“New year—a new chapter, new verse, or just the same old story? Ultimately we write it. The choice is ours.”

—Alex Morritt

Jobs Update

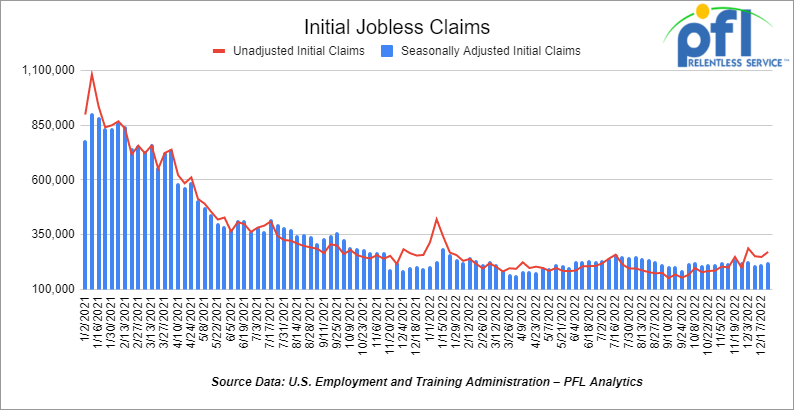

- Initial jobless claims for the week ending December 24th, 2022 came in at 225,000, up +9,000 people week-over-week.

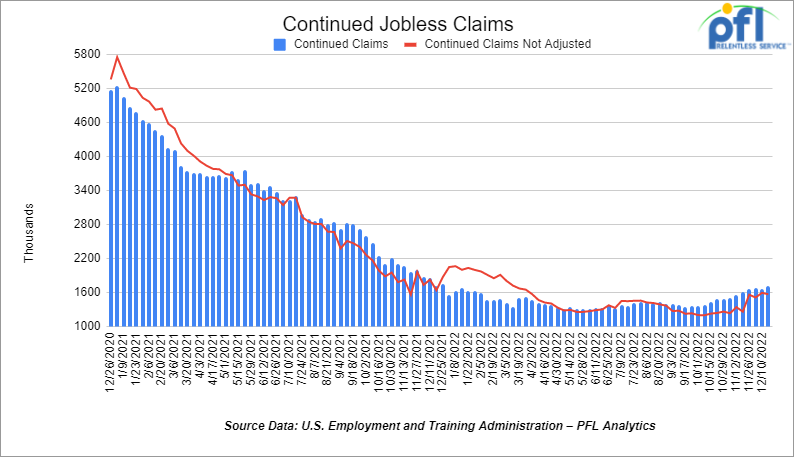

- Continuing jobless claims came in at 1.71 million people, versus the adjusted number of 1.669 million people from the week prior, up 41,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -73.55 points (-0.22%), closing out the week at 33,147.25, down -56.68 points week over week. The S&P 500 closed lower on Friday of last week, down- 9.78 points (-0.25%), and closed out the week at 3,839.50, down -5.33 points week over week. The NASDAQ closed lower on Friday of last week, down -11.61 points (-0.11%), and closed the week at 10,466.48 10,497.86, down -31.38 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,600 this morning up 315 points.

Oil closed higher on Friday of last week and up week over week

WTI traded up $1.86 per barrel (+2.4%) to close at $80.26 per barrel on Friday of last week to end the year, up 70 cents per barrel week over week. Brent traded up US$2.45 per barrel (+2.94%) on Friday of last week, to close at US$85.91 per barrel, up $1.99 per barrel week over week.

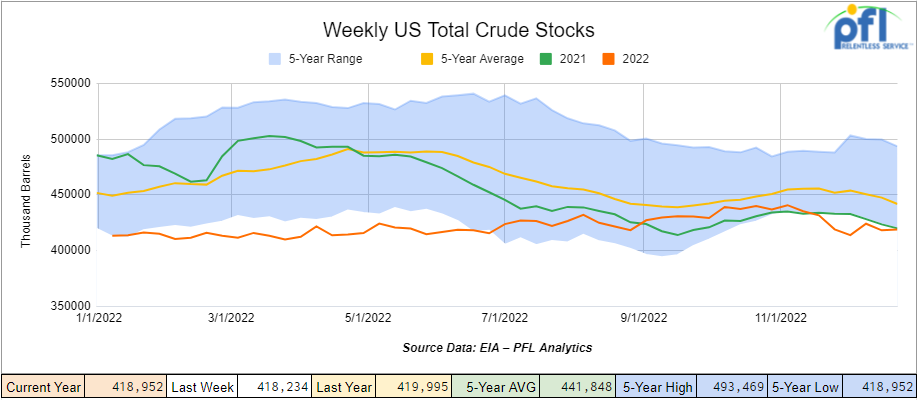

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 700,000 barrels week over week. At 419 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

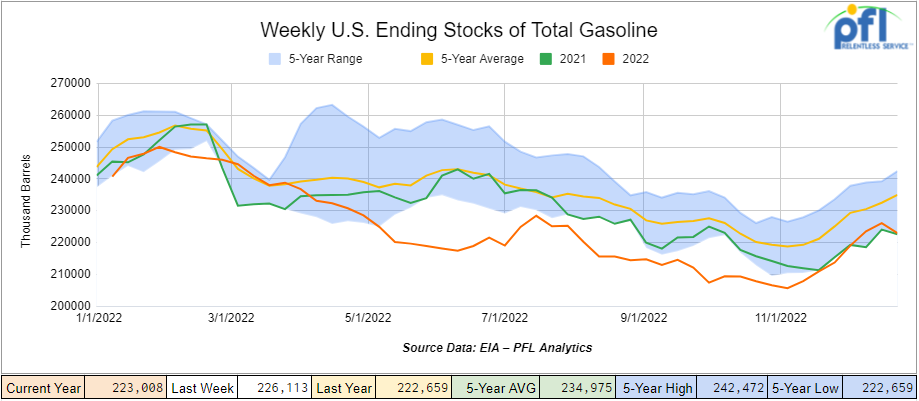

Total motor gasoline inventories decreased by 3.1 million barrels week over week and are 4% below the five-year average for this time of year.

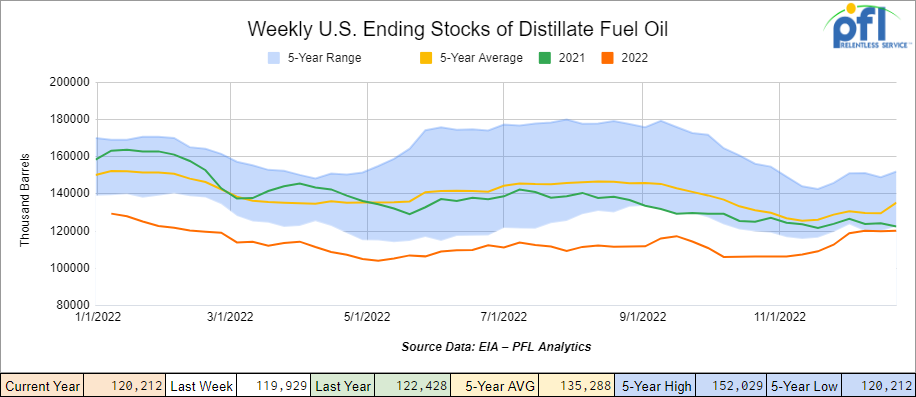

Distillate fuel inventories increased by 300,000 barrels week over week and are 7% below the five-year average for this time of year

