“We are masters of the unsaid words, but slaves of those we let slip out.”

– Winston Churchill

Jobs Update

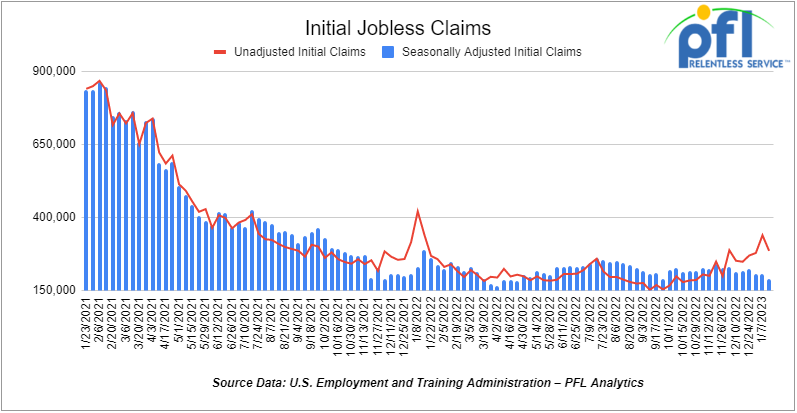

- Initial jobless claims for the week ending January 14th, 2023 came in at 190,000, down -15,000 people week-over-week.

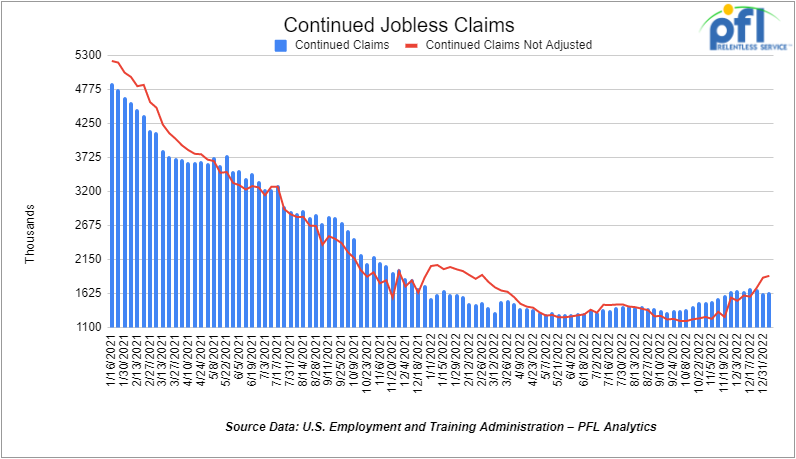

- Continuing jobless claims came in at 1.647 million people, versus the adjusted number of 1.630 million people from the week prior, up +17,000 people week over week.

Stocks closed higher on Friday of last week and mixed week over week

The DOW closed higher on Friday of last week, up +330.93 points (+1%), closing out the week at 33,375.49, down -927.12 points week over week. The S&P 500 closed higher on Friday of last week, up +73.76 points (1.89%) and closed out the week at 3,972.61, down -26.48 points week over week. The NASDAQ closed higher on Friday of last week, up +288.17 points (2.6%), and closed the week at 11,140.44, up 61.28 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,459 this morning down -15 points.

WTI closed higher on Friday of last week and up week over week

WTI traded up $0.98 per barrel (+1.2%) to close at $81.31 per barrel on Friday of last week, up $1.45 per barrel week over week. Brent traded up US$1.47 per barrel (+1.7%) on Friday of last week, to close at US$87.63 per barrel, up $2.35 per barrel week over week.

