicles and Parts (+22.54%).

Source Data: AAR – PFL Analytics

Rig Count

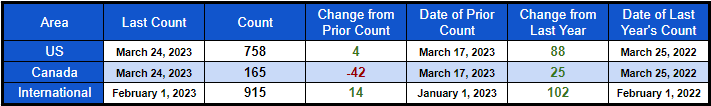

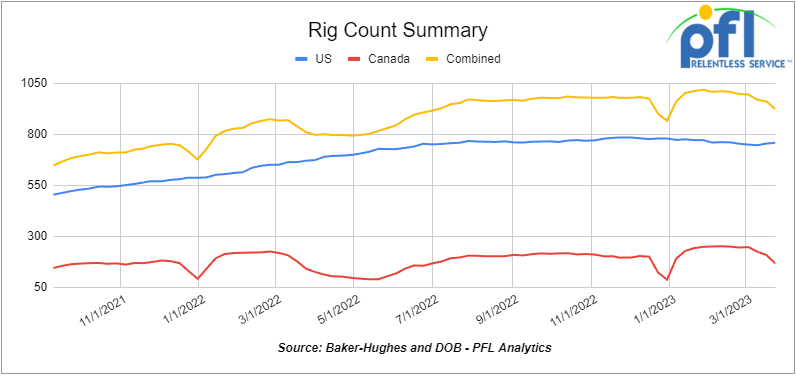

North American rig count was down by -38 rigs week over week. U.S. rig count was up 4 rigs week over week and up by +88 rigs year over year. The U.S. currently has 758 active rigs. Canada’s rig count was down by -42 rigs week-over-week and up by +25 rigs year over year. Canada’s overall rig count is 165 active rigs. Overall, year over year, we are up +113 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,217 from 24,945, which was a loss of -728 railcars week-over-week. Canadian volumes were mixed; CN’s shipments decreased by -4.8% week over week, and CP’s volumes were higher by +3.8% week over week. U.S. shipments were lower across the board. The NS had the largest percentage decrease and was down by -21%.

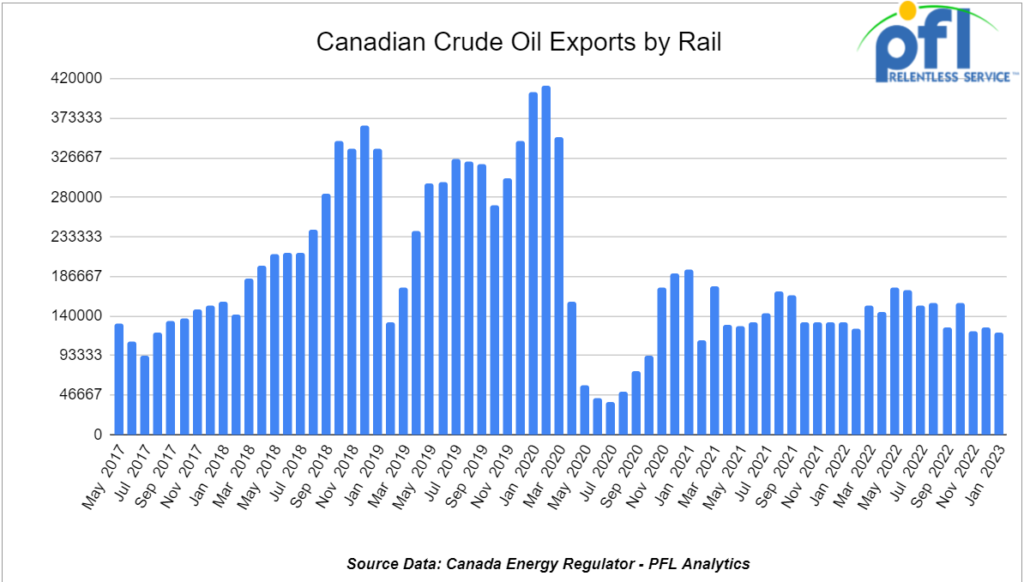

We are watching Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on March 22, 2023. For January 2023, Canada exported 120,075 barrels per day by rail (down by -6,123 barrels per day month over month); the weakest showing since February of 2021.

We are expecting to see volumes increase as we head into April as the weather warms and producers begin to build inventory awaiting the arrival of the 590,000 barrel per day Trans Mountain Expansion. The pipeline will connect Alberta to Canada’s West coast and is expected to come online sometime in Q1 of 2024 and is more than 80% complete. Line fill is expected to start towards the end of Q4.