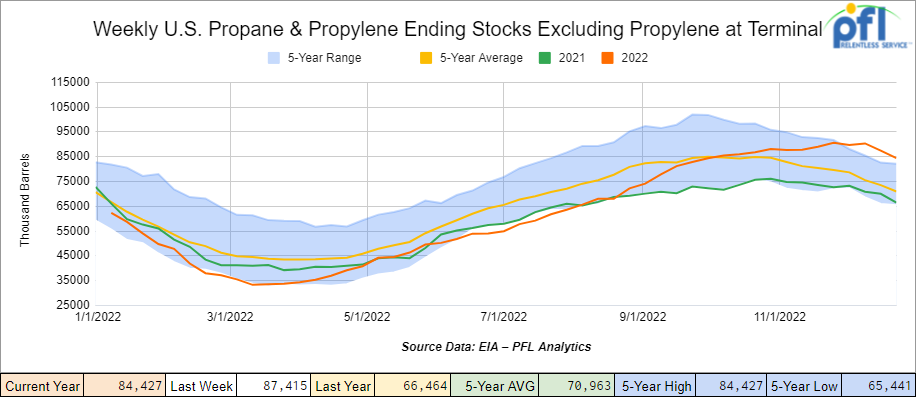

Propane/propylene inventories decreased by 3 million barrels week over week and are 18% above the five-year average for this time of year.

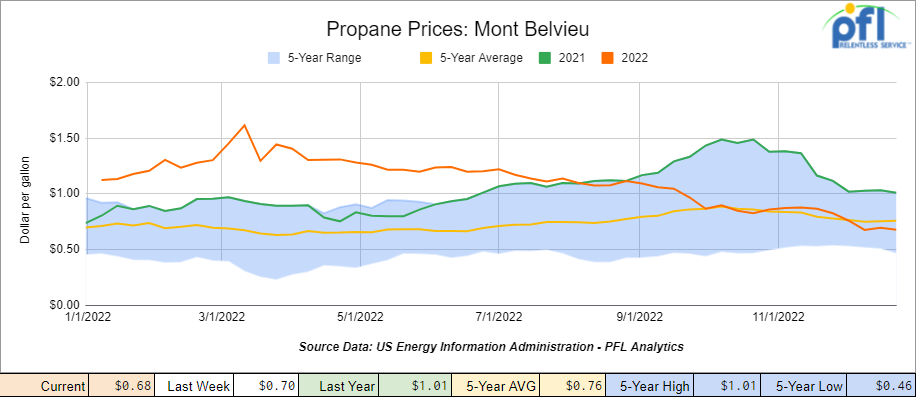

Propane prices were down two cents per gallon week of week closing out the week at 68 cents per gallon, down 33 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 11.2 million barrels last week.

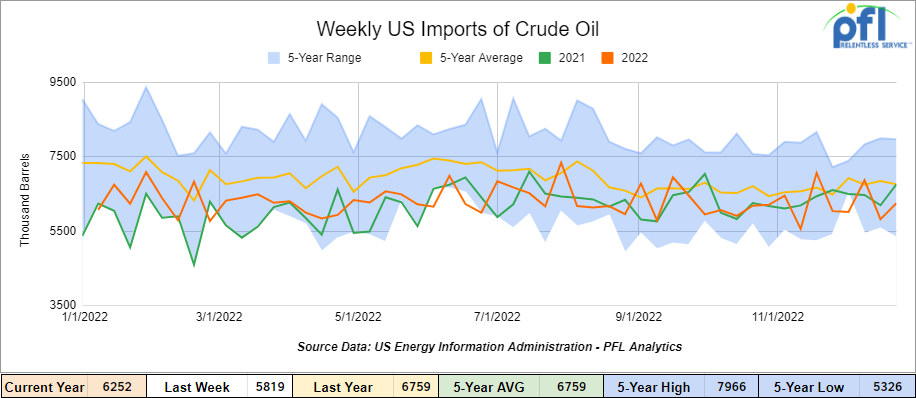

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending December 23rd, 2022, an increase of 433,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 3.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 536,000 barrels per day, and distillate fuel imports averaged 160,000 barrels per day during the week ending December 23rd, 2022.

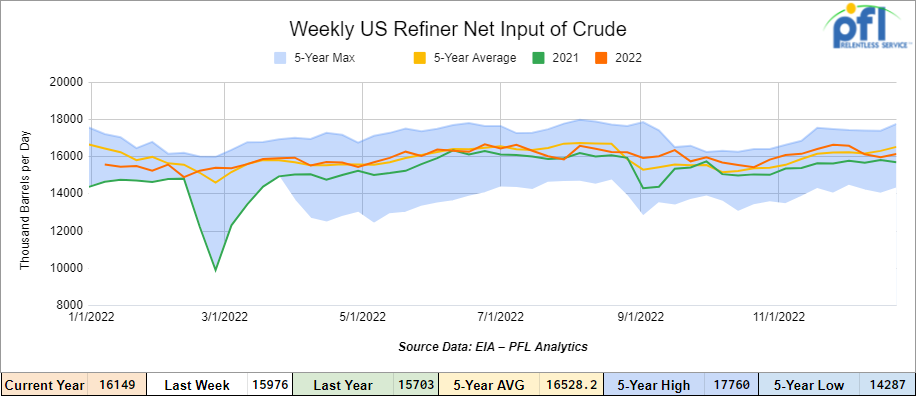

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending December 23, 2022 which was 173,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $79.89, down -$0.37 per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 24th, 2022.

Total North American weekly rail volumes were down (-6.44%) in week 51 compared with the same week last year. Total carloads for the week ending on December 23rd were 291,941, down (-4.74%) compared with the same week in 2021, while weekly intermodal volume was 256,603, down (-8.31%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant increase coming from Motor Vehicles and Parts (+13.52%). The largest decrease was from Coal (-15.36%).

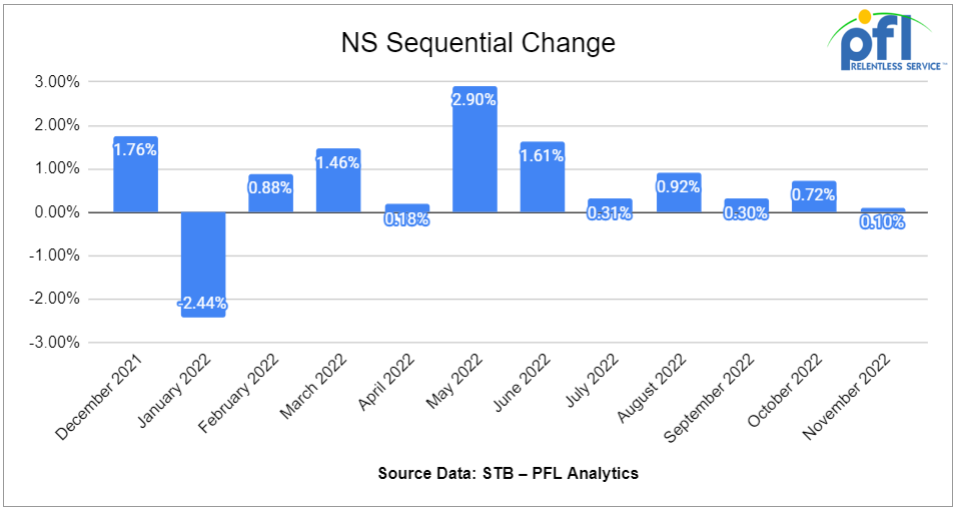

In the east, CSX’s total volumes were down (-0.07%), with the largest decrease coming from Chemicals (-10.96%) and the largest increase from Coal (+24.73%). NS’s volumes were up (2.46%), with the largest decrease coming from Chemicals (-10.02%) and the largest increase from Coal (+24.84%).