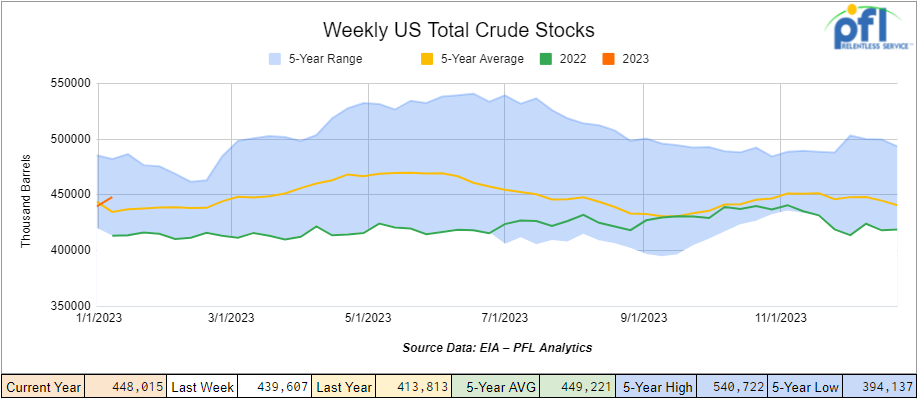

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.4 million barrels week over week. At 448.0 million barrels, U.S. crude oil inventories are 3% above the five-year average for this time of year.

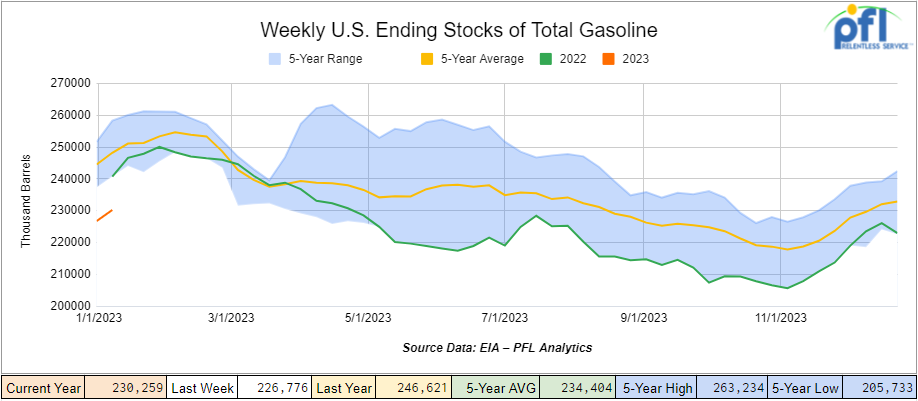

Total motor gasoline inventories increased by 3.5 million barrels week over week and are 8% below the five-year average for this time of year.

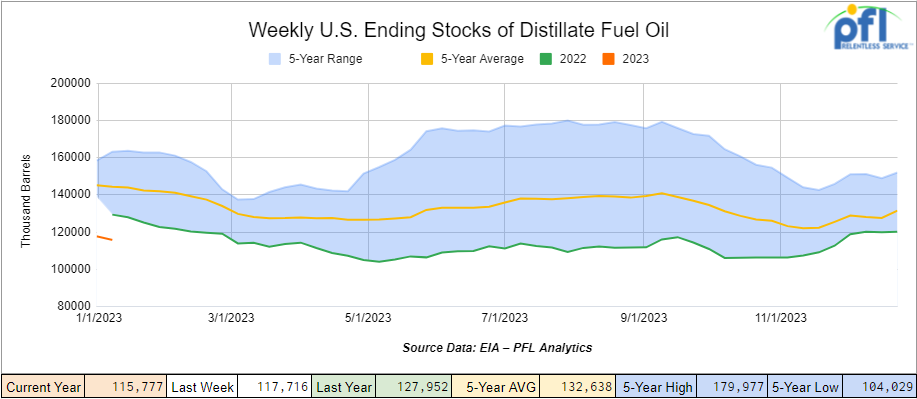

Distillate fuel inventories decreased by 1.9 million barrels week over week and are 20% below the five-year average for this time of year.

