“When you reach the end of your rope, tie a knot in it and hang on.”

Franklin D. Roosevelt

COVID 19 and Markets Update

We hope that everyone had a fantastic Memorial Day and were able to spend the time with family and friends and had a chance to reflect on those and their families that made the ultimate sacrifice for us!In the United States, we currently have 1.6 million confirmed COVID 19 cases and 99,462 confirmed deaths

Status of US Stay-at-Home and Re-Opening Orders

Well folks, the United States are now open for business with all states now open in some capacity. Some hardline democratic left leaning states still have major restrictions in place such as California, Illinois, Michigan and New York.On Thursday of last week, according to the Labor Department, U.S. workers filed an additional 2.4 million jobless claims, bringing the total losses since the coronavirus pandemic to almost 39 million – now exceeding the entire population of Canada.

While oil futures slid two percent on Friday of last week, it managed to close up 13 per cent week over week. West Texas Intermediate crude for July delivery closed down 67 cents to settle at $33.25 per barrel last Friday. Meanwhile, Brent for July settlement fell 93 cents to end the trading session at $35.13 per barrel on the ICE Futures Europe exchange

Oil is higher in overnight trading and as of the writing of this report, WTI is poised to open at $34.39 up $1.14 per barrel from Friday’s close.

The DOW traded down slightly on Friday 8.96 points (or 0.04%) to close out the week at 24,456.16 on the back of continuing tensions with China and geopolitical concerns. In overnight trading, DOW futures traded higher and as of the writing of this report is expected to open up 540 points.

You would think that the world would come together in an effort to fight COVID 19, but serious geopolitical risks for trade are reemerging. China is set to impose new national security legislation on Hong Kong after last year’s pro-democracy unrest, a Chinese official said last Thursday, drawing a warning from President Donald Trump that Washington would react “very strongly” against the attempt to gain more control over the city. The City of Hong Kong responded with demonstrations ignoring all social distancing rules laid down by the Chinese regime. Thousands of protesters swarmed some of Hong Kong’s busiest neighborhoods on Sunday, singing, chanting and erecting roadblocks of torn-up bricks and debris, as the police repeatedly fired tear gas, pepper spray and a water cannon during the city’s largest street mobilization in months.

Kim Jong-un of North Korea is at it again. After another weeks long absence from public view, North Korea’s leader, Kim Jong-un, has convened the country’s top military-governing body, outlining “new policies for further increasing” its nuclear capabilities and promoting top weapons officials, the North’s state-run media said on Sunday.

During the meeting of the Central Military Commission on the ruling Workers’ Party of Korea, Mr. Kim was said to have promoted Ri Pyong-chol to Vice Chairman of the Commission, expanding his influence. Ri has been in charge of building nuclear weapons and their delivery missiles.

U.S. airlines are showing signs of life and reporting small but notable upticks in passengers ahead of Memorial Day weekend. Delta says demand for beach destinations and activity “out west” grew and it is adding more flights to allow for social distancing on planes. Meanwhile, United Airlines unveiled new cleaning and safety protocols it hopes will put passengers’ minds at ease, including sneeze guards at check-in and touch-less kiosks.

A massive supply change swift is taking place in America that will affect intermodal traffic flows. At this time, it is difficult to pinpoint how traffic flows will be reset as more manufacturers are relocating out of China and most are trying to not rely on China for essential goods and services. Stay tuned to next week’s PFL rail report which will highlight the shifts underway and potential impact on rail.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

Railcar Volumes

Total North American rail volumes were down 20.5% year over year in week 19 (U.S. -22.1%, Canada -12.0%, Mexico -33.2%), resulting in quarter to date volumes that are down 19.7% and year to date volumes that are down 10.4% (U.S. -11.9%, Canada -6.2%, Mexico -6.7%). All of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-13.8%), coal (-39.8%), motor vehicles & parts (-90.2%) and metallic ores & metals (-27.6%).In the East, CSX’s total volumes were down 26.2%, with the largest decreases coming from intermodal (-18.1%), motor vehicles & parts (-96.4%) and coal (-43.1%). NS’s total volumes were down 30.9%, with the largest decreases coming from intermodal (-19.7%), coal (-59.9%), motor vehicles & parts (-92.7%), metals & products (-49.7%) and chemicals (-27.0%).

In the West, BN’s total volumes were down 20.9%, with the largest decreases coming from coal (-43.2%), intermodal (-11.1%), motor vehicles & parts (-83.4%) and petroleum (-37.1%). UP’s total volumes were down 24.6%, with the largest decreases coming from intermodal (-24.5%), motor vehicles & parts (-91.0%), coal (-29.8%) and chemicals (-19.5%). The largest increase came from grain (+18.2%).

In Canada, CN’s total volumes were down 16.4% with the largest decreases coming from motor vehicles & parts (-92.6%), petroleum (-38.8%), metallic ores (-22.5%), stone sand & gravel (-65.1%), intermodal (-3.4%) and coal (-27.7%). The largest increase was farm products (+63.6%). RTMs were down 14.9%. CP’s total volumes were down 9.3%, with the largest decreases coming from motor vehicles & parts (-87.7%), petroleum (-46.5%), coal (-27.9%) and stone sand & gravel (-71.8%). RTMs were down 10.1%.

