“Hate cannot drive out hate; only love can do that”.

– Martin Luther King Jr.

Jobs Update

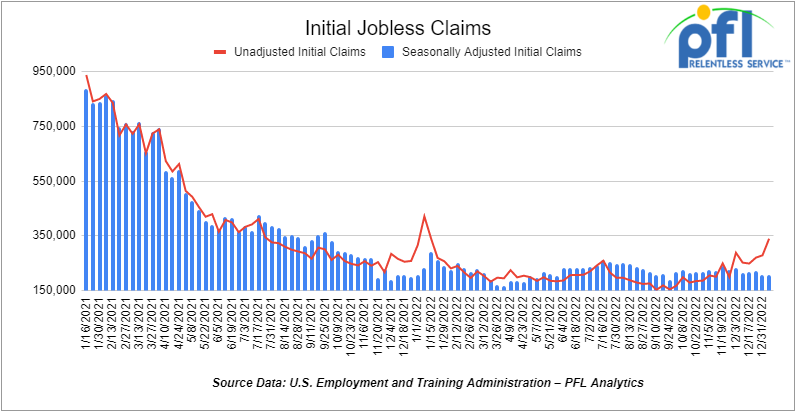

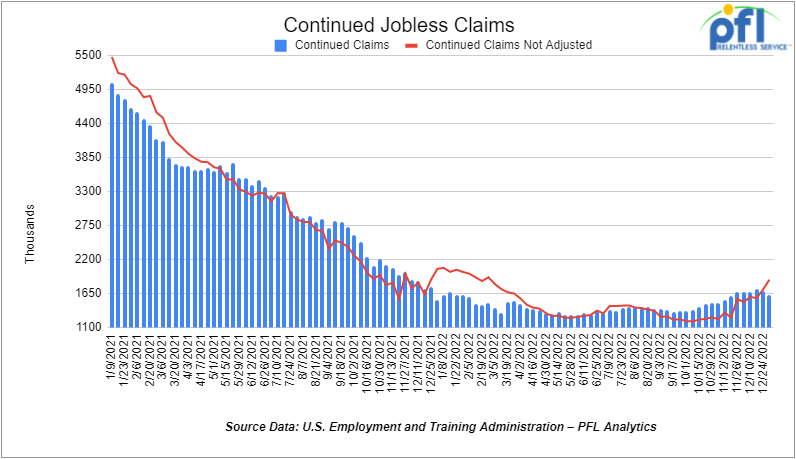

- Initial jobless claims for the week ending January 7th, 2023 came in at 205,000, down -1,000 people week-over-week.

- Continuing jobless claims came in at 1.634 million people, versus the adjusted number of 1.697 million people from the week prior, down -63,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up +112.64 points (+0.33%), closing out the week at 34,302.61, up 672 points week over week. The S&P 500 closed higher on Friday of last week, up +15.92 points (0.40%), and closed out the week at 3,999.09, up 104.01 points week over week. The NASDAQ closed higher on Friday of last week, up +78.05 points (0.74%), and closed the week at 11,079.16, up 509.84 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,360 this morning down -56 points.

WTI closed higher on Friday of last week and up week over week

WTI traded up $1.47 per barrel (+1.9%) to close at $79.86 per barrel on Friday, up $6.09 per barrel week over week. Brent traded up US$1.25 per barrel (+1.5%) on Friday of last week, to close at US$85.28 per barrel, up $6.71 per barrel week over week.

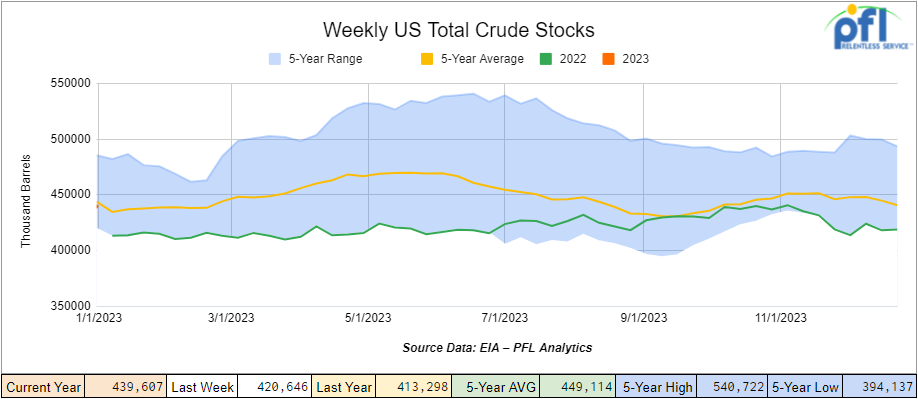

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 19 million barrels week over week. At 439.6 million barrels, U.S. crude oil inventories are 1% above the five-year average for this time of year.