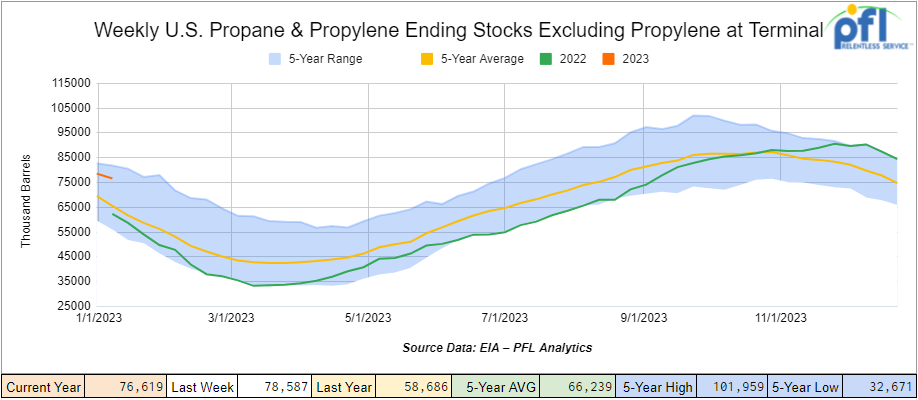

Propane/propylene inventories decreased by 2.0 million barrels week over week and are 21% above the five-year average for this time of year.

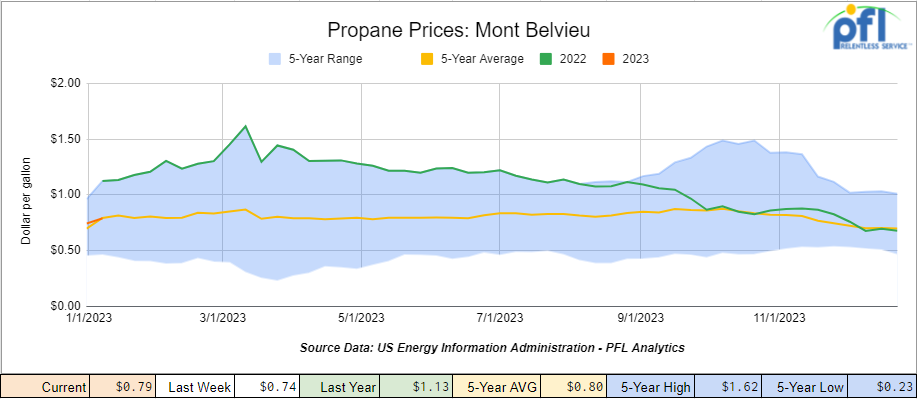

Propane prices were up +5 cents per gallon week over week, closing at 79 cents per gallon, down -34 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 2.4 million barrels for the week ending January 13th, 2023.

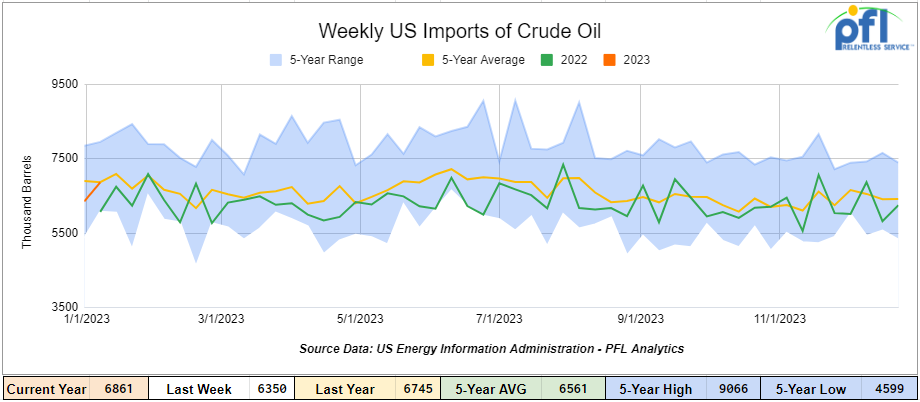

U.S. crude oil imports averaged 6.9 million barrels per day during the week ending January 13th, 2023, an increase of 511,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 1.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 556,000 barrels per day, and distillate fuel imports averaged 148,000 barrels per day during the week ending January 13th, 2023.