KCS’s total volumes were down 28.7%, with the largest decreases coming from intermodal (-30.9%) and motor vehicles & parts (-97.5%).

During the first quarter of this year, new railcar orders decreased 2,300 units or -27% to 6,200 units from 8,500 during the fourth quarter of 2019. Backlog fell 10% to 46,300. We expect order trends to continue given current headwinds related to weak rail volumes, elevated railcar storage levels, PSR implementation and a distressed energy sector. FTR Intel recently lowered its 2020 delivery forecast to 20.6K units (from 38.2K units) and lowered its 2021 delivery forecast to 22.3K units (from 35.8K units). This forecast now assumes a 64% year-over-year decline in 2020 and an 8% year-over-year increase in 2021.

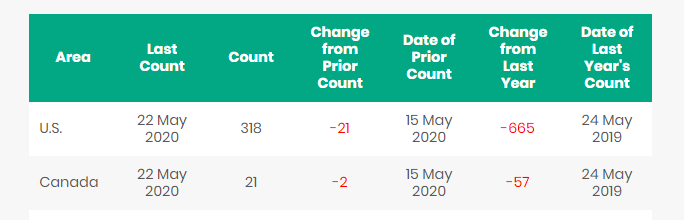

North American Rig Count

Total North American rail volumes were down 20.9% year over year in week 20 (U.S. -22.0%, Canada -15.7%, Mexico -27.1%), resulting in quarter to date volumes that are down 19.9% and year to date volumes that are down 11.0% (U.S. -12.5%, Canada -6.7%, Mexico -7.8%). All of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-12.3%), coal (-42.2%), motor vehicles & parts (-87.9%) and metallic ores & metals (-29.7%).In the East, CSX’s total volumes were down 23.9%, with the largest decreases coming from motor vehicles & parts (-91.7%), intermodal (-13.8%) and coal (-44.6%). NS’s total volumes were down 29.6%, with the largest decreases coming from intermodal (-19.9%), coal (-60.5%), motor vehicles & parts (-91.1%), metals & products (-46.4%) and chemicals (-22.7%).

In the West, BN’s total volumes were down 20.9%, with the largest decreases coming from coal (-47.3%), intermodal (-8.6%), petroleum (-45.3%) and motor vehicles & parts (-79.9%). UP’s total volumes were down 24.2%, with the largest decreases coming from intermodal (-20.8%), motor vehicles & parts (-91.1%), coal (-26.3%), chemicals (-15.5%) and stone sand & gravel (-26.8%).

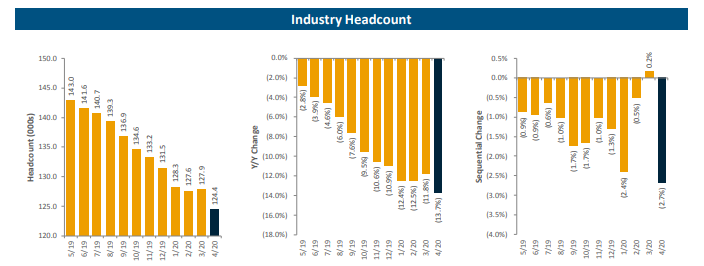

In Canada, CN’s total volumes were down 19.6% with the largest decreases coming from motor vehicles & parts (-92.6%), stone sand & gravel (-72.9%), metallic ores (-23.6%), petroleum (-37.1%) and intermodal (-4.9%). The largest increase was farm products (+95.5%). RTMs were down 20.2%. CP’s total volumes were down 12.4%, with the largest decreases coming from motor vehicles & parts (-93.2%), petroleum (-44.8%) and coal (-23.1%). RTMs were down 9.5%. KSU’s total volumes were down 27.7%, with the largest decreases coming from intermodal (-27.2%), motor vehicles & parts (-96.2%) and petroleum (-33.5%). The Surface Transportation Board (STB) has released April headcount data for the U.S. rails. For the industry as a whole, April headcount was down 13.7% year over year versus March headcount that was down 11.8% year over year. On a sequential basis, industry headcount was down 2.7%. The most substantial year over year decline occurred at the NS while the most substantial sequential decline occurred at the BN. More detail on the recent monthly trends in headcount is provided on the following in the chart below:

North American Rig Count Summary

Railcar Markets

PFL is offering: Various tank cars for lease with potential dirty to dirty service including gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Sand cars, Box cars, coal cars and hoppers. A number of cars are available for sale.

PFL is seeking: Older DOT 111 cars 25,000 to 26,000 – can be either coiled or non-coiled on a 3-5 year lease – must be clean. 15-20 5200 Cuft hoppers for grain service, Plate C boxcars for purchase, lined cars suitable for propylene glycol service

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

Lease Offers

Lease Bids

Sales Offers

Sales Bids

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|