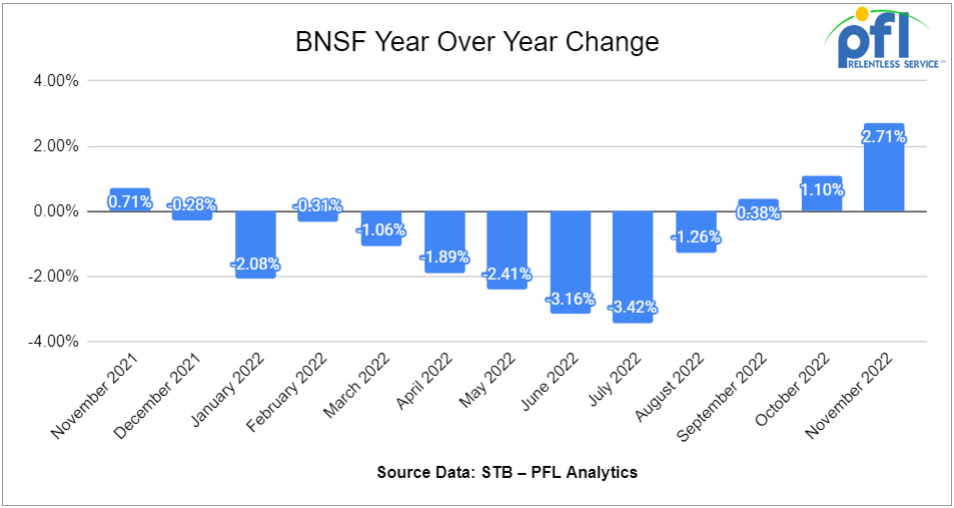

In the West, BN’s total volumes were down (-19.47%), with the largest decreases coming from Coal (-41%), and the largest increase coming from Motor Vehicles and Parts (+10.36%). UP’s total rail volumes were up (+0.41%) with the largest decrease coming from Forest Products (-21.50%) and the largest increase coming from Motor Vehicles and Parts (+15.99%).

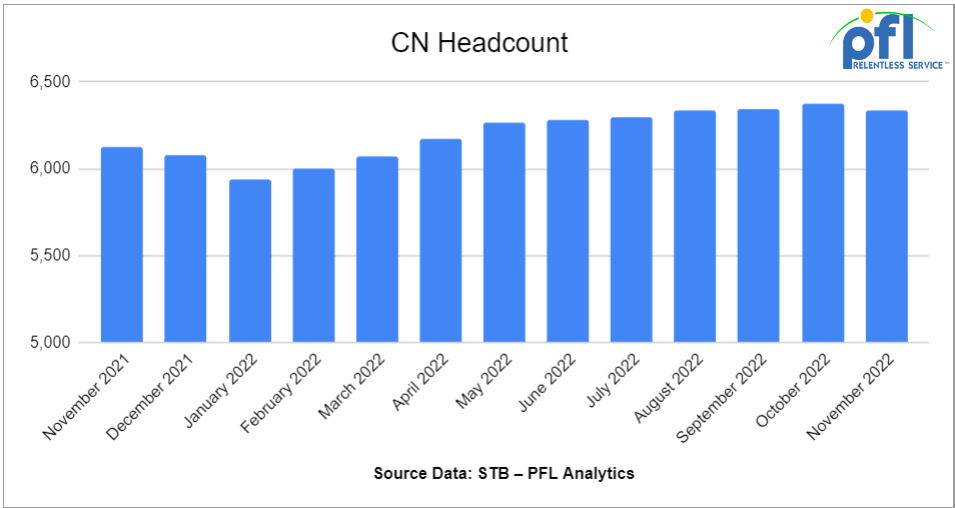

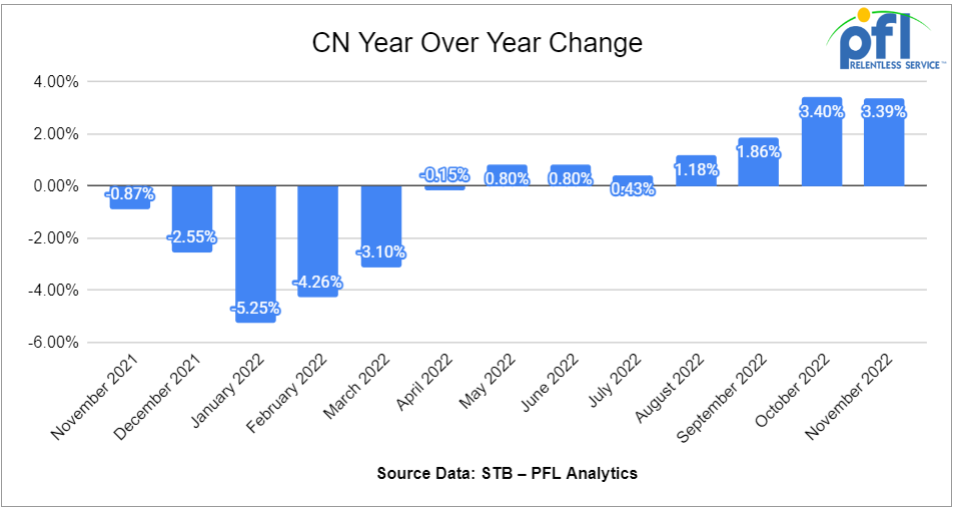

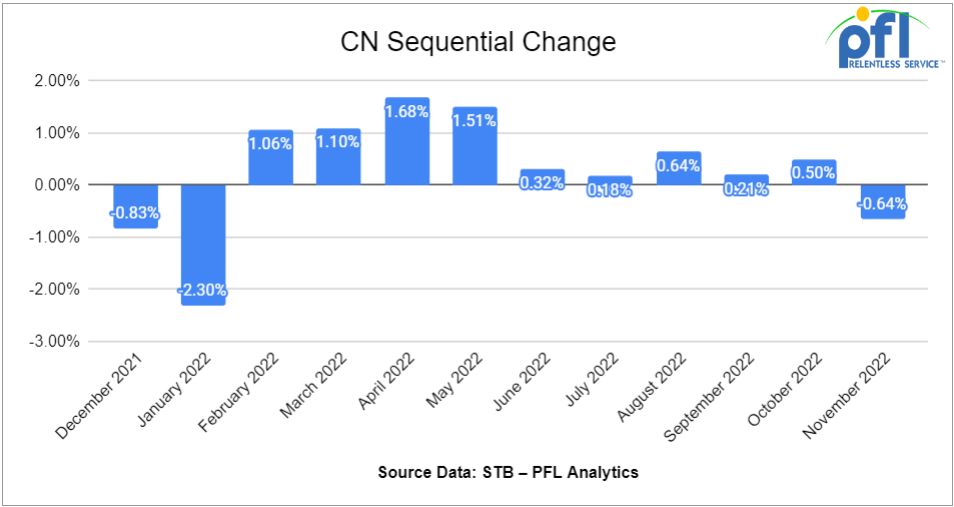

In Canada, CN’s total rail volumes were down (-12.34%) with the largest decrease coming from Intermodal (-32.32%) and the largest increase coming from Motor Vehicles and Parts (14.34%). CP’s total rail volumes were down (-22.79%) with the largest decrease coming from Intermodal (-44.95%) and Other (-43.33%). The largest increase coming from Petroleum and Petroleum Products (+35.07%).