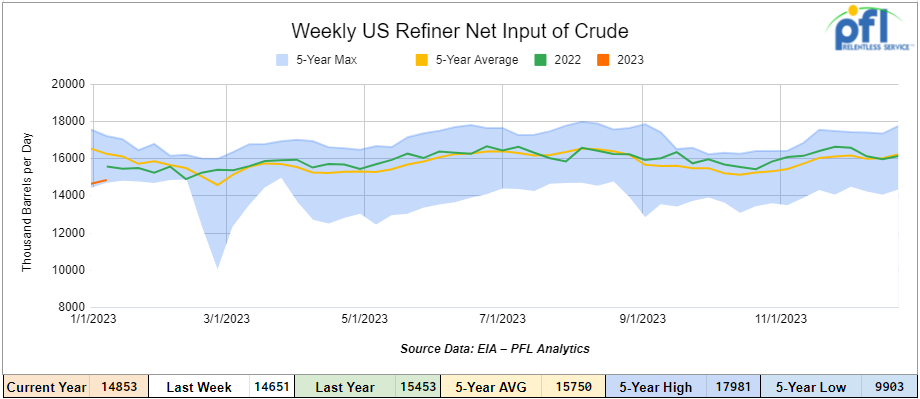

U.S. crude oil refinery inputs averaged 14.9 million barrels per day during the week ending January 13, 2023 which was up 203,000 barrels per day week over week.

As of the writing of this report, WTI is poised to open at $81.87 up $0.23 per barrel from Monday’s close.

North American Rail Traffic

Week Ending January 14th, 2022.

Total North American weekly rail volumes were down (-0.14%) in week 2 compared with the same week last year. Total carloads for the week ending on January 14th were 362,926, up (+5.55%) compared with the same week in 2022, while weekly intermodal volume was 303,646, down (-6.17%) compared to the same week in 2022. 8 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant increase coming from Grain (+21.22%). The largest decrease was from Chemicals (-7.26%).

In the east, CSX’s total volumes were up (+0.32%), with the largest decrease coming from Chemicals (-9.92%) and the largest increase Motor Vehicles and Parts (+29.99%). NS’s volumes were up (4.69%), with the largest decrease coming from Chemicals (-4.3%) and the largest increase from Other (+45.40%).

In the West, BN’s total volumes were down (-6.18%), with the largest decreases coming from Chemicals (-14.12%), and the largest increase coming from Grain (+28.15%). UP’s total rail volumes were up (0.03%) with the largest decrease coming from Forest Products (-20.74%) and the largest increase coming from Grain (+15.19%).

In Canada, CN’s total rail volumes were up (4.84%) with the largest decrease coming from Other (-9.42%) and the largest increase coming from Nonmetallic Minerals (+27.91%). CP’s total rail volumes were up (+0.55%) with the largest decrease coming from Intermodal (-32.46%) and the largest increase coming from Other (+86.36%).

KCS’s total rail volumes were up (+6.23%) with the largest decrease coming from Farm Products (-22.42%) and largest increase coming from Other (+50.51%).