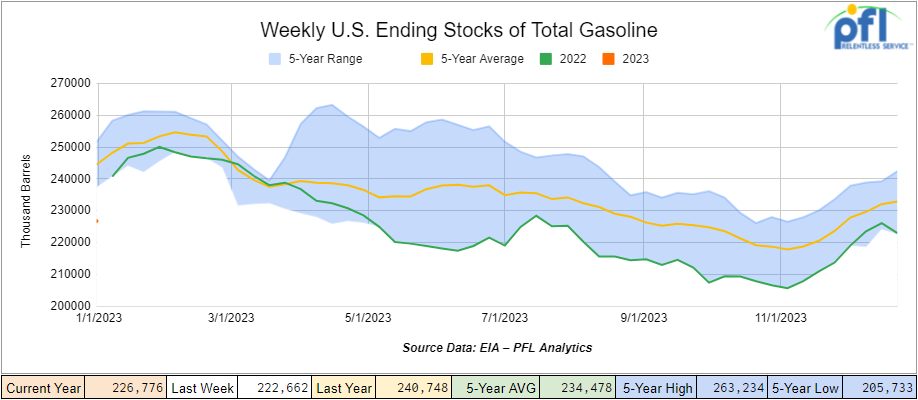

Total motor gasoline inventories increased by 4.1 million barrels week over week and are 7% below the five-year average for this time of year.

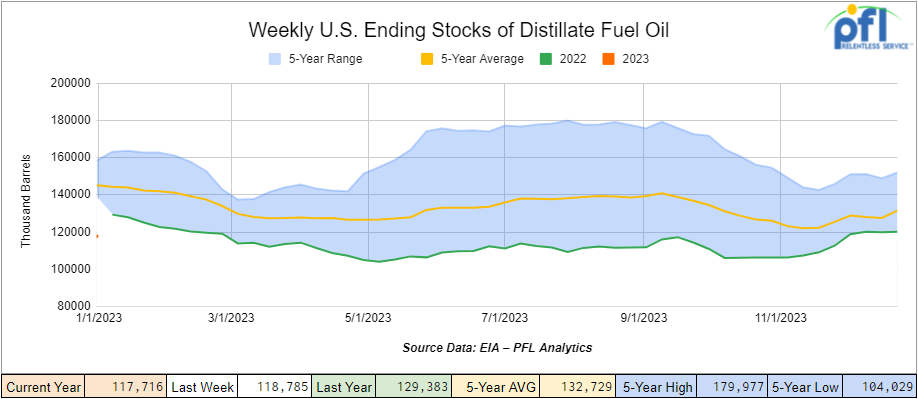

Distillate fuel inventories decreased by 1.1 million barrels week over week and are 18% below the five-year average for this time of year.

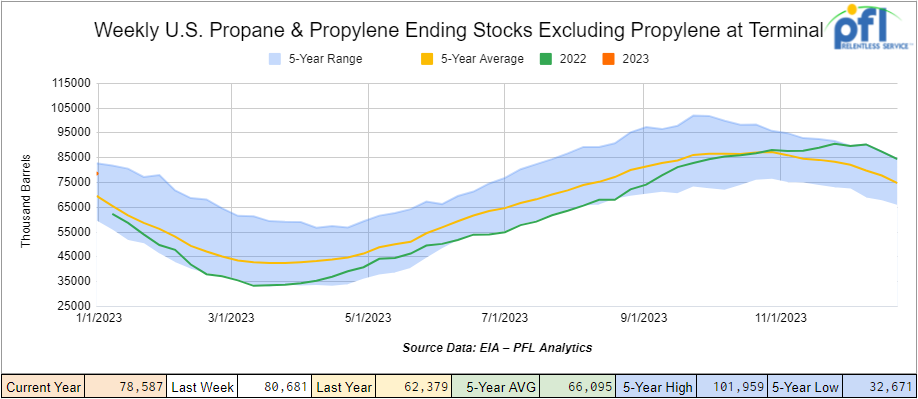

Propane/propylene inventories decreased by 2.1 million barrels week over week and are 18% above the five-year average for this time of year.