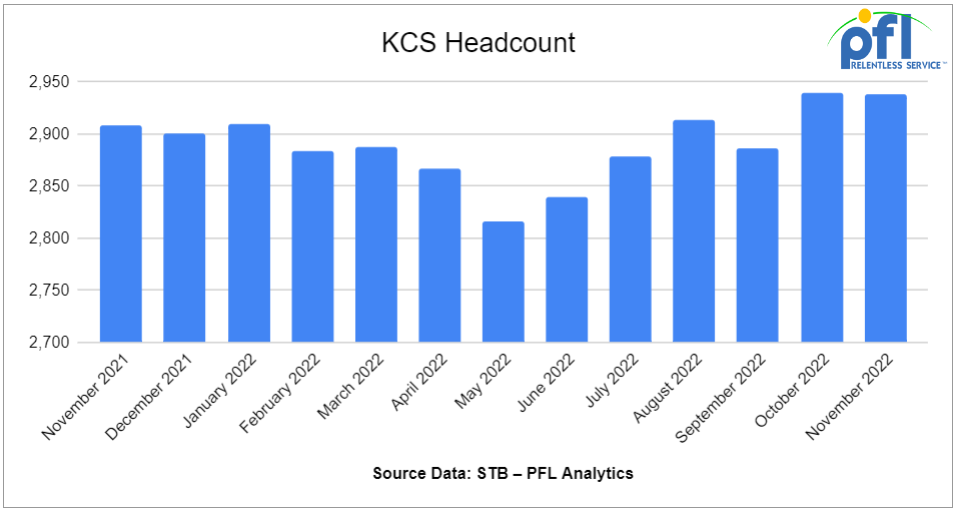

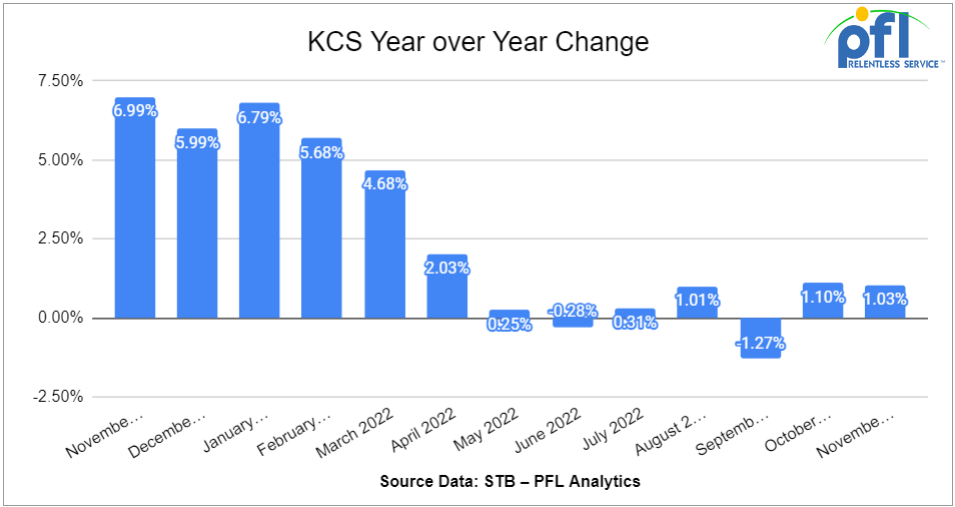

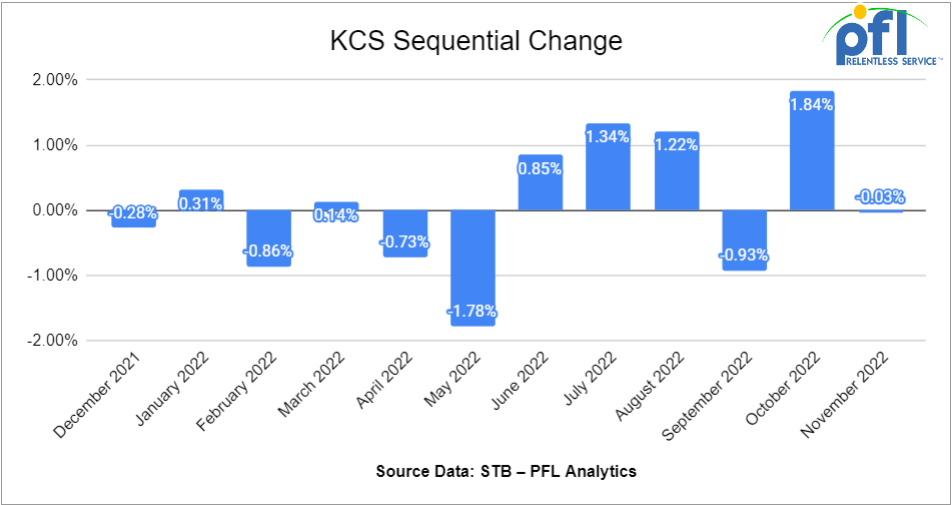

KCS’s total rail volumes were up (+1.27%) with the largest decrease coming from Farm Products (-18.82%) and largest increase coming from Grain (+41.88%).

Source Data: AAR – PFL Analytics

Rig Count

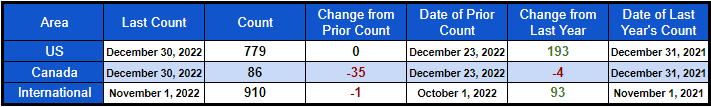

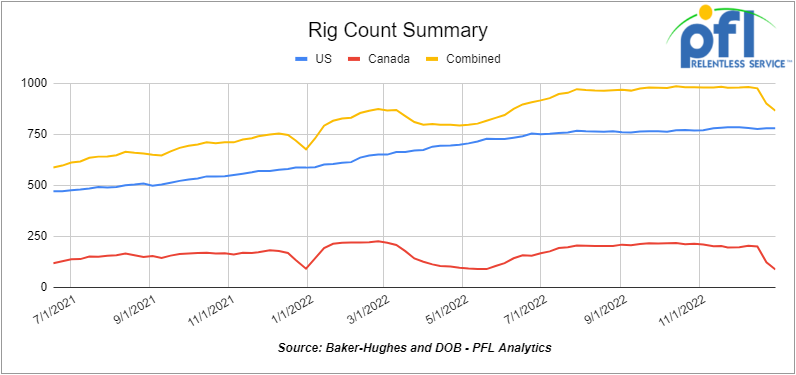

North American rig count was down by -35 rigs week over week. U.S. rig count was flat week-over-week but up by +193 rigs year over year. The U.S. currently has 779 active rigs. Canada’s rig count was down by -35 rigs week-over-week, and down by -4 rigs year-over-year. Canada’s overall rig count is 86 active rigs. Overall, year over year, we are up +189 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

Keystone Startup commenced last week

As anticipated, TC Energy announced the start up of the Keystone Pipelines cushing extension late last week,earlier than we expected putting a damper on crude by rail out of Alberta. In a statement the company said: “After completing repairs, inspections and testing we proceeded with a controlled restart of the Cushing Extension, safely returning the Keystone Pipeline to service today. The Cushing Extension will operate under plans approved by the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA).”