Source Data: AAR – PFL Analytics

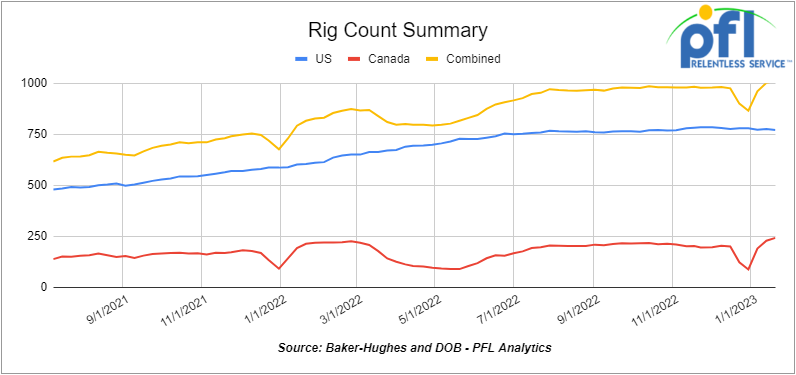

Rig Count

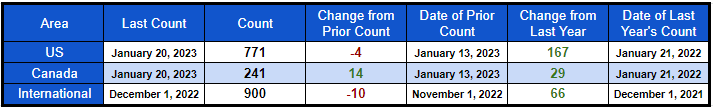

North American rig count was up by 10 rigs week over week. U.S. rig count, down by -4 rigs week-over-week and up by +167 rigs year over year. The U.S. currently has 771 active rigs. Canada’s rig count was up by 14 rigs week-over-week and up by 29 rigs year-over-year. Canada’s overall rig count is 241 active rigs. Overall, year over year, we are up +196 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,836 from 23,554, which was a gain of 282 railcars week-over-week. Canadian volumes were higher; CP’s shipments increased by +31% week over week, and CN’s volumes were up by +4.9% week over week. U.S. shipments were mostly higher. The BN had the largest percentage increase and was up by +8%. The CSX was down by -4.5%.

We are watching Intermodal – To ‘struggle’ in 2023 FTR

Todd Tranausky, Vice President for rail and intermodal at FTR and a friend of PFL said during a webinar last week that intermodal is going to have a tough time. Previous conversations with PFL were along the same lines and we agree with Todd and seeing it in the numbers reported by the AAR – car loads are up intermodal is down. Why? Weaker demand, a competitive truck market and a shift in U.S. port activity away from the West Coast to East and Gulf ports that utilize shorter inland hauls.

Intermodal’s ability to compete with trucks has steadily eroded since the second half of 2022, and that will persist through the middle point of this year, according to Todd. Todd further said “Intermodal will have an uphill climb relative to truckload in terms of attracting volume, and this just piles on in addition to the port shifts that call for more short-haul than long-haul movements.”

That market environment favoring trucks could result in better pricing for rail shippers, but it remains to be seen how much the railroads are willing to respond to that pricing pressure, especially given higher operational costs following the new labor agreement, he said.

Todd in a telephone conversation with PFL is bearish on service at the class 1’s improving in the short term even though more staff has been added as he expects more early retirement and the workers being hired now don’t seem to stick around that long. “We definitely saw some progress on the hiring process, but it took the first half of the year to get where they were just treading water,” Todd said.

Poorer service will lead to more rail cars on the system than needed because of bad turn times which is something that shippers seem to be getting used to, but of course don’t like. Makes for a tight railcar market – good for the car owner /lessor not so good for shippers for obvious reasons. If service does improve expect to see more rail cars sent to storage!

Meanwhile, the Federal Railroad Administration is warning class 1’s that it will take action if they fail to adequately address deficiencies in their training, qualification and certification programs for train crews. In a January 5th letter to the top executives at the seven class 1’s and Association of American Railroads, FRA Administrator Amit Bose noted that some changes made to training, qualification and certification programs have not adequately addressed the deficiencies the agency identified in audits of those programs. Bottom line is, Class 1’s under a lot of pressure to perform and to increase staff, but do it safely and get America rolling in full force. Stay tuned to PFL.

We Were at MARS in Chicago Last Week

MARS this year in Chicago was an incredible conference and PFL was a proud sponsor. Official registration was 951 people, but there was way more hanging around in the lobby – locals just there for meetings. PFL was there in full force with Curtis Chandler, David Cohen and Brian Baker in attendance and we had a very busy table in the exhibition hall. All shippers at the conference were focused on service of the class 1’s and turn times. Folks, it was the same old same old – no specific promises from the class 1’s bottom line but all claim they are doing what they can. People were there to do deals – seemingly everyone has something going on and have 2023 objectives that need to be met. For more information on MARS contact PFL today.

We Continue to watch Natural Gas and Freeport

Natural gas continued its decline last week closing out the trading week at $3.174 per MMBTU at Henry Hub.