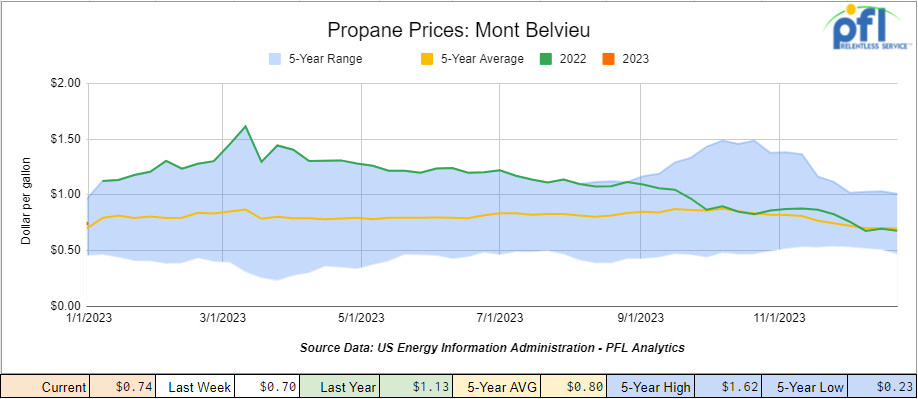

Propane prices were up 4 cents per gallon week over week, closing at 74 cents per gallon, down 39 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 22.4 million barrels for the week ending January 6th, 2023.

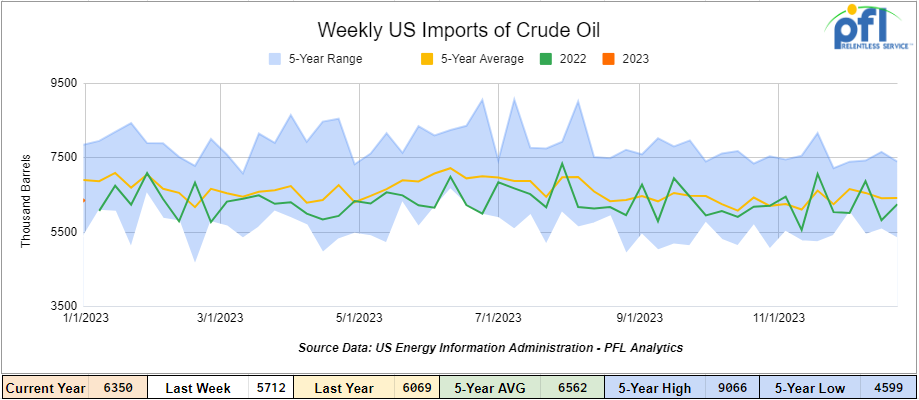

U.S. crude oil imports averaged 6.4 million barrels per day last week, an increase of 637,000 barrels per day during the week ending January 6th, 2023. Over the past four weeks, crude oil imports averaged 6 million barrels per day, 3.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 516,000 barrels per day, and distillate fuel imports averaged 209,000 barrels per day during the week ending January 6th, 2023.

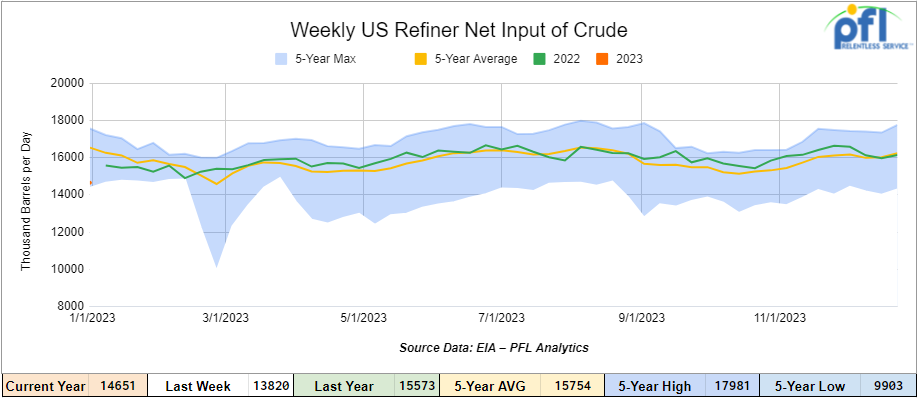

U.S. crude oil refinery inputs averaged 14.7 million barrels per day during the week ending January 6, 2023, which was up 831,000 barrels per day week over week.