Crude by rail out of Alberta and Saskatchewan is popular for raw Bitumen (no dilutent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. Gibson currently operates a 50,000 barrel per day Dilutent Recovery Unit out of Hardisty Alberta and Cenovus is looking to add 200,000 barrels per day of capacity in four clips of 50,000 barrels per day each. This will mean a lot of rail cars are going to be needed.

Before crude by rail out of Canada can come back in a meaningful way, supply needs to significantly exceed pipeline capacity and that is not happening right now. The latest basis numbers don’t work for traditional crude by rail out of Canada and with Enbridge accepting 100% of all nominations for April deliveries on decreased Alberta production. We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins. WCS for May delivery settled on Friday of last week at US$14.50 below the WTI-CMA. The implied value was US$54.91. On Thursday of last week, it settled at US$14.80 below the WTI-CMA for May delivery. The implied value was US$55.32/bbl.

We are watching Enbridge Line 5

The seemingly never-ending battle over line 5 continues folks. Canada’s Enbridge Inc. said on Thursday of last week that it was “disappointed” by the U.S. Army Corps of Engineers’ decision to extend the federal permitting process for the company’s proposed Great Lakes Tunnel that would rehouse its Line 5 oil pipeline underneath the Straits of Mackinac.

Enbridge said the move will delay its plan to replace a section of the existing Line 5 pipeline, which runs underwater for four miles (6.4 km) between Lakes Michigan and Lake Huron, and push back the start of construction until 2026.

“While we are supportive of a thorough, comprehensive and carefully considered permitting process that ensures adequate opportunity for review and comment, we are disappointed with the extended timeline for a project of this scope,” Enbridge spokesman Ryan Duffy said in a statement last week.

Enbridge submitted an application to build the $750-million tunnel in 2020 to address concerns Line 5 could leak into the Great Lakes. The 70-year-old pipeline carries 540,000 barrels per day from Superior, Wisconsin, to Sarnia, Ontario, and is at the center of a long-running legal dispute between Enbridge and the State of Michigan, which says it should be shut down.

The Detroit District of the U.S. Army Corps of Engineers (USACE) is responsible for evaluating Enbridge’s permit application and received more than 17,000 public comments during a scoping period that ended in October 2022, the USACE said in a statement.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

• 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

• 150, 23.5K DOT 111 Tanks needed off of Any in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

• 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

• 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

• 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of Any in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

• 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of Any in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

• 25-50, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

• 40, 30K 117R or 117J Tanks needed off of CP in MN for 1 Year . Cars are needed for use in Ethanol service.

• 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• 30-40, DOT 113 Tanks needed off of in for 5 Years. Cars are needed for use in CO2 service.

• 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

• 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

• 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

• 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

• 25-50, 5000-5100 Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

• 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

• 10-20, 20-25 CPC 1232 or 117J tanks needed off of UP CN in Illinois for 3-5 years. Cars are needed for use in Liquid feed service.

• 100-150, 4000CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

• 25, 30K 117Rs or Js Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Diesel service.

• 25, 340W Pressure Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Propane service.

• 100, 28.3K 117, CPC 1232, DOT 111 Tanks needed off of Any in Midwest for 1-2 Years. Cars are needed for use in Fuel Oil service.

• 25, 30K 117Rs or Js Tanks needed off of Any Class One in Midwest for 2-3 years. Cars are needed for use in Ethanol service.

• 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of Any in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

• 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 100-300, 31.8k CPC1232 or 117J Tanks needed off of various class 1s in Canada / US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , 340W Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 25.5K-28.3K 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

• 10, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, 3200 Covered Hoppers needed off of UP or BN in Texas.

• 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

• 10, 4000 Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

• 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

• 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 50, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 100, 6400CF, Covered Hoppers located off of NS or CSX in NY. Cars are clean Brand New and available for Sublease for 6-7 Months

• 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean/UAN.

• 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer/Corn syrup. Free Move

• 20, 20, Dot 111 Tanks located off of CSX in GA. Cars are clean

• 2, 20, Dot 111 Tanks located off of UP in TX. Cars are clean

• 5, 20, Dot 111 Tanks located off of UP in Tx. Cars were last used in Sulfuirc Acid. Free Move

Sales Offers

• 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

• 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

• 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|