Freeport LNG’s shut-in 2 BCF per day LNG export facility in Texas started receiving natural gas from pipelines over the Martin Luther King Jr holiday weekend, according to data from Refinitiv, a possible sign the plant is finally moving closer to exiting an outage.

The last time gas flowed to Freeport was in late December when the plant was using the fuel to maintain a flare system. Officials at Freeport, which shut in due to a fire at the facility on June 8, 2022, said the plant was still on track to restart in the second half of January, pending regulatory approvals. Stay tuned to PFL for further updates we have a close eye on this one.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 30-50, 117 Tanks needed off of Any in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 10, 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, Covered Hoppers needed off of UP or BN in Texas.

• 10-12, Pressure Tanks needed off of UP in utah to cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 50, CPC1232 or 117J Tanks needed off of UP or CSX in multiple locations for 3-5 Years. Cars are needed for use in Tall Oil service. Lined or Unlined

• 100-300, Any Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, Any Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 2-4, Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 5, CPC1232 Tanks needed off of CSX in West Virginia for 2 years plus. Cars are needed for use in Polyacrylamide service. Unlined

• 10-15, 300W Pressures needed off of BNSF, KCS, or UP in Texas for 5-8 years. Cars are needed for use in Various service.

• 5, Tanks needed off of KCS in Texas for 5 years. Cars are needed for use in Calcium Chloride service. Need the cars for 5 years to load from Monterey MX to Corpus and transload to trucks. Need to be lined

• 50, Covered Hoppers needed off of BNSF, CN, CP, NS, orUP in the midwest for 5 years. Cars are needed for use in DDG service.

• 50-65, trough tops Covered Hoppers needed off of most class 1s in various locations for 2-3 years. Cars are needed for use in Fertilizer service.

• 25, gravity and pneumatic Covered Hoppers needed off of NS and others maybe in the east or south for Open. Cars are needed for use in Sugar service. Open to purchase as well.

• 10-100, Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 20, Boxcars needed off of BNSF or UP in the west for 1-3 years. Requires sliding doors.

• 10, Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennesse & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• Up to 60, Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 25-50, Covered Hoppers needed off of various class 1s in Texas for 3-4 months. Cars are needed for use in Urea / Potash service. 3 hatch gravity dumps

• 20, Covered Hoppers needed off of BNSF, KCS in Texas for 3-5 years. Cars are needed for use in Potash service. 3-bay gravity dumps

• Up to 40, Covered Hoppers needed off of any class 1 in the east for 1-3 years. Cars are needed for use in Fertilizer service. Would consider a gondola as well. Call for details.

• 30, Covered Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• 30, any Boxcars needed off of CP, UP in any location for 3 years. Cars are needed for use in Barite Powder service. Call for details

• 30, any Gondolas needed off of CP, UP in any location for 3 years. Cars are needed for use in Barite Powder service. Call for details

• 40, Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 30-40, Mill Gondolas needed off of CSX, NS in the northeast for 3-5 Years. Call for details

• 20-30, Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

• 50-100, Any Tanks needed off of UP or BN in Any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

• 225, Covered Hoppers needed off of CSX, NS in the southeast for 5 years. Cars are needed for use in Plastic service. Call for details

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20-30, PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

• 100, Tanks needed off of CSX or NS in the east. Cars are needed for use in Molton Sulfer service.

• 20, Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 10, Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20, Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

PFL is offering:

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 150, 3250 CF, hopper Hoppers located off of various class 1s in multiple locations. For sale

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 100, 29K, 117R Tanks located off of UP in Washington. Cars are clean Built in 2014. Coiled and insulated.

• 100, 29K, 117R Tanks located off of UP in Washington State. 2014. Coiled and insulated clean

• 150, 31.8, 117R Tanks located off of KCS in Texas. Cars are clean Currently being shopped. Call for info.

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 100, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 200, 29K, 117J Tanks located off of BNSF, UP in Oklahoma & Texas. Cars are clean Hempel 15500 Lining.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|