As of the writing of this report, WTI is poised to open at $79.57, down -$0.29 per barrel from Monday’s close.

North American Rail Traffic

Week Ending January 7th, 2022.

Total North American weekly rail volumes were down (-3.01%) in week 1 compared with the same week last year. Total carloads for the week ending on January 7th were 323,172, up (+3.21%) compared with the same week in 2022, while weekly intermodal volume was 255,090, down (-10.18%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant increase coming from Petroleum and Petroleum Products (+18.13%). The largest decrease was from Chemicals (-13.88%).

In the east, CSX’s total volumes were up (+2.18%), with the largest decrease coming from Chemicals (-10.15%) and the largest increase from Grain (+67.3%). NS’s volumes were down (-1.15%), with the largest decrease coming from Chemicals (-17.05%) and the largest increase from Other (+28.4%).

In the West, BN’s total volumes were down (-7.44%), with the largest decreases coming from Chemicals (-7.47%), and the largest increase coming from Petroleum and Petroleum Products (+33.65%). UP’s total rail volumes were down (-3.13%) with the largest decrease coming from Forest Products (-16.71%) and the largest increase coming from Motor Vehicles and Parts (+26.28%).

In Canada, CN’s total rail volumes were down (-6.02%) with the largest decrease coming from Intermodal (-25.55%) and the largest increase coming from Petroleum and Petroleum Products (+26.11%). CP’s total rail volumes were down (-8%) with the largest decrease coming from Intermodal (-31.13%) and the largest increase coming from Other (+108.11%).

KCS’s total rail volumes were up (+6.22%) with the largest decrease coming from Chemicals (-20.38%) and the largest increase coming from Coal (+48.27%).

Source Data: AAR – PFL Analytics

Rig Count

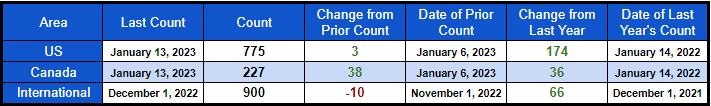

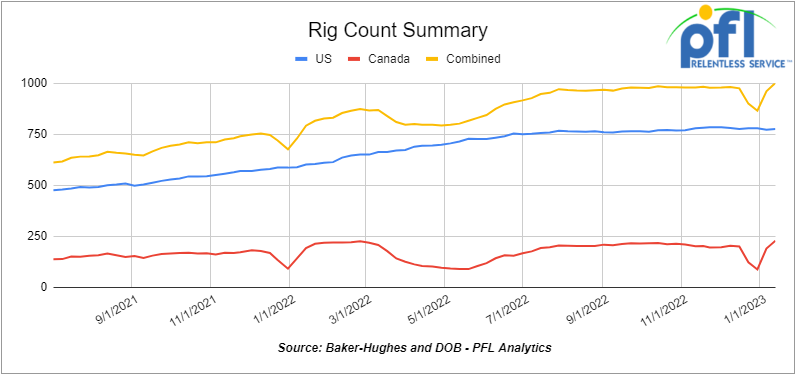

North American rig count was up by 41 rigs week over week. U.S. rig count is up by 3 rigs week-over-week and up by +174 rigs year over year. The U.S. currently has 775 active rigs. Canada’s rig count was up by 38 rigs week-over-week, and up by 36 rigs year-over-year. Canada’s overall rig count was 227 active rigs. Overall, year over year, we are up +210 rigs collectively and have breached 1,000 active rigs a level not seen since 2019.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,554 from 23,656, which was a loss of 102 railcars week-over-week Canadian volumes were down; CP’s shipments decreased by -13.7% week over week, and CN’s volumes were down by -2.9% week over week. U.S. shipments were higher on all class 1’s. The CSX had the largest percentage increase and was up by+23%.