“The Keystone Pipeline System is now operational to all delivery points. As always, we continue to monitor the system 24/7 as we deliver the energy customers and North Americans rely on. The pipeline system will operate with additional risk-mitigation measures, including reduced operating pressures. We maintain our commitment to our ongoing safety-led response and will fully remediate the incident site. We will share the learnings from the investigation as they become available”. Stay tuned to PFL for further updates.

We are watching the fall out of the Deep Freeze last week

The deep freeze did not only have ramifications on a massive human scale with 27 people dying in Buffalo alone, but had consequences for refiners, plants and producers.

Refiners in the U.S. Gulf Coast are seeking to resume operation at a dozen facilities that halted operations due to the recent freeze, a total of 3.6 million barrels per day in operable capacity, with Port Arthur and Deer Park taking at least one-two weeks before a full return. Suncor announced late last week that it would be down in Colorado for at least three months as it grapples with starting up its refinery operations in Commerce City, Colorado affecting the flow of nearly 100,000 barrels per day of crude and refined products that feeds Colorado, as ninety-five percent (95%) of what the refinery produces stays within the state.

Other facilities across the country are having start-up issues and increased rail activity into storage has been evident while facilities struggle to get back and running.Natural gas producers are particularly vulnerable to well freeze-offs during times of severe cold and getting those wells back to production can be difficult. Natural gas production of course affects LPG’s and ultimately rail. America’s largest natural gas producer, EQT Corp, experienced a plunge in production up to 30% due to severe cold weather that led to Appalachian Basin Well disruption. Speaking to Bloomberg Television on Wednesday of last week, the EQT Chief Executive Officer, Toby Rice said output fell by between 1 billion and 1.5 billion cubic feet per day amid the extreme cold snap that started last week with a blast of Arctic air and strong winds leading to subzero temperatures affecting an estimated 150 million people. EQT produces 5 billion cubic feet per day.

We are watching Russia who rejected price cap

The Kremlin banned exports of Russian crude oil and refined products to foreign buyers that adhere to a price cap, but Moscow held back from the most drastic retaliatory measures that could have further disrupted global oil supplies. The restriction on Russian crude exports will begin on Feb. 1 and last until at least July 2023, according to the decree published on Tuesday of last week.

The market price for Russia’s flagship crude is already trading below the $60-per-barrel threshold set by the European Union and G-7. The U.S. and the European Union have already halted purchases, suggesting the decree’s initial impact may be limited in scope. President Vladimir Putin’s decree charges the government with preparing further legal acts to counteract the Western price cap.

Russia will watch developments in the global oil market in the first quarter of 2023 to see the impact of the price cap before deciding whether to take any further retaliatory measures, such as a price floor, people familiar with discussions said earlier this month.

Price-Cap Effects

The market has been waiting for Moscow’s response to the $60-per-barrel cap since Dec. 5th, when the group of seven industrialized nations’ limit on Russian seaborne crude exports came into force. The price cap means anyone wanting to access an array of vital western services, especially insurance, is now only able to do so if they pay $60 or less. The step was aimed at curtailing revenue the Kremlin is using to fund its attack on Ukraine and at the same time keep the crude flowing to the global market. The price level will be reviewed every two months.

Russia’s oil output may fall by 500,000-700,000 barrels a day early this year, equating to roughly 5%-6% of the nation’s current production, according to Deputy Prime Minister Alexander Novak.