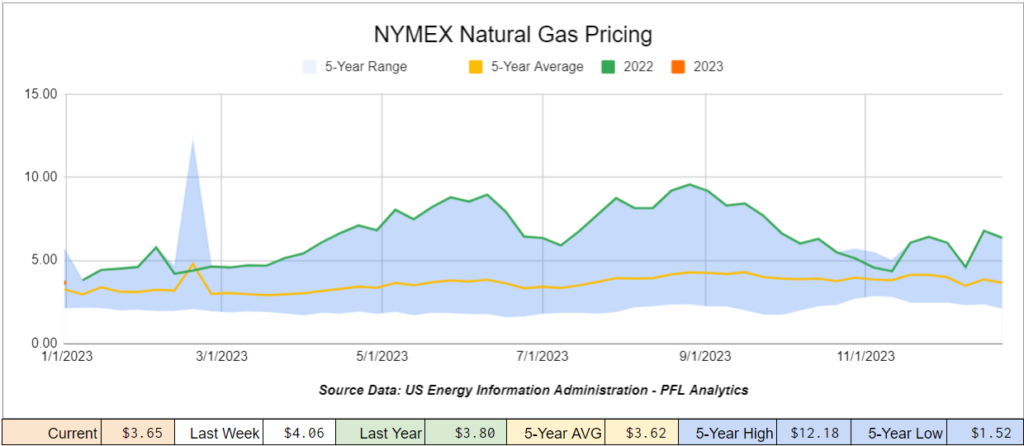

We continue to watch Natural Gas

Natgas continued to tumble last week as growing production and warm weather has set in and some calling winter over. What has become a significant problem for the price of natural gas is not only the weather and rising production but the continued delay in Freeport’s LNG terminal restart. Top U.S. Natgas exporter, Freeport LNG, according to market sources is expected to further extend the seven-month-long outage of its liquefied natural gas (LNG) export plant in Texas to February, as it awaits regulatory approvals. When the facility is operational Freeport is 20% (2 BCF per day) of U.S. LNG exports.

Freeport LNG spokeswoman said the restart timeline still stands and the company was still targeting the second half of this month for the safe, initial restart of its liquefaction facility, pending regulatory approvals.

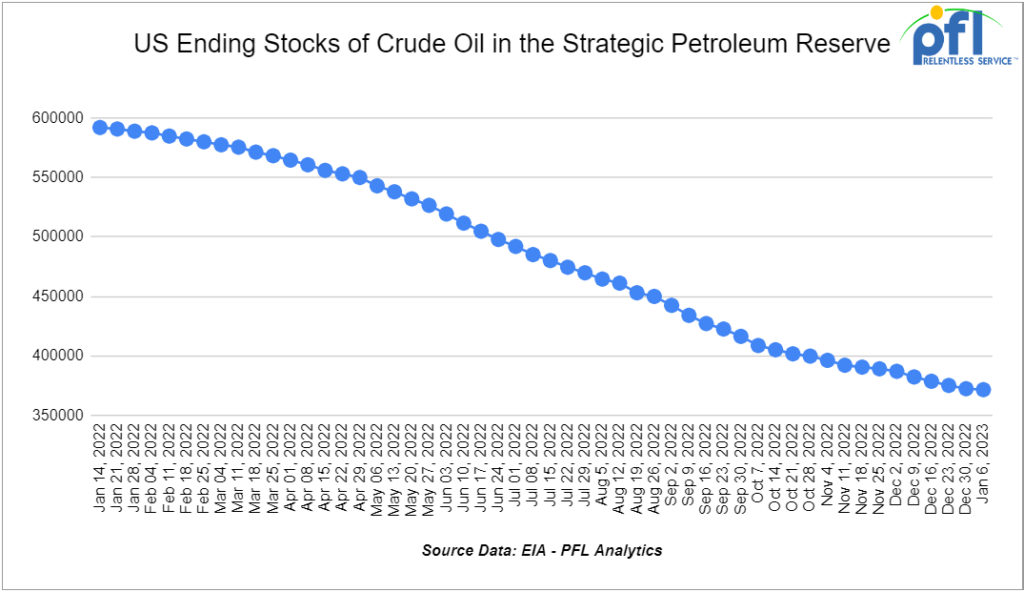

We continue to watch the Strategic Petroleum Reserves

On 12/19/2022 we reported the following:

“The U.S. Department of Energy’s (DOE) Office of Petroleum Reserves announced on Friday of last week that it will start repurchasing crude oil for the Strategic Petroleum Reserve (SPR) that it sold. According to the DOE this repurchase is an opportunity to secure a good deal for American taxpayers by repurchasing oil at a lower price than the $96 per barrel average price it was sold for, as well as to strengthen energy security. Last Friday’s notice will pilot this new approach by starting with a purchase of up to 3 million barrels of sour crude oil.”

Not so fast folks, it looks as though all offers to supply and fill us back up were rejected last week. The U.S. The Department of Energy (‘DOE”) has rejected the first batch of offers from oil companies to resupply a small amount of oil to the nation’s Strategic Petroleum Reserves (“SPR”) in February, according to a DOE spokesperson. “Following review of the initial submission, DOE will not be making any award selections for the February delivery window,” a DOE spokesperson said in an emailed statement.

“DOE will only select bids that meet the required crude specifications and that are at a price that is a good deal for taxpayers,” the spokesperson said. We don’t know any details as far as what was submitted.

President Joe Biden had announced a 180 million barrel sale from the SPR in late March of 2022 to combat surging gasoline prices after the February invasion of Ukraine by Russia. In releasing reserves from the SPR, it has caused stress on the equipment at the facilities themselves, costing taxpayers an estimated $50 Billion in equipment upgrades so far. The SPR was never designed to be a commercial oil storage facility. With oil closing near $80 per barrel on Friday of last week we will have to see where this one goes. To us it does not look like a win for taxpayers. Crude by rail implications are unclear with Venezuela crude hitting our shores this week! As a recap, below is a chart showing where we sit now volume wise in the SPR and where we came from:

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 30-50, 117 Tanks needed off of Any in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 30-50, 117 Tanks needed off of Any in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 10, 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, Covered Hoppers needed off of UP or BN in Texas.

• 10-12, Pressure Tanks needed off of UP in utah to cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 50, CPC1232 or 117J Tanks needed off of UP or CSX in multiple locations for 3-5 Years. Cars are needed for use in Tall Oil service. Lined or Unlined

• 100-300, Any Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, Any Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 2-4, Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

or use in Cement service. C612

• 100, Tanks needed off of CSX or NS in the east. Cars are needed for use in Molton Sulfer service.

• 20, Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 10, Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20, Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

PFL is offering:

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 150, 3250 CF, hopper Hoppers located off of various class 1s in multiple locations. For sale

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 100, 29K, 117R Tanks located off of UP in Washington. Cars are clean Built in 2014. Coiled and insulated.

• 100, 29K, 117R Tanks located off of UP in Washington State. 2014. Coiled and insulated clean

• 150, 31.8, 117R Tanks located off of KCS in Texas. Cars are clean Currently being shopped. Call for info.

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 200, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 200, 29K, 117J Tanks located off of BNSF, UP in Oklahoma & Texas. Cars are clean Hempel 15500 Lining.

• 139, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Brand New Cars!

• 100, 5,700 – 5,800 CF, Hoppers located off of various class 1s in multiple locations. Pneumatic Covered Hopper

• 100, 5000 – 5001 CF, Hoppers located off of various class 1s in multiple locations. Pressureaide

• 100, 4200 CF, Hoppers located off of various class 1s in multiple locations. Aluminum Rotary Hopper

• 100, 4000 – 4999 CF, Hoppers located off of various class 1s in multiple locations. Steel Quad Hopper

• 100, 3000 CF, Covered Hoppers located off of various class 1s in multiple locations. Gravity

• 150, 31.8K, 117R Tanks located off of various class 1s in Texas.

• 32, 111A Tanks located off of various class 1s in multiple locations. Exterior Coiled & 4” Fiberglass Insulated; Full Head Shield; All cars are perfect for chemical as well as crude/oil service. All cars will qualify for DOT117R retrofit with application of removable bottom outlet valve handle and are available for inspection.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|