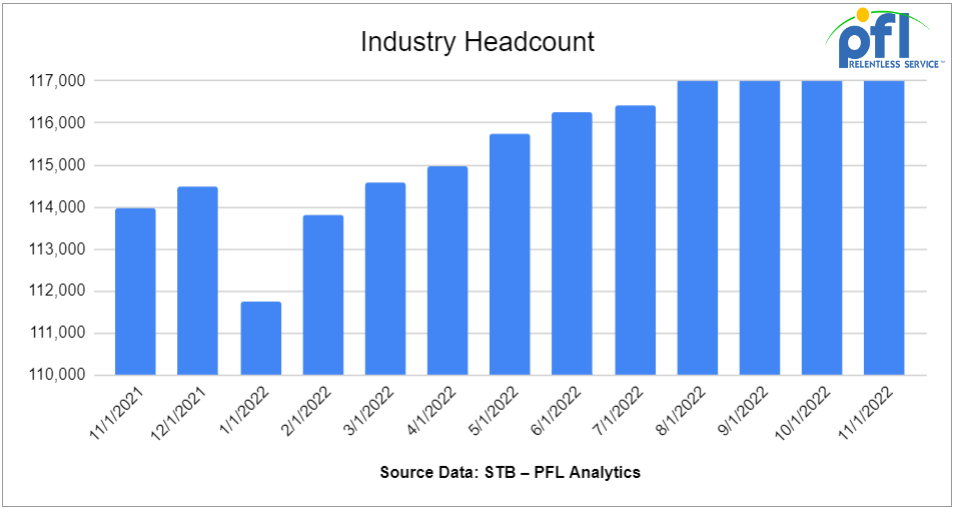

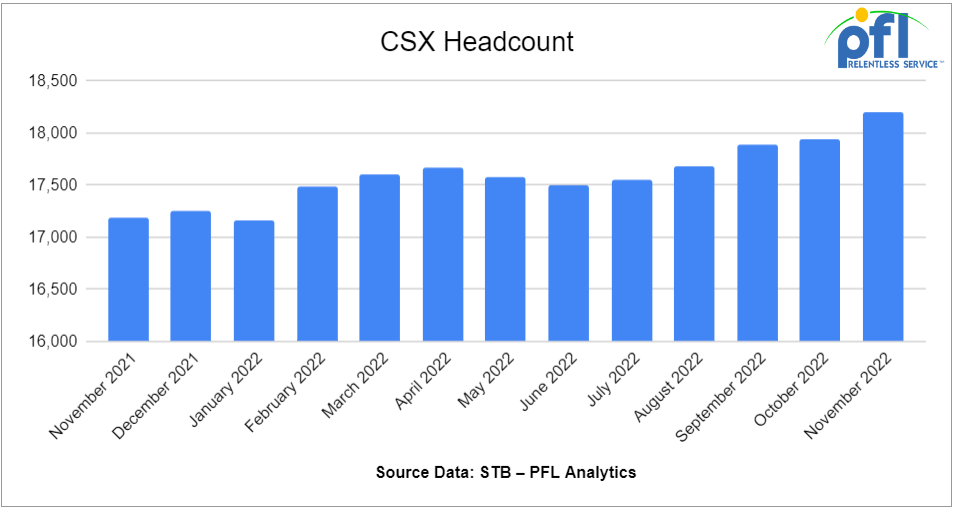

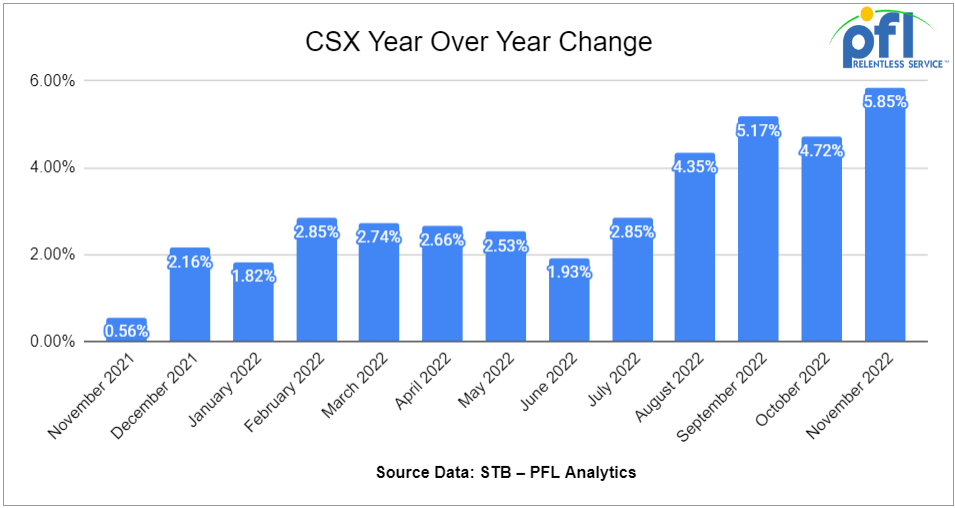

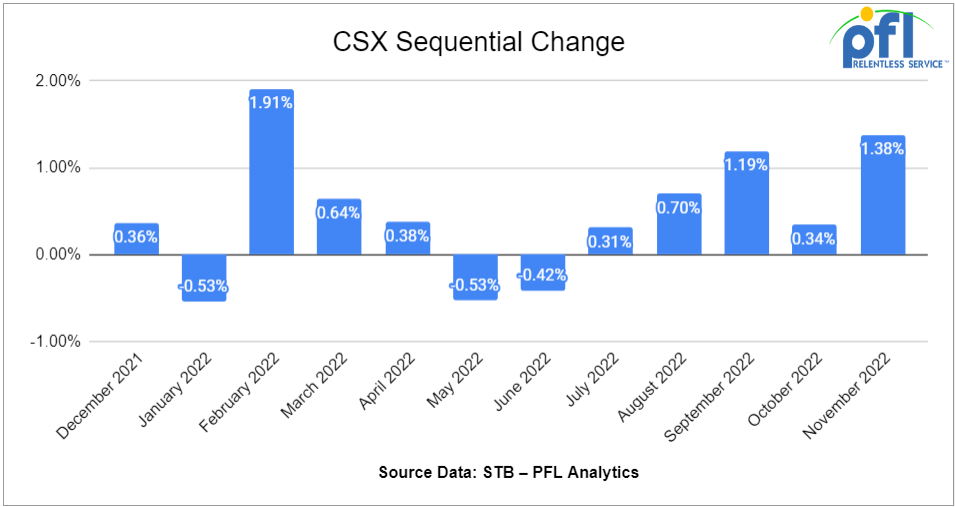

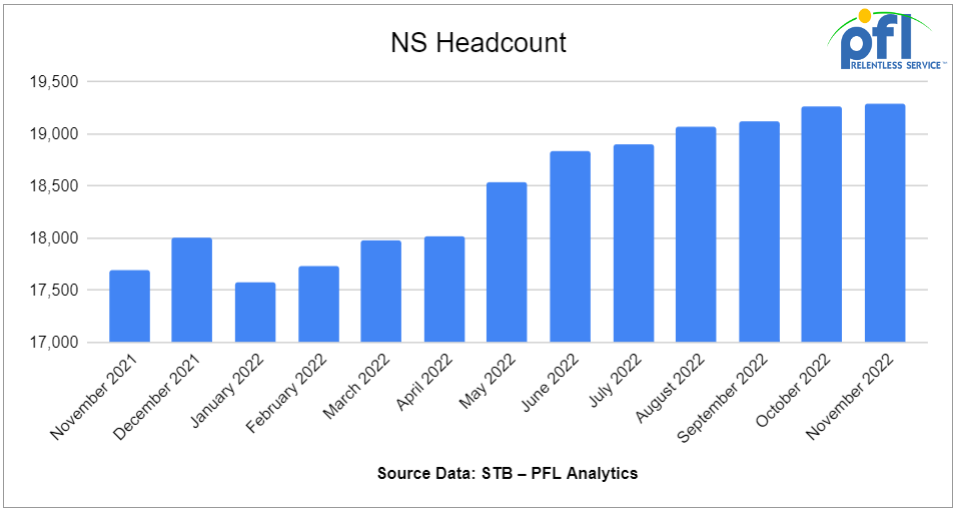

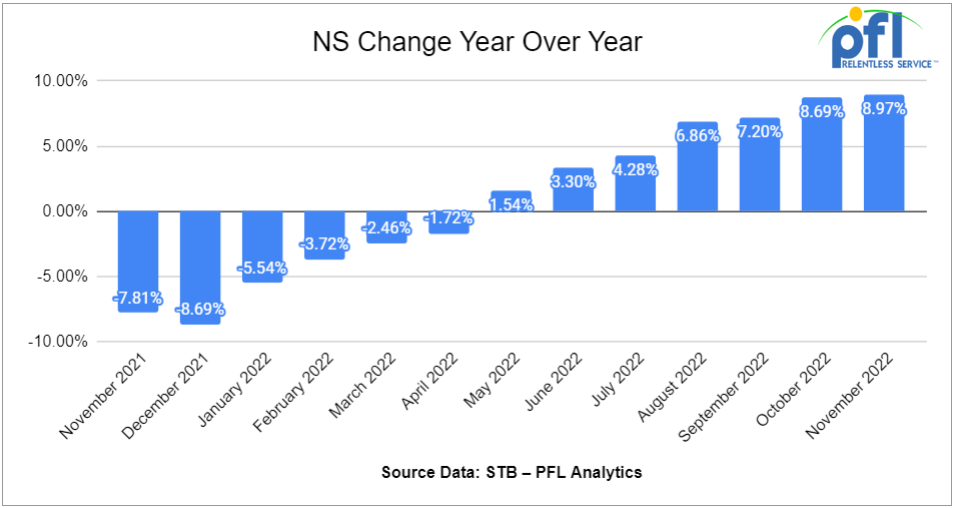

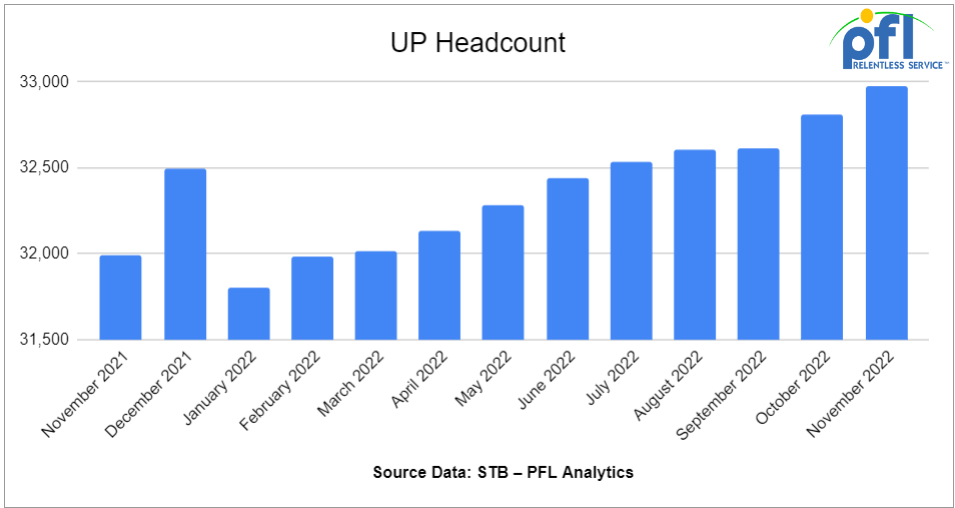

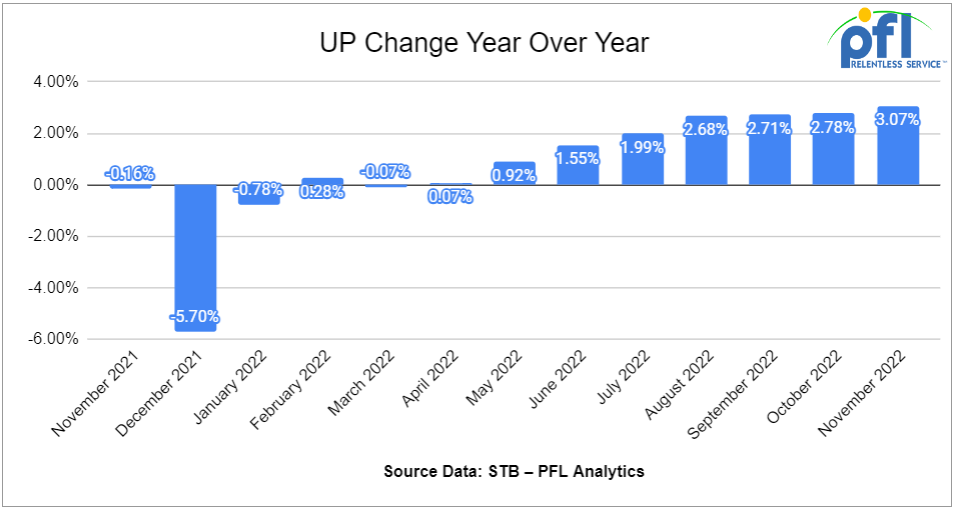

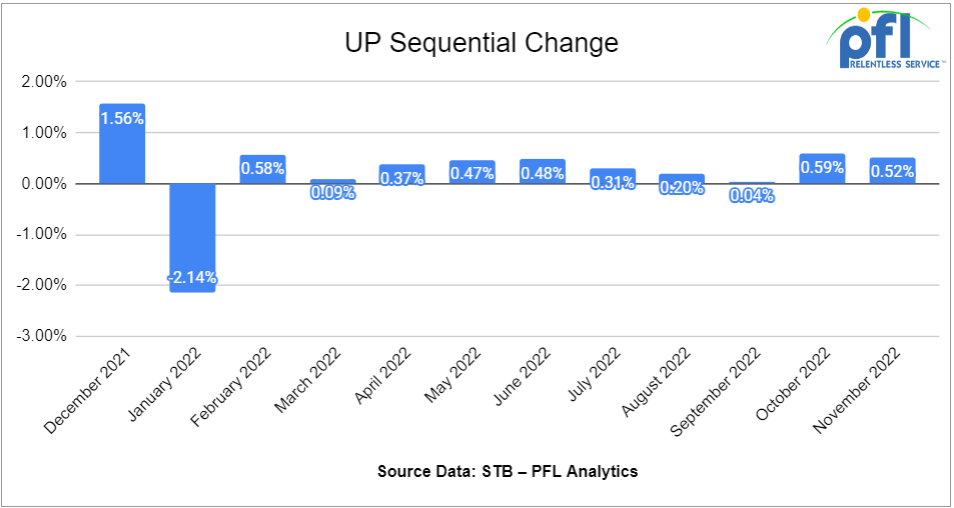

We are watching Class 1 Industry Headcount

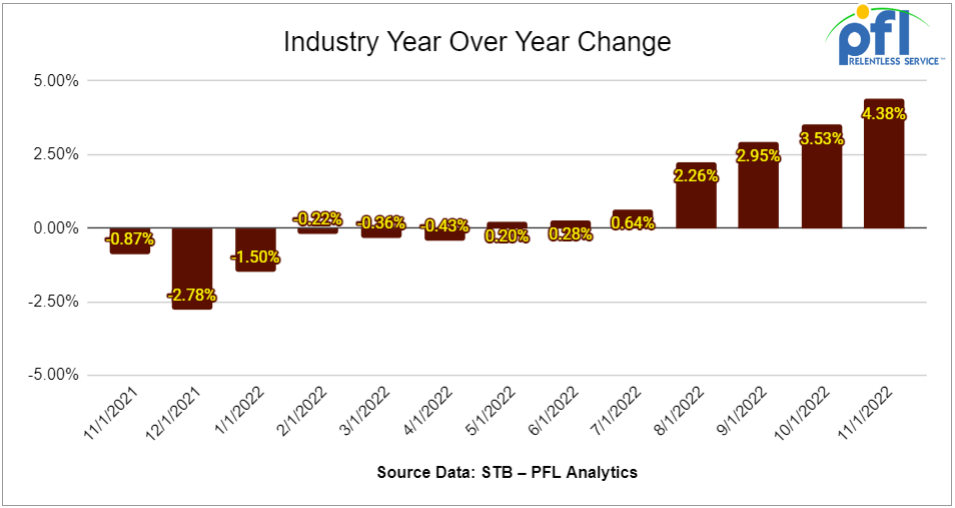

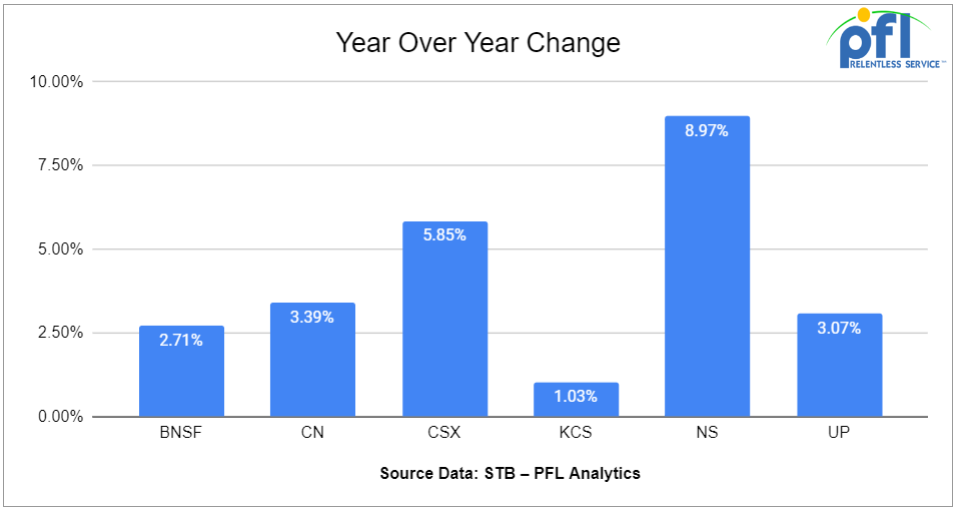

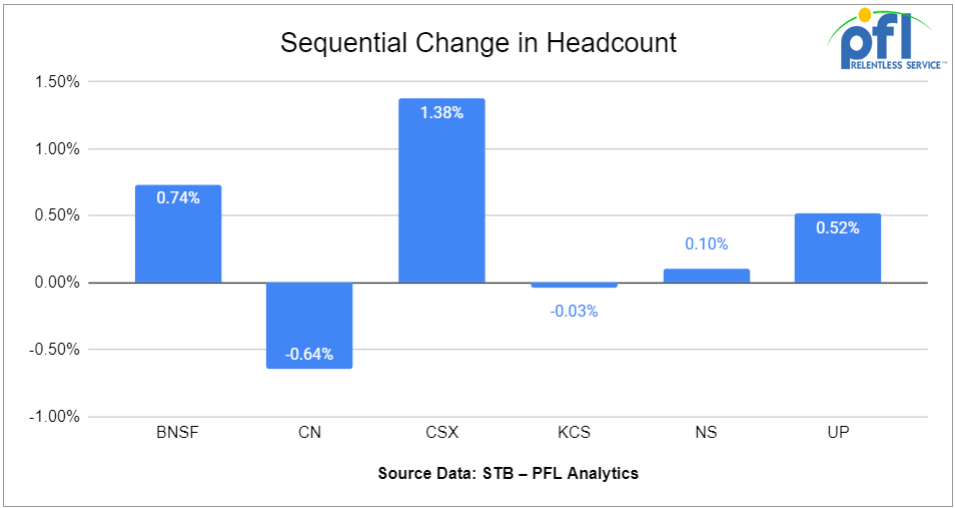

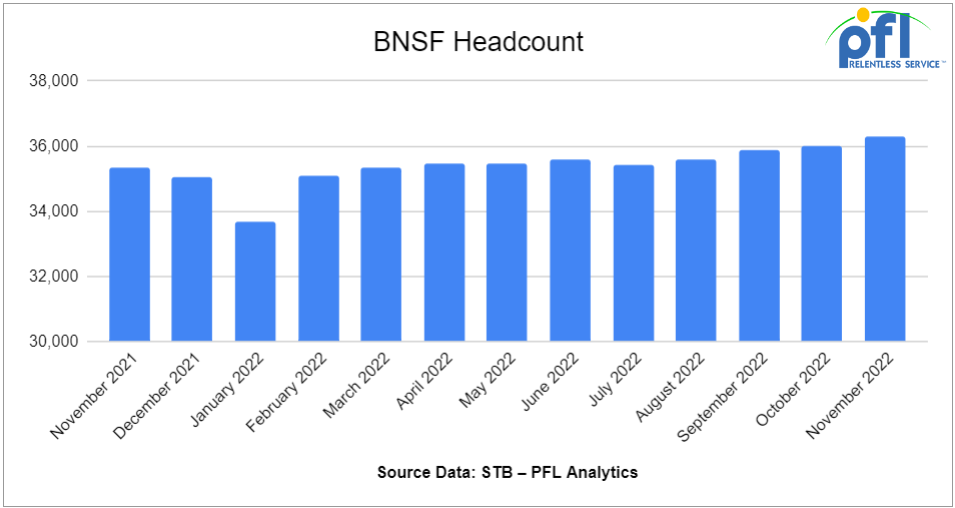

Class I’s employed 118,944 people as of November, a 0.62% increase from October employment levels and a 4.38% increase year over year, according to STB.

Five of six employment categories were up month over month. They were: transportation (other than train and engine), up 1.34% to 4,779 employees professional and administrative, up 1.11% to 9,998; executives, officials and staff assistants, up 0.96% to 8,030, maintenance of equipment and stores, up 0.77% to 17,774; and transportation (train and engine), up 0.74% to 49,934.

The only category to post a month over month decrease in employment was maintenance of way and structures, which dropped slightly 0.05% to 28,429 employees.

Year over year, all categories logged increases: executives, officials and staff assistants, up 10.29%; transportation (T&E), up 6.29%; maintenance of equipment and stores, up 3.15%; transportation (other than T&E), up 2.8%; professional and administrative, up 2.47%; and maintenance of way and structures, up 1.31%

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 100-300, C&I Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, Any Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 2-4, Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 5, CPC1232 Tanks needed off of CSX in West Virginia for 2 years plus. Cars are needed for use in Polyacrylamide service. Unlined

• 10-15, 300W Pressures needed off of BNSF, KCS, or UP in Texas for 5-8 years. Cars are needed for use in Various service.

• 5, Tanks needed off of KCS in Texas for 5 years. Cars are needed for use in Calcium Chloride service. Need the cars for 5 years to load from Monterey MX to Corpus and transload to trucks. Need to be lined

• 5, Tanks needed off of BNSF in Texas for 2 years. Cars are needed for use in P-dichlorobenzene service. Immediate need •Unlined•

• 50, Covered Hoppers needed off of BNSF, CN, CP, NS, orUP in the midwest for 5 years. Cars are needed for use in DDG service.

• 50-65, trough tops Covered Hoppers needed off of most class 1s in various locations for 2-3 years. Cars are needed for use in Fertilizer service.

• 25, gravity and pneumatic Covered Hoppers needed off of NS and others maybe in the east or south for Open. Cars are needed for use in Sugar service. Open to purchase as well.

• 15, 117J or R Tanks needed off of CN in the midwest for 1-5 Years. Cars are needed for use in Food Grade Ethanol service.

PFL is offering:

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 150, 3250 CF, Sand Hoppers located off of various class 1s in multiple locations. For sale

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 100, 29K, 117R Tanks located off of UP in Washington. The railcars are clean and were built in 2014. Coiled and insulated.

• 100, 29K, 117R Tanks located off of UP in Washington State. 2014. Coiled and insulated clean

• 150, Sand Hoppers located off of various class 1s in multiple locations. Offered at a Great Price

• 150, 31.8, 117R Tanks located off of KCS in Texas. Cars are clean Currently being shopped. Call for info.

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 200, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 200, 29K, 117J Tanks located off of BNSF, UP in Oklahoma & Texas. Cars are clean Hempel 15500 Lining.

• 139, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Brand New Cars!

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|